5. Giving UDE Values for Condition

This chapter contains the following sections:

- Section 5.2, "Interest Rate Association for Account Class"

- Section 5.3, "UDE Values for Select Customer Accounts"

5.1 Interest and Charges UDE Maintenance

This section contains the following topics:

- Section 5.1.1, "Invoking the Interest and Charges UDE Maintenance Screen"

- Section 5.1.2, "Printing UDE Values"

- Section 5.1.3, "Maintaining Rate Codes"

- Section 5.1.4, "Defining Effective Date for Rate Code"

- Section 5.1.5, "Closing Rate for Date"

5.1.1 Invoking the Interest and Charges UDE Maintenance Screen

You will recall that when you create a product you link it to a rule. A rule consists of System Data Elements and the User Data Elements. A rule identifies the method in which interest or charge is to be calculated. When building a rule you do not identify the values of UDEs.

When you apply a product on an account class (in the Product Preferences screen), interest for all the accounts will be calculated according to the interest rule that you have linked to the product. That is, the principal, period and type of rate (not the numeric value) will be picked up from the accounts in the same manner. However, the numeric value for the rate can be different for each account class.

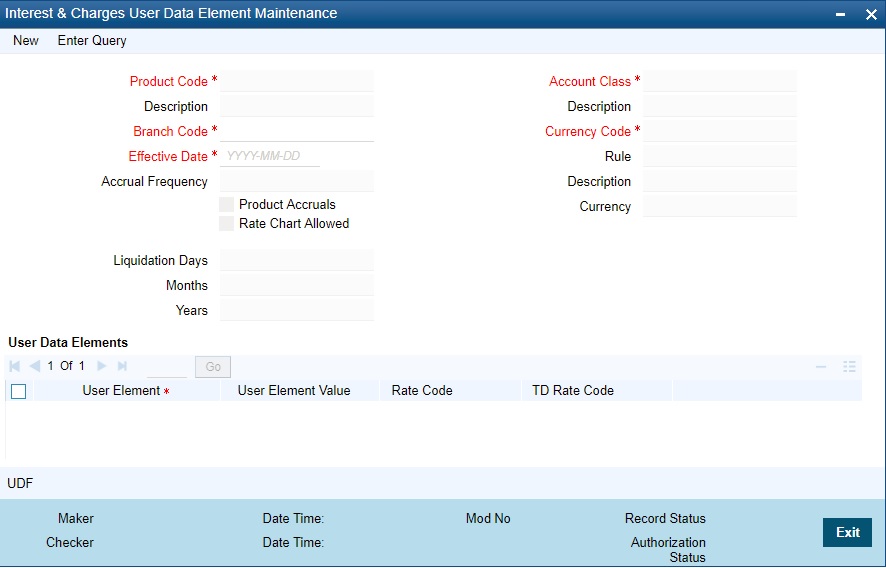

You can enter the actual values of the UDEs, for each account class to which you link the product, in the ‘Interest & Charges User Data Element Maintenance’ screen. You can invoke the ‘Interest & Charges User Data Element Maintenance’ screen by typing ‘ICDUDVAL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

When interest is calculated for the account classes, the principal, period and the rate will be picked up in the same manner. However, the value of the rate that is to be applied on each account class will be different.

Maintaining Different Effective Dates for UDEs

You must maintain the UDE values for each account class and currency combination on which you apply a product. If not, the system will assume all UDE values to be zero.

Product Code

Every product that you create is linked to a rule. When you build a rule, you identify the UDEs that would be required to calculate interest or charges. You do not give the UDE a value. This is because you can link a rule to many products and apply a product to many account classes (for which interest or charge is calculated using the same method but which have different UDE values).

For each account class (and currency) on which you apply a product, you should specify the values of the UDEs (which you identified for the rule that is linked to the product) in the UDE Values Maintenance screen.

The UDE values that you maintain here for a condition will be picked up when interest or charge is calculated for the account class.

Branch Code

You must specify the code of the branch for which the UDE Values being maintained are applicable as a general condition.

The branch code is displayed based on the Common Branch Restrictions for ‘ICRATES’ for your branch. The branches that are allowed for your home branch are displayed in the option list for Branch Code. This occurs only if ‘ICRATES’ has been maintained as a Restriction Type in the Common Branch Restrictions screen. If not, all Branch Codes are displayed including the ‘ALL’ option.

