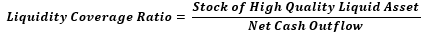

LCR is the first standard that assesses the short-term liquidity challenges of a bank.

Topics:

· Inputs

· Preconfigured Regulatory LCR Scenario

The LRRCMAS application requires the following inputs for LCR calculation:

· Liquidity haircut for each asset level should be provided through business assumption with assumption category as valuation change and assumption subcategory as the haircut.

· The business assumption which defines the outflow percentage should be defined through appropriate business assumptions. For example, retail deposit Run-off is defined through business assumption with category as incremental cash flow and sub-category as Run-off.

· The business assumption which defines the inflow percentage should be defined through appropriate business assumptions. For example, Rollover Reverse Repo is defined through business assumption with category as cash flow movement and subcategory as a Roll Over.

· Liquidity Horizon is specified as the Runtime parameter.

The application supports a ready-to-use MAS LCR, which has the regulatory scenario with associated HQLA haircuts, inflow, and outflow percentage or rates preconfigured in the form of rules and business assumptions.

Topics:

· Determining Maturity of Cash Flows

· Identifying Deposit Stability

· Identifying and Treating Pledged Deposits

· Classifying Operational Deposits

· Calculating Contractually Required Collateral

· Calculating Excess Collateral

· Calculating Downgrade Impact Amount

· Calculating Net Derivative Cash Inflows and Outflows

· Calculating Twenty-Four Month Look-back Amount

· Calculating Operational Amount

· Calculating HQLA Transferability Restriction

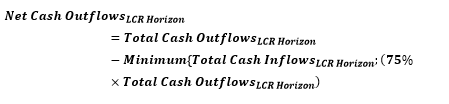

· Calculating Net Cash Outflows

· Calculating Liquidity Coverage Ratio

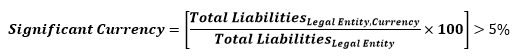

· Significant Currency Liquidity Coverage Ratio Calculation

All assets, whether owned by the bank or received from counterparties as collateral, that meet the high quality liquid asset criteria specified by MAS, are classified as follows:

· Level 1 Assets

· Level 2A Assets

· Level 2B(I) Assets

· Level 2B(II) RMBS Assets

· Level 2B(II) non-RMBS Assets

Level 1 assets can be included in the stock of HQLA without limit and Level 2 assets can only include 40% of the stock of HQLA. Of this, Level 2B and Level 2B(II) assets can only include of 15% and 5% of the stock of HQLA, respectively. Any asset not classified as an HQLA is considered as an Other Asset.

Topics:

· Identifying and Treating Level 1 Assets

· Identifying and Treating Level 2A Assets

· Identifying and Treating Level 2B(I) Assets

· Identifying and Treating Level 2B(II) RMBS Assets

· Identifying and Treating Level 2B(II) Non-RMBS Assets

Level 1 assets are assets which qualify to be fully included as part of the stock of high-quality liquid assets computing LCR. The application identifies the following as HQLA Level 1 assets:

1. Cash which includes coins, banknotes, and restricted cash. The value included in the stock of HQLA is the cash balance.

2. Central bank reserves (including excess and required reserves), to the extent that the central bank policies allow them to be drawn down in times of stress. These include the following:

a. Banks’ overnight deposits with the central bank.

b. Term deposits with the central bank that satisfy the following conditions:

— They are explicitly and contractually repayable on notice from the depositing bank.

— They constitute a loan against which the bank can borrow on a term basis or an overnight but automatically renewable basis (only where the bank has an existing deposit with the relevant central bank).

The value of eligible term deposits that are included in the amount net of any withdrawal penalty.

3. Sukuk issued by Singapore Sukuk Pte. Ltd.

4. Marketable securities, assigned a 0% risk-weight, which satisfy the following conditions:

§ Issuer type or Guarantor type is one of the following:

— Sovereign

— Central Bank

— Public Sector Entity

— Regional Government, Municipalities, and State Agencies

— Multi-lateral Development Bank

— The Bank For International Settlements (BIS)

— The International Monetary Fund

— The European Central Bank and European Commission

§ Not an obligation of a financial institution or any of its affiliated entities

5. Debt securities issued in domestic currencies in the country in which the liquidity risk is being taken or in the bank’s home country where the issuer type is the sovereign or central bank and the risk weight assigned to the issuer is greater than 0%.

6. Debt securities issued in foreign currencies are eligible up to the amount of the bank’s stressed net cash outflows in that specific foreign currency stemming from the bank’s operations in the country in which the liquidity risk is being taken or in the bank’s home country where the issuer type is the sovereign or central bank and the risk weight assigned to the issuer is greater than 0%.

The application identifies the following as HQLA Level 2A assets.

1. Marketable securities, assigned a 20% risk-weight, which satisfy the following conditions:

§ Issuer type or Guarantor Type is one of the following:

— Sovereign

— Central Bank

— Public Sector Entity

— Regional Government, Municipalities, and State Agencies

— Multi-lateral Development Bank

§ Price has not decreased, or haircut has not increased by more than 10% over 30 days during a relevant period of significant liquidity stress which is specified by the bank.

§ Not an obligation of a financial institution or any of its affiliated entities.

2. Debt securities (including commercial paper) issued by corporates, Sukuk issued by an institution other than Singapore Sukuk Pte Ltd. and covered bonds, which satisfy the following conditions:

§ Issuer type is not the bank itself for which the computations are being carried out or any of its affiliated entities

§ Assigned a rating equal to or greater than AA- or,

§ Price has not decreased, or haircut has not increased by more than 10% over 30 days during a relevant period of significant liquidity stress which is specified by the bank.

§ For corporate debt securities, the issuer type is not a financial institution or its affiliated entities.

The application identifies the following as HQLA Level 2B(I) assets:

Debt securities (including commercial paper) issued by corporates, and Sukuk issued by institutions other than Singapore Sukuk Pte Ltd. satisfying the following conditions:

· Issuer type is not the bank itself for which the computations are being carried out or any of its affiliated entities.

· Assigned a rating between A+ to A-

· Price has not decreased, or haircut has not increased by more than 20% over 30 days during a relevant period of significant liquidity stress which is specified by the bank.

· For corporate debt securities, issuer type is not a financial institution or its affiliated entities

The application identifies the Residential Mortgage-Backed Securities (RMBS) satisfying the following conditions listed as HQLA Level 2B(II) RMBS assets:

· Issuer type is not the bank for which the computations are being carried out or any of its affiliated entities.

· Issuer type of the underlying assets is not the bank itself for which the computations are being carried out or any of its affiliated entities.

· Assigned a rating equal to or greater than AA.

· Price has not decreased, or haircut has not increased by 20% over a 30-day period during a relevant period of significant liquidity stress specified by the bank.

· The underlying asset pool consists of residential mortgages only and does not contain any structured products.

· The underlying mortgages are “full recourse’’ loans, and have a maximum Loan-To-Value ratio (LTV) of less than or equal to 80%

· The securitizations are subject to “risk retention” regulations which require issuers to retain an interest in the assets they securitize.

The application identifies the following assets as HQLA Level 2B(II) Non-RMBS assets:

1. Marketable securities which satisfy the following conditions:

§ Issuer type is not a financial institution or its affiliated entities.

§ Issuer and guarantor type is a Sovereign or Central Bank.

§ Assigned a rating between BBB+ and BBB-.

§ Price has not decreased, or haircut has not increased by more than 20% over a 30-day period during a relevant period of significant liquidity stress which is specified by the bank.

2. Debt securities issued by corporates, and Sukuk issued by institutions other than Singapore Sukuk Pte Ltd, which satisfy the following conditions:

§ Issuer type is not a financial institution or its affiliated entities (in case of corporate debt securities).

§ Assigned a rating between BBB+ and BBB-.

§ Price has not decreased, or haircut has not increased by more than 20% over a 30-day period, during a relevant period of significant liquidity stress which is specified by the bank.

3. Common equities which satisfy the following conditions:

§ Issuer type is not a financial institution or its affiliated entities.

§ Are exchange-traded and centrally cleared.

§ Are a constituent of the major stock index in the legal entity’s home jurisdiction, or where the liquidity risk is taken, as decided by the supervisor in the jurisdiction where the index is located.

§ Are denominated in the domestic currency of the legal entity’s home jurisdiction or in the currency of the jurisdiction where the liquidity risk is taken.

§ Price has not decreased, or haircut has not increased by more than 40% over a 30-day period during a relevant period of significant liquidity stress specified by the bank.

NOTE:

The value of eligible securities included in the HQLA is the market value less hedge termination cost if any.

