Most countries have implemented deposit insurance schemes to safeguard the interest of the depositors if bankruptcy of the depository institution. With the introduction of regulations such as Basel III, the insured part of a deposit must be identified and treated appropriately for liquidity risk purposes. Recent regulations, such as FDIC 370, mandating banks to identify and report the insurance coverage at an account level for various ownership rights and capacities to ensure that the insurer pays out the amount due to depositors promptly.

OFS Deposit Insurance Calculations for Liquidity Risk Management covers deposit insurance calculations for liquidity coverage ratio and other calculations required for Liquidity Risk Management. The application identifies insurance eligible accounts under a particular deposit insurance scheme. The right and capacity under which these accounts are held, and the insurance limit provided by the country-specific insurer for each account. It allocates the insurance limit to the account level based on the ownership right and capacity and identifies the insured and uninsured portion of the account. Specifically, this release addresses the FDIC 370 guidelines, which will be followed by coverage for other countries.

The approach to the guidelines for the bank’s deposits is split into three aspects:

· Prerequisites for Insurance Calculation

· ORC Classification and Insurance Calculation

For brokered deposits, the bank may provide data in a reduced format as per Alternative Recordkeeping requirements. For such accounts, the ORC Classification is a download in OFS DICLRM. The Insurance calculation and the allocation process for these accounts are done with the bank’s accounts.

Topics:

· Prerequisites for Insurance Calculation

· ORC Classification and Insurance Calculation

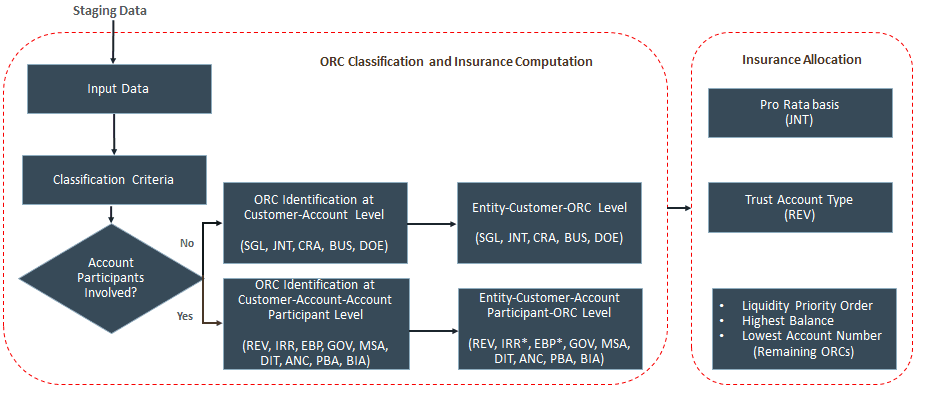

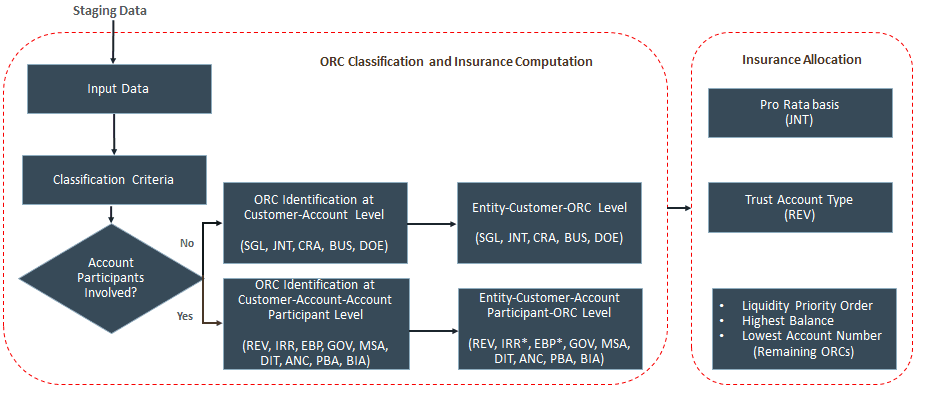

For the Bank’s accounts, the classification and calculation process to comply with FDIC Part 370 guidelines is as shown in the following diagram:

Figure 7: Solution Process Flow

Before classifying accounts and calculating the insurance, you must determine the following prerequisites. They are used during ORC classification or insurance determination. These include identifying FDIC Insurance eligible accounts, Identification and treatment of merged entities, Pre-insurance computations, and Treatment for deposits denominated in foreign currencies.

Topics:

· Identification of FDIC Insurance Eligible Accounts

· Entity based insurance calculation.

· Treatment of Deposits Denominated in Foreign Currencies

· Recognition of Death of Parties

The first step in determining insurance is to identify the subset of deposit accounts that are eligible for insurance coverage from the FDIC. Only FDIC Insurance-eligible accounts go through the FDIC Part 370 classification criteria and insurance calculation.

A deposit account is identified as eligible for deposit insurance coverage by FDIC based on the following criteria:

· Account domicile

· Domicile of the covered institution or its branch

· Whether the customer is internal to the organization structure or not

Additionally, identification and inclusion of overseas military banking facilities for the United States are also treated under the eligibility criteria.

NOTE:

Deposits held by a depositor in the same right and capacity with multiple insured entities or the US branch of foreign entities are covered separately per entity for all the US branches of each foreign legal entity.

Only deposit accounts that have a balance greater than zero are considered for deposit insurance.

Prepaid Cards and Credit Cards with excess balance are also considered as eligible accounts for deposit insurance.

FDIC Insurance coverage is extended at a legal entity level. This indicates that all the accounts belonging to the same counterparty, same right and capacity, and the same legal entity are aggregated for insurance determination.

In a domestic scenario, the coverage is at the legal entity level, which indicates that the branches of a legal entity are not covered separately but are included in the legal entity coverage.

In certain instances, wherein a branch is covered separately from the legal entity, such as a branch of a foreign legal entity, the application provisions identifiers to capture and process this information. The granularity of the Insurance calculation as per FDIC Part 370 is as follows:

· Insured Legal Entity/Separately insured Branch: Ownership Right and Capacity - Customer

In this case, the beneficial owner is the customer.

· Insured Legal Entity/Separately insured Branch: Ownership Right and Capacity - Customer - Beneficial Party

In this case, the beneficial owner is a party other than the customer. The insurance is provided on a pass-through basis.

NOTE:

· Banking facilities in overseas military bases are considered as domestic and treated accordingly. That is, FDIC covers all the domestic branches of a domestic legal entity along with the legal entity itself. This includes overseas military operations of a domestic legal entity. There is no separate coverage at the branch level.

· Deposits held in multiple US branches of a foreign legal entity, in the same right and capacity, are aggregated together for FDIC insurance. The coverage is not at an individual US branch level.

During restructuring, such as mergers, the FDIC has a six months grace period in recognizing the financial institution for insurance calculations. If two depository institutions, whether insured entities or separately insured branch and entities (in the case of US branches of foreign banks), merge or go through an acquisition, the deposit treatment for these institutions are as follows:

· If the restructuring occurred less than or equal to 6 months from the As of Date:

Treat the two entities as separate entities and compute the deposit insurance for the accounts held by them separately.

· If the restructuring occurred greater than 6 months from the As of Date:

a. If there are term deposits whose maturity is greater than 6 months from the restructuring date and are not renewed within 6 months, then the application treats them separately from the acquiring entity for deposit insurance calculation purposes till the maturity of such deposits.

b. If there are term deposits that are renewed within 6 months of the restructuring on identical terms as the original terms, the application treats them separately from the acquiring entity for deposit insurance calculation purposes till the first maturity.

Deposits held in foreign currencies are covered by FDIC, provided they meet other criteria for insurance eligible accounts. The application determines deposit insurance in terms of US dollars for all accounts, including foreign currency denominated deposits. The currency conversion rates used for this purpose are the 12 PM rates, meaning noon buying rates for cable transfers quoted by the Federal Reserve Bank of New York, unless a different source is specified under the agreement. The exchange rate source for the conversion of foreign currency-denominated deposits is captured separately from the rates used for other computations at an insured entity/branch level.

This section applies to the FDIC Customer type Individual only. FDIC provides a six months grace period for recognizing an individual customer’s death for deposit insurance coverage. That is an individual is recognized as dead only after 6 months from the date of his/her death for deposit insurance purposes. This grace period applies to customers only and does not apply to account participants such as beneficiaries.

In this process, an initial aggregation is done by the customer. If a customer’s total funds in all accounts held at a Legal Entity level is less than the Standard Maximum Deposit Insurance Amount (SMDIA) and the setup master entry for the component code FDIC_DEP_AGGR_option is Yes, the initial aggregation is done at a Customer level. When the option is chosen as No, the aggregation is only done at an Ownership Right and Capacity (ORC) level.

A deposit account, if eligible for deposit insurance coverage from FDIC should be classified into one of the 14 ORCs as listed by FDIC. The classification is done using multiple criteria, such as customer type, fiduciary relationship criteria, deposit primary purpose, and so on.

After the classification is done, the insurance calculation is completed at a granularity level by the ORC to which the record is classified. For each ORC, the aggregated amounts are compared to the SMDIA. If the aggregated amount is lesser than the SMDIA, then the entire amount is insured, else, the funds up to SMDIA are insured and the portion exceeding the SMDIA is uninsured.

Topics:

· Certain Retirement Accounts (CRA)

· Employee Benefit Plans (EBP)

· Revocable Trust Accounts (REV)

· Irrevocable Trust Accounts (IRR)

· Mortgage Servicing Accounts (MSA)

· Accounts held by a Depository Institution as the Trustee of an Irrevocable Trust (DIT)

· Custodian Accounts for American Indians (BIA)

Coverage under this ORC extends to accounts that are either owned by one natural person or treated as if one natural person owns them. The single accounts category includes the following:

· Individually owned accounts

· Accounts in the name of a deceased person or the estate of a deceased person

· Sole proprietorship accounts

The following are also included in SGL ORC:

· Retained Interest from Irrevocable Trust

· The interest of Ineligible beneficiaries for Revocable Trust

· The interest of Ineligible beneficiaries for Irrevocable Trust

· Single accounts for Taxes and Insurance premiums of mortgagors

· Business accounts not engaged in independent activity

· Joint accounts where the number of owners has reduced to one

SGL ORC is also the default ORC for any FDIC Insurance eligible account that has all its data elements available but does not fit the classification criteria for the other ORCs.. For example, if an account has any data elements missing, it will be marked as ‘Pending’. However, if an account has all the data elements present, but does not fit into any ORC bucket, then it is tagged as SGL.

Topics:

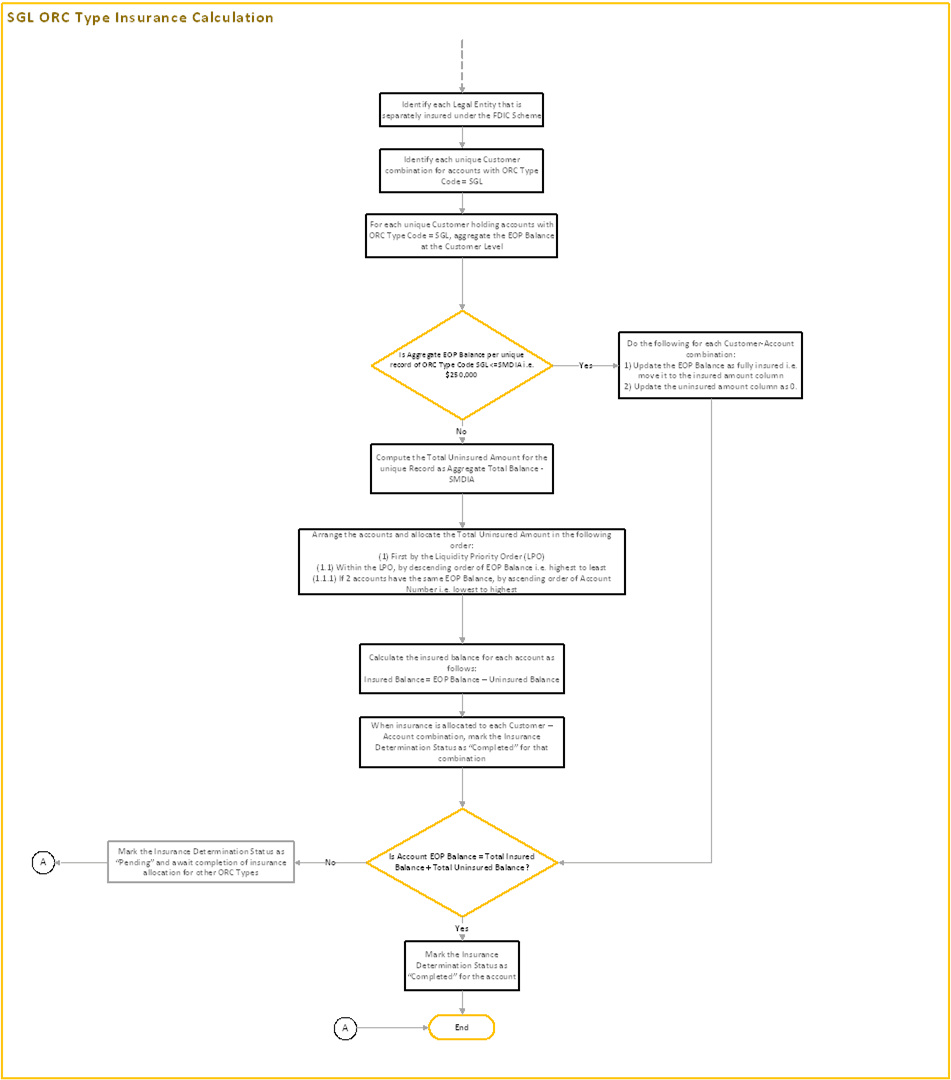

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied in the following way:

A deposit held by an individual in his or her capacity in a single account is insured for a maximum of up to the SMDIA.