If your home branch is HO, then the Branch Code option list displays ‘ALL’ in addition to the list of branches allowed for your Home Branch.

If you try to maintain a UDE value for a specific branch, the system will check if the UDE value has been first maintained with Branch Code ‘ALL’. If it has not been maintained, an error message will be displayed forcing you to first maintain the UDE value for the Branch Code ‘ALL’.

The Rate Code option list will show all the rate codes maintained in the IC Rate Code Branch Availability screen. During UDE maintenance for a specific branch, if the Rate Code chosen is not available for the specific Branch, then a configurable override will be displayed.

Effective Date

The ‘Effective Date’ of a record is the date from which a record takes effect. You can maintain different values for a UDE, for different effective dates for each account class (and currency) on which you apply a product. When interest is calculated on a particular day for the account class, the value of the UDE corresponding to the date will be picked up.

The UDE values of a condition can be different for different dates. Typically, you would want to open records with different Effective Dates if the values of UDEs vary within the same liquidation period.

Rule

Every product that you create is linked to a rule. So when a product is selected from the Option list, the rule which is linked to it gets defaulted here.

Account Class

The different accounts in your bank may be classified into account classes. The different types of current accounts and savings accounts that you maintain are examples of account classes.

In this field, the account class gets defaulted from the interest product.

Currency Code

In this field, the currency code gets defaulted from the interest product.

User Element Amounts Currency

A User Data Element could be of ‘Amount’ type when it indicates a tier structure, a slab structure or just an amount that you would want to use in a formula. In this field, the currency in which the UDE is specified gets defaulted from the interest product.

Product Accruals

In this field, the product accrual gets defaulted from the interest product.

Accrual Frequency

The interest on an account can be accrued over a period. The term accrual frequency refers to the interval between two successive automatic accruals.

In this field, the accrual frequency gets defaulted from the interest product.

Rate Chart Allowed

The system defaults this preference from account class indicating the system should calculate TD interest based on the LDMM float rate maintained in the ‘LD MM Floating Rate input’ screen ( ‘CFDFLTRI’), If this box is checked, then system will pick interest rates based on different tenors, minimum amount, currency and effective date for a TD.

Note

- When you chick ‘Rate Chart Allowed’, the system does not display the UDE value corresponding to LD/MM. During IC calculations, the system adds the UDE value to the LD/MM derived rate and applies the interest accordingly.

- If ‘Rate Chart Allowed’ is checked, for Web branch transactions during TD account class defaulting, you need to maintain LD/MM floating rate code for the TD.

- During partial redemption/pre closure, the system picks the rate only for TDs having ‘Rate Chart Allowed’ checked.

Liquidation Frequency

The term ‘liquidation frequency’ refers to the interval between two successive periodic liquidations.

In this field, the liquidation frequency gets defaulted from the interest product

Implications of Closing UDE Record

Continuing with the example, if you close the UDE record with Effective Date 01 January 1998, in May 1998, for the entire liquidation period the UDE values specified for 01 April 1998 will apply for the product CRIN.

Note

Only if the periodicity (specified while creating a rule) is ‘Daily’ will the UDE values that you define for different effective dates be picked up. If you specified the rule application periodicity as ‘Periodic’ the UDE value as of the liquidation date will be picked up.

Identifying and Specifying Values for UDEs

For each account class, you must specify the values of all the UDEs that you identified while building the rule. The UDE value that you specify here will be picked up while calculating interest for the account class.

All the UDEs that you have identified for the rule (to which the product is linked) will be displayed here. The UDEs that are displayed here can be of four types. They are:

- Rate

- Amount

- Number

The interest that you charge on a debit balance is an example of a debit rate. The interest that you charge on a credit balance is an example of a credit rate.

A User Data Element will be an amount under the following circumstances:

- in the case of a tier structure, the upper and lower limit of a tier or a tier amount

- in the case of a charge, when it is indicated as a flat amount

- any amount that can be used in the definition of formula(e)

When you build a rule you will indicate the UDE to be a number if the interest or charge is defined based on the number of transactions or the number of account statements. A UDE under this category can also be used to store a numerical value that may be used in a formula.

Now, for each of the UDEs that are displayed, you must specify the values. If the type of UDE that you have identified for the rule is a ‘Rate’ element, you can either specify a Rate Code or enter a ’value’ for the Rate element.

