3. Maintaining Account Class

While defining CIF records and Customer Accounts, you would have noticed that many of the fields have option lists positioned next to them. While some option lists contain pre-defined values for some option lists to be populated you need to capture data through separate screens. For instance, while maintaining CIF records you need to associate each customer with a customer category. For this purpose you will need to maintain customer categories before you begin to maintain CIF records. Similarly, each customer account needs to be associated with an account class. Therefore, you will need to maintain account classes before you start defining customer accounts.

This chapter contains the following sections:

- Section 3.1, "Account Class Maintenance"

- "Example 3.2" on page 47

- "Example 3.3" on page 54

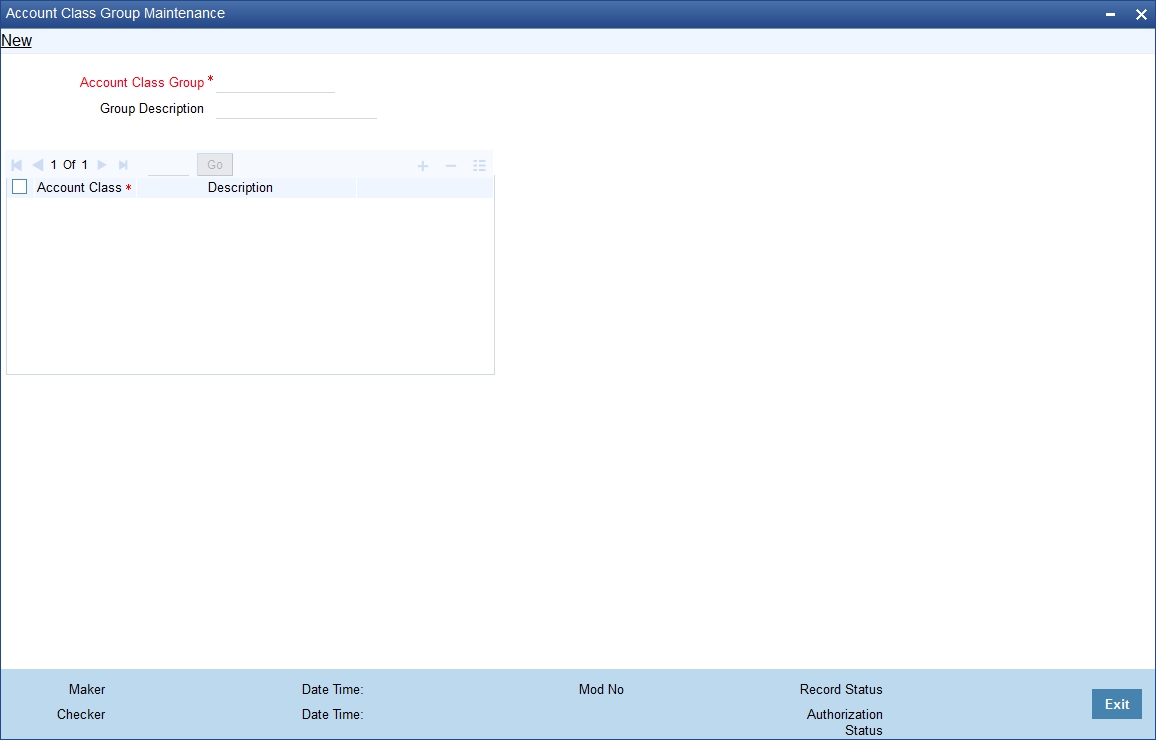

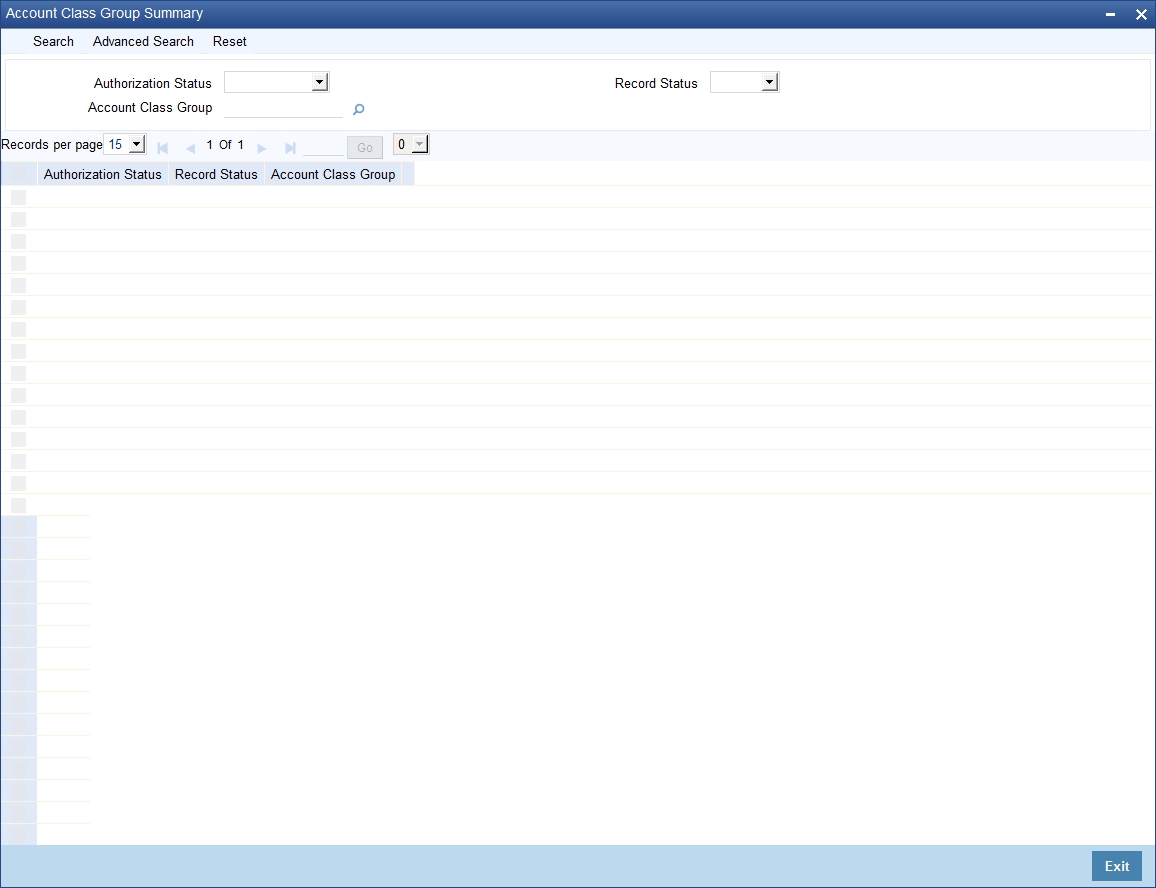

- Section 3.4, "Account Class Group Maintenance"

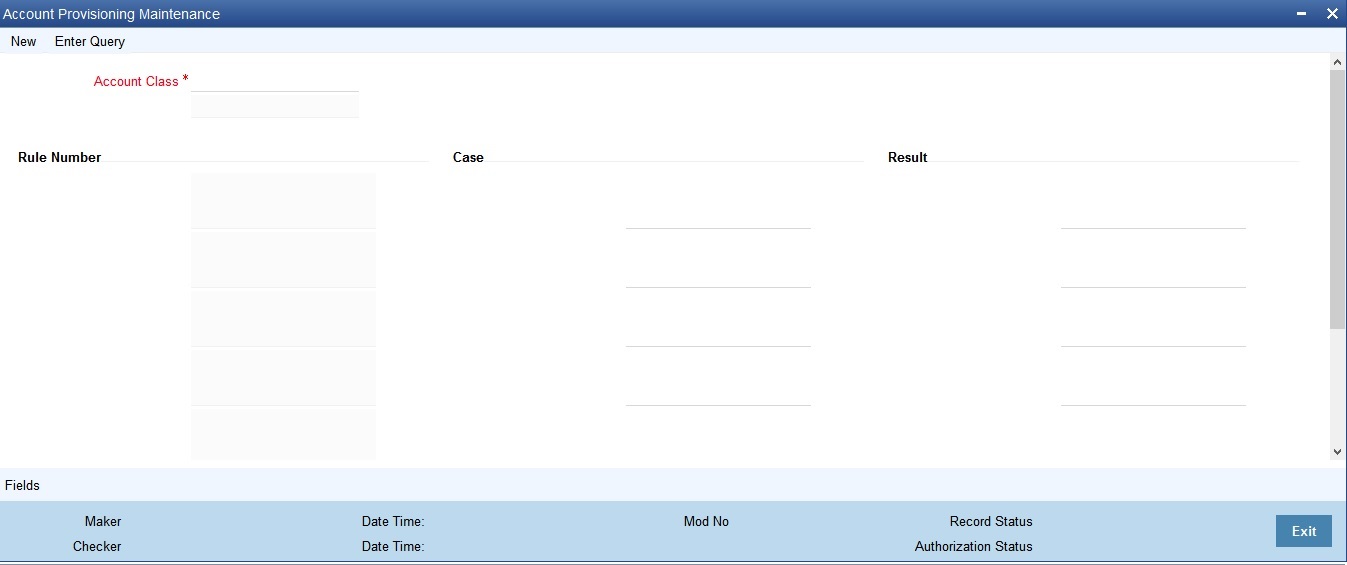

- Section 3.5, "Account Class Provisioning Maintenance"

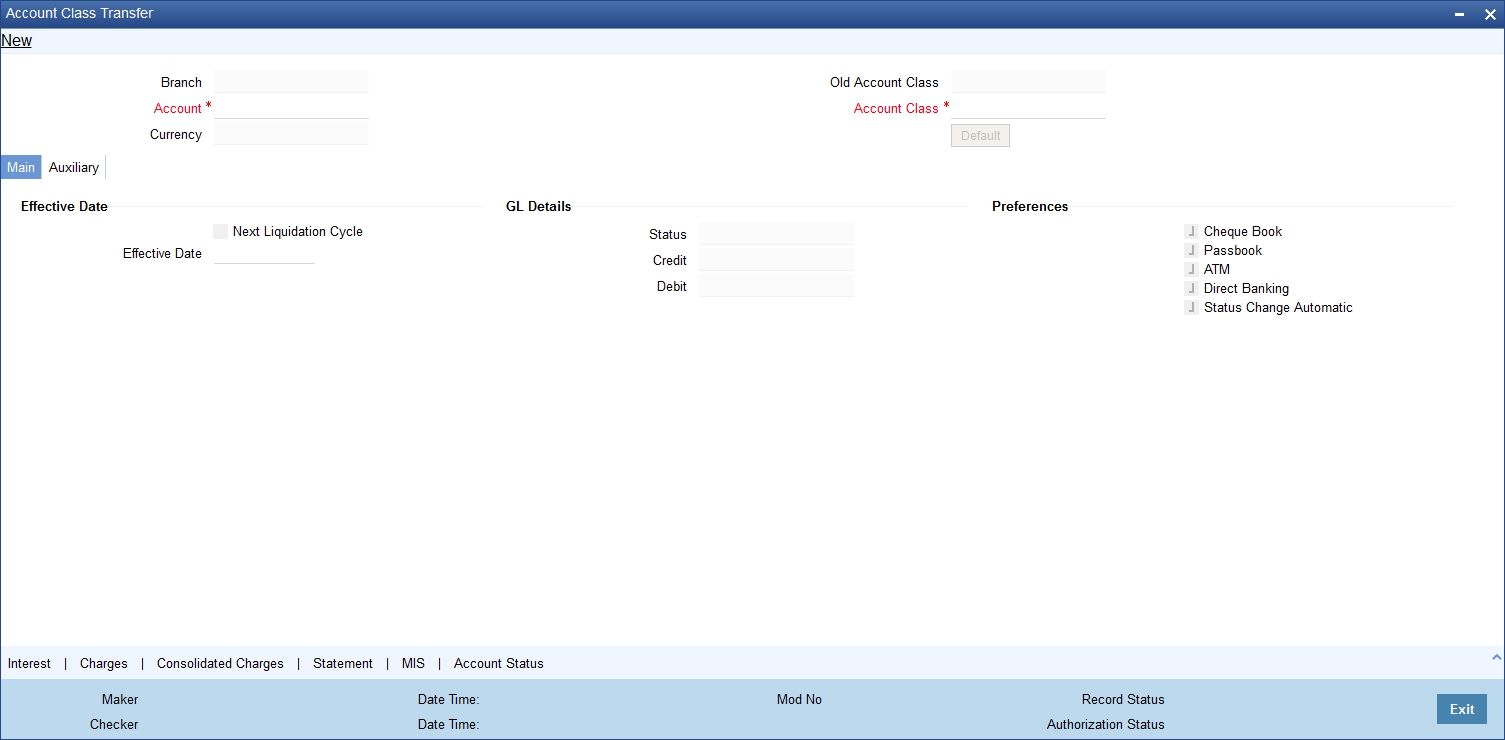

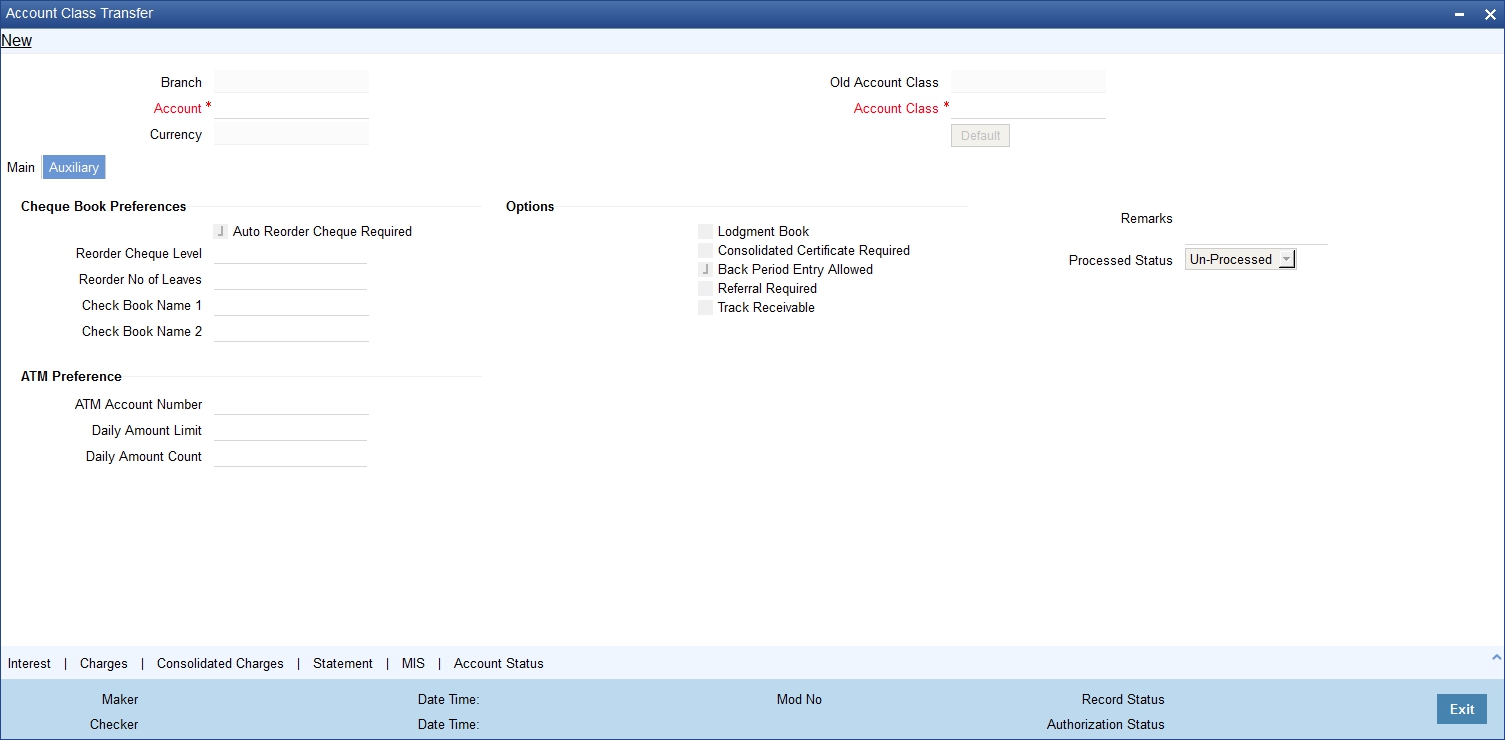

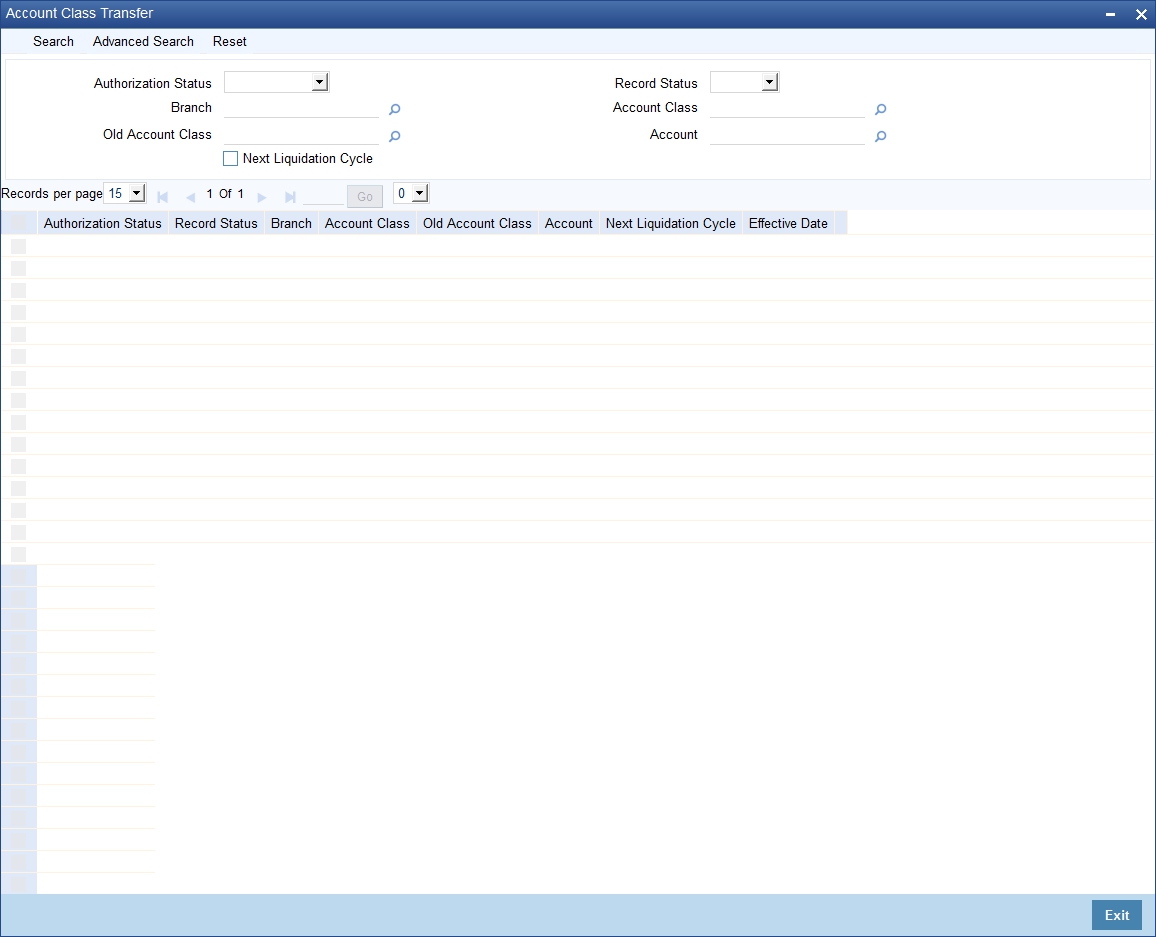

- Section 3.6, "Account Class Transfer"

