3. Maintenance Required for Processing Interest and Charges

This chapter enumerates the maintenance of the following reference information used by the Interest and Charges module in Oracle FLEXCUBE:

- Branch Parameters

- Rules

This chapter contains the following sections:

3.1 Rules

A ‘Rule’ identifies the method in which interest or charge has to be calculated. For example, to calculate interest for an account you would require the following data:

- the principal (the amount for which you want to calculate interest)

- the period (i.e., the number of days for which you want to apply interest)

- the rate (the rate at which you want to compute interest)

Using the formula PNR/100 you can calculate interest for the account. When you define a rule you define exactly how each of these components (the principal, the period, and the rate) is to be to be picked up from the account for calculating interest.

In the case of charges, you may have to specify the conditions for which you would need to apply charges. For example, you may want to apply charges on the basis of the debit turnover in an account. When you define a Rule to calculate the charge, you have to specify how the debit turnover in the account has to be picked up and how the charge has to be applied.

Data Elements

The components required to calculate interest (the principal, period, and rate) are broadly referred to as ‘Data Elements’. Data elements are of two types:

- System Data Elements (SDEs)

- User Data Elements (UDEs)

The balance in the account for which the interest has to be calculated, the turnover of the transactions on which a charge has to be applied, etc., depend on the activities that take place in the customer account over a period of time. This information is constantly updated in the system and is readily available for computation of interest or charges. Data elements of this sort are called System Data Elements.

Data elements like the rate at which interest has to applied, the tier structure based on which interest needs to be computed etc., are called User Data Elements (UDEs). UDEs fall into three types:

- Rate

- Amount

- Number

You can specify different values for a user data element. For example, you can apply different interest rates on the basis of the debit balance, as follows:

- balances less than 0 upto 10,000: 5%

- balances between 10,000 and 20,000: 7.5%

- balances greater than 20,000: 10%

Using the System Data Elements and the User Data Elements you can create formulae to compute interest and charges. In other words, formulae connect SDEs to the UDEs to give a result which is the interest or charge that has to be applied.

A Rule, therefore, is made up of SDEs, UDEs, and Formula (e).

3.2 Branch Parameters

This section contains the following topics:

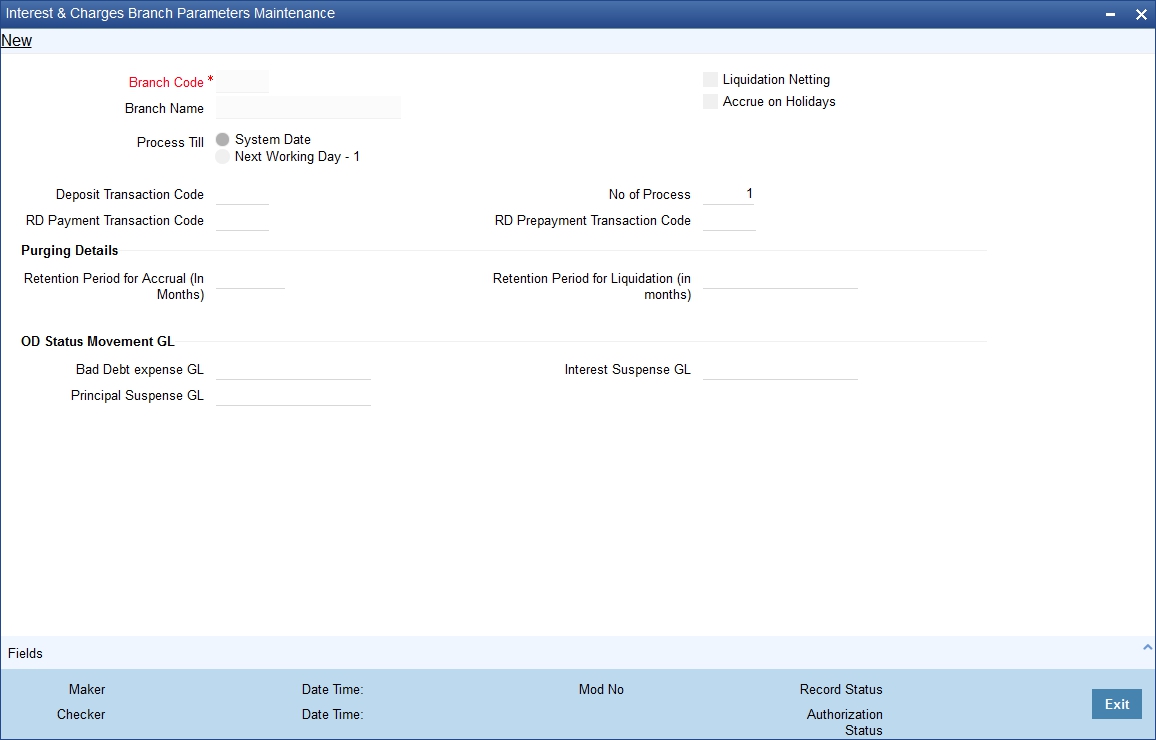

3.2.1 Maintaining Branch Parameters

You can use the ‘Interest & Charges Branch Parameters’ screen for maintaining parameters related to Interest and Charges. These parameters can be maintained for each branch of your bank. You can invoke the ‘Interest & Charges Branch Parameters’ screen by also entering ‘ICDBRMNT’ in the field at the top right corner of the Application toolbar and clicking the adjoining arrow button.

You can maintain the following parameters here:

Branch Code

Branch code of the current branch is defaulted here. However; you can specify branch code from the adjoining option list, if needed.

Branch Name

Name of the specified branch is defaulted here.

Liquidation Netting

Check this box if you need netting for interest/charges liquidation.

Accrue on Holidays

Check this box if accrual on holiday is required. The system posts a consolidated accrual entry for the holiday period if this flag is checked. By enabling ‘Accrue on Holidays’ at branch level, you can post accrual entries for holidays for the required branches. This is applicable for all IC products with Accrual Frequency as ‘Daily’.

During IC EOD, the system processes the accrue based on ‘Accrue on Holidays’ from ‘IC Branch Parameter Maintenance’ screen

Process Till

Select a date till which you need to process interest/charges from the options. The following options are available for selection:

- System Date – Select if you need to process till system date.

- Next Working Day-1 – Select if you need to process till next working day.

Deposit Transaction Code

Specify a valid deposit transaction code from the adjoining option list.

No of Process

Number of the process is defaulted as ‘1’ here; however, you can modify if needed.

RD Payment Transaction Code

Specify a valid RD payment transaction code from the adjoining option list.

RD PrePayment Transaction Code

Specify a valid RD prepayment transaction code from the adjoining option list.

Purge Details

You can maintain the following purging details here:

Retention Period for Accrual (In Months)

Specify a valid retention period for interest/charges for purging and archiving accruals.

Retention Period for Liquidation (In months)

Specify a valid retention period for interest/charges for purging and archiving liquidation entries from ictb_entries_history.

OD Status Movement GL

You can maintain the following GL details here:

Bad Debt Expense GL

Specify a GL for posting the entry by debiting the bad debt expense GL and crediting the principal suspense GL during status movement. Bad debt expense GL is used to post entries during write off status.

Principal Suspense GL

Specify the GL for posting the offset entry during the movement of principal amount to suspense GL.

Interest Suspense GL

Specify the GL from where the unrecognized interest is moved to this GL during the status change. Alternatively, you can select the interest suspense GL from the option list. The list displays all valid values maintained in the system.

3.3 Rules for Interest and Charges

This section contains the following topics:

- Section 3.3.1, "Invoking Interest and Charges Rule Maintenance"

- Section 3.3.2, "System Elements (SDEs)"

- Section 3.3.3, "User Elements (UDEs)"

- Section 3.3.4, "Formulas Button"

- Section 3.3.5, "Applying Prepayment Penalties on Deposits"

- Section 3.3.6, "Maintenance for Prepayment Penalties"

- Section 3.3.7, "Maintaining Rule for Calculating Commission on HDB"