If you specify a Rate Code for the UDE, the value that you have maintained for the rate code will be picked up while calculating interest. However, if you choose to enter a ‘spread’ for the Rate Code, the appropriate value will be computed. (A ‘Spread’ is a positive or negative value that you add or deduct to the value specified for the Rate Code). If you do not specify a spread, the rate maintained for the Rate Code will be picked up.

If the type of UDE is an amount, the value that you enter will be in the currency that you specified in the UDE amounts currency field (in the Interest Preferences screen). If you specified the UDE amounts currency as the local currency and the account class is in a foreign currency, all UDE values will be converted to the local currency. Currency conversions will be on the basis of the exchange rates maintained for the day.

TD Rate Code

Specify the rate code to be used for TD calculation. The adjoining option list displays all rate codes maintained using the ‘LD MM Floating Rate Input’ screen ‘CFDFLTRI’. You can select the appropriate one. You can use TD rate code only when ‘Rate Chart Allowed’ flag is enabled for the account class linked to product and for defining TD Rate code in rule UDE Type, it should be always maintained as ‘Rate as Rate Code’ for interest rate pickup for the account.

Note

Here you can define either Rate code or TD rate code and not both.

For more information on Floating Rate, refer ‘Maintaining Floating Interest Rates’ under ‘Retail Lending’ User Manual.

5.1.2 Printing UDE Values

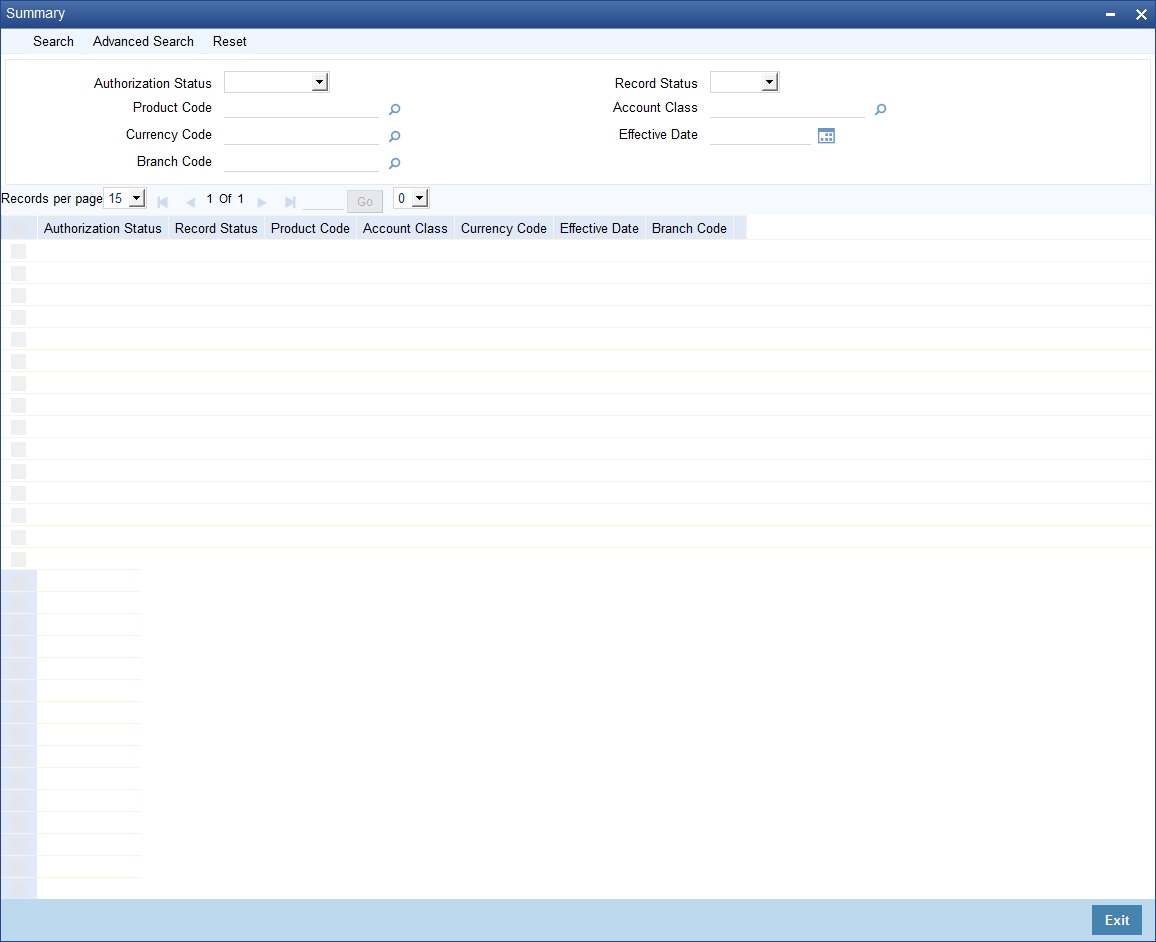

You can print out UDE values. You can invoke the ‘Interest & Charges User Data Element Summary’ screen by typing ‘ICSUDVAL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

