3. Maintaining Syndication Funds

3.1 Introduction

Finance syndication is an agreement reached between a contributor and a Bank or Financial institution which pool funds. The details related to syndication of these funds are maintained in the system as Islamic syndication funds. This chapter provides an input on various attributes maintained for an Islamic syndication fund.

3.2 Islamic Finance Syndication

This section contains the following topics:

- Section 3.2.1, "Maintaining Islamic Finance Syndication"

- Section 3.2.2, "Main Tab"

- Section 3.2.3, "Syndication Mapping Tab"

- Section 3.2.4, "Contributing Parties Tab"

- Section 3.2.5, "Service Charge Tab"

- Section 3.2.6, "Viewing Linkage Details"

- Section 3.2.7, "Validations for Financial Syndication"

- Section 3.2.8, "Syndication Amendment"

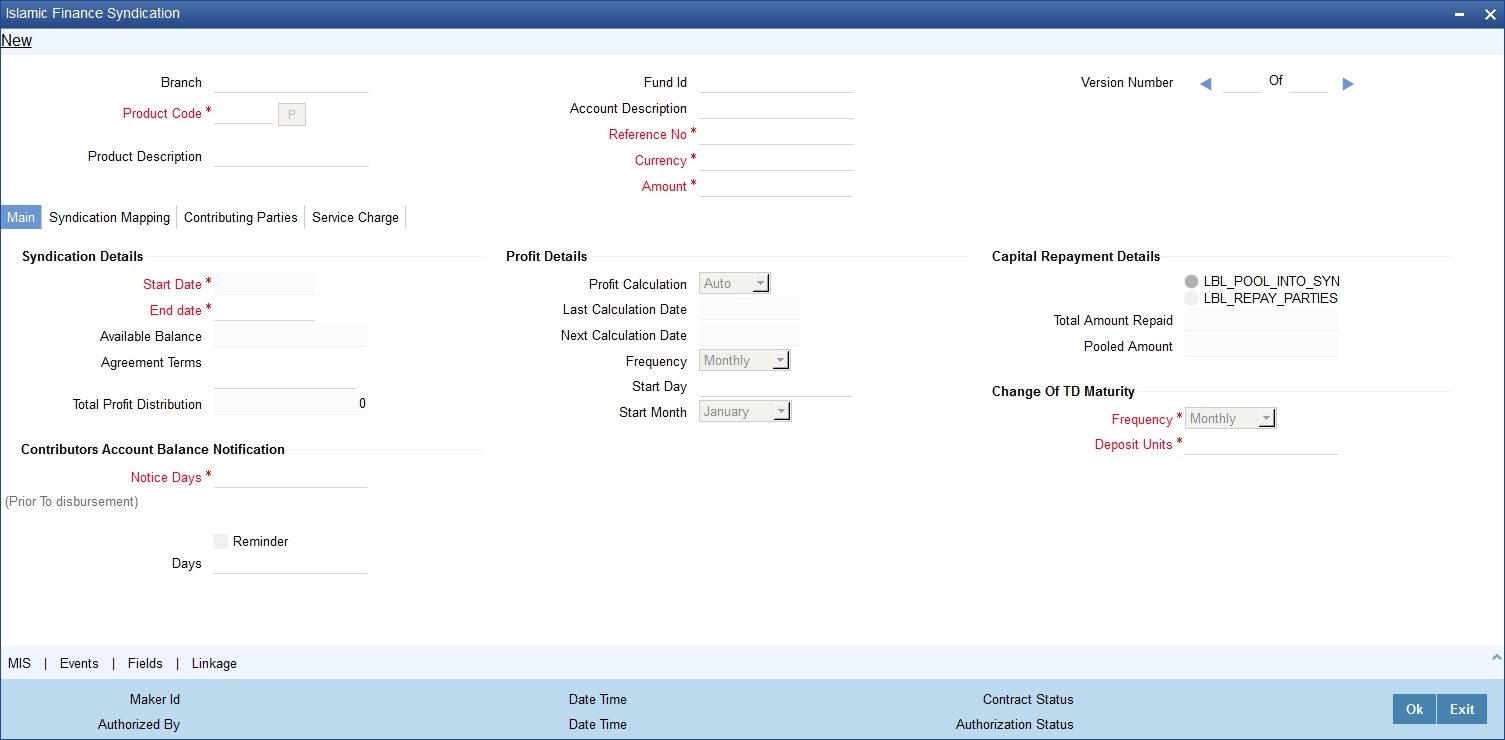

3.2.1 Maintaining Islamic Finance Syndication

Oracle FLEXCUBE facilitates maintenance of Islamic syndication funds using ‘Islamic Fund Online’ screen. You can invoke ‘Islamic Fund Online’ screen by typing ‘IADISLNS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can maintain the following parameters here:

Branch Code

The system displays branch code of the current branch here.

Product Code

Specify a valid product code you need to maintain as Islamic syndication fund. The adjoining option list displays all valid product codes supporting Islamic syndication. You can select the appropriate one.

Product Description

The system defaults the description of the selected product code here.

Fund ID

The system generates an ID of the syndication fund associated with the selected product.

Description

Specify a short description for Islamic syndication fund you are maintaining.

Reference No

The system generates a unique reference number for the selected product here.

Currency

Specify the currency you need to assign to the generated fund ID. The adjoining option list displays all valid currencies maintained. You can select the appropriate one.

Amount

Specify the syndication amount in the specified currency for the generated fund.

3.2.2 Main Tab

The additional information related to Islamic syndication fund is maintained in ‘Main’ tab. Click on the ‘Main’ tab to maintain additional information.

Syndication Details

You can maintain the following syndication details here:

Start Date

The system defaults current date as the start date for Islamic fund syndication and you cannot modify the same.

End Date

Specify the date till when you need to create Islamic fund syndication from the adjoining calendar.

Available Balance