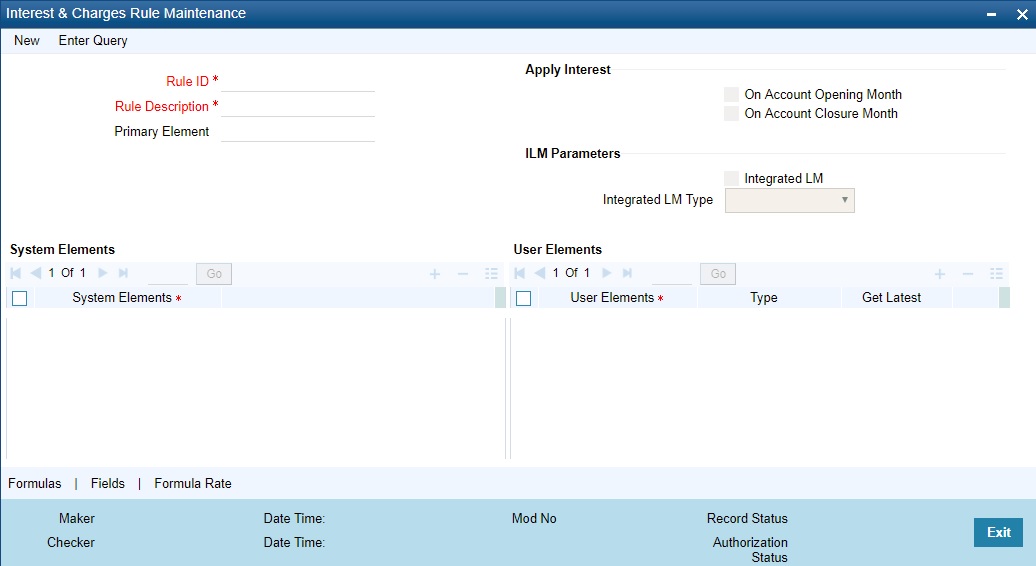

3.3.1 Invoking Interest and Charges Rule Maintenance

You can define Rules in the Interest and Charge Rule Maintenance screens. For a Rule, you can define:

- the System Data Elements applicable

- the User Data Elements applicable

- the formula(e)

In addition to specifying how the SDEs and UDEs are connected through the formulae, you also define certain other attributes for a Rule. You can invoke the ‘Interest and Charges Rule Maintenance’ screen by typing ‘ICDRUMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Rule Identification

Assign each Rule that you define a unique code. This code should, ideally, represent the type of interest or charge that you are defining. When you want to link a product to a Rule, it should be possible for you to identify the Rule with only the code you have assigned it.

Description

Enter a short description of the Rule, indicating the type of interest in the Description field. This will be used by the system for all display and printing purposes.

Enter at least three characters for the description of the Rule.

Primary Element

Select the System Data Element (SDE) that must be deemed as the principal component for the interest rule you are defining. This is typically done for rules defined for prepayment penalty application for time deposits. The SDE maintained to pick up amounts withdrawn before the maturity date, is typically set as the primary component, for such rules.

Apply Interest

By default, interest will always be applied from the day an account is opened till the day before it is closed. However, you have the option of excluding the month in which the account is opened or closed from being considered for interest application.

- On Account Closure Month

- On Account Opening Month

However, while processing interest manually, you have the option to specify a date till which you want to liquidate interest.

Maintaining ILM Parameters

Integrated LM

Choose this option if you want to use the product for Integrated Liquidity Management processing.

Integrated LM Type

Select the type of System Account to which the product ought to be linked from the adjoining drop-down list. This list displays the following values:

- Pool Leader: Indicates that the Rule will apply to Header accounts in a structure.

- Pool Reallocation: Indicates that the rule will apply to Parent and Child Accounts below the Header Account.

3.3.2 System Elements (SDEs)

The first thing that you have to do while defining a Rule is to pick up the System Date Elements that you would use in the rule. You can pick up as many of them as necessary; only those that are picked up here can be used in the formulae for the Rule subsequently.

To recall, an SDE identifies the principal and the period for which you would like to apply interest or charges. The attributes for each SDE is defined through the ‘System Data Elements Maintenance’ screen. In this screen you can only identify the SDEs which you would like to use to build interest rules.

In order to specify exemption of tax on interest, you will have to use the ‘DIRT exempt’ SDE provided specifically for this purpose.

Refer to the SDE chapter of this user manual for details of DIRT exemption.