- "Example 3.7" on page 76

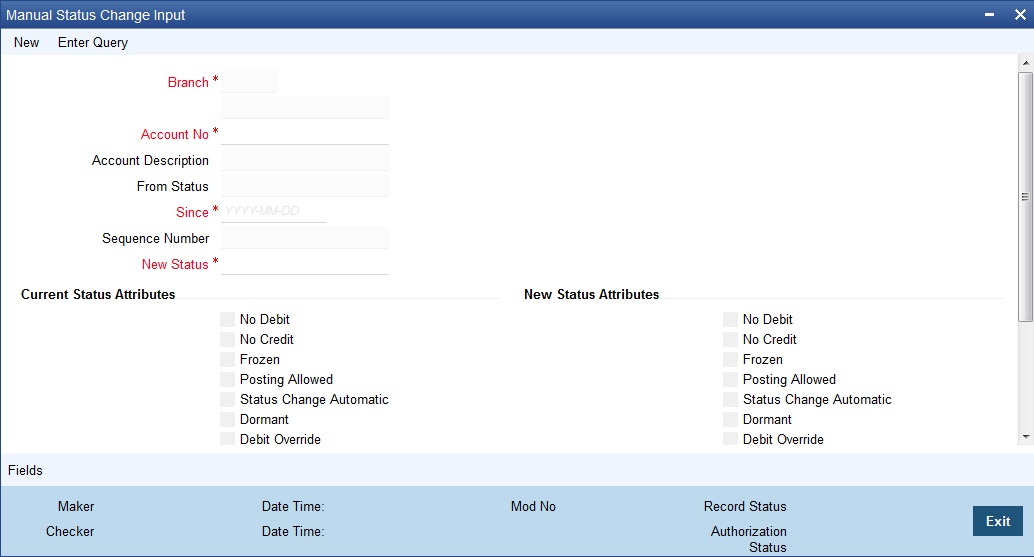

- Section 3.8, "Manual Status Change Input"

- Section 3.9, "Maintaining Turnover Limits"

3.1 Account Class Maintenance

This section contains the following topics:

- Section 3.1.1, "Maintaining Account Classes"

- Section 3.1.2, "Invoking Account Class Maintenance Screen"

- Section 3.1.3, "Statement Parameters Tab"

- Section 3.1.4, "Preferences Tab"

- Section 3.1.5, "GL Lines Button"

- Section 3.1.6, "Auto Deposits Button"

- Section 3.1.7, "Status Rule Button"

- Section 3.1.8, "Amount Block Button"

- Section 3.1.9, "Restriction Button"

- Section 3.1.10, "Statement Button"

- Section 3.1.11, "REG Button"

- Section 3.1.12, "Branches/Currencies Button"

- Section 3.1.13, "Customer Categories Button"

- Section 3.1.14, "Notice Button"

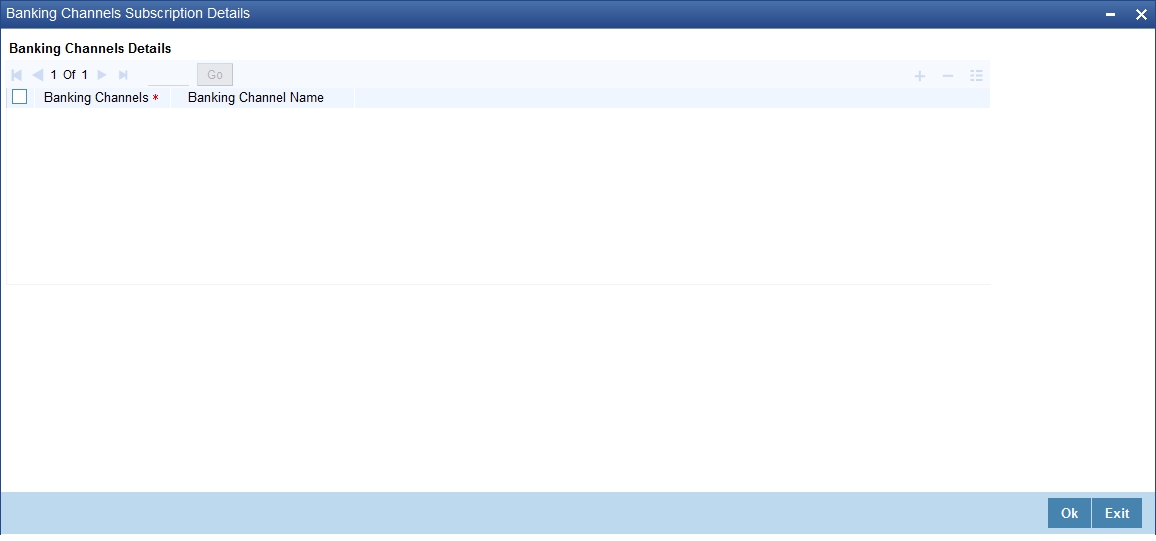

- Section 3.1.15, "Banking Channels Button"

- Section 3.1.16, "Default Limits"

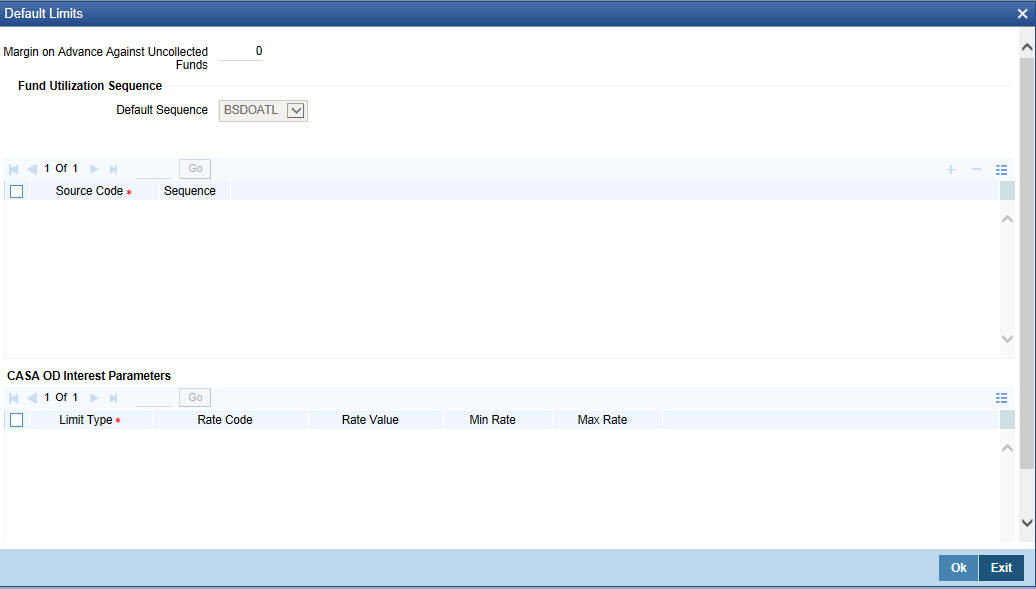

3.1.1 Maintaining Account Classes

In the Oracle FLEXCUBE system, you can classify the customer accounts of your bank into different groups and assign each an identifying code. For instance, you may define a group called INDSB to represent savings accounts held by individuals, SB-INS to comprise institutional savings accounts, COR-CU for corporate current accounts.

Each group is referred to as an Account Class and is maintained in the ‘Account Class’ screen. For each class, you also define certain common attributes applicable to all accounts in this class, such as, the General Ledger lines to which the accounts in this class report to, facilities granted to the account holders (pass book, check book, ATM etc.).

In the ‘Customer Accounts Maintenance’ screen, where you open accounts for the customers of your bank, each customer account is linked to an account class, and the attributes defined for the account class are by default applicable to the customer account. For instance, if the frequency of account statement generation has been defined as daily for an account class CU-COR, the system generates statements for all accounts under this class on a daily basis. However, some of the parameters defined for the account class, can be revised at the account level for any of the accounts linked to the class. Account level parameters will supersede those defined for the account class.

While defining the account classes you should also keep in mind that the interest rate structure is also specified for an account class (in the Interest and Charges module).

The account class table is maintained at the Bank Level by the Head Office branch

3.1.2 Invoking Account Class Maintenance Screen

You can invoke the ‘Account Class Maintenance’ screen by typing ‘STDACCLS’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Defining an Account Class includes the maintenance of the following parameters:

Assigning a unique Code to the Account Class and associating an appropriate description with the class

Indicating the type of account for which account class is being maintained

Specifying the period after which accounts in this class should become dormant if no customer transaction is posted into the account.

Indicating the date from when new accounts can be created under the account class.

Indicating the end date after which the new accounts cannot be created for the account class.

Maintaining the different statuses applicable to the accounts for which the account class is being defined. This would be used for tracking NPA’s on current and savings accounts.

Maintaining status-wise GLs for provisioning

Identifying the reporting lines (GL Line, Central Bank Lines and the Head Office Lines) for each status.

Maintaining account statement details like the type of statement that is to be generated, the frequency at which statements should be generated for all accounts under a class.

Indicating the preferences unique to an account class like the check book, passbook or ATM facilities to be given to account holders under this account class; whether overdraft facility should be allowed for accounts linked to this class; whether the credit limit should be checked for all accounts under the class; interest and charges to be computed for accounts under this class.

Specifying preferences regarding account holder facilities, interest computation etc.

Indicating whether status change for all accounts belonging to the account class should be automatic or manual.

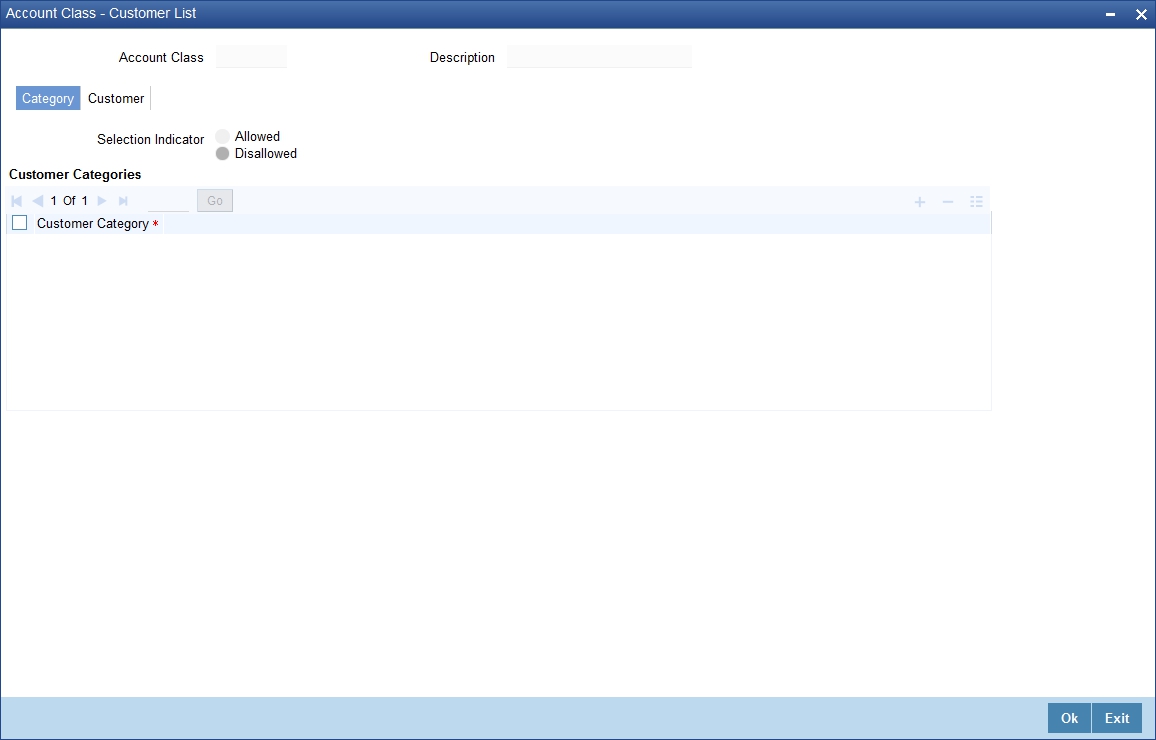

Identifying and assigning preferred branches, currencies and customers to the account class.

Specifying whether receivables should be tracked for the account class. This specification will default to all accounts that are linked to this account class.

Specifying whether reordering of Cheque Books for all accounts linked to this account class should be triggered automatically or not. If yes, the parameters for the same.

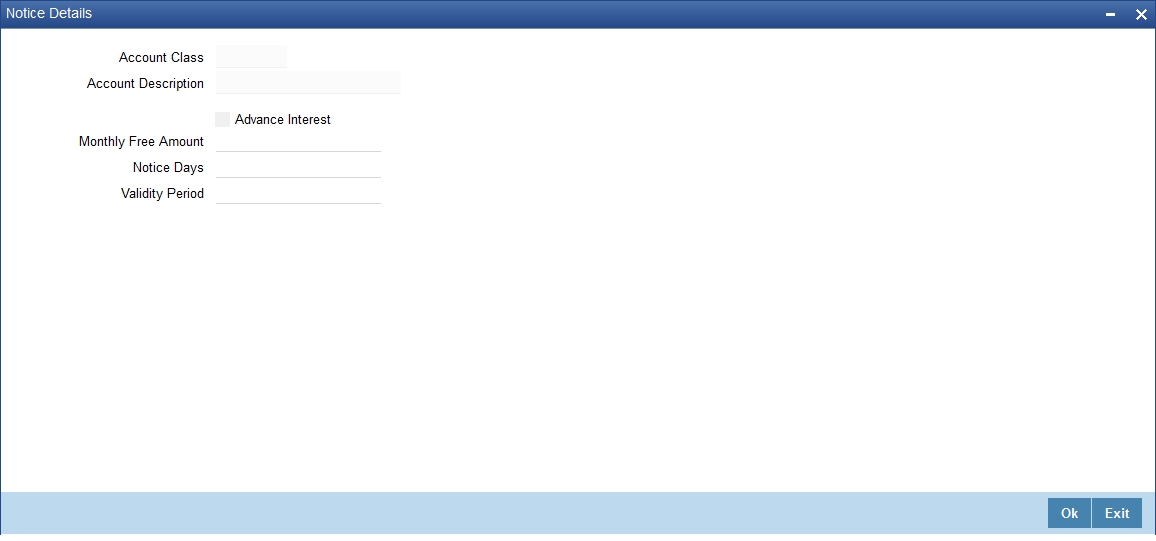

Specifying liquidation preferences for debit interest and charges, to notify your customers through a Debit Interest Notification message (in the case of charges, a Charge Notification message) before debiting the customer’s personal current account for debit interest or charges.

Maintaining initial funding details for new accounts.

Indicating whether Escrow transfer is applicable or not for new accounts

Each of the parameters has been discussed in detail in the subsequent sections

Account Class and Description

The account class code is a unique 6-character code, which identifies the class. Along with the class code you need to assign an appropriate description to the account class.

For instance, let us assume you are defining a class for savings account of individuals. You could associate the code SB IND with it. Similarly, the description that you associate with it could be something like this – ‘Savings accounts of individuals’.

Multi Currency Accounts

The multi-currency account class Flag is applicable only for current and savings account.

Account Type

The six different types of accounts that you can maintain are:

- Nostro account - your bank’s accounts with another bank

- Miscellaneous Debit - Each transaction is entered with a reference number. In the miscellaneous debit account a single debit transaction is matched subsequently with credits against the same reference number.

While posting transactions into this account, if the first entry is a debit, the subsequent reconciling entries should be all credits.

The system gives you a break-up of the balance by the reference number

- Miscellaneous Credit - as in miscellaneous debit account, in the miscellaneous credit accounts you post each transaction with a reference number. In a miscellaneous credit account a single credit entry is matched subsequently with debit entries with the same reference number.

The system gives you a break-up of the balance by reference numbers

- Savings Account

- Current Account

Account Code

As per your bank’s requirement you can choose to classify account classes into different account codes. The bank can decide the manner in which the account classes are to be assigned to different account codes. An account code can consist of a maximum of four characters.

Depending on the customer account mask maintained, the value in the account code field would be used during the generation of customer account numbers through the ‘Customer Accounts Maintenance’ screen.

If you have decided to include account code as part of the customer account number (in the account number mask), then at the time of creating a new customer account number, you will need to select the account class for the account number being generated. In the option-list provided, the account class is displayed along with the associated account code. When the account number gets populated, it is the account code that forms a part of the customer account number.

IBAN Account Type

Specify the IBAN account type if BBAN format has an account type.

Start Date

Specify the date from which the account class should become active, using the adjoining calendar. You will be able to create accounts under this account class from this date.

End Date

You can also specify the life span of the account class by indicating the end date.

The end date for an account class refers to the termination date after which, creation of new account under the account class is disallowed.

Consequently, the option list for Account Class in all further transactions screen in Oracle FLEXCUBE, will not display the ‘expired’ account class as of the system date. However, the existing accounts for the account class will be active even after the end date.

Note

If you do not specify an End Date for the account class, the account is taken to be an open-ended account class.

Dormancy Days

You have to indicate the period after which an account in an account class becomes inactive or dormant if customer transactions are not posted into the account. The system allows only three numeric characters for Dormancy Days.

