The Application Preferences tab helps to select some set-up parameters required for LRMM processing. These include the selection of Contractual Cash Flow processes, mandatory dimensions, and aggregation dimensions. LRM Functional Administrators can set the application preferences.

NOTE:

For an LRM Analyst, with LRM Approver or LRM Reviewer role, to view the Application Preferences tab, you must map the function “View LRM Application Preference” in the System Administration > Function - Role Map in Oracle Financial Services Analytical Applications window. For more information, see Appendix A of the OFS Analytical Applications Infrastructure User Guide.

Topics:

· Understanding Application Preferences

· Contractual Cash Flow Process Selection

· Mandatory Dimension Configuration

· Aggregation Dimension Selection

NOTE:

Every SKU in the Liquidity Risk Solution (LRS) pack leverages this common user interface.

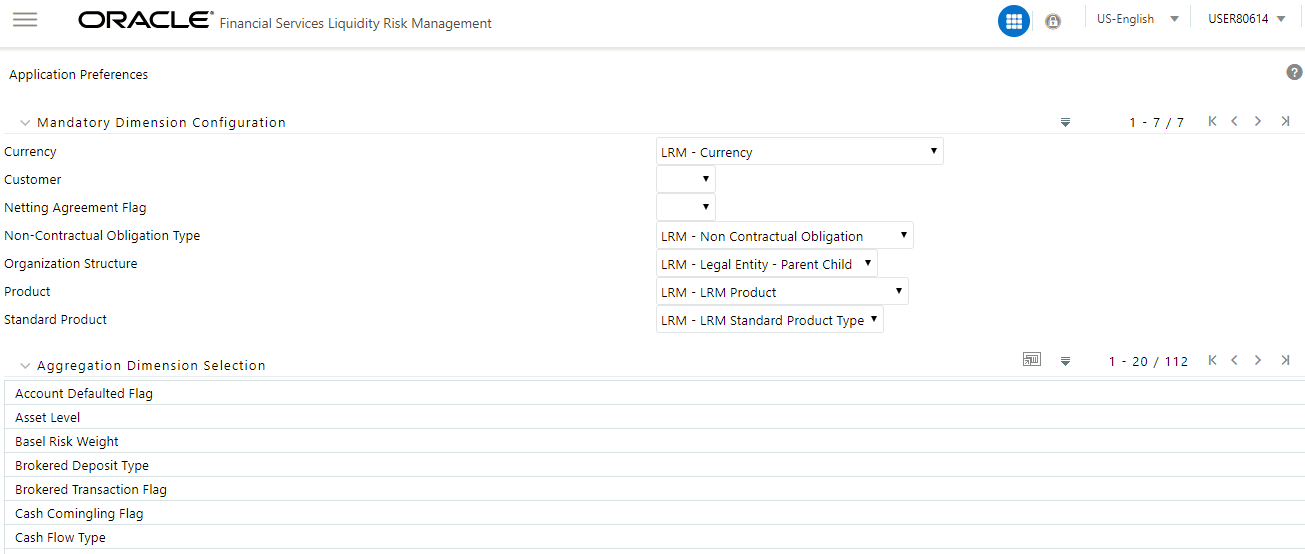

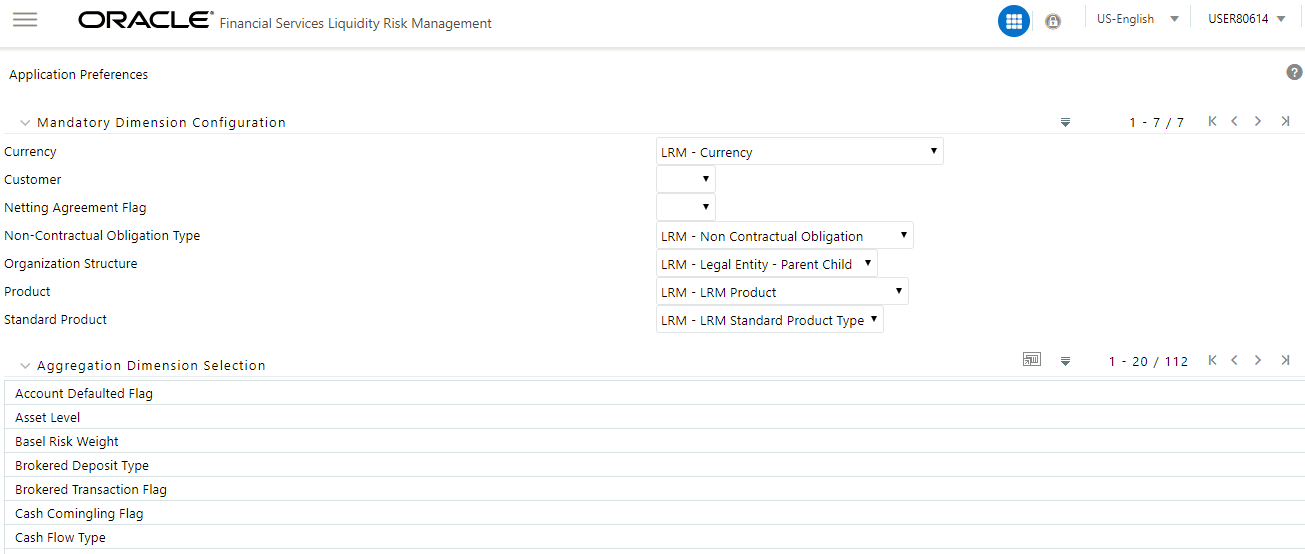

In the Oracle Financial Services Analytical Applications Infrastructure home screen, select Financial Services Liquidity Risk Management. To open the Application Preferences window, select Liquidity Risk Management, and then select Application Preferences on the Left-Hand Side (LHS) menu.

Figure 5 Application Preferences

The Application Preferences window has the following sections:

· Contractual Cash Flow Process Selection