The application identifies whether a bank’s asset or a mitigant received under rehypothecation rights meets all the operational requirements prescribed by MAS. If an asset classified as HQLA meets all the relevant operational criteria it is identified as eligible HQLA and included in the stock of HQLA.

The application checks for the following operational criteria:

a. Operational Capability to Monetize HQLA

An asset is considered HQLA only if the bank has demonstrated the operational capability to monetize such an asset and has periodically monetized such an asset. The application captures this information for each asset as a flag.

b. Unencumbered

The application looks at the encumbrance status and includes only those assets in the stock which are unencumbered. If partially encumbered, then the portion of the asset that is unencumbered is considered as HQLA and included in the stock. If an asset is pledged to the central bank or a PSE but is not used, the unused portion of such an asset is included in the stock. The application assigns the usage of a pledged asset in the ascending order of asset quality that is the lowest quality collateral is marked as used first.

c. HQLA Under the Control of the Liquidity Management Function

To be considered eligible HQLA the asset is under the control of the management function of the bank that manages liquidity. The application captures this information for each asset as a flag.

d. Termination of Transaction Hedging HQLA

If an HQLA is hedged by a specific transaction, then the application considers the impact of closing out the hedge to liquidate the asset that is, the cost of terminating the hedge while computing the stock of HQLA. The hedge termination cost is deducted from the market value of the asset and the difference is included in the stock of HQLA.

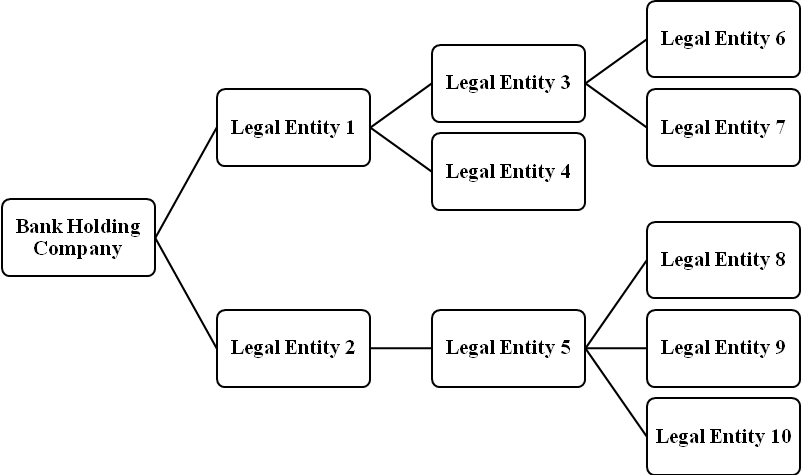

e. Transferability Restriction during Consolidation

Surplus HQLA held by a subsidiary can be included in the stock of the parent company only if it is freely available to the parent during times of stress. The assets that have transfer restrictions are identified through a flag. The application only includes the restricted assets to the extent required to cover the subsidiary’s net cash outflows while including the unrestricted assets fully into the consolidated stock of HQLA.

f. Exclusion of Certain Rehypothecated Assets

Any asset that a bank receives under rehypothecation right is not considered eligible HQLA if the counterparty or beneficial owner of the asset has a contractual right to withdraw the asset at any time within 30 calendar days.

g. Unsegregated Assets

The application includes unsegregated assets, received as collateral under rehypothecation rights, for derivative transactions, in the stock of HQLA. Conversely, it excludes all segregated assets from the stock of HQLA.

The stock of High-Quality Liquid Assets (SHQLA) is calculated at the legal entity and currency granularity. This is performed by the rule LRM - Stock of High-Quality Liquid Asset Computation.

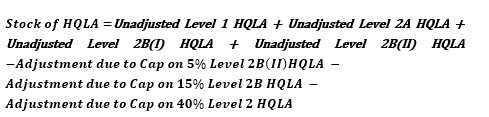

All unencumbered assets classified as Level 1, 2A, or 2B, which meet the HQLA eligibility criteria, are included in the SHQLA. The formula for calculating SHQLA is as follows:

Where,

The application applies the relevant liquidity haircuts to the market value of each eligible HQLA based on the haircuts specified as part of a business assumption. The sum of haircut adjusted market value of all assets which are not other assets, and which are classified as eligible HQLA comprises of the stock of HQLA. The stock includes the bank’s assets which are unencumbered, that is not placed as collateral; as well as assets received from counterparties where the bank has a rehypothecation right and where such assets are not rehypothecated.

NOTE:

All calculations are based on the market value of assets.

The following steps are involved in computing the stock of HQLA:

Topics:

· Calculating Stock of Liquid Assets

· Identifying Eligible HQLA on Unwind

· Unwinding of Transactions Involving Eligible HQLA

· Calculating Adjusted Stock of HQLA

· Calculating Adjustments to Stock of HQLA Due to Cap on Level 2 Assets

1. Calculating Stock of Level 1 Assets

The stock of Level 1 assets equals the market value of all Level 1 liquid assets held by the bank as of the calculation date that is eligible HQLA, less the amount of the minimum reserve, less hedge termination costs (if any), less withdrawal penalty on time deposits (if any).

2. Calculating Stock of Level 2A Assets

The stock of Level 2A liquid assets equals 85 percent of the market value of all Level 2A liquid assets held by the bank as of the calculation date that are eligible HQLA, less hedge termination costs (if any).

3. Calculating Stock of Level 2B(I) Assets

The stock of Level 2B(I) liquid assets equals 50 percent of the market value of all Level 2B(I) liquid assets held by the bank as of the calculation date that are eligible HQLA, less hedge termination costs (if any).

4. Calculating Stock of Level 2B(II) RMBS Assets

The stock of Level 2B(II) RMBS liquid asset amount equals 75 percent of the market value of all Level 2B RMBS liquid assets held by the bank as of the calculation date that is eligible HQLA, less hedge termination costs (if any).

5. Calculating Stock of Level 2B(II) Non-RMBS Assets

The stock of Level 2B(II) liquid assets equal 50 percent of the market value of all Level 2B non-RMBS liquid assets held by the bank as of the calculation date that is eligible HQLA, less hedge termination costs (if any).

The application identifies the assets placed as collateral which are eligible HQLA if they are not encumbered. Placed collateral is marked as eligible HQLA on unwinding if it fulfills all of the following criteria:

· Asset Level is Level 1, Level 2A, Level 2B(I), Level 2B(II) RMBS, or Level 2B(II) non-RMBS asset.

· Meets HQLA Operational Requirements on Unwind.

The application identifies all transactions maturing within the LCR horizon where HQLA is placed or received. These transactions include repos, reverse repos, secured lending transactions, collateral swaps, and so on. Such transactions are to be unwound that is, the original position is to be reversed and the cash or stock of HQLA has adjusted accordingly. This is done to avoid including any asset in the stock that should be returned to its owner before the end of the LCR horizon. The unwinding of transactions results in adjustments to the stock of HQLA, such as additions to or deductions from the stock of HQLA.

The total stock of HQLA is determined as a minimum of two Stocks. The formula for this calculation is as follows:

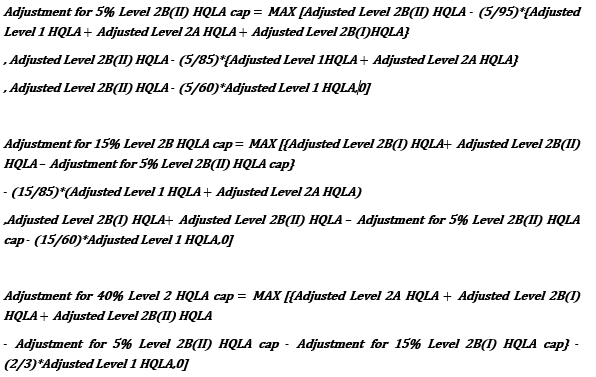

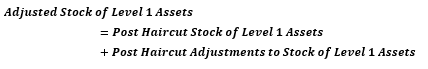

1. Adjusted Stock of Level 1 Assets

The formula for calculating adjusted stock of Level 1 assets is as follows:

NOTE:

Adjustments relate to the cash received or paid and the eligible Level 1 asset posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

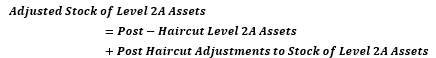

2. Adjusted Stock of Level 2A Assets

The formula for calculating adjusted stock of Level 2A assets is as follows:

NOTE:

Adjustments relate to eligible Level 2A assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

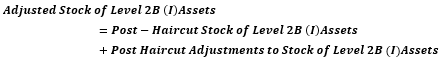

3. Adjusted Stock of Level 2B(I) Assets

The formula for calculating adjusted stock of Level 2B(I) assets is as follows:

NOTE:

Adjustments relate to eligible Level 2B(I) assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

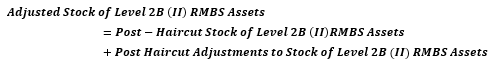

4. Adjusted Stock of Level 2B(II)RMBS Assets

The formula for calculating adjusted stock of Level 2B(II) RMBS assets is as follows:

NOTE:

Adjustments relate to eligible Level 2B(II) RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

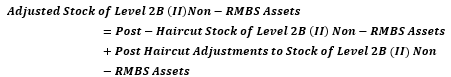

5. Adjusted Stock of Level 2B(II) Non-RMBS Assets

The formula for calculating adjusted stock of Level 2B(II) non-RMBS assets is as follows:

NOTE:

Adjustments relate to eligible Level 2B Non-RMBS assets posted or received as collateral or underlying assets as part of a secured funding transaction, secured lending transaction, asset exchanges, or collateralized derivatives transaction.