Note

However, while maintaining transaction codes, if you have checked the Consider for Account Activity field, all transactions posted to any account under this account class linked to the particular transaction code will become active from dormant irrespective of the dormancy period. If a customer-initiated transaction is posted into the account with the dormant status the account status will be updated to Active from Dormant since the Transaction Code associated with the account has the Consider for Account Activity option enabled.

Dormancy Parameters

As stated above, if Transaction Code associated with the account has the Consider for Account Activity option enabled, the dormant status of the account will be updated to Active. Apart from this, you can specify the parameter that is required for re activating the account. To indicate the re activation parameters for the dormant account choose any from the following options:

- Debit

- Credit

- Any

- Manual

In case of a transaction, the system will check for the parameter you have specified here and accordingly change the status of the account. However, the parameter maintained at the account level will super cede the parameter you have specified here.

Account Statement Format

Specify the format in which account statement should be generated. The adjoining option list displays all valid formats maintained in the system. You can select the appropriate one.

Display IBAN in Advices

For an account class you can indicate whether the IBAN number of the customers involving the accounts within the class should be printed on advices sent to the customer. If you would like to print the IBAN number of the customers on advices sent to the customers involving the account class, you can enable the Display IBAN in Advices option by checking it.

Your specification will be made applicable to all customers linked to the account class. You will be allowed to change this option for a specific account.

Note

IBAN Account numbers for specific customers can be captured while defining a specific account through the IBAN Sub-screen of the ‘Customer Account Maintenance’ screen.

Dual Ccy Deposit

Check this box to enable the account class for Dual Currency Deposit (DCD) type.

Dual Currency Deposit (DCD) is a short-term currency-linked deposit that allows you to earn a higher interest rate than regular time deposits.

Note

You will be allowed to check this field only for ‘Deposit’ Account Type. If this box is checked for other Account types, system throws an error.

The reporting of all turnovers of the particular account class will be directed to the GL that you identify as the natural GL. Based on the characteristic of the account balance; you can specify whether the turnover is to be posted to the Debit GL or to the Credit GL. For instance, if the account class is for overdrafts, the balance is normally a debit whereas current accounts normally do not have a debit balance.

Applicable Customer Status

Specify the applicable customer status from the drop-down list. The available options are:

- Major

- Minor

- Both

- Not Applicable

Note

- By default ‘Not applicable’ option would be selected when a new account class is created.

- If you select ‘Minor’ option at the CIF level and ‘Applicable customer status’ as ‘Major’ at the account class level then the system displays an error message as “The A/c class you selected is for major customer.”

- Similarly if you uncheck ‘Minor’ option at the CIF level and select ‘Applicable customer status’ as ‘Minor’ at the account class level then the system displays an error messages as “The A/c class you selected is for minor customer”

Specifying Liquidation Preferences for Debit Interest and Charges

You must specify the liquidation preferences for debit interest and charges, for those accounts classes where interest/charge has to be debited from a Receivable GL before actually debiting the customer account. This feature is applicable only for the debit interest and any charges on the account calculated through the IC module. The preferences that you need to specify are:

- Liquidate Using Receivable - Indicates whether receivable tracking is required for IC Debit interest and IC charges

- Debit Notice – enabling this option indicates that a notification needs to be sent to customers before debiting the customer account for the interest / charge calculated for the period.

- Liquidation Days – specifies the number of working days from the actual liquidation date before the interest/charge can be liquidated into the customer account. Working days are calculated on the basis of the Local Holiday Calendar.

- Liquidation Mode – debit interest or charges can be liquidated either Manually or Automatically. If you choose the automatic mode of liquidation, debit interest or charges are liquidated automatically as part of the BOD process on the liquidation date. However, after having specified Auto as the mode of liquidation, if you wish to liquidate them manually for a specific account, the System intimates you with an override message. Manual interest liquidation can be triggered through the ‘Debit Interest Liquidation’ screen. Manual liquidation is recommended during Account Closure.

- Verify Funds –enabling this option indicates that an available balance check should be performed for receivable tracking. As a result, the System performs the available balance check before debiting the account. The available balance also includes the limit amount. Verification of funds is applicable only in the case of Auto-Liquidation. If you leave this option unchecked, the System performs a ‘force-liquidation’ regardless of whether the account has sufficient funds or not.

Note

- You will not be allowed to change these preferences at the account level. However in the Amounts and Dates section of the ‘Customer Accounts Maintenance’ screen, both the total debit interest due as well as the charges due, are displayed.

- If there is any outstanding interest or charges on the account, the outstanding amount is displayed as an override while saving the transaction involving the account.

- While closing an account closure, the System verifies whether there is any outstanding debit interest or charges on the account. You will need to liquidate these before Account Closure.

An error log is created to store the error details of accounts for which liquidation could not be performed due to the following reasons:

- The Verify Funds option is enabled and partial liquidation is performed

- The Verify Funds option is enabled and the account has insufficient funds

- Accounting entries do not get passed successfully irrespective of whether the Verify Funds option is set or not.

Refer the End of Day processing for Debiting Receivable GLs section in the Daily Processing of IC chapter of the IC User Manual for details on end of day processes on Auto and Manual liquidation.

Maintaining Details for Free Banking

For account classes for which a free banking period is being provided, you can indicate the free banking parameters. These include:

- The number of days after the account opening date, for which no charges would be levied on the account. This is the free banking period. Charging for the account would commence when the free banking period has elapsed.

- Whether an advice (charge start advice) is to be sent to the customer, indicating the commencement of charging on the account

- The number of days before the charge start date, the charge start advice is to be sent to the customer, indicating the commencement of charging on the account.

Specifying Initial Funding Preferences

You need to specify the following details pertaining to initial funding for opening accounts under the account class.

Event Class Code

Specify the event class code maintained for initial funding process for the module code ‘DE’. This adjoining option list displays all valid event class codes maintained in the system. You can choose the appropriate one.

Charge Role to Head Code

Specify the class code that you wish to use for posting charge-related accounting entries for initial funding. This adjoining option list displays all valid class codes maintained in the system. You can choose the appropriate one.

Refer the section ‘Maintaining Event Class for Account Initial Funding’ in the chapter titled ‘Creating Classes’ under Modularity User Manual for further details about the event class code.

Maintaining Provisioning Details

When you define an account class, you can specify whether provisioning is applicable for accounts using the class. You can make the following specifications in the Provisioning Details section in the ‘Account Classes’ screen:

- Auto Provisioning Required - Check this box if provisioning is applicable

- Provision Frequency - Frequency at which the provisioning would be done, either daily or monthly

Note

The frequency you define here is only applicable if you have indicated individual account-wise status processing for accounts in the Branch Parameters. If you have indicated status processing at Group/CIF level, then the provisioning batch process executes at the frequency maintained in the ‘Branch Parameters’ screen for your branch, and not at the frequency maintained in the Account Classes screen.

- The currency in which the provisioning amount must be calculated – either account currency or local currency

- Default exposure category for accounts using the account class

- Event class for which the provisioning accounting entries would be defined

The specifications you make here are inherited by any account that uses the account class.

In addition to these preferences, you must also indicate:

- The accounting roles and heads representing the GLs to which the accounting entries for provisioning must be passed, for each account status

- Whether provisioning entries for an account must be rebooked when provisioning is done after an automatic status change for the account

You can maintain these details for each account status in the ‘Status Details’ screen.

Maintaining Escrow Details

The following Escrow details can be maintained for the account class:

Escrow Transfer Applicable

Check this box to enable Escrow transfer for the accounts belonging to the selected account class.

Transaction Code

Select the Transaction Code to be used for Escrow transfer from the adjoining option list. The option list displays only those transaction codes which are not enabled for Escrow processing at the ‘Transaction Code Maintenance’ screen.

Note

This is a mandatory input if Escrow transfer is enabled for the account class.

Transaction Code for Reversal

Select the transaction code to be used for Escrow Reversal transactions from the adjoining option-list. The option list displays only those transaction codes which are not enabled for Escrow processing at the ‘Transaction Code Maintenance’ screen.

Note

During account class amendment, the system does not allow you to disable Escrow process for an account class if a Project account has been created using that account class.

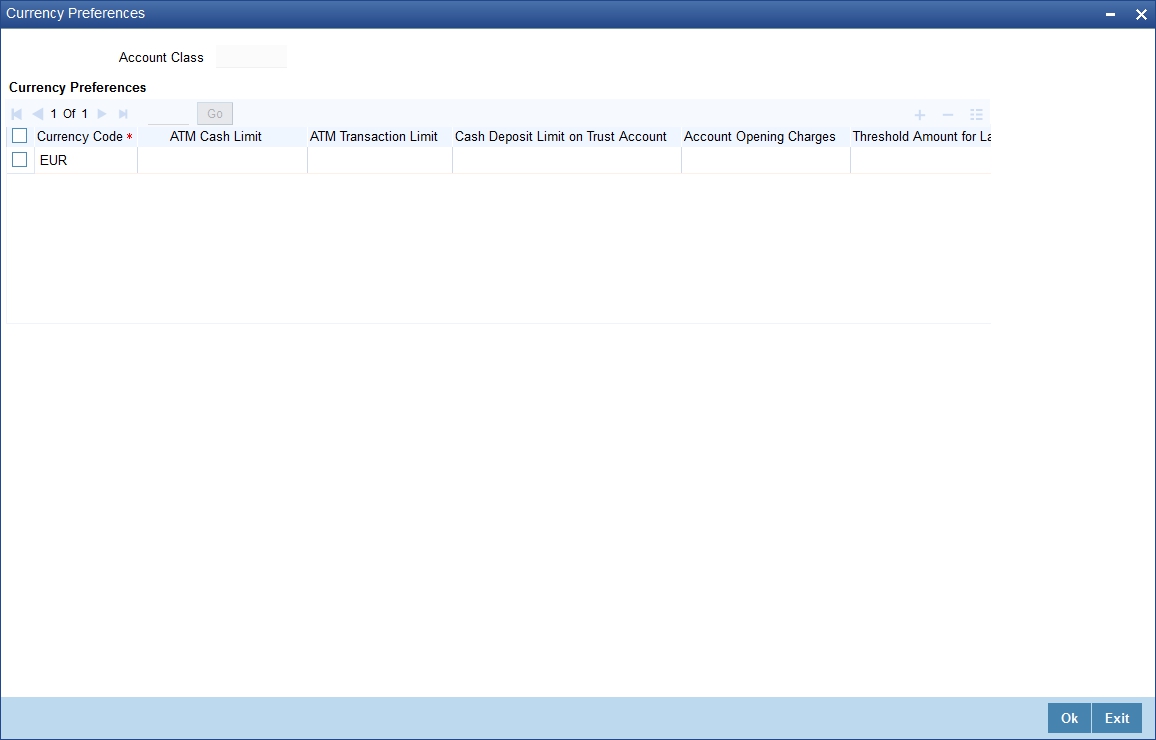

Cash Deposit Limit on Trust Account

If you have checked the box ‘Escrow Transfer Applicable’, you will have to specify the maximum cash that can be deposited in the Trust accounts under this account class.

Maintaining Required Sweeps

Sweep in can be initiated for a CASA account if the balance is insufficient. This sweep in process is applicable for all modules of Oracle FLEXCUBE and Channel which initiated the debit transaction on the CASA account.

Enable Sweep in

Check this box to enable sweep in.

Enable Reverse Sweep in

Check this box to enable reverse sweep in. You can check this box only if the ‘Enable Sweep in’ check box is checked. If the check box is checked without checking ‘Enable Sweep in’, the system disable saving, current account class creation and amendment of the account class.

The system defaults these values at account level and are not modifiable for auto deposit accounts. However, the vice verse is applicable.

You can modify these check boxes at CASA and Term Deposit Account Class levels as part of Account class amendment, only if no active accounts are available under that account class. If active accounts are available, the system will disable modification of ‘Enable Sweep in’ and ‘Enable Reverse Sweep in’ check boxes at account class level.

Consider Primary Account Minimum Balance for Sweep

Check this box to consider primary account minimum balance for sweep.

If you modify or save an account class maintenance with ‘Enable Sweep in’ as unchecked and ‘Consider Primary Account Minimum Balance for Sweep' as checked, then the system displays an error message as ‘Consider Primary Account Minimum Balance for Sweep can be enabled only if Enable Sweep in flag is checked’.

During a debit transaction if the available balance for the primary account is below the minimum balance and ‘Consider Primary Account for Minimum Balance Sweep’ is checked at account class level then the system does the cover account sweeps as follows:

- The amount to be swept is arrived at considering the minimum balance requirement of the primary account.

- The system transfers the shortfall from the cover accounts without considering the minimum balance requirement of cover accounts.

- If the primary account or cover account is below minimum balance, then the system displays override message.

Considering the minimum balance requirement of primary account will remain at the cover account sweep level and will not be applicable for sweep from auto deposits or term deposits.

If ‘Consider Primary Account Minimum Balance for Sweep’ is checked, reverse sweep for all linked accounts considers eligible amount for reverse sweep after keeping the minimum balance of primary account.

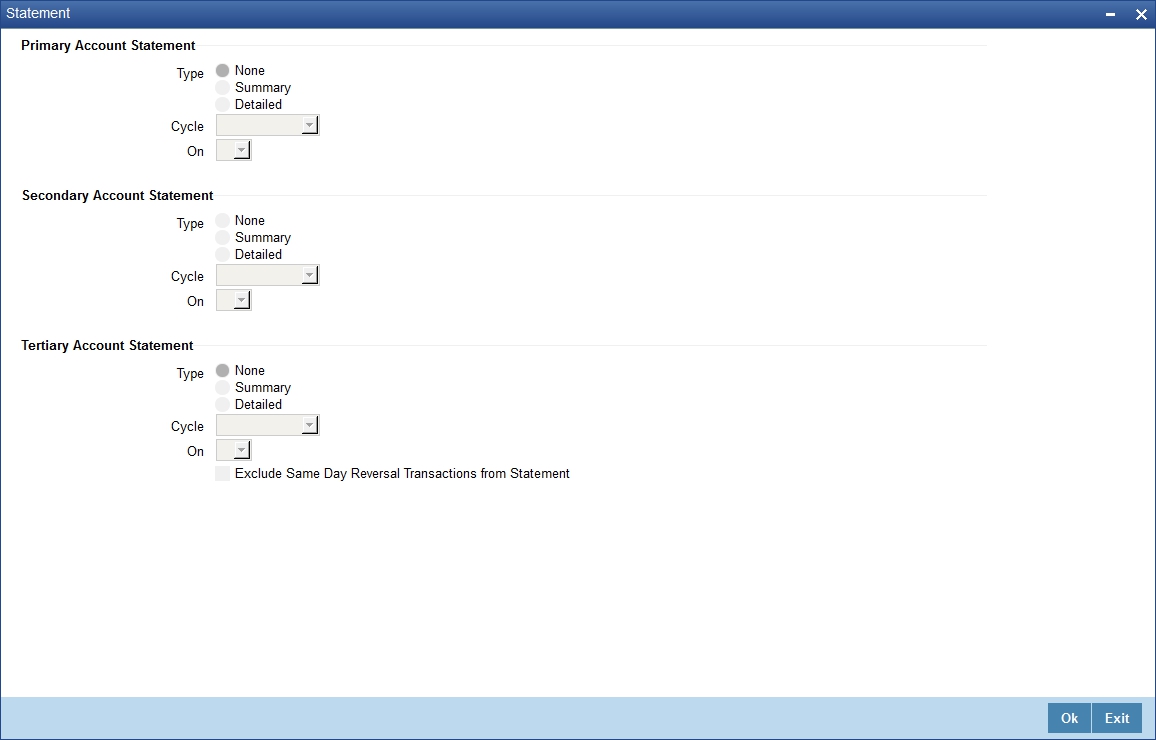

3.1.3 Statement Parameters Tab

For each account class that you maintain you have the option of generating account statement details, periodically, for all customer accounts associated with the account class.

If you need to generate account statements that would need to be sent across multiple media, generated at different frequencies, you can define up to three different frequencies at which the statements could be generated, with a primary, secondary and tertiary frequency.

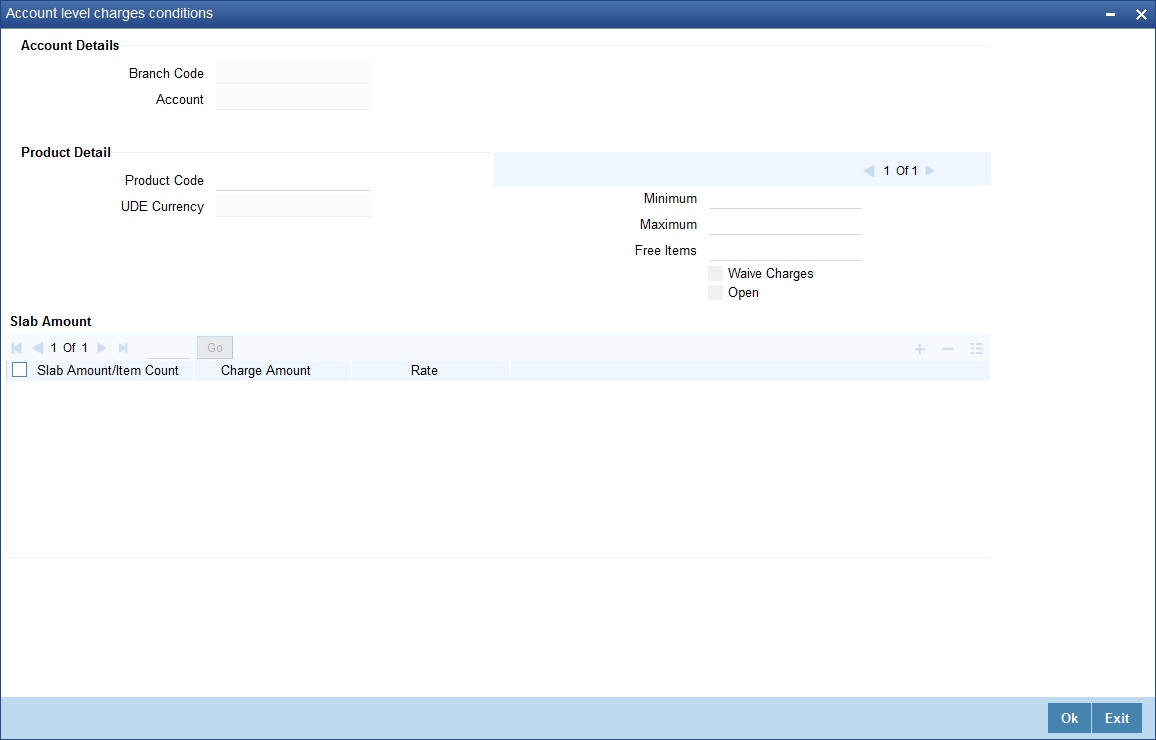

Click ‘Statement Parameters’ tab to invoke the screen for maintaining these details. The screen is displayed below:

As part of specifying the account statement preferences you can indicate the following for each of the statements, whether primary, secondary or tertiary:

Type

The first preference that you specify for each account class is to indicate whether the periodic generation an account statement is required. If the generation of an account statement is necessary, you have to specify the format in which it is to be generated. The options available are:

- Detailed – indicating that the statement should be a detailed account of all the customer transactions within the account class.