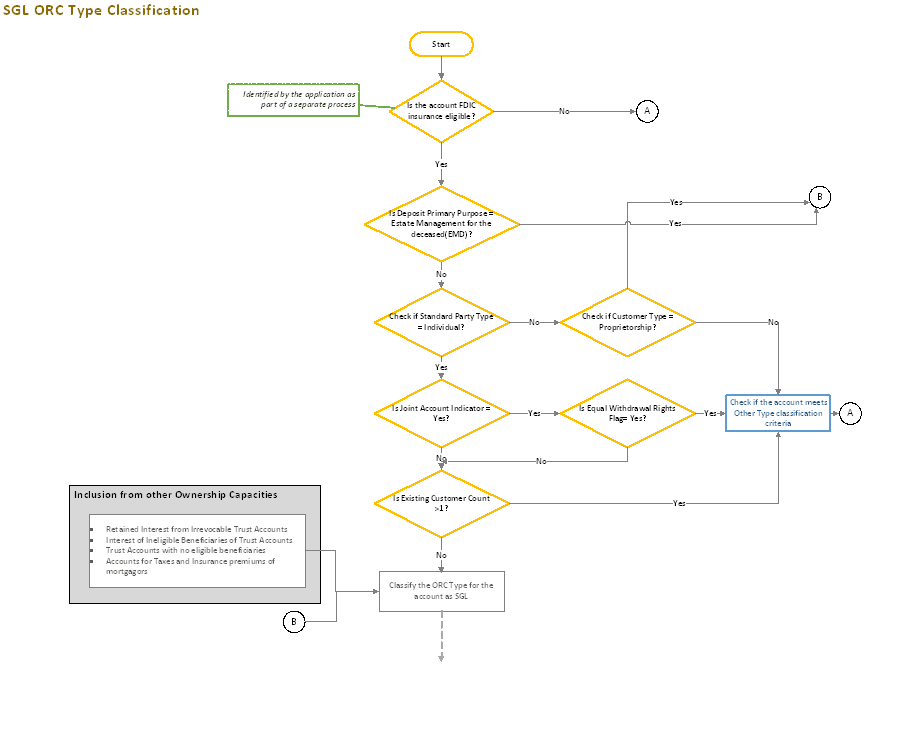

The process flow for Single Accounts (SGL) ORC Type Classification is as follows.

Figure 8: Process Flow - SGL ORC Type Classification

Figure 9: Process Flow - SGL ORC Type Classification (continued)

A joint account is a deposit owned by two or more individuals who meet the following criteria:

a. Each co-owner must be a natural person.

b. All co-owners must have equal withdrawal rights.

c. All co-owners have signed the signature card or equivalent.

Topics:

· Treatment in case of Death of co-owner

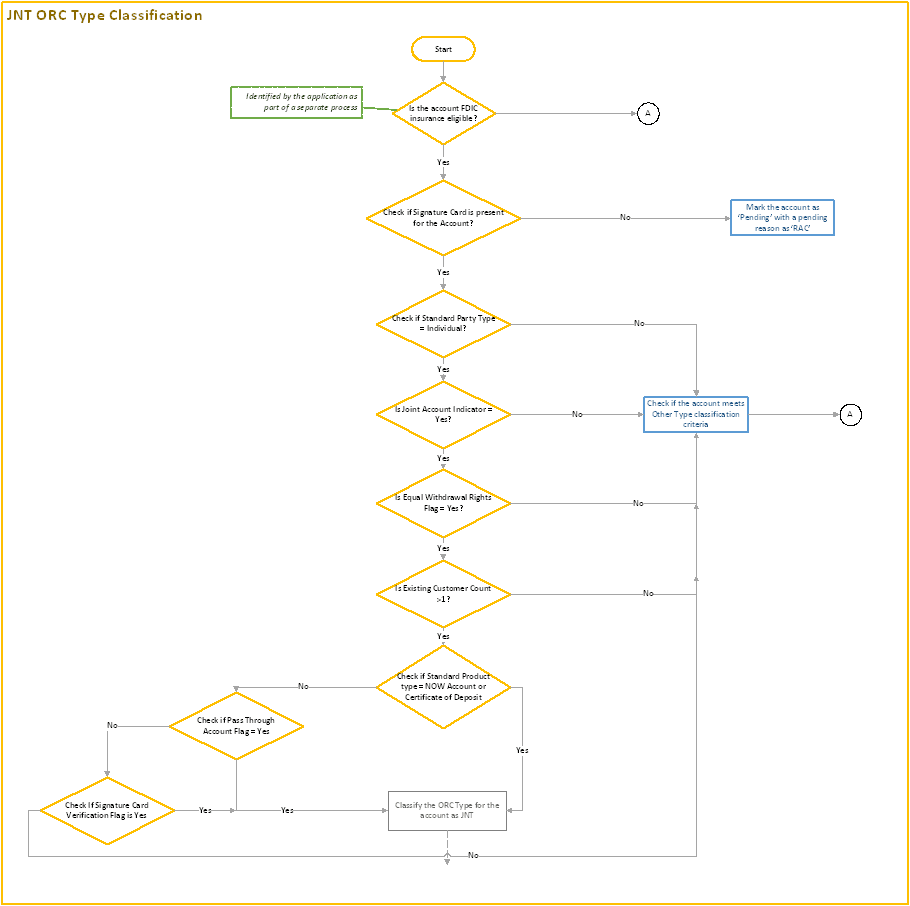

The Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For JNT, this translates to:

Each co-owner of a joint account is insured up to SMDIA for the combined amount of his or her interests in all joint accounts at the same IDI. In determining a co-owner’s interest in a joint account, the Application assumes each co-owner is an equal owner.

Given that the FDIC does not distinguish coverage based on whether the Joint accounts are held under ‘Rights of survivorship’ or ‘Tenants in common’, the application treats death across all joint accounts in the same manner. If a co-owner dies, the deposit balance applicable to the co-owner is distributed to the other co-owners.

For a Joint account on the death of a co-owner, if the number of surviving owners is not more than 1, then such accounts revert to be treated in the SGL category.

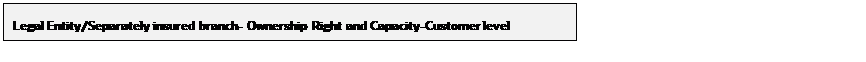

The process flow for Joint Accounts (JNT) ORC Type classification is as follows.

Figure 10: Process Flow - JNT ORC Type Classification

Figure 11: Process Flow - JNT ORC Type Classification (continued)

This Ownership Right and Capacity include Individual Retirement Accounts (IRA) such as Traditional and Roth IRAs, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, Simplified Employee Pension (SEP) IRAs, and Section 457 deferred compensation plans. This also includes self-directed Keogh Plans and self-directed Defined Contribution plans.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

Insurance calculation for this ORC is done at this level irrespective of whether the customer has named beneficiaries or not.

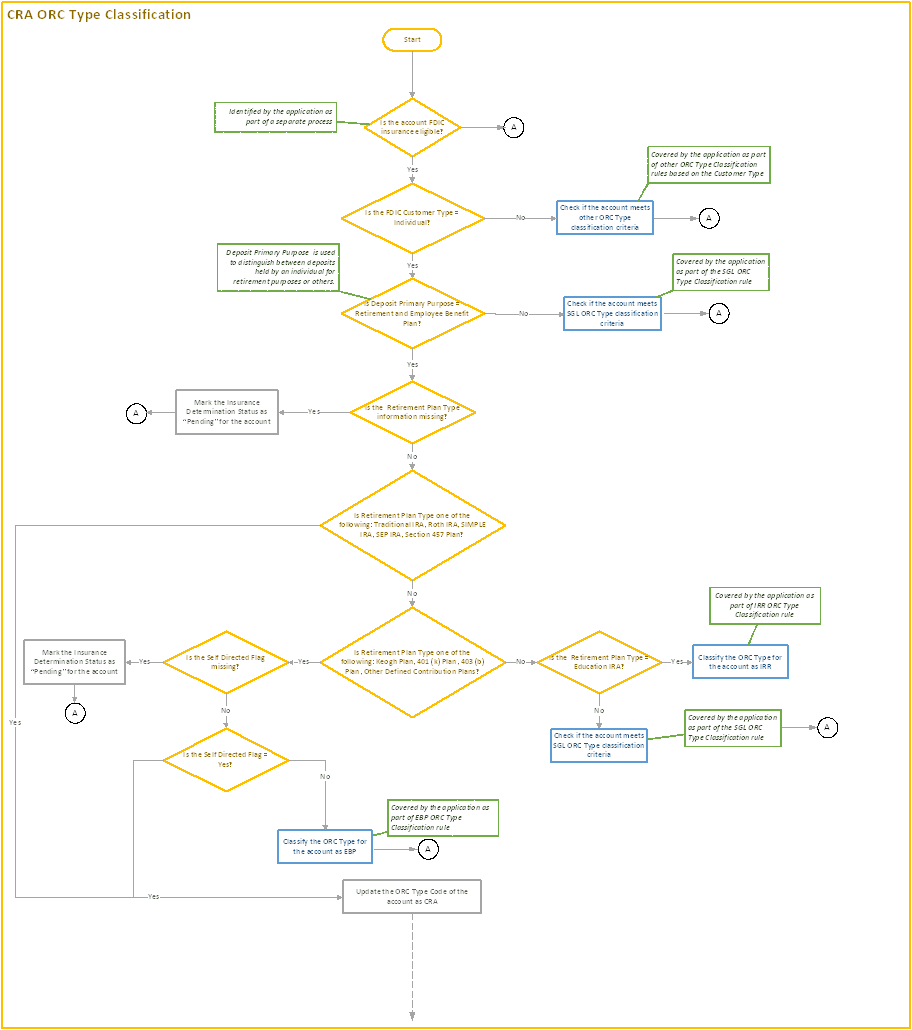

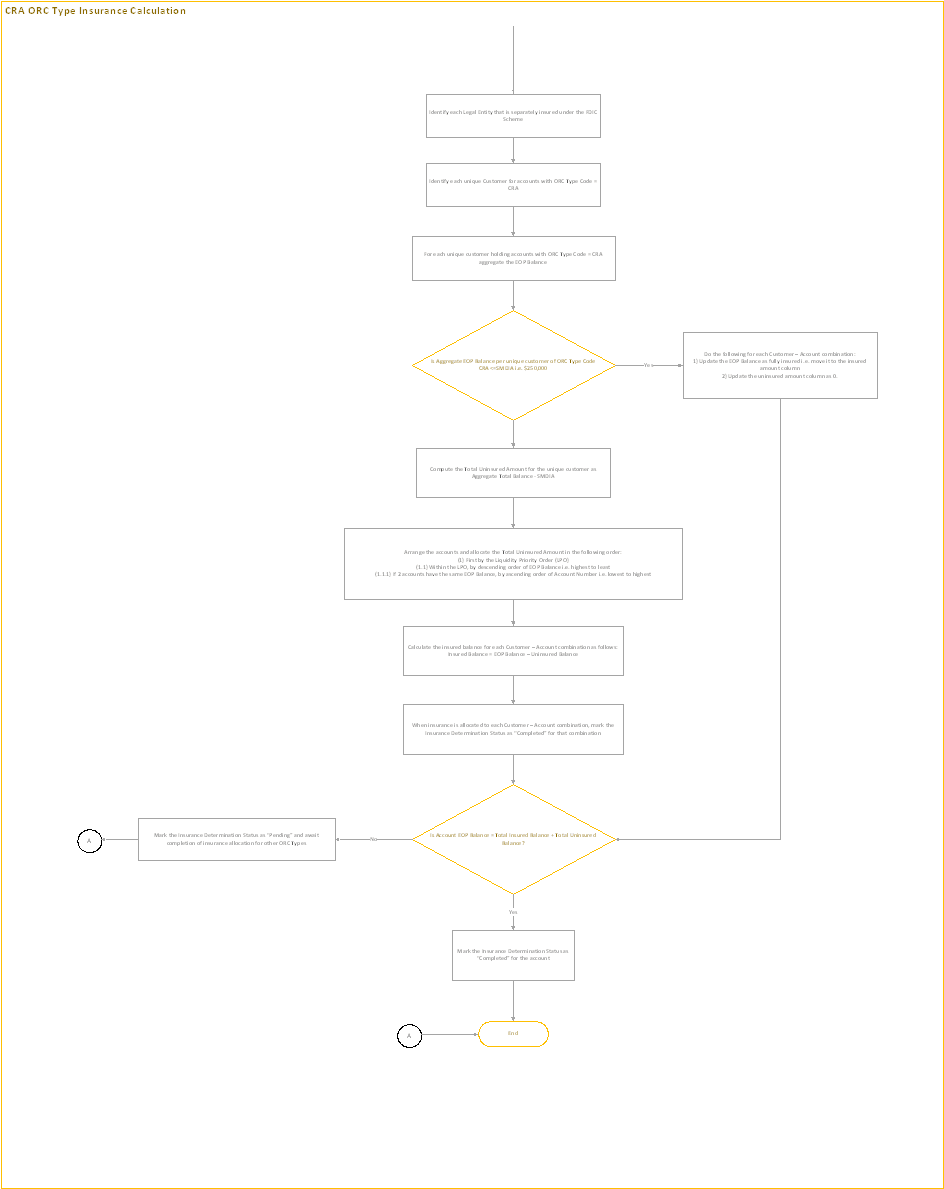

The process flow of Certain Retirement Accounts (CRA) is as follows.