This section includes the computations involved in the calculation of adjustments to SHQLA due to the cap on Level 2 assets.

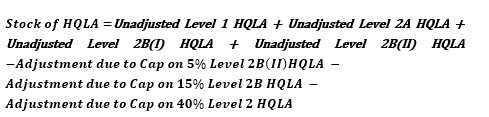

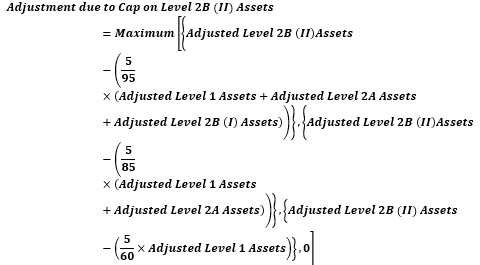

1. Adjustment Due to Cap on Level 2B(II) Assets

Level 2B(II) assets can only constitute up to 5% of the stock of HQLA after taking into account the impact of unwinding transactions maturing within the LCR horizon. Adjustment to the stock of HQLA due to cap on Level 2B(II) assets is calculated as follows:

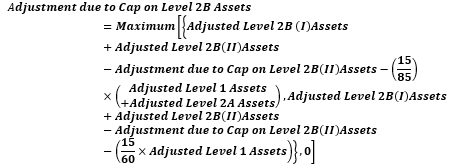

2. Adjustment Due to Cap on Level 2B Assets

Level 2(B) assets can only constitute up to 15 % of the stock of HQLA after taking into account the impact of unwinding transactions maturing within the LCR horizon. Adjustment to Stock of HQLA due to the cap on Level 2B assets is calculated as follows:

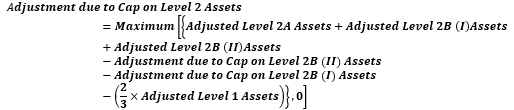

3. Adjustment Due to Cap on Level 2 Assets

Level 2 assets can only constitute up to 40% of the stock of HQLA after taking into account the impact of unwinding transactions maturing within the LCR horizon. Adjustment to Stock of HQLA due to the cap on Level 2 assets is calculated as follows:

To calculate the Liquidity Coverage Ratio, the application identifies the maturity of certain transactions as follows:

1. For liabilities having embedded optionality, such as callable features, that reduces the maturity of the account, the application considers the earliest date, which is the first call date, as the revised maturity date.

2. For assets having embedded optionality that reduces the maturity of the account, where the collateral received is not rehypothecated, the application considers the earliest date, which is the first call date, plus notice period as the revised maturity date.

3. For derivatives having embedded optionality that reduces the maturity of the account, where the collateral received is not rehypothecated, the application considers the earliest date, which is the first call date, as the revised maturity date.

4. For assets or derivatives, where the collateral received has been re-hypothecated for a period greater than the maturity of the asset itself, the application considers the maturity date of the liability, against which the collateral received is rehypothecated, as the revised maturity of the asset.

5. For assets or derivatives having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period greater than the first call date plus notice period but less than the original maturity of the asset itself, the application considers the maturity date of the liability, against which the collateral received is rehypothecated, as the revised maturity of the asset.

6. For derivatives having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period greater than the first call date but less than the original maturity of the asset itself, the application considers the maturity date of the liability, against which the collateral received is rehypothecated, as the revised maturity of the asset.

7. For assets having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period less than the first call date plus notice period, the application considers the first call date plus notice period as the revised maturity of the asset.

8. For derivatives having embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period less than the first call date plus notice period, the application considers the first call date as the revised maturity of the asset.

9. For assets and derivatives which do not have embedded optionality that reduces the maturity of the account, where the collateral received has been rehypothecated for a period less than the maturity of the asset itself, the application considers the original maturity date of the asset, as the revised maturity of the asset.

10. For assets and derivatives which do not have embedded optionality that reduces the maturity of the account, where the collateral received has not been rehypothecated, the application considers the original maturity date of the asset, as the revised maturity of the asset.

NOTE:

The revised maturity is computed by the application as per regulatory expectation and is used for the calculation of LCR.

This section provides the steps involved in insurance allocation.

Topics:

· Identifying Insurance Eligible Accounts

· Allocating Deposit Insurance

The identification of insurance eligible accounts involves looking at the inclusion as well as the exclusion criteria. The application requires users to provide the following inclusion criteria:

1. Ownership Category

There are three ownership categories available in LRRCMAS:

§ SDIC-DI: Ownership categories include single accounts, joint accounts, sole proprietorship, trusts, and company.

§ SDIC-CPFRS: Ownership categories include CPF Retirement Sum Scheme (CPFRS).

§ SDIC-CPFIS: Ownership categories include CPF Investment Scheme (CPFIS).

As per the Singapore Deposit Insurance Corporation (SDIC), a separate limit is assigned to a depositor combination based on the ownership category of accounts. Users are required to provide the ownership categories that get a separate limit. If a particular customer gets a single limit irrespective of whether the accounts are held as single, joint, or a combination, the ownership category should have a single default value.

2. Product Type

This is a list of product types that are covered under the respective jurisdiction’s deposit insurance scheme. The insurance limit is allocated to only those accounts of a customer whose product types match those that are covered by the deposit insurance. For Singapore, SDIC Deposit Insurance covers all types of deposits such as current accounts, savings accounts, and term deposits, which must be provided as inputs.

3. Product Type Prioritization

The sequence in which the insured amount is to be allocated to each product type is captured. For instance, product prioritization may be specified as a current account, savings account, and term deposit. This indicates that the insured amount is allocated first to a current account held by the customer. After current accounts have been fully covered, the remaining amount is allocated to savings accounts and finally to term deposits.

NOTE:

In case product type prioritization is not specified, the default allocation will be proportionate to the EOP balance of each account irrespective of the product type.

4. Currency Eligibility for Insurance

This is a list of currencies in which the accounts are denominated that are eligible for insurance coverage under a deposit insurance scheme. Some jurisdictions cover foreign currency deposits under their deposit insurance schemes. If eligible currencies are specified for insurance, then the insured balance is allocated to all accounts belonging to the particular legal entity which have the associated attributes required for assigning the insured balance. For instance, if SDIC Deposit Insurance ensures only Singapore Dollar-denominated deposits. The eligible currency against SDIC Deposit Insurance should be provided as the Singapore Dollar.

The application includes insurance exemption criteria covering deposits of foreign sovereigns, central and state governments, and banks, and so on. The deposits that are eligible for insurance under a particular insurance scheme are identified based on the inclusion and exclusion criteria as specified by the users.

As part of the MAS Run, the application allocates the deposit insurance to accounts based on the guidelines specified by the SDIC Deposit Insurance. The insurance limit captured against each deposit insurance scheme is allocated to the insurance-eligible accounts under that scheme based on the ownership category and the depositor combination.

The insurance limit, which is the maximum deposit balance covered by an insurance scheme per customer, is captured against each insurance scheme - ownership category combination. Customers having an account in multiple legal entities get a separate deposit insurance limit per legal entity. As per the SDIC Deposit Insurance scheme, the limit amount must be provided in the Stage Insurance Scheme Master table at the granularity of insurance scheme.

The insurance limit is allocated to accounts as per the procedure given as follows:

1. The application identifies the established relationship flag at a customer level.

2. The accounts are sorted by the specified product type prioritizations.

3. The insurance allocation is done based on the principal balance from the highest to the least, in the order of product type prioritization.

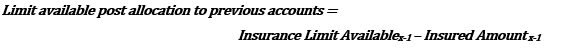

4. The insurance limit available is allocated to account 1 to n - 1 as per the following formula:

Where,

Insurance Limit Available:

x: Number of accounts up to the current account to which insured amount is to be allocated

n: Total number of accounts of a customer which are eligible for insurance coverage under a given ownership category

5. The remaining available insurance is allocated to the last account that is account n for which insurance was not allocated.