- Summary - indicating that only a summary of the transaction details is enough.

- None – indicating that neither a summary nor a detailed account of transactions is required.

Cycle

The system generates the account statement details at a frequency that you specify. The frequency can be:

- Annual

- Semi-annual

- Quarterly

- Monthly

- Fortnightly

- Weekly

- Daily

If you indicate that the statement generation frequency is weekly, you should also indicate the day of the week on which the account statement is due. Similarly, for a monthly statement you should indicate the day of the month.

To specify the frequency for a monthly statement you can specify a number between 1 and 31 (corresponding to the system date). If you set the statement date to 30, then account statements will be generated on:

- The last working day for months with < 30 days.

- For months with 30 days on the 30th; if 30th is a holiday on the next working day.

If you set the statement date to 31, then account statements will be generated on:

- The 31st, for month with 31 days; if 31st is a holiday on the next working day.

- The last working day for months < 31 days.

For all other cycles, account statement would be generated on the last day of that cycle.

Offline Limit

This is the limiting amount till which transactions will be carried out between account(s) for the account class you are defining here, between branches when the database connectivity is not functional.

Enter the off-line limit here.

Note

- If you are defining primary, secondary and tertiary statements, the frequency for each must be different and unique; for instance, if you define a monthly primary statement, you cannot define a secondary or tertiary statement with a monthly frequency.

- Offline limit is maintained only for primary level.

Document List

Specify the following details:

Document Type

Specify the document type. The adjoining option list displays all the document types that are maintained in the system. You can select the appropriate one.

Customer Type

Specify the customer type. The adjoining option list displays all the customer types that are maintained in the system. You can select the appropriate one.

Mandatory

Select from the list to indicate that the document specified here is mandatory.

Note

The document list is defaulted in the account based on the customer type. If any document is mandatory at the account class, then that document is captured and checked in the ‘Account Class Maintenance’ screen otherwise the system does not allow saving the account.

Document Notification Details

Send Notification

Check this box to indicate whether to send notifications or reminders for not submitting the mandatory documents.

Frequency (Notification)

Specify the frequency of notification to be sent from the adjoining drop-down list. The frequency can be one of the following:

- Daily

- Weekly

- Monthly

- Quarterly

- Half yearly

- Yearly

Days (Reminder)

Specify the number of days left for the expiry or submission due date of the documents for sending the reminder.

Statement of Fees Parameters

Statement of Fees Required

Check this box if a statement of fees is required for the account class.

Cycle

The cycle of statement generation. Select the value from the drop-down list. The options are:

- Semi Annual

- Quarterly

- Monthly

- Fortnightly

- Weekly

- Daily

- Annual

On

Select the day of statement generation from the dropdown list.

Delivery Channel

The various delivery methods for the statement. Select the value from the dropdown list

- Postal

- Deliver to Branch

- Internet Banking

- No Printing

Package of Services Description

The description for package of services

Maintaining Cheque Book Preferences

Oracle FLEXCUBE provides you with the facility to automatically trigger the reorder of Cheque Books for all accounts reporting to a specific account class. However, you have the option of changing your preferences at the account level also.

To facilitate automatic reordering of Cheque Books, you have to maintain the following details:

Cheque Book

To indicate that automatic reordering of cheque books should be allowed and for specifying the details for the same, you have to check this option. If not selected, you will not be able to maintain the automatic reordering preferences for the account class.

Auto Reorder of Cheque Book

You have to select this option to specify that automatic reordering of Cheque Books is required for all accounts reporting to this account class. This field will be enabled only if you have checked the ‘Cheque Book’ option explained above.

Reorder Level

Here, you have to indicate the level at which the reordering of Cheque Book should happen. Automatic reordering will be set off by the system when the unused number of cheque leaves becomes equal to or less than the re-order level that you maintain here. This field will be enabled only if you have indicated that automatic reordering of Cheque Books is required i.e. the ‘Auto Reorder of Cheque Book’ option is checked.

Reorder No of Leaves

In this field you have to specify the number of leaves that should be ordered for the new Cheque Book. This field will be enabled only if you have checked the ‘Auto Reorder of Cheque Book’ option.

Max No. of Cheque Rejections

Specify the maximum number of cheque rejections that can be allowed for an account.

3.1.3.1 Processing Automatic Reordering of Cheque Books

The automatic reordering of Cheque Books is processed at EOD by executing a batch function.

The following conditions should be satisfied for initiation of automatic reordering:

- The ‘Auto Reorder of Cheque Book’ option is turned on at the account level

- The number of unused check leaves for the account is less than or equal to the reorder level maintained at the account level. The system will pick up the number of leaves to be reordered from the field ‘Reorder Number of Leaves’ maintained for the account.

The numbering of cheque leaves for the new Cheque Book will depend on the ‘Cheque Number Unique for Branch’ option in the ‘Bank Parameters’ screen. If this option is checked, the numbering will begin from the Last Number + 1 of the Cheque Book that was delivered last to any account. If you do not select this option, the number will start from the Last Number +1 of the Cheque Book delivered to the same account previously.

The value of ‘Include for Cheque Book Printing’ and ‘Cheque Type’ (specifications defined in the ‘Cheque Book Details’ screen) will be defaulted from the previous order of the Cheque Book.

Capturing Details about Specially Designated Nationals

Specially Designated Nationals (SDN) are those customers with whom you need to refrain from trading in any form. The US government publishes a list of such nationals and circulates this list among banks and other financial organizations. You can to maintain the details of SDNs in Oracle FLEXCUBE.

The details of Specially Designated Nationals are updated and published by the US government on a regular basis. You could download these details from their web site. You have two options to replicate the contents of this file into Oracle FLEXCUBE. They are:

Upload the file into Oracle FLEXCUBE through the SDN Upload screen.

Maintain the details of each SDN manually.

Both these options have been elaborated upon in the subsequent sections.

3.1.3.2 Maintaining SDN Details Manually

Through the ‘Specially Designated Nationals’ screen you can capture the details of SDN customers manually. Invoke this screen, by typing ‘STDSDNMN’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The screen is as shown below:

The following details have to be captured:

- Name of the Specially Designated National (SDN)

- Date of Birth of the SDN: Specify the Date of Birth of the SDN in YYYYMMDD format

- Country of Origin: You can specify the SDN’s country of origin by selecting the same from the option list provided

- Remarks: You can specify any additional remarks, if required

- Alias Names of the SDN: You can specify a maximum of fifteen alias names

- Addresses of the SDN: You can specify a maximum of fifteen addresses (of address line 1 to address line 4) for a SDN

3.1.4 Preferences Tab

Preferences are the options or attributes that uniquely distinguish an account class. You can specify the preferences of an account class in the ‘Preference’ screen. To invoke this screen, click ‘Preferences’ button in ‘Account Class Maintenance’ screen.

The screen is as shown below:

The following are the preferences that you can specify for an account class:

- Limit Check – you can check this box to indicate that a limit check for sufficient availability of funds in the account will be made for all accounts belonging to the account class

- Overdraft Facility – if checked indicates that all accounts belonging to this class would be allowed an overdraft facility (facility to draw a specified amount over and above the balance in the account)

- Component-wise Tracking Required for Overdraft - check this box to indicate if Component-wise tracking is required or not. If component wise tracking required for overdraft is checked and no appropriation sequence is maintained in status rule, then the system displays an error message on save. You cannot modify this once the account class is authorized.

- Interest Charges – if checked indicates that for interest and charges computation the Interest and Charges module will process accounts linked to this class.

- Track Accrued IC – if checked, indicates whether accrued interest in the Interest and Charges module on an account linked to this class, would be considered while computing credit utilization for the account.

- Passbook Facility – if checked, indicates that accounts linked to the account class are issued passbooks.

- ATM Facility – if checked, indicates that accounts linked to the class will avail the ATM facility

- Direct Banking Facility - if checked, indicates that accounts linked to the class will avail Direct banking facility.

- Project Account - Check this box to track the working capital of the project.

- Daylight Limit – if checked indicates that you can specify daylight overdraft limit for all the accounts belonging to this account class. While modifying the maintenance, if you uncheck this box, the daylight overdraft limit will be made zero for all the accounts belonging to this account class.

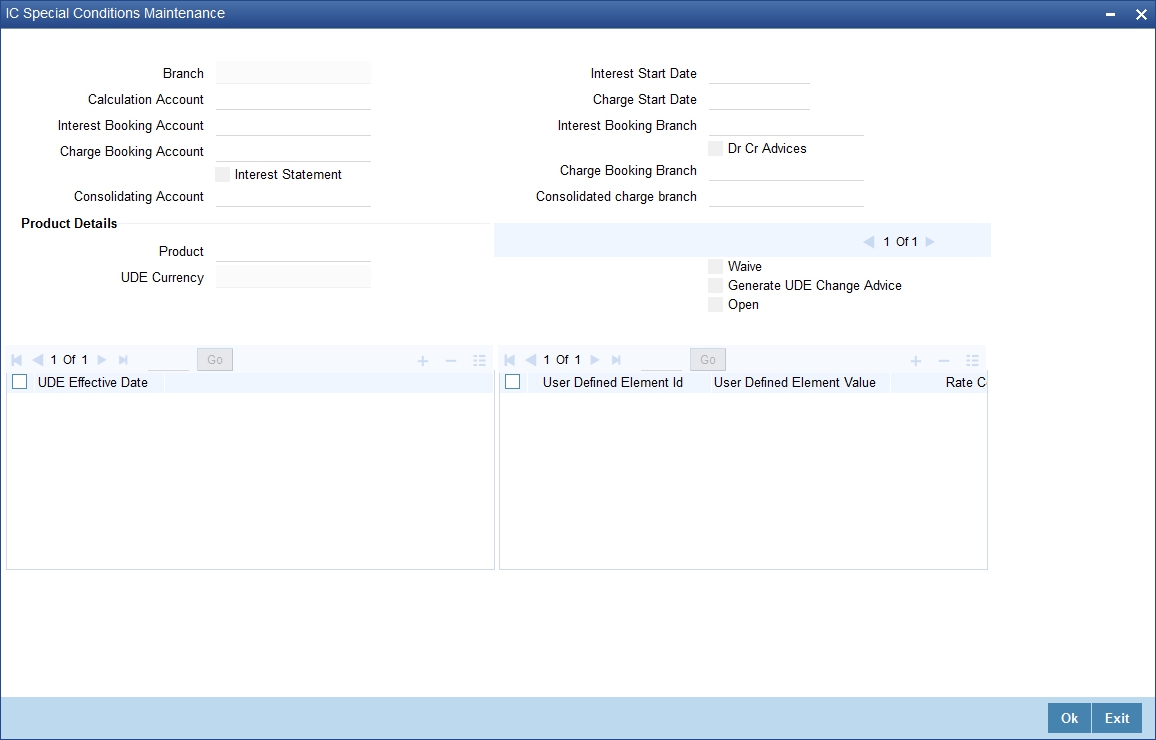

- Debit/Credit Advices – If checked, indicates that for all accounts belonging to this class, the system will generate a debit/credit advices on interest liquidation. The advices are generated during end of day processing in SWIFT or/and MAIL format. You can also specify this preference through the ‘Special Conditions’ screen.

- Track Receivable – if checked, you can choose to block the subsequent credit that happens to the settlement account (linked to this account class) of a loan contract or retail teller contract, if the system detects insufficient funds in the account, during liquidation. In other words, the system will track the account for receivables (credits). As and when a credit happens, the funds will be allocated to the loan or the retail teller contract for liquidation.

- Posting Allowed – This check box is checked by default. Uncheck this check box to setup Monetary Accounts for the selected Account Class.

This check box is provided to handle IRA Monetary Accounts. Using this facility, you can avoid posting into the IRA Monetary Accounts from Teller/Journal screens and ensure that the details are computed only through IRA subscriptions.

Note

Uncheck this checkbox only for specific Inter-Branch Accounts.

- Available Balance Check Required – Check this box to enable the system to check for the available of funds before posting a debit entry to a customer account.

- Referral Required - enabling this option indicates whether a referral check should be performed on accounts belonging to the account class. Consequently, the system checks the available balance (not the current balance) while performing the referral checks for all transactions involving the account. If a transaction involving the account results in the account moving to overdraft, the account and transaction details will be sent to the Referral Queue.

- Lodgement Book - If you wish to allow orders of lodgement books for all accounts that use an account class, you can indicate so, in the ‘Account Class Maintenance’ screen, by selecting the Lodgement Book option.

- Back Period Entry Allowed – if checked, indicates that back-valued entries can be posted to account belonging to the class as long as the account is open. You will be allowed to change this specification for a specific account.

- IBAN Required - Check this box if IBAN is required for the account class.

Note

IBAN Required is restricted for TD and Nostro account class. The system displays an error message if user defines IBAN Required for Nostro or TD account.

- For Financial Inclusion Account - Check this box to indicate that the account class is for FI customers. The system allows only savings account type for FI customer account class.

- Integrated Liquidity Management – check to indicate that the accounts created under this account class would be part of an ILM Structure.

- Large Debit Balance Tracking Required – Check this if you require large debit balance tracking for the account class.

- Defer the Balance Update - Check this box to defer the balance update. If ‘Defer the Balance Update’ is checked, then the balance will be updated during EOD.

While posting back-valued transactions, the System verifies whether the Back Period Entry Allowed option has been enabled for the account class. If the option has not been enabled an error message is displayed. This check is also performed while uploading journal entry transactions.

Replicate Customer Signature

Check this box to indicate that customer signature should be replicated. On checking this option, the signature of the customer gets defaulted to account level.

Spend Analysis

Spend analysis classifies the debit transactions from an account under different spend classes. Check this box to enable spend analysis for the accounts that are associated with this account class.

If you check this box, the system allows you to enable spend analysis at the account level. However, you can disable spend analysis for individual accounts by unchecking the checkbox ‘Spend Analysis’ at the account level.

If you do not check this box, the system disables spend analysis for all accounts associated with this account class. In that case, you cannot enable spend analysis at the account level.

Note

You can modify the status of this checkbox. While modifying this, the system verifies whether spend analysis is enabled for any customer account associated with this account class. If spend analysis is enabled for a customer account, the system will not allow you to modify this option. In that case, you need to disable it at the account level first and then modify the status for the account class.

No. of Days For Salary Block

Specify the number of days for salary block. At the time of salary credit in to a customer account, the system will place an amount block for the number of days specified here from the date of salary credit. The amount blocked will be equal to the loan instalments due during this period.

No of days for Closing Unauthorized Accounts with No Activity

Specify the number of days after which the unauthorized accounts without any activity should be automatically closed.

No of days for Closing Authorized Accounts with No Activity

Specify the number of days after which the authorized accounts without any activity should be automatically closed. This is applicable for Term Deposits as well.

No. of Days after which Notification is to be sent if No Activity

Specify the number of days after which a notification needs to be sent to the channels if the account is inactive. If the account is inactive for the particular period of time as mentioned in this field, then the account is closed by the system and the funds will be transferred as per the maturity instructions.

Frequency

Select the frequency at which notifications need to be sent from the drop down list. The field needs to be mandatorily updated if a value has been entered in the ‘No. of Days after which Notification is to be sent if No Activity’ field. The list of values provided are as follows:

- Once

- Daily

- Weekly

- Monthly

- Yearly

This field needs to be mandatorily updated if the ‘No. of Days after which Notification is to be sent if No Activity’ field is updated with a value. If a value has been provided in the ‘Frequency’ field and no value is provided in the ‘No. of Days after which Notification is to be sent if No Activity’ field, then an error is displayed which states that a value needs to be in the No. of Days after which Notification is to be sent if No Activity’ field.

If these two fields have been updated, then a notification is sent to the channels only when a TD account is created with the ‘Goal Reference Number’.

Minimum ECA Block Amount

Specify minimum ECA block amount.

RT-Charge Product For Passbook Issue

Specify the RT product from the adjoining option list. The list displays all the active RT products. You can select the appropriate one.

Enabling Printing of Account Statistics

You can enable printing statistics in respect of accounts using an account class, either period code-wise or financial year-wise, for the following customer information:

- Low and High Balance for a period–The lowest and highest current balances for the period.

- Average credit and debit balance for a period–This is computed as the sum of credit/(debit) current balances in a period, divided by the number of days of credit/(debit) balance during the period.

- Credit and debit days–The number of days the account was in credit/(debit) balance in the period.

- Credit and Debit Turnover–The credit/(debit) turnover for the period.

- Excess days in debit balance–The number of days in a month when the account exceeded the overdraft limits.

- Overdraft Limit–This is computed by summing the temporary overdraft limit and the sub-limit of the account. For each month, this would represent the limit on the last date of the month.

- Credit grade of the Customer–This would be the prevalent rating on the last day of the period. For the current period, this information is provided up to the previous working day.

To enable printing of this information for all accounts using an account class, you must enable the Account Statistics option in the Account Class Maintenance.

For each account class for which account statistics has been enabled, an accounting End of Day (EOD) process updates the statistics table both period-wise and according to financial years. The book-dated balances are used for computation of statistics, and the balances are maintained according to accounting periods.

For information about viewing the period-wise account statistics, refer the section Querying on Account Statistics, found earlier in this chapter.

Status Change Automatic

If you check this option, the status of the account will be changed automatically by the system as per the conditions maintained in the ‘Status Rule Definition’ screen. If you do not select this option, you have to change the status manually through the ‘Manual Status Change’ screen. These screens are discussed in detail in the subsequent sections of this document. This specification will be defaulted to all the accounts reporting to this account class.

Exclude Same Day Reversal transaction from Statement

If you do not wish transactions booked and reversed on the same day to be reflected in the account statement, you can specify the preference here. This feature is applicable only for the customer account legs and not for the related GL legs. Also, reversals made through the DE module will not be considered for exclusion.

Your specification for this at the account class level defaults to all accounts involving the class. You can change it for a specific account.

For comparing transactions the System will look for similarity of reference number and date.

Consolidation for Inward Clearing

You need to indicate whether or not consolidation is required for inward clearing transactions in a batch at the Account Class level. The indication for this option is carried forward to the ‘Customer Account Maintenance’ screen. If this option is unchecked here, it cannot be checked in the ‘Customer Account Maintenance screen’.