Figure 12: Process Flow - CRA ORC Type Classification

Figure 13: Process Flow - CRA ORC Type Classification (continued)

Under this ORC, all the defined benefit plans and defined contribution plans that are not self-directed are covered.

A defined benefit plan is one where the employer aggregates money in a retirement account and arranges to pay employees a fixed monthly payout during retirement, or mostly referred to as a pension.

A defined contribution plan, like 401(k), requires employees to put in their own money into the retirement accounts. The employer may also make contributions regularly. Future benefits in this type of plan are subject to investment fluctuations. Defined contribution plans that are not self-directed are covered in this ORC.

Overfunding amounts are computed by the Application by taking into consideration the Total Allocation Percentage of all employee benefit plan participants associated with an Employer. If the Total Percentage is less than 100%, it is determined that there is Overfunding in the deposit account. This amount does not belong to any participant and instead belongs to the Employer.

All Overfunding amounts for an Employer are aggregated and receive a separate SMDIA under EBP ORC.

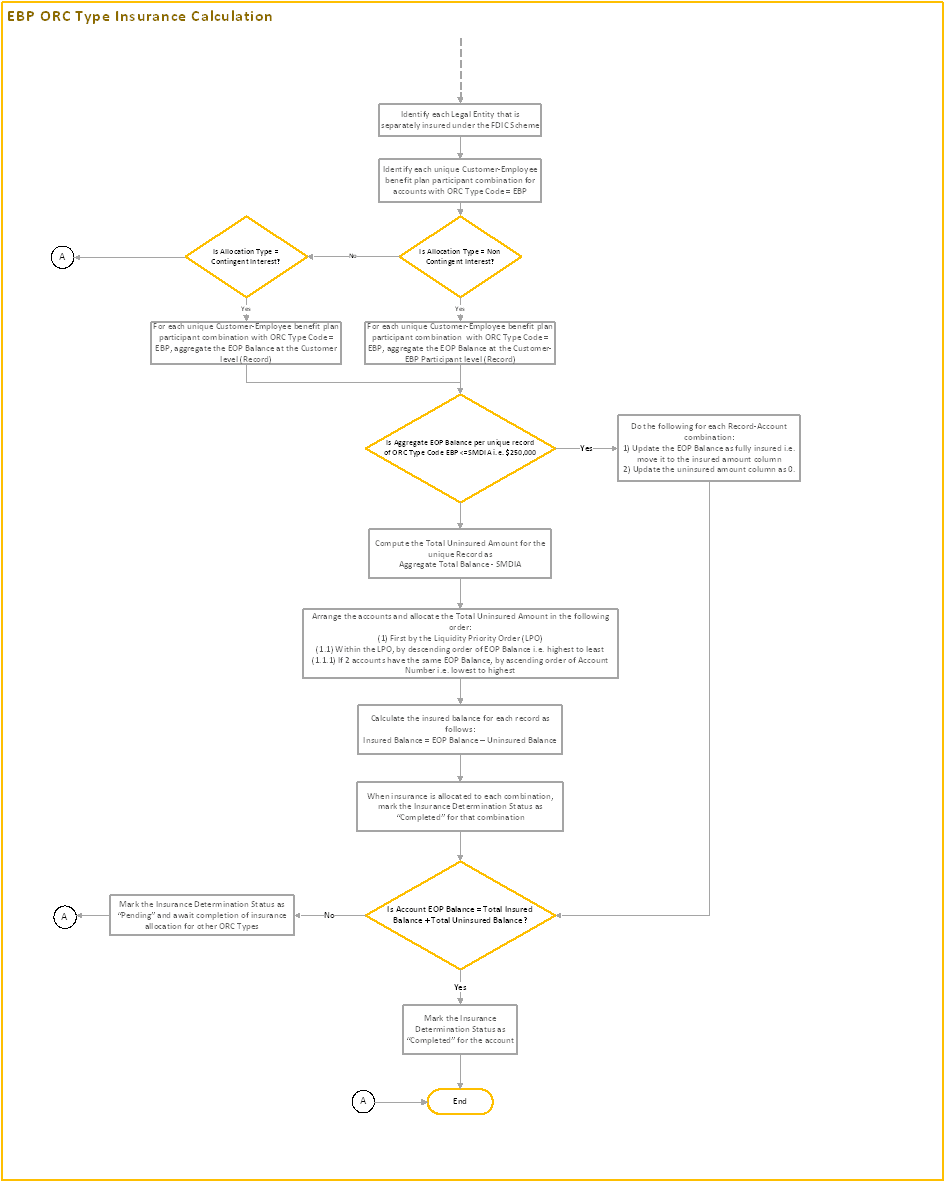

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) for Non-Contingent Interests are applied at:

For EBP, this translates to:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) for Contingent interests are applied at:

For EBP, this translates to:

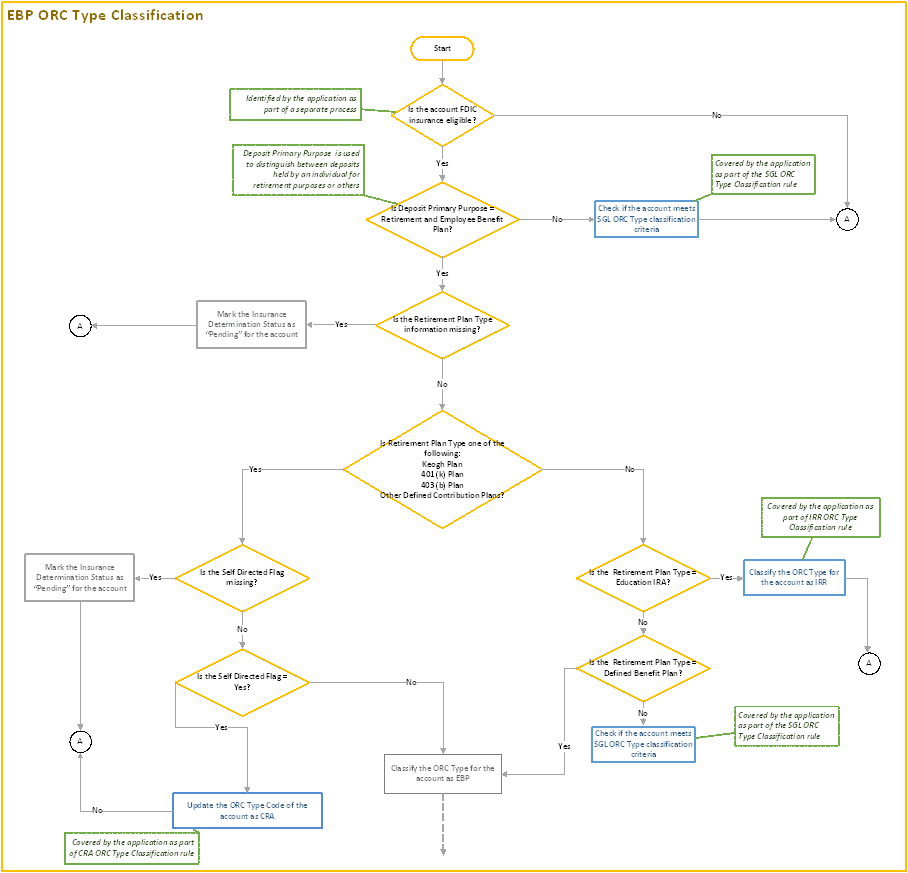

The process flow of EBP ORC Type Classification is as follows.

Figure 14: Process Flow - EBP ORC Type Classification

Figure 15: Process Flow - EBP ORC Type Classification (continued)

A trust account is a legal arrangement through which funds or assets are held by a third party for the benefit of another party, which may be an individual or a group. The creator of the trust is known as a grantor or settlor. The beneficial parties are called the beneficiaries and the third party is called the trustee.

FDIC provides insurance coverage to both Revocable and Irrevocable Trust accounts under ORC REV and IRR respectively. The terms of a Revocable Trust account, as the name suggests, can be revoked or modified at any time. An Irrevocable Trust on the other hand once set in place, cannot be modified.

To receive coverage under REV and IRR ORC, certain requirements must be fulfilled. The following is common for both REV and IRR:

Topics:

· Identification of Eligible Beneficiaries

· Life Estate Beneficiary Treatment

A named beneficiary of a Trust account is deemed to be eligible for coverage under REV and IRR only if the beneficiary meets the following criteria:

· A natural person

· A charitable or non-profit organization

All other types of beneficiaries are either ineligible or invalid.

An ineligible beneficiary does not meet the requirements of an eligible beneficiary but is still able to legally receive the bequest under law. In such cases, to calculate deposit insurance, the result is a reversion of funds to the single account of the grantor. Under FDIC guidelines, for ineligible beneficiaries of a revocable trust, the amounts are treated as funds in the single account of the grantor.

An Invalid beneficiary is unable to legally receive the bequest under state law. For deposit insurance, bequests to invalid beneficiaries are ignored and the funds are allocated to the remaining beneficiaries. Under FDIC guidelines, for an invalid beneficiary, the funds associated with the beneficiary should be allocated to other beneficiaries. The Application takes the Invalid beneficiary’s Account participant interest and divides it equally among other beneficiaries’ Account participant’s interests.

The Application identifies eligible beneficiaries by using the FDIC Customer type dimension as in the following example.

Beneficiary (Account Participant) |

Account Participant Description |

FDIC Customer Type Code |

Eligible Beneficiary Flag (Processing) |

|---|---|---|---|

Hema |

Individual |

IND |

Yes |

Rekha |

Individual |

IND |

Yes |

Nirma |

Others |

OTH |

No |

Oxfam |

Charitable or Non-profit organization recognized by the IRS |

NFP |

Yes |

Amnesty International |

Charitable or Non-profit organization recognized by the IRS |

NFP |

Yes |

When a beneficiary is an individual, in case of death of the beneficiary, the insurance allocation varies whether there are any substitute beneficiaries named or not. The death of a beneficiary is recognized immediately for FDIC purposes, without any grace period given as follows:

· Beneficiaries deceased with Successor beneficiaries

· Beneficiaries deceased without Successor beneficiaries

Under FDIC guidelines, for the beneficiaries deceased, if the successor beneficiary(s) is eligible, the Application divides the amount equally among the successor beneficiaries for the deceased beneficiary.

A) All beneficiaries deceased: Under FDIC guidelines, in this case, the amount belonging to the deceased beneficiary will be treated as funds in the Single/Joint account of the grantor or grantors.

B) Some beneficiaries deceased: In this case, the funds belonging to the deceased beneficiary is ignored for insurance calculation.

A Life Estate Beneficiary (LEB) can use the deposit assets during their life and the ownership is changed upon death. This person has the right to receive income from the trust or to use the trust assets before all other beneficiaries. The beneficiaries who inherit the estate after the LEB are called “Remainder Beneficiaries”. FDIC provides coverage to both Life Beneficiaries.