You can use the following SDEs for fetching the numeric equivalent value of the customer’s FATCA classification and identify the IGA domicile status.

- CUST_FATCA_CLASSFN – This SDE returns the numeric equivalent value of the customer’s FATCA classification.

- IGA_DOMICILE – This SDE returns the IGA Domicile status of the customer from Entity FATCA classification record. The value can be 0, 10, 11 or 20.

For more information on SDEs, refer to the section ‘System Data Elements Maintenance’ in the chapter ‘Maintaining System Data Elements’ in this User Manual.

3.3.3 User Elements (UDEs)

In the same way that you pick up the SDEs applicable for the rule that you are defining, you should identify the UDEs which you would be using in the rule. The UDEs that you pick up could be any of the following types:

- Rate

- Amount

- Number

The interest that you charge on a debit balance is an example of a debit rate. The interest that you pay on a credit balance is an example of a credit rate.

A User Data Element will be an amount under the following circumstances:

- in the case of a tier structure, the upper and lower limit of a tier or a tier amount;

- in the case of a charge, when it is indicated as a flat amount

- any amount that can be used in the definition of formula(e)

A UDE as a number is typically used for a Rule where interest or charges are defined based on the number of transactions. A UDE under this category can also be used to store a numerical value that may be used in a formula. For example, in the formula you would like to multiply an intermediate result with a certain number before arriving at the final result. The ‘certain number’ in the formula can be a UDE.

You can enter the actual values of the UDEs (like the interest rate, the upper limit for the tier, etc.) in the IC User Data Element Maintenance screen. This is because you can specify different values for each data element. A rule can, therefore, be applied on different accounts since it just represents a method of interest calculation. The following example illustrates this.

Note

You can modify the values of the UDEs that you choose. However, remember to check the formulae where you have used the user data element. The modified data element will apply only from the current interest period. It will not have a retrospective effect.

Identifying the UDE Value that should be used for back-period interest calculations

While creating an IC Rule, you have to define the UDEs that will be used in the formulae that you have defined.

For each UDE that you define for the purpose of calculating tax, you can specify whether the tax should be computed based on the latest value for the UDE element or whether the system should use the UDE value effective for the corresponding liquidation cycle.

If you select Use Current, irrespective of the liquidation cycle to which the calculation belongs, the system picks up the latest UDE value and computes the tax amount. If you indicate that the system should apply the Effective rate of UDE values, the UDE value effective for the liquidation cycle will be picked up.

Note

You can select the Use Current option when the formula associated with the rule is of type Tax. However, you have to ensure that you do not set the periodicity to Daily while defining the tax formula.

