The EBA Delegated Act (DA) Liquidity Coverage Ratio calculations cater to the guidelines on liquidity coverage requirement for Credit Institutions that were published by the European Commission in October 2014 as a supplement to Regulation (EU) 575/2013. The Commission proposed several adjustments to reflect the Union specificities, most notably for certain covered bonds and securitized assets.

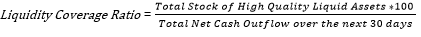

The liquidity coverage ratio addresses the short-term liquidity needs of an institution during a stressful situation. It estimates whether the stock of high-quality liquid assets is sufficient to cover the net cash outflows under stress situations over a specified future period, in general, lasting 30 calendar days (or LCR horizon). The liquidity coverage ratio is calculated at the legal entity level, on a standalone and consolidated basis.

Topics:

· Inputs

· Preconfigured Regulatory LCR Scenario

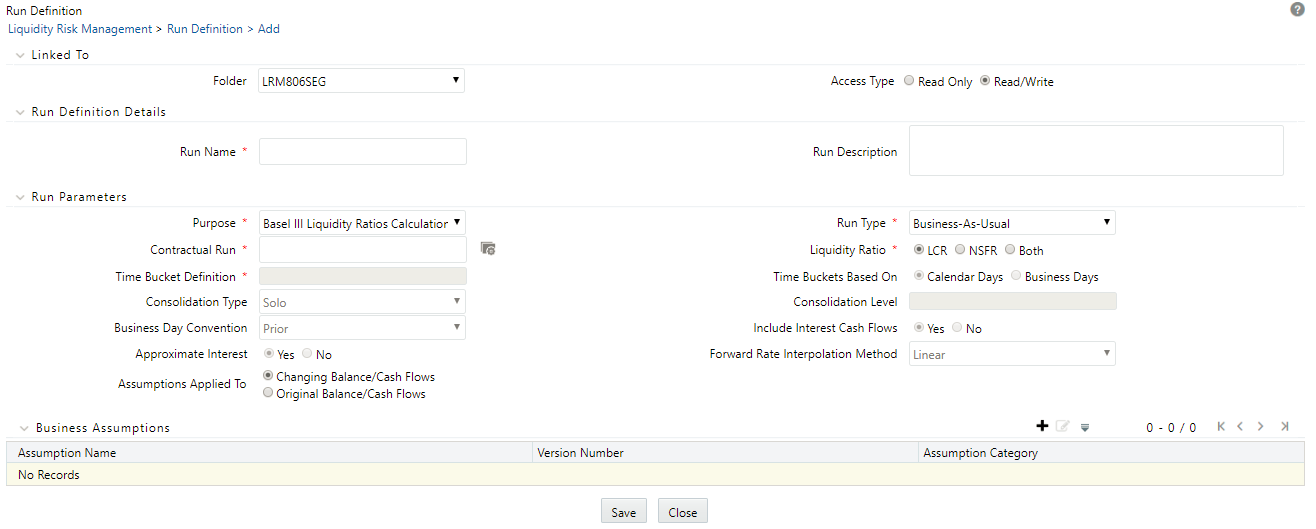

The application requires the following inputs for LCR calculation:

· Liquidity haircut for each asset level, which is provided through business assumption with assumption category as valuation change and assumption subcategory as the haircut.

· The business assumption that defines the outflow percentage. It is defined through appropriate business assumptions. For example, retail deposit Run-off is defined through business assumption with category as incremental cash flow and subcategory as Run-off.

· The business assumption that defines the inflow percentage. It is defined through appropriate business assumptions. For example, Rollover Reverse Repo is defined through business assumption with category as cash flow movement and subcategory as a Rollover.

· Liquidity Horizon is specified as the Runtime parameter.

This section provides a high-level LCR Calculation Process Flow (Under EBA Delegated Act).

Topics:

· Determining Maturity of Cash Flows

· Classifying Operational Amount

· Calculating Operational Amount

· Calculating Deposit Insurance

· Identifying Deposit Stability

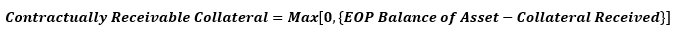

· Calculating Contractually Required Collateral

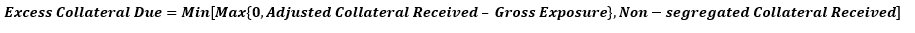

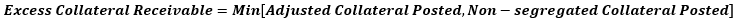

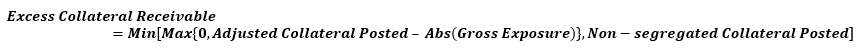

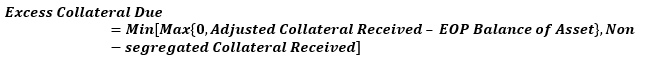

· Calculating Excess Collateral

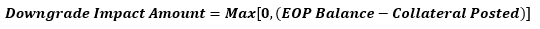

· Calculating Downgrade Impact Amount

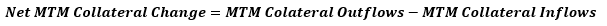

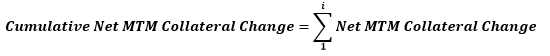

· Calculating Net Derivative Cash Inflows and Outflows

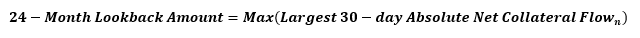

· Calculating Twenty-Four Month Look-back Amount

· Calculating Operational Amount

· Calculating HQLA Transferability Restriction

· Calculating Cash Inflows and Outflows

· Alternative Liquidity Approaches

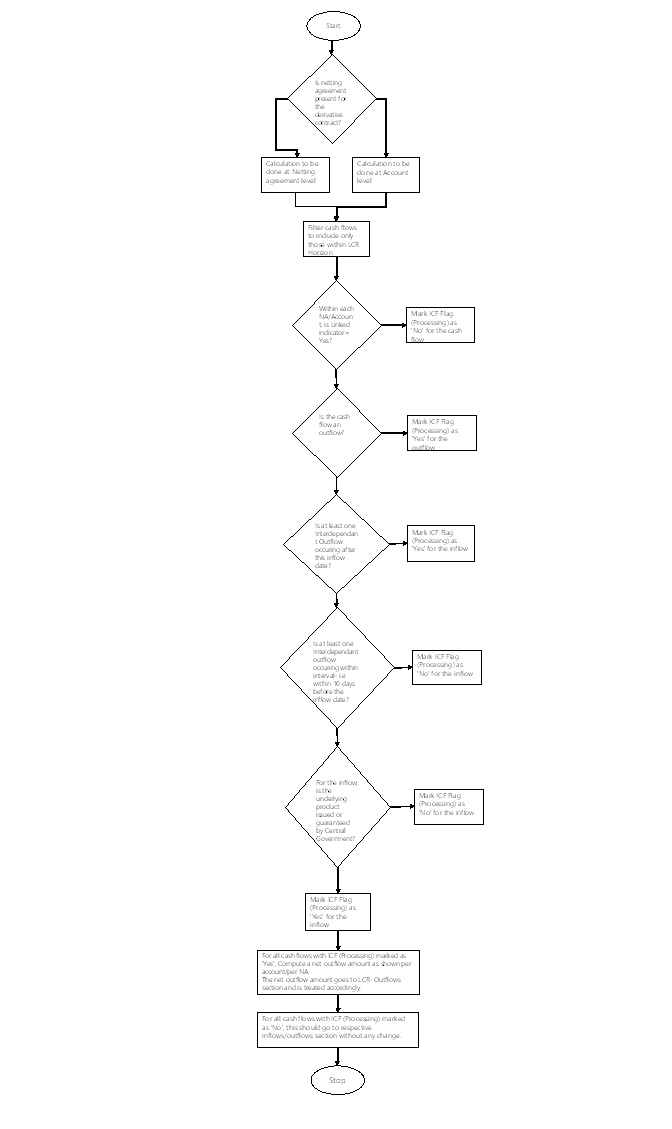

· Interdependent Cash Flows (LCR)

· Calculating of Liquidity Coverage Ratio

The application supports a ready-to-use delegated act LCR calculation that has the regulatory scenarios with associated HQLA haircuts, inflow, and outflow rates preconfigured in the form of business assumptions as prescribed by the European Banking Authority as part of the Commission Delegated Regulation (EU) 2015/61.

High quality liquid assets are assets that can be easily sold or used as collateral to obtain funds at little or no loss of value even under stress scenarios. All assets, whether owned by the bank or received from counterparties as collateral, that meet the high quality liquid asset criteria specified by BIS, are classified as follows:

· Level 1 Assets

· Level 2A Assets

· Level 2B Assets

Level 1 assets excluding covered bonds can be included without limit, Level 1 covered bonds can only include 70% of the stock of Level 1 assets and Level 2 assets can only include 40% of the stock of HQLA. Of this, Level 2B assets can only include 15% of the stock of HQLA. Any asset not classified as an HQLA is considered an Other Asset.

NOTE:

1. The application assigns relevant regulatory haircuts to each asset classified as HQLA as part of the preconfigured regulatory scenario. This haircut can be modified by the user for stress testing.