The system computes the balance available for the specified syndication fund.

Agreement Terms

Specify terms agreed between the contributors and the Bank for fund syndication.

Total Profit Distribution

The system computes the total profit distributed among the contributors till the current date.

Profit Details

You can maintain the following profit details here:

Profit Calculation

Select a valid method to calculate profit for the specified syndication fund from the adjoining drop-down list. This list displays the following values:

- Auto – Select if you want to auto calculate the profit for syndication fund.

- Manual – Select if you want to manually calculate the profit for syndication fund.

Last Calculation Date

The system displays the date when the profit was last calculated.

Next Calculation Date

The system displays the date when the next profit calculation is due.

Frequency

Select a valid frequency period at which you need to calculate profit from the adjoining drop-down list. This list displays the following values:

- Monthly – Select if you need to calculate the profit monthly.

- Quarterly – Select if you need to calculate the profit quarterly.

- Half Yearly – Select if you need to calculate the profit half yearly.

- Yearly – Select if you need to calculate the profit half yearly.

Start Day

Specify a valid day from when you need to start calculating the profit.

Start Month

Select a valid month from when you need to start calculating the profit from the adjoining drop-down list, if the profit calculation mode is ‘Auto’. This list displays the names of months.

Capital Repayment Details

Select a valid method to repay the capital amount from the options available. The system displays the following values for selection:

- Pool into Syndication – Select if you need to pool the capital amount into syndication

- Repay to the Parties – Select if you need to repay the capital amount to the contributors

Total Amount Repaid

The system computes the sum of amounts paid to syndication fund from various financing transaction, if ‘Capital Repayment Mode’ is maintained as ‘Repay to the Parties’.

Pooled Amount

The system computes the sum of amounts paid to syndication fund from various financing transaction, if ‘Capital Repayment Mode’ is maintained as ‘Pool into Syndication’.

Change of TD Maturity Details

You can maintain the following details related to TD Maturity changes:

Frequency

Select frequency at which you need to extend the maturity date of the deposit account from the adjoining drop-down list. This list displays the following values:

- Monthly – Select if you need to extend maturity date of deposit account monthly.

