Net Stable Funding Ratio (NSFR) is one of the two minimum standards developed to promote funding and liquidity management in financial institutions. Liquidity Coverage Ratio (LCR) is the first standard that assesses the short term liquidity challenges of a bank. NSFR assesses the bank’s liquidity risks over a longer time horizon. Both the standards, complement each other, are aimed at providing a holistic picture of a bank’s funding risk profile, and aid in better liquidity risk management practices.

Topics:

· Overview

· Preconfigured RBI Regulatory NSFR Scenarios

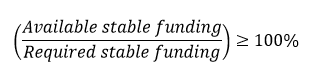

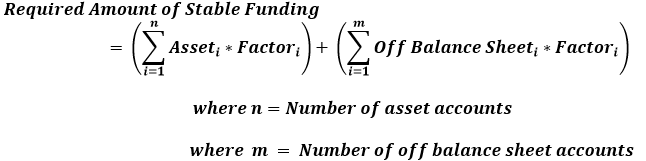

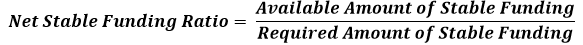

NSFR is defined as the amount of available stable funding relative to the required stable funding. Available stable funding refers to the portion of capital and liabilities expected to be reliable over the horizon of 1 year. Required stable funding refers to the portion of assets and off-balance sheet exposures over the same horizon. The NSFR ratio is expected to be at least 100%.

The Available Stable Funding (ASF) factor and Required Stable Funding (RSF) factor is applied through business assumptions and reflects through the execution of a Business as Usual (BaU) run in the OFS LRRCRBI application. The ASF and RSF factors are applied as weights at the account level and the Total ASF and Total RSF are obtained by taking a sum of all the weighted amounts. The ratio is then computed by the application as the Total ASF amount divided by the Total RSF amount. A set of predefined business assumptions for ASF and RSF as defined in the NSFR guidelines are prepackaged in the application. For the complete list of preseeded ASF and RSF assumptions see Regulation Addressed through Business Assumptions section.

Topics:

· Computing Available Amount of Stable Funding

· Computing Required Amount of Stable Funding

· Computing Net Stable Funding Ratio

One of the various dimensions used to allocate ASF and RSF factors is the maturity bucket of the instrument. For NSFR computation, maturity bands are used to allocate the factors. The RBI NSFR band is predefined as per regulatory guidelines and has the following values:

· Less than 6 months

· Greater than or equal to 6 months but less than 1 year

· Greater than or equal one year

· Open maturity

· All accounts will be categorized on one of these bands depending on the maturity date. Note that to categorize any product into open maturity, the LRM - Classification of Products as Open Maturity rule should be edited and the product must be included in the rule.

The available stable funding factor is a pre-determined weight ranging from 0% to 100% which is applied through business assumptions for accounts falling under the dimensional combinations defined. The weights are guided by the NSFR standard. The available stable funding is then taken as a total of all the weighted amounts where an ASF factor is applied.

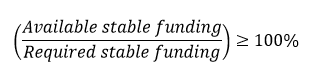

The formula for calculating the Available Amount of Stable Funding is as follows:

The following is an example of applying the ASF factor:

Consider an assumption defined with the following dimensional combination and ASF factors, with the based on the measure being Total stable balance:

Dimensional Combination |

ASF Factor |

||

|---|---|---|---|

Product |

Retail/Wholesale Indicator |

Residual Maturity Band |

|

Deposits |

R |

<= 6 months |

95% |

Deposits |

R |

6 months - 1 year |

95% |

Deposits |

R |

>= 1 year |

95% |

If five accounts are falling under this combination, then after the assumption is applied, the resulting amounts with the application of ASF factors is as follows.

Account |

Stable Balance |

ASF Weighted Amount |

|---|---|---|

A1 |

3400 |

3230 |

A2 |

3873 |

3679.35 |

A3 |

9000 |

8550 |

A4 |

1000 |

950 |

A5 |

100 |

95 |

NOTE:

The application does not compute ASF items such as Tier 1 and Tier 2 capital, deferred tax liabilities, and minority interest. The items are taken as a download from the OFS Basel application. By updating the latest Basel Run Skey as a setup parameter. The application picks up the respective standard accounting head balances and applies the respective ASF factors.

If OFS Basel is not installed, then the following items must be provided as a download in the FCT_STANDARD_ACCT_HEAD table.

· Gross Tier 2 Capital

· Deferred Tax Liability related to Other Intangible Asset

· Deferred Tax Liability related to Goodwill

· Deferred Tax Liability related to MSR

· Deferred Tax Liability related to Deferred Tax Asset

· Deferred Tax Liability related to Defined Pension Fund Asset

· Net CET1 Capital post-Minority Interest Adjustment

· Net AT1 Capital post-Minority Interest Adjustment

· Total Minority Interest required for NSFR

The required stable funding factor is a pre-determined weight ranging from 0% to 100% which is applied through business assumptions for the accounts falling under the defined dimensional combinations. The weights are guided by the NSFR standard. The required stable funding is then considered as a sum of all the weighted amounts where an RSF factor is applied.

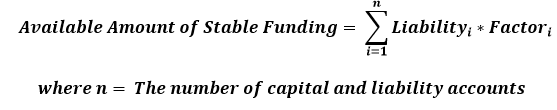

The required stable funding factor is a weight function and is applied similarly as that of the ASF. The following formula used for calculating the Required Amount of Stable Funding is as follows:

Off balance sheet items are considered under the application of RSF factor and are given the appropriate factor as guided. Some combinations, such as lines of credit, have a predefined RSF factor as guided and are available as preseeded assumptions. Other off balance sheet products such as Variable Rate Demand Notes (VRDN) and Adjustable Rate Notes (ARN) do not have predefined factors and are left to the discretion of the jurisdictions. For such products, define assumptions and apply the desired RSF factors as applicable.

Derivatives are handled by applying both ASF and RSF factors as applicable. They can behave as either an asset or a liability, depending on the marked to market value. Application of factors on derivatives is done on the market value after subtracting the variation margin posted or received against the account. The computation is as follows:

1. NSFR derivative liabilities = Derivative liabilities - (Total collateral posted as variation margin against the derivative liabilities)

2. NSFR derivative assets = Derivative assets - (Cash collateral received as variation margin against the derivative assets)

3. The factors are then applied as follows:

§ ASF factor application

ASF amount for derivatives = 0% * Max ((NSFR derivative liabilities -NSFR derivative assets), 0)

§ RSF factor application

RSF amount for derivatives = 100% * Max ((NSFR derivative assets- NSFR derivative liabilities), 0)

Derivative liabilities refer to those derivative accounts where the market value is negative. Derivative assets refer to those derivative accounts where the market value is positive. Apart from the variation margin, the initial margin against derivative contracts is also treated with the appropriate factor.