6. If the insurance limit is available after allocating to the principal balances, it is allocated to the accrued interest from the highest to the least in the order of Product Type prioritization.

An illustration of this procedure is provided as follows considering an insurance limit of 50,000 Singapore Dollar (SGD) for each depositor combination under each ownership category for each legal entity as follows.

NOTE:

· For the Single, Joint, and Sole proprietorship category, the insurance limit is aggregated for each customer per legal entity.

· Each account holder in the joint ownership category has an equal share for insurance calculation until specifically provided by the legal entity.

· Trusts with distinct account numbers are treated separately. Trust accounts are insured on a per account-beneficiary basis without aggregation.

· Client accounts with distinct account numbers are treated separately. Client accounts are insured on a per-account basis without aggregation.

The inputs to this calculation, including account details and customer details, are as follows.

Legal Entity |

Account Number |

Standard Product Type |

Account Balance |

Account Currency |

Ownership Category |

Primary Holder |

Secondary Holder |

Account Attribute |

Unique Depositor Combination |

Limit Applicable |

Total Deposit per Unique Depositor |

Insured Amount |

Uninsured Amount |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Legal Entity 1 |

100001 |

Saving Account |

40,000 |

SGD |

Single |

Customer 001 |

|

|

1 |

50,000 |

110,665 |

50,000 |

60,665 |

Legal Entity 1 |

100002 |

Current Account |

36,903 |

SGD |

Single |

Customer 001 |

|

|

|

|

|

|

|

Legal Entity 1 |

100003 |

Term Deposit |

33,762 |

SGD |

Single |

Customer 001 |

|

|

|

|

|

|

|

Legal Entity 1 |

100004 |

Term Deposit |

40,681 |

USD |

Single |

Customer 001 |

|

|

|

- |

40,681 |

- |

40,681 |

Legal Entity 1 |

100005 |

Saving Account |

7,355 |

SGD |

Single |

Customer 002 |

|

|

2 |

50,000 |

29,852.50 |

29,852.50 |

- |

Legal Entity 1 |

100006 |

Term Deposit |

44,995 |

SGD |

Joint |

Customer 002 |

Joint Account with Customer 003 |

|

|

|

|

|

|

Legal Entity 1 |

100007 |

Term Deposit |

44,995 |

SGD |

Joint |

Customer 003 |

Joint Account with Customer 002 |

|

3 |

50,000 |

22,497.50 |

22,497.50 |

- |

Legal Entity 1 |

100008 |

Saving Account |

7,568 |

SGD |

Single |

Customer 004 |

|

|

4 |

50,000 |

44,773 |

44,773.00 |

- |

Legal Entity 1 |

100009 |

Saving Account |

37,205 |

SGD |

Sole proprietorship |

Customer 004 |

|

|

|

|

|

|

|

Legal Entity 1 |

200100 |

Saving Account |

29,451 |

SGD |

Single |

Customer 101 |

|

|

5 |

50,000 |

86,390 |

50,000 |

36,390 |

Legal Entity 1 |

200101 |

Current Account |

79,640 |

SGD |

Joint |

Customer 101 |

Joint Account with Customer 102 |

|

|

|

|

|

|

Legal Entity 1 |

200102 |

Term Deposit |

10,700 |

SGD |

Joint |

Customer 101 |

Joint Account with Customer 103 |

|

|

|

|

|

|

Legal Entity 1 |

200103 |

Term Deposit |

11,769 |

SGD |

Sole proprietorship |

Customer 101 |

|

|

|

|

|

|

|

Legal Entity 1 |

200103 |

Term Deposit |

79,640 |

SGD |

Joint |

Customer 102 |

Joint Account with Customer 101 |

|

6 |

50,000 |

39,820 |

39,820.00 |

- |

Legal Entity 2 |

100010 |

Saving Account |

7,337 |

SGD |

Single |

Customer 005 |

|

|

7 |

50,000 |

7,337 |

7,337.00 |

- |

Legal Entity 3 |

100011 |

Term Deposit |

45,016 |

SGD |

Trust |

Customer 005 |

|

For benefit of son |

8 |

50,000 |

45,016 |

45,016.00 |

- |

Legal Entity 4 |

100012 |

Term Deposit |

6,574 |

SGD |

Trust |

Customer 005 |

|

For benefit of daughter |

9 |

50,000 |

6,574 |

6,574.00 |

- |

Legal Entity 5 |

100013 |

Saving Account |

4,759 |

SGD |

Trust |

Customer 005 |

|

For benefit of spouse |

10 |

50,000 |

4,759 |

4,759.00 |

- |

Legal Entity 6 |

100014 |

Saving Account |

20,517 |

SGD |

Company |

Customer 008 |

|

Office Account |

11 |

50,000 |

20,517 |

20,517.00 |

- |

Legal Entity 7 |

100015 |

Saving Account |

24,254 |

SGD |

Company |

Customer 008 |

|

Client Account for Customer X |

12 |

50,000 |

24,254 |

24,254.00 |

- |

Legal Entity 8 |

100016 |

Saving Account |

68,691 |

SGD |

Company |

Customer 008 |

|

Client Account for Customer Y |

13 |

50,000 |

68,691 |

50,000.00 |

18,691.00 |

Legal Entity 9 |

100017 |

Saving Account |

68,691 |

SGD |

Single |

Customer X |

|

|

14 |

50,000 |

68,691 |

50,000.00 |

18,691.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Entity 1 |

100018 |

Deposit |

50,101 |

SGD |

CPFIS |

Customer 501 |

|

|

15 |

50,000 |

50,101 |

50,000.00 |

101.00 |

Legal Entity 1 |

100019 |

Deposit |

45,493 |

SGD |

CPFRS |

Customer 502 |

|

|

16 |

50,000 |

45,493 |

45,493.00 |

- |

Legal Entity 1 |

100020 |

Deposit |

14,252 |

SGD |

CPFRS |

Customer 503 |

|

|

17 |

50000 |

64,590 |

50000 |

14590 |

Legal Entity 1 |

100021 |

Deposit |

50,338 |

SGD |

CPFIS |

Customer 503 |

|

|

|

|

|

|

|

Legal Entity 1 |

100022 |

Deposit |

58,412 |

SGD |

Single |

Customer 504 |

|

|

18 |

50,000 |

58,412 |

50,000.00 |

8,412.00 |

Legal Entity 1 |

100023 |

Deposit |

10,700 |

SGD |

CPFRS |

Customer 504 |

|

|

19 |

50000 |

52,469 |

50000 |

2469 |

Legal Entity 1 |

100024 |

Deposit |

41,769 |

SGD |

CPFIS |

Customer 504 |

|

|

|

|

|

|

|

After the insurance limit is allocated at an account level, the application determines the deposit stability as follows:

1. Stable Deposits

A stable deposit is the portion of a deposit which is fully covered by deposit insurance provided by an effective deposit insurance scheme or a public guarantee that provides equivalent protection and which satisfies one of the following conditions:

a. It is held in a transactional account by the depositor.

Or,

b. The depositor has an established relationship with the reporting legal entity.

For MAS, if a deposit is partially covered by insurance and meets the other criteria, the insured portion of such deposits is considered stable while the uninsured portion is considered less stable.

Stable deposits receive a 5% Run-off rate unless they meet additional deposit criteria.

2. Highly Stable Deposits

All stable deposits identified as per the criteria specified in point 1 above are classified as meeting additional insurance criteria if the insurance scheme under which they are covered satisfies the following conditions:

a. It is based on a system of prefunding via the periodic collection of levies on banks with insured deposits.

b. Has adequate means of ensuring ready access to additional funding in the event of a large call on its reserves, for example, an explicit and legally binding guarantee from the government, or a standing authority to borrow from the government.

c. Access to insured deposits is available to depositors in a short period once the deposit insurance scheme is triggered.

Such deposits receive a 3% Run-off rate.

3. Less Stable Deposits

All insured and uninsured deposit or funding balances that do not meet the stable deposits criteria are classified as less stable deposits: This includes the following:

a. Insured balance of deposits meeting stable deposits criteria but denominated in ineligible foreign currencies.

b. Uninsured balance of deposits meeting stable deposits criteria.

c. Insured balance of deposits which are not transactional accounts and the customer has no established relationship with the bank.

d. Deposit balance where the insurance coverage status is Uninsured.

Such deposits receive a 10% Run-off rate.

A deposit is considered a pledged deposit when it is placed as a security against a loan or loans extended by the bank. It indicates that when a customer receives a loan from a bank and contractually places the deposits held within the same bank as collateral, then the bank marks the respective deposits as pledged deposits.

