RELEASE NOTES

This document includes following topics:

- Theme of The Release

- Highlights

- Capability Enablers

- Wearables

- Customer Experience

- New Business Functions

- Qualifications

- Browser Support

- Known Issues and Limitations

1. Theme of The Release

1.1 Overview

Banks are shifting their strategic focus to the customer experience that require a new approach in bringing efficiency for the customer to fulfil their banking needs.

Open banking is an emerging trend in financial technology; one based on using APIs that enable third party providers (TPPs) to build applications and services around a financial institution.

The theme of OBDX 18.2 release was to build foundation framework for Open Banking and PSD2 regulations that enables third parties to offer services around financial institution.

Additionally the platform has been enhanced to support new business functions for India market that will enable banks for faster implementation.

2. Highlights

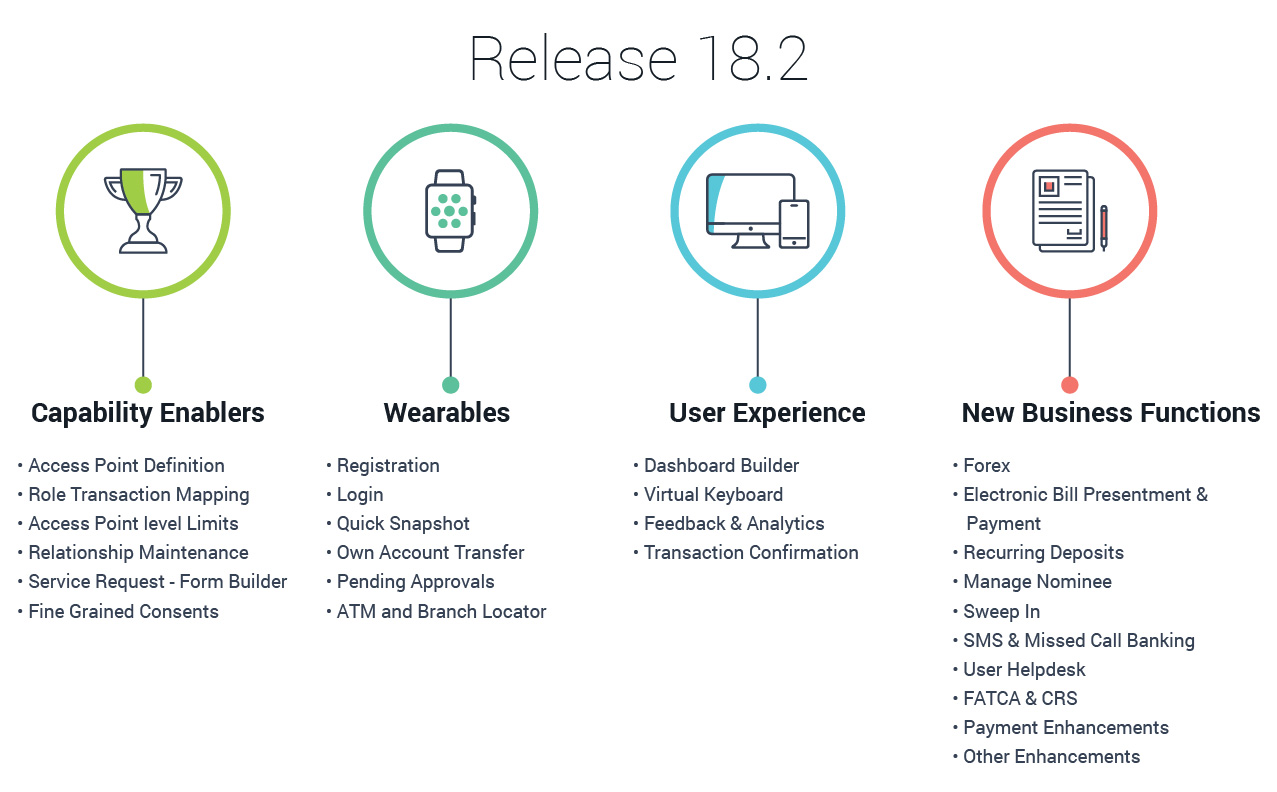

This chapter gives a brief summary about the enhancements done in the four areas.

2.1 Capability Enablers:

These capabilities provide the framework to support a set of business functions supporting PSD2 and open banking requirements and also provide governance around the set of functions that can be made available to users basis the relationship i.e. mode of operation.

2.2 Wearables:

Smart watch industry is expanding tremendously; adoption of smart watches is increasing day by the day due to its ease of use and features being available. Like any other industry digital banking is also putting its foot forward on building application for wearables. Being able to pay with just a gesture, instead of with cash, credit card or smartphone, is the new trend and demand of the customer and wearable banking is the solution to such needs.

2.3 User Experience:

User experience is the first impression that the customer gets after using the application. It’s what people see, that directly influences how customers and clients think of the Bank. Keeping this in mind a new feature of Dashboard builder has been developed in OBDX, which will facilitate banks in designing a dashboard as per their need. An option to provide Feedback is also provided for the end user, which will let the banks know about the impression the customer is having about the application and its area of improvement.

2.4 New Business Functions:

Consumers want to interact with their financial institution where, when, and how they want and not mandatorily through the conventional channel of visiting branches. This necessitates the need to have maximum business functions available on the OBDX platform for the user.

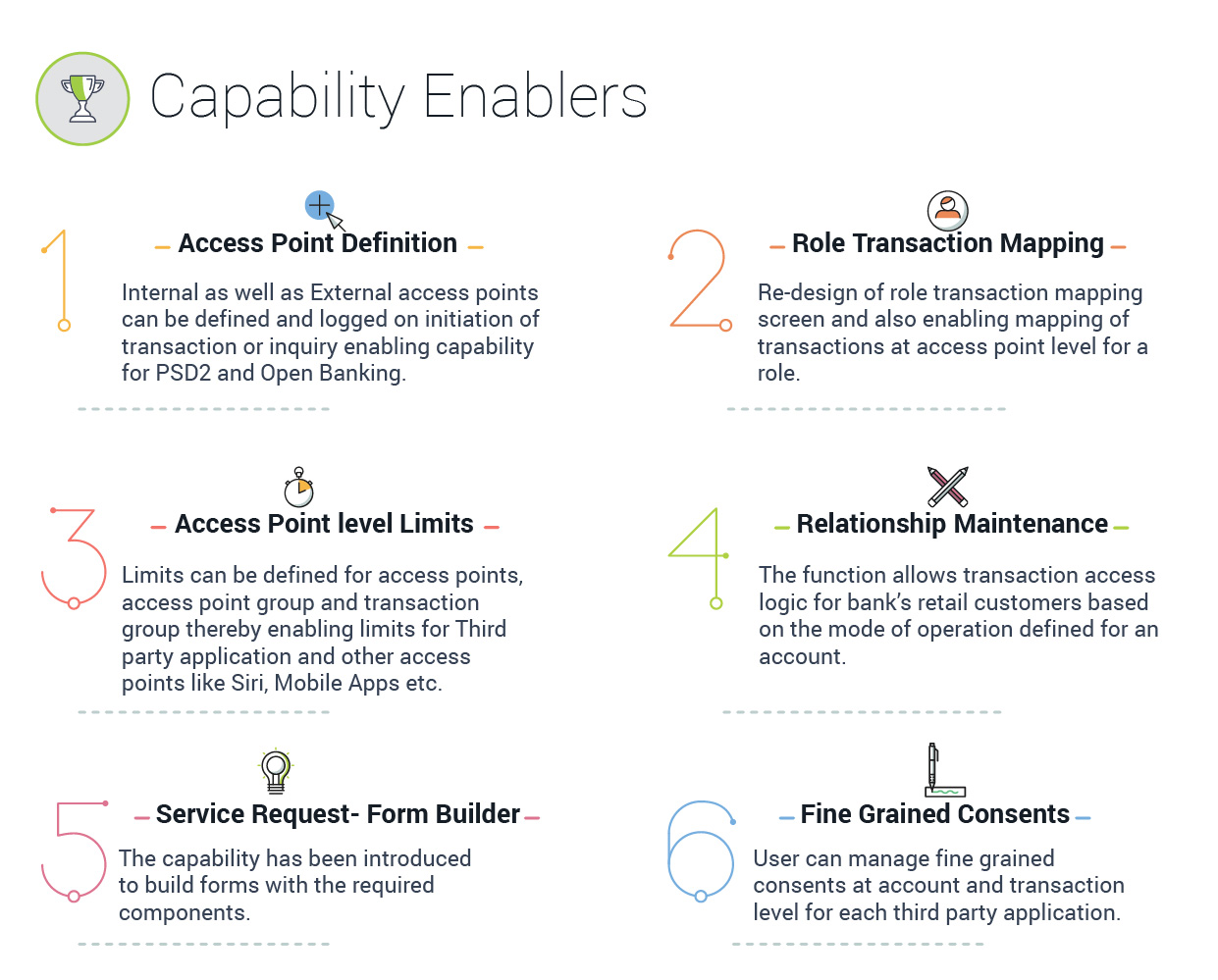

3. Capability Enablers

Following capabilities have been built as part of this function in release 18.2.

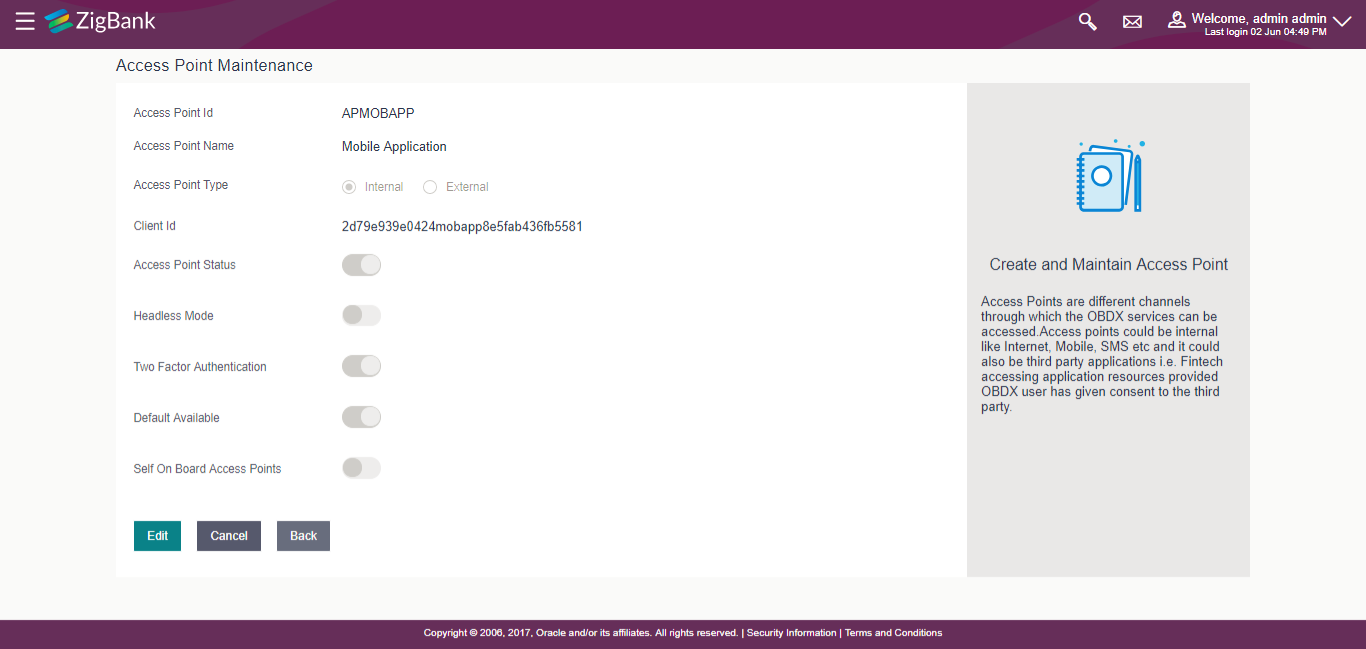

3.1 Access Point Definition:

Access points are different channels/medium through which transactions or inquiries can be performed.