- Quarterly – Select if you need to extend maturity date of deposit account quarterly.

- Half Yearly – Select if you need to extend maturity date of deposit account half yearly.

- Yearly – Select if you need to extend maturity date of deposit account yearly.

Units

Specify the number of units by which you need to move the TD maturity extension for selected frequency.

Contributors Account Balance Notification

You can maintain the following notification details related to contributors account balance:

Notice Days

Specify number of working days prior to which you need to issue the notice to the contributing parties for the amount to be disbursed.

Note

Value of notice days is the difference between the disbursement schedule due date and the current date of the system.

Reminder

Check this box if you need to send a reminder for the previously issued notice.

Days

Specify number of working days after which you need to send the reminder for the previously issued notice, if you have checked the ‘Reminder’ check box.

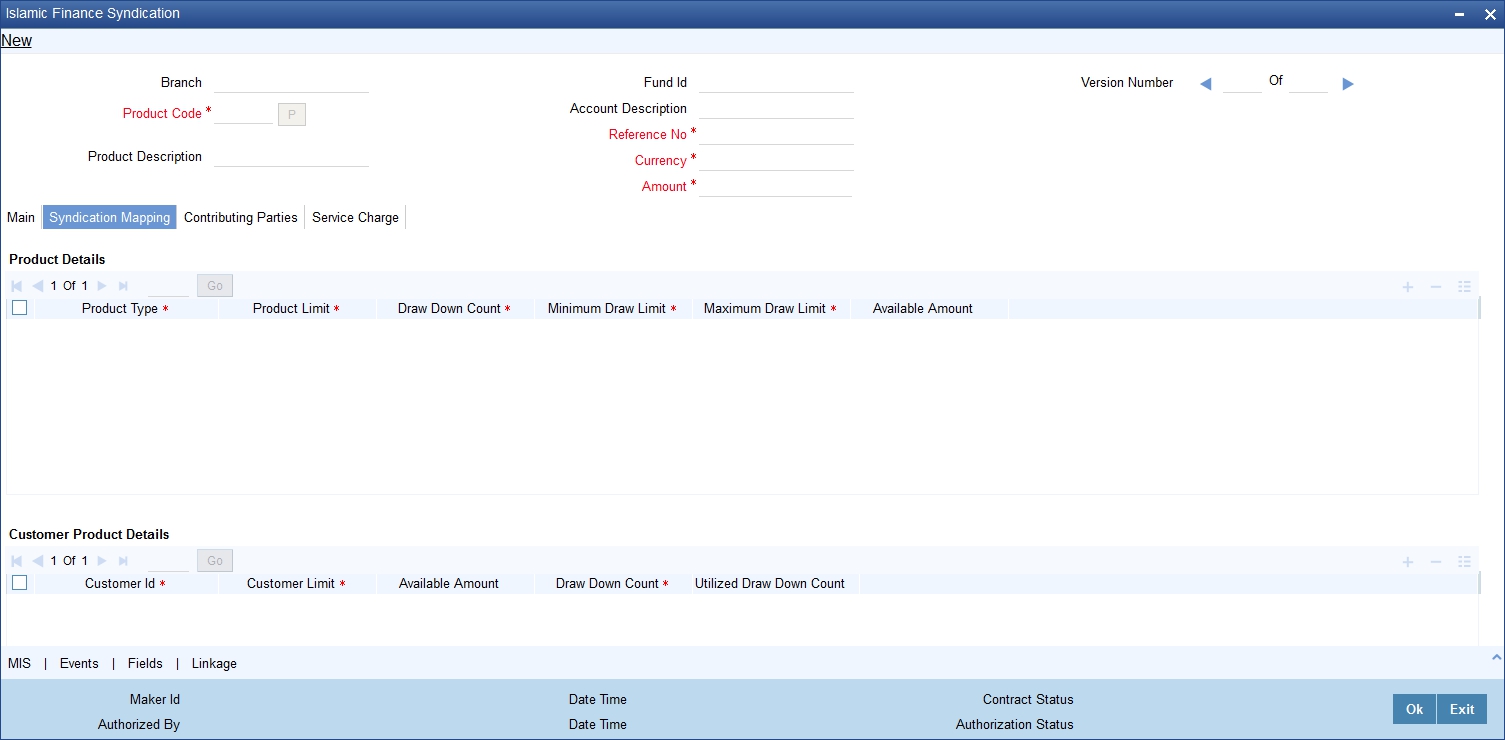

3.2.3 Syndication Mapping Tab

The system enables association or mapping of syndication fund to eligible product type with limit amount. These product types can in turn be mapped to the borrowers with limit amount.

You can map syndication fund, product types, and borrowers under ‘Syndication Mapping’ tab. Click ‘Syndication Mapping’ tab on ‘Islamic Syndication Fund’ screen.

You can maintain the following parameters here:

Product Details

The following product details can be maintained here:

Product Type

Specify a valid product type you need to maintain for the specified product. The adjoining option list displays all valid product types maintained for Islamic products. You can select the appropriate one.

Product Limit

Specify a valid limit you need to allow for the specified product type.

Draw Down Count

Specify number of times you need to disburse the fund for the specified product type.

Minimum Draw Limit

Specify minimum amount you want to disburse for the specified product type.

Maximum Draw Limit

Specify minimum amount you want to disburse for the specified product type.

Available Amount

The system computes the balance amount available for the specified product type.

Customer Product Details

You can maintain the following customer product details:

Customer ID

Specify a valid ID of the customer you need to maintain for the specified product. The adjoining option list displays all valid customer IDs maintained for Islamic products. You can select the appropriate one.

Customer Limit

Specify maximum amount you need to allow for the specified customer and product type combination.

Available Amount

The system computes the balance amount available for the specified customer and product type combination.

Draw Down Count

Specify number of times you need to disburse the fund for the specified customer and product type combination.

Utilized Draw Down Count

The system computed the number of times customer has utilised the allotted amount through CI contracts.