3.1.4.1 Processing for Consolidation of Inward Clearing

During the Inward Clearing process, the consolidated entry for clearing will be passed according to the following grouping:

- Remitter’s Account

- Clearing Product

- Instrument Currency

- Remitter’s branch

- End point

A consolidated clearing entry will be passed using a separate Transaction Code maintained in the ‘Clearing Product Preferences’ screen. This Transaction Code should be set with Cheque Mandatory option as No in the ‘Transaction Code Maintenance’ screen.

One consolidated clearing entry will be passed for each of the above groups. Entries will be passed against a common reference no. generated for each of the groups. After the consolidated entry has been passed, each individual instrument will be processed separately to pass charge entries (if applicable) at the transaction level.

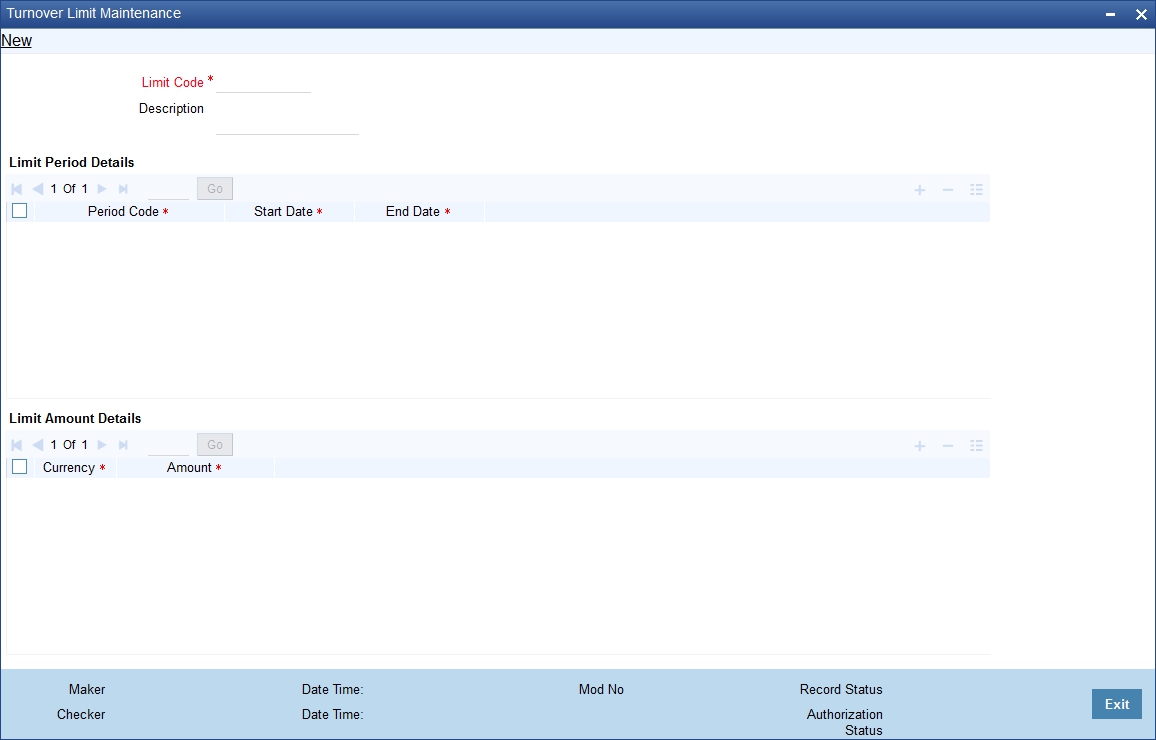

Specifying Turnover Limit Preferences

You can specify turnover limits for an account class and thereby monitor the turnover in all accounts linked to the account class.

Turnover Limit Code

Specify a turnover limit code that should be linked to the account class. The adjoining option list displays all valid turnover limit codes maintained in the system using the ‘Turnover Limit Maintenance’ screen. You can choose the appropriate one.

Passbook Compression Preferences

Compression Required

Check this box to specify that transaction compression is applicable to the accounts under the particular account class.

Limit for Unprinted Transactions

Specify the maximum limit for unprinted transactions that can be printed without compression.

Transaction Code

Specify the Transaction code to be used for printing the description for compressed entry on passbook. Alternatively, you can select the transaction code from the option list. The list displays all valid transaction code maintained in the system.

The ‘Limit for Unprinted Transactions’ and ‘Transaction Code’ fields will be enabled only if ‘Compression Required’ field is checked.

If ‘Compression Required’ field is checked, it is mandatory to maintain the values in ‘Limit for Unprinted Transactions’ and ‘Transaction Code’ fields, else the system will display an appropriate error message.

Collateral Linkage

Allow Collateral Linkage

Check this box to allow collateral linkage.

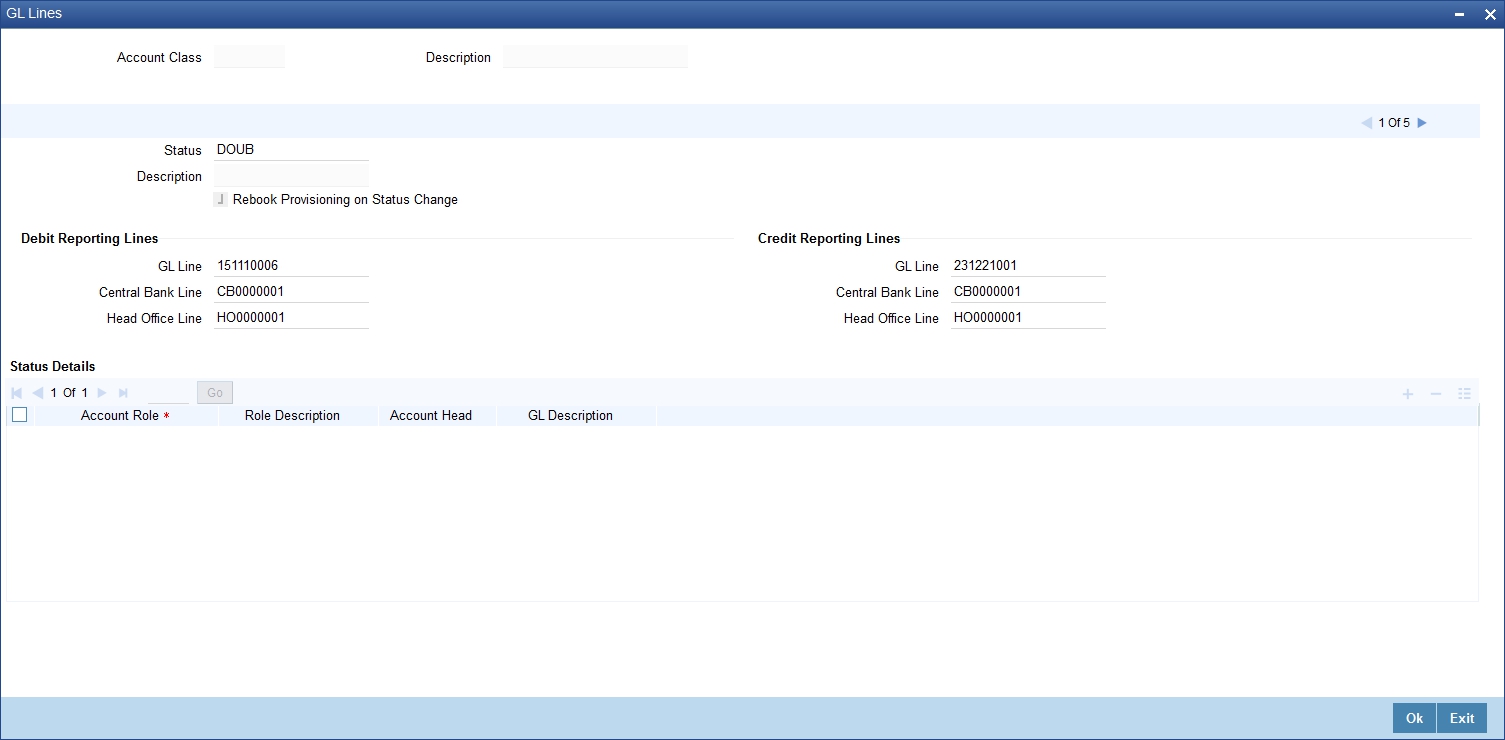

3.1.5 GL Lines Button

Current and Savings accounts that have not generated any interest over a specific period or have remained inactive with interest overdue may be identified as ‘NPAs’ (Non-Performing Asset). In Oracle FLEXCUBE, you can assign different status codes to an account class, which will be applicable to all the accounts under it. The accounts will move from one status to the other based on the number of days they have remained inactive in the system. The status of an account will determine whether the account should be marked as an NPA or not.

Further, you can also specify the reporting lines (for GL, Central Bank, and Head Office) to which accounting entries should be passed when an account moves from one status to the other. You can post all debit and credit balances of one account class to a single General Ledger account. Conversely, you also have the option of posting debits and credits to separate GLs.

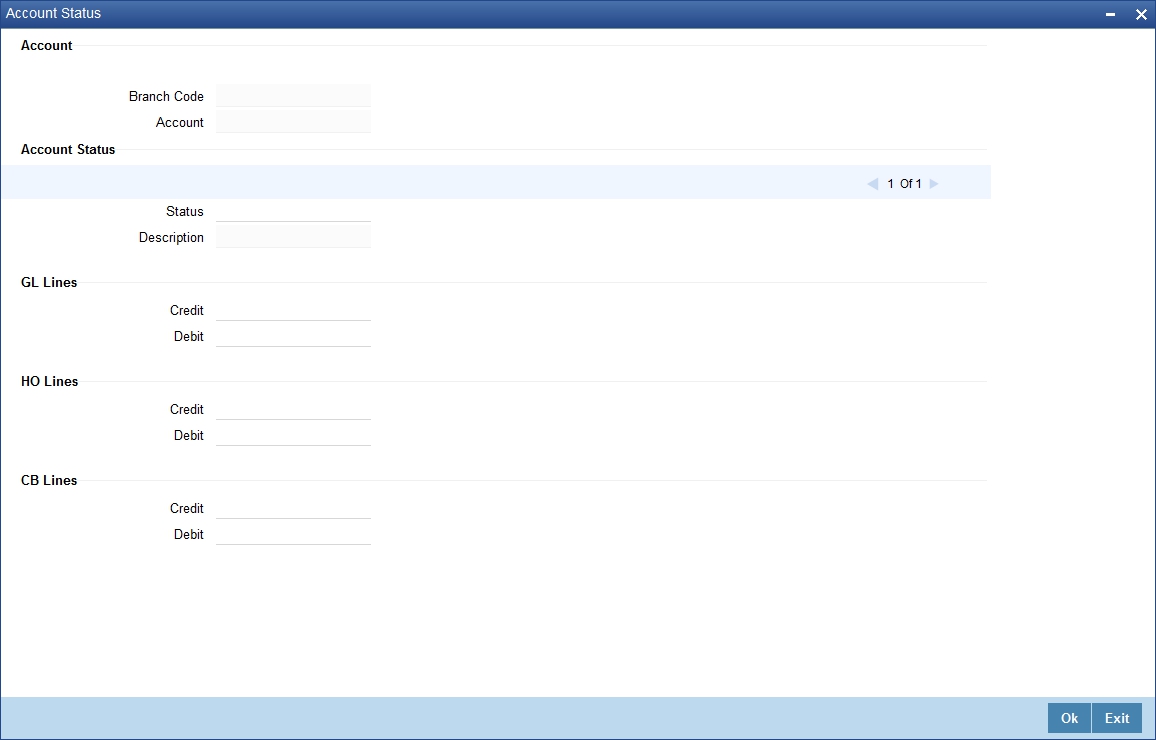

The status codes and the reporting lines for each status may be defined in the ‘Status Details’ screen. Click the ‘GL Lines’ button in the ‘Account Classes’ screen to invoke it.

The screen is as shown below:

You can specify the following details in this screen:

Status

You can select the different status codes applicable to the account class, in this field. Use the Add icon to define each status and the attributes for the same. You can use the navigation icons to move from one status to the other.

Only status codes with status type ‘Account’ will be available in the option-list if the Status Processing Basis is defined as ‘Contract/Account’ for all branches, in the Branch Parameters. If the Status Processing Basis is defined as ‘Group/CIF’ level for any branch, then the statuses of type ‘Both’ are available. In this case, it is mandatory to link all the statuses defined.

On selection of the status, the associated description will be displayed alongside.

Specifying Reporting line Details

Dr and Cr GL Lines

Select the debit GL account, to which all debit balances within a specific account class will report to, when it moves to the status being defined. You can identify the debit GL from the list of existing GLs. Likewise, all credits within a particular account class will report to the GL account that you have identified to track credits.

Dr and Cr Central Bank Lines

Select the Central Bank Debit line to which all debit accounts belonging to an account class should report to when it moves to the selected status. You have maintained Central Bank Debit lines in the ‘Reporting Lines Maintenance’ screen. You can select the appropriate CB Debit Line from the available option-list.

Similarly, all accounts belonging to an account class, if in credit should report to a Central Bank Credit Line for the selected status. You can identify the CB Credit Line that should be associated with the status from the option-list available.

Dr and Cr Head Office Lines

This is the Debit Head Office GL maintained in the ‘Reporting Lines Maintenance’ screen to which all accounts belonging to this class will report, if they move to the status being defined.

Similarly, select the Credit Head Office GL maintained in the ‘Reporting Lines Maintenance’ screen to which all accounts belonging to this class will report to, when they move to the status being defined.

Note

As a mandatory requirement, you have to associate the status ‘NORM’ (Normal) when maintaining status codes for an account class.

Accounting Roles and Heads for Provisioning

In addition to the provisioning preferences that you specify for an account class, you must also maintain the accounting roles and heads representing the GLs to which the accounting entries for provisioning must be passed, for each account status. You can maintain this information in the ‘Status Details’ screen, when you define each of the status codes.

Rebook Provisioning on Status Change

In the ‘Status Details’ screen, you can indicate whether provisioning entries for an account must be rebooked when provisioning is done after an automatic status change for the account. Rebooking essentially means that fresh provisioning is done, after writing back the previous provisioning amount.

The provisioning batch process, when executed, not only computes the provisioning amount; it also records the current status of the account and checks whether the current status is different from the status that was prevalent when the process was previously executed. If so, the old provisioning amount is reversed (if the Rebook Provision option has been set in the Status Details), and the entries for the new provisioning amount are booked into the provisioning and write back GLs maintained for the current status in the Status Details.

If the Rebook Provision has not been set, there is no reversal of the old provisioning amount, and the differential provisioning entries are passed, as usual, into the GLs maintained for the new status.

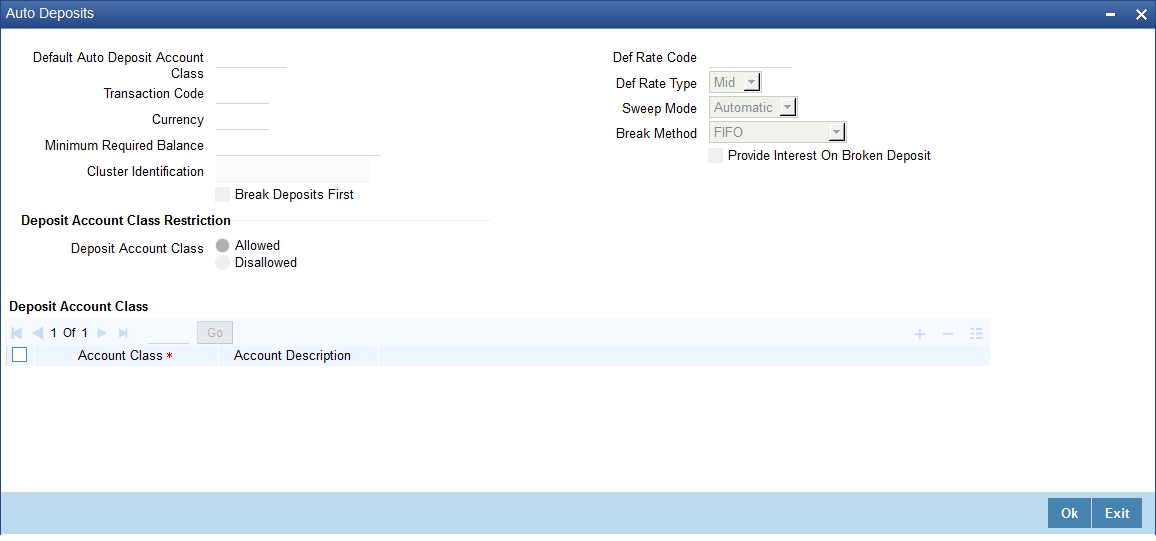

3.1.6 Auto Deposits Button

Auto deposits are the linked deposit accounts to the savings accounts. These accounts are created once the threshold balance exceeds in the customer accounts. You can maintain these accounts using ‘Auto Deposits’ screen. Click the button ‘Auto Deposit’ in the ‘Account Class Maintenance’ screen to invoke it.

The screen is as shown below:

You have to specify the following fields in this screen.

Default Auto Deposit Account Class

Specify the deposit type of account class for the auto deposit account.

Transaction Code

Specify the transaction code (DPN - New deposit account) for the book event to trigger at the time of creation of auto deposit account.

Currency

Specify the currency in which the deposit account has to created.

Minimum Required Balance

Specify the balance that is required to be maintained at the linked savings account. If any balance exists beyond this balance in the account then the system creates an auto deposit account as part of batch process.

Cluster Identification

The system displays the cluster ID linked with the deposit account class linked to the saving account class.

Def Rate Code

Select the code of the differential rate; whether ‘Mid’ or ‘Standard’.

Def Rate Type

Select the type of differential rate code; whether ‘Mid’ or ‘Buy’ or ‘Sell’

Sweep Mode

Select the mode of sweep from the following options.

- Automatic - For the deposit to be created as part of the batch

- Manual - For the deposit to be created manually

Break Method

Select the method in which the break of auto deposit should happen, from the following options.

- MAXB - The system breaks the maximum valued deposit account or the deposit account having the maximum balance in order of descending amount.

- MINB - The system breaks the deposit account having minimum balance in order of ascending amount.

- FIFO - The system breaks the deposit account in order of chronological account creation date.

- LIFO - The system breaks the deposit account in order of reverse chronological account creation date (the latest created deposit account breaks first).

Provide Interest On Broken Deposit

Check this field to indicate the system to calculate interest on the deposits. This is done when the attached account class is mapped to the IC product.

Break Deposits First

Check this field to indicate the system to break the deposit accounts created and transfer the proceedings to the savings account. The system breaks the deposits when the savings account does not have sufficient balance to withdraw the amount.

