11. Daily Processing of Interest and Charges

The interest and charges batch function processes liquidation’s and accruals for the day. This process should be executed after the end of transaction input has been marked for the day, for your branch.

For those accounts marked for auto liquidation and accrual, the End of Day process

- Passes liquidation entries

- Passes accrual entries

- Reverses accrual entries (if there have been changes to the data relating to interest or charges)

This chapter contains the following topics:

- Section 11.1, "Maintenance Consistency Checks"

- Section 11.2, "IC Intra-day Batch"

- Section 11.3, "Liquidating Interest Automatically"

- Section 11.4, "Automatic Accruals"

- Section 11.5, "Reversing Accrual Entries"

- Section 11.6, "Consolidated Charges Processing"

- Section 11.7, "End of Day processing for Debiting Receivable GLs"

11.1 Maintenance Consistency Checks

When you mark the end of transaction input for the day, the IC Maintenance Consistency Check reports any inconsistencies in the data that you have maintained. The IC Maintenance Consistency Check reports the following inconsistencies in data:

- unauthorized accounts

- unauthorized account classes

- unauthorized currencies

- unauthorized products

- unauthorized rules

- invalid account entry setup

- unauthorized General Conditions

11.2 IC Intra-day Batch

IC Intra-day job reduces the processing time of ICEOD batch process. As part of IC Intra-day batch system does Resolution, VD Balance update; back valued processing, Calc & Accrual (not posting entries) during the day. Intra-day job runs only for branches, where IC_INTRADAY_BATCH is installed.

The following points can be noted:

- During a day, if multiple transactions happens to account and intra-day is run, then each time adjustment to the accrual amount are posted to deferred tables and in EOD, such entries are consolidated based on same value date and user id and accounting entries are posted.

- In case of back dated account, with account open date before a liquidation cycle, intra-day accrual happens only till the liquidation date and not till current date. Accruals till current date is done at EOD.

- In case of Cumulative TD accounts, multiple cumulative rate pick-ups for TDs opened on same day happens at EOD and not in intra-day.

- If exchange rate is changed in intra-day, and post that if an intra-day accrual happens, then revised exchange rate is impacted only in EOD on actual posting.

- If accrual changed from product level to account level or vice versa, after an intra-day, it only impacts accruals posted after change.

- Full redemption made to an account with account level accrual, post an intra-day accrual, accrual calculated is posted online and reversal of accrual also happens online on redemption.

- Full redemption made to an account with product level accrual, post an intra-day accrual, accrual calculated and reversal of accrual happens in EOD, since consolidated amounts are posted for product level accrual.

- If RD payment reversal is made to an account, post an intra-day accrual, the unprocessed accrual will be posted on reversal. And in EOD, reversal for posted amount happens. This is common for both account & product level accruals.

- If cheque is rejected after manual renewal, then recalculation happens only in EOD and not in next intra-day.

- During ILIQ date, if any change is made post an intra-day, then revised accruals will be posted only in EOD.

11.3 Liquidating Interest Automatically

You will recall that you can liquidate interest for accounts either

- automatically

- on an ad hoc basis

If you opt to liquidate interest automatically, you must specify the liquidation date and frequency for the product (in the Product Preferences screen) which you apply on the account(s). On the scheduled liquidation date, interest will automatically be liquidated by the IC End of Day process for the accounts.

If the interest liquidation day falls on a holiday, interest for those accounts that are to be liquidated on the holiday will be liquidated by the End of Day process that is run on the last working day before the holiday. However, processing for a holiday will be done on the next working day will be done on the subsequent working day if the holiday falls in the next financial cycle.

An ad-hoc liquidation can be carried out any time on an account, even if it has been defined for automatic liquidation. An ad-hoc liquidation of interest on an account (defined for auto liquidation) will liquidate interest till the date that you have specified. The subsequent automatic liquidation of the account will be for the remaining days in the liquidation period.

Generating Interest Statement

Interest Statements will be generated for applicable accounts. That an interest statement should be generated is specified for the interest liquidation event (ILIQ).

Generating Rate Change Advice

The Rate Change Advice will be generated when you mark the end of financial input for the day. This advice will be generated for all those accounts that had a UDE change event in any of the UDE rate values in the products linked to them.