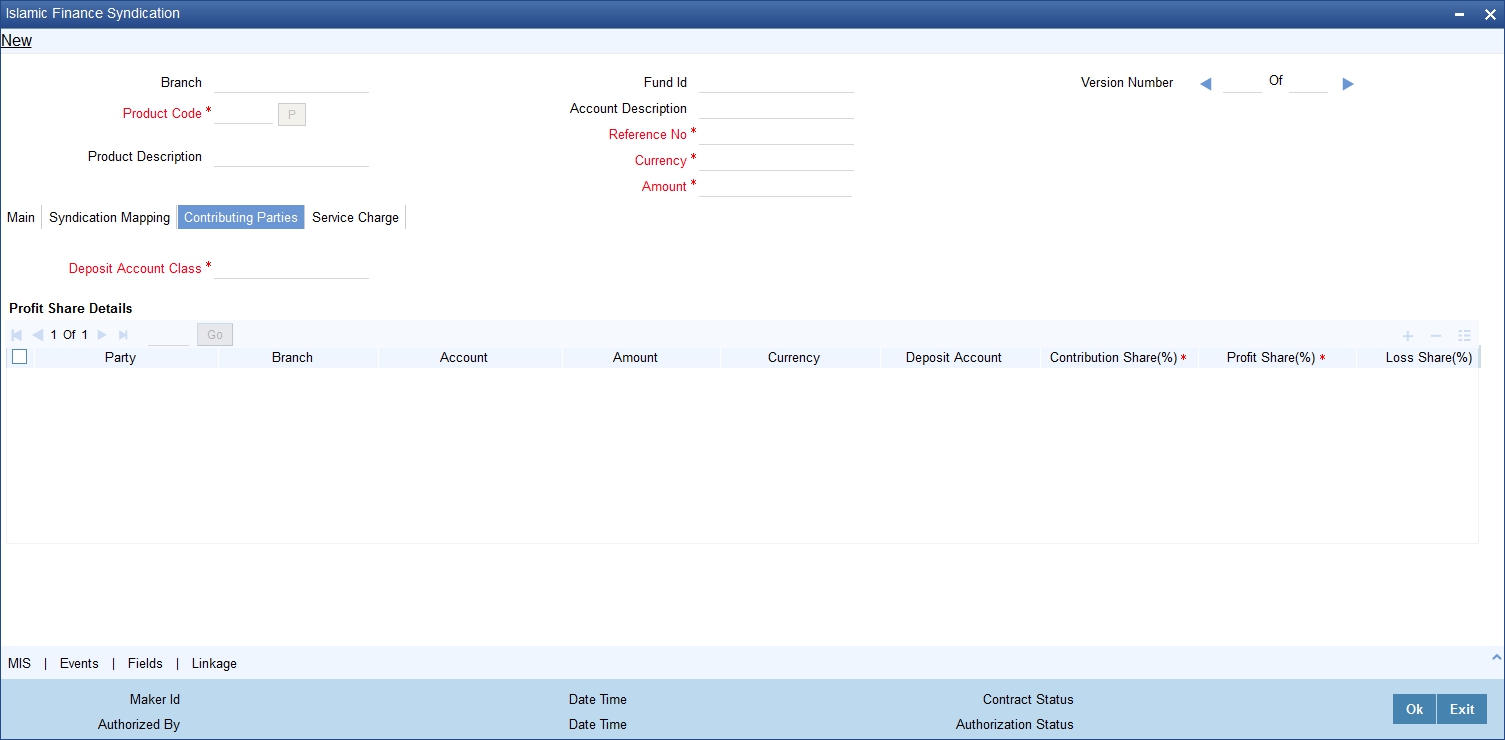

3.2.4 Contributing Parties Tab

Fund pooled by the contributors is equal to the syndication amount. That is, the sum of the contributors’ share is equivalent to the syndication amount. You can track the amount contributed by the individual party through a deposit account, created during EOD as part of capital subscription batch. You can maintain the details related to contributing parties under ‘Contributing Parties’ Tab. Click ‘Contributing Parties’ tab on ‘Islamic Syndication Fund’ screen.

You can maintain the following parameters here:

Deposit Account Class

Specify valid account class you need to maintain for the generated deposit class. The adjoining option list displays account classes maintained for Islamic accounts, provided they are not associated with any fund ID. You can select the appropriate one.

Note

- Mudharabha rate is ‘0’ for the linked TD account class

- Tenor of the account class is same as that of syndication fund.

- Auto rollover is disabled

Profit Share Details

You can maintain the following profit share details here:

Party

Specify valid customer ID of the customer you need to maintain the contributing details. The adjoining option list displays all valid customer IDs maintained for Islamic accounts. You can select the appropriate one.

Branch

Current branch of the account is defaulted here.

CASA

Specify valid customer account you need to maintain for the specified party. The adjoining option list displays all valid Islamic accounts maintained for the selected contributing party. You can select the appropriate one.

Amount

The system calculates and displays the amount subscribed by the contributor, during capital subscription.

Currency

Syndication currency is defaulted here.

Deposit Account

The system displays deposit account number, created as part of capital subscription batch, for all parties involved in syndication.

Note

The deposit account is not created for the Bank

Contribution Share (%)

Specify percentage of amount invested by the specified party.

Profit Share

Specify percentage of profit gained by the specified party.

Loss Share

The system defaults the contribution share percentage as the loss share percentage while saving the fund.

