5. Account Creation

5.1 Introduction

Microfinance Loan Accounts in the Micro Finance module represent the receivable accounts that you create while disbursing a loan. These accounts derive their feature from the Microfinance Loan Product. Microfinance Loan Accounts are mapped to the Asset GL through the accounting Role MICROFINANCE_LOAN_ACCOUNT. This role has to be mapped to the respective Asset GL of the Bank. You can override some product features at the account level.

The system allows you to do the following actions on the Microfinance Loan accounts:

- Account Main Details Maintenance/Light Loans

- Liability details and UDE Values Maintenance

- Account Preferences/Defaults

- Account Component schedules

- Charges Maintenance and Settlement details

- Linkages Information

- Events, Events Due and Events Overdue

This chapter contains the following sections:

5.2 Creating a Loan Account

This section contains the following topics:

- "Example 5.2.1" on page 3

- "Example 5.2.2" on page 9

- "Example 5.2.3" on page 15

- "Example 5.2.4" on page 28

- "Example 5.2.5" on page 30

- "Example 5.2.6" on page 33

- "Example 5.2.7" on page 34

- "Example 5.2.8" on page 35

- "Example 5.2.9" on page 36

- "Example 5.2.10" on page 37

- "Example 5.2.11" on page 38

- "Example 5.2.12" on page 39

- "Example 5.2.13" on page 41

- "Example 5.2.14" on page 43

- "Example 5.2.16" on page 44

- "Example 5.2.17" on page 44

- "Example 5.2.18" on page 45

- "Example 5.2.19" on page 46

- "Example 5.2.20" on page 47

- "Example 5.2.21" on page 48

- "Example 5.2.22" on page 48

- "Example 5.2.23" on page 50

- "Example 5.2.24" on page 53

- "Example 5.2.25" on page 56

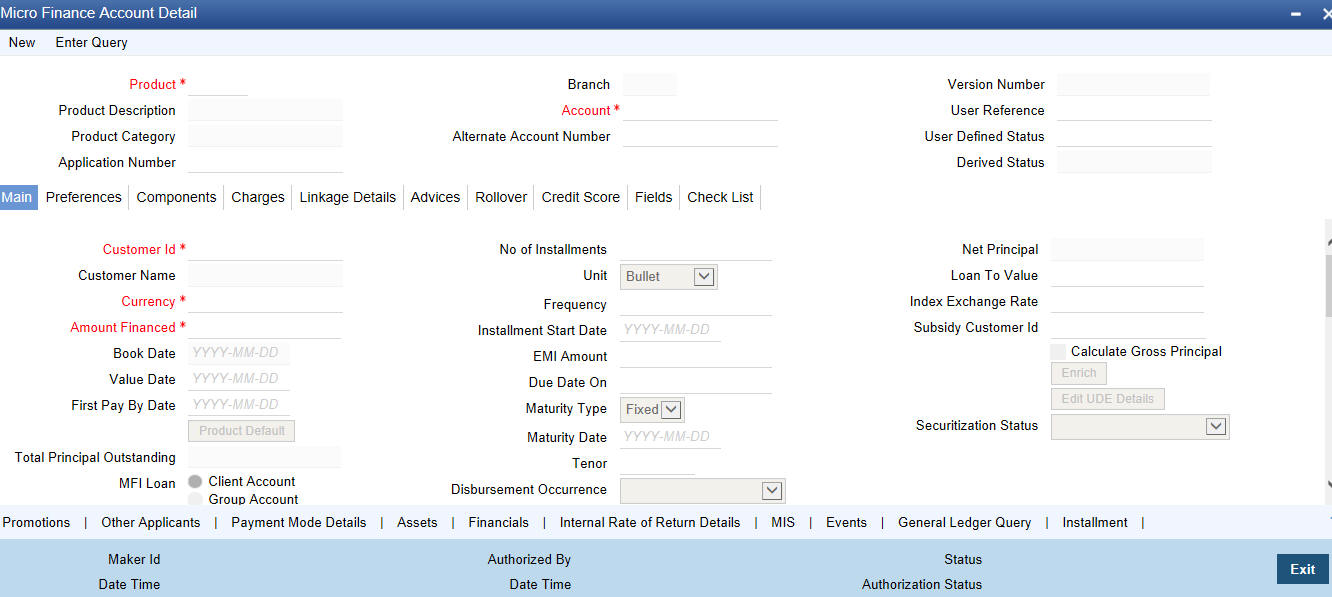

You can capture the Customer, Currency and Amount Financed and create a Light Loan. This is a default Loan that takes all other details from the defaults the product provides. You can create a loan account using the ‘Micro Finance Account Details’ screen. You can invoke this screen by typing ‘MFDACCNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following generic details in the Account Details screen:

Product

Click the option list to select a Product Code from the list of values. Double click on a Product Code to select a particular code. The product codes are maintained in the Product Definition screen.