As part of this release, capability has been built in OBDX to define access points in the system and uniquely identify each access point from which the transaction is performed or an inquiry is made. Access Points can be of type ‘Internal’ or ‘External’.

Internal Access points are defined as part of Day 0 definition whereas External Access Points are typically third party applications that can be defined by the administrator to support open banking and PSD2 requirements.

Internal Access Points available as part of OBDX system are as follows:

- Internet

- Mobile App

- Mobile Browser

- SMS

- Missed Call

- Siri/Chatbot

- Snapshot

- Wearables

- Major highlights of this framework:

- Uniquely identify each access point in the system from which transaction is initiated

- Mapping of transactions to an application role for each access point

- Access Points can be clubbed to create access point groups

- Definition of limits package for an access point or access point group

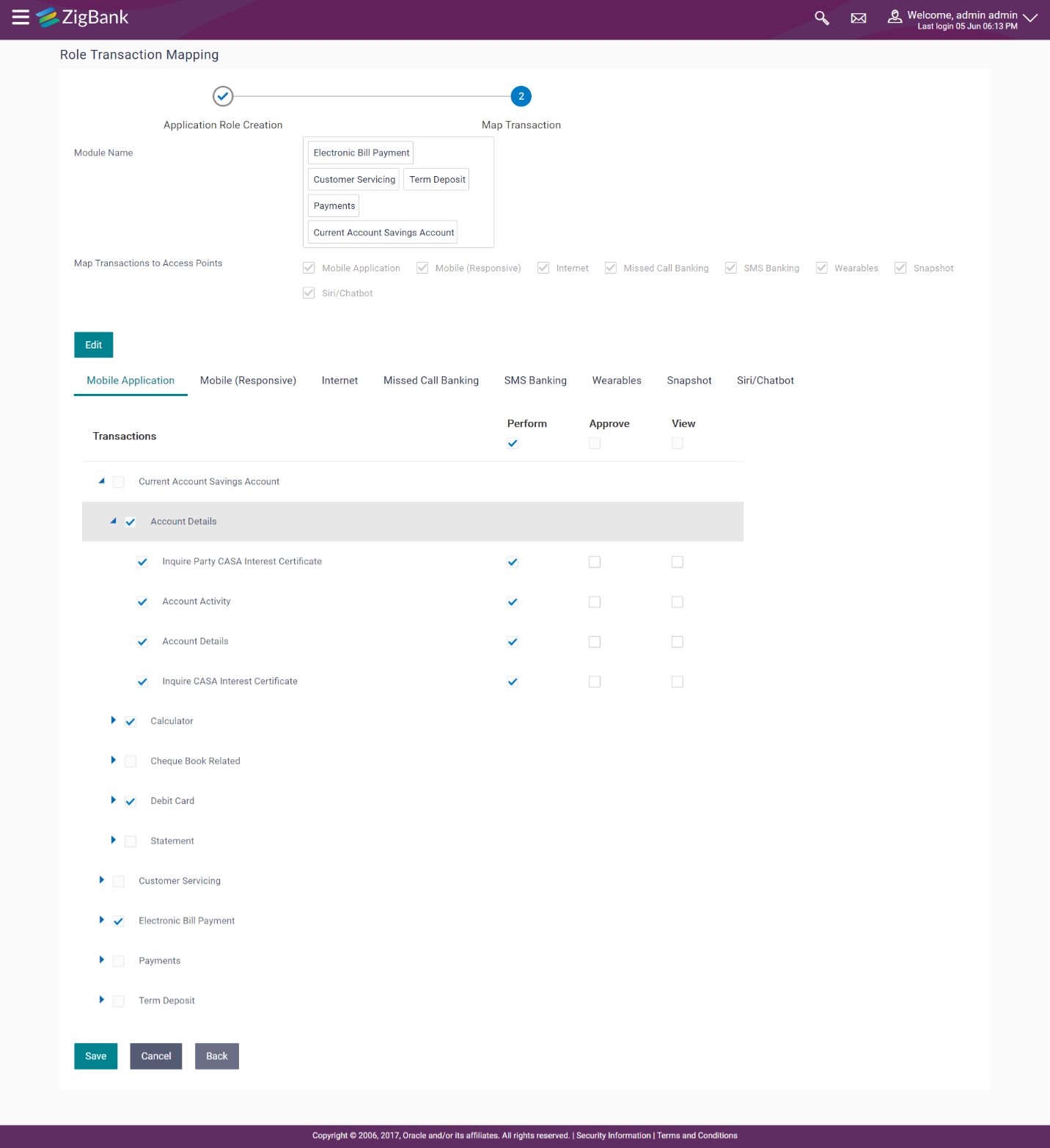

3.2 Role Transaction Mapping:

OBDX has a set of pre-defined application roles that can be used to provision users along with definition of allowed set of operations. E.g. of pre-defined application roles could be Maker, Approver, Customer etc.

As part of this release, existing Role Transaction Mapping screen has been re-designed and enhanced to enable creation of new application roles and also enabling mapping of transactions to application roles for Access Points.

Administrator![]() Administrator is a set of individuals that administer the applicant/Affiliate entity. For example, Accountants, Authorized Signatories for organizations, Power of Attorney for individuals. can create the application roles for the User Segments (Retail/Corporate/ Administrator) and map transactions to the application roles for internal as well as external access points.

Administrator is a set of individuals that administer the applicant/Affiliate entity. For example, Accountants, Authorized Signatories for organizations, Power of Attorney for individuals. can create the application roles for the User Segments (Retail/Corporate/ Administrator) and map transactions to the application roles for internal as well as external access points.

The advantage of mapping the transactions at an access point level is that the bank can control transaction access at each Access point. For e.g. Banks may want all the retail functions to be available on internet but not on SMS Banking and Siri/Chatbot.

Application roles mapped to External Access Points are defined for Third Party![]() A party is any individual or business entity having a banking relationship with the bank. Providers (TPPs). Each external role is mapped to a scope (defined in Identity Management System) defined for External Access Point.

A party is any individual or business entity having a banking relationship with the bank. Providers (TPPs). Each external role is mapped to a scope (defined in Identity Management System) defined for External Access Point.

For Internal Access Points, user can perform transactions that are mapped to the application role assigned to that user. In case of External Access Points, third party provider can perform only those transactions (on behalf of the user), which are mapped to the application role along with the scope assigned to that external access point (TPPs).

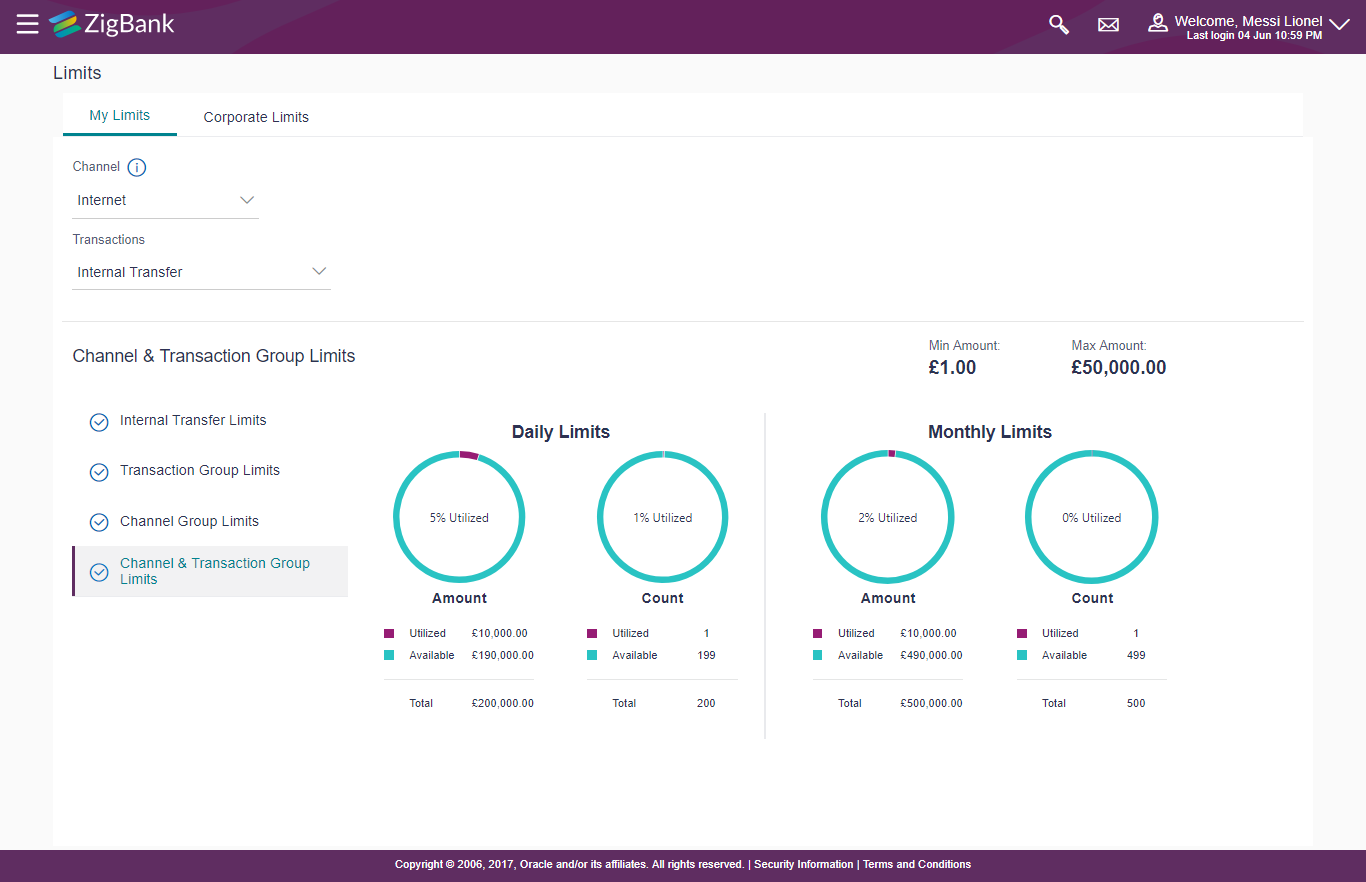

3.3 Access Point specific Limits:

As part of this release, enhancements have been done in the limits module on the administration side as well as for the business user.

Administrative Functions

- Access Point Group Maintenance

New function introduced in the system through which the system administrator can group a set of defined access points i.e. internal and external. Limits package can be created for the defined access point group. - Transaction Group Maintenance

New function introduced in the system through which the system administrator can group a set of transactions to create a transaction group. As part of limits package creation, the administrator can select the transactions or transaction group to associate limits. - Limit Package Management

Existing maintenance screen have been enhanced to support following features - Creation of Limits Package for a specific access point or an access point group

- Assignment of Limits for a transaction group as part of limits package creation

- Limit Package Mapping

Following maintenances have been enhanced to support limit package definition for an access point or an access point group - User Management (System and Corporate Administrator)

- System Rule Maintenance (System Administrator)

- Party Preference (System Administrator and Corporate Administrator)

Business User specific functions

View Limits

Existing screen for the business user to view transaction limits has been enhanced to display following details;

- Access point and access point group specific limits

- Transaction and transaction group specific limits

Option is also provided to the Retail User to edit (reduce bank offered limits) the limits assigned for a specific transaction, transaction group, access point and for group of access points.