The stake of the LEB is intangible. The FDIC allocates insurance to LEB in the following way:

· A fixed amount of SMDIA under REV ORC

· (A Factor * Trust amount), under IRR ORC (Factor based on IRS Actuarial tables)

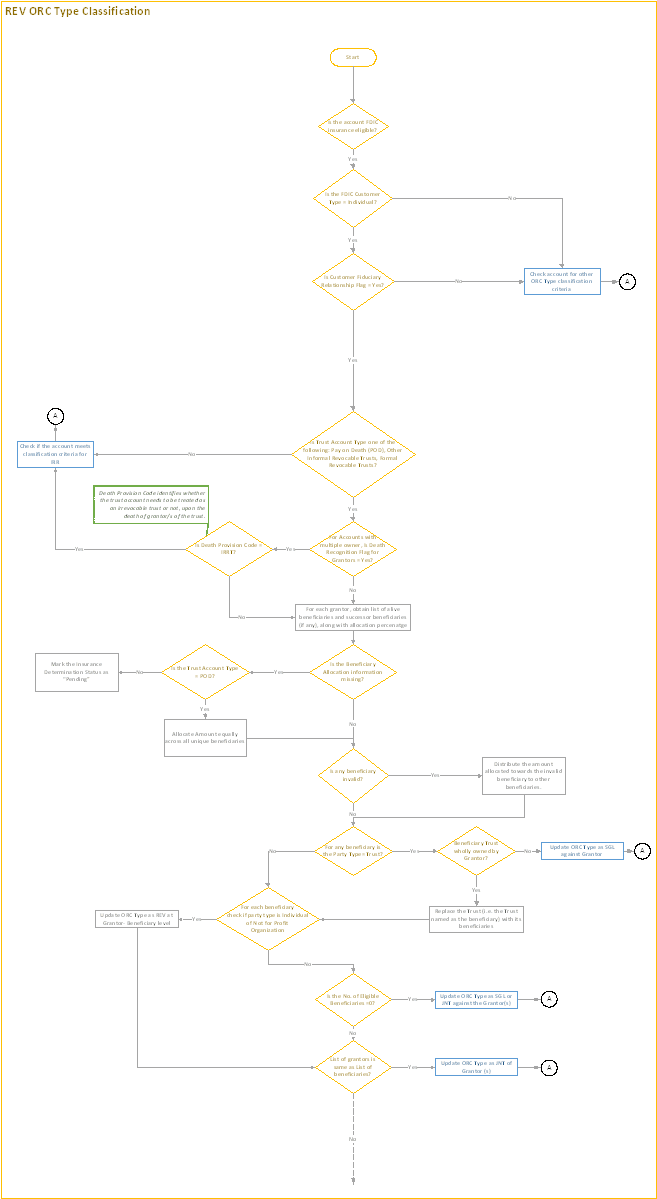

A revocable trust account is a deposit account owned by one or more people expressing the intent that on the death of the owner, the deposited funds will pass to one or more named beneficiaries. A revocable trust account can be revoked, terminated, or amended at the discretion of the owner(s).

FDIC deposit insurance covers two types of revocable trusts — informal revocable trusts and formal revocable trusts. Insurance calculation does not depend on the type of revocable trusts.

Topics:

· Grantors as Beneficiary case

· Beneficiary as another Trust account

FDIC regulations provide that where the co-owners of a revocable trust account are themselves the sole beneficiaries of the corresponding trust, the account shall be insured as a joint account.

When a Trust account names another trust account as Beneficiary, the set of owners of both Trusts are compared. If the Beneficiary Trust is owned by the Grantor or Grantors, then the Beneficiary Trust is replaced by its actual Beneficiaries. If not, this Beneficiary Trust is treated like any ineligible beneficiary.

If the account has no eligible beneficiaries, then the amount in the trust account is treated under the Single ORC or Joint ORC of the grantor or grantors.

The insurance limit is calculated as follows:

1. When the number of beneficiaries is five or fewer:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For REV, this translates to:

2. When the number of beneficiaries is more than five and beneficiary share is unequal:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For REV, this translates to:

3. When the allocation across the beneficiaries is equal, irrespective of the number of eligible beneficiaries, the Insurance limit of SMDIA is at a grantor level. In other words, the treatment is the same as the case where the number of beneficiaries is five or fewer.

The process flow of REV ORC Type Classification is as follows.

Figure 16: Process Flow - REV ORC Type Classification

Figure 17: Process Flow - REV ORC Type Classification (continued)

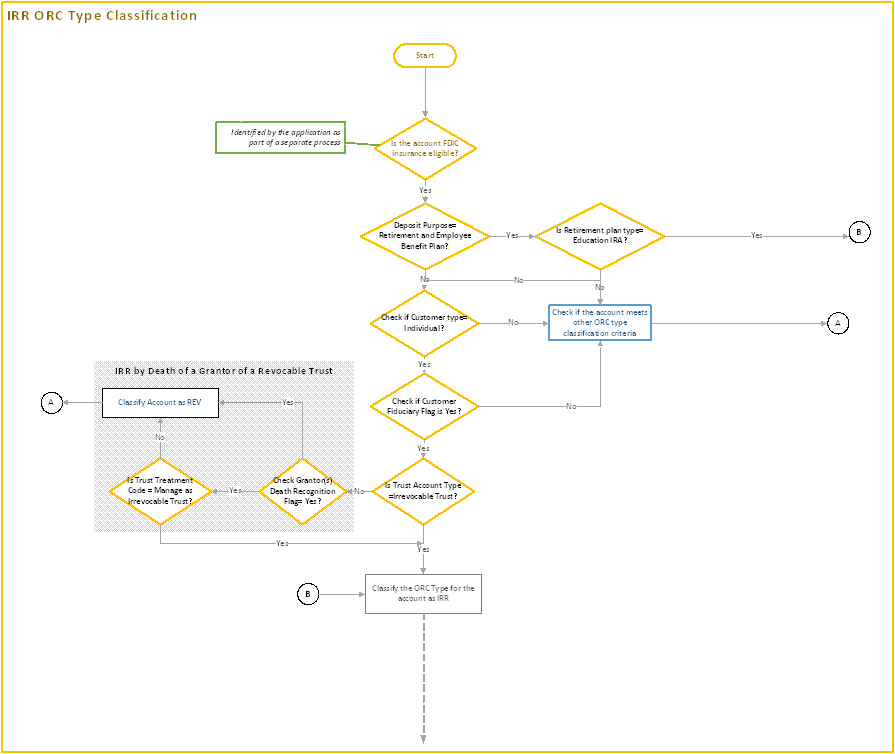

Irrevocable trust accounts are deposit accounts held by an irrevocable trust established by a statute, written trust agreement, or valid court order. An irrevocable trust may also be created through the death of the grantor of a revocable living trust.

The following types of interests are present in an Irrevocable Trust:

· Retained Interest

Retained Interest represents those assets that can be returned by the trustee to the grantor by the terms of the trust agreement. For deposit insurance purposes, the funds under Retained interest are treated under SGL ORC.

· Non-Contingent Interest

Non-contingent trust interest is defined in the FDIC’s regulations as an interest capable of determination without evaluation of contingencies. The only exception for contingencies, in this case, is present worth/life expectancy.

· Contingent Interest

Contingent interest is a beneficiary interest that is subject to any types of contingency other than present worth/life expectancy.

The application identifies these interests under the Allocation Type Code dimension.

Topics:

· Creation by Death of a Grantor of a Revocable Trust

Certain Revocable Trusts which have multiple co-owners have a provision in the Trust Agreement to convert the Trust into an Irrevocable Trust on the death of any co-owner. When such a clause is triggered, the Revocable Trust receives coverage under IRR ORC. The Application identifies this treatment through the Trust Treatment Code dimension.

The amounts of such cases are treated as Non-Contingent interests.

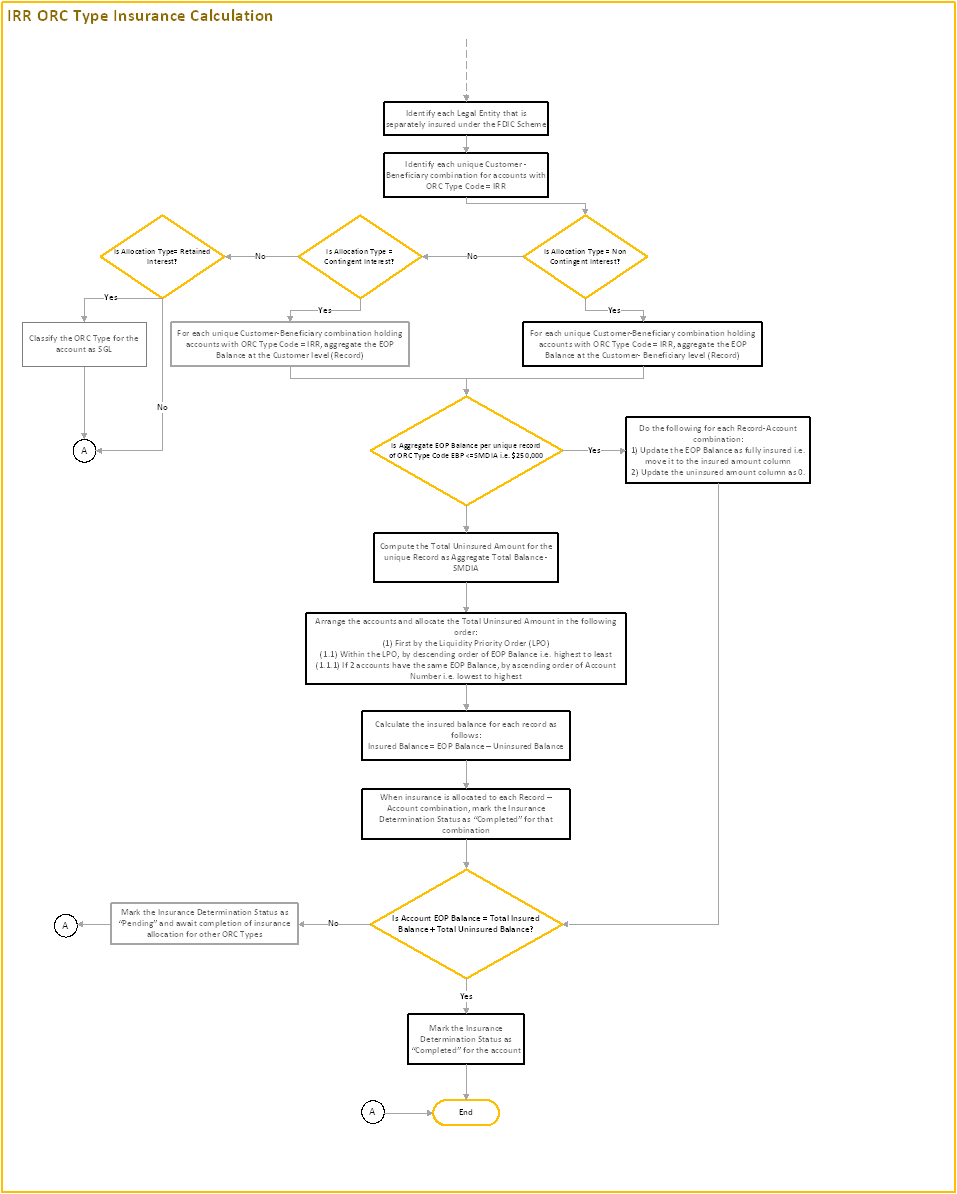

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) for Non-Contingent Interests are applied at:

For IRR, this translates to:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) for Contingent interests are applied at:

For IRR, this translates to:

The process flow of IRR ORC Type Classification is as follows:

Figure 18: Process Flow - IRR ORC Type Classification

Figure 19: IRR ORC Type Classification (continued)

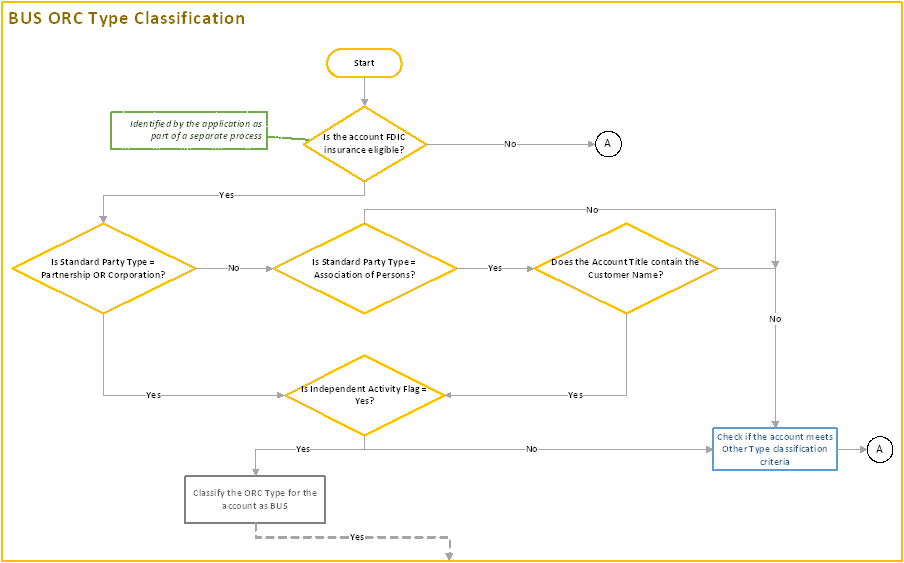

This ORC includes accounts from unincorporated associations, Partnerships, and Corporations engaged in the independent activity. The business itself is a beneficial party in this case. A deposit account that is a sole proprietorship or doing business as a (DBA) account is not insured under this ORC-this is insured as a single account of the owner.

For an unincorporated association, the Application checks for additional criteria such as the name of the association in the account title. This is an additional classification criterion for such accounts to be considered under the BUS ORC. If the title of the account does not have the name of the Unincorporated Association, the account will be insured under the SGL ORC of the account holders.