2. The value included in the stock of HQLA is net of any hedge termination cost or gain, as applicable.

Topics:

· Identifying and Treating Level 1 Assets

· Identifying and Treating Level 2A Assets

· Identifying and Treating Level 2B Assets

The application identifies the following assets as HQLA Level 1 assets:

1. Cash which includes coins, banknotes, and restricted cash. The value included in the stock of HQLA is the cash balance Central bank reserves, to the extent that the central bank policies allow them to be drawn down in times of stress. These include bank’s overnight deposits and term deposits that can be withdrawn immediately Central bank reserves, include the balance held by a bank with the central bank directly, or through a correspondent bank less any minimum reserve requirement. The value of eligible term deposits that are included in the amount net of any withdrawal penalty.

2. Assets issued or guaranteed by one of the following:

§ European Central Bank

§ The Central Bank of a Member State

§ The Central Government of a Member State

3. Assets which satisfy the following conditions:

§ Issuer type or guarantor type is one of the following:

— Central Bank

— Central Government

§ The party, that is issuer or guarantor, belongs to a third country.

§ The party is assigned a minimum of a credit quality step 1 credit assignment.

4. Assets which satisfy the following conditions:

§ Issuer type or guarantor type is one of the following:

— Regional Government

— Local Authority

— Public Sector Entity

§ The exposure to the party is treated similarly to the exposure to its respective central government, whether belonging to a Member State or a third country.

5. Assets which satisfy the following conditions:

§ Issuer type or guarantor type is one of the following:

— Central Bank

— Central Government

§ The party, that is issuer or guarantor, belongs to a third country.

§ The party is not assigned a credit quality step 1 credit assessment.

Such assets are included in the stock of HQLA only up to the extent of the bank’s net stressed cash outflows in that currency arising from the bank’s operations in that foreign jurisdiction.

6. Assets which satisfy the following conditions:

§ Issuer type or guarantor type is one of the following:

— International Organization

— Multilateral Development Bank

§ The party is assigned a credit quality step 1 credit assessment.

7. Assets issued by credit institutions which satisfy the following criteria:

§ The institution is backed by a Member State central government, regional government or local authority.

§ The exposure to the regional government or local authority is treated similarly to the exposure to its respective central government.

§ The backing authority is obligated to ensure the financial viability of the institution.

8. Assets issued by credit institutions which satisfy the following criteria:

§ The institution is a promotional lender.

§ 90% of its loan is guaranteed a Member State central government, regional government or local authority.

§ The exposure to the regional government or local authority is treated similarly to the exposure to its respective central government.

9. Covered bonds which satisfy the following criteria:

§ Are subject to special supervision which protects bondholders and whose proceeds are invested in a manner that enables the issuer to pay claims on the bonds when they arise.

§ Have an issue size of at least EUR 500 million.

§ Are assigned a minimum of credit quality step 1 credit assessment or a risk weight of <=10%.

§ Not more than 15% of the outstanding issue of covered bond is collateralized by assets issued by institutions assigned a credit quality Step 1.

§ The institution and issuer meet the transparency requirements which accord preferential treatment to covered bonds.

§ The underlying asset pool is more than 2% of the outstanding amount of the covered bond.

10. Sight deposits of the credit institution, which belongs to an institutional protection scheme or a cooperative network, maintained with the central institution of the network, where the central credit institution is legally required to invest the deposit amount in liquid assets of a specified level. The amount included in the stock of Level 1 assets is that portion of the deposit which is invested in Level 1 assets.

11. Assets issued by credit institutions which satisfy the following conditions:

§ Guarantor type is one of the following:

— Central Government

— Regional Government

— Local Authority

§ The guarantor belongs to a Member State.

§ The exposure to the guarantor is treated similarly to the exposure to its respective central government.

§ The guarantee was given before 30 June 2014.

§ The guarantee is direct, explicit, irrevocable, and unconditional and covers the failure to pay principal and interest when due.

The amount included in the stock of HQLA is only to the extent guaranteed before 30 June 2014.

12. Senior bonds issued by member state-sponsored impaired assets management agencies of the following countries:

§ Ireland

§ Spain

§ Slovenia

Such bonds are included in the stock of HQLA only till 31 December 2023.

13. Investments in Collective Investment Units (CIUs) which satisfy the following criteria:

§ The following information relating to the CIU is published:

— The categories of assets in which the CIU is authorized to invest.

— if investment limits apply, the relative limits and the methodologies to calculate them.

— the business of the CIU on an annual basis.

§ The underlying assets of the CIU are liquid assets which are classified as Level 1 assets. This is classified by the application.

— Should not be self-issued.

— The issuer is subject to special supervision and it ensures sufficient cooperation with the competent authority.

NOTE:

The maximum value of the investment in CIUs by a particular entity included in the stock of HQLA is EUR 500 million across all CIUs held by the entity.

The application assigns and applies a 0% haircut to all assets classified as Level 1 except covered bonds and CIU’s. Covered bonds classified as Level 1 assets are assigned a haircut of 7%.

CIUs classified as Level 1 assets, are assigned haircuts as follows:

· 0% on coins, banknotes, and exposures to central banks.

· 12% on covered bonds.

· 5% on other levels 1 assets.

The application identifies the following assets as HQLA Level 2A assets:

1. Assets which satisfy the following conditions:

§ Issuer type or guarantor type is one of the following:

— Regional Government

— Local Authority

— Public Sector Entity

§ The party, that is issuer or guarantor, belongs to a Member State

§ The exposure is assigned a risk weight of less than or equal to 20%.

2. Assets which satisfy the following conditions:

§ Issuer type or guarantor type is one of the following:

— Central Bank

— Central Government

— Regional Government

— Local Authority

— Public Sector Entity

§ The party, that is issuer or guarantor, belongs to a third country.

§ The exposure is assigned a risk weight of less than or equal to 20%.

3. Covered bonds which satisfy the following criteria:

§ Are subject to special supervision which protects bondholders and whose proceeds are invested in a manner that enables the issuer to pay claims on the bonds when they arise.

§ Have an issue size of at least EUR 250 million.

§ Are assigned a minimum of credit quality step 2 credit assessment or a risk weight of <=20%.

§ Not more than 15% of the outstanding issue of covered bond is collateralized by assets issued by institutions assigned a credit quality step 1.

§ The institution and issuer meet the transparency requirements which accord preferential treatment to covered bonds.

§ The underlying asset pool is more than 7% of the outstanding amount of the covered bond when the issue size is greater than or equal to 500 EUR million.

§ The underlying asset pool is more than 2% of the outstanding amount of the covered bond when the issue size is greater than or equal to 250 and less than 500 EUR million provided the bonds are assigned a minimum credit quality step 1 credit assessment or risk weight of less than or equal to 10%.

4. Covered bonds issued by credit institutions in third countries which satisfy the following criteria:

§ Are subject to special supervision, in the third country, which protects bondholders and whose proceeds are invested in a manner that enables the issuer to pay claims on the bonds when they arise.

§ Have an issue size of at least EUR 250 million.

§ Are assigned a minimum of credit quality step 1 credit assessment or a risk weight of less than or equal to 10%.

§ Not more than 15% of the outstanding issue of covered bond is collateralized by assets issued by institutions assigned a credit quality step 1.

§ The institution and issuer meet the transparency requirements which accord preferential treatment to covered bonds.

§ The underlying asset pool is more than 7% of the outstanding amount of the covered bond when the issue size is greater than or equal to 500 EUR million and 2% of the outstanding amount when the issue size is greater than or equal to 250 and less than 500 EUR million.

§ Backed by a pool of assets of one or more of the following types mentioned:

— Debt securities issued or guaranteed by third country’s central government or central bank or multilateral development bank or international organization that are assigned a minimum of credit quality step 1.

— Debt securities issued or guaranteed by third country’s public sector entity or regional government or local authority bank that are assigned a minimum of credit quality step 1, and the exposure is assigned a minimum of credit quality step 2.

— Residential loans having a maximum loan-to-value (LTV) ratio of 80% and assigned a risk weight <= 35%.

— Loans secured by commercial immovable property having a maximum LTV ratio of 60%.

— Maritime loans having a maximum LTV ratio of 60%.

5. Corporate debt securities which satisfy the following conditions:

§ Are assigned a rating of credit quality step 1 or risk weight less than or equal to 20%.

§ The issue size is greater than or equal to EUR 250 million.

§ The time to maturity when the security was issued was less than or equal to 10 years.

6. Sight deposits of the credit institution, which belongs to an institutional protection scheme or a cooperative network, maintained with the central institution of the network, where the central credit institution is legally required to invest the deposit amount in liquid assets of a specified level. The amount included in the stock of Level 2A assets is that portion of the deposit which is invested in Level 2A assets.

The application assigns and applies a 15% haircut to all assets classified as Level 2A except CIUs.

7. Investments in Collective Investment Units (CIUs) which satisfy the following criteria:

§ The following information relating to the CIU is published:

— the categories of assets in which the CIU is authorized to invest.

— if investment limits apply, the relative limits and the methodologies to calculate them.

— the business of the CIU on an annual basis.

§ The underlying assets of the CIU are liquid assets which are classified as Level 2A assets. This is classified by the application.

§ Should not be self-issued.

§ The issuer is subject to special supervision and it ensures sufficient cooperation with the competent authority.

NOTE:

The maximum value of the investment in CIUs by a particular entity included in the stock of HQLA is EUR 500 million across all CIUs held by the entity.