The Net Stable Funding Ratio is calculated as follows:

OFS LRRCRBI supports ready-to-use RBI NSFR assumptions according to RBI guidelines on the Net stable funding ratio.

This section explains the business assumptions which support NSFR as per the RBI circular RBI/2017-18/178 DBR.BP.BC.No.106/21.04.098/2017-18.

NOTE:

This section provides only contextual information about business assumptions. For more detailed information, see the OFS LRS application (UI).

Topics:

· Regulation Addressed through Business Assumptions

· Regulation

Addressed through Business Rules

The application supports multiple assumptions with preconfigured rules and scenarios based on regulator-specified NSFR scenario parameters. The list of preconfigured business assumptions and the corresponding reference to the regulatory requirement that it addresses is provided in the following tables.

Topics:

· Available Stable Funding Factor

· Required Stable Funding Factor

This section enlists all the preseeded assumptions acting on liabilities and capital items which receive an ASF factor.

Sl. No. |

Assumption Name |

Assumption Description |

Regulatory Requirement Addressed |

Regulatory Reference RBI/2017-18/178 DBR.BP.BC.No.106/21.04.098/ 2017-18 |

|---|---|---|---|---|

1 |

RBI-Capital items, DTL and minority interest |

[RBI]: Tier 1 and Tier 2 capital, deferred tax liabilities and minority interest. |

This assumption defines the long-term funding sources with an effective maturity of one year or more, primarily tier 1 and tier 2 capital instruments along with deferred tax liability and minority interest, which are assigned a 100% ASF factor for the NSFR computation. |

Paragraphs - 7.2A, 7.2B, 7.6B |

2 |

RBI- Stable retail deposits with maturity less than 1yr |

[RBI]: ASF- Stable and highly stable deposits as defined in the LCR from customers treated as retail with a remaining maturity of less than 1 year. |

The ASF factors applicable to the stable portion of deposits, from retail customers and SMEs treated like retail customers for LCR, with a remaining maturity of less than 1 year are predefined as part of this assumption. This assumption applies a 95% ASF factor on the stable portion of the retail deposits. |

Paragraph - 7.3 |

3 |

RBI- Stable retail deposits with maturity more than 1yr |

[RBI]: ASF- Stable and highly stable deposits as defined in the LCR from customers treated as retail with a remaining maturity of more than 1 year and cash flow maturity of less than 1 year. |

The ASF factors applicable to the stable portion of deposits, from retail customers and SMEs treated like retail customers for LCR, with a remaining maturity of more than 1 year with cash flow maturities within 1 year, are predefined as part of this assumption. This assumption applies a 95% ASF factor on the stable portion of cash flows. |

Paragraph - 7.3 |

4 |

RBI- Less stable retail deposits with maturity less than 1yr |

[RBI]: ASF- Less stable deposits as defined in the LCR from customers treated as retail with a remaining maturity of less than 1 year. |

The ASF factors applicable to the less stable portion of deposits, from retail customers and SMEs treated like retail customers for LCR, with a remaining maturity of less than 1 year, are predefined as part of this assumption. This assumption applies a 90% ASF factor on the stable portion of retail deposits. |

Paragraph - 7.4 |

5 |

RBI-Less stable retail deposits- Cash flow basis |

[RBI]: ASF- Less stable deposits as defined in the LCR from customers treated as retail with a remaining maturity of more than 1 year and cash flow maturity of less than 1 year. |

The ASF factors applicable to the less stable portion of deposits from retail customers and SMEs treated like retail customers for LCR, with a remaining maturity of more than 1 year with cash flow maturity within 1 year, are predefined as part of this assumption. This assumption applies a 90% ASF factor on the stable portion of cash flows. |

Paragraph - 7.4 |

6 |

RBI- Other funds from retail with mat less than 1yr |

[RBI]: Other funding from customers treated as retail with a residual maturity of less than 1 year. |

The ASF factors applicable to the funding other than deposits, from customers who are treated as retail for the purposes of LCR, with a remaining maturity of less than 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on the funding with a remaining maturity of less than 6 months and 50% on the funding with a remaining maturity between 6 months to 1 year. |

Paragraphs - 7.5D and 7.6A |

7 |

RBI- Other funds from retail with mat more than 1yr |

[RBI]: Other funding from customers treated as retail with an account residual maturity of more than 1 year. |

The ASF factors applicable to the funding other than deposits, from customers who are treated as retail for the purposes of LCR, with a remaining maturity of more than 1 year with cash flow maturity within 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on cash flows with maturity less than 6 months and a 50% to cash flows with a maturity period between 6 months to 1 year. |

Paragraphs - 7.5D and 7.6A |

8 |

RBI ASF - Op dep with mat less than 1 yr |

RBI ASF on the operational portion of operational deposits, generated by clearing, custody, and cash management activities, with a remaining maturity of less than 1 year. |

The ASF factor applicable to the balance held in operational accounts to fulfill operational requirements is predefined as part of this assumption. This assumption applies a 50% ASF factor on the operational balances with a remaining maturity of less than 1 year. |

Paragraph - 7.5B |

9 |

RBI ASF - Non op portion of op dep from SME with mat less than 1 yr |

RBI ASF on the non-operational portion for operational accounts from SMEs AoP, Trusts, partnerships, and HUFs not treated as retail, with remaining maturity less than 1 year. |

The ASF factor on the non-operational portion of operational accounts, from small and medium enterprises, the association of persons, trusts, partnerships, and Hindu undivided families not treated as retail, with a remaining maturity of less than 1 year are predefined as part of this assumption. This assumption applies a 0% ASF factor on non-operational balances of operational accounts with a remaining maturity of less than 1 year. |

Paragraph - 7.6B |

10 |

RBI ASF - Non op dep from SME less than 1 yr |

RBI ASF on non-operational wholesale funding, from SMEs AoP, Trusts, partnerships, and HUFs not treated as retail, with remaining maturity less than 1 year. |