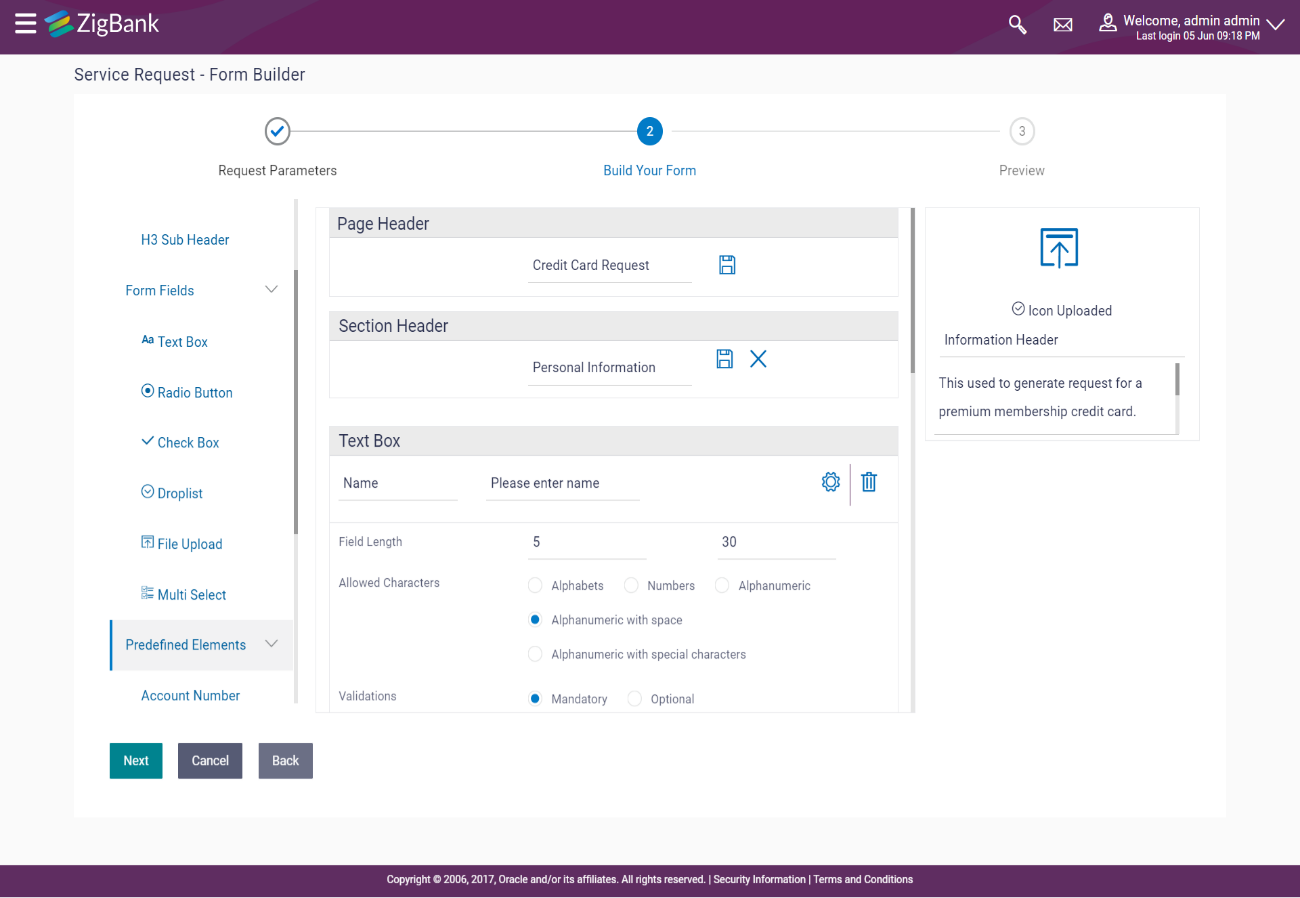

3.4 Service Request – Form Builder :

Service Request is a formal request from the customer for some information or to perform some action on his/her account that needs intervention from the bank user.

As part of this release, following capabilities have been built as part of Service Request module:

- System/Bank Administrator can build the service request form by defining form fields along with attributes like field name, type, allowed characters and error message. Additionally, the built form can be previewed before confirmation

- Service Request Form availability to retail users for service request creation

Assignment of requests to bank administrator to update the SR![]() A Service Request is a user request for information or advice, or for a standard change. status so that the user is informed of the request

A Service Request is a user request for information or advice, or for a standard change. status so that the user is informed of the request

3.5 Relationship Maintenance:

As part of this release, new capability has been introduced in the system through which the administrator can set up the transaction access logic for bank’s retail customers based on the mode of operation defined for an account.

For e.g. If the mode of operation is ‘Either or Survivor’, there could be a need to provide an access of all transactions to the 2nd holder whereas, in case of ‘Jointly’, provide an access of only inquiries and restrict all financial transactions to the 2nd holder from Digital Banking Platform.

Such account and transaction access rules can be set up by the administrator through ‘Relationship![]() Relationship signifies the relationship between parties and accounts whenever the relationship is mapped to account. Maintenance Module’

This account relationship maintenance is a two-step process.

Relationship signifies the relationship between parties and accounts whenever the relationship is mapped to account. Maintenance Module’

This account relationship maintenance is a two-step process.

- Relationship Mapping Maintenance

As part of this function, administrator maps OBDX relationship codes with core banking relationship codes. - Relationship Matrix Definition

As part of this function, the administrator can enable or disable the transaction access based on the account relationships activated as a part of Relationship Mapping maintenance.

Access will be provided to the user on the basis of user role and the transactions enabled for that user role.

3.6 Fine Grained Consents:

As part of this release, new capability has been introduced for the user to define fine grained consents for the third party applications wherein he/she can define the accounts to which the third party can have access and also select the transactions within each of the account that the third party can perform.

User can also revoke complete access of a Third Party application if required.

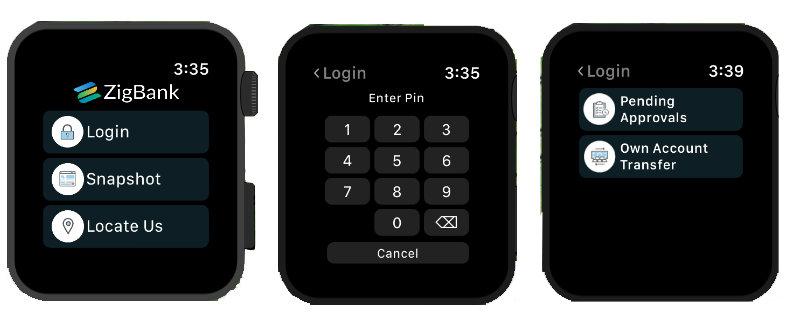

4. Wearables

Watch Banking is a digital channel offered by the banks to its customers to perform simple operations on the go from their watch. It can be an Apple watch or an Android watch from which the customer can initiate inquiries as well as transactions.

The following capabilities have been built as part of release 18.2 under this section.

4.1 Registration

User can register the wearable through the mobile app by pairing the wearable i.e. Apple watch or Android watch with the respective mobile app and define the PIN![]() Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account. for the wearable.

Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account. for the wearable.

4.2 Login

The function allows the user to login to the application through the wearable ( Apple watch and Android) using the PIN as set during registration to access specific set of functions

On Apple watch

On Android

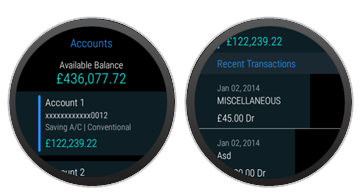

4.3 Quick Snapshot

The function allows the user to view the account summary of checking and savings account along with the last 5 transactions for each of the account through the wearable without having the need to connect/pair to the mobile application.

On Apple watch

On Android

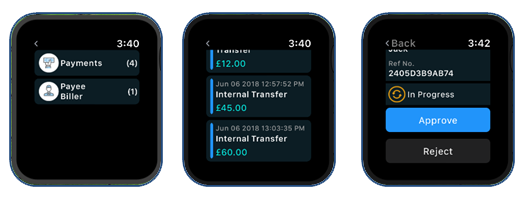

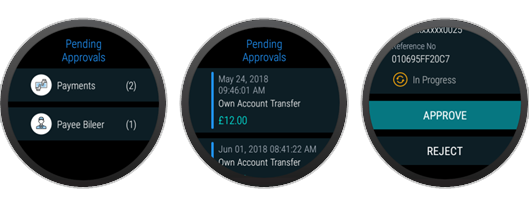

4.4 Transaction Approval

The function allows the corporate user with role approver to view the list of transactions pending for his/her approval, view details of the transaction on the wearable ( Apple watch and Android) and take necessary action of approval/rejection on the transaction.

On Apple watch

On Android

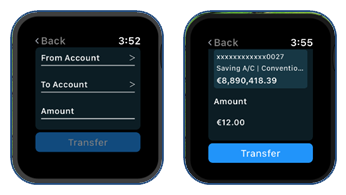

4.5 Own Account Transfer

The function allows the user to initiate funds transfer between his/her own accounts through the wearable Apple watch and Android) by providing the required details for payment.

On Apple watch

On Android

4.6 ATM and Branch Locator

The function allows the user to locate an ATM![]() Automated Teller Machine terminal allows customers having an ATM or debit card to perform several banking transactions such as cash withdrawal, balance inquiry, funds transfer, and so on. or a branch by enabling the current location and system provides the user with the list on the wearable (basis the defined radius in the configuration). User can view details of the ATM or the branch and also get directions to the respective ATM or branch from the current location.

Automated Teller Machine terminal allows customers having an ATM or debit card to perform several banking transactions such as cash withdrawal, balance inquiry, funds transfer, and so on. or a branch by enabling the current location and system provides the user with the list on the wearable (basis the defined radius in the configuration). User can view details of the ATM or the branch and also get directions to the respective ATM or branch from the current location.