From the summary screen specify the necessary criteria and click ‘Search’ button to view the search results. Double-click to open a record for printing and then select ‘Print’ from the Actions menu in the Application tool bar or click print icon.

In the screen, which appears select a checkbox to have the corresponding field in the print out. Then click arrow seen alongside to view the screen.

Now, once more select ‘Print’ from the Actions menu in the Application tool bar or click print icon at the top left corner of this screen to print it out.

Specifying the Branch Code

Specify the branch code for the UDE values you wish to print. Select a branch code from the option list provided.

The branch code is displayed based on the Common Branch Restrictions for ICRATES for your branch. The branches that are allowed for your home branch are displayed in the option list for Branch Code. This occurs only if ‘ICRATES’ has been maintained as a Restriction Type in the Common Branch Restrictions screen. If not, all Branch Codes are displayed including the ‘ALL’ option.

If your home branch is HO, then the Branch Code option list displays ‘ALL’ in addition to the list of branches allowed for your Home Branch.

If you try to maintain a UDE value for a specific branch, the system will check if the UDE value has been first maintained with Branch Code ‘ALL’. If it has not been maintained, an error message will be displayed forcing you to first maintain the UDE value for the Branch Code ‘ALL’.

The Rate Code option list will show all the rate codes maintained in the IC Rate Code Branch Availability screen. During UDE maintenance for a specific branch, if the Rate Code chosen is not available for the specific Branch, then a configurable override will be displayed.

Specifying the Product

Specify the product for which you wish to print UDE values. Select a product from the option list provided. Only those products that have already been associated with the selected branch code will appear for selection.

5.1.3 Maintaining Rate Codes

An Interest Rule is made up of SDEs, UDEs and formulae (refer the chapter ‘Maintaining Rules’ for details). While creating a rule you only identify the UDEs that you would be using to calculate interest. UDEs can be of the following types:

- Amount

- Number

- Rate

You enter the values of UDEs such as Amount and Number in the UDE Maintenance screen. The Debit or Credit rate is the rate at which interest has to be calculated for the accounts linked to the Interest Rule. These rates can be either:

- Fixed

- Floating

If the rates are fixed, you can specify their values in the UDE Maintenance screen. If you want to apply floating rates, you should link the rate type UDEs (identified for the interest rule) to a Rate Code in the UDE Maintenance screen. You can also specify a spread.

Typically, you would apply different rates of interest to different types of accounts. For example, you would apply different interest rates for current and savings accounts. For each currency, therefore, you will have to maintain different interest rates. The following example illustrates this.

You must assign the different rates that you maintain for a currency unique Rate Codes. For example, for savings accounts in USD you can define a Rate Code such as ‘SBUSD’. When you calculate interest for USD savings accounts linked to the rate code ‘SBUSD’, the rate that you maintain here will be picked up.

5.1.4 Defining Effective Date for Rate Code

Each rate that you maintain for a Rate Code and Currency combination should have an Effective Date associated with it. The ‘Effective Date’ of a record is the date on which a record takes effect.

The Effective Date that you specify for a rate is the date on which the rate comes into effect. Once a rate comes into effect, it will be applicable till a rate with another Effective Date is given for the same Rate Code and Currency combination. The following example illustrates this.

Note

- The Effective Date for a particular rate should be later than the Effective Date of the first rate that you have maintained for the Rate Code.

- The dates from which the debit and credit rates are effective can be different.

- There can be only one rate for an Effective Date

- The same rate cannot be entered for two consecutive dates for a Rate Code

- Note that only if you defined the application periodicity for the rule (to which you link a product) as daily will the changes in rate apply for accounts linked to the product. If the application periodicity is periodic, the rate as of the liquidation date will be applied.