If multiple accounts belong to a corporation under different names (Such as those for each Division/department), the application identifies a Primary customer and maps all other accounts of the corporation under the primary customer. The Primary customer is the one who is separately insured by the FDIC.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

The process flow of BUS ORC Type Classification is as follows.

Figure 20: Process Flow - BUS ORC Type Classification

Figure 21: Process Flow - BUS ORC Type Classification (continued)

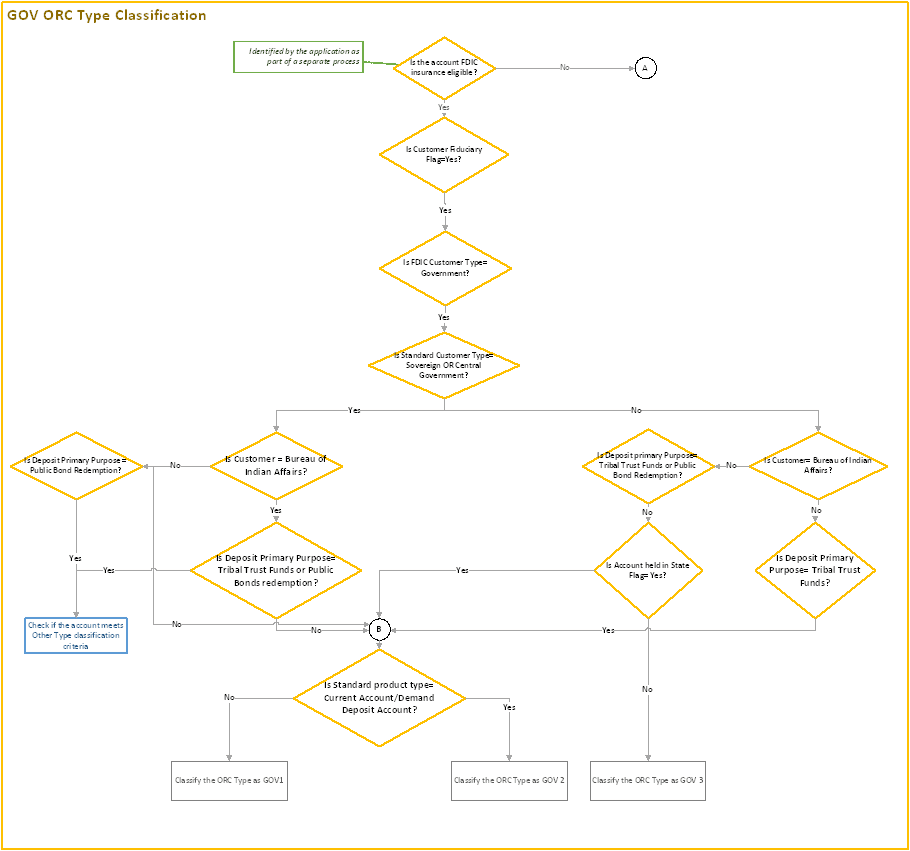

Under this ORC, the coverage is extended to accounts of the federal government, state governments, and other governmental bodies.

Topics:

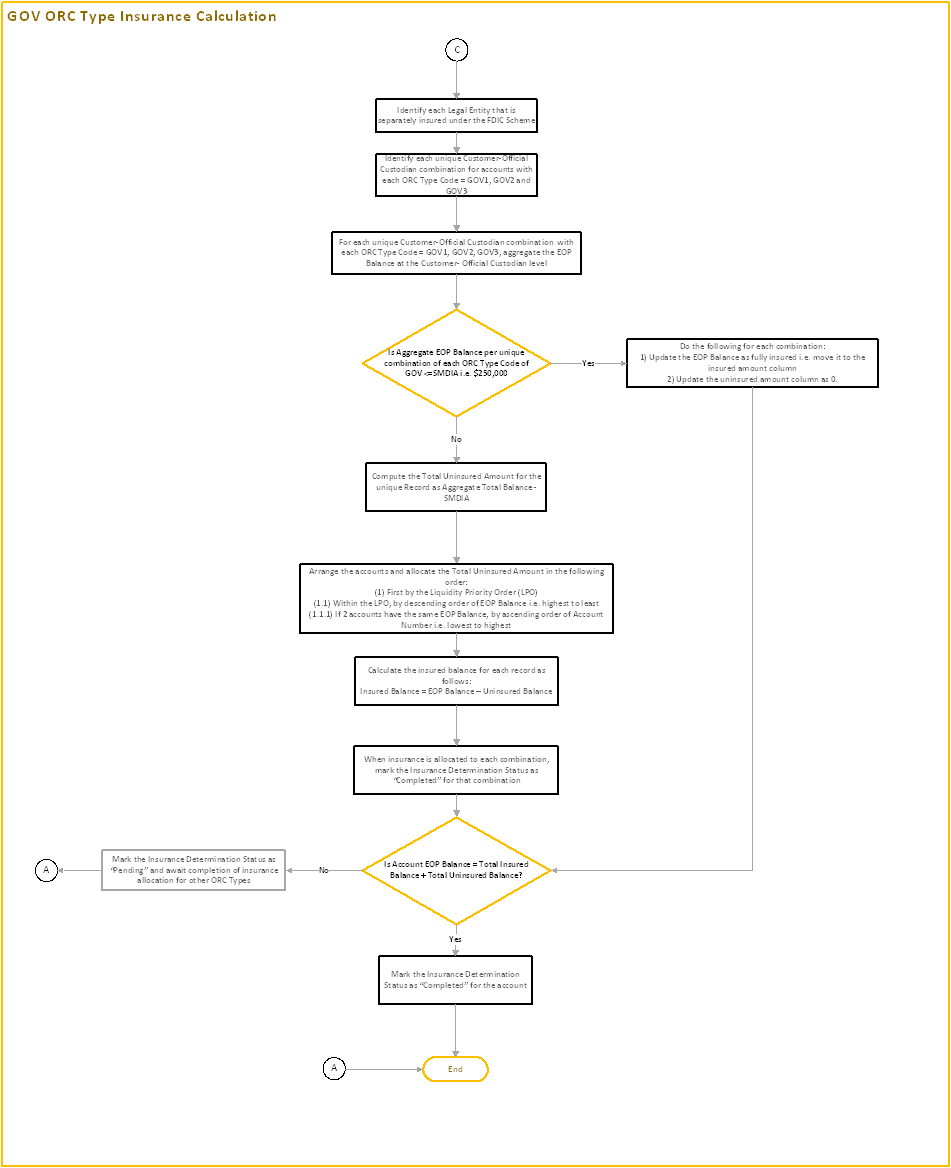

Depending on the deposit product type and whether the account is held in state or not, the Application tags three ORC codes, GOV1, GOV2, and GOV3.

The following are the criteria.

ORC Criteria |

Standard Product type |

ORC |

|---|---|---|

Held by official custodian of The United States.

Official custodian in a CI located in the same state as the public unit. |

Certificate of Deposit, Savings Account, Term Deposits, Money Market Deposit Account, Negotiable Order of Withdrawal accounts |

GOV1 |

Held by official custodian of The United States.

Official custodian in a CI located in the same state as the public unit. |

Demand deposit account |

GOV2 |

Held by official custodian located outside the state in which the public unit is located |

|

GOV3 |

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For GOV, this translates to:

Each official custodian receives coverage up to SMDIA for each of the three codes GOV1, GOV2 and GOV3 separately.

The process flow for GOV ORC Type Classification is as follows.

Figure 22: Process Flow - GOV ORC Type Classification

Figure 23: GOV ORC Type Classification (continued)

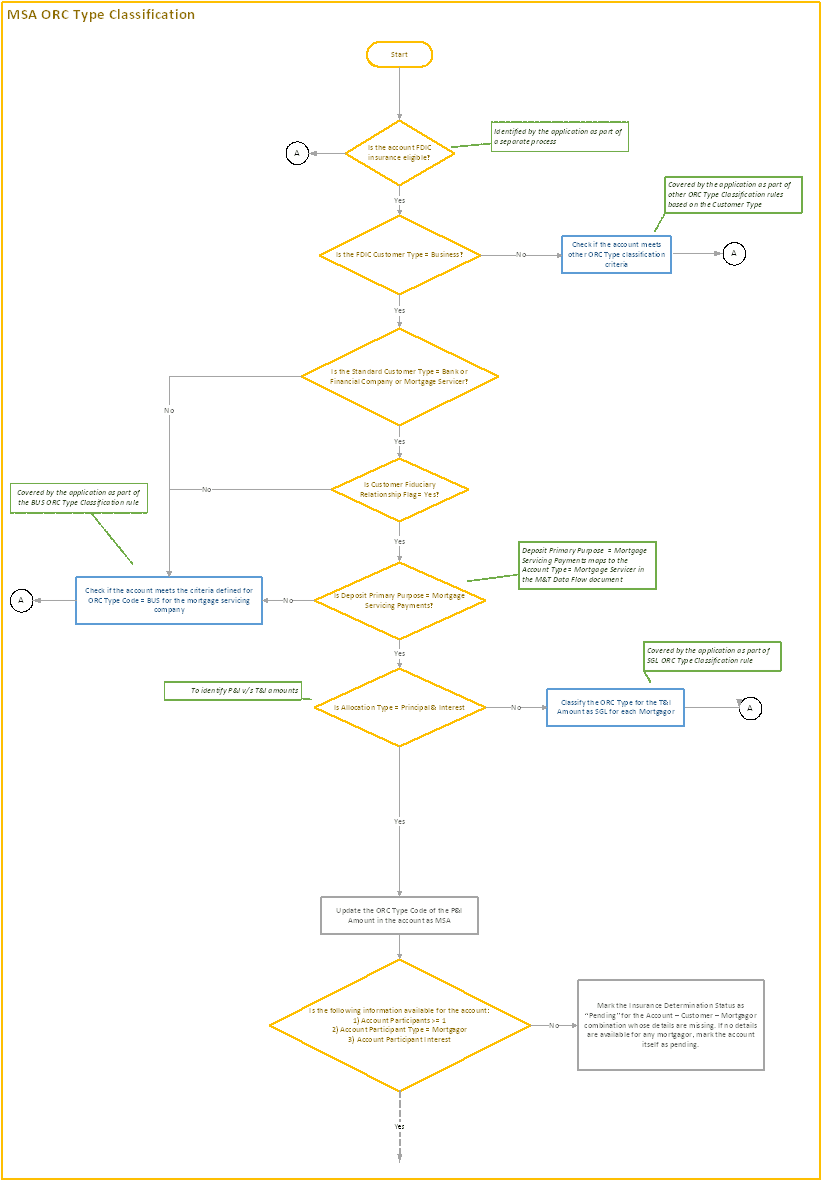

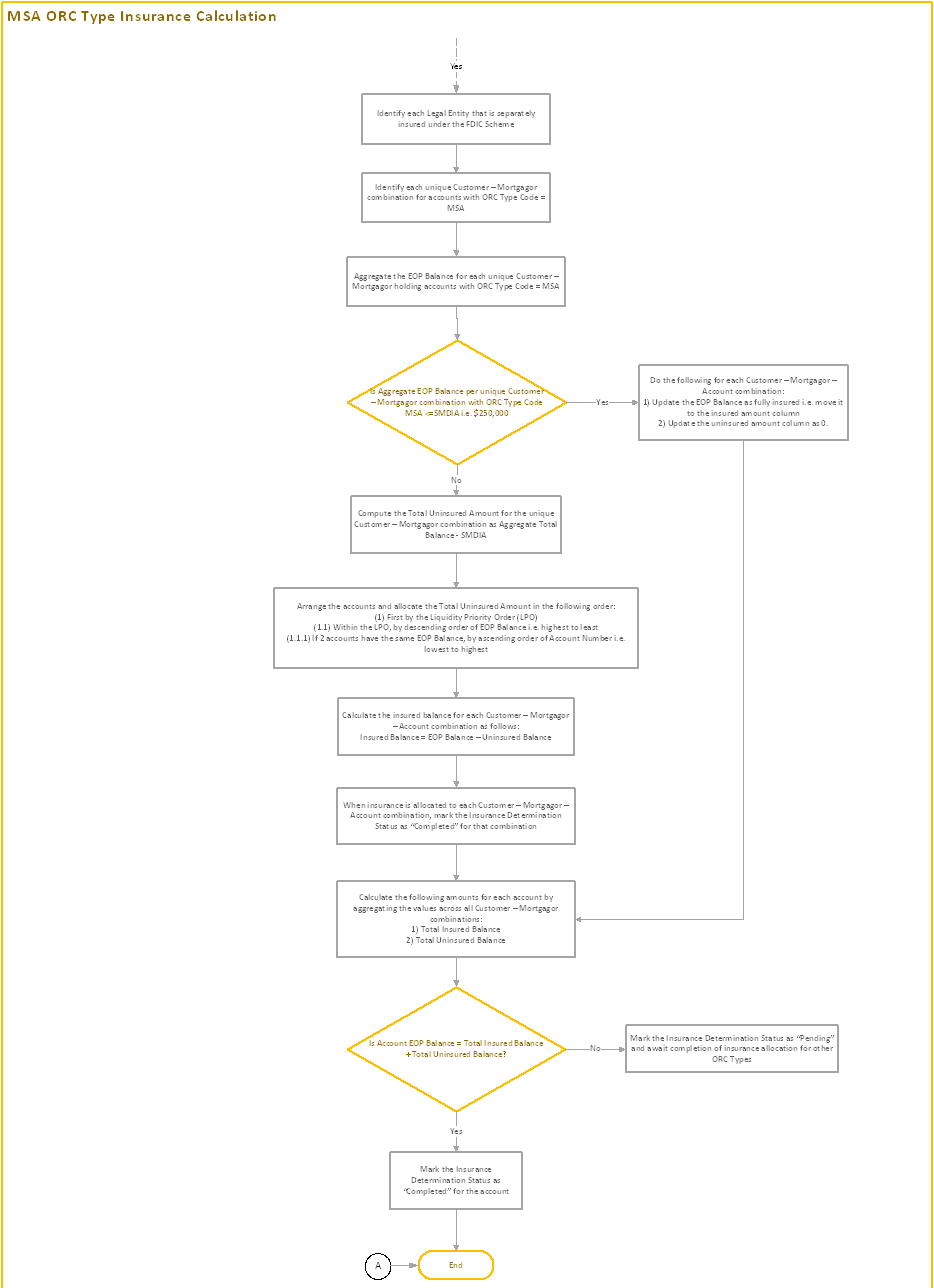

Mortgage servicing accounts are deposit accounts opened by mortgage servicers to hold payments made by mortgagors. To this extent, the Principal and Interest portion of the Mortgage Servicing payments are covered under this right and capacity. The amounts held for payments of taxes and insurance premiums, on the other hand, are not covered in MSA ORC and are treated in the Single ORC classification for the Mortgage Servicer.