On Apple watch

On Android

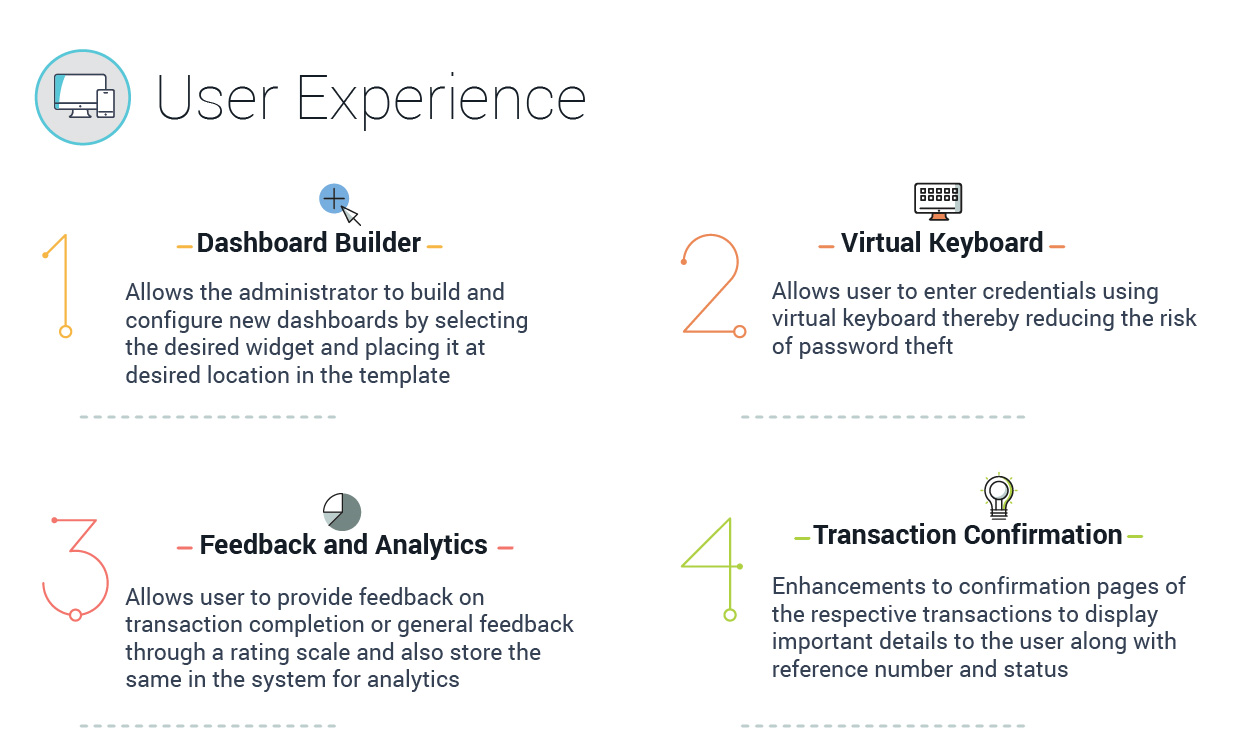

5. Customer Experience

Under this area following enhancements are done as part of 18.2 release:

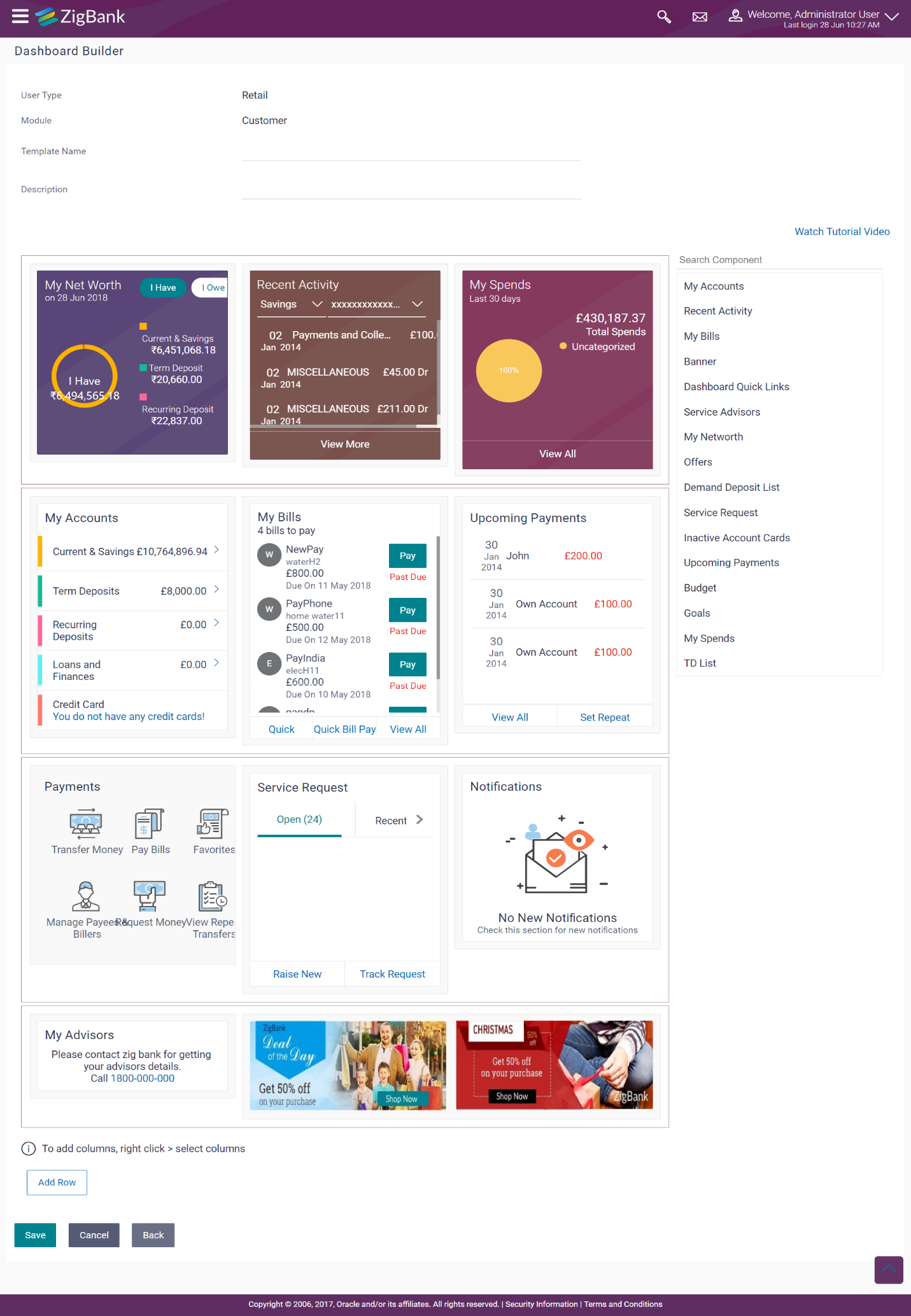

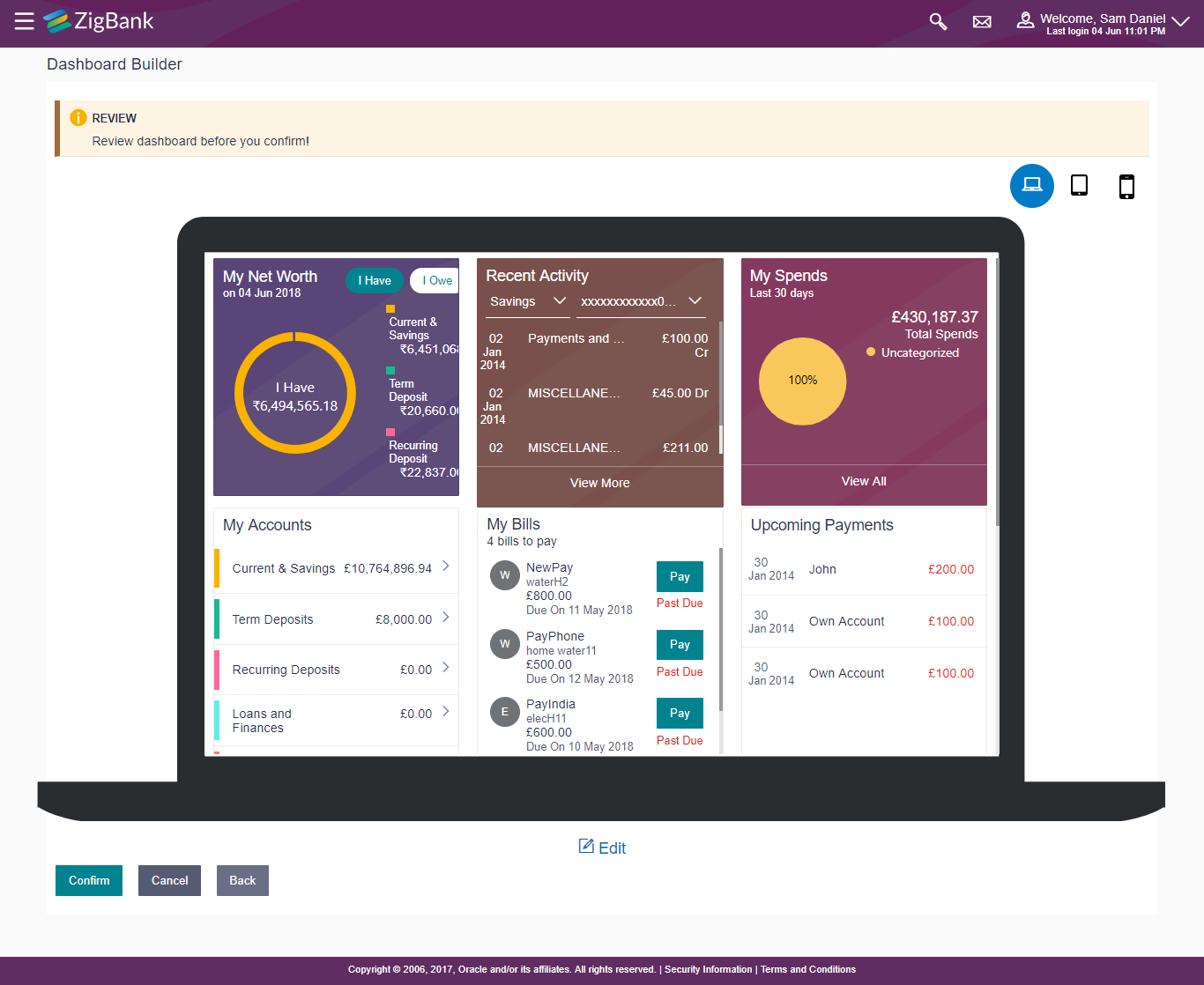

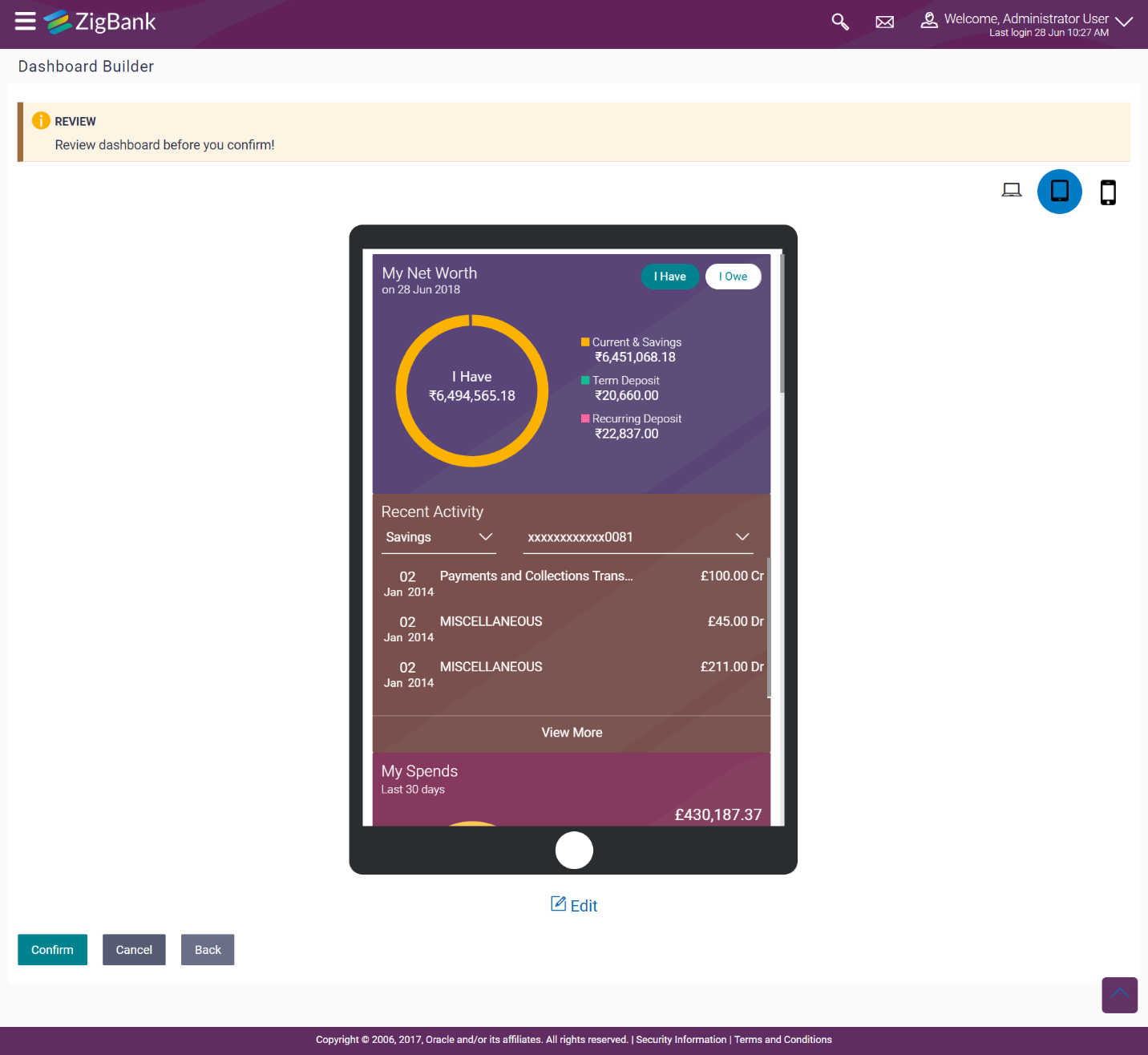

5.1 Dashboard Builder

Dashboard Builder provides capability to the bank to build custom dashboards without customization.