For pledged deposits, the pledged portion of the deposit proceeds is paid out only when the loan against the deposit is repaid in full. Multiple deposits can be placed against multiple liens, such as loans, line of credit, guarantees, and so on forming many-to-many relationships.

The outflows for pledged deposits which will not mature within the LCR horizon may be excluded from LCR calculation if the following conditions are met:

· The loan will not mature or settle in the next 30 days.

· The pledge arrangement is subject to a legally enforceable contract disallowing withdrawal of the deposit before the loan is fully settled or repaid.

· The amount of deposit to be excluded cannot exceed the outstanding balance of the loan.

Topics:

· Identification of Pledged Deposits

· Treatment of Pledged Deposits

Pledged deposits are identified against deposits in the staging area by the lien marked indicator flag. The mapping between pledged deposits and the pledge against it is many-to-many and is a download for the application.

When all the guideline conditions are satisfied, the encumbered portion of pledged deposits is excluded and receives a 0% factor. The unencumbered portion of the pledged deposits is included and receives an appropriate Run-off rate as applicable.

To cater to pledged deposits, the following based measures are used in the business assumptions:

· Unencumbered highly stable balance: This measure populates the portion of the highly stable amount, which is unencumbered.

· Unencumbered stable balance: This measure populates the portion of a stable amount, which is unencumbered.

· Unencumbered less stable balance: This measure populates the portion of the less stable amount, which is unencumbered.

· Encumbered balance: This measure populates the encumbered amount of the deposit.

See Regulations Addressed through Business Assumptions for details of the preseeded assumptions on pledged deposits.

For Secured Accounts involving collateral placed or collateral received, there is an option to compute balances and cash flows in two granularities:

· Account-level

· Account-collateral level

This option enables the treatment of partially secured accounts and granular processing of an account with multiple collaterals. By default, secured funding computations happen at the account level for partially secured accounts. This can be changed to the Account-collateral level by updating the value of the SETUP_MASTER table entry for SEC_TRANS_TREATMENT_PURPOSE_VAL to YES.

Account-level

By default, all computations are done at the account level. This means that if multiple collaterals are securing an account, the collateral level information will be aggregated and processed at an account level.

Account-collateral level

Collateral level measures, such as the ones at the HQLA Asset level, encumbrance period, and so on, are computed at the account- collateral level. This means that if multiple collaterals are securing an account, the collateral level information is processed at the same account- collateral level without aggregating any data.

Operational deposits are those deposits placed by customers with a bank or balances kept by the bank with other financial institutions to meet their payment and settlement requirements and other operational requirements. The application classifies accounts as operational if they meet the following criteria:

1. They are held in specifically designated accounts that are held as operational accounts, by the customers at the bank.

2. They are priced without giving economic incentives to the customer to leave excess funds in the account.

3. They arise out of a clearing, custody, or cash management relationship with the bank.

4. They do not arise out of correspondent banking services or in the context of prime brokerage services.

5. The termination of such agreements requires a minimum notice period of 30 days.

6. If the agreement can be terminated within 30 days, the customer has to pay significant switching or termination costs to the bank.

Any excess balances held in an account classified as an operational deposit over and above that which is required to meet the operational requirements of the customer is assigned a higher outflow rate by the regulator. The application supports a methodology for computing the portion of the balance held for operational purposes which are truly required to meet the operational requirements of the customer. For details see Calculating Operational Amount.

Contractually required collateral is the amount of collateral that is contractually due from one party to the other based on the current exposure and collateral position. This amount must be paid to the party soon and results in outflow for the party owing the collateral and inflow to the party to whom the collateral is due. It can be Contractually Due Collateral or Contractually Receivable Collateral based on the direction of the exposure:

· Topics:

· For Other Assets and Liabilities

This section details the calculation of contractually due collateral and contractually receivable collateral for derivatives.

Topics:

· Calculating Contractually Due Collateral

· Calculating Contractually Receivable Collateral

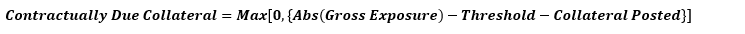

The application computes the value of the collateral that a bank is required to post contractually to its derivative counterparty as follows, if one of the following conditions are met:

1. If Secured Indicator is No, then the contractually due collateral is 0.

2. If Secured Indicator is Yes and CSA Type is One way, then the contractually due collateral is 0.

3. If Secured Indicator is Yes, CSA Type is Two way and Gross Exposure is greater than or equal to 0, then the contractually due collateral is 0.

4. If Secured Indicator is Yes, CSA Type is Two way and Gross Exposure is less than 0, the application computes the contractually due collateral as follows:

Where,

Threshold is the unsecured exposure that a party to a netting agreement is willing to assume before making collateral calls.

5. If Secured Indicator = Yes, CSA Type = Two way and Gross Exposure is <0, then the application computes contractually due collateral for Non-Netted Derivatives as follows:

The contractually due collateral is assumed to be posted and therefore receives the relevant outflow rate specified by the regulator as part of the preconfigured business assumptions for LCR calculations.

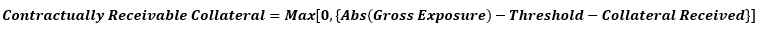

The application computes the value of the collateral that a derivative counterparty is required to post contractually to the bank as per the following procedure:

1. If Secured Indicator is No, then the contractually receivable collateral is 0. Otherwise,

2. If Secured Indicator is Yes and Gross Exposure is less than or equal to 0, then the contractually receivable collateral is 0. Otherwise,

3. If Secured Indicator is Yes and Gross Exposure is is greater than 0, then the application computes the contractually receivable collateral as follows:

The contractually receivable collateral does not receive a pre-specified inflow rate from the regulator and is, therefore, excluded from the LCR calculations. However, the application computes this to report.

This section details the calculation of contractually due collateral and contractually receivable collateral for other assets and liabilities.

Topics:

· Calculating Contractually Due Collateral

· Calculating Contractually Receivable Collateral

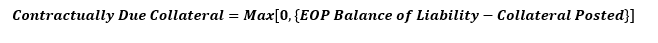

The application calculates contractually due collateral for other assets and liabilities as follows, if one of the following conditions are met:

1. If Balance Sheet Category is Asset, then the contractually due collateral is 0.

2. If Balance Sheet Category is Liability, and Secured Indicator is N, then the contractually due collateral is 0.

3. If Balance Sheet Category is Liability, and Secured Indicator is Y, then the application computes the contractually due collateral as follows:

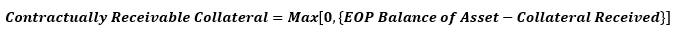

The application calculates contractually receivable collateral for other assets and liabilities as follows, if one of the following conditions are met:

1. If Balance Sheet Category is Liability, then the contractually due collateral is 0.

2. If Balance Sheet Category is Asset, and Secured Indicator is N, then the contractually due collateral is 0.

3. If Balance Sheet Category is Asset, and Secured Indicator is Y then the application computes the contractually due collateral as follows:

Excess collateral is the value of collateral posted or received that is over the collateral required based on the current levels of exposure and collateral position. This amount can be withdrawn by the party which has provided the collateral over its exposure and results in outflow to the party holding the excess collateral and an inflow to the party who has provided the excess collateral. It can be Excess Collateral Due or Excess Collateral Receivable types.

Topics:

· For Other Assets and Liabilities

This section details the calculation of excess collateral due and excess collateral receivable for derivatives.

Topics:

· Calculating Excess Collateral Due

· Calculating Excess Collateral Receivable

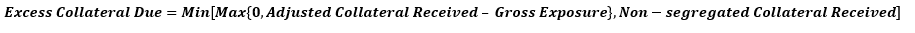

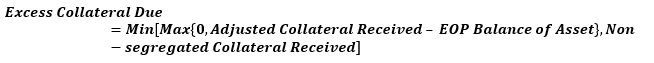

The application computes the value of the collateral that a derivative counterparty has posted to the bank, over the contractually required collateral, and therefore can be withdrawn by the counterparty, as follows:

1. If Secured Indicator is No, then the excess collateral due is 0.

2. If Secured Indicator is Y and Gross Exposure are less than or equal to 0, the application computes the excess collateral due as follows:

Where,

Adjusted collateral received: Collateral received from the counterparty less customer withdrawable collateral.

Customer withdrawable collateral: Collateral received under rehypothecation rights that can be contractually withdrawn by the customer within the LCR horizon without a significant penalty associated with such withdrawal.

3. If Secured Indicator is Y and Gross Exposure are greater than 0, the application computes the excess collateral due as follows:

4. If Secured Indicator is Y and Gross Exposure are greater than 0, then the application computes excess collateral due for Non-Netted Derivatives as follows:

The excess collateral due is assumed to be recalled by the counterparty and therefore receives the relevant outflow rate specified by the regulator as part of the preconfigured business assumptions for LCR calculations.