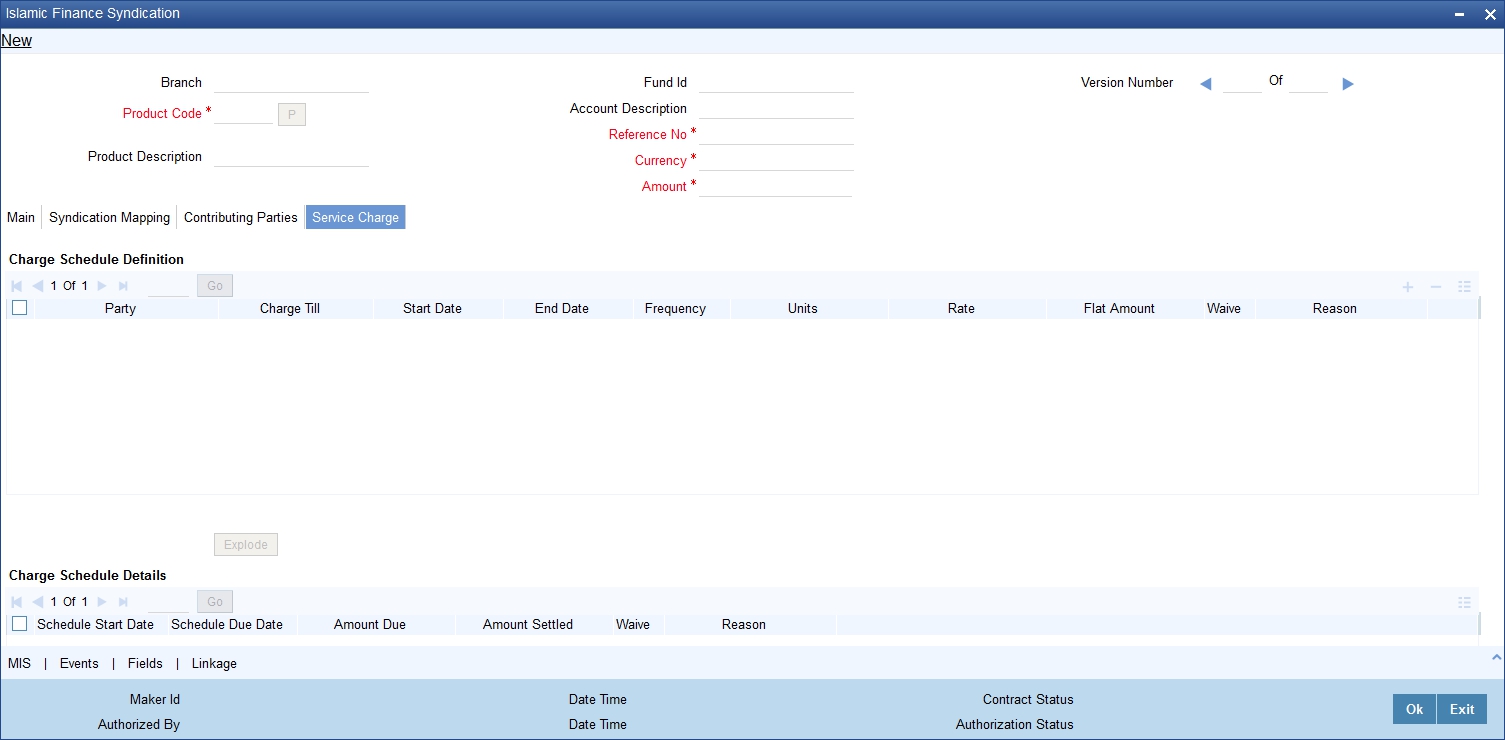

3.2.5 Service Charge Tab

Based on the predefined schedule, all the contributing parties pay service charge to the bank for their share of contribution. Charge schedule is maintained for individual contributing parties involved in the syndication fund. You can define charge schedule and compute the charge schedule based on the definition under ‘Services Charge’ tab. Click ‘Services Charge’ tab to maintain service charge details.

You can maintain the following parameters here:

Charge Schedule Definition

You can define the following charge schedule details:

Party

Specify the contributor for whom the charge details have to be defined. The adjoining option list displays all valid customer IDs maintained for Islamic accounts. You can select the appropriate one.