11.4 Automatic Accruals

While building a formula for the rule to which you have linked the product, if you indicated that the result of the formula is interest that should be accrued, the interest amount for all the accounts linked to the product will be accrued.

When defining the preferences for the product, if you specified the accrual frequency, interest will be accrued, by the End of Day process, according to the frequency you have specified.

Accruals will also be performed whenever there is interest liquidation. For an account on which a liquidation is done out of turn (an ad-hoc liquidation when a periodic liquidation is not due), accrual entries will be passed till the date of liquidation.

Entries will be passed to the accrual accounts that you specified while creating the product (that you have applied on the account). If you specified that accrual entries have to be passed for a product rather than for individual accounts, a consolidated entry will be passed for the product. If not, an entry will be passed for each account on which you have applied the product.

Note

An ad-hoc liquidation of interest on an account (defined for auto liquidation) will liquidate interest till the date that you have specified. The subsequent accrual of interest will be from the date of the ad hoc liquidation.

The details of accruals for each account will be available in the Accrual Control Journal, a report generated whenever accruals are performed as part of end of day processing.

End of Day processing for Tax/Non tax IC products

In case of IC product maintained as a Tax product or non-tax product, the EOD processing occurs in the following manner:

The system applies the existing formula for calculation the credit interest for all accounts of the Non –Tax products. The processing of all Non Tax products is done first. The system calculates, accrues and liquidates these accounts and then subsequently processes the Tax products.

You need to maintain the formula for Tax products in the given format:

- TOT_INTEREST_AMOUNT > TDS_LIMIT

- INTEREST_AMOUNT * TAX_RATE

The TDS amount is deducted from the customer account and the relevant accounting entries will be posted for all Tax products. However, no accounting entries are posted for Non Tax products.

For the Event IACR (Interest Accrual), no accounting entries are posted for Tax products. The following accounting entries for the TDS amount will be passed when the ILIQ event (Interest Liquidation event) is triggered:

- Dr Customer

- Cr Tax payable

11.5 Reversing Accrual Entries

Some changes in IC maintenance may necessitate the reversal of accrual entries already passed. These reversal entries are passed by the IC Daily functions. Some of the situations that require a reversal of accruals are:

- Closure of a product to which an account is linked

- Delinking of an account from a product

11.6 Consolidated Charges Processing

When the liquidation event (LIQD) is triggered for charge products linked to consolidated charge products, charges are computed depending upon the rule associated, but the corresponding entries are not posted. Similarly, for account classes linked to consolidated charge products, charges are computed during liquidation (LIQD) but are not posted.

A consolidated entry (comprising the charge entries for all linked charge products, for all account classes using the consolidated charge product) is posted when the liquidation is executed in respect of the consolidated charge product, after applying the applicable discounting and the range (minimum / maximum) validations.

11.7 End of Day processing for Debiting Receivable GLs

This section contains the following topics:

- Section 11.7.1, "Liquidating Debit Interest and Charges"

- Section 11.7.2, "Auto Liquidation"

- Section 11.7.3, "Manual Liquidation"

- Section 11.7.4, "Processing Write-off for the new Status"

- Section 11.7.5, "Processing Recovery of OD Account"

11.7.1 Liquidating Debit Interest and Charges

In the Account Class maintenance screen you have specified the liquidation preferences for debit interest and charges, in respect of those accounts classes where interest / charge has to be debited from a Receivable GL before actually debiting the customer account. You have also identified the Receivable GL in the preferences section of the ‘IC Products’ screen.

As a result, during the end of day processes the receivable GL is debited instead of the customer account for debit interest and charges. The Debit Interest Notification message (in the case of charges, the Charge Notification message) containing the due date and the amount due is generated and sent to the customer only if you have specified this as a preference for the account class.

The interest receivable is stored at the following level:

- Branch + Account

- Product

- Formula Number

- Book Date

Details of the Related Account, Receivable GL, Actual Liquidation date (which is computed on the basis of your specification in the Account Class screen), Interest Amount Due and Charges Due are also stored.

Debit interest (and charges) can be liquidated either manually or automatically. This specification is defaulted from the Account Class linked to the account. During liquidation (ILIQ), the Customer Account is debited and the Receivable GL is credited. The Liquidation Reference Number is a combination of:

BRN_ + Prod_ + Currency + ‘L’ + Formula number

11.7.2 Auto Liquidation

Auto liquidation is performed as part of the IC BOD operations. All accounts that have debit interest and / or charges due on the application date are processed. All pending liquidations are processed. All account with interest amount due and / or charges due where the Due Date is less than or equal to the Application Date are processed.

If the verify funds option is enabled for the account class of the account, a check to verify the availability of funds is also performed. In case there are funds to process the amount partially, partial liquidation is also performed.

Note

Remember to set up the IC BOD processing as a mandatory process. It should be executed during the BOD processes for Interest Liquidation as well as Charge Liquidation.

11.7.3 Manual Liquidation

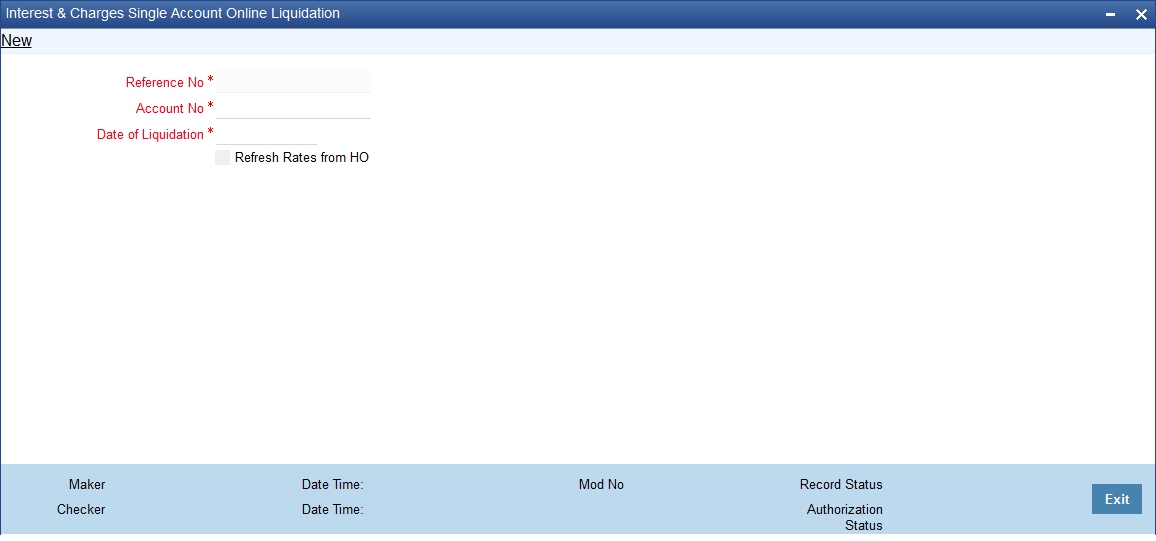

Manual liquidation for either debit interest or charges (or both) is triggered through the Interest and Charges Single Account Online Liquidation screen available in the Application Browser.

You can invoke the ‘Interest & Charges Single Account Online Liquidation’ screen by typing ‘ICDLIQAC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