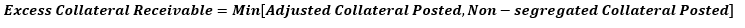

The application computes the value of the collateral that the bank has posted to its derivative counterparty, over the contractually required collateral, and therefore can be withdrawn by the bank, as follows:

1. If Secured Indicator is No, then the excess collateral receivable is 0.

2. If Secured Indicator is Y and Gross Exposure are greater than or equal to 0, the application computes the excess collateral receivable as follows:

Where,

Adjusted collateral posted: Collateral posted by the bank less firm withdrawable collateral.

Firm withdrawable collateral: Collateral provided under rehypothecation rights that can be contractually withdrawn by the bank within the LCR horizon without a significant penalty associated with such withdrawal.

3. If Secured Indicator is Y and Gross Exposure are less than 0, the application computes the excess collateral receivable as follows:

The excess collateral receivable does not receive a pre-specified inflow rate from the regulator and is, therefore, excluded from the LCR calculations. However, the application computes this to report.

This section details the calculation of excess collateral due and excess collateral receivable for other assets and liabilities.

Topics

· Calculating Excess Collateral Due

· Calculating Excess Collateral Receivable

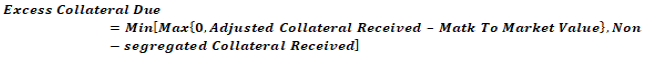

The application calculates the excess collateral due for other assets and liabilities as follows, if one of the following conditions are met:

1. If Balance Sheet Category is Liability, then the contractually due collateral is 0.

2. If Balance Sheet Category is Asset, and Secured Indicator is N, then the contractually due collateral is 0.

3. If Balance Sheet Category is Asset, and Secured Indicator is Y, then the application computes the contractually due collateral as follows:

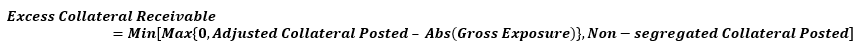

The application calculates the excess collateral receivable for other assets and liabilities as follows, if one of the following conditions are met:

1. If Balance Sheet Category is Asset, then the contractually due collateral is 0.

2. If Balance Sheet Category is Liability, and Secured Indicator is N, then the contractually due collateral is 0.

3. If Balance Sheet Category is Liability, and Secured Indicator is Y, then the application computes the contractually due collateral as follows:

This section details the calculation of downgrade impact amount for derivatives and other liabilities.

Topics:

· Calculating Downgrade Impact Amount for Derivatives

· Calculating Downgrade Impact Amount for Other Liabilities

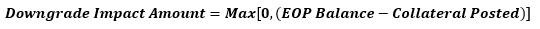

The application calculates the downgrade impact amount for derivatives as follows, if one of the following conditions are met:

1. If a downgrade trigger does not exist for the derivatives contract or netting agreement, the downgrade impact amount is 0.

2. If Net Exposure greater than 0, the downgrade impact amount is 0.

3. If Net Exposure less than or equal to 0, the downgrade impact amount is calculated as follows:

The application calculates the downgrade impact amount for other liabilities, including annuities, that have an associated downgrade, derivatives as follows, if one of the following conditions are met.

1. If a downgrade trigger does not exist for the liability account, the downgrade impact amount is 0.

2. The downgrade impact amount for liabilities other than derivatives and securitizations is calculated as follows:

NOTE:

Any liability account that is triggered due to a particular level of rating downgrade has an outflow corresponding to a pre-specified percentage of the downgrade impact amount. For instance, if a 3-notch downgrade is specified, then the downgrade impact amount will outflow only for those accounts that have a trigger of 1-notch, 2-notches, and 3-notches. If a 2-notch downgrade is specified, then the downgrade impact amount will outflow only for those accounts that have a trigger of 1-notch and 2-notches. The rating downgrade and the outflow percentage as specified by the regulator are part of the preconfigured business assumptions for LCR calculations.

This section provides info ration about calculating net derivative cash inflows and outflows.

Topics:

· Cash Flow Netting at Derivative Contract Level

· Cash Flow Netting at Netting Agreement Level

Cash flows from each derivative contract are netted as follows:

1. When cash inflows and outflows are denominated in the same currency and occur at the same time bucket:

a. The cash inflows and outflows are summed up and the net value is computed as follows:

b. If the net cash flow is positive and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash outflow.

c. If the net cash flow is negative and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash inflow.

2. When cash inflows and outflows are denominated in different currencies but settle within the same day:

a. The cash inflows and outflows are summed up after being converted to the reporting currency and the net value is computed.

b. If the net cash flow is positive and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash outflow.

c. If the net cash flow is negative and there is no netting agreement associated with the derivative contract, the value is treated as net derivative cash inflow.

3. When cash inflows and outflows are denominated in different currencies and do not settle within the same day:

a. The cash outflows from each derivative contract without an associated netting agreement are summed up and treated as net derivative cash outflows.

b. The cash inflows from each derivative contract without an associated netting agreement are summed up and treated as net derivative cash inflow.

NOTE:

If a derivative contract has a netting agreement associated with it, the cash flow is further netted across contracts at the netting agreement level.

For derivative contracts which have a netting agreement associated with them, the net cash flows computed at the derivative contract level are further netted across multiple contracts under the same netting agreement as follows:

1. For derivative contracts, that belong to a single netting agreement, whose payment netting agreement flag is Yes:

a. The cash inflows and outflows occurring in each time bucket, denominated in each currency, are summed up across all contracts whose payment netting agreement flag is Yes, and the net value is computed.

b. If the net cash flow is positive, the value is treated as net derivative cash outflow.

c. If the net cash flow is negative, the value is treated as net derivative cash inflow.

2. For derivative contracts, that belong to a single netting agreement, whose payment netting agreement flag is No:

a. The cash outflows occurring in each time bucket, denominated in each currency, are summed up separately for each derivative contract whose payment netting agreement flag is No, and treated as net derivative cash outflow.

b. The cash inflows occurring in each time bucket, denominated in each currency, are summed up separately for each derivative contract whose payment netting agreement flag is No and treated as net derivative cash inflow.

NOTE:

Cash flow netting for netting agreements is done separately for each currency. Cash flows are not netted across currencies, instead, the inflows and outflows converted into the reporting currency are summed up separately to report the net derivatives cash inflow and net derivatives cash outflow at an entity level.

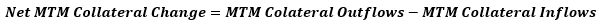

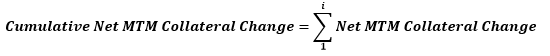

The application computes the 24-month look-back amount, to define outflows due to increased liquidity requirements related to market valuation changes on derivatives as follows:

· The Mark-to-Market (MTM) value of collateral outflows and inflows due to valuation changes on derivative transactions are captured at a legal entity level. The values over a 24-month historical time window from the as of date are identified.

· The application computes the largest 30-day absolute net collateral flow occurring within each rolling 30-day historical time window as follows:

a. The net Mark-to-Market collateral change is computed for each day within a particular 30-day historical time window as follows:

b. The cumulative net Mark-to-Market collateral change is computed for each day within a particular 30-day historical time window as follows:

Where,

i: Each day within a particular 30-day historical time window.

n: Each 30-day historical time window.

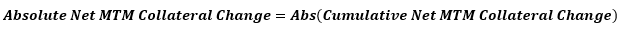

c. The absolute net Mark-to-Market collateral change is computed for each day within the rolling 30-day historical time window as follows:

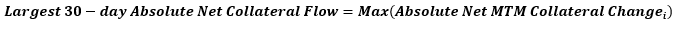

d. The largest 30-day absolute net collateral flow occurring within the rolling 30-day historical time window is identified as follows:

NOTE:

Steps (a) to (d) are repeated for each rolling 30-day historical time window.

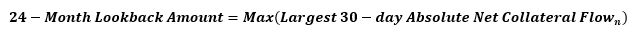

3. The 24-month look-back amount is calculated as follows:

NOTE:

1. This calculation is done for each legal entity separately.

2. The largest 30-day absolute net collateral flow is computed in 30-day blocks on a rolling basis. For example, the first 30-day block is As of Date to As of Date - 29; the second 30-day block is As of Date - 1 to As of Date - 30 and so on.

3. The 24-month look-back amount is computed as the maximum of the largest absolute net collateral flow during all rolling 30-day periods in every 24 months.

The 24-month look-back calculations are illustrated in the following table, considering a 34-day historical time window instead of 24-months. This results in 5 rolling 30-day windows.

