Recurring Deposits

A Recurring Deposit is a special kind of Term Deposit offered by banks. It is an investment tool which permits those with an ability to make regular deposits earn decent returns on their investment.

Basically consisting of regular deposits and an interest component, a Recurring Deposits provides flexibility and ease of use to individuals compare to rigid fixed deposits.

It is a deposit held at a bank for a fixed term, generally ranging from a month to a few years. If compared to regular savings accounts, the interest earned on recurring deposit is higher.

Customers opt to invest in recurring deposits as they are a safe and secure mode of investment and yield higher returns than regular checking or savings accounts.

Pre-requisites

- Transaction access is provided to retail customers.

- Recurring Deposit accounts are maintained in the host system under a party ID mapped to the customer.

Features Supported In the Application

The retail module of the application supports the following features:

- Apply for a New Recurring Deposit

- View Recurring Deposit Details

- Edit Maturity Instruction

- Redeem Recurring Deposit

- View Recurring Deposit Statement

- Request Statement

- Calculate installments for Recurring Deposit

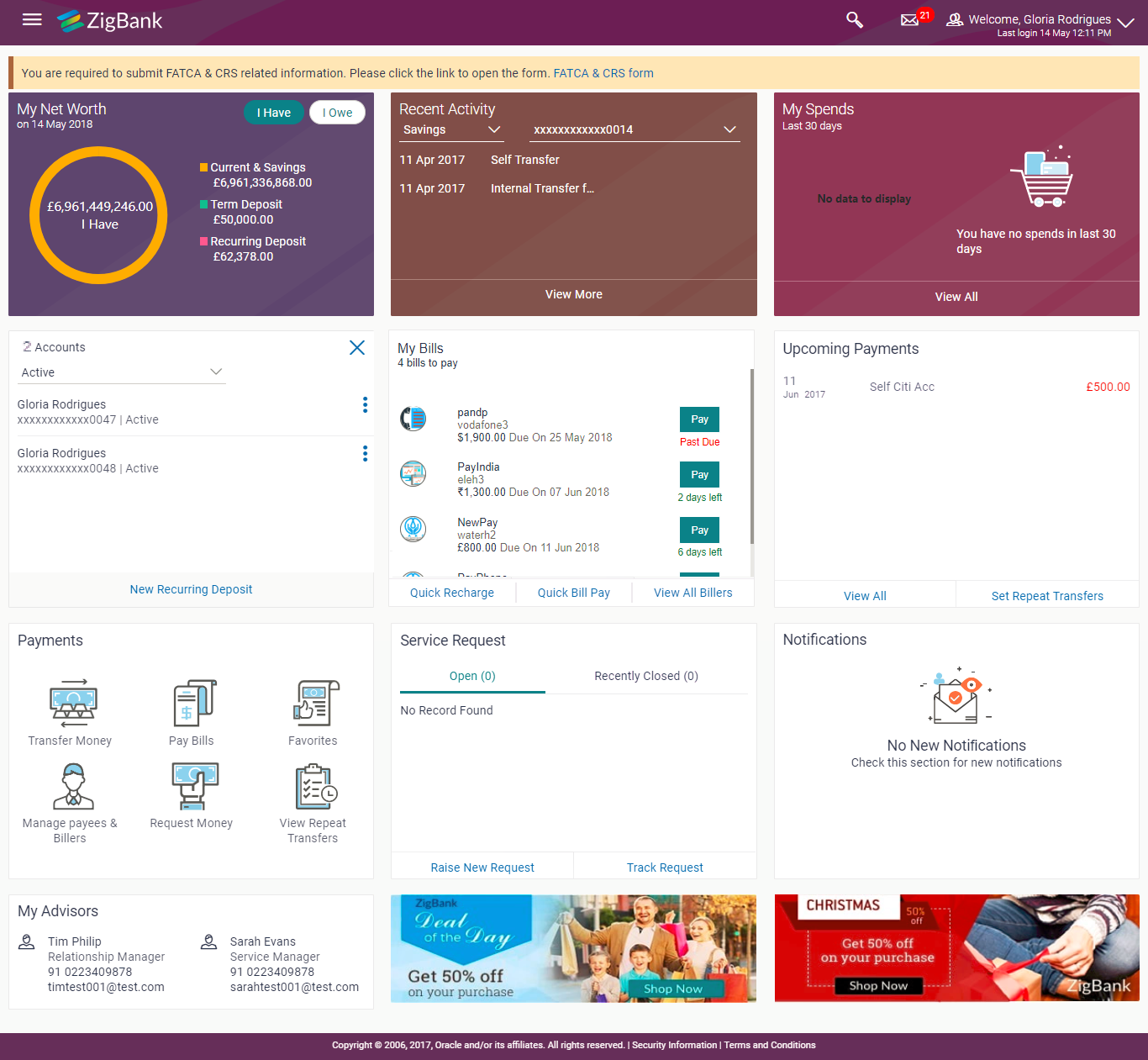

RECURRING DEPOSIT WIDGET

The Recurring Deposit widget showcases a summary of the accounts held by the customer. It provides the facility for users to access all the important features and information related to the account.

![]() How to reach here:

How to reach here:

Dashboard > My Accounts Widget > Recurring Deposit

Click on components to view in detail.

|

Recurring Deposits This section lists down all the active and inactive recurring deposits that the customer holds with the bank.

|

|

|

New Recurring Deposit: The customer can click on the New Recurring Deposit link provided in this widget to book new recurring deposit. |