5.1.5 Closing Rate for Date

This feature may be used if you do not want to use a rate for back-dated processing done, past the date. For example, you are on 31 March 1998 and your rate table has got rates for 01 March 1998, 15 March 1998, and 31 March 1998. If you close the rates for 01 March and 15 March, any back-dated processing that is done today, or subsequently, the rates defined for 01 March or 15 March will not be used. The rate as of 31 March will be used.

You will recall that subsequent to the definition of an interest product, you will associate the interest product with an account class and define the numeric values for the user data elements linked to the product. (Refer to the chapter ‘Giving UDE Values for a condition’ for further details).

5.2 Interest Rate Association for Account Class

This section contains the following topics:

5.2.1 Associating Interest Rate to Account Class

To recall, you associate an account class to a specific IC product through the ‘Interest & Charges – User Defined Element Values Maintenance’ screen. The rates applied are based on the IC rules maintained. Along with the different UDE rates defined in this screen, you also need to maintain whether a particular UDE applies for a credit interest rate or for a debit interest rate. Through this maintenance, the debit or credit rate for a particular account class and currency combination can be found.

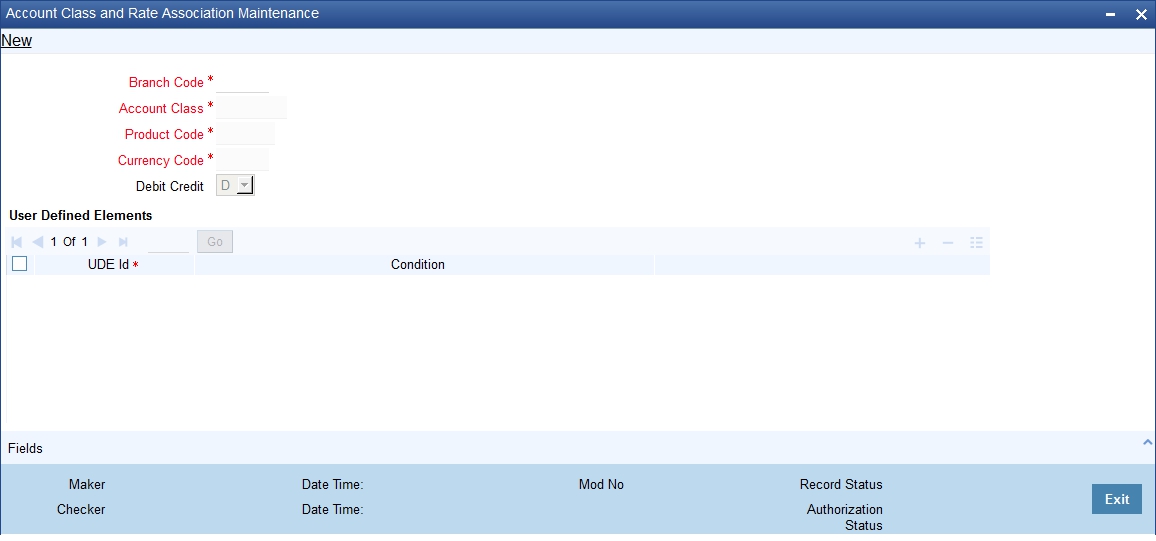

It is through the ‘Account Class & Rate Association Maintenance’ screen that you maintain the above specifications. You can invoke the ‘Account Class & Rate Association Maintenance’ screen by typing ‘STDACRMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Here, you specify the following:

Branch Code

The code of the branch for which a UDE is maintained.

The branch code is displayed based on the Common Branch Restrictions for ICRATES for your branch. The branches that are allowed for your home branch are displayed in the option list for Branch Code. This occurs only if ‘ICRATES’ has been maintained as a Restriction Type in the ‘Common Branch Restrictions’ screen. Otherwise, all branch codes are displayed including the ‘ALL’ option.

If your home branch is HO, the ‘Branch Code’ option list displays ‘ALL’ in addition to the list of branches allowed for your home branch.

Account Class

The account class to which a UDE applies to. Only the following account class types are made available here:

- Deposit

- Savings

- Current

For more information on account classes, you can refer to the section ‘Maintaining Account Classes’ in the chapter titled ‘Maintaining Mandatory Information’ in the Core Entities (CE) User Manual.

Product

The IC product name associated at the User defined Elements Maintenance for the chosen account class. For a given account class, only one IC product should be associated.

Currency Code

The currency for the chosen account class and IC product combination. The list of all currencies maintained through the ‘Currency Definition – Detailed’ screen is made available in the option list provided.