· Mandatory Dimension Configuration

· Aggregation Dimension Selection

This section is applicable only when both OFS LRS and OFS ALM are installed in the same information domain (infodom).

Contractual Cash Flow Process Selection displays a list of ALM processes which are executed for cash flow generation. The cash flow engine in ALM can be executed in one or multiple processes; these can be Contractual, or Scenario-based. Each generates cash flows for various asset and liability products. LRM processes these cash flows and this list displays the available ALM cash flow processes.

To select the process for the Contractual Cash Flow Process, follow these steps.

1. In the Application Preferences window, under Contractual

Cash Flow Process Selection, click  to

select the process. The browser is displayed.

to

select the process. The browser is displayed.

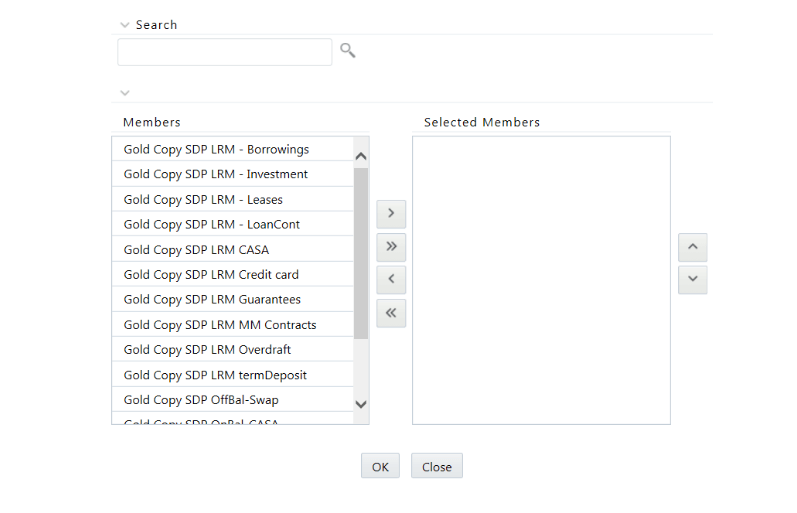

Figure 6 Contractual Cash Flow Process Selection

2. Select one or multiple contractual cash flow processes, the outputs of which will be used by LRS.

3. Click  to

move the selected items to Selected Members

section or click

to

move the selected items to Selected Members

section or click  to

select all members.

to

select all members.

4. Using  up

or down arrows, you can sequence the contractual cash flow processes.

up

or down arrows, you can sequence the contractual cash flow processes.

