10. Maintaining Account Structure

Oracle FLEXCUBE repays loan from multiple accounts. In Oracle FLEXCUBE, the loan account is the primary account and all the other accounts linked to it are cover accounts. While paying the settlement if the primary account has insufficient amount, the system will check the cover accounts for the remaining amount according to the preference.

In case of single account structure, the primary account will have only one cover account and the cover account will have only one primary account for making the account structure free of duplicate accounts. Every account has its own account structure. While closing an account under an account structure, you need to remove that account from the account structure manually else the system will not allow the closure of the account. If you want to amend an account structure, the system will check whether any amount block is open on the account structure. If any amount block is opened, then the system will throw an error. You can also configure the error code.

This chapter contains the following sections:

- Section 10.1, "Defining Account Structure"

- Section 10.2, "Debiting Transaction into the Primary Account"

- Section 10.3, "Maintaining Account Structure"

- Section 10.4, "Viewing Account Structure Maintenance Summary"

10.1 Defining Account Structure

Oracle FLEXCUBE allows you to have a primary account and secondary account and then link these two accounts.

If you amend an account structure, then the system will check if the status of any amount block created due to the account structure is open. If one or more amount block is open, then the system will display an error message. If a customer account is element of some account structure, then before closing that account, you should remove that account from the account structure manually; else the system will not allow you to close the account.

10.2 Debiting Transaction into the Primary Account

During settlement, if there is no sufficient balance in the primary account to cover up the debit/cheque amount, then the system will check for the balance in the cover account from the account structure and processes as follows:

- The system will do the partial transaction using the available amount in the primary account

- If the settlement is not done fully in the previous level, then the system will check for the balance in the cover account to complete the transaction. If there is sufficient balance, then the system will place an amount block on the cover account for the settled amount.

- If the primary account and cover account, for which the amount block is created, are of different currency, the system will create an amount block in the cover account currency. The system will then debit the settlement amount from the primary account.

The system uses the ‘Mid Rate’ for currency conversion.

In case there is a stop payment on the cheque, the validation of stop payment will precede and the settlement will not go through.

10.2.1 Processing Amount Block

The system will use the primary account and cover account amount block to identify the amount block which is created due to debit transaction processing in primary account. This process is configured either at post EOTI level or at BOD level. The system will process as follows:

- Remove the amount block from cover account

- Debit the cover account for the amount of ‘Amount Block’