User Element Identification

The relevant UDE name for the chosen account class and IC product combination. The UDEs here are made available from the ‘Interest and Charges – User Defined Element Values Maintenance’ screen.

Debit Credit

The type of UDE. It could be either associated to a debit interest rate or a credit interest rate.

The following points are noteworthy:

- For a Deposit type account class, a credit UDE alone has to be maintained

- For savings and current account class types, both the credit and debit UDEs have to be maintained.

- If the underlying account class of an IC product (Credit or/and Debit product) gets modified in the IC maintenance, this maintenance also has to be modified to reflect the new changes.

5.3 UDE Values for Select Customer Accounts

This section contains the following topics:

5.3.1 Modifying UDE Values for Select Customer Accounts

To recall, when you associate an interest product with an account class, you have to define the values for the user data elements (UDEs) identified for the product. The values specified for the UDEs would apply on all accounts that are part of the account class. However, your bank may want to change the UDE values for select accounts. Oracle FLEXCUBE allows you to change UDE values for specific accounts, based on specified criteria.

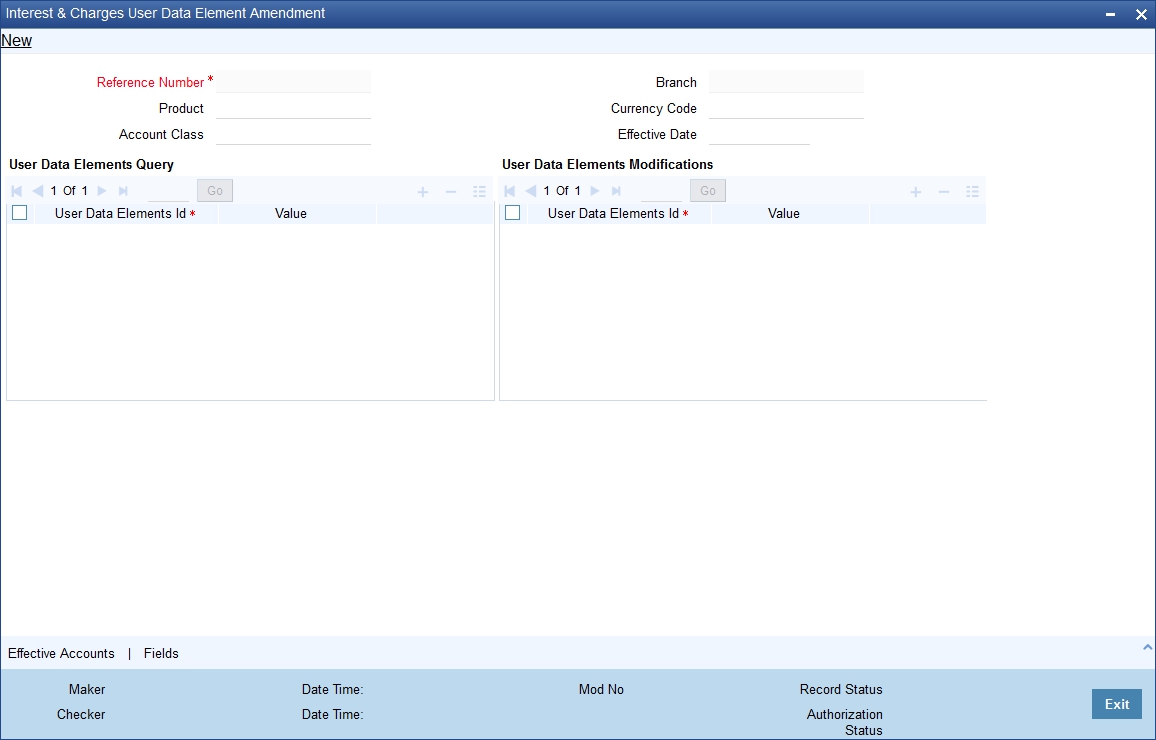

You can modify UDE values in the ‘User Defined Elements Values Maintenance’ Query screen. Invoke this screen from the Application Browser. You can invoke the ‘Interest & Charges User Data Element Amendment’ screen by typing ‘ICDUDEUL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Reference Number

Reference number is auto generated by the system. First three characters are taken as current branch.

Branch

This indicates the branch code for maintaining Interest and Charges User Defined Element Values. It gets defaulted to the current branch.