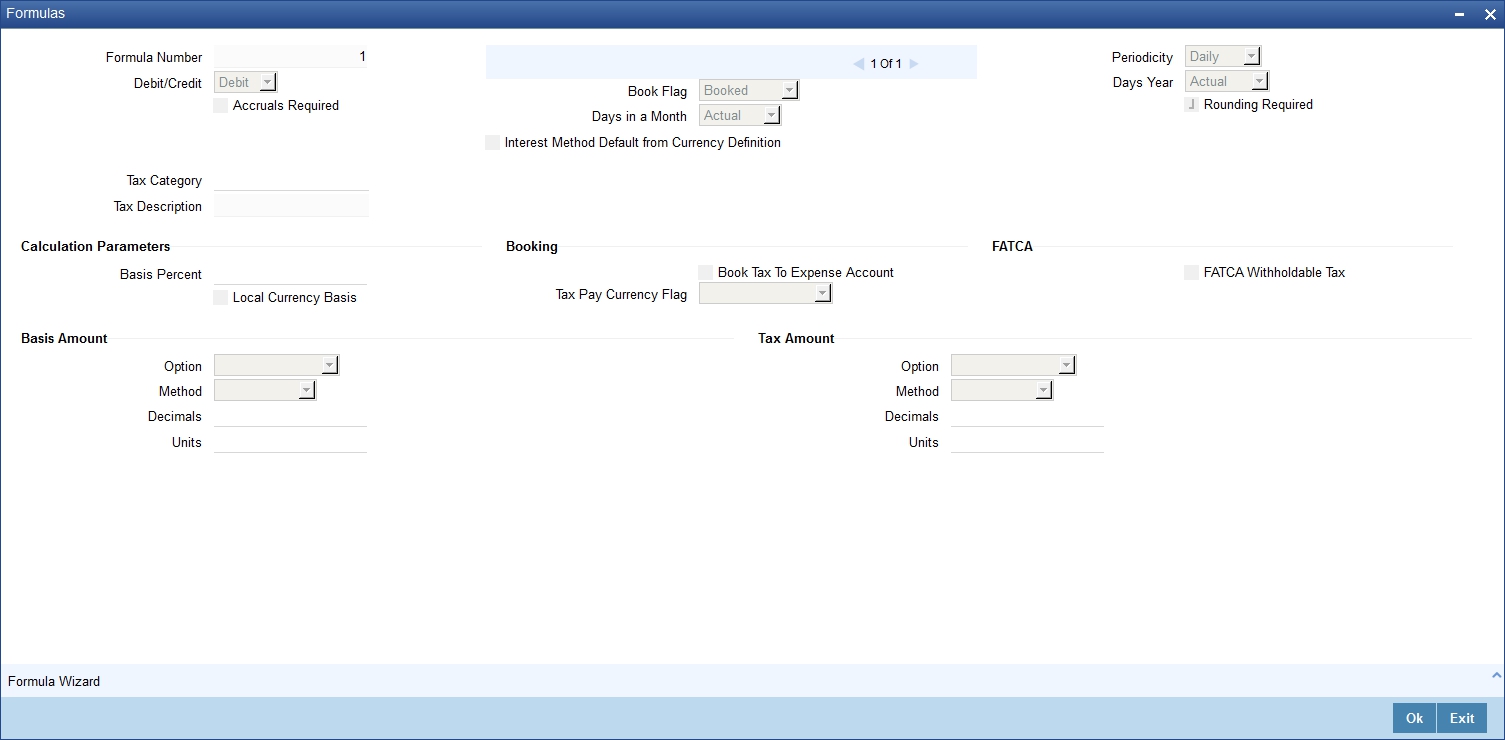

3.3.4 Formulas Button

Using the SDEs and the UDEs that you have specified for a Rule, you can calculate interest. You have to specify the method for calculating interest in the form of formulae. Using the SDEs and the UDEs you can create any number of formulae for a Rule. Click ‘Formulas’ button to invoke ‘Formulas’ screen.I

The following are the attributes of a formula:

Formula Number

Using the SDEs and the UDEs that you have specified for a Rule, you can calculate interest. You have to specify the method for calculating interest in the form of formulae. Using the SDEs and the UDEs you can create any number of formulae for a Rule.

In this field, the formula number that you are defining for a Rule will be displayed.

Book Flag

The Booking Flag of a formula denotes whether the result of a formula should be:

- Booked (that is, if the resulting amount should be posted to the customer account).

- Non-booked (that is, the result of the formula is to be used in another formula and not to be posted to the customer account).

- Tax (that is, the formula is used to calculate tax. The tax can be borne either by the customer or the bank).

- Penalty (that is, formula is used to calculate penalty. This differentiate between penalty and debit interest formula because during early redemption interest formula goes through recalculation with either positive or negative interest rate).

Periodicity

The Periodicity of a rule application denotes whether the formula you are defining has to be:

- applied for each change during the interest period (or daily)

- only for the last day of interest period (periodic)

The following example illustrates how the concept of periodicity of application of a formula functions:

Note that the periodicity that you enter here is different from the liquidation periodicity. The Periodicity that you define for a rule is a calculation periodicity. The Liquidation Periodicity is the interval between two successive automatic liquidations.

- You can define the liquidation periodicity when you create a product

- You define the periodicity of formula application in this screen

Debit / Credit

The result of a formula will be an amount that has to be either debited from the customer account or credited to it. For example, the debit interest that you charge on an overdraft would be debited from the customer account; while, the credit interest that you pay would be credited to the customer account. In this screen, you indicate this.

Often, when calculating interest for an account, you would want to debit interest under certain conditions and, under certain other conditions, credit interest. In such a case, you can build formulae to suit both conditions. The formula that is used to calculate interest for the account would depend on the condition that is fulfilled.