In this case the system breaks the auto deposit account and restores the savings account with balance to allow withdrawing the money.

For example, the customer has the total balance in the account for $5675 including $650 as auto deposit. He withdraws $5500 from an ATM. As part of intraday batch (DESWPBAT), the system breaks the auto deposit account of $650 and restores the balance amount to savings. So his current standings would be $175 in his savings account and he does not hold any auto deposit account.

Deposit Account Class Restriction Details

You can set restrictions to the selected account class here:

Deposit Account Class

Select restriction type for the selected deposit account from the options. The following options are available for selection:

- Allowed – Select to allow account classes specified under ‘Deposit Account Class’ section.

- Disallowed Select to disallow account classes specified under ‘Deposit Account Class’ section.

While saving account class, the system validates if the Default Deposit Account Class mentioned in the Auto Deposit sub screen is part of the allowed list of Deposit Account classes. If the default deposit account class is not part of the allowed list, then the system will show an error message as “The Auto deposit account class is not part of the allowed list of Deposit Account Class".

Specifying Deposit Account Class

You can maintain the deposit account class details:

Account Class

Specify the account class for which you need to set the restrictions. The adjoining option list displays account classes which are active and authorized. Select the appropriate one.

Account Description

The system displays the description of the selected account class.

3.1.6.1 Handling Batches for AD Creation

The following batches are available in the system to handle batches for AD creation:

- DEDEPBAT – If AD instruction is maintained at account level, then the batch creates AD. If instruction is not maintained at the account level, then the batch creates AD based on account class level maintenance. Batch is maintained in DE module in the ‘End of Txn Input’ stage.

- DEAUTDEP – The system will create AD only if account level instructions are maintained. If not maintained, then AD will not be created for that account. Batch is maintained in IC module in the ‘End of Txn Input’ stage

- DESWPBAT – Intra day batch for AD creation.

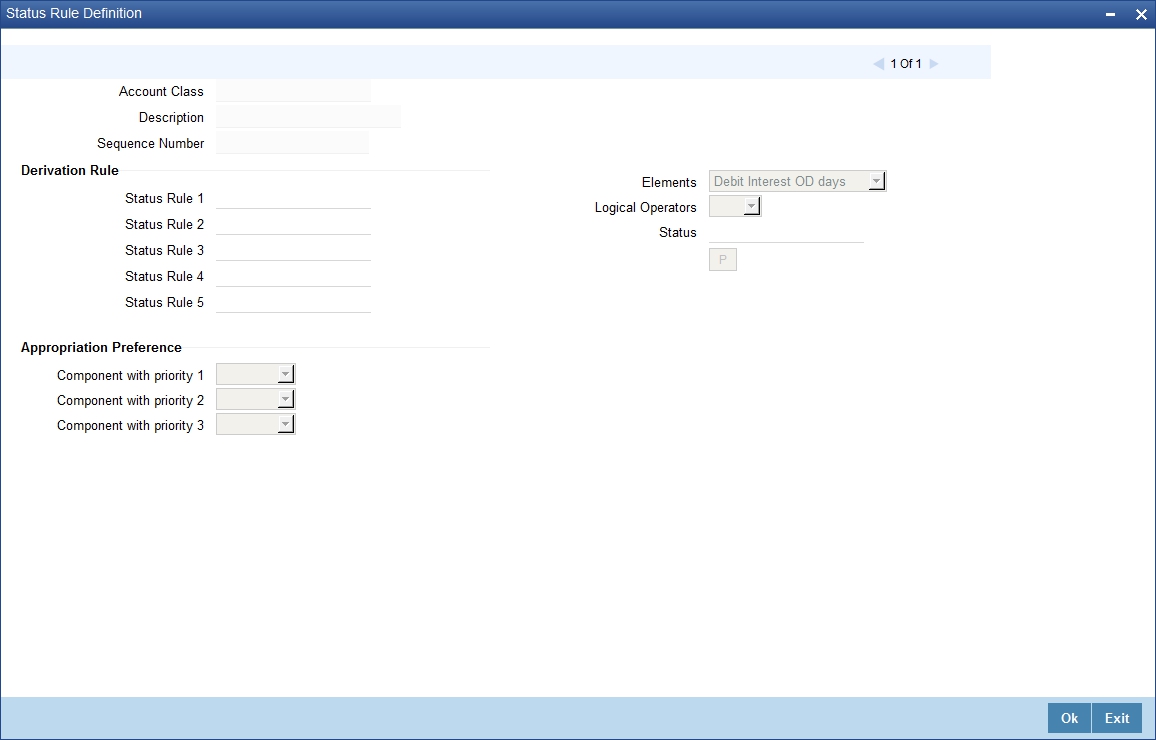

3.1.7 Status Rule Button

If you have opted for automatic status change for all accounts belonging to an account class, you have to maintain the criteria based on which the system will bring about the status change automatically.

You can define the different criteria in the ‘Status Rule Definition’ screen. Click the button ‘Status Rule’ in the ‘Account Class Maintenance’ screen to invoke it.

The screen is as shown below:

In this screen, you can define five conditions for each status applicable to an account class. An account will be said to be in a specific status if any one of the five conditions associated with the status holds true for an account. Conversely, if all the conditions are false, the account will automatically move to the next available status for which the condition is true.

A user defined status INTR is used for both OD and Loan accounts. When a loan is in adversity status and the customer pays the entire overdue amount, the status of the loan changes to a user defined account status ‘INTR’ rather than ‘NORM’, so would the other OD and loan accounts of the same customer across branches.

Only backward movement of any other status to INTR is applicable. The account status cannot change from NORM to INTR. The status sequence of INTR is maintained as the immediate sequence number next to NORM.

The following elements are available based on which you can build a condition for automatic status change. You can associate each of these elements with an account, in the ‘Customer Accounts Maintenance’ screen.

The set of elements are as follows:

- Frozen

- Dormant

- No Debits

- No Credits

- Stop Payment

- Current Status

In addition, the following elements will also be available for processing:

- OD (overdraft) Days

- Inactive Days

- Overline Days

- TOD (Temporary Overdraft) Days

- Customer Classification

- Due Count

- Overdue Days

- Customer Credit Ranking

- Debit Interest Overdue Days

- Overdue Limit Breach Days

- Overdue Expiry Days

- Overdue No Credit days

- Principal Overdue Days

- Principal Overdue Amount

- Principal Overdue Local Currency Equivalent Amount

- Interest Overdue Days

- Interest Overdue Amount

- Interest Overdue Local Currency Equivalent Amount

- Charge Overdue Days

- Charge Overdue Amount

- Charge Overdue Local Currency Equivalent Amount

- Account Interim Days

Appropriation Preference

You can define the appropriation sequence for overdraft accounts for each account status.

Appropriation sequence maintenance is mandatory if the ‘Component-wise Tracking for Overdraft’ is checked.The appropriation preference sequence can be modified anytime and this will be applicable for the existing accounts also.This modification will effect only for future credits and appropriation.

Component with priority 1

Select the component with first priority from the adjoining drop-down list. The options available are:

- Principal

- Interest

- Charge

Component with priority 2

Select the component with second priority from the adjoining drop-down list. The options available are:

- Principal

- Interest

- Charge

Component with priority 3

Select the component with third priority from the adjoining drop-down list. The options available are:

- Principal

- Interest

- Charge

Status Change for Overdraft Accounts

Oracle FLEXCUBE processes the status change for overdraft accounts based on the following rules:

- Debit Interest OD Days

- OD Limit Breach Days

- OD Expiry Days

- No Credit days

- Account Interim Days

Debit Interest OD Days

The system processes the status change on overdraft account, if the customer fails to pay the debit interest of the overdraft account for specified number of days.

For example,

OD Utilization date: 01-Jan-2011

Days after which Status Change should happen: 90 Days

Debit interest due date: 01-Feb-2011

In this example, the system modifies the customer account status based on the status rule maintenance, if the customer fails to pay the debit interest by 02-May-2011.

OD Limit Breach Days

The system processes the status change on OD account, if the OD limit of the overdraft account is breached for a specified number of days. The system tracks the overdraft limit breach days based on the utilizations done at the line level.

OD Expiry Days

The system processes the status change on overdraft account, if the OD utilization of the overdraft account is not settled beyond the expiry date.

No Credit Days

The system processes the status change on OD account if there is no credit transaction into the overdraft account for a specified number of days.

Logical Operators

Logical Operators are indicators of certain conditions that you specify while building a rule. These operators are used in combination with the elements discussed earlier. The following is a list of logical operators that you would require to build a status rule:

Operator |

Description |

AND |

The conjunction ‘and’ |

OR |

The conjunction ‘or’ |

> |

Greater than |

>= |

Greater than or equal to (please note that there is no space between the two symbols) |

< |

Less than |

<= |

Less than or equal to (please note that there is no space between the two symbols) |

< > |

Not equal to (please note that there is no space between the two symbols) |

= |

Equal to |

Oracle FLEXCUBE allows data store for tracking of SOD debit interest due. During Interest liquidation for debit interest, the system populates the SOD Debit Interest Due Data Store with the Amount Due as debit interest for the SOD utilized amount and the due date of payment for the interest amount.

The debit interest due amount is adjusted in the SOD utilized amount and the system checks for any credit entries for the SOD corresponding to the debit interest. During EOD, if any credit entry exists for the account, then the system does adjustments on the amount due for the SOD debit interest due data store. The system also adjusts the debit interest payment against the oldest available debit interest due amount, and so on.

Oracle FLEXCUBE provides SDEs for ‘SOD Due Count’ and ‘SOD Overdue Days’ for status rule generation. During EOD while running the status update batch, the system calculates SDE ‘SOD Due Count’ value as the count of the records having due amount not equal to zero from the SOD debit interest due data store. The system updates the ‘SOD Overdue Days’ with the number of days since the last debit interest payment done for the account.

Oracle FLEXCUBE provides an account status called ‘DIDF’ for an SOD account, which is available as part of ‘Status Rule Screen’. If the ‘SOD Due Count ’or ‘SOD Overdue Days’ satisfies the condition specified in the status change rule, then the system changes the status for the account to ‘DIDF’.

While running the status change batch, the system updates the ‘No Debit’ flag as ‘Y’ for ‘DIDF’ status account. If payment for the debit interest happens on the SOD account against the utilized amount, and if on recalculation the value of SDE ‘SOD Due Count’, or ‘SOD Overdue Days’ is not met, the status batch changes the status of the OD account from ‘DIDF’ to the previous account status and updates the ‘No Debit’ flag as ‘N’.

Account Interim Days

The system processes the OD status change based on the account interim days when the INTR status is maintained at the account class level. The SDE Account Interim Days (ACCOUNT_INTR_DAYS) holds the number of days (the difference between the last date on which the account has changed to INTR status and the application date) the account is in intermediate (INTR) status. The account status changes to INTR based on the formula maintained at the rule level.

Note

- Amount block is not considered because of the possibilities of simultaneous utilizations of the SOD.

- Any credit transaction towards the SOD account is tracked under interest due for the SOD.

- Any impact on account status after the execution of account status change batch for the day, gets reflected in the next EOD execution.

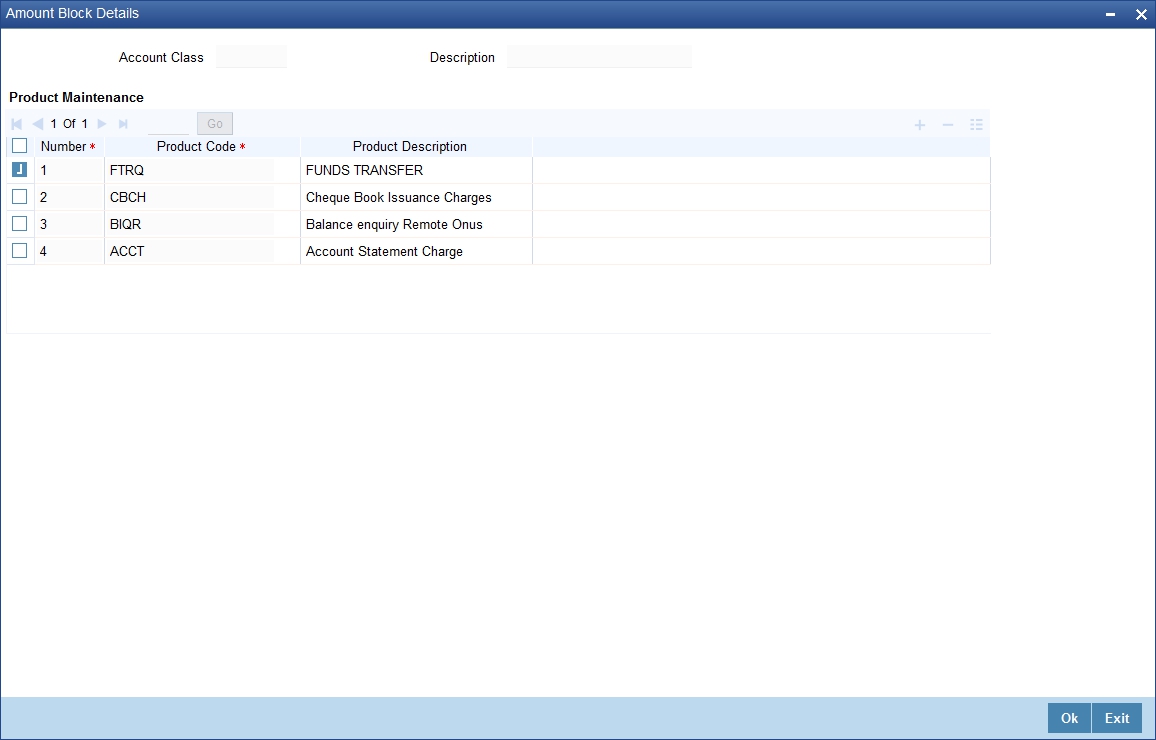

3.1.8 Amount Block Button

The allocation of funds will occur as per the product sequence you maintain in the ‘Product Maintenance’ screen invoked from the ‘Account Class Maintenance’ screen. Click the ‘Amt Block’ button to access this screen.

The screen is as shown below:

In this screen, you will specify the sequence of products based on which funds will be made available when a credit is posted to an account with a track receivable option. The sequence number is automatically generated by the system. All authorized products of your bank will be available in the option-list. On selection of the product, the product description will appear alongside.

Whenever a credit happens to an account with a track receivable option, the system will check if the account has any receivable being tracked against it. If yes, the amount is blocked as a receivable and this process continues until the amount needed for liquidation becomes fully available.

The batch process run as part of EOD/BOD will liquidate the loan contract or retail teller contracts.

If the amount received is not sufficient for full liquidation, then depending on the minimum amount required for liquidation, the system would initiate a partial liquidation for loans but for retail teller contracts liquidation will be initiated only when full amount is available.

The following example illustrates the manner in which the system will use the sequence for allocation of funds:

Assume that you have maintained the following product sequence for funds allocation:

Sequence No. |

Product |

1 |

ADBN |

2 |

LDBD |

3 |

ABCD |

The liquidation schedule dates for the various loan contracts are as follows:

Contract |

Liq. Schedule Dt. |

Liqd. Amt. (in USD) |

LDBD001 |

1st January 2002 |

1000 |

LDBD002 |

1st January 2002 |

500 |

ADBN001 |

2nd January 2002 |

1000 |

ABCD001 |

2nd January 2002 |

500 |

Further, all contracts are marked for auto liquidation and the settlement account for all contracts is A1. The balance in account A1 as on 1st January 2002 is 500 USD.

Action |

Details |

Batch liquidation run as part of BOD/EOD on 1st Jan. |

Liquidation does not occur as the system detects insufficient funds in A1 (only 400 USD). The account is marked for receivable tracking and a block is placed on 400 USD. |

A credit of 500 USD to A1 on 2nd Jan. |

The total amount blocked gets updated to 1000 USD. Since we have two contracts involving the same product (LDBD) maturing on the same date, funds will be allocated to the first contract, LDBD001 (based on the Contract Reference Number). Subsequent credits to the account will be used towards loan LDBD002. Since contracts with LDBD have earlier schedule dates, funds will be allocated to them though, as per the product sequence, contracts with ADBN should receive the funds first. The liquidation schedule date takes precedence in this case. Further credits to account, A1 will be allocated against the contract ADBN001 followed by the contract ABCD001. This will be based on the product sequence number since both contracts have the same schedule dates. Within a contract, allocation of funds towards the various components like interest, penalty interest etc. will be determined by the ‘Liquidation Order’ maintained for the loan product. To sum up, the schedule date of the loan contract takes precedence followed by the product sequence and finally the liquidation order. |

Note

If insufficient funds are detected in an account with a receivable tracking, the system will trigger the event ‘LBLK’ indicating that enough funds are not available and that subsequent credits made to the account will be blocked as a receivable.