- Credit the parent account for the amount of ‘Amount Block

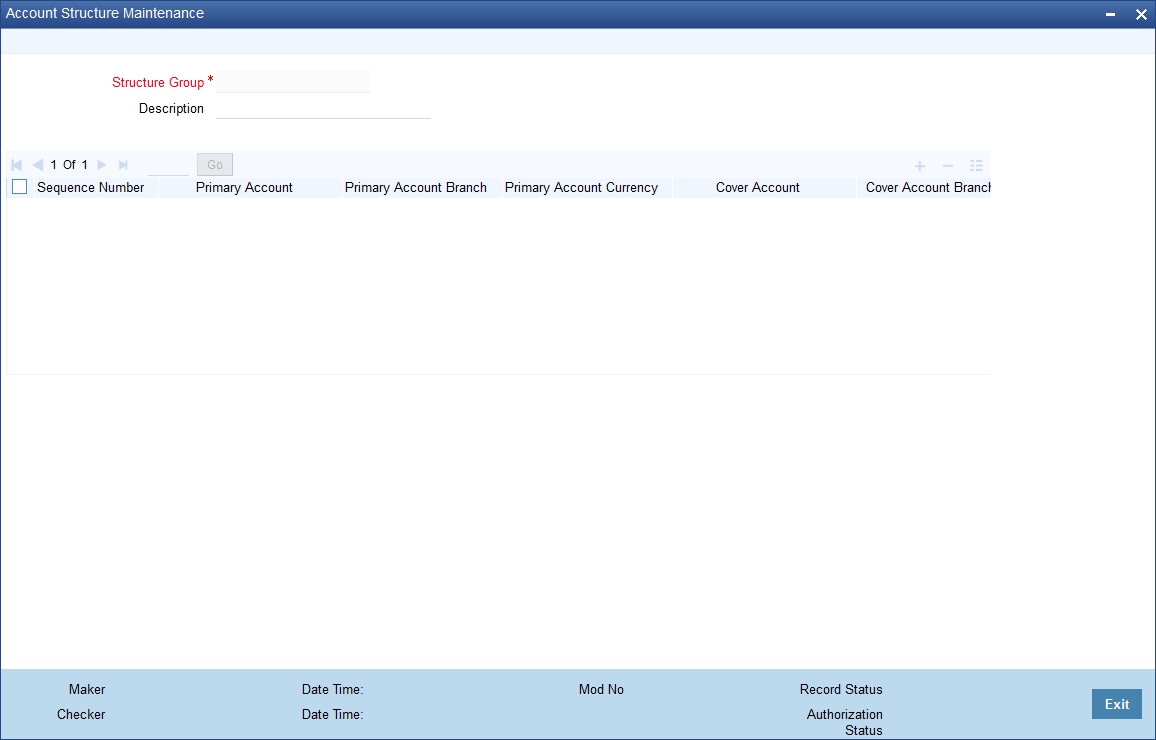

10.3 Maintaining Account Structure

You can specify the account structure in the ‘Sweep Structure Maintenance’ screen. You can invoke the screen by clicking ‘Sweep In Setup‘ in the ‘Customer Accounts Maintenance’ Screen.

For Further details on maintaining the details for Cover Account, refer ‘Maintaining Sweep Structure’ in Maintaining Customer Accounts’ chapter of this module.

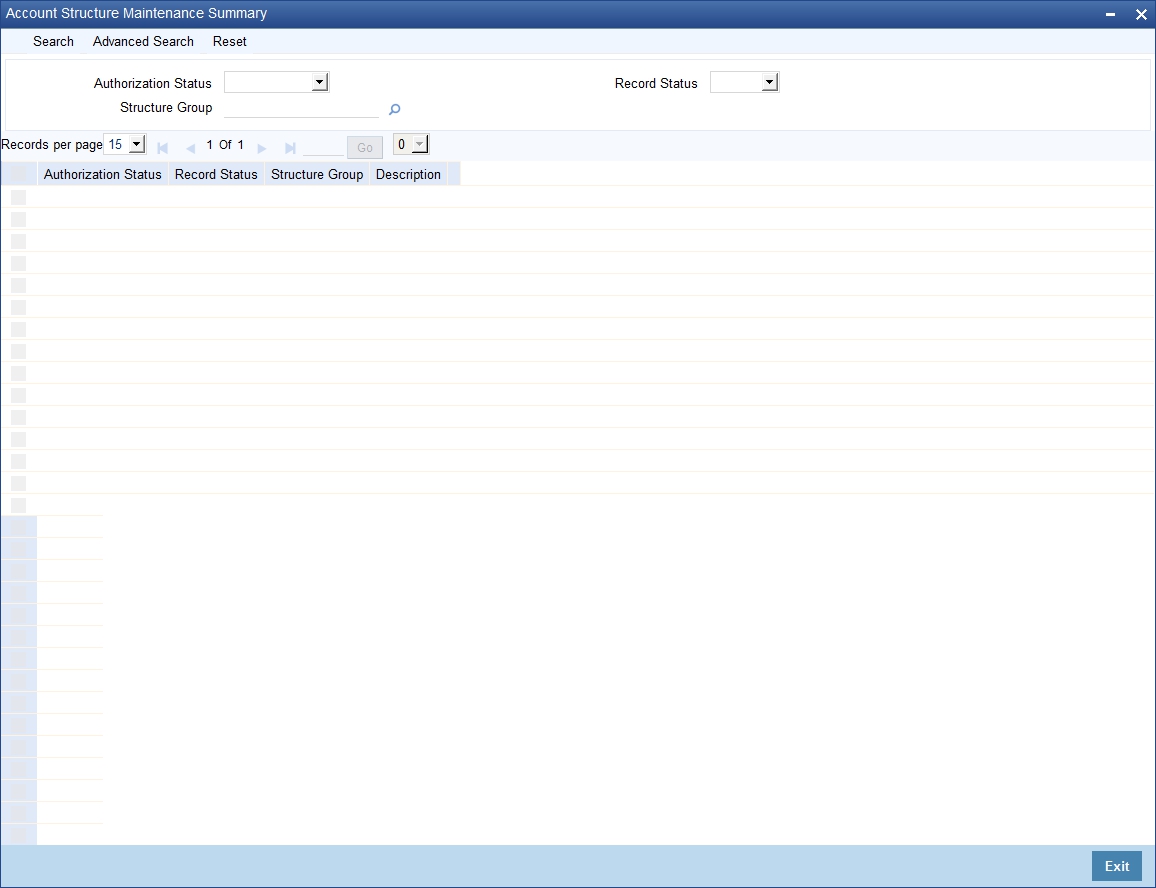

10.4 Viewing Account Structure Maintenance Summary

You can view the summary details of the account structure in the ‘Account Structure Maintenance Summary’ screen.

To invoke this screen, type ‘CASSTRUC’ in the field at the top right corner of the Application tool bar and click the adjoining arrow button.

You can query on records based on any or all of the following criteria:

- Authorization Status

- Structure Group

- Record Status

- Description

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them: