13. Maintaining Interest Statement Details

When defining interest rules in the Rule Maintenance screen, you identify the components that should be used in the calculation of interest -- that is, the principal, the number of interest days, the tier structure, the rate, etc. Interest for an account will be calculated according to the formulae defined for the rule that you have applied on the account. The result of a formula is the interest for the account.

When you liquidate interest for an account, you can generate an ‘interest statement’ for the benefit of the account holder. An Interest Statement would, typically, provide the account holder information about the interest that was applied on the account.

In Oracle FLEXCUBE, you can build interest statements to suit the requirements of your bank. You can define the details that you would like to include in interest statements in the ‘Interest Statement Maintenance’ screen.

Note

An interest statement will be printed for an account only if the statement details are maintained for it.

This chapter contains the following sections:

- Section 13.1, "Interest Statements"

- Section 13.2, "Printed Value Identification"

- Section 13.3, "Interest Statement Generation"

13.1 Interest Statements

This section contains the following topics:

13.1.1 Maintaining Interest Statements

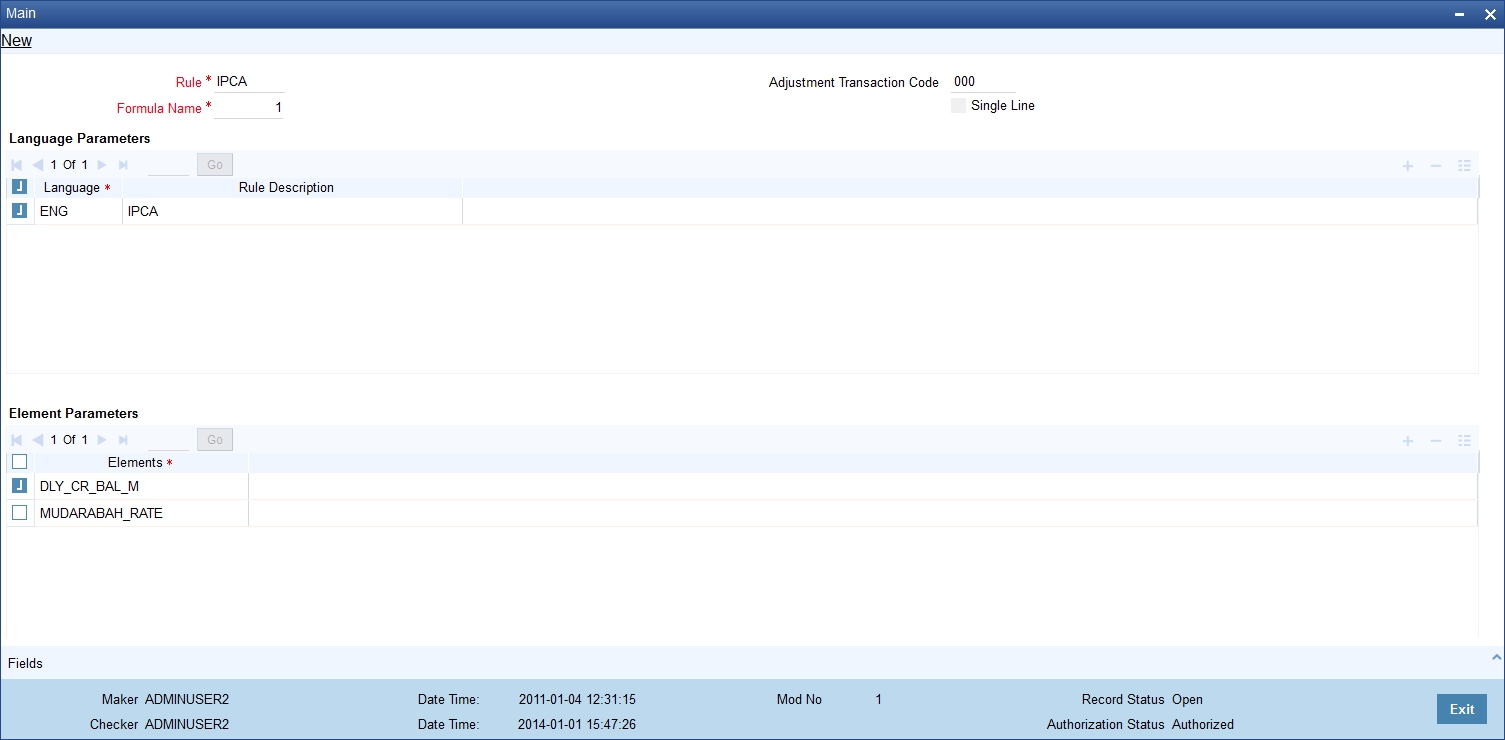

You can maintain Interest statements via the ‘Interest Statement Maintenance’ screen. You can invoke the ‘Interest Statement Maintenance’ screen by typing ‘ICDISFMT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.I

Rule

Interest is calculated for an account using the formulae that you have defined for the interest rule (applied on the account). To recapitulate, depending on your definition, the result of formulae may be an amount that is to be:

- booked

- not booked

- a tax amount

A tax amount or an amount that is to be ‘booked’ would, usually, be posted to the customer account. The result of formulae that are posted to customer accounts will be reflected in the interest statement you provide your customer.

The codes that you have used while defining interest and charge rules, SDEs, and UDEs, will be printed per se in an interest statement, if you choose not to maintain the details for an interest statement. For example, when you defined a rule to calculate debit interest you may have assigned the code ‘DRIN’. This rule code will be printed on the interest statement if you do not maintain a specific description for it while maintaining the interest statement.

The purpose of maintaining an interest statement is to explain to an account holder each accounting entry with reference to the interest rule that was applied.

Adjustment Transaction Code

When maintaining interest statements, you can identify the transaction code against which manual interest adjustment entries are posted. All entries tracked against the particular transaction code will be reflected in the interest statement that is generated.

A list of transaction codes maintained in the ‘Transaction Codes Maintenance’ screen is displayed in the option list positioned next to this field. You can select the appropriate transaction code.

13.2 Printed Value Identification

An interest rule consists of SDEs and UDEs. Using the SDEs and UDEs that you identified for a rule, you can build formulae. The result of a formula is an amount that is posted, as interest or charge, to an account.

When interest is liquidated for an account, the SDE is picked up from the account and the UDE value is picked up from the ‘UDE Maintenance’ screen. You can choose to print the details of the UDE and the SDE that was used to compute interest or charge for an account in the interest statement.

You can choose to print the details of the:

- rule

- the SDEs

- the UDEs

that were used to calculate interest or charge for an account (in the interest statement) in a language of your choice.

In the Elements field, you can invoke a list of the SDEs that you identified for the rule (specified in the Rule field). Choose an SDE by double clicking on it. Now, for the SDE that you have chosen, you can enter a description in the Header field. You can describe the SDE in a language of your choice.

Similarly, enter a description for each of the UDEs that you have specified for the rule.

13.3 Interest Statement Generation

The interest statement will be generated whenever interest is liquidated for an account. This liquidation could either be the periodic automatic liquidation, or an ad hoc one.