The application identifies the following assets as HQLA Level 2B assets:

1. Asset-backed security meeting the following criteria:

§ Has a rating of at least credit quality step 1 or risk weight up to 20%.

§ Are Senior bonds.

§ The underlying asset is one of the following types:

— First, lien residential loan having either maximum Loan-To-Value ratio (LTV) of 80% or maximum Loan-To-Income ratio (LTI) of 60%.

— Fully Guaranteed Residential Loans.

— Commercial Loans or Leases or Credit Facilities.

— Auto Loans or Leases.

— Personal Loans or Credit Facilities.

— Are not self-issued.

Asset-backed securities fulfilling above criteria are assigned haircuts as follows:

§ 25% on first-lien residential loans, fully guaranteed residential loans, and auto loans and leases.

§ 35% on commercial loans, leases, credit facilities, or personal loans.

2. Corporate debt securities which satisfy the following conditions:

§ Are assigned a minimum rating of credit quality step 3 or risk weight >= 20% and <=100%.

§ The issue size is >= EUR 250 million.

§ The time to maturity when the security was issued was <=10 years.

The application assigns and applies a 50% haircut to all corporate debt securities classified as Level 2B.

3. Shares which satisfy the following conditions:

§ Are a component of a major stock index.

§ Issuer type is not a financial institution or its affiliated entities.

§ Price has not decreased, or haircut has not increased by more than 40% over a 30-day period during a relevant period of significant liquidity stress which is specified by the bank.

§ Are denominated in the domestic currency of the legal entity’s home jurisdiction. If denominated in a foreign currency, they are included in the stock of HQLA as Level 2B assets only to the extent of the bank’s net stressed cash outflows in that currency arising from bank’s operations in that foreign jurisdiction.

4. Restricted-use committed liquidity facility provided by the following:

§ European Central Bank.

§ Central Bank of a Member State.

§ Central Bank of a third country.

§ The application assigns and applies a 0% haircut to all restricted-use committed liquidity facilities classified as Level 2B.

5. Exposures in the form of extremely high quality covered bonds meeting the following criteria:

§ Issue size of at least EUR 250 million.

§ Institution periodically receives information about the pool, geographical distribution, maturity structure, loan percentage more than 90 days past due.

§ The underlying asset pool is more than 10% of the outstanding amount of the covered bond.

§ National law to protect bondholders supervises issuer and the covered bonds. The laws of third countries are at least equal to respective union laws.

§ Backed exclusively by a pool of assets having the following asset types fulfilling accompanying criteria:

— A debt security issued or guaranteed by member state’s central government or central bank or ECB or public sector entity or regional government or local authority.

— Residential loan having maximum Loan-To-Value ratio (LTV) of 80% and risk weight up to 35%.

— The residential loan fully guaranteed by eligible credit protection provider having maximum Loan-To-Income ratio (LTI) of 33%.

The application assigns and applies a 30% haircut to all covered bonds classified as Level 2B.

6. Sight deposits of the credit institution, which belongs to an institutional protection scheme or a cooperative network, maintained with the central institution of the network, meeting one of the following criteria:

§ The central credit institution is legally required to invest the deposit amount in liquid assets of a specified level and has invested the deposit amount in Level 2B liquid assets. In this case, the amount included in the stock of Level 2B assets is that portion of the deposit which is invested in Level 2B assets.

§ The central credit institution has no obligation to invest the deposit amount in liquid assets

7. Liquidity Facility provided by the central institution of an institutional network of cooperative banks or institutional protection schemes. Considered as Level 2B up to the portion of funding not collateralized by any specific liquid asset.

The application assigns and applies a 25% haircut such liquid facilities classified as Level 2B.

8. A non-interest bearing asset which satisfies the following conditions:

§ Issuer type or guarantor type is one of the following:

— Central Bank

— Central Government

— Regional Government

— Local Authority

— Public Sector Entity

§ The party, that is issuer or guarantor, belongs to a third country.

§ The exposure is assigned a minimum rating of credit quality step 5 or risk weight of <=100%.

§ Is not an obligation of a financial institution or any of its affiliated entities.

The application assigns and applies a 50% haircut to all non-interest bearing assets classified as Level 2B.

9. Asset-backed security meeting the following criteria:

§ Has a rating of at least credit quality step 1 or risk weight up to 20%.

§ Is Senior bond.

§ Underlying asset pool is First lien residential loan having maximum Loan-To-Value ratio (LTV) of > 80% and maximum Loan-To-Income ratio (LTI) of > 45%.

§ Are not self-issued.

§ Asset-backed security issue date greater than or equal to 1-Oct-2015 meets the following criteria:

— Underlying of Asset Based Security is not subject to Loan-to-Income Ratio.

— Underlying Loan is issue date less than 1-Oct-2015.

— Such Asset-backed security are included in the stock of HQLA only till 1-October-2025

10. Investments in Collective Investment Units (CIUs) which satisfy the following criteria:

§ The following information relating to the CIU is published:

— the categories of assets in which the CIU is authorized to invest.

— if investment limits apply, the relative limits and the methodologies to calculate them.

— the business of the CIU on an annual basis.

§ The underlying assets of the CIU are liquid assets which are classified as Level 2B assets. This is classified by the application.

§ Should not be self-issued.

§ The issuer is subject to special supervision and it ensures sufficient cooperation with the competent authority.

NOTE:

The maximum value of the investment in CIUs by a particular entity included in the stock of HQLA is EUR 500 million across all CIUs held by the entity.

CIUs classified as Level 2B assets are assigned haircuts as follows:

· 30% on Level 2B securitizations backed by residential and auto loans.

· 35% on Level 2B covered bonds.

· 40% on Level 2B securitizations backed by commercial and personal loans.

· 55% on Level 2B corporate bonds, shares and non-interest Bearing assets.

The application identifies whether a bank’s asset or a mitigant received under re-hypothecation rights meets all the operational requirements prescribed by the regulator. If an asset classified as HQLA meets all the relevant general requirements and operational criteria it is identified as eligible HQLA and included in the stock of HQLA. The application checks for the following general requirements and operational criteria:

· Unencumbered

The application looks at the encumbrance status and includes only those assets in the stock which are unencumbered. If partially encumbered, then the portion of the asset that is unencumbered is considered as HQLA and included in the stock. If an asset is pledged to the central bank or a PSE but is not used, the unused portion of such an asset is included in the stock. The application assigns the usage of a pledged asset in the ascending order of asset quality. The lowest quality collateral is marked as used first.

· Exclusion of Certain Rehypothecated Assets

Any asset that a bank receives under a re-hypothecation right is not considered eligible HQLA if the counterparty or beneficial owner of the asset has a contractual right to withdraw the asset at any time within 30 calendar days.

· Operational Capability to Monetize HQLA

An asset is considered HQLA only if the bank has ready access to their liquid asset holdings, demonstrated the operational capability to monetize such an asset, and has periodically monetized such an asset via outright sale or repurchase agreement. The application captures this information for each asset as a flag.

· HQLA Under the Control of the Liquidity Management Function

To be considered eligible HQLA the asset is required to be under the control of the management function of the bank that manages liquidity. The application captures this information for each asset as a flag.

· Termination of Transaction Hedging HQLA

If an HQLA is hedged by a specific transaction, then the application considers the impact of closing out the hedge to liquidate the asset that is, the cost of or gain from terminating the hedge while computing the stock of HQLA. The hedge termination cost or gain is adjusted to the market value of the asset for inclusion in the stock of HQLA.

· Exclusion of Certain Issuers

An asset issued by the institution, its parent, subsidiaries, or affiliates does not qualify to be included in the stock of HQLA. The application identifies the self-issued flag based on the issuer of the asset and excludes self-issued assets from the stock of HQLA. Similarly, certain assets issued by financial institutions are excluded from the stock of HQLA. This is addressed during the classification of an asset as an HQLA.

· Liquid and readily marketable

The application checks the following criteria for determining whether an asset is liquid and readily marketable:

§ Availability of timely and observable market prices

§ Listed on a recognized exchange

§ High trading volumes

§ Presence of active secondary market

§ Presence of a two-way market

This is addressed during the classification of an asset as an HQLA.

· Transferability Restriction during Consolidation

Assets held in a third country, where there are restrictions to their free transferability, are included in the stock of HQLA only to the extent required to meet liquidity outflows in that third country. Assets held in a nonconvertible currency are included in the stock of HQLA only to the extent required to meet liquidity outflows in that currency. The application identifies such restrictions and includes them in the stock of HQLA appropriately during the consolidation process.

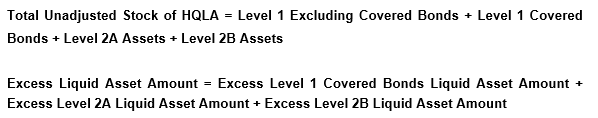

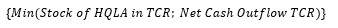

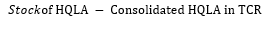

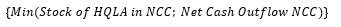

All unencumbered assets classified as Level 1, 2A, or 2B, which meet the HQLA eligibility criteria, are included in the Stock of High-Quality Liquid Assets (SHQLA). The formula for calculating SHQLA is as follows:

Where:

The application applies the relevant liquidity haircuts to the market value of each eligible HQLA based on the haircuts specified as part of a business assumption. The sum of haircut adjusted market value of all assets which are not other assets and which are classified as eligible HQLA includes the stock of HQLA. The stock includes the bank’s assets which are unencumbered, that is not placed as collateral; as well assets received from counterparties where the bank has a re-hypothecation right and where such assets are not rehypothecated.