The ASF factor on non-operational wholesale funding, from small and medium enterprises, association of persons, trusts, partnerships, and Hindu undivided families not treated as retail, with a remaining maturity of less than 1 year are predefined as part of this assumption. This assumption applies a 0% ASF factor on non-operational funding with a remaining maturity of less than 6 months and a 50% ASF factor on non-operational funding with a remaining maturity between 6 months to 1 year. |

Paragraphs - 7.6A, 7.6B and 7.5D |

11 |

RBI ASF - Non op dep from SME greater than 1 yr |

RBI ASF on non-operational wholesale funding, from SMEs AoP, Trusts, partnerships, and HUFs not treated as retail, with remaining maturity greater than 1 year and where the cash flows are occurring within 1 year. |

The ASF factor applicable to non-operational cash flows, from SMEs AoP, Trusts, partnerships, and HUFs not treated as retail, with a remaining maturity of greater than 1 year with cash flow maturity within 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on non-operational cash flows with cash flow maturity of less than 6 months and a 50% ASF factor on non-operational cash flows with a remaining maturity between 6 months to 1 year. |

Paragraphs - 7.6A, 7.6B and 7.5D |

12 |

RBI ASF - Non op portion of op dep from CB PSE MDB NDB with mat less than 1 yr |

RBI ASF on the non-operational portion of operational deposits, from Central banks, PSE, MDB, NDB, generated by clearing, custody, and cash management activities, with remaining maturity of less than 1 year. |

The ASF factor applicable to the non-operational portion of operational accounts from central banks, public sector entity (PSE), multilateral development bank (MDB), national development bank (NDB), with a remaining maturity of less than 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on the non-operational portion of operational accounts from central banks with a remaining maturity of less than 1 year and a 50% ASF factor on the non-operational portion of operational accounts from central banks, PSE, MDB, and NDB with a remaining maturity of less than 1 year. |

Paragraphs - 7.5 C, 7.5D and 7.6A |

13 |

RBI ASF - Non op funds from CB PSE MDB NDB greater than 1 yr |

RBI ASF on non-operational funding, from central banks, PSE, MDB, NDB, with remaining maturity greater than 1 year and where the cash flows are occurring within 1 year. |

The ASF factor applicable to non-operational cash flows from central banks, PSE, MDB, NDB, with a remaining maturity of greater than 1 year with cash flow maturity within 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on non-operational cash flows from central banks with cash flow maturity of less than 6 months, a 50% ASF factor for cash flow maturity between 6 months to 1 year, a 50% ASF factor on non-operational cash flows from PSE, MDB, and NDB with cash flow maturity of less than 1 year. |

Paragraphs - 7.5 C, 7.5D and 7.6A |

14 |

RBI ASF - Non op funds from CB PSE MDB NDB less than 1 yr |

RBI ASF on non-operational funding, from Central banks, financial institutions (banks) PSE, MDB, NDB, with remaining maturity less than 1 year. |

The ASF factor on non-operational funding from central banks, PSE, MDB, NDB, with a remaining maturity of less than 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on non-operational funding from central banks with a remaining maturity of less than 6 months, a 50% ASF factor for non-operational funding from PSE, MDB, and NDB between 6 months to 1 year and 50% ASF factor on non-operational funding from PSE, MDB, and NDB with a remaining maturity of less than 1 year. |

Paragraphs - 7.5 C, 7.5D and 7.6A |

15 |

RBI ASF - Non op portion of op dep from corp with mat less than 1 yr |

RBI ASF on the non-operational portion of operational deposits, from financial and non-financial corporates, generated by clearing, custody, and cash management activities, with a remaining maturity of less than 1 year. |

The ASF factor applicable to the non-operational portion of operational accounts from financial and non-financial corporates, with a remaining maturity of less than 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on the non-operational portion of operational accounts from financial corporates with a remaining maturity of less than 1 year and a 50% ASF factor on the non-operational portion of operational accounts from non-financial corporates with a remaining maturity of less than 1 year. |

Paragraphs - 7.5 A, 7.6B |

16 |

RBI ASF - Non op funds from Corp greater than 1 yr |

RBI ASF on non-operational funding, from financial and non-financial corporates, with remaining maturity greater than 1 year and where the cash flows are occurring within 1 year. |

The ASF factor applicable to non-operational cash flows from financial and non-financial corporates, with a remaining maturity of greater than 1 year with cash flow maturity within 1 year, are predefined as part of this assumption. This assumption applies a 50% ASF factor on non-operational cash flows from non-financial corporates with cash flow maturity of less than 6 months and between 6 months to 1 year. The assumptions apply a 0% ASF factor on non-operational cash flows from financial corporates with cash flow maturity of less than 6 months and a 50% ASF factor on non-operational cash flows from financial corporates with cash flow maturity between 6 months to 1 year. |

Paragraphs - 7.5 A, ,7.5, 7.6A |

17 |

RBI ASF - Non op funds from Corp less than 1 yr |

RBI ASF on non-operational funding, from financial and non-financial corporates, with remaining maturity less than 1 year. |

The ASF factor on non-operational funding from financial and non-financial corporates, with remaining maturity less than 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on non-operational funding from financial corporates with a remaining maturity of less than 6 months and a 50% ASF factor for non-operational funding from financial corporates with a remaining maturity between 6 months to 1 year. The assumptions also apply a 50% ASF factor on non-operational funding from non-financial corporates with a remaining maturity of less than 6 months and between 6 months to 1 year. |

Paragraphs - 7.5 A, ,7.5, 7.6A |

18 |

RBI ASF - Non op portion of op dep other parties with mat less than 1 yr |

RBI ASF on the non-operational portion of operational deposits, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB and NDB, generated by clearing, custody, and cash management activities, with a remaining maturity of less than 1 year. |

The ASF factor applicable to the non-operational portion of operational accounts from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB, with remaining maturity less than 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor on the non-operational portion of operational accounts from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, and sovereign, PSE, MDB and NDB with a remaining maturity of less than 1 year. |

Paragraphs - 7.6B |

19 |

RBI ASF - Non op funds other parties less than 1 yr |

RBI ASF on non-operational funding, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB, with remaining maturity less than 1 year. |

The ASF factor applicable to non-operational funding, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB, with remaining maturity less than 1 year are predefined as part of this assumption. This assumption applies a 0% ASF factor and a 50% ASF factor on non-operational funding from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB and NDB with a remaining maturity of less than 6 months and between 6 months to 1 year, respectively. |

Paragraphs - 7.6A, 7.5D |

20 |

RBI ASF - Non op funds other parties greater than 1 yr |

RBI ASF on non-operational funding, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB, with remaining maturity greater than 1 year and where the cash flows are occurring within 1 year. |