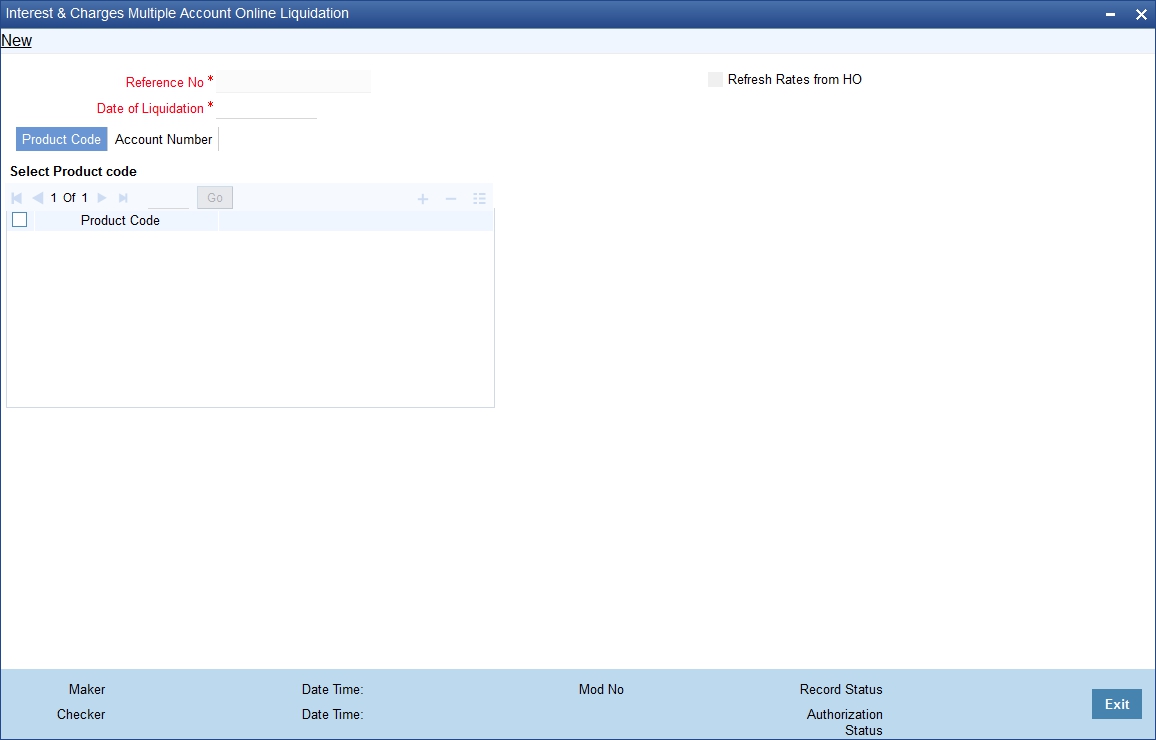

Manual liquidation for either debit interest or charges (or both) is triggered through the Interest and Charges Multiple Account Online Liquidation screen available in the Application Browser.

You can invoke the ‘Interest & Charges Multiple Account Online Liquidation’ screen by typing ‘ICDOLIQ’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

During manual liquidation you must specify the Account Number and the Value Date. The account number is the book account. The value date is defaulted to the application date. You can change the Value Date if required. While passing the entries, the System ensures that the Value Date is not less than the Booking Date of the receivable.

Some of the checks performed during manual liquidation are:

- All accounts that have interest due on or before the application date are picked up for processing

- Accounting entries are passed as of the Value Date that you specify

- The verify funds option is not applicable for manual liquidation. The System displays an override in case of insufficient funds. You have the option of stopping or continuing the liquidation.

Note

Liquidation (both auto and manual) will be in the order of the Liquidation Date. If any interest is due from the previous period, it will be liquidated first.

Formula-wise prioritizing is not done while processing, i.e. if two debit interest formulae/products are due on the same date, the System will not follow any specified order in processing them.

11.7.4 Processing Write-off for the new Status

When the status of an OD account changes to Write-off, then before triggering IC EOD batch, the system triggers the status change batch at EOTI stage.

When the status of an OD account changes to Charge-off, then the system processes Write-off as follows:

- Liquidates the interest accrued till date, into the OD account.

- Reverses interest income for the current financial year or reverse income days, whichever is least.

- Marks principal amount as bad debit

- Automatically transfers balance amount of OD account, if Reporting Line is maintained

11.7.5 Processing Recovery of OD Account

To recover OD account, then before processing status change batch, the system triggers ICSOD at EOTI stage. The ICSOD batch updates the paid interest for the recovery transaction done on a day in data store.

If total recovery is processed for the OD account, then you can process online liquidation of the accrued interest and post the recovery transaction on OD account from ‘Online Liquidation’ screen.

Note

If Liquidate Using Receivable is checked and Liquidation Days is not maintained, and if the account has sufficient balance, then system will debit the account directly instead of the receivable GL. If Liquidation Days is maintained (which is greater than zero), then the system will always debit receivable GL without considering the account balance.