Note

For a Booking formula, the system automatically checks this box and disables this option.

Days in a month

The method in which the ‘N’ of the formula for interest calculation, PNR/100, has to be picked up is specified for a formula. This is done through two fields: Days in a month and Days year.

The number of interest days for an account can be arrived at in three ways. One, by considering:

- one by considering the actual number of days in a month

- two, the US method of considering 360 days in a year

- three, the Euro method of considering 360 days in a year

Days year

The interest rate is always taken to be quoted per annum. You must therefore indicate the denominator value (the total number of days in the year) based on which interest has to be applied. You can specify the days year as

- Actual number of days (leap year will be 366, non leap year will be 365)

- 360 days

- 365 days (leap and non leap will be 365)

If you specify that the actual days in a year should be used for calculation of interest days, all calculations will be according to the number of calendar days in the year. For example, if it is a leap year, 366 days will be taken as the total period.

In case you choose to consider each year as having 360 days, all calculations will be based on this assumption. Irrespective of the number of days in the relevant year according to the calendar, the value will be calculated on the assumption that there are 360 days in the year.

In conclusion, the number of days to be used for calculation of interest can be any of the following combinations:

- Actual/Actual (the actual number of days in a month/Actual number of days in a year)

- Actual/360

- 360/Actual

- 360/360

- 360/365

The following table illustrates how this is achieved in Oracle FLEXCUBE:

Days to be considered |

Specification in Oracle FLEXCUBE |

Actual/Actual |

Click on Actuals in ‘Days in a Month’ field. Click on Actuals in ‘Days in a Year’ field. |

Actual / 360 |

Click on Actuals in ‘Days in a Month’ field. Click on 360. days in ‘Days Year’ field. |

360/Actual |

Click on 30 days in ‘Days in a Month’ field. Click on Actuals in ‘Days Year’ field. |

360/360 |

Click on 30 days in ‘Days in a Month’ field. Click on 360 days in ‘Days Year’ field. |

Accruals Required

Only if you indicate that interest should be accrued (for a formula) will it be done. You can opt to accrue the interest due to one formula and choose not to accrue the interest due to another formula that you are defining for the same rule.

Note

Only a booking formula can have accruals.

You can indicate, as a preference (in the Product Preferences screen), if all the accrual entries generated can be passed for a product rather than for individual accounts linked to the product.

The interest that is accrued can be posted into different accounts. The result of each formula is an accounting role and you can map each into a different GL/SL (Accounting Head).

Rounding Required

When building an interest rule, you can indicate if the results of non-booking formulae should be rounded-off by choosing the Round Results option.

Tax Category

If the formula that you are creating is a tax formula, you have to specify if the tax amount would be borne by the customer or the bank. For example, if the tax on the credit interest that you pay your customer is borne by the customer, you need to indicate this here. If, on the other hand, you charge a customer interest on the debit balance and bear the tax on your income, you should indicate that the bank would bear the tax. In either case, when you have to pay tax ultimately, one entry would involve the Tax Payable GL. The accounting Role, in both cases would be ‘Tax’. Choose the GL/SL head depending on whether the customer or the bank bears the tax.

Specify the ‘tax category’ to which the Tax Rule belongs, from the option list provided. Only valid categories (open and authorized) are maintained here. If the tax category is not maintained, then the tax booked under this tax rule will not be considered for waiver/tax computation processing. However, normal tax processing will occur as usual.

Note

When the formula is Tax, you will invariably be using the result of a previous formula (e), which would return the actual interest that is applied. The tax formula should then indicate the method in which tax should be calculated on this interest. Note that a tax formula will not be accrued. It is suggested that a tax formula be ’periodic’.

For specifying exemption of tax, you will have to use the ‘DIRT exempt’ SDE in building the rule.

When you create a product, the accounting roles available would depend on the formulae that you have defined. For example, only if you have built a tax formula for an interest rule, would the accounting role ‘Tax’ be available for the product.

Calculation Parameters

Local Currency Basis

Check this option to indicate that the Basis Amount on which the tax is going to calculated, should be converted to local currency.