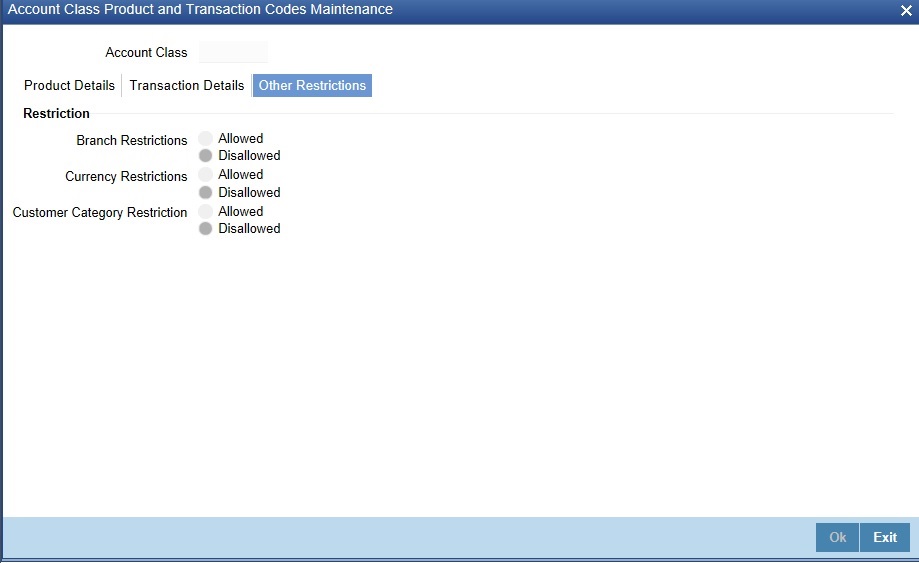

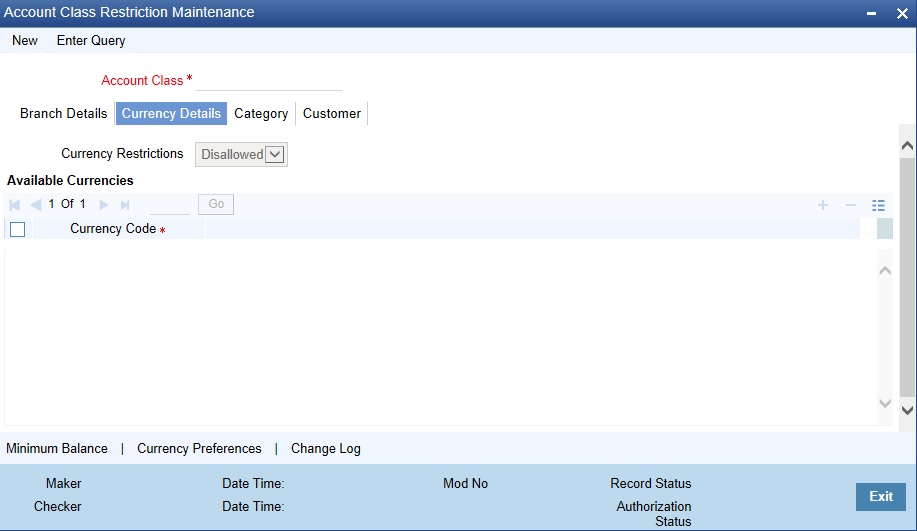

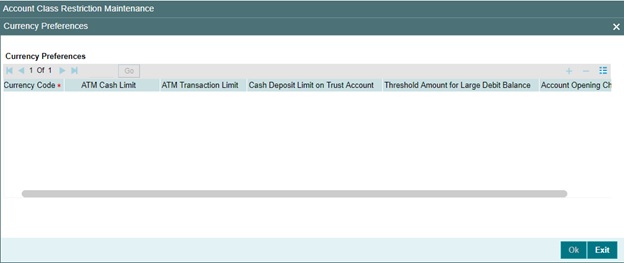

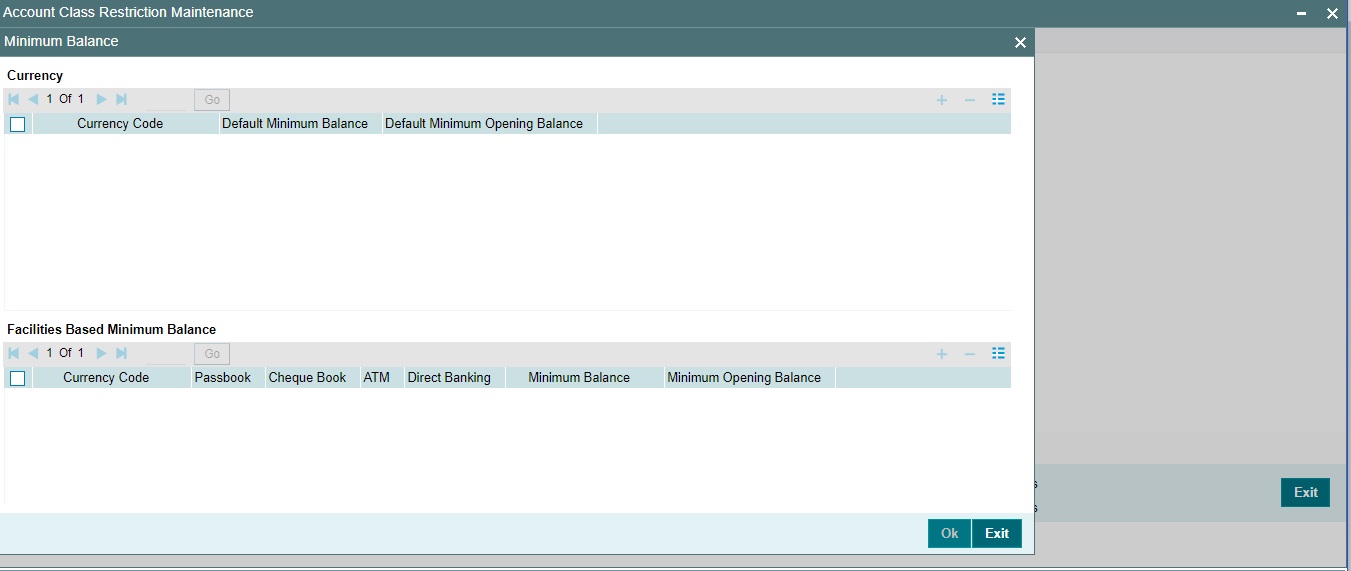

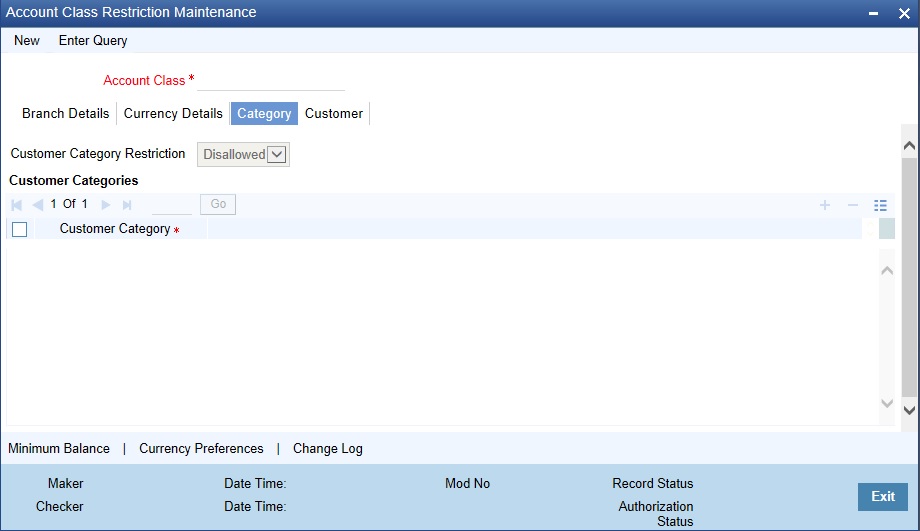

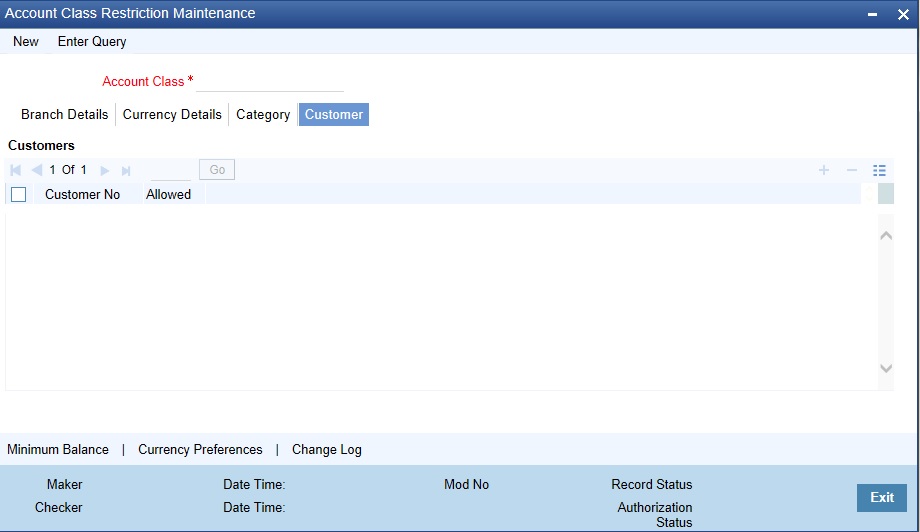

3.1.9 Restriction Button

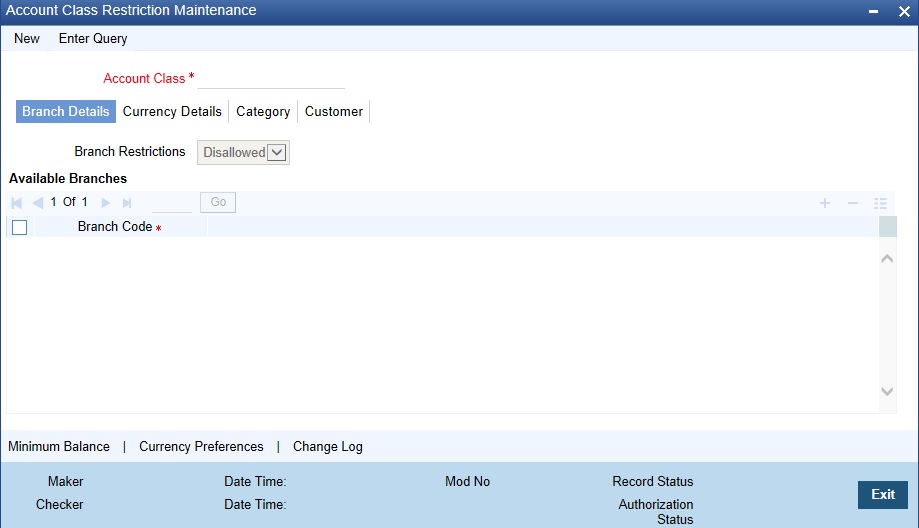

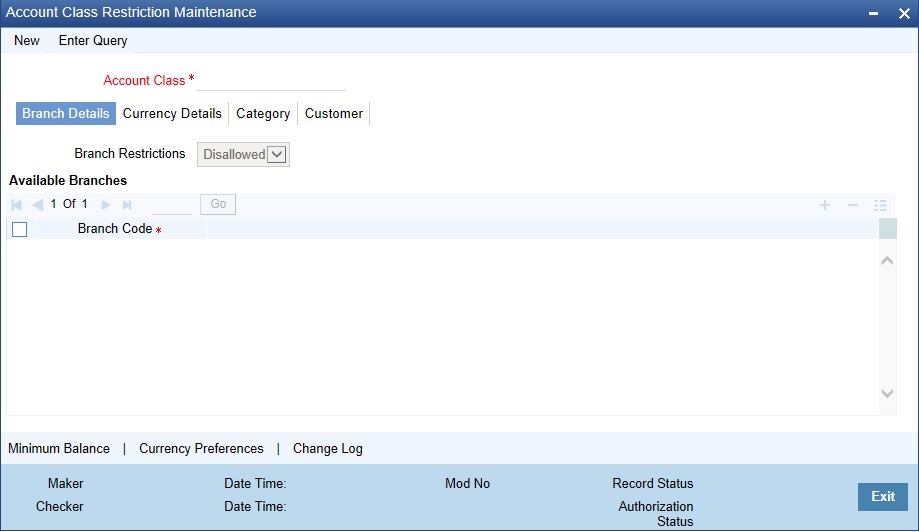

You can place restrictions on transactions involving customer accounts, at the account class level. As discussed earlier (for customer account), these restrictions get defaulted to all accounts that are linked to the account class. But you are allowed to change these restrictions for individual accounts as well.

To maintain the restrictions click the ‘Restriction’ button in the ‘Account Classes’ screen. The ‘Product and Transaction Codes Restriction’ screen is displayed

The restrictions can be based on:

- Products: Choose from the provided options - Allowed or Disallowed

- Transaction Codes: Choose from the provided options - Allowed or Disallowed

- Other Restrictions: Select the appropriate from the below available

options.

- Branch Restrictions: Choose from the provided options - Allowed or Disallowed

- Currency Restrictions: Choose from the provided options - Allowed or Disallowed

- Category Restrictions: Choose from the provided options - Allowed or Disallowed

Validation of Restrictions

During maintenance or online operations, in the respective contract screens for the restricted transactions, when you specify the customer account, the system checks whether the account class used by the specified account is restricted for the product that has been selected, or the debit/credit transaction type. If so, an override is sought when such contracts are saved.