NOTE:

All calculations are based on the market value of assets.

The following steps are involved in computing the stock of HQLA:

Topics:

· Calculating Stock of Liquid Assets

· Identifying Eligible HQLA on Unwind

· Unwinding of Transactions Involving Eligible HQLA

· Calculating Adjusted Stock of HQLA

· Calculating Excess Liquid Asset Amount

This section explains the calculation of stock of liquid assets.

1. Calculating Stock of Level 1 Assets

The stock of Level 1 assets equals (1-haircut percent) of the market value of all Level 1 liquid assets held by the bank as of the calculation date that is eligible HQLA, less the amount of the minimum/mandatory reserves less hedge termination costs (if any), less withdrawal penalty on time deposits (if any).

2. Calculating Stock of Level 2A Assets

The stock of Level 2A liquid assets equals (1-haircut percent) of the market value of all Level 2A liquid assets held by the bank as of the calculation date that are eligible HQLA, less hedge termination costs (if any).

3. Calculating Stock of Level 2B Assets

The stock of Level 2B liquid assets equals (1-haircut percent) of the market value of all Level 2B liquid assets held by the bank as of the calculation date that are eligible HQLA, less hedge termination costs (if any).

The application identifies the assets placed as collateral which are eligible HQLA if they are not encumbered. Placed collateral is marked as eligible HQLA on unwinding if it fulfills all of the following criteria:

· Asset Level is Level 1, 2A or 2B asset.

· Meets HQLA Operational Requirements on Unwind.

The application identifies all transactions maturing within the LCR horizon where HQLA is placed or received. These transactions include repos, reverse repos, secured lending transactions, collateral swaps, and so on. Such transactions are unwound that is, the original position is reversed and the cash or stock of HQLA has adjusted accordingly. This is done to avoid including any asset in the stock that should be returned to its owner before the end of the LCR horizon. The unwinding of transactions results in adjustments to the stock of HQLA, such as additions to or deductions from the stock of HQLA.

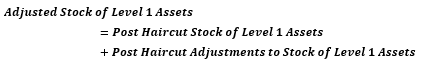

1. Adjusted Stock of Level 1 Assets

The formula for calculating adjusted stock of Level 1 assets is as follows:

NOTE:

Adjustments relate to the cash received or paid and the eligible Level 1 asset posted or received as collateral or underlying assets as part of secured funding, secured lending, and asset exchange transactions.

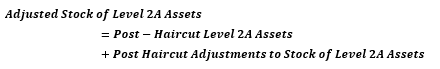

2. Adjusted Stock of Level 2A Assets

The formula for calculating adjusted stock of Level 2A assets is as follows:

NOTE:

Adjustments relate to eligible Level 2A assets posted or received as collateral or underlying assets as part of secured funding, secured lending, and asset exchange transactions.

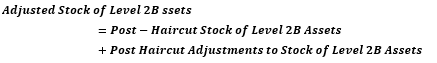

3. Adjusted Stock of Level 2B Assets

The formula for calculating adjusted stock of Level 2B RMBS assets is as follows:

NOTE:

Adjustments relate to eligible Level 2B RMBS assets posted or received as collateral or underlying assets as part of secured funding, secured lending, and asset exchange transactions.

The regulation requires banks to maintain the composition of the stock of HQLA as follows:

· A minimum of 60 % should include Level 1 assets.

· A minimum of 30 % should include Level 1 assets excluding extremely high quality covered bonds.

· A maximum of 15% should include Level 2B assets.

The Level 1 covered bonds, Level 2A, and 2B assets more than the composition prescribed by the regulator are excluded from the stock of HQLA. The application computes the excess liquid asset amounts as per the following procedure:

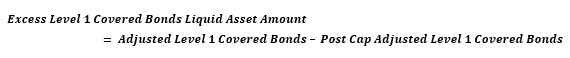

1. Excess Level 1 Covered Bonds Liquid Asset Amount

The formula for calculating excess Level 1 covered bonds liquid asset amount is as follows:

Where,

Post-Cap Adjusted Level 1 Covered Bonds = Minimum [Adjusted Level 1 Covered Bonds, (Adjusted Level 1 Assets Excluding Covered Bonds *70/30)]

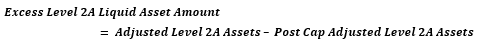

2. Excess Level 2A Liquid Asset Amount

The formula for calculating excess Level 2A liquid asset amount is as follows:

Where,

Post-Cap Adjusted Level 2A Assets = Minimum [Adjusted Level 2A Assets, {(Adjusted Level 1 Assets Excluding Covered Bonds + Post-Cap Adjusted Level 1 Covered Bonds)*40/60}, Maximum {(Adjusted Level 1 Assets Excluding Covered Bonds*70/30) – Post-Cap Adjusted Level 1 Covered Bonds, 0}]

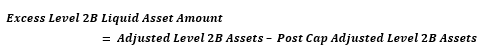

· Excess Level 2B Liquid Asset Amount

The formula for calculating excess Level 2B liquid asset amount is as follows:

Where,

Post-Cap Adjusted Level 2B Assets = Minimum [Adjusted Level 2B Assets, (Adjusted Level 1 Assets Excluding Covered Bonds + Post-Cap Adjusted Level 1 Covered Bonds + Post-Cap Adjusted Level 2A Assets)*15/85, Maximum {(Adjusted Level 1 Assets Excluding Covered Bonds + Post-Cap Adjusted Level 1 Covered Bonds)*40/60 – Post-Cap Adjusted Level 2A Assets,0}, Maximum {(70/30*Adjusted Level 1 Assets Excluding Covered Bonds) – Post-Cap Adjusted Level 1 Covered Bonds – Post-Cap Adjusted Level 2A Asset),0}]

To calculate the Liquidity Coverage Ratio, the application identified the maturity of certain transactions as follows:

1. For liabilities having embedded optionality, such as callable features, that reduces the maturity of the account, the application considers the earliest date, which is the first call date, as the revised maturity date.

2. For assets having embedded optionality that reduces the maturity of the account, where the collateral received is not rehypothecated, the application considers the earliest date, which is the first call date, plus notice period as the revised maturity date.

3. For derivatives having embedded optionality that reduces the maturity of the account, where the collateral received is not rehypothecated, the application considers the earliest date, which is the first call date, as the revised maturity date.

4. For assets or derivatives, where the collateral received has been rehypothecated for a period greater than the maturity of the asset itself, the application considers the maturity date of the liability, against which the collateral received is rehypothecated, as the revised maturity of the asset.

5. For assets or derivatives having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period greater than the first call date plus notice period but less than the original maturity of the asset itself, the application considers the maturity date of the liability, against which the collateral received is rehypothecated, as the revised maturity of the asset.

6. For derivatives having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period greater than the first call date but less than the original maturity of the asset itself, the application considers the maturity date of the liability, against which the collateral received is rehypothecated, as the revised maturity of the asset.

7. For assets having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period less than the first call date plus notice period, the application considers the first call date plus notice period as the revised maturity of the asset.

8. For derivatives having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period less than the first call date plus notice period, the application considers the first call date as the revised maturity of the asset.

9. For assets and derivatives which do not have embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period less than the maturity of the asset itself, the application considers the original maturity date of the asset, as the revised maturity of the asset.

10. For assets and derivatives which do not have embedded optionality that reduces the maturity of the account, where the collateral received has not been rehypothecated, the application considers the original maturity date of the asset, as the revised maturity of the asset.

NOTE:

The revised maturity is computed by the application as per regulatory expectation and is used for the calculation of LCR.

Operational deposits are those deposits placed by customers with a bank or balances kept by the bank with other financial institutions to meet their payment and settlement needs and other operational requirements. The application classifies accounts as operational if they meet the following criteria:

1. They are held in specifically designated accounts, which is held as operational accounts, at or with the depositing institution.

2. They arise out of a clearing, custody, or cash management relationship with the bank.

3. They do not arise out of correspondent banking services or in the context of prime brokerage services.

4. The termination of such agreements requires a minimum notice period of 30 days.

5. If the agreement can be terminated within 30 days, the customer must pay significant switching or termination costs to the depositing institution.

The application supports a new methodology to compute the operational portion of the EOP balance of deposits and balances with banks classified as operational deposits. The regulation requires banks to apply the preferential rate only on that portion of the operational deposit balance that is truly held to meet operational needs.

The following steps are involved in computing the operational balance:

1. All deposits and balances with banks classified as operational as per regulatory guidelines are identified. This is a separate process in LRM.

2. The EOP balances of eligible operational accounts are obtained over a user-defined historical window including the As of Date. To identify historical observations, the f_reporting_flag must be updated as Y for one execution of the Run per day in the LRM Run Management Execution Summary UI. The application looks up the balance for such accounts against the Run execution for which the Reporting Flag is updated as Y for each day in the past.

The historical window is captured in the Setup Master as part of the parameter named DAYS_HIST_OPER_BAL_CALC_UPD.