The ASF factor applicable to non-operational cash flows, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB, with remaining maturity greater than 1 year with cash flow maturity within 1 year, are predefined as part of this assumption. This assumption applies a 0% ASF factor and 50% ASF factor on non-operational cash flows from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB and NDB with cash flow maturity of less than 6 months and between 6 months to 1 year, respectively. |

Paragraphs - 7.6A, 7.5D |

21 |

RBI ASF- Trade date payables |

[RBI]: Trade date payables arising from purchases of foreign currencies, financial instruments, and commodities that are expected to settle or have failed but are expected to settle within the standard settlement cycle. |

The ASF factor applicable to trade payable cash flows arising from purchases of foreign currencies, financial instruments, and commodities expected to settle within the standard settlement cycle, are predefined in this assumption. This assumption applies a 0% ASF factor on the trade payable cash flows. |

Paragraph - 7.6 D |

22 |

RBI ASF- Liabilities with open maturity |

[RBI]: Secured deposits and all other borrowings and which do not have a stated maturity. |

The ASF factor applicable to all the other funding without any stated maturity are predefined in this assumption. This assumption applies a 0% ASF factor on all the funding without any maturity. |

Paragraph - 7.6 B |

23 |

RBI

ASF-Borr and Liabilities with maturities beyond 1 year |

[RBI]: Borrowings and liabilities with residual maturities and cash flows falling beyond 1 year. |

The ASF factors applicable to all other funding are with a remaining maturity of greater than 1 year with cash flow maturity within 1 year, are predefined in this assumption. This assumption applies a 0% ASF factor on the cash flows. |

Paragraph - 7.2 C |

24 |

RBI ASF- Non Op Portion of Op Dep- Othr Parties -Mat in 1yr |

[RBI]: ASF - the non-operational portion of operational deposits from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB, generated by clearing, custody, and cash management activities with a remaining maturity of less than 1 year. |

The ASF factor applicable to the non-operational portion of operational accounts from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB with remaining maturity less than 1 year are predefined as part of this assumption. This assumption applies a 0% ASF factor on the non-operational portion of operational accounts from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, and sovereign, PSE, MDB, and NDB with a remaining maturity of less than 1 year. |

Paragraph 7.5 D |

25 |

RBI ASF- Non Operational Funds -Other Parties |

[RBI]: ASF - non-operational funding from all the financial institutions and government-sponsored entities that are not covered above. |

The ASF factor applicable to non-operational funding from the financial institutions and government-sponsored entities that are not covered above with remaining maturity less than 1 year are predefined as part of this assumption. This assumption applies a 0% ASF factor and a 50% ASF factor on non-operational funding from the financial institutions and government-sponsored entities that are not covered above with a remaining maturity of less than 6 months and between 6 months to 1 year, respectively. It applies a 100% ASF factor on non-operational funding from the financial institutions and government-sponsored entities that are not covered above with a remaining maturity of 1 year or more. |

Paragraph 7.5 D |

26 |

RBI ASF- Non Op Funds -Other Parties -Cash flow basis |

[RBI]: ASF - non-operational funding, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB with remaining maturity greater than 1 year and where the cash flows are occurring within 1 year. |

The ASF factor applicable to non-operational cash flows, from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB with remaining maturity greater than 1 year with cash flow maturity within 1 year and greater than 1 year are predefined as part of this assumption. This assumption applies a 0% ASF factor and 50% ASF factor on non-operational cash flows from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, sovereign, PSE, MDB, and NDB with cash flow maturity of less than 6 months and between 6 months to 1 year respectively. It applies a 100 % ASF factor on non-operational cash flows from all except retail, SME, AoP, Trusts, partnerships, HUF, corporates, banks, central banks, and sovereign, PSE, MDB, and NDB with cash flow maturity of 1 year or more. |

Paragraph 7.5 D |

27 |

RBI- Other Capital Instruments |

[RBI]: ASF - other Capital Instruments that are not covered above |

This assumption defines the long-term funding sources with an effective maturity of one year or more, all the other capital instruments except Tier 1 and Tier 2 capital instruments along with deferred tax liability and minority interest, which are assigned a 100% ASF factor for the NSFR computation. |

Paragraph 7.2 B |

This section enlists all the preseeded assumptions acting on assets and off-balance sheet items that receive an RSF factor.

Sl. No. |

Assumption Name |

Assumption Description |

Regulatory Requirement Addressed |

Regulatory Reference RBI/2017-18/178 DBR.BP.BC.No.106/21.04.098/2017-18 |

|---|---|---|---|---|

1 |

RBI- Coins and banknotes |

[RBI]: Coins, banknotes, cash, and restricted cash held by the bank. |

The RSF factor applicable to coins, banknotes, and cash held by the bank, is predefined as a part of this assumption. This assumption applies a 0% RSF factor on the coins, banknotes, and cash held by the bank. |

Paragraph - 9.2 A |

2 |

RBI- Central bank reserves |

[RBI]: All central bank reserves, including, required reserves and excess reserves. |

The RSF factors applicable to required and excess central bank reserves are predefined as a part of this assumption. This assumption applies a 0% RSF factor to all central bank reserves. |

Paragraph - 9.2 B |

3 |

RBI- Unencumbered claims on central banks |

[RBI]: Unencumbered loans and other claims on central banks. |

The RSF factors applicable to fully performing unencumbered loans and claims on central banks, with a remaining maturity of less than 1 year, are predefined as part of this assumption. This assumption applies 0%, 50%, and 100% RSF factors to the loans and claims on central banks with a remaining maturity of less than 6 months, between 6 months and 1 year, and 1 year or more, respectively. |

Paragraphs - 9.2 C, 9.6 C, 9.9 C |

4 |

RBI- Encumbered claims on central banks |

[RBI]: Encumbered loans and other claims on central banks. |

The RSF factors applicable to fully performing encumbered loans and claims on central banks, maturing within a year and encumbrance period 1 year or more, are predefined as part of this assumption. For the qualifying assets with an encumbrance period of less than 6 months, the assumption applies 0%, 50%, and 100% RSF factors based on a remaining maturity of less than 6 months, between 6 months and 1 year, and 1 year or more, respectively. For assets with encumbrance period of between 6 months and 1 year, the assumption applies 50%, and 100% RSF factors based on a remaining maturity of less than 1 year and 1 year or more respectively. A 100% RSF factor is applied to all assets maturing within a year and encumbrance 1 year or more. |