Charge Till

Select period until which you need to charge the parties involved in syndication fund, from the adjoining drop-down list. This list displays the following values:

- Syndication End Date – Select if you need to charge till syndication end date

- Defined Period – Select if you need to charge for the defined period

Start Date

Specify a valid date from when you need to collect charge from the adjoining calendar, if you have selected to charge till defined period.

End Date

The system defaults the end date for collection of charges based on the selected frequency and unit, if the charge till is defined period. Else, fund end date will be defaulted while saving the fund.

Frequency

Select frequency to define the charge calculation basis for the contributor, from the adjoining drop-down list. This list displays the following values:

- Monthly – Select if you need to extend maturity date of deposit account monthly.

- Quarterly – Select if you need to extend maturity date of deposit account quarterly.

- Half Yearly – Select if you need to extend maturity date of deposit account half yearly.

- Yearly – Select if you need to extend maturity date of deposit account yearly.

Units

Specify the number of frequency units till which you need to calculate the charge, if the charge till is defined period. Else, the system derives the units based on the maintained frequency, start date and end date

Rate

Specify a valid percentage of the available deposit amount to be deducted as charge from the specified party.

Flat Amount

Specify a valid amount to be deducted as charge from the specified party.

Waive

Check this box if you need to waive charges to be collected from the specified party.

Reason

Specify a valid reason for waiving the charges, if you have selected to waive of charges.

Charge Schedule Details

You can define the following charge schedule details:

Schedule Start Date

When you either save the fund or click the ‘Explode’ button, the system defaults the schedule start date as follows:

- Defaults the schedule start date as the start date defined in the charge schedule definition, for the first schedule.

- Defaults the corresponding values with the previous schedule’s due date.

Schedule Due Date

When you either save the fund or click the ‘Explode’ button, the system derives the schedule due based on the values defined for units and frequency.

Amount Due

If the charge is defined as flat amount for the party, then the system defaults the same defaulted as the amount due. Else, the system will not display any value initially; however, during the charge schedule batch, the system calculates and displays the amount based on the percentage of the amount (rate % maintained in the charge definition grid) in the term deposit created for the party in the subsequent EODs.

Amount Settled

The system displays the amount debited from the contributor.

Waive

Check this box if you need to waive charges to be collected from the specified party for the specified schedule.

Reason

Specify a valid reason for waiving the charges, if you have selected to waive of charges.

Click ‘Explode’ button to derive charge schedule details for the party specified in the ‘Charge Schedule Definition’ section. These details are computed based on the parameters maintained in the ‘Charge Schedule Definition’ section for the specified party. If the charge is not defined for any of the contributor along with the contributor’s ID, then the system displays the override message as, “Charge schedule is not defined for the party(s).”

If the charge basis is maintained as rate, then the system will not compute the ‘Amount Due’ when you click the ‘Explode’ button.

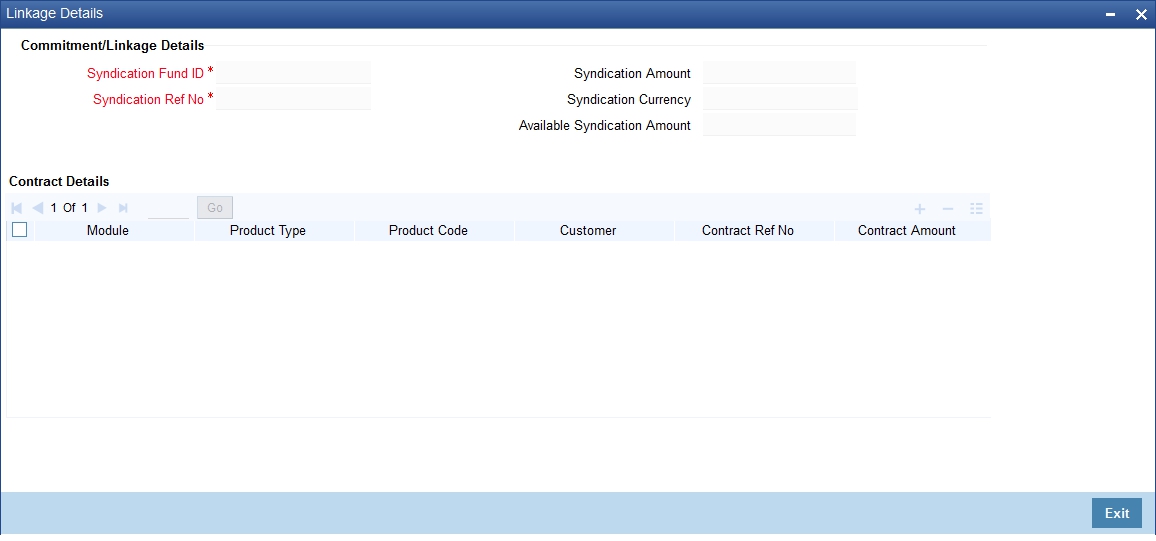

3.2.6 Viewing Linkage Details

Syndication fund is associated to various financing transactions. The system enable you to view the linkage details associated with the syndication fund in the linkage details screen. Click ‘Linkage’ button on the ‘Islamic Finance Syndication’ screen to invoke ‘Linkage Details’ sub screen.

You can view the following linkage details here:

- Linkage Details

- Syndication Fund ID

- Syndication Ref No

- Syndication Amount

- Syndication Currency

- Available Syndication Amount

- Contract Details

- Module

- Product Type

- Product Code

- Customer

- Contract Ref No

- Contract Amount

- Contract Currency

- Disbursement Amount

- Outstanding Amount

- Amount Paid

- Account Status

3.2.7 Validations for Financial Syndication

While saving the syndication fund, the system will validate the following and displays the corresponding error message if the validation fails:

Validation |

Error Message |

Syndication amount must be greater than or equal to the sum of product limit |

“Sum of the product limit is greater than the syndication amount” |

Product limit must be greater than or equal to the sum of customer product limit for a product type |

“Sum of the customer product limit for the product type <product_type>is greater than the product limit” |

Product limit must be configured for the product before calculating the sum of customer product limit for a product type |

“Customer limit for the product type(s) are specified without product limit configuration” |

Sum of profit share % of all the parties involved must be equal to 100% |

“Sum of the profit share % should be equal to 100” |

Sum of the contribution share % of all the parties involved must be equal to 100% |

“Sum of the contribution share % should be equal to 100” |

Multiple investments must not be maintained for a single party |

“Duplicate party(s) provided in the profit share details grid” |

Charge definition must be defined only for the parties involved in syndication fund |

“Charge is defined for the party(s) not involved in syndication fund” |

You must maintain either of the following charge basis fields for charge computation:

|

|

If none are maintained, |

“Charge basis fields rate or flat amount has to be entered” |

If both are maintained, |

“Charge basis fields rate or flat amount has to be entered” |

You must map at least one product type and the related customer for a syndication fund |

“Customer and product type matrix not maintained.” |

3.2.8 Syndication Amendment

The system enables you to amend the following after saving syndication fund:

- Product type limit

- Customer Product Type

- If the frequency of profit and charge schedule is modified, then the system defaults the respective next calculation date.

- Charge definition parameters

The system will re-compute the schedule details for charge definitions with schedule due date later than the application date. The new schedule definition for the party will appear as a separate row and the previous details will be neglected.

The system will not enable modification of the following after saving syndication fund:

- Syndication amount

- Charge schedule definition under following conditions:

- Before first authorization

- After first authorization – charge schedule definitions whose fund start date is the current date

While amending and saving the syndication fund, the system will validate the following, including those validated while saving the fund and displays the corresponding error message if the validation fails:

Validation |

Error Message |

Product limit mapped to a customer must not be deleted |

“Product type(s) cannot be deleted since the same is mapped to a customer” |

Customer product limit utilized by the customer must not be deleted |

“Customer product limit for product type cannot be deleted since the customer has utilized the limit” |

Reduction of customer product draw down count must be to the extent of utilization |

“Customer drawdown count can only be reduced to the extent of utilized limit” |