Loans

A loan is nothing but an amount of money that is lent by a bank to a borrower for a certain period of time. Banks charge borrowers interest for the amount lent. Hence, loan accounts are valuable income generating assets for banks. It is therefore important for banks to enrich the end user’s loan servicing experience so as to increase user satisfaction and retention. In order to achieve this, banks are constantly making efforts to enhance the online channel banking experience for their users by introducing and revamping loans servicing features on the digital platform.

The application provides a platform by which banks are able to offer their users an enriching online banking experience in servicing their loans.

Users can manage their banking requirements efficiently and effectively through the OBDX self-service channels. The loan module offers users a host of services that include, but are not limited to, viewing their loan account details, schedules and balances and also the facility to make loan repayments.

Features Supported In the Application

The retail loans module of the OBDX application supports the following features:

- Loans Widget

- View Loan Details

- Loan Repayment

- Loan Disbursement Inquiry

- Loan Schedule Inquiry

- Loan Statements

- View Closed Loans

- Loan Calculator and Loan Eligibility Calculator

Pre-requisites

- Transaction access is provided to retail user.

- Loan accounts are maintained in the host system under a party ID mapped to the user.

Loans and Finances Widget - Overview

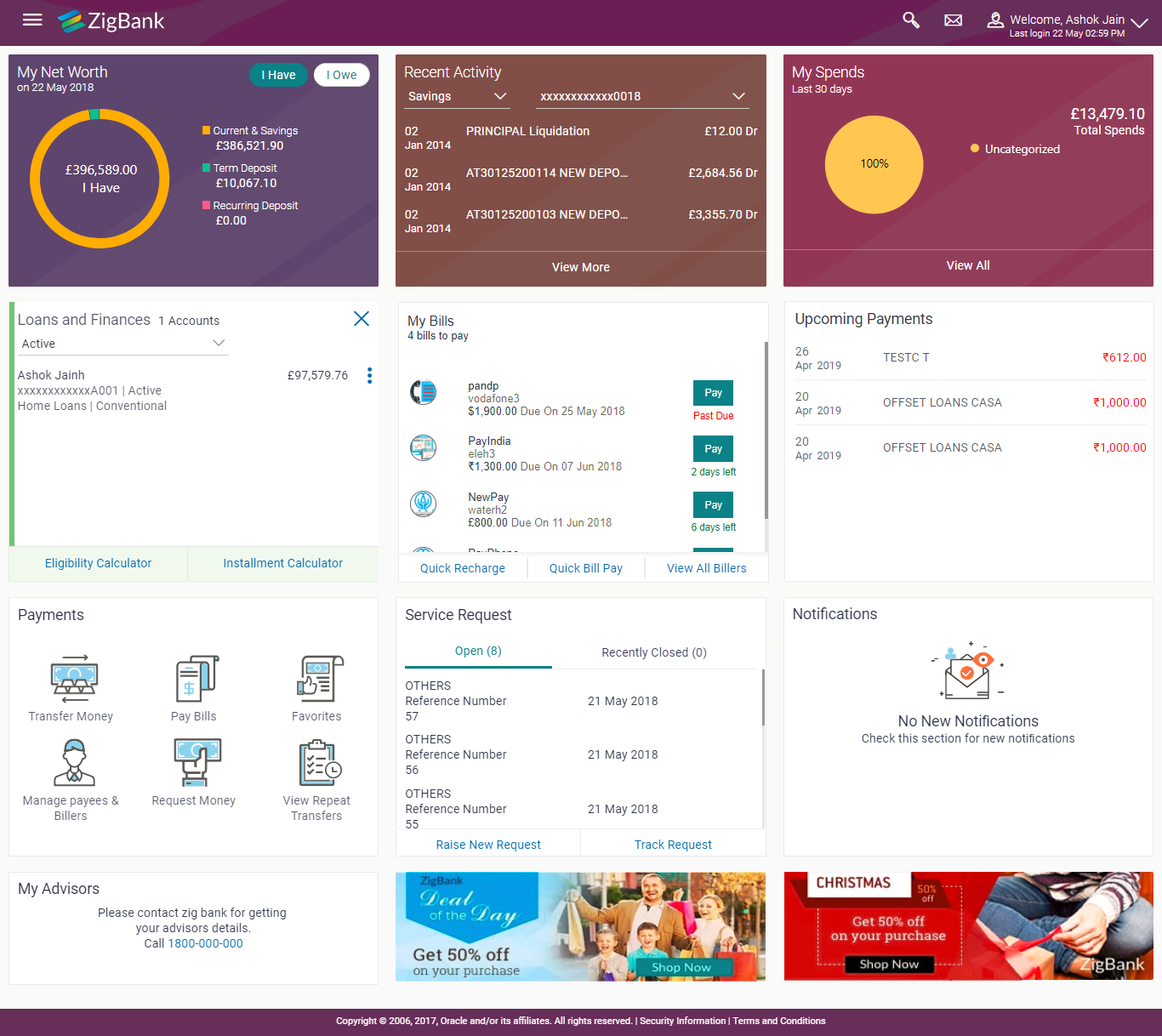

The retail overview/ dashboard page displays an overview of the user’s holdings with the bank as well as links to various transactions offered to the user. The ‘My Accounts’ widget displays the user’s holdings in each account type such as Current and Savings Accounts, Term Deposits, Loans and Credit Cards. On clicking on any account type record, the widget displaying details specific to that account type is displayed. One such widget is the Loans widget which is displayed on selection of account type, ‘Loans’ under the My Accounts widget.

The loans widget has been designed to showcase the lending profile of a user. By viewing the loans widget, the user should be able to gain an insight into the current position of the loans he holds with the bank.

|

Active Loans The loans and finances widget provides the user with the option to view the summary of both the active loans and closed loans individually. On selecting the status option ‘Active’, all the active loan accounts of the user held with the bank are listed down. Each account is displayed along with the outstanding amount, the name of the primary holder (along with nickname if enabled), the loan offer name, as well as the type of loan i.e. conventional or Islamic. The user is able to view further details and perform various tasks on any loan account by selecting a specific loan from the widget. |

|

|

Inactive/ Closed Loans: On selecting the status option ‘Inactive/Closed’, all the loans of the user that have been closed are listed down in the widget. The total number of closed loans is displayed and each loan account is listed along with the name of the primary holder (along with nickname if enabled), the loan offer name, loan type i.e. conventional or Islamic and outstanding balance as zero. The user is able to view further details of any closed loan by selecting a loan from the widget. |

|

|

Eligibility Calculator: The loans and finances widget also contains a link by clicking on which the user can navigate to the loan eligibility calculator. This calculator enables users to compute the amount of loan they are eligible for based on certain criteria. |

|

|

Installment Calculator: In addition to the link provided to navigate to the loan eligibility calculator, the loans and finances widget also contains a link by which the user can navigate to the loan installment calculator. The installment calculator enables the user to identify the installment amount payable on a loan of a certain amount for a specific duration. |