Paragraph - 10.4 |

5 |

RBI-Unenc loans to fin insti secured by Level 1 asset |

[RBI]: Unencumbered loans to financial institutions where the loan is secured against Level 1 assets as defined in the LCR. |

The RSF factors applicable to the unencumbered loans given to financial institutions secured by a Level 1 asset, with residual maturity less than 1 year, are predefined as a part of this assumption. The assumption applies RSF factor of 10%,50%,100% on the unencumbered secured loans given to financial institutions secured by Level 1 asset with a remaining maturity of less than 6 months, 6 months to 1 year and 1 year or more, respectively, where the collateral received can be rehypothecated for the life of the loan. The assumption applies RSF factor of 15%,50%,100% on the unencumbered secured loans given to financial institutions secured by Level 1 asset with a remaining maturity of less than 6 months, 6 months to 1 year and 1 year or more respectively, where the collateral received cannot be rehypothecated for the life of the loan. |

Paragraphs - 9.4, 9.5 B, 9.6 C, 9.9 C |

6 |

RBI-Encum loans to fin insti secured by Level 1 asset |

[RBI]: Encumbered loans to financial institutions where the loan is secured against Level 1 assets as defined in the LCR. |

The RSF factors applicable to the encumbered loans given to financial institutions secured by a Level 1 asset, with residual maturity less than 1 year, are predefined as a part of this assumption. The assumption applies relevant RSF factors on the encumbered secured loans based on the encumbrance period and residual maturity. The Level 1 asset received as collateral can further be rehypothecated to raise funds. |

Paragraphs - 9.6 B, 9.9 A, 10.4 |

7 |

RBI- Unenc loans to fin insti secured by Non-Level 1 assets |

[RBI]: Unencumbered loans to financial institutions where the loan is secured against assets belonging to levels other than Level 1, as defined in the LCR. |

The RSF factors applicable to the unencumbered loans given to financial institutions secured by assets belonging to levels other than Level 1, with residual maturity less than 1 year, are predefined as a part of this assumption. The assumption applies RSF factor of 15%, 50%, 100% on the unencumbered secured loans given to financial institutions secured by assets belonging to levels other than Level 1 with a remaining maturity of less than 6 months, 6 months to 1 year and 1 year or more, respectively. |

Paragraphs - 9.5 B, 9.6 C, 9.9 C |

8 |

RBI- Encum loans to fin insti securd by Non-Level 1 assets |

[RBI]: Encumbered loans to financial institutions where the loan is secured against assets belonging to levels other than Level 1, as defined in the LCR. |

The RSF factors applicable to the encumbered loans given to financial institutions secured by assets belonging to levels other than Level 1, with residual maturity less than 1 year, are predefined as a part of this assumption. The assumption applies relevant RSF factor on the encumbered secured loans based on the residual maturity and encumbrance period of the loan. |

Paragraphs - 9.9 A, 10.4 |

9 |

RBI- Unenc unsecured loans to financial instituitions |

[RBI]: Unencumbered unsecured loans excluding overdrafts to financial institutions. |

The RSF factors applicable to the unencumbered unsecured loans given to financial institutions, with residual maturity less than 1 year, are predefined as a part of this assumption. The assumption applies RSF factor of 15%, 50%, and 100% on the unencumbered unsecured loans given to financial institutions, with a remaining maturity of less than 6 months, 6 months to 1 year, and 1 year or more, respectively. |

Paragraphs - 9.5 B, 9.6 C, 9.9 C |

10 |

RBI- Enc unsecured loans to financial instituitions |

[RBI]: Encumbered unsecured loans to financial institutions. |

The RSF factors applicable to the encumbered unsecured loans given to financial institutions, with residual maturity less than 1 year, are predefined as a part of this assumption. The assumption applies relevant RSF factor on the encumbered secured loans given to financial institutions based on the residual maturity and encumbrance period of the loan. |

Paragraphs - 9.9 A, 10.4 |

11 |

RBI- Unenc loans to others, mat less than 1yr |

[RBI]: Unencumbered loans with residual maturity less than a year to other counterparties, that is, Non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns. |

The RSF factors applicable to fully performing unencumbered loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns, with a remaining maturity of less than 1 year, are per defined as part of this assumption. This assumption applies 50% RSF factors on the loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns with a remaining maturity of less than 1 year. |

Paragraphs - 9.6 E, 9.9 B, 10.4 |

12 |

RBI- Enc loans to others, mat less than 1yr |

[RBI]: Encumbered loans with residual maturity less than a year to other counterparties, that is, Non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns. |

The RSF factors applicable to fully performing encumbered loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns, with a remaining maturity of less than 1 year, are per defined as part of this assumption. This assumption applies 50% RSF factors on the encumbered loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns with a remaining maturity of less than 1 year. |

Paragraph - 10.4 |

13 |

RBI- Unenc loans to others, mat more than 1 yr |

[RBI]: Unencumbered loans with residual maturity more than a year to other counterparties, that is, Non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns. |

The RSF factors applicable to fully performing unencumbered loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns, with a remaining maturity of more than 1 year with standardized risk weights under Basel 2 approach, are per defined as part of this assumption. This assumption applies a 65 % RSF factors on the loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises and sovereigns with a remaining maturity of more than 1 year and risk weight more than or equal to 35%. It applies an RSF factor of 85% on the loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns with a remaining maturity of more than 1 year and risk weight greater than 35%. |

Paragraphs - 9.7 B, 9.8 A |

14 |

RBI - Enc Loans to others, mat more than 1yr |

[RBI]: Encumbered loans with residual maturity more than a year to other counterparties, that is, Non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns. |

The RSF factors applicable to fully performing encumbered loans to non-financial corporates, retail and small business customers, sovereigns, Public sector enterprises, and sovereigns, with a remaining maturity of more than 1 year with standardized risk weights under Basel 2 approach, are per defined as part of this assumption. This assumption applies relevant RSF factors on the encumbered loans based on the residual maturity, encumbrance period, and the risk weigh associated with the loan. |

Paragraphs - 9.9 A, 10.4 |

15 |

RBI- Unenc non HQLA assets |

[RBI]: Unencumbered securities, with maturity less than 1 year, which does not qualify as high-quality liquid assets under the LCR Rule. |