Overfunding amounts are computed by the Application by taking into consideration the Total Allocation Percentage of all the mortgagors concerning a Mortgage Servicer. If the Total Percentage is less than 100%, it is determined that there is Overfunding in the deposit account. This amount does not belong to any participant and instead belongs to the Mortgage Servicer. Overfunding Amounts are also treated under MSA ORC and allotted a separate SMDIA as compared to the Principal and Interest Amounts.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For MSA, this translates to:

Mortgagors will be insured for up to SMDIA for all mortgages held with the same mortgagor.

The process flow for MSA ORC Type Classification is as follows.

Figure 24: Process Flow - MSA ORC Type Classification

Figure 25: Process Flow - MSA ORC Type Classification (continued)

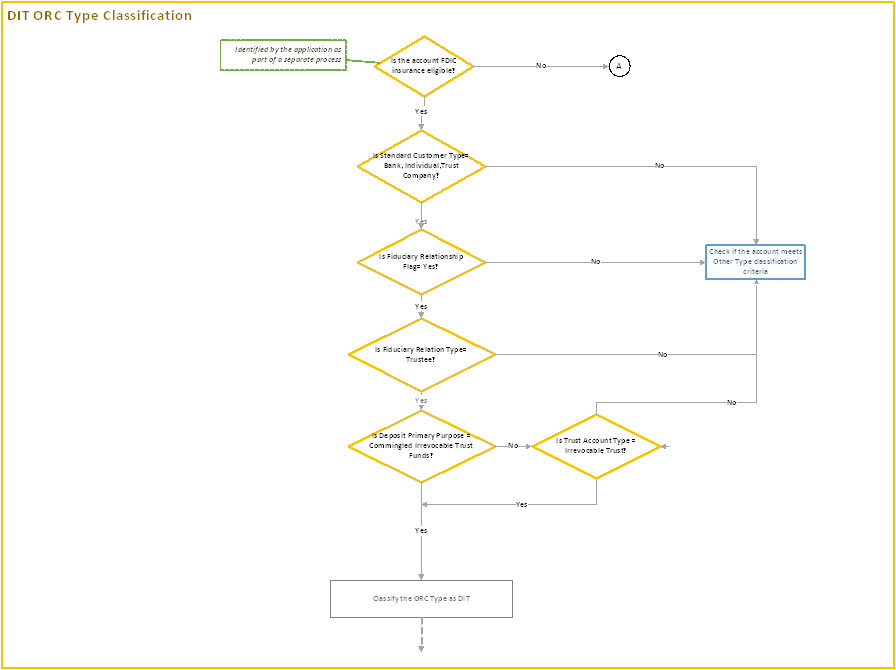

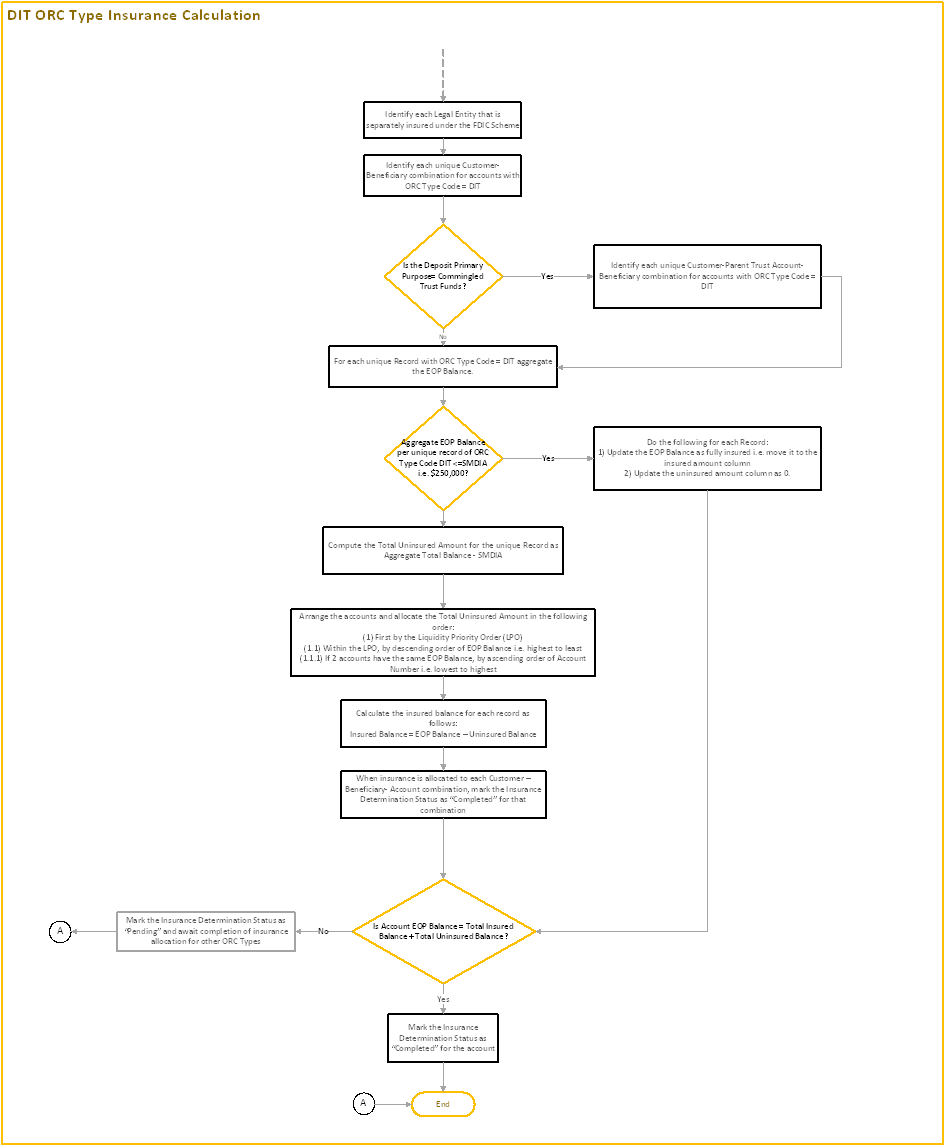

Under this ORC, coverage is extended to accounts held by an IDI as a trustee of an irrevocable trust. This category is applicable whether the IDI as trustee holds the trust funds in a deposit account at the IDI, or whether the IDI as trustee places the funds into a deposit account at another IDI.

Deposit insurance coverage for irrevocable trusts in this category is separate from, and in addition to, deposit insurance coverage for other ownership categories.

Topics:

For Accounts with Commingled Trust Funds, Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For DIT, this translates to:

For Irrevocable Trust Accounts where an IDI is a Trustee, Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For DIT Trust account at beneficiary level, this translates to:

The FDIC insures each trust fund owner or beneficiary represented for up to the SMDIA.

Under this ORC, both allocated and unallocated funds are covered.

The process flow for DIT ORC Type Classification is as follows.

Figure 26: Process Flow - DIT ORC Type Classification

Figure 27: Process Flow - DIT ORC Type Classification (continued)

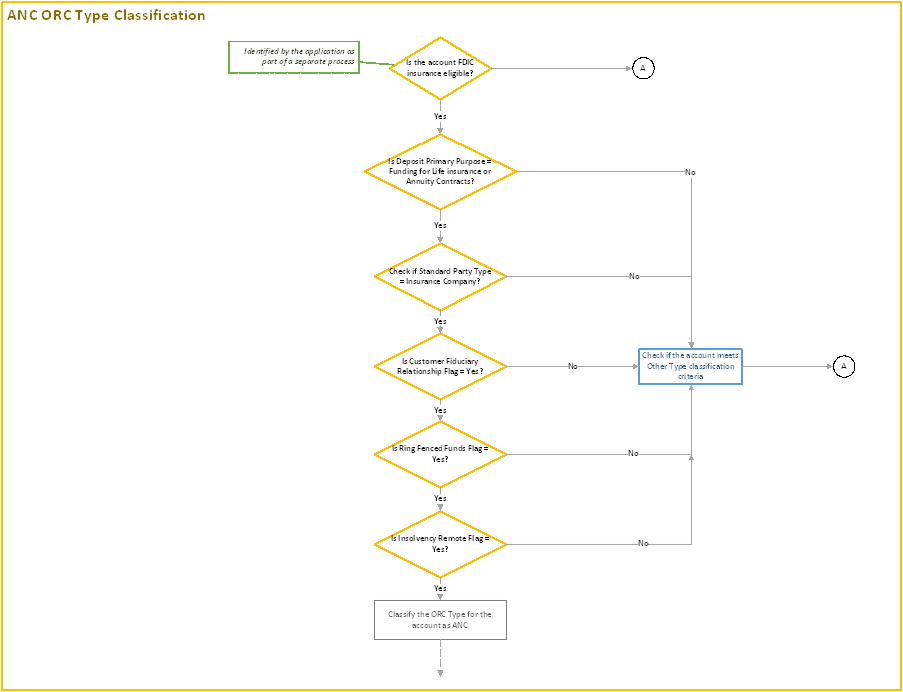

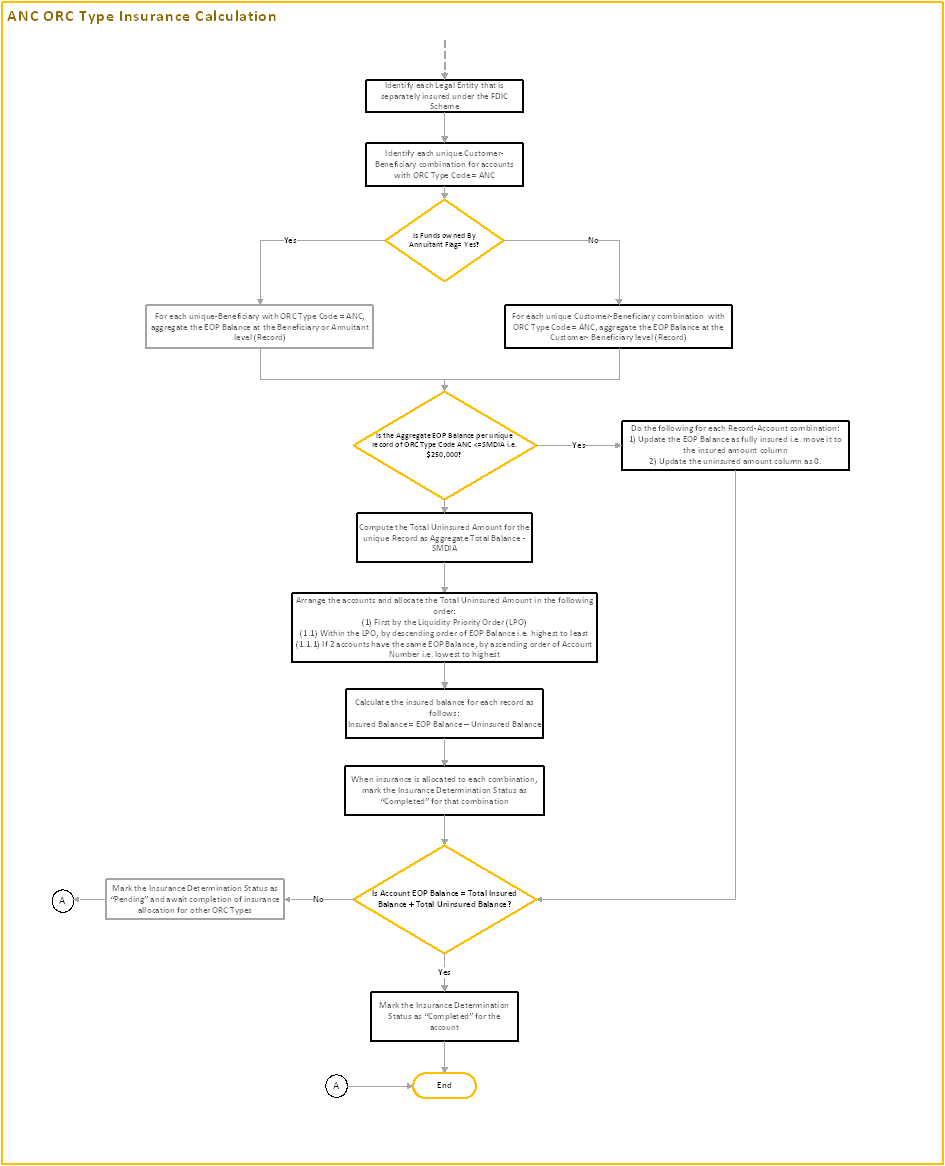

Under this ORC, the coverage is extended to deposit accounts that are set up by an insurance company or other corporation to hold funds for the sole purpose of funding life insurance or annuity contracts and any such benefits incidental to those contracts.