5. Click OK. The process IDs are stored in appropriate tables. The application selects all the cash flows associated with the ALM cash flow engine’s process IDs. It then picks up these ID. After it is stored, it picks up the relevant cash flows against the process IDs.

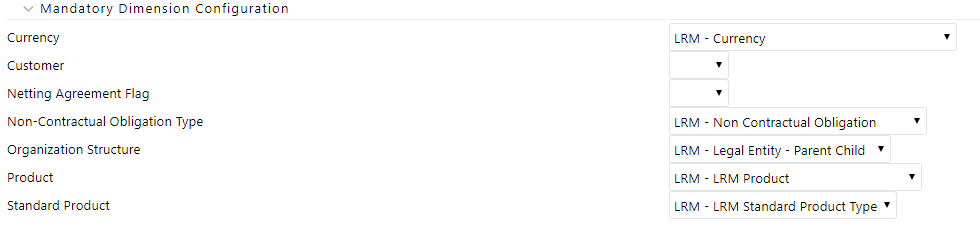

The application requires some dimensions to be selected mandatorily for downstream calculations. These include currency, organization structure, and standard product. The parameters selected as part of this field are displayed in the BAU window under the Dimension browser.

The Mandatory Dimension Configuration section has the following fields:

Figure 7 Mandatory Dimension Configuration

· Currency

For Currency, only one hierarchy is present. LRM - Currency is automatically selected in the Currency field.

· Customer

To identify the intercompany cash flows, customer dimension is mandatory. However, there is no hierarchy selection required.

· Organization Structure

For Organization Structure, there are multiple selections available. Select from the available options:

§ LRM - Legal Entity: This is a BI Hierarchy where all the legal entities appear in a single level.

§ LRM - Legal Entity - Parent Child: This is a parent-child hierarchy where the legal entities are displayed in ascending/descending order of their parentage. The root being Business Holding Unit (BHU).

§ LRM - Org Structure Country Flag: This is a Non-BI Hierarchy used in 4G reporting line reclassification. Ignore this hierarchy in this selection.

For example, if the LRM - Legal Entity is selected for Organization Structure, in the Application Preferences,

the selected Organization Structure (LRM - Legal Entity) along with the aggregation dimension members appear under the Dimension Selection section in the BAU window.

Figure 8 Dimension Selection

· Netting Agreement Flag

This dimension identifies whether the derivative contract is part of the netting agreement. Based on this flag, the net derivative cash inflow or outflows are determined. Hierarchy selection is not required for this dimension.

· Non-Contractual Obligation Type

This dimension identifies the non-contractual obligations part of the LRM Instrument table.

· Product

For Product, there following two hierarchies are present as ready-to-use:

§ LRM - Product: This is a single level hierarchy that lists all the products at the lowest level. This is the default selection.

§ LRM - Product Balance Sheet Category: This is a five-level hierarchy describing the higher levels of the products.

· Standard Product

For Standard Product, only one hierarchy is present. LRM - Standard Product Type is automatically selected in the Standard Product field.

The mandatory dimensions selected as part of this section appear in the dimension browser to support liquidity risk calculations.

The aggregation dimension selection is done to aggregate the cash flows for business assumption application. All cash flows are aggregated based on Aggregation Dimension Selection. For example, if you require cash flows to be aggregated at a very high level, you can select a lesser number of dimensions. If you require cash flows to be aggregated at a very granular level, then all dimensions are selected. Further, the business assumption works on the dimensions selected and is restricted to the dimensions selected in this particular selection.