The RSF factors applicable to unencumbered securities, with a remaining maturity of less than 1 year and which do not qualify, as High quality liquid assets under the LCR Rule, are predefined as part of this assumption. The assumption applies a 50% RSF factor on unencumbered securities, which do not qualify as High quality liquid assets under the LCR Rule, with a remaining maturity of less than 1 year. |

Paragraph - 9.6 E |

16 |

RBI- Unenc non HQLA securities mat greater than 1yr |

[RBI]: Unencumbered securities, with a maturity greater than 1 year which does not qualify as HQLA under the LCR Rule. |

The RSF factors applicable to unencumbered securities, with a remaining maturity of more than 1 year and which do not qualify as High quality liquid assets under the LCR Rule, are predefined as part of this assumption. The assumption applies an 85% RSF factor on unencumbered securities, with a remaining maturity of more than 1 year and which do not qualify as High quality liquid assets under the LCR Rule. |

Paragraph - 9.8 C |

17 |

RBI- Enc non HQLA assets |

[RBI]: The encumbered portion of securities, with maturity less than 1 year which does not qualify as High quality liquid assets under the LCR Rule. |

The RSF factors applicable to the encumbered portion of the securities, with a remaining maturity of less than 1 year and which do not qualify as High quality liquid assets under the LCR Rule, are predefined as part of this assumption. The assumption applies a 50% RSF factor on the encumbered portion of the securities, with a remaining maturity of less than 1 year, encumbrance period of less than 1 year, and which do not qualify as High quality liquid assets under the LCR Rule. It applies a 100% RSF factor on the encumbered portion of the securities, with a remaining maturity of less than 1 year, encumbrance period of 1 year or more and which do not qualify as High quality liquid assets under the LCR Rule. |

Paragraphs - 9.6 B, 9.9 A |

18 |

RBI- Enc non HQLA assets mat greater than 1yr |

[RBI]: The encumbered portion of securities, with a maturity greater than 1 year which do not qualify as HQLA under the LCR Rule. |

The RSF factors applicable to the encumbered portion of the securities, with a remaining maturity of more than 1 year and which do not qualify as High quality liquid assets under the LCR Rule, are predefined as part of this assumption. The assumption applies an 85% RSF factor on the encumbered portion of the securities, with a remaining maturity of 1 year or more, encumbrance period of less than 1 year and which do not qualify as High quality liquid assets under the LCR Rule. It applies a 100% RSF factor on the encumbered portion of the securities, with a remaining maturity of 1 year or more, encumbrance period of 1 year or more and which do not qualify as High quality liquid assets under the LCR Rule. |

Paragraphs - 9.9 A and 10.4 |

19 |

RBI-Unencumbered Level 1 assets |

[RBI]: Unencumbered assets that qualify for inclusion in Level 1 of High quality liquid assets as defined in the LCR. |

The RSF factors applicable to unencumbered assets, which qualify for inclusion in Level 1 of High quality liquid assets as defined in the LCR, are predefined as a part of this assumption. The assumption applies a 5% RSF factor on the unencumbered Level 1 assets. |

Paragraph - 9.3 |

20 |

RBI-Unencumbered Level 2A and 2B assets |

[RBI]: Unencumbered assets that qualify for inclusion in Level 2A and 2B of High quality liquid assets as defined in the LCR. |

The RSF factors applicable to unencumbered assets, which qualify for inclusion in Level 2A, and 2B of High-quality liquid assets as defined in the LCR, are predefined as a part of this assumption. The assumption applies a 15% RSF factor on the unencumbered Level 2A assets and an RSF factor of 50% on the unencumbered Level 2B assets. |

Paragraphs - 9.5 A. 9.6 A |

21 |

RBI-Encumbered Level 1 assets |

[RBI]: The encumbered portion of assets that qualify for inclusion in Level 1 of High quality liquid assets as defined in the LCR. |

The RSF factors applicable to the encumbered portion of assets, which qualify for inclusion in Level 1 of High-quality liquid assets as defined in the LCR, are predefined as a part of this assumption. The assumption applies 50% and 100% RSF factors on the encumbered portion of Level 1 assets, with encumbrance period of less than 1-year and1 year or more, respectively. |

Paragraphs - 9.3, 9.6 B, 9.9 A, 10.4 |

22 |

RBI- Encumbered Level 2 assets |

RBI- Encumbered Level 2 assets. |

The RSF factors applicable to the encumbered portion of assets, which qualify for inclusion in Level 2A, and 2B of High-quality liquid assets as defined in the LCR, are predefined as a part of this assumption. The assumption applies 15%, 50%, and 100% RSF factors on the encumbered portion of Level 2A assets, with encumbrance period of less than 6 months, between 6 months to 1-year and1 year or more, respectively. It applies 50% and 100% RSF factors on the encumbered portion of Level 2B assets, with encumbrance period of less than 1-year and1 year or more respectively. |

Paragraphs - 9.6 A and B, 9.9 A and 10.4 |

23 |

RBI-Unencumbered operational balances with other banks |

[RBI]: Operational portion of Unencumbered deposits held at other financial institutions, for operational purposes and are subject to the 50% ASF treatment. |

The RSF factors applicable to the operational portion of unencumbered deposits held at other financial institutions to fulfill the operational requirements, with a remaining maturity of less than 1 year, are predefined as part of this assumption. The assumption applies RSF factor of 50% and 100% on the operational portion of unencumbered deposits held at other financial institutions, with a remaining maturity of less than 1-year and1 year or more, respectively. |

Paragraph - 9.6 D |

24 |

RBI- Unencumbered non operational balances with other banks |

[RBI]: Non-operational portion of Unencumbered deposits held at other financial institutions, for operational purposes and are subject to the 50% ASF treatment. |

The RSF factors applicable to the non-operational portion of unencumbered deposits held at other financial institutions to fulfill the operational requirements, with a remaining maturity of less than 1 year, are predefined as part of this assumption. The assumption applies RSF factor of 15%, 50%, and 100% on the non-operational portion of unencumbered deposits held at other financial institutions, with a remaining maturity of less than 6 months, between 6 months to 1-year and1 year or more, respectively. |

Paragraphs - 9.6 D, BIS FAQ July 2016, point 32 |

25 |

RBI-Unencumbered residential mortgage loans |

[RBI]: Unencumbered residential mortgage loans which would qualify for a) 35% or lesser risk weight as per Basel 2 standardized approach for credit risk b) higher than 35% risk weight as per Basel 2 standardized approach for credit risk. |