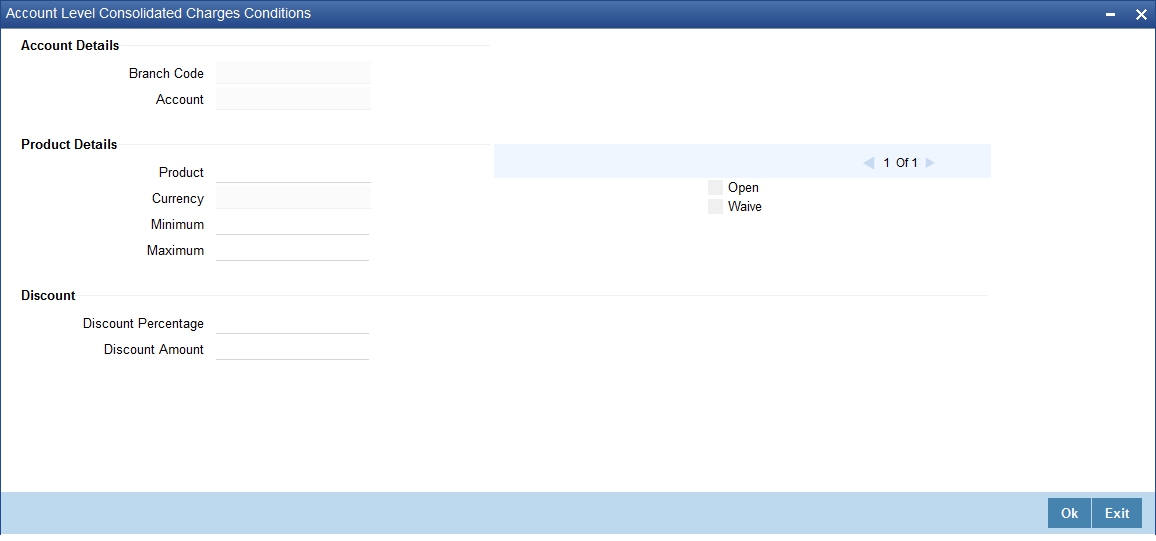

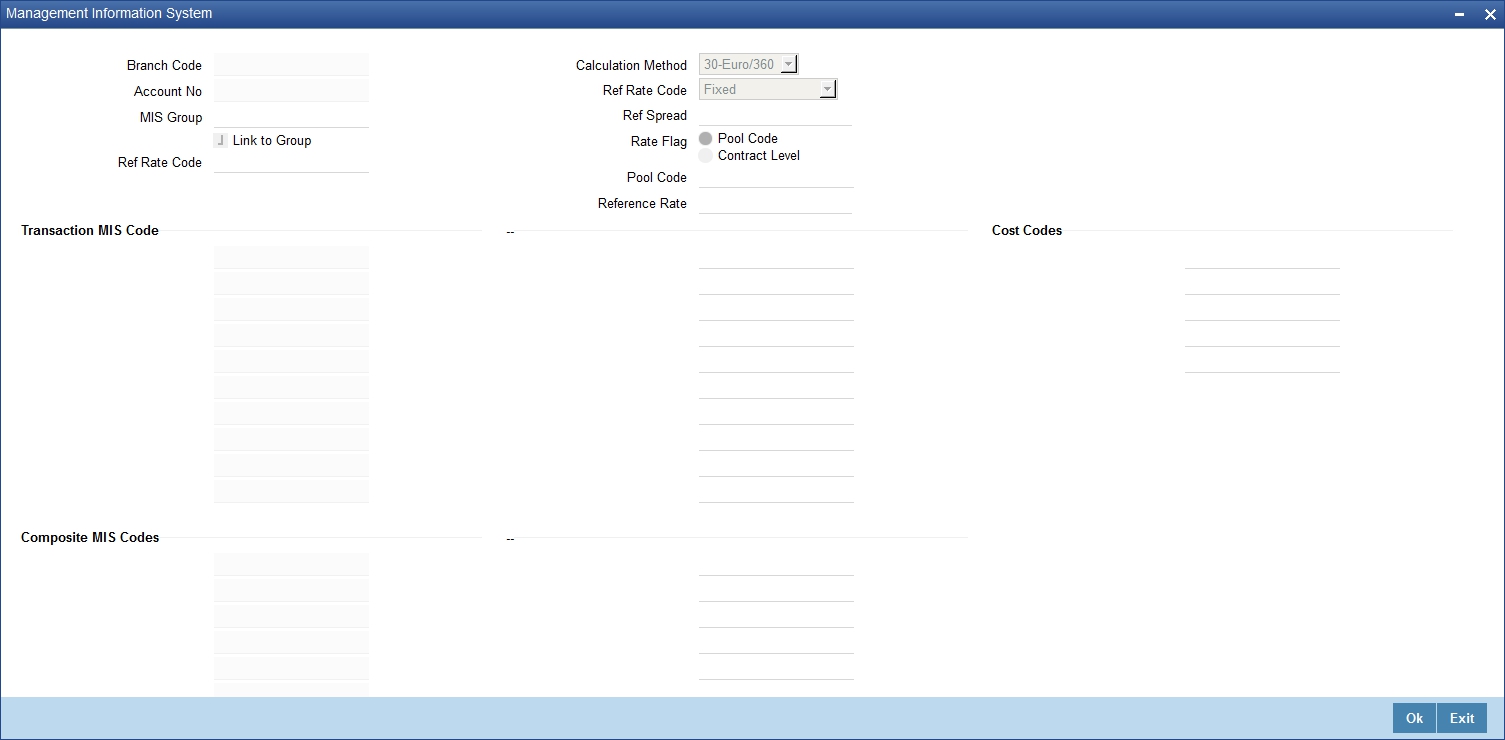

3.1.10 Statement Button

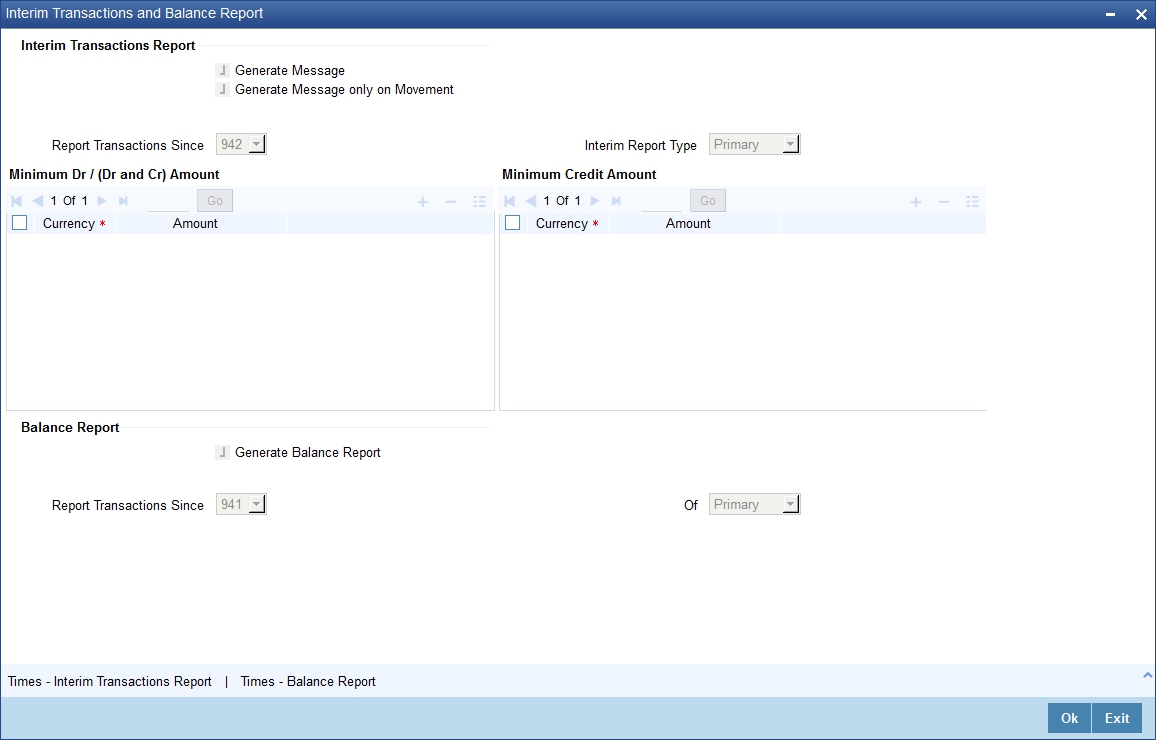

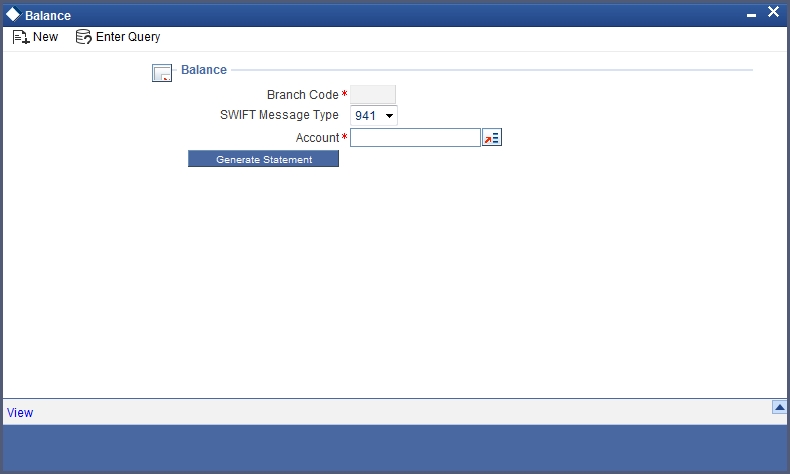

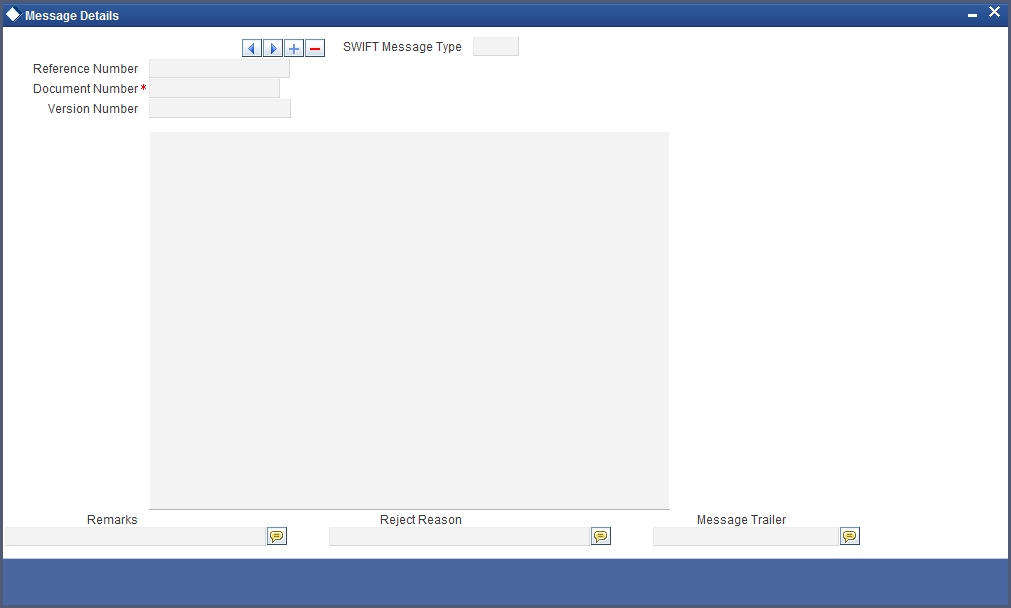

To receive the details of account balances you need to capture the relevant information in the MT 941/MT942 message. The account balance details can be linked to the message by employing the statement screen. To invoke this screen click on the ‘Statement’ button, in the ‘Account Class Maintenance’ screen. You need to specify the details for an MT 941/MT942 message.

The screen is as shown below:

This screen contains the details necessary for the account generation parameters. The message details the balance of an account or group of accounts under a particular account class. The account balances indicate the condition of the account for an identified time period.

Specifying Interim Transactions Report

Generate Message

Check this box to indicate that the accounts belonging to the account class are to be considered for periodic interim statement generation i.e., MT942.

Generate Message Only On Movement

Check this box to indicate that the interim statement needs to be generated only if additional entries have been posted subsequent to the previous interim statement generation.

Report Transaction Since

This is a list of all the transactions the accounts under a class have undergone, on basis of which the transactions would be reported in the interim account statement. You can choose the appropriate values applicable:

- Previous MT942: This indicates that all transactions posted and authorized since previous MT942 would be sent in the current interim statement

- Previous MT940/MT950: This indicates that all transactions posted and authorized since previous MT940/MT950 would be sent in the current interim statement. If this option is selected, user will have to specify the cycle of account statement to be considered.

Minimum Debit (Debit and Credit) Amount and Currency

Specify the minimum transaction amount for the debit transaction, which is eligible for reporting in the interim statement. This amount should be qualified by a currency. The amount for the corresponding account currency will be defaulted from here while opening the account.

If you do not specify the minimum credit amount, the system will consider the minimum debit amount specified here for reporting the credit transactions also.

Minimum Credit Amount and Currency

Specify the minimum transaction amount for the credit transaction, which is eligible for reporting in the interim statement. This amount should be qualified by a currency. The amount for the corresponding account currency will be defaulted from here while opening the account.

Generate Balance

To indicate that accounts under certain account classes are to be considered for generation of their balance messages, check this box. The valid values for this action are Y and N.

Of

Select the mode of message for balance generation form the option list

Report Transaction Since

This is a list of all the transactions the accounts under a class have undergone, in the interval of balance messages generated for the accounts under the respective classes. You can choose the appropriate values applicable:

- Previous MT940: This indicates all transactions posted and authorized since the issue of a previous MT 940 in the current balance report.

- Previous MT941: This indicates all transactions posted and authorized since the issue of a previous MT 941 in the current balance report.

- Previous MT950: This indicates all transactions posted and authorized since the issue of a previous MT 950 in the current balance report.

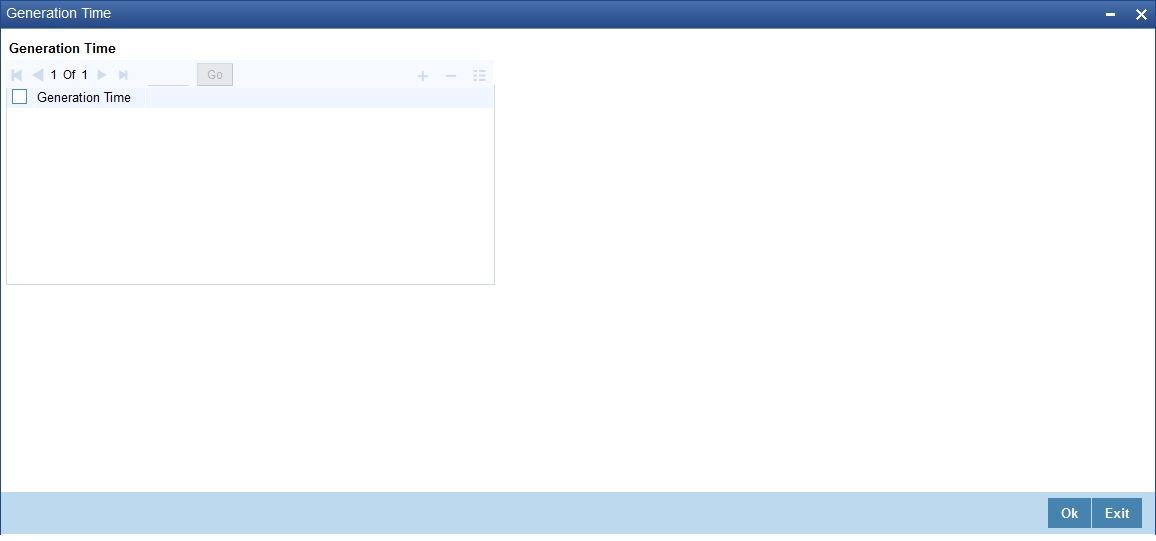

You can synchronize the time instance by hours for generation of balance messages by clicking the ‘Times’ button.

This screen is employed to indicate the the time instance in hours for the generation of the balance reports.

Message Generation Time

Specify the timing for generation of the MT 941/MT942 messages. You can specify the time interval in hours only.

A new message type is created for the balance report process which can be run as part of a scheduled task. This message type is ACST_BALANCE and ACST_INT_DTL.

3.1.10.1 Balance Statement Handoff

The balance statement can be handed off as part of scheduled task under Oracle. You need to assign its frequency in hours. This process is initiated for all accounts requiring a balance account statement. As discussed previously the time for generation of the statement is determined and specified. In case of no subsequent transactions reports, the statement is not generated.

3.1.10.2 Assigning Balance Statement as Job

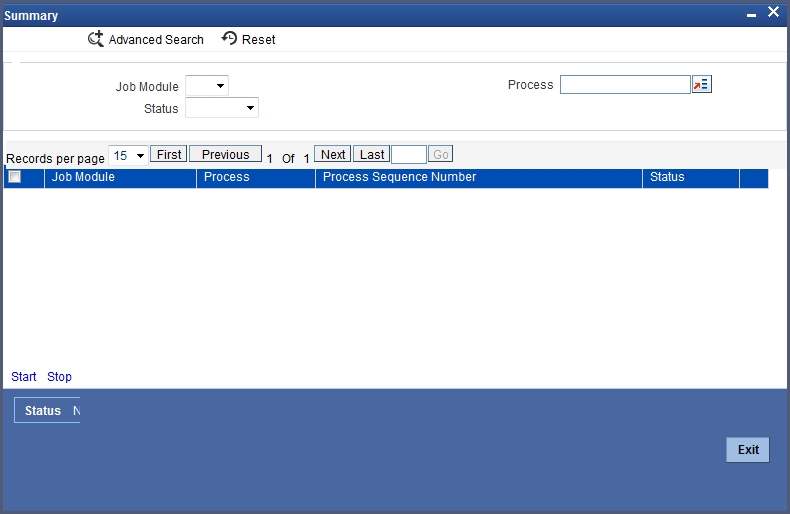

The balance statement can be facilitated to run as part of a scheduled job as part of the Oracle jobs initiated during processing.

The ‘Jobs Browser’ screen of the application provides you the facility to run the balance statement as a synchronized task, subject to specified time intervals in hours.

Invoke the ‘Jobs Browser’ screen from the application typing ‘CSSJOBBR’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

The screen is as shown below:

In the above screen, you can base your queries on any or all of the following parameters and fetch records:

- Job Module

- Status

- Process

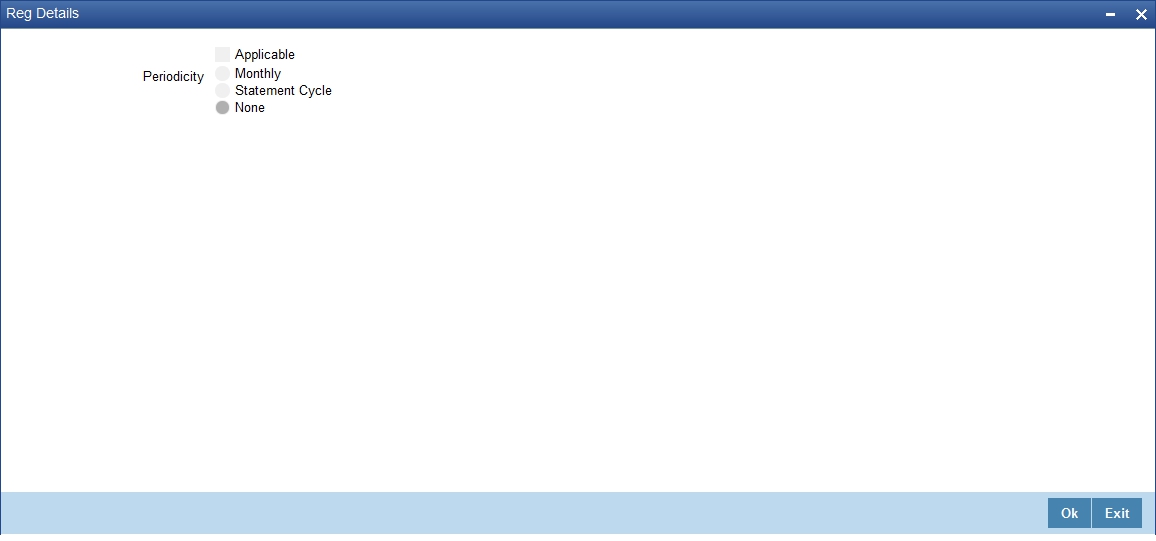

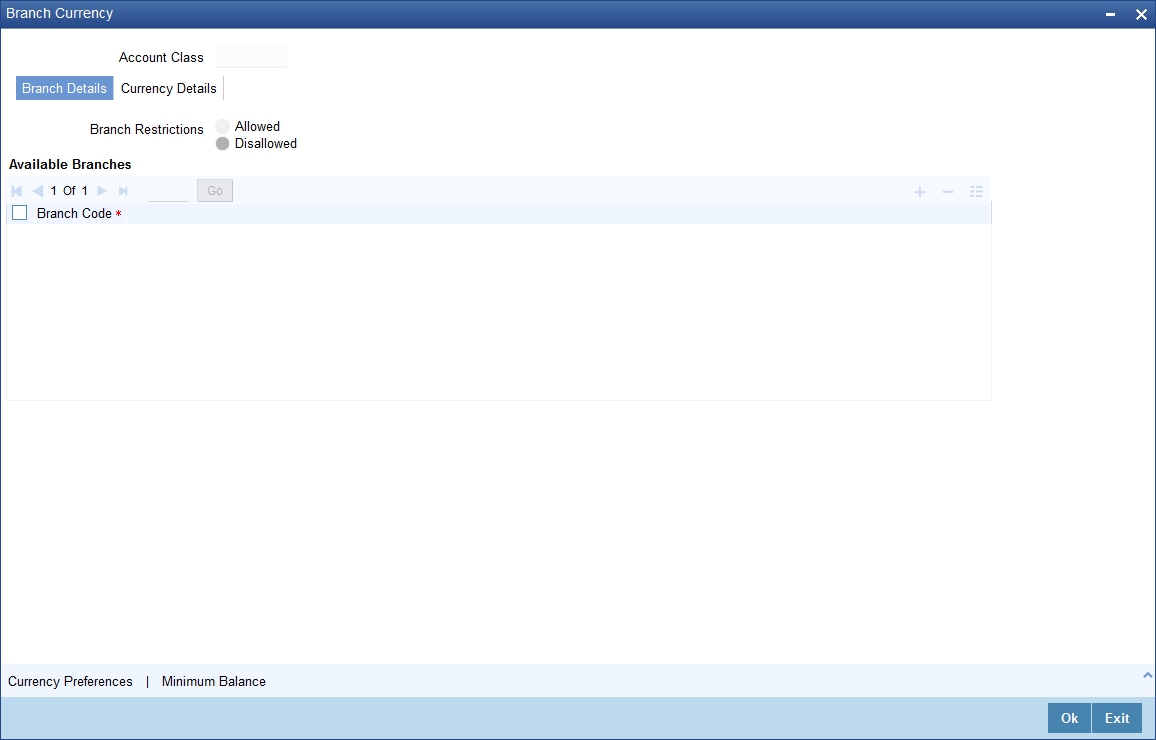

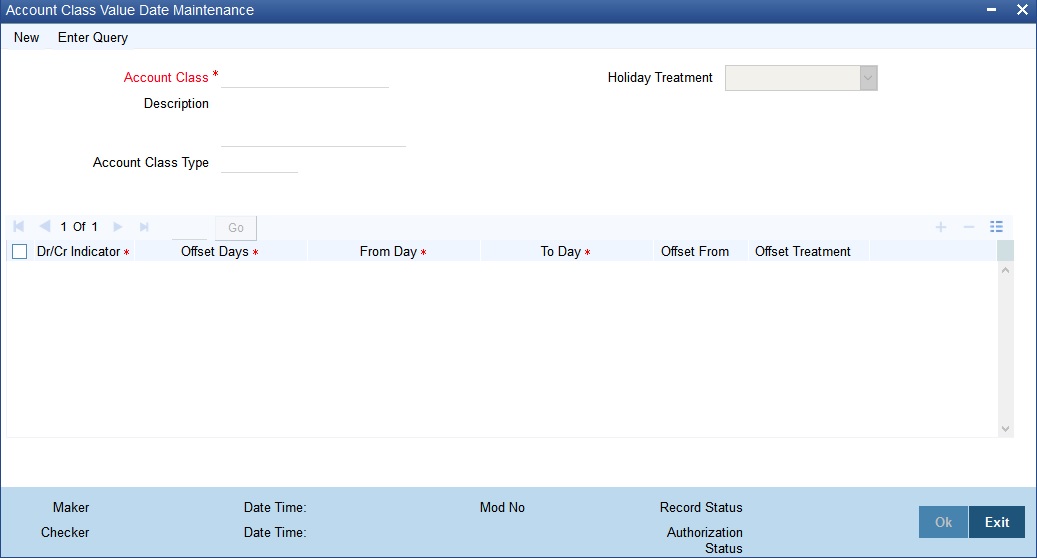

Select the option ‘Generate Balance Report’ from the Process option list. All associated accounts of the particular branch that have been marked for generation of balance statements are procured by Oracle FLEXCUBE.