As part of this release, capability has been introduced for the system administrator to build dashboard templates for retail as well as corporate customers.

System Administrator can configure new dashboards by selecting the desired widget and placing at a desired location in template. As part of configuration, administrator can add and edit rows and columns to add more widgets.

These dashboards are responsive and can adapt to any type device that bank wants to enable it to the customers’ i.e. desktop, mobile and tablet. System allows the administrator to preview the dashboards on different types of devices before enabling it.

The administrator can build multiple dashboards with various attributes/widgets. Further these templates can be mapped to the user segment, party or even to a specific user.

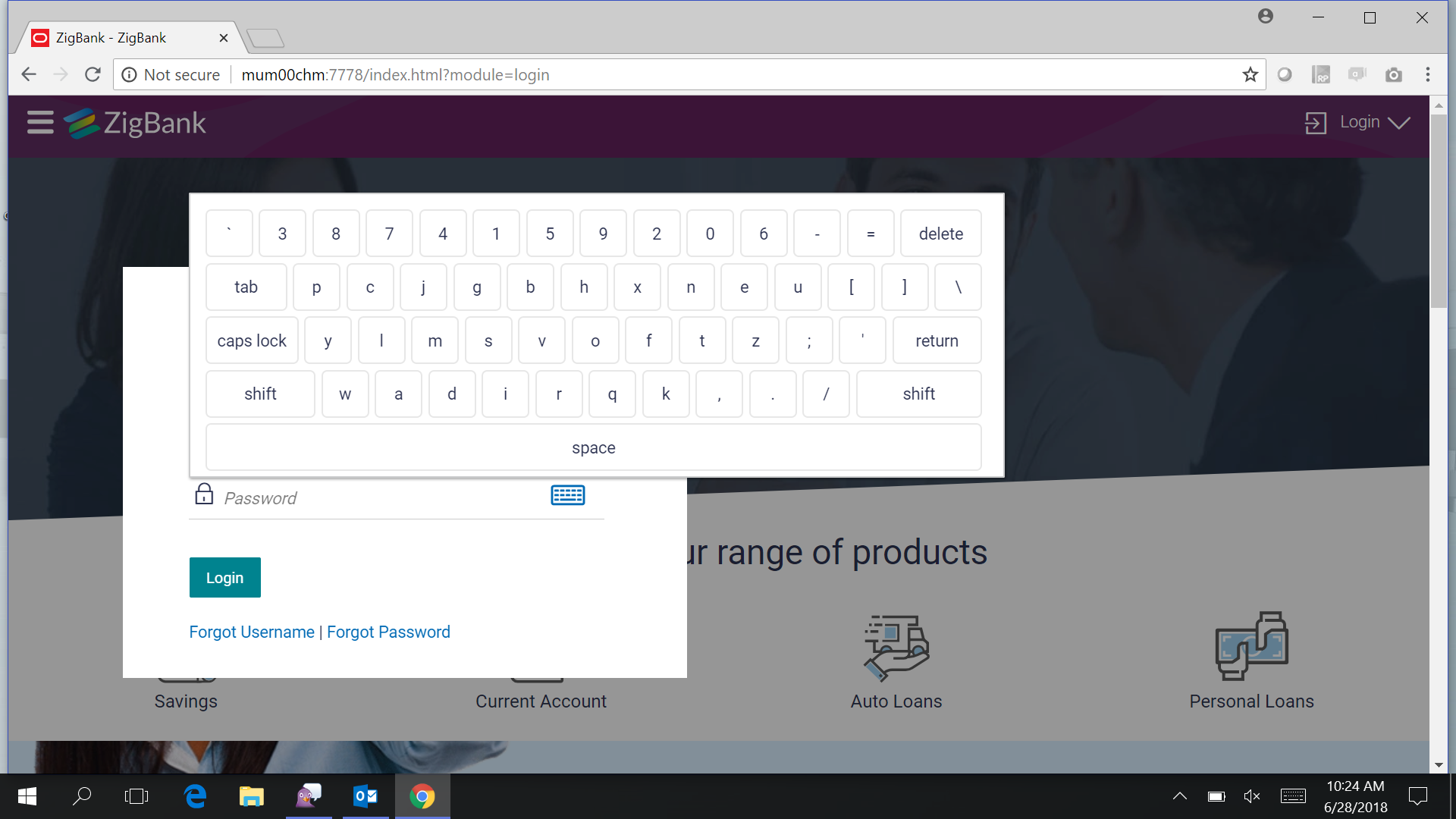

5.2 Virtual Keyboard

Virtual Keyboard is a software component that allows user to enter characters for password input without the need for physical keys.

As part of this release, capability of virtual keyboard has been introduced in the application for the users to enter the password using virtual keyboard thereby reducing the risk of password theft.

Following screens have been enhanced to provide an option to enter the credentials using virtual keyboard.

- User Login Page

- Forced Change Password

- Change Password

- Self Registration

- Originations – User Registration

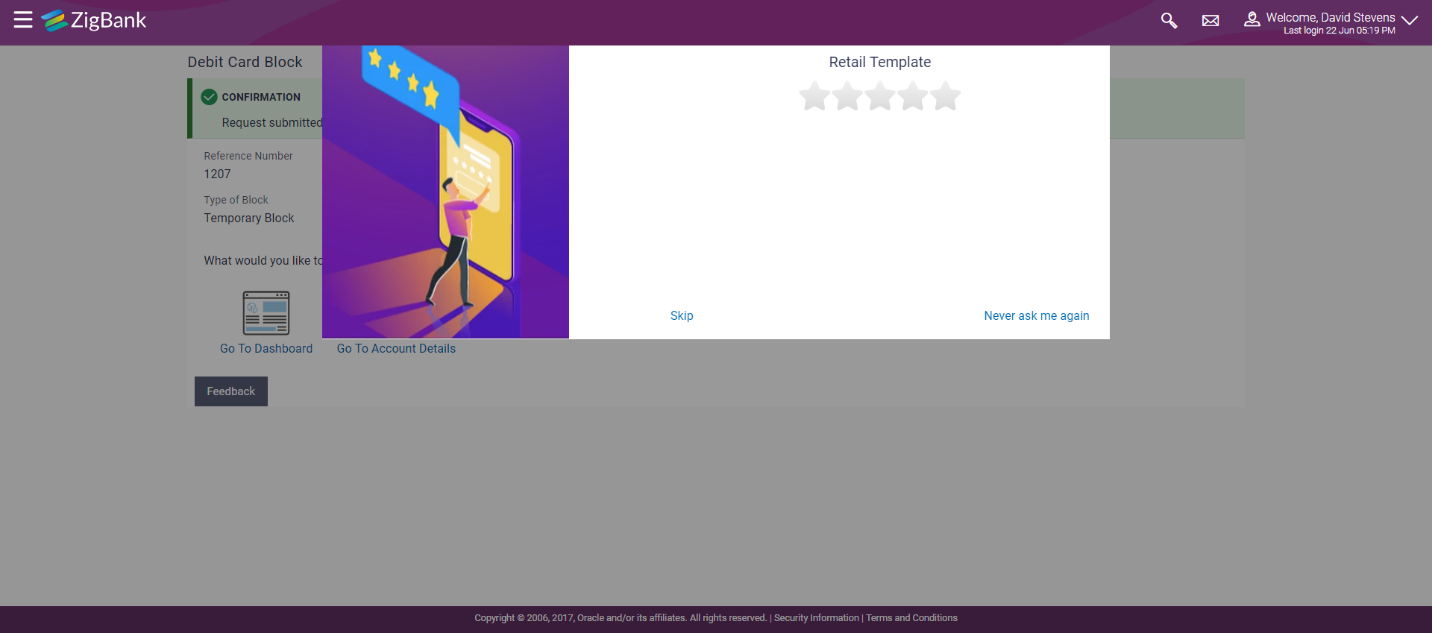

5.3 Feedback and Analytics

Customer experience and satisfaction are very important aspects for the banks and it differentiates one bank from another, hence measuring customer satisfaction is exceedingly important. Feedback capture allows the customers to express their opinion on the services offered by the bank.

As part of this release, the following capabilities have been built as part of feedback:

- Feedback Template definition

- Feedback capture on transaction completion

- General Feedback capture

- Feedback Analytics

Feedback template definition allows the administrator to define the feedback question, select the rating scale, add question and option set along with deciding the set of transactions for which feedback capture needs to be enabled.

The business user i.e. retail as well as corporate user can capture feedback on transaction completion if the transaction is enabled for feedback capture as part of template. The user also has an option to capture general feedback.

The feedback captured by the user i.e. the rating captured along with options selected for the subsequent question asked are stored in the system so that the administrator can carry out analysis and take necessary action.