The RSF factors applicable to unencumbered residential mortgage loans, with standardized risk weights under Basel 2 approach, are per defined as part of this assumption. The assumption applies RSF factors of 50% and 65% on the unencumbered residential mortgage loans, with a remaining maturity of less than 1-year and1 year or more, respectively, with risk weights less than or equal to 35%. It applies RSF factors of 50% and 85% on the unencumbered residential mortgage loans, with a remaining maturity of less than 1-year and1 year or more respectively, with risk weights greater than 35%. |

Paragraphs - 9.7 A and 9.7 B |

26 |

RBI-Encumbered residential mortgage loans |

[RBI]: Encumbered residential mortgage loans which would qualify for a) 35% or lesser risk weight as per Basel 2 standardized approach for credit risk b) higher than 35% risk weight as per Basel 2 standardized approach for credit risk. |

The RSF factors applicable to fully performing encumbered residential mortgage loans, with standardized risk weights under Basel 2 approach, are per defined as part of this assumption. This assumption applies RSF factors of 50% and 65 % on the encumbered residential mortgage loans, with a remaining maturity of less than 1 year and greater than equal to 1 year, respectively; encumbrance period is less than 1 year and risk weight is less than or equal to 35%. It applies an RSF factor of 100% on the encumbered residential mortgage loans with a remaining maturity of more than 1 year, encumbrance period of more than 1 year and risk weight is more than 35%. |

Paragraphs - 9.9 A and 10.4 |

27 |

RBI- Unencumbered commodities |

[RBI]: Unencumbered physically traded commodities, including gold. |

The RSF factor applicable to the unencumbered balance of physically traded commodities including gold are predefined as a part of this assumption. The assumption applies an 85% RSF factor on the unencumbered balance of the commodities. |

Paragraph - 9.8 D |

28 |

RBI- encumbered commodities |

[RBI]: Encumbered physically traded commodities including gold. |

The RSF factor applicable to the encumbered balance of physically traded commodities including gold is predefined as a part of this assumption. The assumption applies 85% and 100% RSF factors on the encumbered balance of the commodities, with encumbrance period of less than 1 year and 1 year or more, respectively. |

Paragraph - 10.4 |

29 |

RBI- Trade date receivables |

[RBI]: Trade date receivables arising from purchases of foreign currencies, financial instruments, and commodities that are expected to settle or have failed but are expected to settle within the standard settlement cycle. |

The RSF factor applicable to trade date receivables arising from purchases of foreign currencies, financial instruments, and commodities that are expected to settle or have failed but are expected to settle within the standard settlement cycle, are predefined as part of this assumption. The assumption applies a 0% RSF factor to the trade receivables, which expected to settle within the settlement cycle. |

Paragraphs - 9.2 D |

Off-Balance Sheet |

||||

1 |

RSF OBS- Credit and liquidity facilities to client |

[RBI]: Off-balance sheet exposures- Irrevocable, revocable and conditionally revocable credit and liquidity facilities offered to any clients by the bank. |

The RSF factor applicable to irrevocable, revocable, and conditionally revocable credit and liquidity facilities offered to any clients by the bank, is predefined as part of this assumption. The assumption applies a 5% RSF factor to the undrawn amount of irrevocable, revocable, and conditionally revocable credit and liquidity facilities. |

Paragraph - 9.1 |

2 |

RBI- Guarantees and letters of credit |

[RBI]: Off-balance sheet exposures- Guarantees and letters of credit. |

The RSF factor applicable to the Guarantees and Letters of credit offered by the bank is predefined as part of this assumption. The assumption applies a 5% RSF factor to the EOP balance of the Guarantees and Letters of credit. |

Paragraph - 9.1 |

3 |

RBI-Non contractual obligations type |

[RBI]: Non-contractual obligations type such as potential requests for debt repurchases, managed funds, and so on. |

The RSF factor applicable to the non-contractual obligations type such as potential requests for debt repurchases, managed funds, and so on is predefined as part of this assumption. The assumption applies a 5% RSF factor to the aforesaid non-contractual obligations amount. |

Paragraph - 9.1 |

4 |

RBI-Non contractual obligations |

[RBI]: Non-contractual obligations type such as potential requests for debt repurchases, managed funds, and so on. |

The RSF factor applicable to the non-contractual obligations for structured products such as Variable rate notes (VRDNs), Adjustable rate notes (ARDNs), and so on offered by the bank, is predefined as part of this assumption. The assumption applies a 5% RSF factor to the EOP balance for aforesaid non-contractual obligations. |

Paragraph - 9.1 |

This section enlists all the preseeded assumptions for derivatives.

Sl. No. |

Assumption Name |

Assumption Description |

Regulatory Requirement Addressed |

Regulatory Reference RBI/2017-18/178 DBR.BP.BC.No.106/21.04.098/2017-18 |

|---|---|---|---|---|

1 |

RBI- Additional Derivative Liability for RSF |

[RBI]: RSF an additional portion of derivative liabilities to be included as part of RSF. |

The RSF factor applicable to all derivative contracts including netted derivative contracts, where the aggregate mark to the market value of the contracts before any variation margin adjustment is negative is predefined as part of this assumption. The assumption applies a 100% RSF factor to the 20% of negative mark-to-mark value for the aforementioned derivative contracts. |

Paragraph - 9.9 D |

2 |

RBI - Net NSFR Derivative Liabilities - STMP |

[RBI]: ASF derivative liabilities net of derivative assets, where derivative liability is net of any variation margin posted and the derivative asset is net of the cash margin received. The transactions are a part of the central bank's short term monetary policy and liquidity operations. |

The ASF factor applicable to all the derivative contracts including netted derivative contracts which are a part of the central bank's short term monetary policy and liquidity operations, where the net aggregate mark to the market value of the contracts for an entity including any variation margin adjustment is negative is predefined as part of this assumption. The assumption applies a 0% ASF factor to the derivative liabilities net of derivative assets, where the net aggregate mark to the market value of the contracts is negative. |

Paragraph 10.14 |

3 |

RBI - Net NSFR Derivative Liabilities - Non-STMP |

[RBI]: ASF derivative liabilities net of derivative assets, where derivative liability is the net of any variation margin posted and the derivative asset is the net of cash margin received. The transactions made are not part of the central bank's short term monetary policy and liquidity operations. |

The ASF factor applicable to all the derivative contracts including netted derivative contracts which are not a part of central bank's short term monetary policy and liquidity operations, where the net aggregate mark to the market value of the contracts for an entity including any variation margin adjustment is negative is predefined as part of this assumption. The assumption applies a 0% ASF factor to the derivative liabilities net of derivative assets, where the net aggregate mark to the market value of the contracts is negative. |