Basis %

Specify factor for computation of the taxable amount. The basis percentage should be greater than 0 and less than or equal to 100. The basis amount would first be multiplied by this percentage to arrive at the actual basis amount on which tax needs to be computed. The inverse of the same factor would then be applied to the calculated tax amount to arrive at the actual tax amount.

Booking

Book Tax to Expense Account

Indicate whether or not the tax on interest and charges should be processed as an Expense type of tax and booked into a Tax Expense account, to be paid to the Government.

Tax Payable Currency Flag

Specify the currency in which the tax on interest and charges should be paid.

FATCA

FATCA Withholdable Tax

Check this box to indicate that the tax being maintained is a FATCA tax.

If this field is checked and ESCROW processing is not done, then the system will post the audit log irrespective of whether the tax was withheld or not.

- If the rule returns WITHHOLD, then the system will computed the tax amount and decision will be set to Y – WITHHOLD.

- If the rule returns NO WITHHOLD, then the tax amount will be zero and the decision will be set to N – NO WITHHOLD.

Basis Amount

Option

Specify the rounding option for conversion of the amount to calculation currency. It could either be Currency Default or Specific.

‘Currency Default’ indicates that the rounding details would be taken from the rounding parameters defined in the Currency Maintenance screen. ‘Specific’ indicates that the rounding parameter would be defined or picked up from the Tax Rule itself.

Method

This field is enabled only if the Calculation Currency Rounding Option is selected as ‘Specific’. Select either of the following options:

- Truncate

- Round Up

- Round Down

- Round Near

Truncate indicates that the amount would be rounded to the number of decimals specified for the currency

Round Up indicates that the amount would be rounded up based on the number of decimals and the nearest rounding unit for the currency

Round Down indicates that the amount would be rounded down based on the number of decimals and the nearest rounding unit.

Round Near indicates that the amount would be rounded up or down based on the number of decimals and the nearest rounding unit

Decimals

This field is enabled only if the Calculation Currency Rounding Option is selected as ‘Specific’. Specify the number of decimals up to which the rounding/truncation has to be done. The rounding decimals defined here should be less that or equal to the decimals defined in the Currency Maintenance screen.

Units

This field is enabled only if the Calculation Currency Rounding Option is selected as ‘Specific’. This represents the least amount that can be measured in a particular currency. You need to specify the unit up to which the amount should be rounded. The unit defined here should be a multiple of the unit defined in the Currency Maintenance screen.

Tax Amount

Option

Specify the rounding option for conversion of the amount to tax currency. This could either be Currency Default or Specific.

‘Currency Default’ indicates that the rounding details would be taken from the rounding parameters defined in the ‘Currency Maintenance’ screen.

‘Specific’ indicates that the rounding parameter would be defined/picked up from the Tax Rule itself.

Method

This field is enabled only if the calculation rounding option is selected as ‘Specific’. Specify the method in which the rounding should be done for calculating the actual tax amount. It could be either of the following:

- Truncate

- Round Up

- Round Down

- Round Near

Truncate indicates that the amount would be rounded to the number of decimals specified for the currency.

Round Up indicates that the amount would be rounded up based on the number of decimals and the nearest rounding unit for the currency.

Round Down indicates that the amount would be rounded down based on the number of decimals and the nearest rounding unit.

Round Near indicates that the amount would be rounded up or down based on the number of decimals and the nearest rounding unit.

Decimals

This field is enabled only if the Calculation Currency Rounding Option is selected as ‘Specific’. Specify the number of decimals up to which the rounding/truncation has to be done. The rounding decimals defined here should be less that or equal to the decimals defined in the Currency Maintenance screen.

Units

This field is enabled only if the Calculation Currency Rounding Option is selected as ‘Specific’. Specify the unit up to which the amount needs to be rounded. The unit defined here must be a multiple of the unit defined in the Currency Maintenance screen.