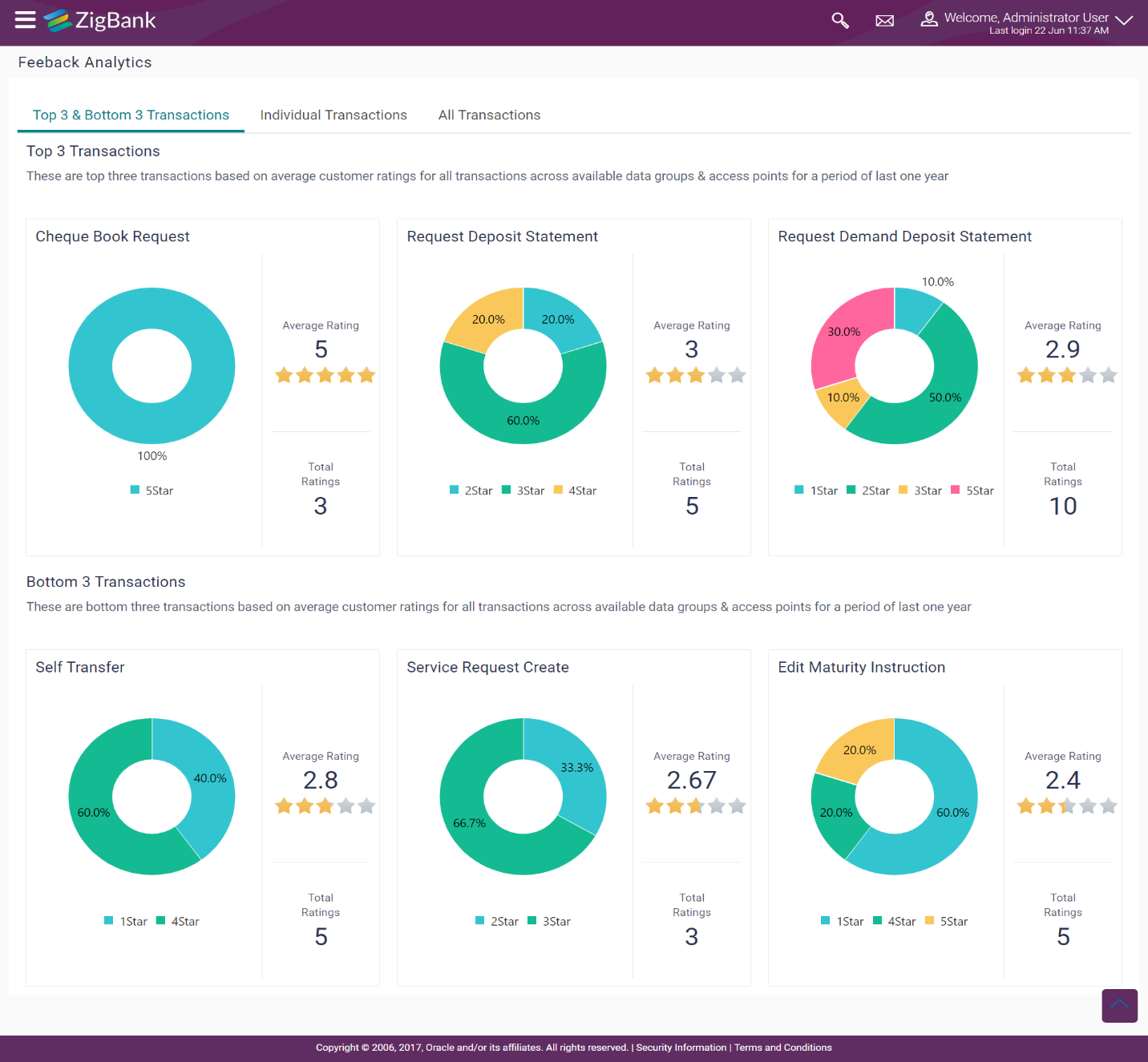

Feedback analytics functionality provides quick insights and analytics into to the customer feedback data captured for various transactions.

5.4 Transaction Confirmation

As a part of this release, transaction confirmation screens have been enhanced to show important details about the transaction along with the transaction reference number and status.

This feature was earlier available on payee maintenance and payment confirmation pages and now has been extended to the transactions available under following modules.

- Current and Savings Accounts

- Term Deposits

- Loans & Finances Credit cards

- Personal Finance Management

- Trade Finance

6. New Business Functions

Following capabilities have been built as part of business functions in release 18.2

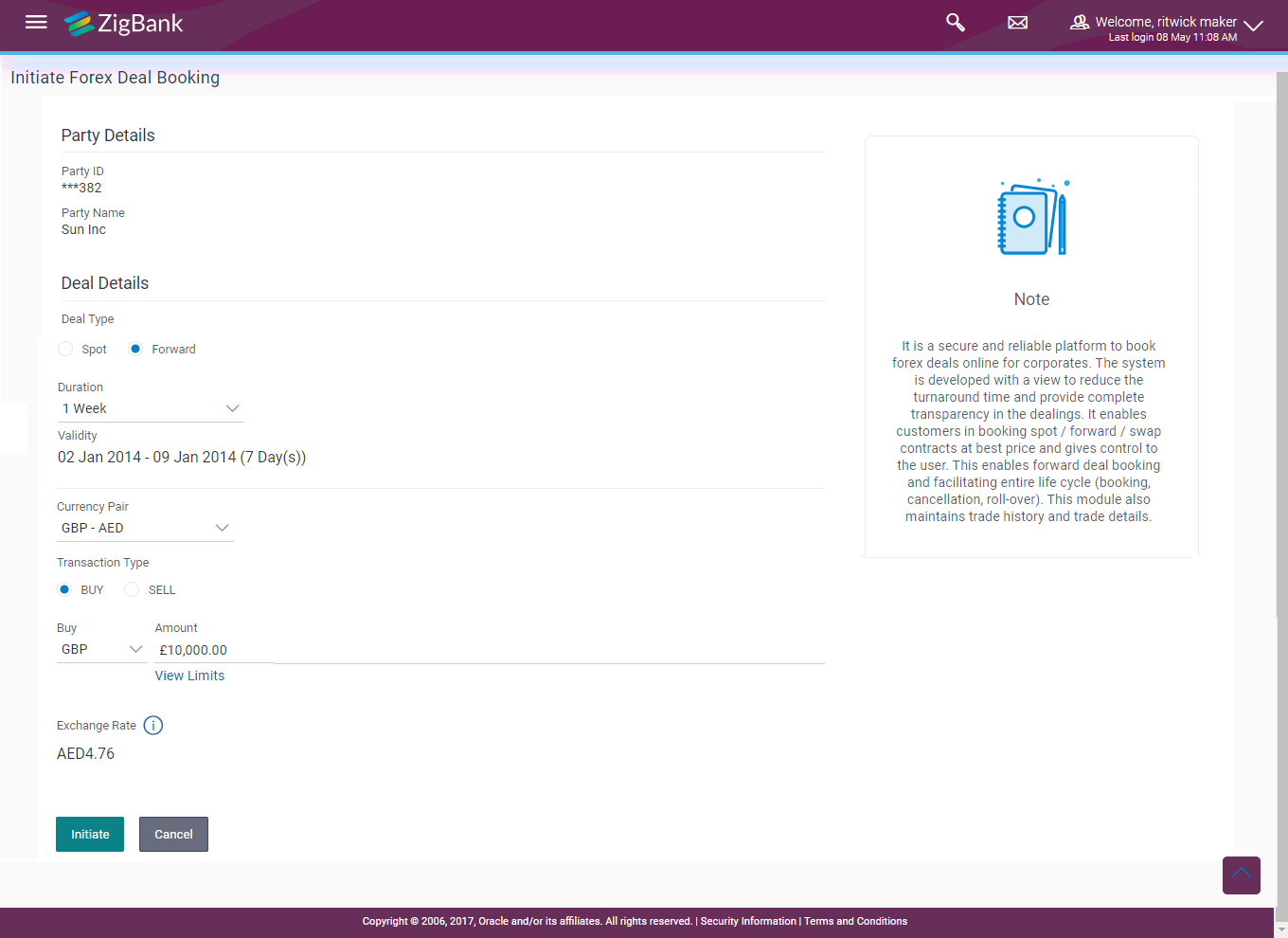

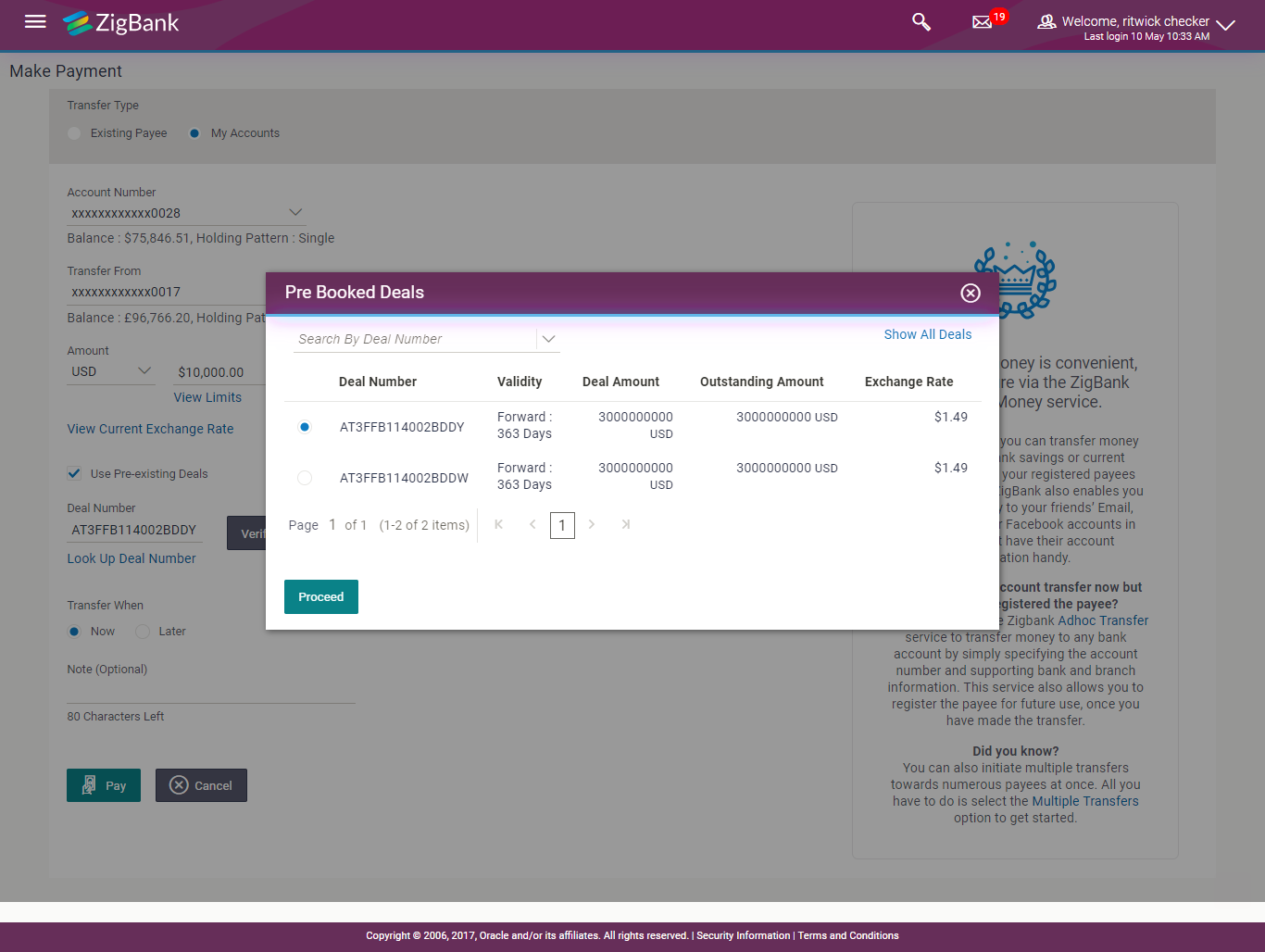

6.1 Forex Deal Booking

Corporates make cross border transfers and to safeguard themselves from the fluctuating currency conversion rates, book forex deals and subsequently use them as part of payment transaction.

As part of this release, following features have been built for the corporate user:

Book Spot/Forward deal

Utilization of booked deal in payments

Following feature has been built as part of administrative maintenance:

Addition of currency pairs: This feature enables the administrator to select currency pairs that will be available for corporate users to book deals and use it while doing international payments.