Rolling 30-Day Period |

Day |

Mark-To-Market Collateral Outflows Due To Derivative Transaction Valuation Changes (a) |

Mark-To-Market Collateral Inflows Due To Derivative Transaction Valuation Changes (b) |

Net Mark-To-Market Collateral Change (c = a - b) |

Cumulative Net Mark-To-Market Collateral Change (d = Cumulative c) |

Absolute Net Mark-To-Market Collateral Change [e = Abs (d)] |

|---|---|---|---|---|---|---|

As of Date to As of Date - 29 |

As of Date |

65 |

14 |

51 |

51 |

51 |

As of Date - 1 |

65 |

9 |

56 |

107 |

107 |

|

As of Date - 2 |

74 |

83 |

-9 |

98 |

98 |

|

As of Date - 3 |

71 |

97 |

-26 |

72 |

72 |

|

As of Date - 4 |

84 |

89 |

-5 |

67 |

67 |

|

As of Date - 5 |

8 |

57 |

-49 |

18 |

18 |

|

As of Date - 6 |

40 |

59 |

-19 |

-1 |

1 |

|

As of Date - 7 |

42 |

87 |

-45 |

-46 |

46 |

|

As of Date - 8 |

100 |

6 |

94 |

48 |

48 |

|

As of Date - 9 |

41 |

30 |

11 |

59 |

59 |

|

As of Date - 10 |

45 |

9 |

36 |

95 |

95 |

|

As of Date - 11 |

9 |

32 |

-23 |

72 |

72 |

|

As of Date - 12 |

59 |

67 |

-8 |

64 |

64 |

|

As of Date - 13 |

61 |

10 |

51 |

115 |

115 |

|

As of Date - 14 |

22 |

36 |

-14 |

101 |

101 |

|

As of Date - 15 |

63 |

81 |

-18 |

83 |

83 |

|

As of Date - 16 |

36 |

3 |

33 |

116 |

116 |

|

As of Date - 17 |

61 |

22 |

39 |

155 |

155 |

|

As of Date - 18 |

94 |

37 |

57 |

212 |

212 |

|

As of Date - 19 |

3 |

18 |

-15 |

197 |

197 |

|

As of Date - 20 |

13 |

27 |

-14 |

183 |

183 |

|

As of Date - 21 |

24 |

56 |

-32 |

151 |

151 |

|

As of Date - 22 |

57 |

75 |

-18 |

133 |

133 |

|

As of Date - 23 |

66 |

87 |

-21 |

112 |

112 |

|

As of Date - 24 |

33 |

71 |

-38 |

74 |

74 |

|

As of Date - 25 |

29 |

30 |

-1 |

73 |

73 |

|

As of Date - 26 |

64 |

25 |

39 |

112 |

112 |

|

As of Date - 27 |

54 |

39 |

15 |

127 |

127 |

|

As of Date - 28 |

51 |

6 |

45 |

172 |

172 |

|

As of Date - 29 |

35 |

31 |

4 |

176 |

176 |

|

As of Date - 1 to As of Date - 30 |

As of Date - 1 |

65 |

9 |

56 |

56 |

56 |

As of Date - 2 |

74 |

83 |

-9 |

47 |

47 |

|

As of Date - 3 |

71 |

97 |

-26 |

21 |

21 |

|

As of Date - 4 |

84 |

89 |

-5 |

16 |

16 |

|

As of Date - 5 |

8 |

57 |

-49 |

-33 |

33 |

|

As of Date - 6 |

40 |

59 |

-19 |

-52 |

52 |

|

As of Date - 7 |

42 |

87 |

-45 |

-97 |

97 |

|

As of Date - 8 |

100 |

6 |

94 |

-3 |

3 |

|

As of Date - 9 |

41 |

30 |

11 |

8 |

8 |

|

As of Date - 10 |

45 |

9 |

36 |

44 |

44 |

|

As of Date - 11 |

9 |

32 |

-23 |

21 |

21 |

|

As of Date - 12 |

59 |

67 |

-8 |

13 |

13 |

|

As of Date - 13 |

61 |

10 |

51 |

64 |

64 |

|

As of Date - 14 |

22 |

36 |

-14 |

50 |

50 |

|

As of Date - 15 |

63 |

81 |

-18 |

32 |

32 |

|

As of Date - 16 |

36 |

3 |

33 |

65 |

65 |

|

As of Date - 17 |

61 |

22 |

39 |

104 |

104 |

|

As of Date - 18 |

94 |

37 |

57 |

161 |

161 |

|

As of Date - 19 |

3 |

18 |

-15 |

146 |

146 |

|

As of Date - 20 |

13 |

27 |

-14 |

132 |

132 |

|

As of Date - 21 |

24 |

56 |

-32 |

100 |

100 |

|

As of Date - 22 |

57 |

75 |

-18 |

82 |

82 |

|

As of Date - 23 |

66 |

87 |

-21 |

61 |

61 |

|

As of Date - 24 |

33 |

71 |

-38 |

23 |

23 |

|

As of Date - 25 |

29 |

30 |

-1 |

22 |

22 |

|

As of Date - 26 |

64 |

25 |

39 |

61 |

61 |

|

As of Date - 27 |

54 |

39 |

15 |

76 |

76 |

|

As of Date - 28 |

51 |

6 |

45 |

121 |

121 |

|

As of Date - 29 |

35 |

31 |

4 |

125 |

125 |

|

As of Date - 30 |

93 |

68 |

25 |

150 |

150 |

|

As of Date - 2 to As of Date - 31 |

As of Date - 2 |

74 |

83 |

-9 |

-9 |

9 |

As of Date - 3 |

71 |

97 |

-26 |

-35 |

35 |

|

As of Date - 4 |

84 |

89 |

-5 |

-40 |

40 |

|

As of Date - 5 |

8 |

57 |

-49 |

-89 |

89 |

|

As of Date - 6 |

40 |

59 |

-19 |

-108 |

108 |

|

As of Date - 7 |

42 |

87 |

-45 |

-153 |

153 |

|

As of Date - 8 |

100 |

6 |

94 |

-59 |

59 |

|

As of Date - 9 |

41 |

30 |

11 |

-48 |

48 |

|

As of Date - 10 |

45 |

9 |

36 |

-12 |

12 |

|

As of Date - 11 |

9 |

32 |

-23 |

-35 |

35 |

|

As of Date - 12 |

59 |

67 |

-8 |

-43 |

43 |

|

As of Date - 13 |

61 |

10 |

51 |

8 |

8 |

|

As of Date - 14 |

22 |

36 |

-14 |

-6 |

6 |

|

As of Date - 15 |

63 |

81 |

-18 |

-24 |

24 |

|

As of Date - 16 |

36 |

3 |

33 |

9 |

9 |

|

As of Date - 17 |

61 |

22 |

39 |

48 |

48 |

|

As of Date - 18 |

94 |

37 |

57 |

105 |

105 |

|

As of Date - 19 |

3 |

18 |

-15 |

90 |

90 |

|

As of Date - 20 |

13 |

27 |

-14 |

76 |

76 |

|

As of Date - 21 |

24 |

56 |

-32 |

44 |

44 |

|

As of Date - 22 |

57 |

75 |

-18 |

26 |

26 |

|

As of Date - 23 |

66 |

87 |

-21 |

5 |

5 |

|

As of Date - 24 |

33 |

71 |

-38 |

-33 |

33 |

|

As of Date - 25 |

29 |

30 |

-1 |

-34 |

34 |

|

As of Date - 26 |

64 |

25 |

39 |

5 |

5 |

|

As of Date - 27 |

54 |

39 |

15 |

20 |

20 |

|

As of Date - 28 |

51 |

6 |

45 |

65 |

65 |

|

As of Date - 29 |

35 |

31 |

4 |

69 |

69 |

|

As of Date - 30 |

93 |

68 |

25 |

94 |

94 |

|

As of Date - 31 |

51 |

97 |

-46 |

48 |

48 |

|

As of Date - 3 to As of Date - 32 |

As of Date - 3 |

71 |

97 |

-26 |

-26 |

26 |

As of Date - 4 |

84 |

89 |

-5 |

-31 |

31 |

|

As of Date - 5 |

8 |

57 |

-49 |

-80 |

80 |

|

As of Date - 6 |

40 |

59 |

-19 |

-99 |

99 |

|

As of Date - 7 |

42 |

87 |

-45 |

-144 |

144 |

|

As of Date - 8 |

100 |

6 |

94 |

-50 |

50 |

|

As of Date - 9 |

41 |

30 |

11 |

-39 |

39 |

|

As of Date - 10 |

45 |

9 |

36 |

-3 |

3 |

|

As of Date - 11 |

9 |

32 |

-23 |

-26 |

26 |

|

As of Date - 12 |

59 |

67 |

-8 |

-34 |

34 |

|

As of Date - 13 |

61 |

10 |

51 |

17 |

17 |

|

As of Date - 14 |

22 |

36 |

-14 |

3 |

3 |

|

As of Date - 15 |

63 |

81 |

-18 |

-15 |

15 |

|

As of Date - 16 |

36 |

3 |

33 |

18 |

18 |

|

As of Date - 17 |

61 |

22 |

39 |

57 |

57 |

|

As of Date - 18 |

94 |

37 |

57 |

114 |

114 |

|

As of Date - 19 |

3 |

18 |

-15 |

99 |

99 |

|

As of Date - 20 |

13 |

27 |

-14 |

85 |

85 |

|

As of Date - 21 |

24 |

56 |

-32 |

53 |

53 |

|

As of Date - 22 |

57 |

75 |

-18 |

35 |

35 |

|

As of Date - 23 |

66 |

87 |

-21 |

14 |

14 |

|

As of Date - 24 |

33 |

71 |

-38 |

-24 |

24 |

|

As of Date - 25 |

29 |

30 |

-1 |

-25 |

25 |

|

As of Date - 26 |

64 |

25 |

39 |

14 |

14 |

|

As of Date - 27 |

54 |

39 |

15 |

29 |

29 |

|

As of Date - 28 |

51 |

6 |

45 |