In certain states the funds are directly held by the annuitant who is the ultimate beneficial owner. In such cases, the granularity of insurance computation is different from when the insurance company holds the funds.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For Funds held by the Insurance Company, this translates to:

For Funds held by the Annuitant, Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

The process flow of ANC ORC Type Classification is as follows.

Figure 28: Process Flow - ANC ORC Type Classification

Figure 29: Process Flow - ANC ORC Type Classification

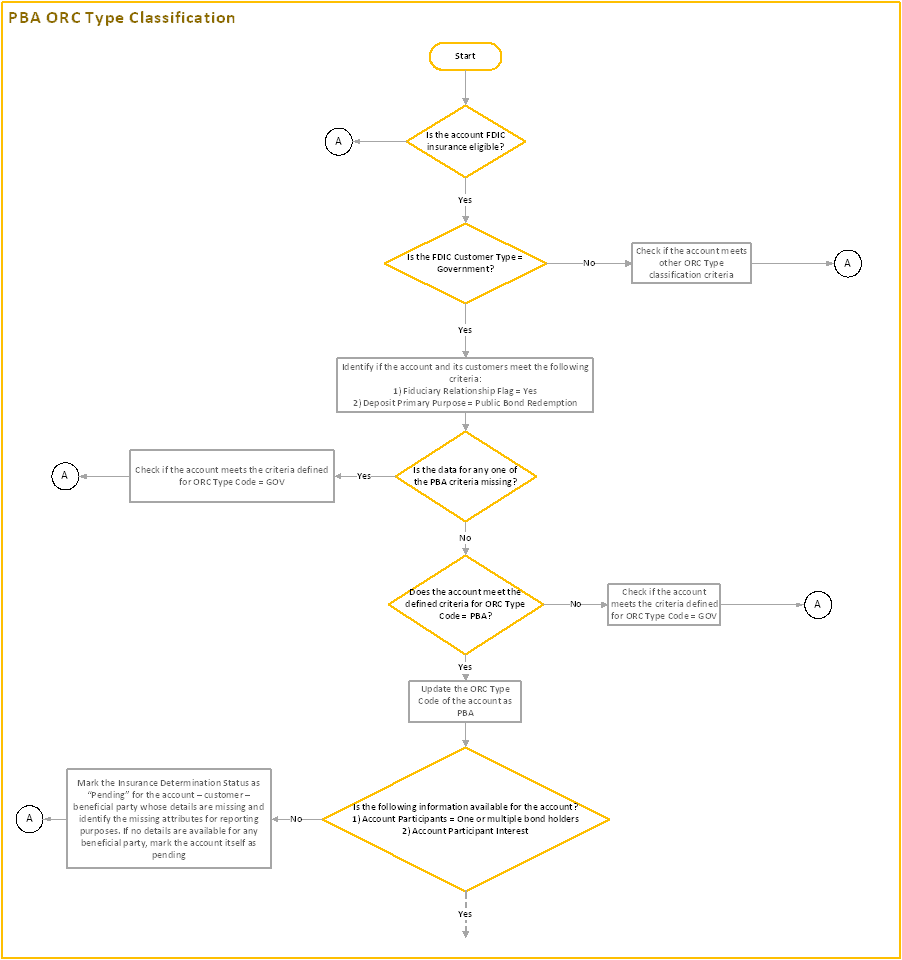

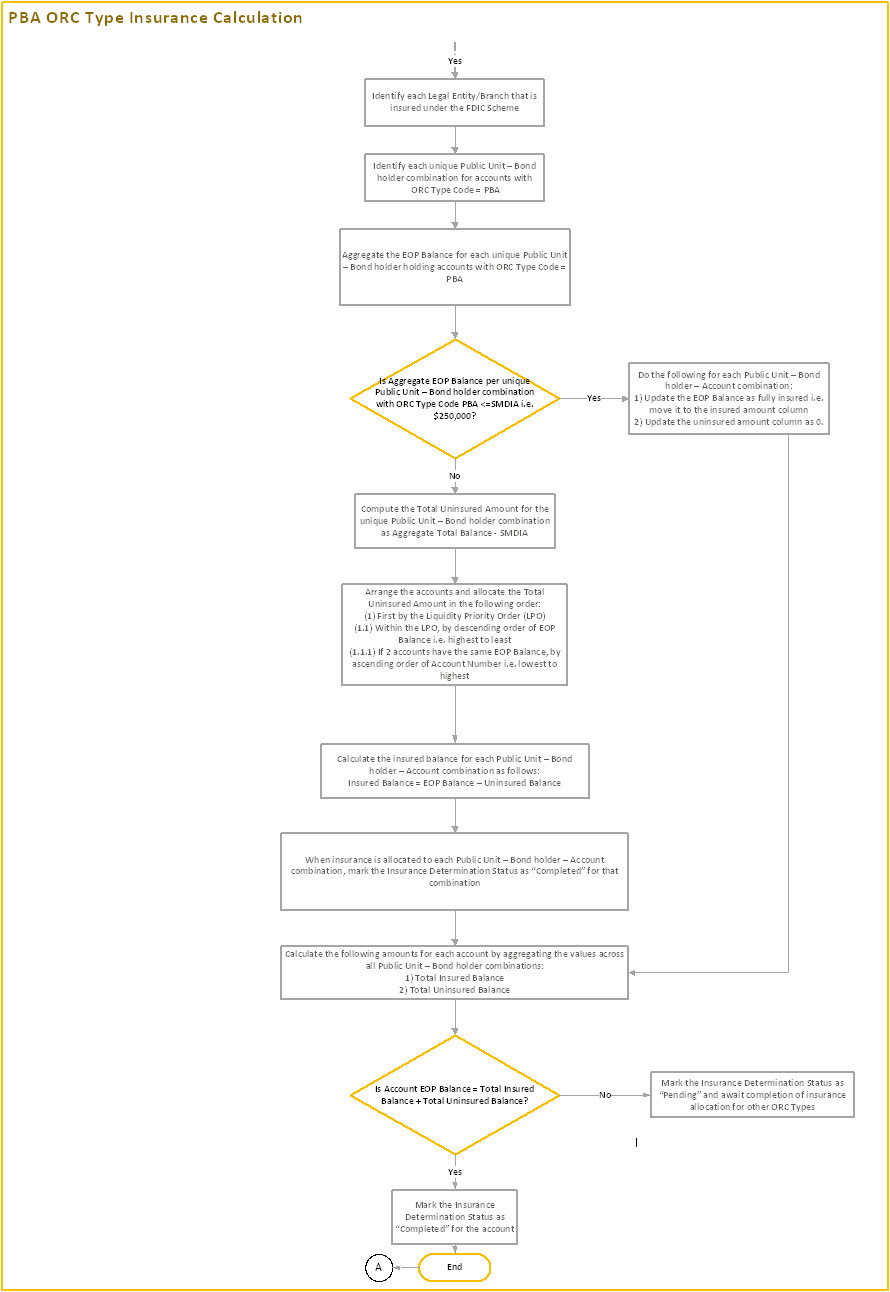

This ORC extends coverage to deposits held by an officer, agent, or employee of a public unit under a law or bond indenture that requires the deposits to be set aside to discharge a debt owed to the holders of notes or bonds issued by the public unit.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For PBA, this translates to:

Bondholders will be insured for up to SMDIA for all bonds issued by the same issuer regardless of whether there are different series involved.

The process flow for PBA ORC Type Classification is as follows.

Figure 30: Process Flow - PBA ORC Type Classification

Figure 31: Process Flow - PBA ORC Type Classification (continued)