3. A rolling 5-day average is calculated for each account over the historical window.

4. The average of the 5-day rolling averages computed in Step 3 is calculated.

5. The operational balance is calculated as follows:

6. The non-operational balance is calculated as follows:

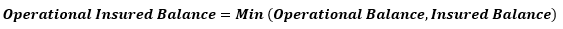

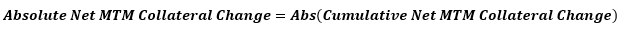

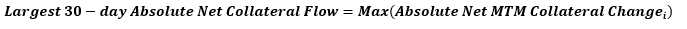

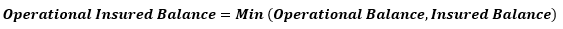

7. The operational insured balance is calculated as follows:

The insured and uninsured balances are calculated as part of a separate process, for example the insurance allocation process, which is explained in detail in the relevant section under each jurisdiction.

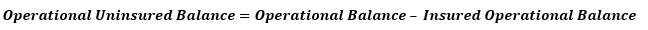

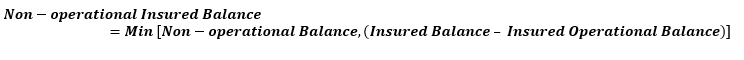

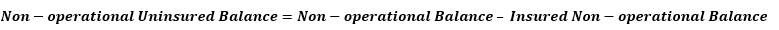

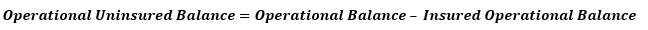

8. The operational uninsured balance is calculated as follows:

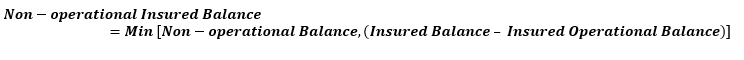

9. The non-operational insured balance is calculated as follows:

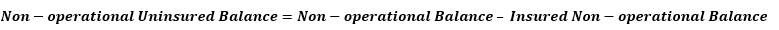

10. The non-operational uninsured balance is calculated as follows:

The operational deposit computation process is illustrated in the following table, assuming a 15-day historical window instead of 90-days and for the As of Date 28th February 2017. The historical balances for 15-days including the As of Date are provided as follows.

Clients With Operational Accounts |

Eligible Operational Accounts |

Historical Time Window |

As of Date |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2/14/ |

2/15/ |

2/16/ |

2/17/ |

2/18/ |

2/19/ |

2/20/ |

2/21/ |

2/22/ |

2/23/ |

2/24/ |

2/25/ |

2/26/ |

2/27/ |

2/28/ |

|

|||

A |

10001 |

102,000 |

102,125 |

102,250 |

102,375 |

102,500 |

102,625 |

102,750 |

102,875 |

103,000 |

103,125 |

103,250 |

103,375 |

103,500 |

103,625 |

103,750 |

|

|

10296 |

23,500 |

23,550 |

23,600 |

23,650 |

23,700 |

23,750 |

23,800 |

23,850 |

23,900 |

23,950 |

24,000 |

24,050 |

24,100 |

24,150 |

24,200 |

|

||

B |

31652 |

65,877 |

59,259 |

59,234 |

59,209 |

59,184 |

59,159 |

59,134 |

59,109 |

59,084 |

59,059 |

59,034 |

59,009 |

58,984 |

58,959 |

58,934 |

|

|

The rolling averages and cumulative average are computed as follows:

Clients with Operational Accounts |

Eligible Operational Accounts |

5-day Rolling Average |

Cumulative Average (a) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2/18/ |

2/19/ |

2/20/ |

2/21/ |

2/22/ |

2/23/ |

2/24/ |

2/25/ |

2/26/ |

2/27/ |

2/28/ |

|||

A |

10001 |

102,250 |

102,375 |

102,500 |

102,625 |

102,750 |

102,875 |

103,000 |

103,125 |

103,250 |

103,375 |

103,500 |

95136 |

10296 |

23,600 |

23,650 |

23,700 |

23,750 |

23,800 |

23,850 |

23,900 |

23,950 |

24,000 |

24,050 |

24,100 |

22721 |

|

B |

31652 |

60,553 |

59,209 |

59,184 |

59,159 |

59,134 |

59,109 |

59,084 |

59,059 |

59,034 |

59,009 |

58,984 |

56931 |

The operational and non-operational balances are computed as follows:

Clients with Operational Accounts |

Eligible Operational Accounts |

Current Balance (b) |

Operational Balance (c = a – b) |

Non-Operational Balance |

Insured Balance |

Uninsured Balance |

Insured Operational Balance |

Uninsured Operational Balance |

Insured Non-Operational Balance |

Uninsured Non-Operational Balance |

|---|---|---|---|---|---|---|---|---|---|---|

A |

10001 |

103,750 |

95,136 |

8,615 |

100,000 |

3,750 |

95,136 |

|

4,865 |

3,750 |

10296 |

24,200 |

22,721 |

1,480 |

|

24,200 |

|

22,721 |

|

1,480 |

|

B |

31652 |

58,934 |

56,931 |

2,003 |

58,934 |

|

56,931 |

|

2,003 |

|

NOTE:

· Negative historical balances are replaced by zero for this computation.

· For operational accounts that have an account start date greater than or equal to 90 historical days including the As of Date, missing balances are replaced by previously available balance.

· For operational accounts that have an account start date less than 90 historical days including the As of Date:

1. Missing balances between the account start date and As of Date are replaced by previously available balance.

2. The rolling average is calculated only for the period from the account start date to the As of Date.

Deposit insurance calculations in LRRCEBA is performed at a Legal Entity and Insurance Scheme - Customer combination.

Multiple schemes in different currencies can be defined per Legal Entity. During Run execution, the deposit amounts, scheme limits, and other relevant amounts are converted into the reporting currency. Additionally, all the comparisons and calculations are performed in the reporting currency.

For every Legal Entity - Insurance Scheme - Customer combination, the application compares the total deposit balance with the scheme limit. After comparison, LRRCEBA determines the following:

· Insured Amount

§ If the total deposit amount is greater or equal to the scheme limit, then:

Insured amount = Scheme limit amount

§ If the total deposit amount is lesser than the scheme limit, then:

Insured amount = Total deposit amount

After the insured amount is calculated, the application computes the uninsured amount.

· Uninsured amount = Total deposit balance - Insured amount

After these computations are performed at the higher granularity, the application allocates these amounts back to the account level.

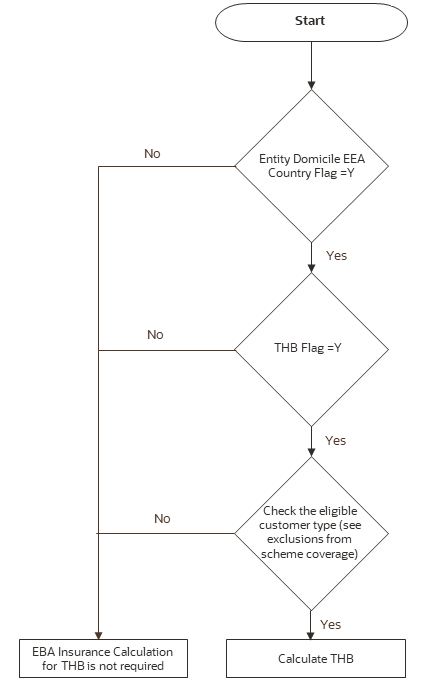

Some countries in Europe provide additional insurance for temporary increases in deposit balances. Such increases can be due to benefits payable on retirement, marriage or civil partnership, compensation claims, real estate dealings, and so on. These events are referred to as Temporary High Balance (THB) events. When such events occur, the deposit balances increase, and the insurance provider offers additional coverage for the amounts.

LRRCEBA supports the inclusion of additional insured amounts in the calculation of the total insured amount for an account. After the insurance allocation is complete at the account level (see the section Deposit Insurance Calculation), the application calculates the total additional insured amount due to temporary high balances.

For every account, the application calculates the insured amount as follows:

New Insured amount = Original insured amount + Additional insured amount due to Temporary High Balance

New Uninsured amount = EOP Balance of account - New insured amount

In case of no additional insured amount due to Temporary High Balance event, the new insured amount is the same as the one computed from the insurance calculation and allocation process as described in section Deposit Insurance Calculation.

Verifying whether the new insured amount must be less than or equal to the EOP balance of the account is included as part of the validations to ensure an accurate representation of data. The following process flow describes the calculation of temporary high balance.

Figure 1: Process Flow - Temporary High Balance

In the European Economic Area (EEA) countries, specific events result in a temporary increase in the balance, for which an additional insurance limit is allocated to the account. An Absolutely Entitled Account (AEA) refers to any account where the depositor is absolutely entitled to the sums held in an account. The following events are considered as Temporary High Balance (THB) events, for the Absolutely Entitled Account (AEA) ownership category as per EBA guidelines.

· Earmarked for Purchase of Private Residential Property

· Proceeds from Sale of Private Residential Property

· Paid on Separation, Divorce, or Dissolution of Civil Union

· Benefits Payable on Retirement

· Claim for Compensation for Unfair Dismissal

· Claim for Compensation for Redundancy

· Benefits Payable for Death or Bodily Injury

· Claim for Compensation for Wrongful Conviction

NOTE:

The application allows you to add any new events as per the jurisdictional requirement by adding data in the tables mentioned in the LRRCEBA Download Specification.