Paragraph 10.14 |

4 |

RBI - Net NSFR Derivative assets |

[RBI]: RSF derivative assets net of derivative liabilities, where derivative liability is net of any variation margin posted and the derivative asset is net of cash margin received. |

The ASF factor applicable to all derivative contracts including netted derivative contracts, where the net aggregate mark to the market value of the contracts for an entity including any cash margin adjustment is positive is predefined as part of this assumption. The assumption applies a 100% RSF factor to the derivative assets net of derivative liabilities, where the net aggregate mark to the market value of the contracts is positive. |

MC Paragraph - 9.9 B |

5 |

RBI- Margin for derivatives |

[RBI]: RSF Treatment of initial margin posted against derivative transactions. |

The RSF factor applicable to the initial margin posted for the derivative contracts is predefined as part of this assumption. The assumption applies an 85% RSF factor to the initial margin posted against the derivative contracts. |

MC Paragraph - 9.8 A |

The list of preconfigured business rules and the corresponding reference to the regulatory requirement that it addresses is provided in the following tables:

Sl. No. |

Rule Name |

Rule Description |

Regulatory Requirement Addressed |

Regulatory Reference |

|---|---|---|---|---|

1 |

LRM - Instrument - NSFR Encumbered Band Surrogate Key Population |

This rule identifies the encumbrance band related to Net Stable Funding Ratio for the encumbrance date at the account level and updates the underlying related unique identifier in the FSI_LRM_INSTRUMENT table. |

The encumbrance period for the asset for the purpose of required stable funding (RSF) calculations is identified as part of this rule. |

MC Paragraph - 10.4 |

2 |

LRM - Instrument - NSFR Residual Maturity Band Surrogate Key Population - Open Maturity |

This rule identifies the maturity band related to the Net Stable Funding Ratio for the maturity date at the account level for the open maturity products and updates the underlying related unique identifier in the FSI_LRM_INSTRUMENT table. |

The products with no stated maturity for the computation of available stable funding (ASF) are identified as part of this rule. |

MC Paragraph - 7.6 B |

3 |

LRM - Stable and Operational Balance Percentage Calculation |

This rule calculates the percentage of the stable balance and the operational balance concerning the end of the period balance of the accounts and updates the same in the FSI_LRM_INSTRUMENT table. |

This rule computes the percentage of the stable and less stable portion of deposits, held by retail and wholesale customers treated as retail for the purposes of LCR, for ASF calculation. |

MC Paragraph - 7.3 and 7.4 |

4 |

LRM - Account Cash flow - Stable and Operational Amount Calculation |

This rule calculates the cash flows associated with the stable portion and less stable portion of the accounts. Also, this rule calculates the cash flows associated with the operational balance portion and the non-operational balance portion. All these above values are updated in FCT_ACCOUNT_CASH_FLOWS. |

This rule calculates the cash flows associated with stable and less stable deposits, held by retail and wholesale customers treated as retail for the purposes of LCR, having residual maturity of more than 1 year and cash flow maturity of more than 1 year. This rule applies the stable and less stable deposit percentage to cash flows with a maturity of more than 1 year. |

MC Paragraph - 7.2 C |

5 |

LRM - Netted Derivatives - Derivative Liability Amount Calculation |

This rule calculates the derivative liability amount for the netted contracts by considering the absolute value of the sum of marked to the market value of all the underlying contracts associated with the netting agreement. |

All the derivative contracts associated with the netting agreement, where the aggregate mark to the market value of the contracts before any variation margin adjustment is negative is computed as part of this rule. |

MC Paragraph - 8.1 |

6 |

LRM - Netted Derivatives - Posted collateral Margin Amount Calculation |

This rule calculates the sum of the value of the collaterals posted as a variation margin related to the netted derivatives and updates this information in the FSI_LRM_INSTRUMENT table. |

The rule computes the value of the all the collaterals posted as variation margin for the netted derivative contracts related to the netting agreement. |

MC Paragraph - 8.1 |

7 |

LRM - Derivatives - Posted collateral Margin Amount Calculation |

This rule calculates the sum of the value of the collaterals posted as a variation margin related to the non-netted derivative contracts and updates this information in the FSI_LRM_INSTRUMENT table. |

The rule computes the value of the all the collaterals posted as variation margin for the non-netted derivative contracts. |

MC Paragraph - 8.1 |

8 |

LRM - Derivatives - Received Variation Margin Calculation |

This rule calculates the sum of the margin amount of cash variation margin received related to the non- netted derivative contracts and updates this information in the FSI_LRM_INSTRUMENT table. |

The rule computes the sum of the cash amount received as variation margin for the non-netted derivative contracts. |

MC Paragraph - 10.1 |

9 |

LRM - Netted Derivatives - Derivative Asset Amount Calculation |

This rule calculates the derivative asset amount for the netted contracts by considering the absolute value of sum of the marked to the market value of all the underlying contracts associated with the netting agreement. |

All the derivative contracts associated with the netting agreement, where the aggregate mark to the market value of the contracts prior to any variation margin adjustment is positive is computed as part of this rule. |

MC Paragraph - 10.1 |

10 |

LRM - Netted Derivatives - Received Variation Margin Calculation |

This rule calculates the sum of the margin amount of cash variation margin received related to the netted derivative contracts at the netting agreement level and updates this information in the FSI_LRM_INSTRUMENT table. |

The rule computes the sum of the cash amount received as a variation margin for the netted derivative contracts associated with netting agreement. |

MC Paragraph - 10.1 |

11 |

LRM - Derivatives - Posted collateral Initial Margin Amount Calculation |

This rule calculates the sum of the margin amount of the initial margin posted for all derivative contracts and updates this information in the FSI_LRM_INSTRUMENT table. |

This rule computes the sum of the initial margin posted for derivative contracts. |

MC Paragraph - 9.8 A |

12 |

LRM - Derivatives - Additional Derivative Liability Amount Calculation |

This rule calculates the additional portion of the derivative liabilities as a percentage of the derivative liability. This percentage is set up master parameterized for the users to edit the same. This value gets updated in the FSI_LRM_INSTRUMENT table. |

20% of all derivative contracts including netted derivative contracts, where the aggregate mark to the market value of the contracts before any variation margin adjustment is negative is configured in this rule. This additional derivative liability amount is used for the purpose of RSF computation. |

MC Paragraphs - 9.9 D |