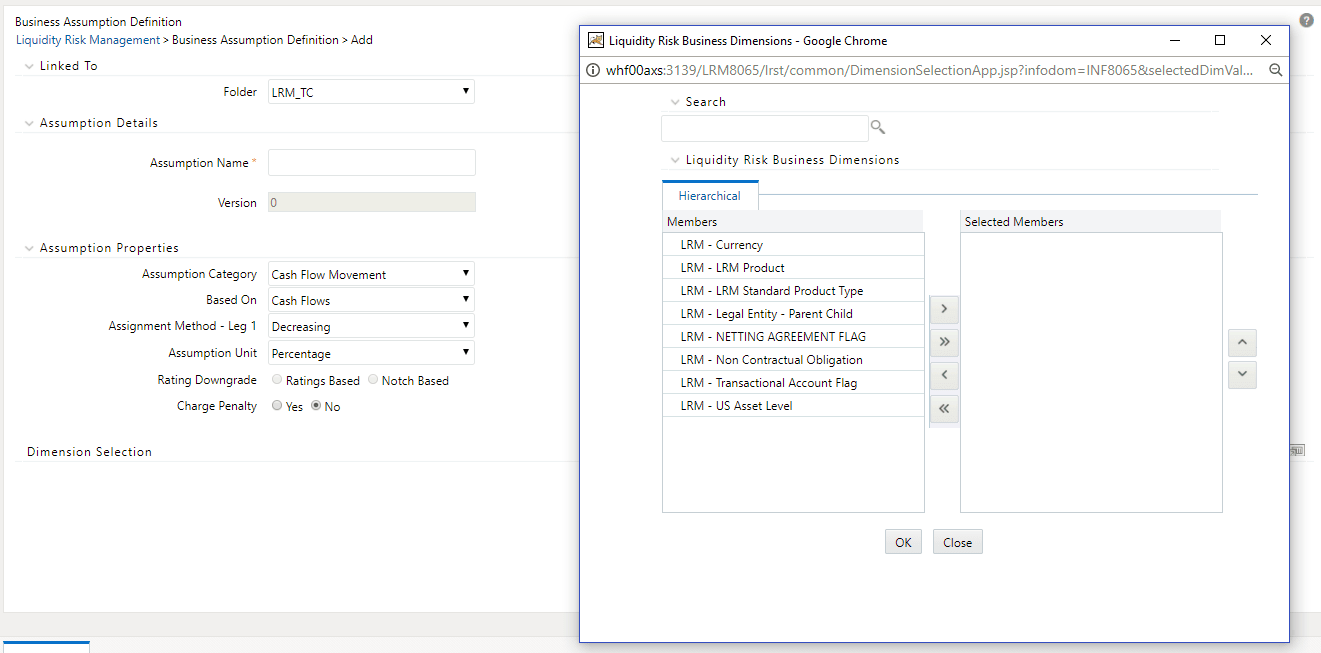

The application preferences made in this field are displayed in the BAU window under the Dimension browser. You are allowed to select the required dimension. For a detailed list of dimensions refer to Annexure: Functional Details, LRS Data Flow and Dimensions.

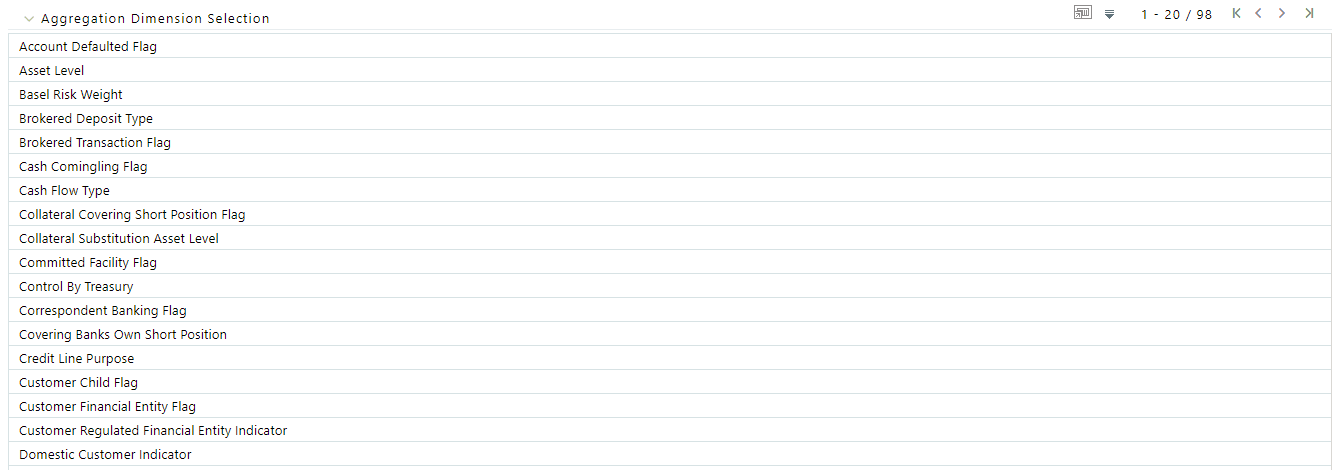

Figure 9 Aggregation Dimension Selection

To select the required dimensions, follow these steps:

1. In the Application

Preferences window, under Aggregation Dimension

Selection, click  to select the members.