74 |

74 |

|

As of Date - 29 |

35 |

31 |

4 |

78 |

78 |

|

As of Date - 30 |

93 |

68 |

25 |

103 |

103 |

|

As of Date - 31 |

51 |

97 |

-46 |

57 |

57 |

|

As of Date - 32 |

12 |

31 |

-19 |

38 |

38 |

|

As of Date - 4 to As of Date - 33 |

As of Date - 4 |

84 |

89 |

-5 |

-5 |

5 |

As of Date - 5 |

8 |

57 |

-49 |

-54 |

54 |

|

As of Date - 6 |

40 |

59 |

-19 |

-73 |

73 |

|

As of Date - 7 |

42 |

87 |

-45 |

-118 |

118 |

|

As of Date - 8 |

100 |

6 |

94 |

-24 |

24 |

|

As of Date - 9 |

41 |

30 |

11 |

-13 |

13 |

|

As of Date - 10 |

45 |

9 |

36 |

23 |

23 |

|

As of Date - 11 |

9 |

32 |

-23 |

0 |

0 |

|

As of Date - 12 |

59 |

67 |

-8 |

-8 |

8 |

|

As of Date - 13 |

61 |

10 |

51 |

43 |

43 |

|

As of Date - 14 |

22 |

36 |

-14 |

29 |

29 |

|

As of Date - 15 |

63 |

81 |

-18 |

11 |

11 |

|

As of Date - 16 |

36 |

3 |

33 |

44 |

44 |

|

As of Date - 17 |

61 |

22 |

39 |

83 |

83 |

|

As of Date - 18 |

94 |

37 |

57 |

140 |

140 |

|

As of Date - 19 |

3 |

18 |

-15 |

125 |

125 |

|

As of Date - 20 |

13 |

27 |

-14 |

111 |

111 |

|

As of Date - 21 |

24 |

56 |

-32 |

79 |

79 |

|

As of Date - 22 |

57 |

75 |

-18 |

61 |

61 |

|

As of Date - 23 |

66 |

87 |

-21 |

40 |

40 |

|

As of Date - 24 |

33 |

71 |

-38 |

2 |

2 |

|

As of Date - 25 |

29 |

30 |

-1 |

1 |

1 |

|

As of Date - 26 |

64 |

25 |

39 |

40 |

40 |

|

As of Date - 27 |

54 |

39 |

15 |

55 |

55 |

|

As of Date - 28 |

51 |

6 |

45 |

100 |

100 |

|

As of Date - 29 |

35 |

31 |

4 |

104 |

104 |

|

As of Date - 30 |

93 |

68 |

25 |

129 |

129 |

|

As of Date - 31 |

51 |

97 |

-46 |

83 |

83 |

|

As of Date - 32 |

12 |

31 |

-19 |

64 |

64 |

|

As of Date - 33 |

34 |

36 |

-2 |

62 |

62 |

The largest 30-day absolute net collateral flow for each rolling 30-day period and the 24-month look-back value (in this example, the 34-day look-back value) are computed as follows:

Rolling 30-Day Period |

Largest 30-Day Absolute Net Collateral Flow [f = Max (e)] |

24 Month Look-back Value [Max (f)] |

|---|---|---|

As of Date to As of Date - 29 |

212 |

212 |

As of Date - 1 to As of Date - 30 |

161 |

|

As of Date - 2 to As of Date - 31 |

153 |

|

As of Date - 3 to As of Date - 32 |

144 |

|

As of Date - 4 to As of Date - 33 |

140 |

The regulator-prescribed lower outflow rate for operational deposits should be applied only to the portion of the EOP balance that is truly held to meet operational requirements. The application supports a new methodology to compute the operational portion of the EOP balance of operational deposits. The following steps are involved in computing the operational balance:

1. All deposits classified as operational as per regulatory guidelines are identified. This is a separate process in LRM.

2. The EOP balances of eligible operational accounts are obtained over a 90-day historical window including the As of Date. For example, As of Date - 89 days. To identify historical observations, the f_reporting_flag must be updated as Y for one execution of the Run per day in the LRM Run Management Execution Summary UI. The application looks up the balance for such accounts against the Run execution for which the Reporting Flag is updated as Y for each day in the past.

NOTE:

The historical time window is captured as a parameter in the SETUP_MASTER table. The default value is 90 days which can be modified by the user. To modify this value. Update the value under the component code DAYS_HIST_OPER_BAL_CALC_UPD

3. A rolling 5-day average is calculated for each account over the historical window.

4. The average of the 5-day rolling averages computed in Step 3 is calculated.

5. The operational balance is calculated as follows:

NOTE:

The calculation of the operational balance can be either a direct download from the staging tables or through the historical balance approach.

NOTE:

The operational balance calculation based on historical lookback is optional. You can choose to compute the operational balances using this method or provide the value as a download. To provide the value as a download, update the value in the SETUP_MASTER table under the component code HIST_OPERATIONAL_BAL_CALC_UPD as N. If the value is ‘Y’ then the value would be calculated through historical balance approach.

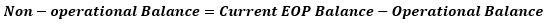

6. The non-operational balance is calculated as follows:

7. The operational insured balance is calculated as follows:

The insured and uninsured balances are calculated as part of a separate process, for example, the insurance allocation process, which is explained in detail in the relevant section under each jurisdiction.

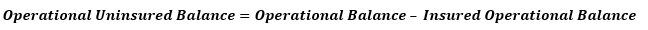

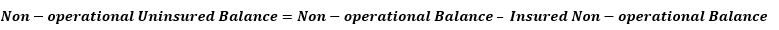

8. The operational uninsured balance is calculated as follows:

9. The non-operational insured balance is calculated as follows:

10. The non-operational uninsured balance is calculated as follows:

The operational deposit computation process is illustrated

as follows assuming a 15-day historical window instead of 90-days and

for the as of date 28th February 2017. The historical balances for 15-days

including the as of date are as follows.

Clients With Operational Accounts |

Eligible Operational Accounts |

Historical Time Window |

As of Date |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2/14/2017 |

2/15/2017 |

2/16/2017 |

2/17/2017 |

2/18/2017 |

2/19/2017 |

2/20/2017 |

2/21/2017 |

2/22/2017 |

2/23/2017 |

2/24/2017 |

2/25/2017 |

2/26/2017 |

2/27/2017 |

2/28/2017 |

||

A |

10001 |

102,000 |

102,125 |

102,250 |

102,375 |

102,500 |

102,625 |

102,750 |

102,875 |

103,000 |

103,125 |

103,250 |

103,375 |

103,500 |

103,625 |

103,750 |

10296 |

23,500 |

23,550 |

23,600 |

23,650 |

23,700 |

23,750 |

23,800 |

23,850 |

23,900 |

23,950 |

24,000 |

24,050 |

24,100 |

24,150 |

24,200 |

|

B |

31652 |

65,877 |

59,259 |

59,234 |

59,209 |

59,184 |

59,159 |

59,134 |

59,109 |

59,084 |

59,059 |

59,034 |

59,009 |

58,984 |

58,959 |

58,934 |

The rolling averages and cumulative average are computed as follows.

Clients with Operational Accounts |

Eligible Operational Accounts |

5-day Rolling Average |

Cumulative Average (a) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2/18/2017 |

2/19/2017 |

2/20/2017 |

2/21/2017 |

2/22/2017 |

2/23/2017 |

2/24/2017 |

2/25/2017 |

2/26/2017 |

2/27/2017 |

2/28/2017 |

|||

A |

10001 |

102,250 |

102,375 |

102,500 |

102,625 |

102,750 |

102,875 |