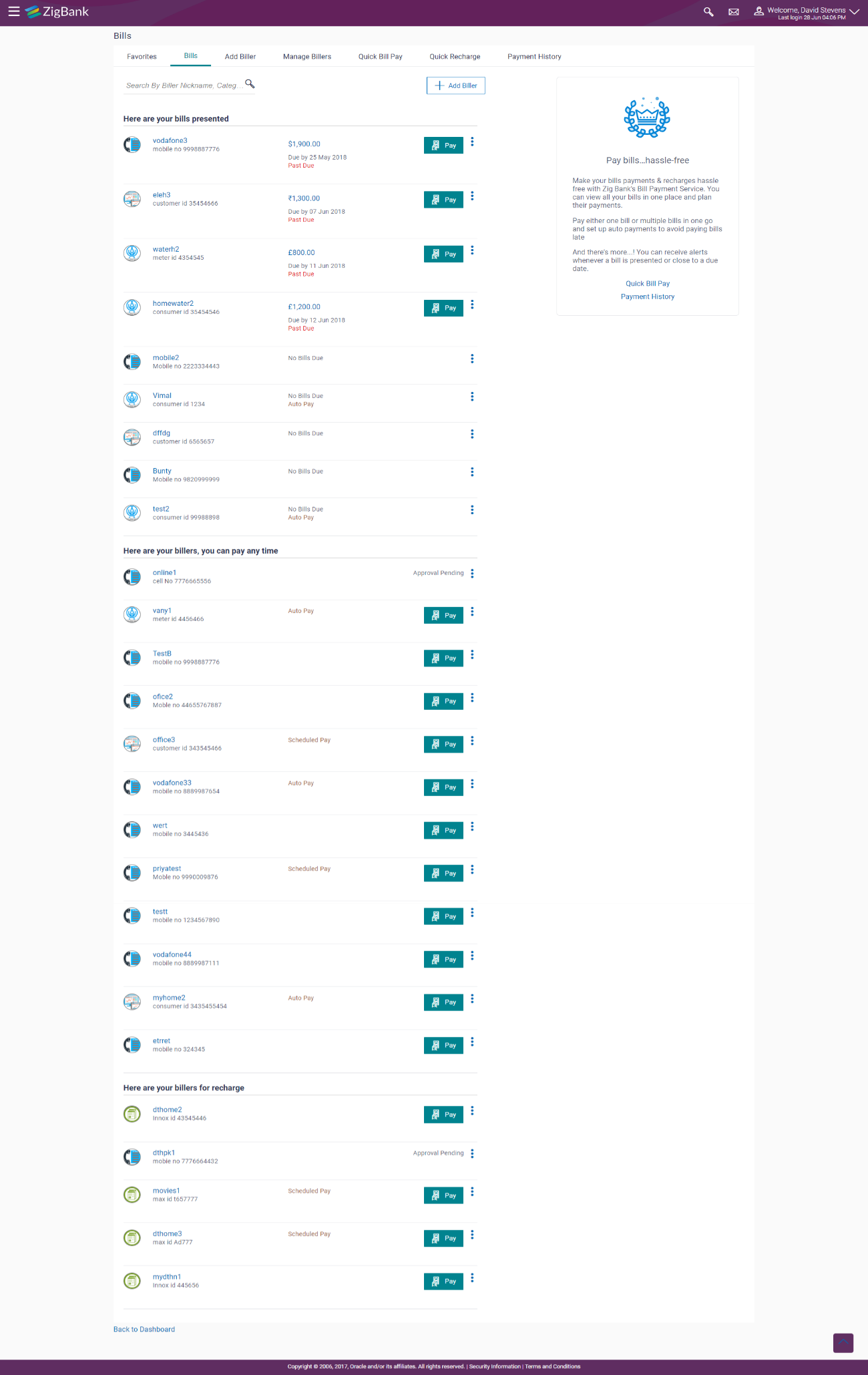

6.2 Electronic Bill Presentment and Payment

Electronic Bill Presentment & Payment (EBPP) is an important functionality that banks provide to customers on channel banking to make bill payments through an automatic payment instruction for the presented bills, make one time payment to the billers and recharge for pre-paid services.

As part of this release, the following capabilities have been built as part of EBPP module:

Administrative Capabilities

Biller Maintenance:

The function enables the administrator to create and maintain billers defining their details like name, address and other important attributes like whether the biller accepts online payment, modes through which the biller accepts the payments etc. Billers can be of following types:

- Presentment type biller: A biller who presents online bills and accepts payments against these bills

- Payment type billers: A biller who does not present bills online but accepts online bill payments

- Presentment and payment type biller: A biller who presents bills and also accepts online payments even when there is no bill presented

- Recharge type biller: A biller who accepts recharges for pre-paid services like DTH, Internet etc.

These billers can be created via Biller creation screen or through a bulk file upload.

Biller Category Maintenance:

Each biller belongs to a category i.e. Electricity, Telecom etc. The function enables the administrator to create and maintain the categories of billers with a provision to upload image files that can be used as icons to denote the billers’ categories.

Business User Capabilities

Biller Registration:

Retail users can register billers by providing the required information and also define a nickname. The registration can go through a validation process if required by the biller and on successful registration; the user will start receiving bills from the next cycle.

Manage & Delete billers:

User can modify the details like biller nickname, can set up auto pay or scheduled pay for the billers and delete the registered billers if required.

Bill Payments:

Retail users can pay bills using their savings & current accounts, debit or credit card depending on the mode of payment acceptable to the biller. Bills can be paid using “Pay Now” or can be scheduled for payment using “Pay Later” option.

Users can create auto pay instructions for presentment type of bills and the bill will be automatically paid before the due date. Upper limit can be set for auto pay instructions and if bill amount breaches the limit, system will alert the user and wait for his intervention to pay the bill.

For billers who do not present bills, users can pay anytime and also schedule a recurring payment. i.e. a fixed sum of money is paid to the biller at a regular interval

Recharges:

Users can recharge their pre-paid services using recharge transaction. An existing pre-paid services plan can be topped up or a new plan can be chosen. The list of plans pre-paid available will be supplied by either the biller or the third party bill aggregator.

Quick Bill Pays and Quick Recharges:

Users can pay bills or carry out recharges for non-registered billers provided the biller accepts such payments.

Payment History:

User can search and view his past bill payments, download or print it.

6.3 Recurring Deposits

Recurring Deposit is an investment tool that permits the customer to hold a deposit with the bank for a fixed term and make regular deposits to earn yields on their investment.

Following list of features are supported in the application:

- Opening of New Recurring Deposit:

This feature enables the customer to open a new recurring deposit by selecting the product, defining the amount, tenor and maturity instructions.

- View Recurring Deposit Details: :

This feature enables the customer to view details of a specific recurring deposit. Details such as holding pattern, account holder information, nomination status, deposit status, applicable interest rate, installment amounts and dates are displayed.

- Edit Maturity Instruction:

The customer may want to modify the maturity instructions of the recurring deposit as defined during opening of the deposit. This feature allows the customer to change the account in which maturity proceeds are to be credited.

- Redeem Recurring Deposit:

This feature allows the customer to redeem the recurring deposit. On pre-mature closure, banks typically pay interest as per the rate of interest applicable for the tenure during which the deposit was kept subject to penal interest (if applicable)

- Request Statement:

This feature enables the customer to request for a physical copy of a recurring deposit account statement for a specific period. The statement will be delivered to the customer’s address registered with the bank

- Calculate installments for Recurring Deposit:

This calculator enables the customer to get information about the monthly installment that needs to be deposited to achieve the target amount in the specified tenor.

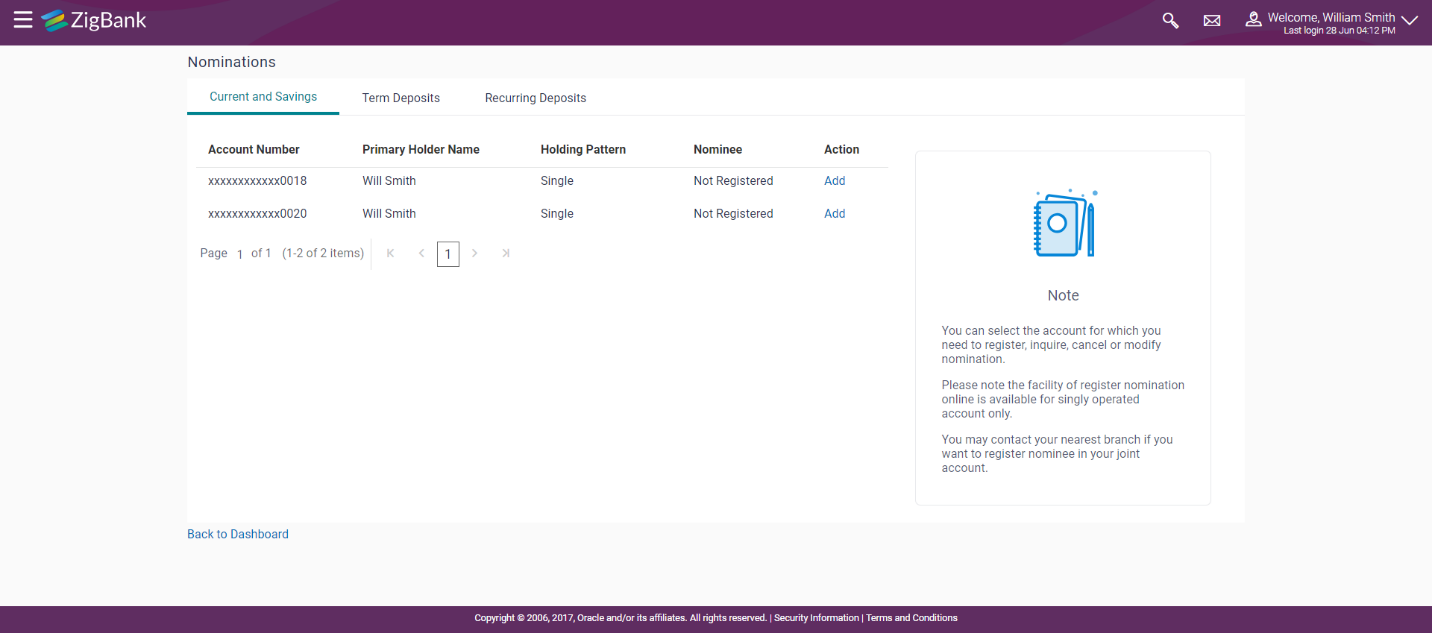

6.4 Manage Nominee

Nomination is the right conferred upon the holder of a bank account to appoint one or more persons who will be entitled to receive the proceeds upon the death of the account holder.

The account holder can add a nominee to singly held current and savings account, term deposit or recurring deposit by specifying the nominee details i.e. name and address.

Features supported in the application

- Add Nominee

- View Nominee

- Edit Nominee

- Delete Nominee

6.5 Sweep-In

This facility allows the bank customer to link a deposit account or CASA![]() Current Account or Savings Accounts are operative accounts through which account holders perform day to day operations such as deposits and withdrawal of money. account as a sweep in account to current or savings account.

Current Account or Savings Accounts are operative accounts through which account holders perform day to day operations such as deposits and withdrawal of money. account as a sweep in account to current or savings account.

In case of insufficiency of funds in the current or savings account, system will automatically transfer/sweep the funds to the beneficiary account i.e. savings or current account from the linked provider account i.e. deposit account or CASA account.

Features supported in the application

- View Sweep In

- Add Sweep In

- Delete Sweep In

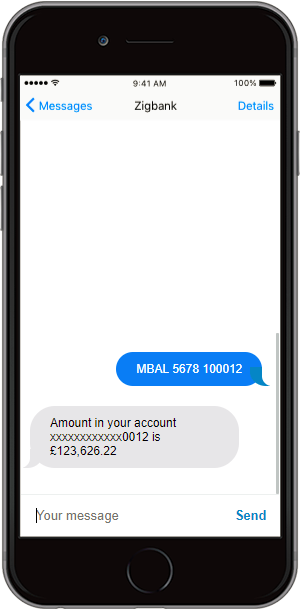

6.6 SMS and Missed Call Banking

SMS and Missed call banking gives the account holder the control to manage his/her account. The account holder has to register his mobile number with the bank to subscribe for SMS and Missed Call Banking.