The branch code is displayed based on the Common Branch Restrictions for ICRATES for your branch. The branches that are allowed for your home branch are displayed in the option list for Branch Code. This occurs only if ‘ICRATES’ has been maintained as a Restriction Type in the Common Branch Restrictions screen. If not, all Branch Codes are displayed including the ‘ALL’ option.

If your home branch is HO, then the Branch Code option list displays ‘ALL’ in addition to the list of branches allowed for your Home Branch.

If you try to maintain a UDE value for a specific branch, the system will check if the UDE value has been first maintained with Branch Code ‘ALL’. If it has not been maintained, an error message will be displayed forcing you to first maintain the UDE value for the Branch Code ‘ALL’.

The Rate Code option list will show all the rate codes maintained in the IC Rate Code Branch Availability screen. During UDE maintenance for a specific branch, if the Rate Code chosen is not available for the specific Branch, then a configurable override will be displayed.

In this screen, you can specify that the customer accounts:

- associated with a particular interest product

- belonging to a particular account class

- maintained in a specific currency

- effective date from which interest rate is picked

should be queried and retrieved for the application of new values for calculating interest.

It is not necessary for you to indicate all the three conditions. For example, if want to change the interest calculation parameters only for accounts belonging to a particular account class, specify only the account class.

Note

At the time of selecting the account class and currency, the system will display only the account classes and currencies associated with the interest product (this is only if you have specified an interest product).

You also need to specify the date from which the new values have to become effective.

In the ‘Query’ section of the screen, click on option list in the ‘User Data Elements’ field. The user data elements associated with the interest product will be displayed. (If you have not specified an interest product, UDE’s associated with all the interest products will be displayed). Select the user data element whose value has to be changed and enter the value of the UDE that has to be changed.

In the ‘Modifications’ section of the screen, select the UDE again and specify the new value for the UDE.

To modify the interest calculation parameters, make the following entries:

- Interest Product – CRIN

- Account Class- INDSBL

- Currency –USD

- Effective Date – 01-OCT-2001

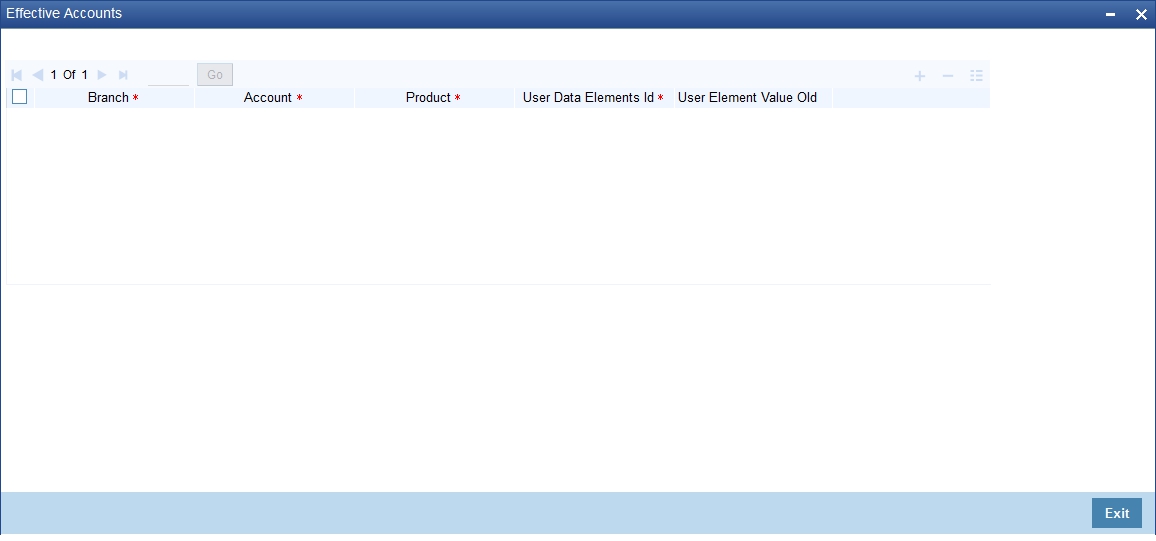

System will check all the customer accounts and displays the accounts that will be affected because of the change in the value of the interest calculation parameters. Click ‘Effected Accounts’ to view the accounts that have been affected.

The system will display a message if the new value of the interest calculation parameters has not affected any accounts.