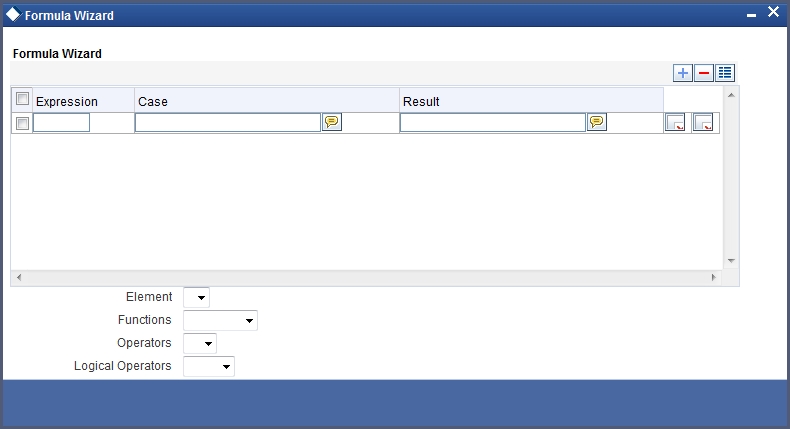

The expression for the SDEs can be viewed by clicking ‘Formula Wizard’ button. You can build expressions for SDEs using ‘Formula Wizard’ screen.I

3.3.5 Applying Prepayment Penalties on Deposits

For time deposits, you can choose to apply prepayment penalties on any withdrawals before the maturity date.

Prepayment penalties are computed based on the following bases:

- The amount withdrawn prior to the maturity date

- The period that has elapsed between the start date of the deposit and the withdrawal date.

- The period that has elapsed between the last liquidation date and the withdrawal date.

For an account foreclosure, prepayment penalty is computed during online liquidation, and for partial withdrawals, it is computed at maturity.

3.3.6 Maintenance for Prepayment Penalties

As part of the Interest and Charges module maintenance in your bank, you must maintain details that will enable the system to pick up the different elements that will be used in the calculation of prepayment penalties. These parameters (including products) need to be operative on the account classes that you have specified as time deposit account classes.

Accordingly, the following system defined elements (SDE’s) are available as inbuilt parameters in Oracle FLEXCUBE, which you can use to set-up an Interest and Charges rule:

- An SDE for the amount withdrawn during a foreclosure or early withdrawal (‘PENALTY_BASIS’).

- An SDE for the number of days elapsed between the start date of the deposit and the withdrawal date (‘DAYS_FROM_START’).

- An SDE for the number of days elapsed between the last liquidation date and the withdrawal date (‘DAYS_FRMLAST_LIQ’).

- An SDE to indicate if a withdrawal has occurred prior to the maturity date for a time deposit account (‘PENALTY_APPLY’, to which a value of 1 is assigned if there is a premature withdrawal on the TD account).

Using the above SDEs (which are inbuilt in Oracle FLEXCUBE), you must maintain an interest rule for the calculation of prepayment penalties, which will include these SDE’s mentioned above, and which will be linked to the appropriate interest product that you have maintained for calculation of time deposit interest. The rule for penalty must be an additional rule, in addition to the rule for computation of normal interest on the time deposit account.

Also, in the transaction code used for debit entries to time deposit accounts, you must indicate the computation of penalties on debit entries due to withdrawals from the account before the maturity date. You must select the IC Penalty Inclusion check box to indicate this.

Refer to the Core Services module user manual for details about maintaining transaction codes.

In the interest rule that you maintain for prepayment penalty application, you must also indicate that the SDE that you have maintained for the withdrawal amount must be a principal component. You can indicate this by specifying the SDE in the ‘Primary Element’ field in the ‘IC Rule Maintenance’ screen.

3.3.7 Maintaining Rule for Calculating Commission on HDB

You can maintain a rule to calculate the commission on highest debit balance for a particular month. In the ‘IC Rule Maintenance’ screen, you need to maintain the following details for calculating the commission.

SDE Elements |

User Elements |

HDB |

DR_COM_RATE |

Click Formulas to provide the following attributes to the formula for calculating the commission.

Debit/Credit |

Book Flag |

Periodicity |

Debit |

Booked |

Monthly |

Click ‘Formula Wizard’ to specify the formula (‘HDB* DR_COM_RATE)/ (100).Or else you can define another formula using the defined SDE.

You can link this rule to IC product with liquidation at month-ends. No accrual for this rule and it is considered as a charge. The CR GL mapped can be treated as a HDB commission income GL for the branch.