Not Absolutely Entitled Account (non-AEA) refers to any account where the depositor is not absolutely entitled to the sums held in an account. For accounts in the non-AEA ownership category, the deposit limit is unlimited. The application does not consider these accounts for Temporary High Balance insurance coverage.

The application first checks if the Legal Entity falls under an EEA country, and then checks if the Branch is domiciled in an EEA country. The application considers the following cases for THB:

· Both the Legal Entity and Branch Domicile is located in an EEA country: The Branch and the Legal Entity are eligible for the THB coverage.

· The Legal Entity is domiciled in an EEA country, and Branch is not Domiciled in an EEA country: The Legal Entity is eligible for the THB coverage and the Branch is not eligible for the THB coverage.

· The Legal Entity is not domiciled in an EEA country, but the branch is domiciled in an EEA country: The Branch and the Legal Entity are not eligible for the THB coverage.

The application achieves this by the following two flags:

· Entity Domicile European Economic Area Country Flag: The flag f_entity_eea_country_flag, identifies whether the Legal Entity domicile country is considered to be a member state of the European Economic Area (EEA). The flag is set to YES if the Legal Entity is domiciled in an EEA Country otherwise the value of the flag is NO.

· Branch Domicile European Economic Area Country Flag: The flag f_branch_eea_country_flag, identifies whether the branch domicile country is considered to be a member state of the European Economic Area. The flag is set to YES if the branch is domiciled in an EEA Country otherwise the value of the flag is NO.

For example, in the following illustration for Legal Entity 1, Branch 1 and Branch 2 have Legal Entity and Branch domiciled, in an EEA country, and therefore are considered for the coverage. However, Branch 3 has the Legal Entity domiciled in an EEA country, but the Branch is domiciled in a non-EEA country, and thus is not considered for the coverage.

Entity |

Entity Domicile |

Entity Domicile EEA Country |

Branch |

Branch Domicile |

Branch Domicile EEA Country |

Entity Coverage |

Branch Coverage |

|---|---|---|---|---|---|---|---|

Legal Entity 1 |

Malta |

Yes |

Branch 1 |

Malta |

Yes |

Yes |

Yes |

Yes |

Branch 2 |

France |

Yes |

Yes |

|||

Yes |

Branch 3 |

Turkey |

No |

No |

|||

Legal Entity 2 |

France |

Yes |

Branch 4 |

France |

Yes |

Yes |

Yes |

Yes |

Branch 5 |

Malta |

Yes |

Yes |

|||

Legal Entity 3 |

United States of America |

No |

Branch 6 |

United States of America |

No |

No |

No |

No |

Branch 7 |

Malta |

Yes |

No |

The application considers accounts under the following Standard Product Types for insurance coverage:

· Savings Account with a balance greater than 0

· Current Account with a balance greater than 0

· Term Deposits

· Credit Cards with a credit balance

· Overdraft with a credit balance

· Certificate of Deposit issued to an individual, which existed on or before July 2nd, 2014.

The application excludes the following deposits from insurance coverage:

· Deposits by non-individuals such as:

§ Bank

§ Hedge Fund Investment Firm

§ Investment Company

§ Personal Investment Company

§ Private Equity Investment Firm

§ Real Estate Investment Trust

§ Small Business Investment Companies

§ Trust and investment company

§ Mutual Funds

§ Government-Sponsored Insurance Entity

§ Insurance Entity

§ Reinsurance Firm

§ Collective Investment Undertaking

§ Employee Pension Fund

§ Social Security Fund Management Company

§ Sovereign

· Deposit by individuals:

§ Individuals involved in financial activities

§ Deposits arising out of transactions in connection with which there has been a criminal conviction for money laundering as defined in Article 1(2) of Directive 2005/60/EC. The application uses the following flag to handle this scenario:

— Frozen Account Due to Anti-money Laundering Event Flag: The flag f_frozen_for_aml_event_flag stores the Frozen Account indicator due to an anti-money laundering event.

This section provides the steps involved in insurance allocation.

Topics:

· Identifying Insurance Eligible Accounts

· Allocation of Deposit Insurance

The identification of insurance eligible accounts involves looking at the inclusion as well as the exclusion criteria. The application requires users to provide the following inclusion criteria:

1. Ownership Category

OFS LRRCEBA allocates the insurance limit separately for each ownership category level. Ownership categories include Absolutely Entitled Account and Non-Absolutely Entitled Account.

2. Product Type

This is a list of product types that are covered under the respective jurisdiction’s deposit insurance scheme. The insurance limit is allocated to only those customer accounts whose product types match those covered by the deposit insurance. In the case of EBA, all types of deposits such as current accounts, savings accounts, and term deposits are covered, which must be provided as inputs.

3. Product Type Prioritization

The sequence in which the insured amount is to be allocated to each product type is captured. For instance, product prioritization may be specified as a current account, savings account, and term deposit. This indicates that the insured amount is allocated first to a current account held by the customer. After current accounts have been fully covered, the remaining amount is allocated to savings accounts and finally to term deposits.

NOTE:

The application allows the prioritization of insurance allocation to be done at a Bank Product level or Product Type level. If no prioritization is provided, the application allocates the amount to all insured accounts in equal priority.

4. Currency Eligibility for Insurance

This is a list of currencies in which the accounts are denominated that are eligible for insurance coverage under a deposit insurance scheme. Some jurisdictions cover foreign currency deposits under their deposit insurance schemes. If eligible currencies are specified for insurance, then the insured balance is allocated to all accounts belonging to the particular legal entity which have the associated attributes required for assigning the insured balance. For instance, EBA insures only in terms of Euro denominated deposits. The eligible currency against the EBA insurance scheme should be provided as Euros.

Deposits denominated in all currencies are covered by the EBA Deposit Guarantee Scheme. However, the payout will be in the insurance limit currency.

As part of the EBA Run, the application allocates the deposit insurance to accounts based on the guidelines specified by the EBA. The insurance limit captured against each deposit insurance scheme is allocated to the insurance eligible accounts under that scheme based on the ownership category and the depositor combination.

The insurance limit, which is the maximum deposit balance covered by an insurance scheme per customer, is captured against each insurance scheme – ownership category combination. Customers having an account in multiple legal entities get a separate deposit insurance limit per legal entity. In the case of the EBA Deposit Guarantee scheme, the limit amount must be provided in the Stage Insurance Scheme Master Table at the granularity of the insurance scheme.

NOTE:

In case the event is eligible for a THB coverage, the insurance limit will be first utilized to cover the entire balance on account of a THB event, and the remaining balance will get covered if there is any unused limit left under the deposit guarantee scheme.

The insurance limit is allocated to accounts as per the following procedure:

1. The application identifies the established relationship flag at a customer level.

2. The accounts are sorted by the specified product type prioritizations.

3. The insurance allocation is done based on the principal balance from the highest to the least, in the order of product type prioritization.

4. The insurance limit available is allocated to account 1 to n – 1 as per the following formula:

Where,

Insurance Limit Available: Limit available post allocation to previous accounts

= Insurance Limit Available x-1 – Insured Amount x-1

X: Number of accounts up to the current account to which the insured amount is to be allocated

n: Total number of accounts of a customer which are eligible for insurance coverage under a given ownership category

The remaining available insurance is allocated to the last account that is account n for which insurance was not allocated.

5. If the insurance limit is available after allocating to the principal balances, it is allocated to the accrued interest from the highest to the least in the order of Product Type prioritization.

The following is an illustration of this procedure. It considers an insurance limit of 100,000 EUR for each depositor combination under each ownership category for each legal entity. The inputs to this calculation, including account details and customer details, are as follows.

Illustration: Conversion of Eligible Balances to Limit Currency

Legal Entity |

Account Number |

Account Currency |

Account Balance |

Account Holding Type |

Temporary High Balance |

Customer Holding Temporary High Balance |

Temporary High Balance Event |

Temporary High Balance |

Insurance Scheme Code |

Insurance Limit Currency |

Converted Account Balance |

Converted Temporary High Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100001 |