The browser is displayed.

to select the members.

The browser is displayed.

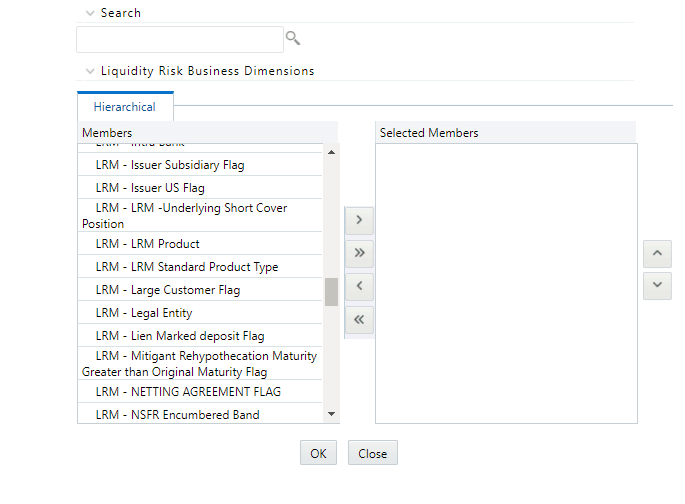

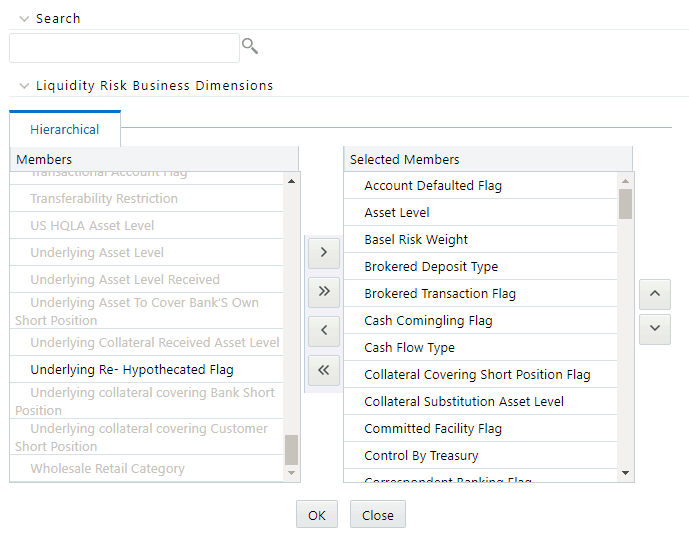

Figure 10: Application Preferences - Hierarchy Browser

2. Select the required members.

3. Click  to move the selected items to Selected

Members section or click

to move the selected items to Selected

Members section or click  to

select all members.

to

select all members.

4. Using  up

or down arrows, you can sequence the dimensions.

up

or down arrows, you can sequence the dimensions.

5. Click OK to complete the selection.

6. To save the selection, click Save and use it for liquidity risk calculations.

Only the selected dimensions appear under the Dimension browser in the BAU window.

NOTE:

To achieve better performance results, it is recommended to use only as many aggregation dimensions as needed by the user.