As part of this release, new capability has been introduced for the user to perform inquiries and non-financial transactions through SMS and Missed Call Banking.

Additionally, an administrative function has been introduced for the administrator to define a template for SMS Banking containing keywords, data attributes and response message for an event and locale combination. For missed call banking, the administrator can define the contact number and response message for event and locale combination.

Sample Message Format for Account Balance Inquiry

MBAL <PIN> <AccNumber>

6.7 User Helpdesk

As part of this release, new capability has been introduced that allows the administrator to perform transaction on request from the business user if the user has forgotten his credentials or is unable to perform a transaction due to other challenges.

To authenticate the user, system sends an OTP to the customer that needs to be communicated to the administrator so that the same can be entered on the screen to create the user’s session.

6.8 FATCA and CRS

FATCA stands for the Foreign Account Tax Compliance Act and is a United States federal law that is in place to counter tax evasion in the United States of America.

CRS stands for Common Reporting Standard and aims at combatting tax evasion on a global level.

As part of this release, new capability has been developed in the system to capture business users’ information so as to comply with FATCA and CRS regulations.

Administrator has an option to enable/disable the FATCA and CRS flag in system configuration and basis this parameter, system can decide whether FATCA & CRS form needs to be displayed to business user to fill in the details.

The forms are displayed based on the customer type i.e. Individuals and Sole Proprietors are displayed the FATCA & CRS Self-Certification Form for Individuals, whereas users (only Trustees, Sole Owners or Authorized Signatories) accessing accounts on behalf of Corporations, Companies and Business Entities are displayed the FATCA & CRS Self-Certification Form for Entities.

Administrators can generate forms pertaining to the FATCA & CRS Declarations from the Generate Reports screen available in the administrator module. The forms will contain details of information submitted by the users in the forms and also contain details pertaining to the date and time at which the form was submitted.

6.9 Payment Enhancements

As part of this release, payments module has been enhanced to include the following features:

- Display Service Charge and Total Debit Amount

The review and confirm screen has been enhanced to display the service charge amount that will be charged to the initiator on initiation of domestic and international transfers. Additionally, the total amount debited from the source account i.e. the sum of the transfer amount and service charge is displayed on the screen.

- Enhancement to Repeat Transfer Transaction

The repeat transfer screen has been enhanced so as to enable the user to initiate a one-time payment towards the payee for which standing instructions have been set. The ‘Pay Now’ transfer will be initiated towards the payee for the same amount as that of each standing instruction. The confirm screen will display specific messages to identify the status of each transaction – the standing instructions as well as the Pay Now transfer.

- Warning Message for Upcoming Transfers

This enhancement has been introduced so as to intimate a user about any transfers that are upcoming towards a payee within the next X days (configurable) and displays a warning message on the review page. The transfer screens impacted are Transfer Funds –Existing Payee, Multiple Transfers, Adhoc Transfers and Repeat Transfers.

- Other Payment Enhancements:

- Duplicate payee check based on Payee Account Number and Network Codes.

- Support of UK and SEPA payments through Adhoc Transfers.

- IMPS network transfers (India region domestic transfers) only with FCR as the host system.

- Enabling the users to select the network (NEFT/IMPS/RTGS) for India region domestic transfers towards registered payees at the time of transfer initiation.

- Facility to confirm destination account numbers at the time of adhoc transfer initiation and payee creation to eliminate incorrect entry of account number. The screens impacted are Adhoc Transfers, Transfer Money – New Payee (applicable only for transfer to Email/Mobile) and Payee Creation.

6.10 Other Enhancements

- Debit Card Enhancements

Enhancements have been made in the debit card module to enable the customer with the below mentioned features:

- Upgrade a debit card:

This feature allows the user to upgrade his existing card by choosing the new debit card type. Details about the new card type can be viewed before choosing the upgrade card. On initiation of request from the user for debit card upgrade, a Service Request is created and assigned to bank administrator for his action i.e. he can approve/reject the request.

- Re-Issue Debit Card:

This feature enables the customer to request for re-issuance of a card if the existing card is not functioning properly due to any physical damage. User need not block existing card for re-issuance request On initiation of request from the user for card re-issuance, a Service Request is created and assigned to bank administrator for his action i.e. he can approve/reject the request.

- Block and Unblock Debit Card:

This feature enables the user to request for a temporarily block on the debit card to prevent any fraudulent transaction. The block is typically placed in scenarios where the user is unsure if the card has been misplaced or stolen. Similarly on finding the card, the user can unblock the card i.e. remove the block so that the same is available for use. On initiation of request from the user for card block/unblock, a Service Request is created and assigned to bank administrator for his action i.e. he can approve/reject the request.

- Hotlist Card:

This feature enables the user to hotlist a debit card if he/she wishes to block the same permanently

- Enable/Disable Debit Card for International Usage:

This feature allows the user to disable international usage if there is no need to use the debit card for any international transactions (online or while visiting other countries).

If the user wishes to carry out international transactions on the debit card, then international usage can be enabled on the card.

- PIN Set and Reset:

This feature has been enhanced to include an additional safety parameter of capturing the user’s date of birth while setting or resetting pin of the debit card.

- Limits for International Usage on Debit Card:

This feature enables the user to define limit for international transactions thereby restricting usage beyond the defined threshold limit.

- Credit Card Enhancements

Enhancements have been made in credit cards to support the following features:

- Alert on Card Re-Issuance:

This will facilitate the customer getting notified through an alert about card re-issuance

- PIN Set and Reset:

This feature has been enhanced to include an additional safety parameter of capturing the user’s date of birth while setting or resetting pin of the credit card

- CASA Enhancements

Enhancements have been made in the CASA module to enable the customer with the below mentioned features:

- Advisor Details:

This feature enables the retail customers to view details of his/her relationship manager and service manager(s) under the widget ‘My Advisors’ on the Dashboard. The advisors can be contacted for any bank related services or query.

- Average Monthly and Quarterly balance:

This feature enables the user to view the maintained average monthly and quarterly balances of the accounts as part of account details.

- TDS Certificate:

As per regulation, interest earned on savings and deposit accounts is subject to tax deduction at source provided the interest is above a specified limit by the regulation.

The information about the collective tax deducted for savings and deposit accounts for a specific period is available in TDS![]() Tax Deduction at Source certificate.

Tax Deduction at Source certificate.

As part of this release, feature of viewing and downloading the TDS certificate with user details has been developed.

- Interest Certificate:

Banks pay interest to the customer for savings and deposit accounts and charge interest on loan accounts.

Interest certificate provides the user with details on the total interest accumulated or debited from the account for a specified tenor.

This feature will enable the customer to view interest certificates for CASA, deposits and loan accounts. User will also have an option to download the same if required.

- Trade Finance:

As part of this release, trade finance module has been enhanced to include the feature of capturing and displaying multiple goods with their units and prices under LCs and Bills. This will be helpful when user is dealing with multiple goods with a same business partner.

- OBPM 14.1.0.0.0 Qualification for Incremental Transactions:

Oracle Banking Payments is a stand-alone Payments Product![]() A product is created based on the bank's business requirements and has certain typical parameters that describe its attributes or characteristics. Every product is defined under Product Class and Product Group.

For example, a product 'Fixed rate home loan' is defined under product group 'Home Loan' and product class 'Loans'. Processor that caters to the payment requirements of both Retail & Corporate segments.

A product is created based on the bank's business requirements and has certain typical parameters that describe its attributes or characteristics. Every product is defined under Product Class and Product Group.

For example, a product 'Fixed rate home loan' is defined under product group 'Home Loan' and product class 'Loans'. Processor that caters to the payment requirements of both Retail & Corporate segments.

Following transactions are qualified with Oracle Banking Payments 14.1.0.0.0 as a part of this release.

- Standing Instructions:

- Create, View and Cancel Standing instruction

- Transactions – Self and Internal Transfers

- File Upload

- File Upload and View Status (Upload in existing OBDX formats)

- Formats - SDSC, SDMC and MDMC

- Transactions – Self, Internal and International Transfers.

- IDCS 18.2.4 Qualification:

Oracle Identity Cloud Service offers core identity and access management capabilities. As part of this release, OBDX has been qualified to offer the following capabilities supporting Identity Management as well as support two legged and three legged OAuth2.0 capabilities

Identity Management Features

- User Onboarding and Management

- Password Policy Definition

- Password Expiry

- Force Change Password for an existing user on expiry

- Force Change Password for new user

- Change Password

- Reset Password

- User Unlock

- Logout

Two Legged OAuth Flow

- Mobile app initiates the request to IDCS and receives an Access Token that is used to access the resources on the resource server

- Device Information is bounded to the token

- Option to De-Register the Device

Three Legged OAuth Flow

Third Party Provider App initiates the OAuth 2.0 flow passing the client ID, client secret, authorization code to IDCS, the user authenticates and provides consent to the Third Party App. Post the consent is obtained from the end user, IDCS provides an access token as well as refresh token to the Third Party Provider.

7. Qualifications

| Sr No | Oracle Banking Digital Experience Modules | Host Integration* | Version |

| 1 | Oracle Banking Digital Experience Originations | Oracle Banking Platform |

2.5.0.2.0 |

| Oracle Financial Services Lending and Leasing | 14.3.0.0.0 | ||

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| 2 | Oracle Banking Digital Experience Retail Servicing | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| Oracle Banking Payments | 14.0.0.0.0 | ||

| 3 | Oracle Banking Digital Experience Corporate Servicing | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| Oracle Banking Payments | 14.0.0.0.0 | ||

| 4 | Oracle Banking Digital Experience SMS Banking | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| 5 | Oracle Banking Digital Experience Retail Peer to Peer Payment | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| 6 | Oracle Banking Digital Experience Merchant Payments | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| 7 | Oracle Banking Digital Experience Customer Financial Insights | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 | ||

| 8 | Oracle Banking Digital Experience Corporate Trade Finance | Oracle FLEXCUBE Universal Banking | 12.4.0.0.0 and 14.0.0.0.0 |

| 9 | Oracle Banking Digital Experience Wallets | Independent of Core Banking solution |

* Refer 'Transaction Host Integration Matrix' section available in module specific user manuals to know transaction level integration details.

8. Browser Support

This chapter lists the qualification of Oracle Banking Digital Experience 18.2.0.0.0 release with various browsers:

| Chrome | Firefox | Microsoft Browser | Safari | |

|---|---|---|---|---|

| Android | Supported * | Not Supported | N/A | N/A |

| Apple watch | Not Supported | Not Supported | N/A | Supported |

| Mac OS X | Supported | Supported | N/A | Supported |

| Windows | Supported | Supported | Supported | Not Supported |

* Support on the Android operating system is limited to Chrome for Android

For complete Browser support policy, please refer to below link: http://www.oracle.com/technetwork/indexes/products/browser-policy-2859268.html

9. Known Issues and Limitations

This chapter covers the known anomalies and limitations in of Oracle Banking Digital Experience Release 18.2.0.0.

9.1 Oracle Banking Digital Experience Known Issues

- Access Point ‘Internet’ needs to be mandatorily provisioned for users requiring only SMS Banking so that first time login process can be completed.

- Issue in View charges for LC and BG and also in BG amendments

- Issue in bulk file upload, International DD issuance with FCUBS 14.1

- Issues in OBDX qualification with IDCS for the following

- First Time Login

- Reset Password and Logout

- Print Password

9.2 Oracle Banking Digital Experience Limitations

NA