EUR |

759967 |

Single |

Yes |

Customer A |

Proceeds from Sale of Private Residential Property |

245000 |

MDCS |

EUR |

759967 |

245000 |

Earmarked for Purchase of Private Residential Property |

430000 |

MDCS |

EUR |

430000 |

||||||||

Legal Entity 1 |

100002 |

GBP |

1243427 |

Single |

Yes |

Customer A |

Proceeds from Sale of Private Residential Property |

650000 |

MDCS |

EUR |

1094216 |

572000 |

Benefits Payable on Retirement |

125000 |

MDCS |

EUR |

110000 |

||||||||

Legal Entity 1 |

100003 |

USD |

7759 |

Single |

No |

|

|

|

MDCS |

EUR |

8690 |

0 |

Legal Entity 1 |

100004 |

EUR |

20172 |

Single |

No |

|

|

|

MDCS |

EUR |

20172 |

0 |

Legal Entity 1 |

100005 |

EUR |

523504 |

Single |

No |

|

|

|

MDCS |

EUR |

523504 |

0 |

Legal Entity 1 |

100006 |

EUR |

26292 |

Single |

No |

|

|

|

MDCS |

EUR |

26292 |

0 |

Legal Entity 1 |

100007 |

EUR |

85255 |

Joint |

No |

|

|

|

MDCS |

EUR |

85255 |

0 |

Legal Entity 1 |

100008 |

EUR |

653019 |

Joint |

No |

|

|

|

MDCS |

EUR |

653019 |

0 |

Legal Entity 1 |

100009 |

EUR |

271034 |

Single |

No |

|

|

|

MDCS |

EUR |

271034 |

0 |

Legal Entity 1 |

100010 |

EUR |

67933 |

Single |

No |

|

|

|

MDCS |

EUR |

67933 |

0 |

Legal Entity 1 |

100011 |

GBP |

80900 |

Joint |

No |

|

|

|

MDCS |

EUR |

71192 |

0 |

Legal Entity 2 |

500001 |

GBP |

8461 |

Single |

No |

|

|

|

MDCS |

EUR |

7445.68 |

0 |

Legal Entity 2 |

500002 |

USD |

6427 |

Single |

No |

|

|

|

MDCS |

EUR |

7198.24 |

0 |

Legal Entity 2 |

500003 |

EUR |

7953 |

Single |

No |

|

|

|

MDCS |

EUR |

7953 |

0 |

Legal Entity 2 |

400001 |

EUR |

124775 |

Single |

No |

|

|

|

MDCS |

EUR |

124775 |

0 |

Legal Entity 2 |

400002 |

EUR |

76065 |

Single |

No |

|

|

|

MDCS |

EUR |

76065 |

0 |

Legal Entity 2 |

400003 |

EUR |

82622 |

Joint |

No |

|

|

|

MDCS |

EUR |

82622 |

0 |

Legal Entity |

Account Number |

Account Holding Type |

Ownership Category Code |

Primary Holder |

Secondary Holder 1 |

Temporary High Balance |

Customer Holding Temporary High Balance |

Temporary High Balance Event |

Converted Account Balance |

Converted Temporary High Balance |

Converted General Category Account Balance |

Number of Account Holders |

General Category Balance Per Customer |

General Category Balance - Customer A |

General Category Balance - Customer B |

General Category Balance - Customer C |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100006 |

Single |

AEA |

Customer C |

|

No |

|

|

26292 |

0 |

26292.00 |

1 |

26292.00 |

|

|

26292.00 |

Legal Entity 1 |

100007 |

Joint |

AEA |

Customer A |

Customer C |

No |

|

|

85255 |

0 |

85255.00 |

2 |

42627.50 |

42627.50 |

|

42627.50 |

Legal Entity 1 |

100008 |

Joint |

NAEA |

Customer C |

Customer A |

No |

|

|

653019 |

0 |

653019.00 |

2 |

326509.50 |

326509.50 |

|

326509.50 |

Legal Entity 1 |

100009 |

Single |

NAEA |

Customer C |

|

No |

|

|

271034 |

0 |

271034.00 |

1 |

271034.00 |

|

|

271034.00 |

Legal Entity 1 |

100010 |

Single |

AEA |

Customer C |

|

No |

|

|

67933 |

0 |

67933.00 |

1 |

67933.00 |

|

|

67933.00 |

Legal Entity |

Account Number |

Temporary High Balance |

Customer Holding Temporary High Balance |

Temporary High Balance Event |

Converted Temporary High Balance |

Temporary High Balance Deposit Start Date |

Insurance Scheme Code |

Temporary High Balance Protection Period (in Months) |

As of Date |

Temporary High Balance Protection End Date |

Additional Protection Valid |

Insurance Eligible Temporary High Balance Amount |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100001 |

Yes |

Customer A |

Proceeds from Sale of Private Residential Property |

245000 |

28-Jun-17 |

FSCS |

6 |

1-Dec-17 |

27-Dec-17 |

Y |

245000 |

Earmarked for Purchase of Private Residential Property |

430000 |

6-Sep-17 |

FSCS |

6 |

2-Dec-17 |

5-Mar-18 |

Y |

430000 |

||||

Legal Entity 1 |

100002 |

Yes |

Customer A |

Proceeds from Sale of Private Residential Property |

572000 |

14-Jul-17 |

FSCS |

6 |

3-Dec-17 |

13-Jan-18 |

Y |

572000 |

Benefits Payable on Retirement |

110000 |

3-Jun-17 |

FSCS |

6 |

4-Dec-17 |

2-Dec-17 |

N |

0 |

The application allocates the insurance limit to all eligible accounts as follows:

Insurance Allocation for Customer A

Legal Entity |

Temporary High Balance Event |

Account Number |

Temporary High Balance Insurance Eligible Amount |

Temporary High Balance Insurance Ineligible Amount |

Available Insurance Limit |

Insurance Allocation Weight |

Temporary High Balance Insured Amount |

Temporary High Balance Uninsured Amount |

|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

Proceeds from Sale of Private Residential Property |

100001 |

245000.00 |

0.00 |

500000 |

29.99% |

149938.80 |

95061.20 |

Legal Entity 1 |

100002 |

572000.00 |

0.00 |

70.01% |

350061.20 |

221938.80 |

||

Legal Entity 1 |

Earmarked for Purchase of Private Residential Property |

100001 |

430000.00 |

0.00 |

500000 |

100.00% |

430000.00 |

0.00 |

Legal Entity 1 |

Benefits Payable on Retirement |

100002 |

0.00 |

110000.00 |

500000 |

0.00% |

0.00 |

110000.00 |

Legal Entity |

Account Number |

Account Holding Type |

General Category Balance |

Uninsured Temporary High Balance |

Total General Category Balance |

Ownership Category Code |

Insurance Limit for General Category |

Insurance Allocation Weight |

Insured General Category Amount |

Uninsured Total General Category Amount |

|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100001 |

Single |

84967.00 |

95061.20 |

180028.20 |

AEA |

100000 |

17.96% |

17959.60 |

162068.60 |

Legal Entity 1 |

100002 |

Single |

412215.76 |

331938.80 |

744154.56 |

AEA |

74.24% |

74236.82 |

669917.74 |

|

Legal Entity 1 |

100007 |

Joint |

42627.50 |

|

42627.50 |

AEA |

4.25% |

4252.52 |

38374.98 |

|

Legal Entity 1 |

100011 |

Joint |

35596.00 |

|

35596.00 |

AEA |

3.55% |

3551.06 |

32044.94 |

|

Legal Entity 1 |

100008 |

Joint |

326509.50 |

|

326509.50 |

NAEA |

Unlimited |

100% |

326509.50 |

0.00 |

Legal Entity 2 |

500001 |

Single |

7445.68 |

|

7445.68 |

AEA |

100000 |

13.31% |

7445.68 |

0.00 |

Legal Entity 2 |

500002 |

Single |

7198.24 |

|

7198.24 |

AEA |

12.86% |

7198.24 |

0.00 |

|

Legal Entity 2 |

400003 |

Joint |

41311.00 |

|

41311.00 |

AEA |

73.83% |

41311.00 |

0.00 |

Legal Entity |

Account Number |

General Category Insured Amount |

Temporary High Balance Insured Amount |

Total Insured Amount |

Converted EOP Balance |

Total Uninsured Amount |

|---|---|---|---|---|---|---|

Legal Entity 1 |

100001 |

17959.60 |

95061.20 |

113020.80 |

759967.00 |

646946.20 |

Legal Entity 1 |

100002 |

74236.82 |

331938.80 |

406175.62 |

1094215.76 |

688040.14 |

Legal Entity 1 |

100007 |

4252.52 |

|

4252.52 |

42627.50 |

38374.98 |

Legal Entity 1 |

100011 |

3551.06 |

|

3551.06 |

35596.00 |

32044.94 |

Legal Entity 1 |

100008 |

326509.50 |

|

326509.50 |

326509.50 |

0.00 |

Legal Entity 2 |

500001 |

7445.68 |

|

7445.68 |

7445.68 |

0.00 |

Legal Entity 2 |

500002 |

7198.24 |

|

7198.24 |

7198.24 |

0.00 |

Legal Entity 2 |

400003 |

41311.00 |

|

41311.00 |

41311.00 |

0.00 |

Insurance Allocation for Customer B

Legal Entity |

Account Number |

Account Holding Type |

General Category Balance |

Uninsured Temporary High Balance |

Total General Category Balance |

Ownership Category Code |

Insurance Limit for General Category |

Insurance Allocation Weight |

Insured General Category Amount |

Uninsured Total General Category Amount |

|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100003 |

Single |

8690.08 |

0.00 |

8690.08 |

AEA |

100000 |

13.48% |

8690.08 |

0.00 |

Legal Entity 1 |

100004 |

Single |

20172.00 |

0.00 |

20172.00 |

AEA |

31.29% |

20172.00 |

0.00 |

|

Legal Entity 1 |

100011 |

Joint |

35596.00 |

0.00 |

35596.00 |

AEA |

55.22% |

35596.00 |

0.00 |

|

Legal Entity 1 |

100005 |

Single |

523504.00 |

0.00 |

523504.00 |

NAEA |

Unlimited |

100.00% |

523504.00 |

0.00 |

Legal Entity 2 |

500003 |

Single |

7953.00 |

0.00 |

7953.00 |

AEA |

100000 |

4.57% |

4569.67 |

3383.33 |

Legal Entity 2 |

400001 |

Single |

124775.00 |

0.00 |

124775.00 |

AEA |

71.69% |

71693.70 |

53081.30 |

|

Legal Entity 2 |

400003 |

Joint |

41311.00 |

0.00 |

41311.00 |

AEA |

23.74% |

23736.63 |

17574.37 |

|

Legal Entity 2 |

400002 |

Single |

76065.00 |

0.00 |

76065.00 |

NAEA |

Unlimited |

100.00% |

76065.00 |

0.00 |

Legal Entity |

Account Number |

General Category Insured Amount |

Temporary High Balance Insured Amount |

Total Insured Amount |

Converted EOP Balance |

Total Uninsured Amount |

|---|---|---|---|---|---|---|

Legal Entity 1 |

100003 |

8690.08 |

0.00 |

8690.08 |

8690.08 |

0.00 |

Legal Entity 1 |

100004 |

20172.00 |

0.00 |

20172.00 |

20172.00 |

0.00 |

Legal Entity 1 |

100011 |

35596.00 |

0.00 |

35596.00 |

35596.00 |

0.00 |

Legal Entity 1 |

100005 |

523504.00 |

0.00 |

523504.00 |

523504.00 |

0.00 |

Legal Entity 2 |

500003 |

4569.67 |

0.00 |

4569.67 |

7953.00 |

3383.33 |

Legal Entity 2 |

400001 |

71693.70 |

0.00 |

71693.70 |

124775.00 |

53081.30 |

Legal Entity 2 |

400003 |

23736.63 |

0.00 |

23736.63 |

41311.00 |

17574.37 |

Legal Entity 2 |

400002 |

76065.00 |

0.00 |

76065.00 |

76065.00 |

0.00 |

Insurance Allocation for Customer C

Legal Entity |

Account Number |

Account Holding Type |

General Category Balance |

Uninsured Temporary High Balance |

Total General Category Balance |

Ownership Category Code |

Insurance Limit for General Category |

Insurance Allocation Weight |

Insured General Category Amount |

Uninsured Total General Category Amount |

|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100006 |

Single |

26292.00 |

0.00 |

26292.00 |

AEA |

100000 |

19.21% |

19211.93 |

7080.07 |

Legal Entity 1 |

100007 |

Joint |

42627.50 |

0.00 |

42627.50 |

AEA |

31.15% |

31148.50 |

11479.00 |

|

Legal Entity 1 |

100010 |

Single |

67933.00 |

0.00 |

67933.00 |

AEA |

49.64% |

49639.58 |

18293.42 |

|

Legal Entity 1 |

100008 |

Joint |

326509.50 |

0.00 |

326509.50 |

NAEA |

Unlimited |

100.00% |

326509.50 |

0.00 |

Legal Entity 1 |

100009 |

Single |

271034.00 |

0.00 |

271034.00 |

NAEA |

Unlimited |

100.00% |

271034.00 |

0.00 |

Legal Entity |

Account Number |

General Category Insured Amount |

Temporary High Balance Insured Amount |

Total Insured Amount |

Converted EOP Balance |

Total Uninsured Amount |

|---|---|---|---|---|---|---|

Legal Entity 1 |

100006 |

19211.93 |

0.00 |

19211.93 |

26292.00 |

7080.07 |

Legal Entity 1 |

100007 |

31148.50 |

0.00 |

31148.50 |

42627.50 |

11479.00 |

Legal Entity 1 |

100010 |

49639.58 |

0.00 |

49639.58 |

67933.00 |

18293.42 |

Legal Entity 1 |

100008 |

326509.50 |

0.00 |

326509.50 |

326509.50 |

0.00 |

Legal Entity 1 |

100009 |

271034.00 |

0.00 |

271034.00 |

271034.00 |

0.00 |

A stable deposit is a deposit whose outstanding balance is either fully or partially covered by the deposit insurance provided by the relevant national deposit insurance organization satisfying one of the following conditions:

· It is held in a transactional account by the depositor.

Or

· The depositor has an established relationship with the reporting legal entity.

· The first step in identifying deposit stability is to allocate deposit insurance limit at an account level.

After the insurance limit is allocated at an account level, the application determines the deposit stability as follows:

1. High Run-off Deposits

Two additional stability criteria are supported for the deposit balances that are subject to higher outflows, if they meet the regulatory criteria for such higher rates. The application identifies the less stable deposits that meet the higher outflow rate criteria as specified by the regulator and classifies them into the following two types:

§ High Run-off Deposits Category 1, which meet the criteria for receiving a higher outflow rate of 15%

§ High Run-off Deposits Category 2, which meet the criteria for receiving a higher outflow rate of 20%

Deposits fulfilling the following criteria are classified as High Run-off Deposits Category:

Criteria A. Total deposit of the customer is greater than EUR 500,000

Criteria B. Is an internet-only account

Criteria C. Interest rate on deposits exceeds the average interest rate

Criteria D. Interest rate on deposits is derived from the market variable flag

Criteria E. Depositor is a resident of a third country, or the deposit is denominated in a currency other than Euro, or the domestic currency of a member state

— Deposits fulfilling criteria A or any two criteria from B to E are classified as High Run-off Deposits Category 1.

— Deposits fulfilling criteria A and any other criteria from B to E or fulfilling any three criteria from A to E are classified as High Run-off Deposits Category 2.

2. Stable Deposits

A stable deposit is that portion of a deposit which is fully covered by deposit insurance provided by an effective deposit insurance scheme or a public guarantee that provides equivalent protection and satisfies one of the following conditions:

a. It is held in a transactional account by the depositor.

Or

b. The depositor has an established relationship with the reporting legal entity, which makes a withdrawal unlikely.

Stable deposits receive a 5% Run-off rate unless they meet additional deposit criteria.

3. Highly Stable Deposits

All stable deposits identified as per the criteria specified in High Run-off Deposits are classified as meeting additional insurance criteria, if the insurance scheme under which they are covered satisfies the following conditions:

a. Has available financial means, raised ex ante by contributions made by members at least annually.

b. Has adequate means of ensuring ready access to additional funding in the event of a large call on its reserves, including access to extraordinary contributions from member credit institutions and adequate alternative funding arrangements to obtain short-term funding from public or private third parties.

c. Ensures a seven working day repayment period from the date of application of the 3% outflow.

Such deposits receive a 3% Run-off rate.

4. Less Stable Deposits

All insured and uninsured deposit balances that do not meet the stable deposits criteria specified earlier are classified as less stable deposits: This includes:

a. Insured balance of deposits meeting stable deposits criteria but denominated in ineligible foreign currencies.

b. Uninsured balance of deposits meeting stable deposits criteria.

c. Insured balance of deposits which are not transactional account and the customer has no established relationship with the bank.

d. Deposit balance where the insurance coverage status is Uninsured.

Such deposits receive a 10% Run-off rate.

NOTE:

All the deposit type amount is calculated only on unencumbered EOP balance. Encumbered EOP balance or blocked amount is not considered if it is blocked/encumbered beyond the LCR horizon.

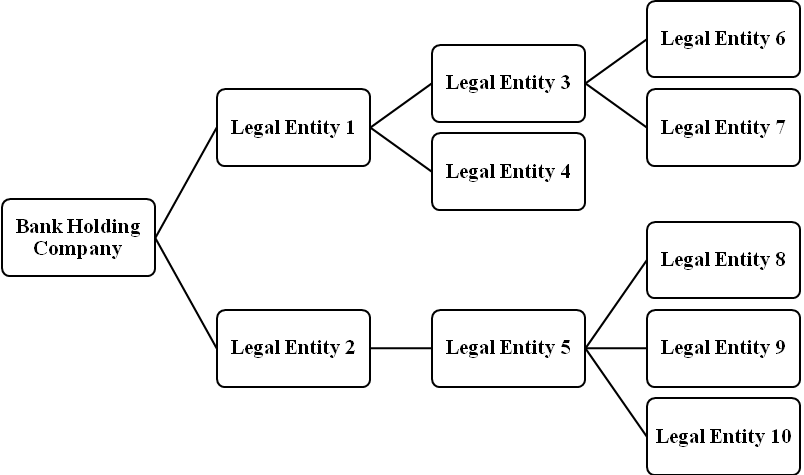

The approach to consolidation as per LCR approach followed by OFS LRRCEBA is as follows:

Identification and Treatment of Unconsolidated Subsidiary

The application assesses whether a subsidiary is a consolidated subsidiary or not by checking the regulatory entity indicator against each legal entity. The application consolidates the cash inflows and outflows of a subsidiary and computes the consolidated LCR, only if the subsidiary is a regulatory consolidated subsidiary. If the entity is an unconsolidated subsidiary, the cash inflows and outflows from the operations of such subsidiaries are ignored (unless otherwise specifically included in the denominator of LCR per regulations) and only the equity investment in such subsidiaries is considered as the bank’s asset and appropriately taken into the numerator or denominator based on the asset level classification.

For instance, legal entity 1 has 3 subsidiaries, legal entity 2, legal entity 3, and legal entity 4. The regulatory consolidated flag for legal entity 4 is No. In this case, legal entity 4 is treated as a third party for consolidation and its assets and cash flows are completely excluded from calculations. Legal entity 1’s interest in legal entity 4 including common equity of legal entity 4 and assets and liabilities where legal entity 4 is the counterparty will not be eliminated as legal entity 4 is considered a third-party during consolidation.