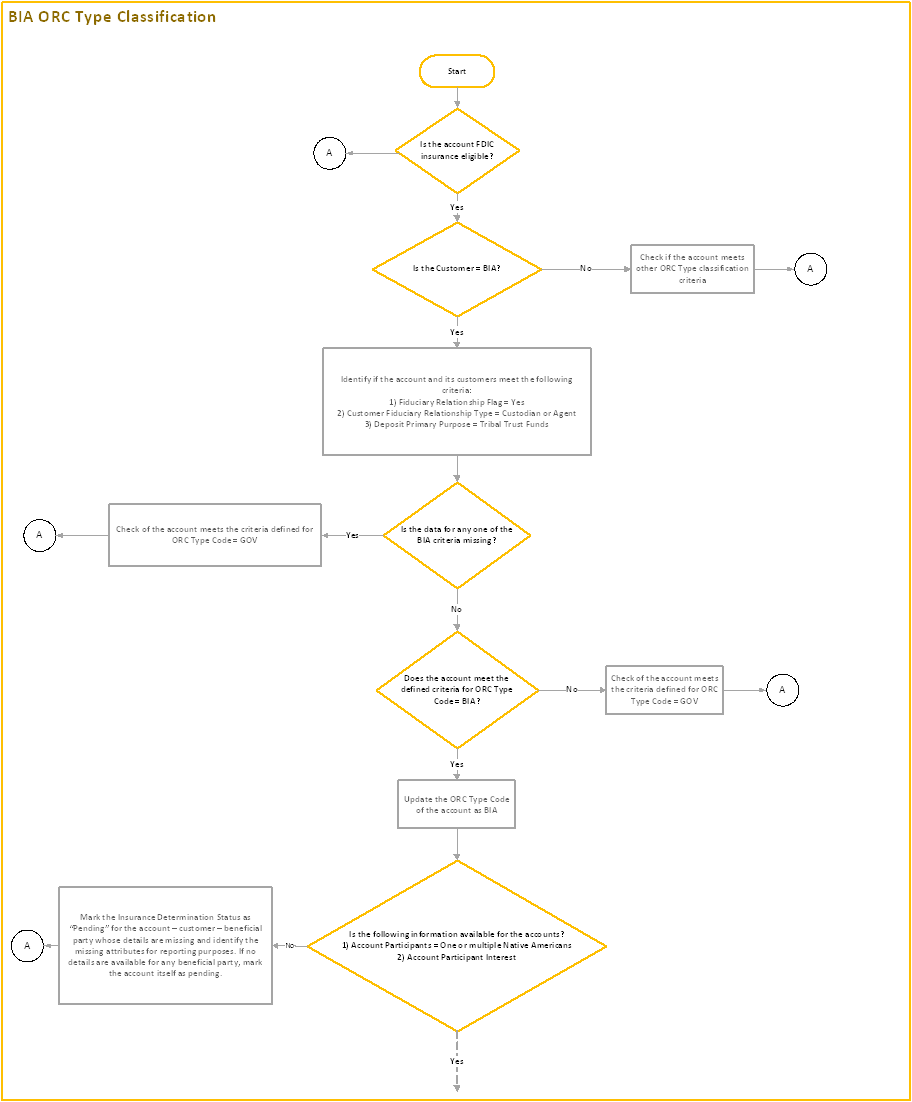

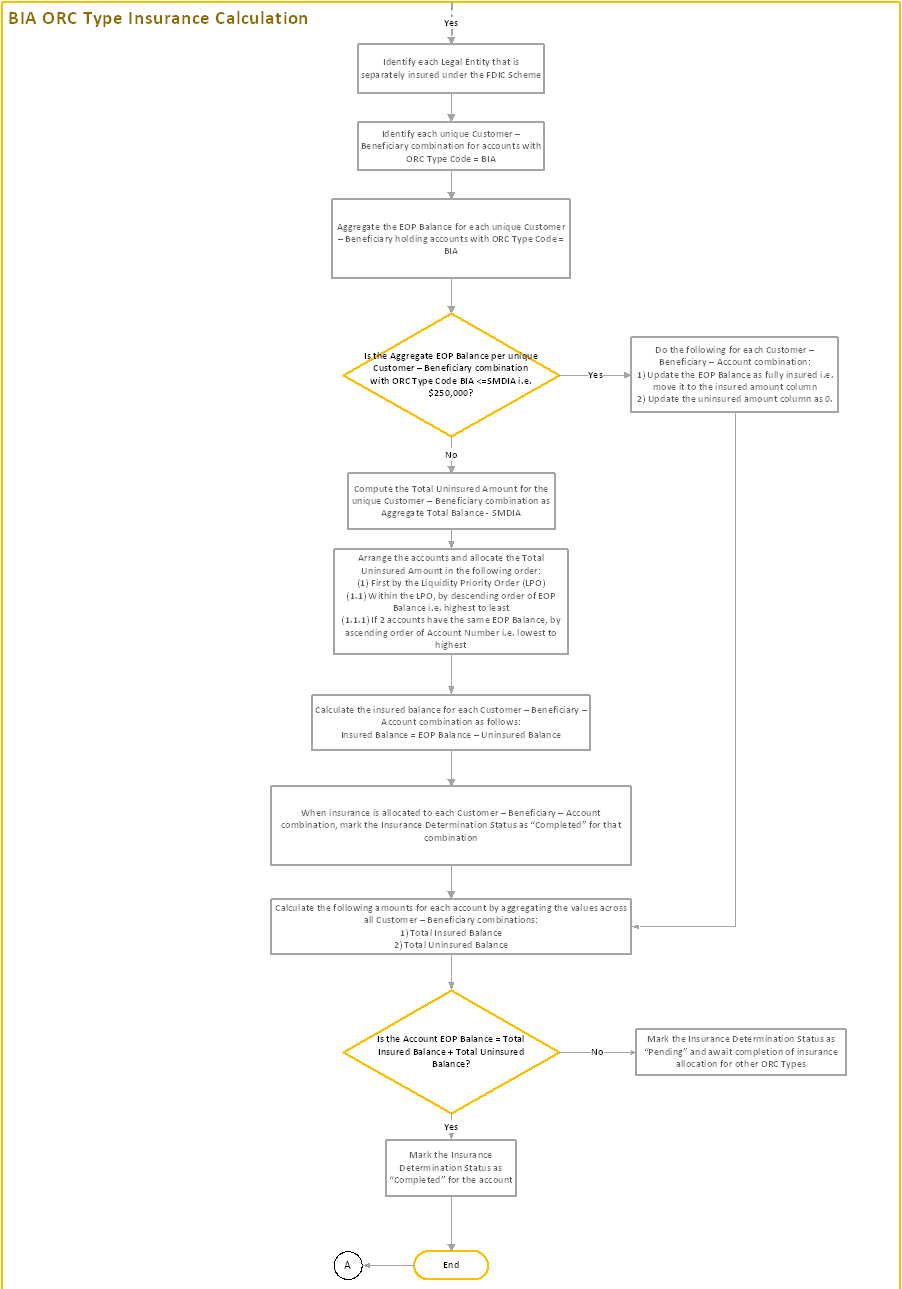

This ORC extends coverage to deposit accounts held by the Bureau of Indian Affairs (BIA) on behalf of Native Americans and deposited into an IDI. If the account does not meet the classification criteria for BIA ORC, then they should be evaluated for GOV and SGL ORCs.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

For BIA, this translates to:

Under this category, the custodian accounts are insured up to SMDIA for each Native American for whom the Bureau of Indian Affairs is acting.

The process flow for BIA ORC Type Classification is as follows.

Figure 32: Process Flow - BIA ORC Type Classification

Figure 33: Process Flow - BIA ORC Type Classification (continued)

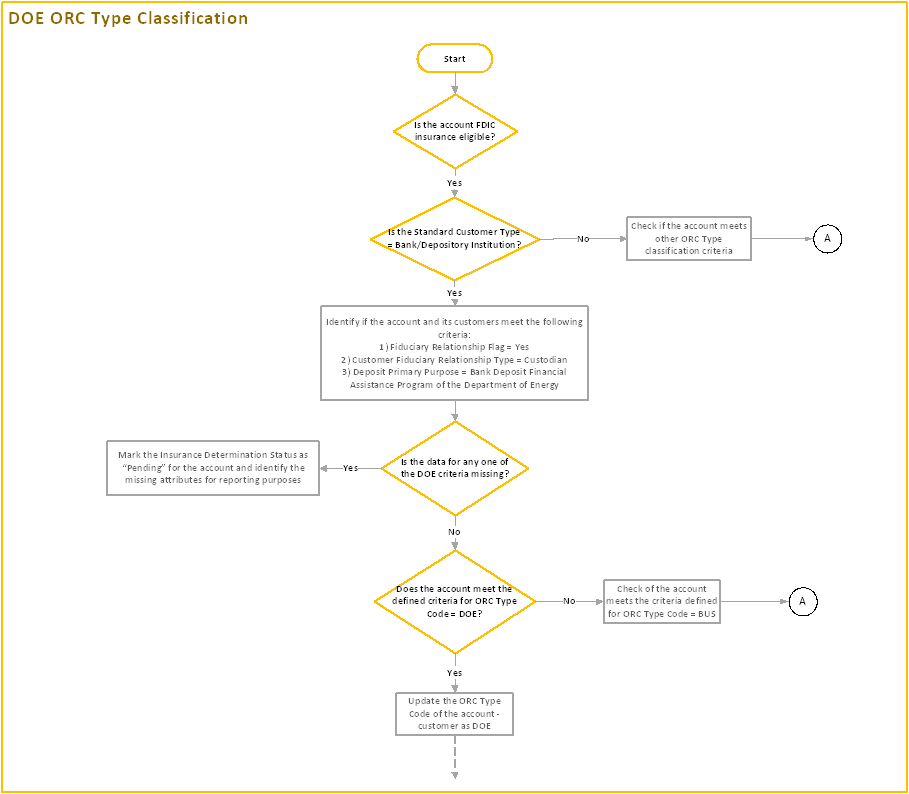

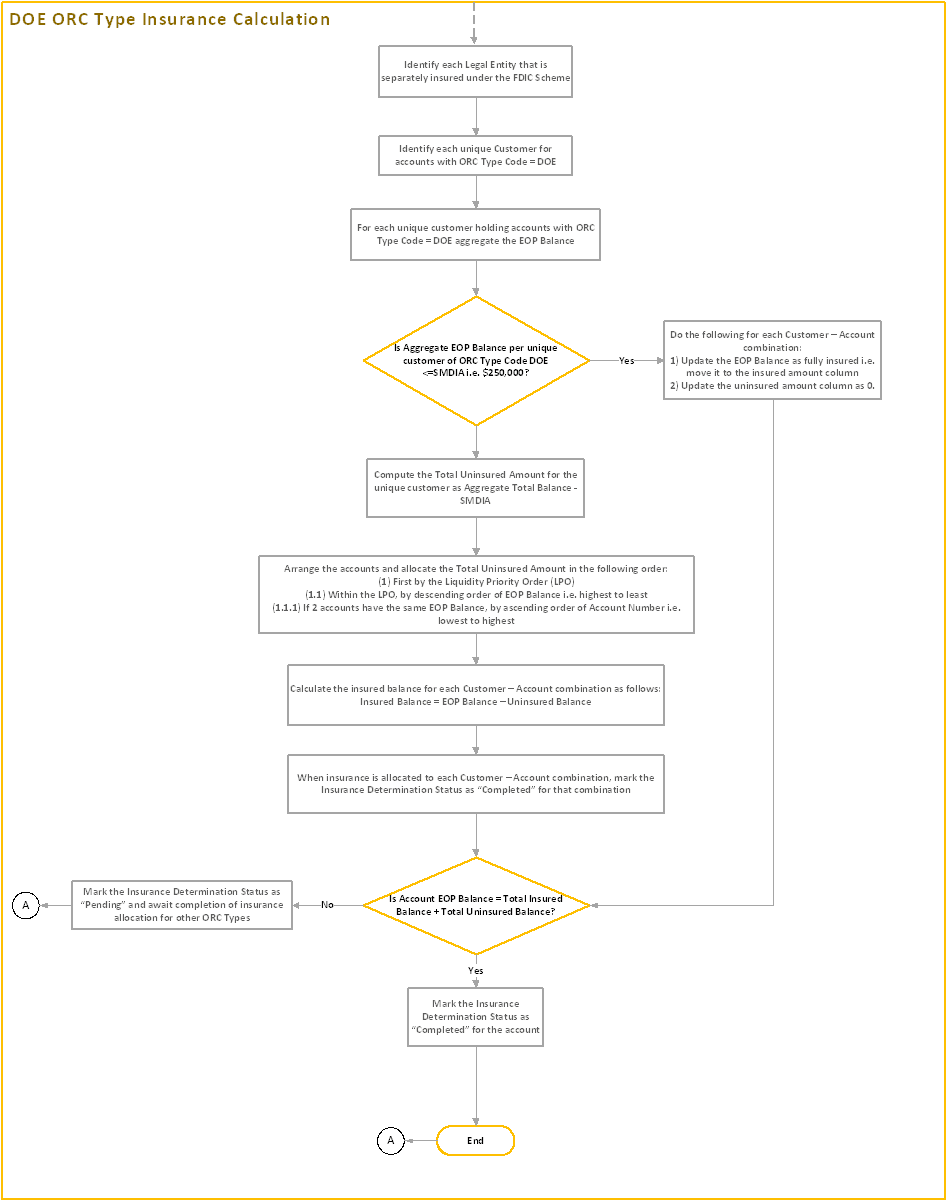

This category consists of funds deposited by an IDI under the Bank Deposit Financial Assistance Program of the Department of Energy.

Topics:

Insurance calculation and the Standard Maximum Deposit Insurance Amount (SMDIA) are applied at:

Each IDI depositing funds under this program will receive coverage up to SMDIA under this ORC.

The process flow for DOE ORC Type Classification is as follows.

Figure 34: Process Flow - DOE ORC Type Classification

Figure 35: Process Flow - DOE ORC Type Classification (continued)

The allocation towards the account level is always concerning the uninsured amounts. The insured amount for each account is calculated as a difference between the Total Balance and Uninsured amounts. The allocation is towards the total End of the Period balance of the account.

Topics:

· Joint accounts and Revocable Trusts

The liquidity priority order is outlined to allocate insured amounts to depositors who have multiple accounts. This order helps in deciding the priority towards allocating uninsured funds and subsequently the insured funds. Except for jointly owned and revocable trust accounts, for all other ORCs, the uninsured amount is allocated by the Standard Product type and is in the following table.

Priority |

Standard Product Type |

|---|---|

1 |

Certificate of deposit |

2 |

Savings account |

3 |

Money market account |

4 |

Negotiable order of withdrawal |

5 |

Demand deposit account |

For example, a customer’s account which is a certificate of deposit carries a higher priority than a savings account. Therefore, uninsured funds for a customer would be allocated to that account first.

If a customer has accounts that are of the same product type, the allocation of uninsured amounts is done based on the End of Period balance. The account with the highest balance gets higher priority.

Rarely, customer accounts have the same product type and same balance. In this case, the account with the lowest number gets priority.

Formal revocable trust accounts receive a higher priority than informal revocable trust accounts. As the revocable trust category allows an account to have single and multiple owners, the suggested debiting order is followed for joint revocable trust accounts.

Priority |

Trust Account Type |

|---|---|

1 |

Formal Revocable Trusts |

2 |

POD |

3 |

Informal Revocable Trusts- Other |

If an account is joint and not titled to a formal or informal trust, uninsured amounts are debited on a pro-rata basis based on the co-owner’s share percentage regardless of the account product type.

Jointly owned revocable trust accounts are treated according to the order for revocable trusts.

Accounts that do not have the requisite information to proceed for ORC Classification or Insurance calculations are parked with a Pending state as Insurance Determination Status.

The following fields are considered optional. A missing value in these fields does not qualify for a Pending Status.

· Customer Type

· Product category

· Participant Type

For each pending record, a reason is populated in the form a pending reason code as per FDIC Part 370 Regulation.

Code |

Comment |

|---|---|

A |

Missing Agent/Custodian information |

B |

Missing Beneficiary Information for Trusts |

RAC |

Missing Right and Capacity Code |

OI |

Missing Official Item |

ARB |

Direct Obligation Brokered Deposit |

ARBN |

Non-Direct Obligation Brokered Deposit |

ARCRA |

Certain Retirement Accounts |

AREBP |

Employee Benefit Plan Accounts |

ARM |

Mortgage Servicing for Principal and Interest Payments |

ARO |

Other Deposits |

ARTR |

Trust Accounts |

As per FDIC Part 370, an IDI may not be required to maintain all information needed by the FDIC to calculate the entire amount of deposit insurance available to each depositor concerning certain types of deposit accounts. For this reason, IDIs are subjected to Alternative Recordkeeping requirements that apply to certain types of accounts such as brokered deposits.

For such accounts, data in a granular form with additional attributes such as ORC, contingent/non-contingent interest, and so on, is taken as a download. These records then go through Insurance calculation and Insurance allocation along with the bank’s deposits.

If data required for insurance computation is missing, then the record will be marked as Pending, similar to that of the bank’s deposits. The Pending Reason code is segregated for Alternative Recordkeeping which is prefixed with AR.