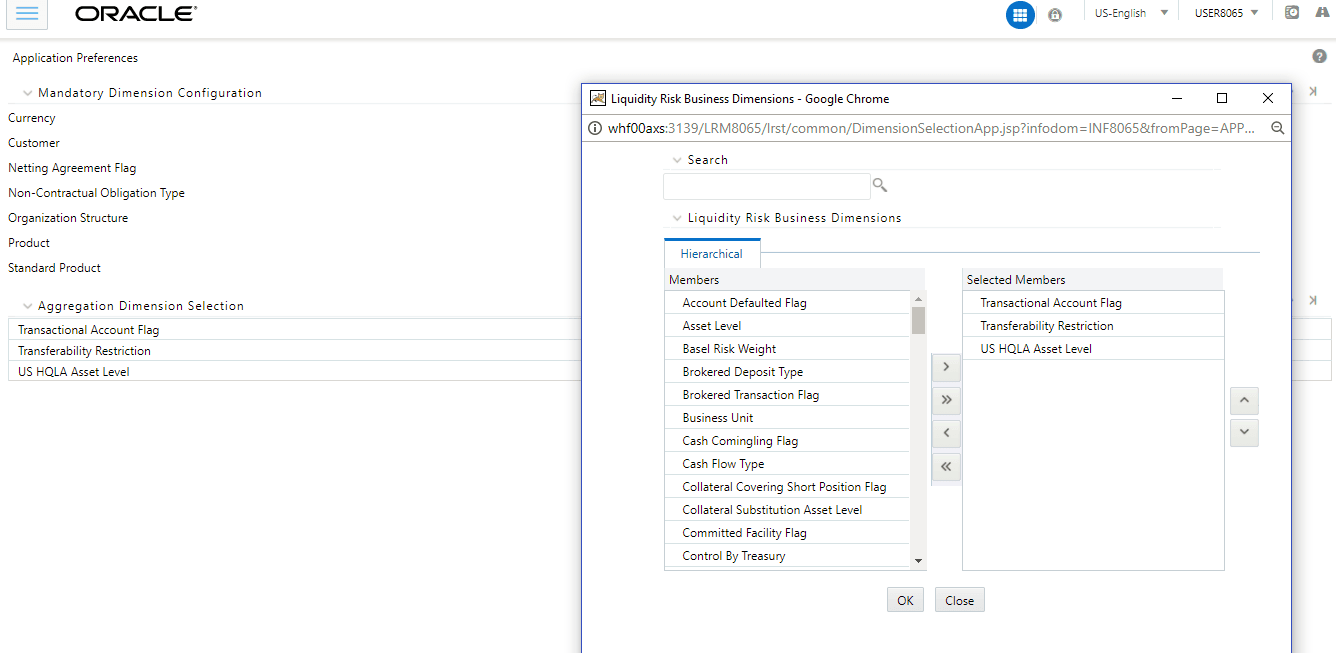

For example, in the following window, only three members are selected in the application preferences dimension browser.

Figure 11: Application Preferences Dimension Browser

Only the selected aggregation dimensions and the mandatory dimensions appear under the Dimension Selection section in the Business Assumption window as shown in the following figure:

Figure 12: Selected Aggregation Dimensions and Mandatory Dimensions Appear Under The Dimension Selection

NOTE:

To add a new mandatory or aggregation dimension, it is recommended to add the following seeded data in FSI_LRM_BUSINESS_DIMENSION and fsi_lrm_lookup_tl with Category ID 25:

· f_is_intraday_specific = ‘Y’

This dimension is used only for the intraday Run and it is not displayed in the Application Preference window. The f_selection_flag must be ‘N’ in this case as the US LCR Run must not be impacted.

· f_lcr_intraday_flag = ‘Y’

This dimension is used for both intraday and US LCR Run. This is displayed in the Application Preference window.

· f_account_dimension = ‘Y’

This dimension is an account level attribute and is used only for intraday assumptions. This is displayed in the Application Preference window.

· f_transaction_dimension = ‘Y’

This dimension is a transaction level attribute and is used only for intraday assumptions. This is displayed in the Application Preference window.

While adding new business dimensions, it is recommended to add those which have a small range of values. Adding dimensions with a large list of values such as account, party, date will defeat the purpose of aggregation of cash flows and will affect performance.

The application currently supports the following dimensions for Asset Level classification:

1. Asset Level

This dimension is used for specifying business assumptions and classifying assets as HQLA as per guidelines other than US Federal Reserve.

2. US Asset Level

This dimension is used for specifying business assumptions and classifying assets as HQLA as per US Federal Reserve guidelines.

Both the dimensions are available for selection as part of the Aggregate Dimension Selection section of the Application Preferences window. However, select only one at a time.

For instance, to define an assumption or execute a Run with the Basel III Liquidity Ratios Calculation or RBI Basel III Liquidity Ratio Calculation Run Purpose, select the Asset Level dimension. To execute a Run with the U.S. Fed Liquidity Ratio Calculation Run Purpose, to select the US Asset Level dimension.

Once a particular Run is executed after selecting the appropriate asset level dimensions, you must not change the asset level dimension until that Run is executed; or it will result in an error.