Click ‘P’ button to populate the Product Category, Value Date, Maturity Date based on the Product Code selected, the main screen will display all these values.

Product Description

A description of the selected product is displayed in this field.

Product Category

The system displays the product category in this field.

Application Number

The system displays the Application Number in this field.

Note: This is applicable only if the origination of the loan is in Oracle FLEXCUBE or is interfaced.

Branch

The system displays the Branch Code of the branch into which the user has logged in, for which the UDE values are maintained.

Account

Based on the parameters that setup at the branch level, the account number would be either auto generated or would have to be captured in this field.

Alternate Account Number

Specify the alternate account number in this field. It can be an account number in the existing system from which the account has migrated to Oracle FLEXCUBE.

Version Number

The system displays the current Version Number of the account. A new version number is created when changes like Roll over, Amendment are made to a loan. This is displayed in the top right corner of the ‘Account Details’ screen.

User Reference Number

A 16-digit User Reference Number is autogenerated and displayed here if the ‘Auto Generate User Ref No’ option is checked in the Branch Parameters. The format of the user reference number is BranchCode + ProductCode + Sequence number. You are allowed to modify the auto-generated User Ref No.

If the ‘Auto Generate User Ref No’ in Branch Parameters is not checked then the User Ref No will be blank by default and you have to specify it manually. Validations are done by the system not to save the account if an unsuppressed payment message is present which has the User Ref No as blank.

User Defined Status

After you enter the account number, the system displays the status of the account in this field. This is based on the products status maintenance rules.

If you have opted for status processing at the ‘Group/CIF’ level as part of your branch preferences, the system defaults the value of CIF status as available in the ‘Customer Maintenance’ screen. This status is the worst status among all the loans, savings accounts and current accounts for the customer within the current branch.

Derived Status

The system defaults the status of the individual loan account here. This is derived from the status maintenance rules of the product, during end of day operations.

5.2.1 Main Tab

The following details regarding the loan account can be maintained in this tab.

Account Details

The Account details include the book date, the value date, the maturity date, and down payment amount of the Loan account. In case of Rolled over loans, the original start date is also stored. The details of the liability parties to the account are maintained. The Main Customer and description are displayed. Also other applicants of a loan such as Co-signers, Guarantors etc can be captured. These details of the co applicants, their responsibility as a Cosigner, guarantor etc, and the contribution of the co applicants to the Loan are provided here.

The UDE values for each Account are maintained here. The UDE values default from the UDE values maintenance for the Product, Currency and effective dates combination. These can be overridden by providing account level UDE values. However the UDE are only those defined at the product level.

The system checks whether the UDE values fall within the minimum and maximum limits specified for the UDEs linked to the product. If a UDE value falls outside the permissible limits, the system will throw an error message,

If there are no product level UDE values maintained, the system will default the UDE value to Zero. However, at the time of saving, if UDE values are zero or any invalid value, then an override will be raised with an appropriate error message. If required this can be configured as an error message. In case of an ERROR, you will have to give a valid value. While if it is an OVERRIDE, you can overlook the message and continue and if it is for an ONLINE AUTHORIZATION the parameter should be authorized appropriately.

The following details are captured here:

To select a customer ID, click the option list. A screen called ‘Find Customer Details’ is displayed. You can enter search criteria in this screen. For example, you can enter the customer name or number and click on the ‘Search’ button. The system then fetches you all the details corresponding to the Customer name or account. Once you find all the details, double-click on the record to return to the account details screen.

Customer Name

Specify the customer name here.

Currency

To select a currency, click the LOV button. A list of currencies is displayed. Double click to select a currency.

Amount Financed

Specify the total loan amount of the loan in this field.

Note

If Calculate Gross Principle is checked, then the amount financed is the gross principal.

Product Default

Click ‘Product Default’ button after entering product code, customer ID, currency and amount financed. The system defaults other details maintained for the selected product. The system also defaults the schedule definitions from the product and computes the detailed schedules. After clicking the ‘Product Default’ button, you cannot change the product code. Also, the system prompts you to click the ‘Product Default’ button once again if you change ‘Customer ID’, ‘Currency’ or ‘Amount Financed’ fields.

Enrich

After product defaulting, you can change the contract details which impact the schedule computation. You should enrich these changed details. Click the ‘Enrich’ button. The system displays appropriate overrides and re-computes schedules and other details depending on the changed values.

Net Principal

The Net Principal is the actual principal amount financed. It is system calculated and excludes any other funded components.

Book Date

In this field, the current date when the loan details were entered is defaulted and cannot be modified.

Value Date

Select the Value date of the loan in this field using the adjoining calendar.

First Pay by Date

Specify the customer’s preferred first pay by date. The system will calculate the schedule due date as follows:

Schedule Due Date = (First Pay by Date) - (The credit days maintained at product level)

In case the calculated first schedule due date is less than or equal to the value date of the contract, then the user has to modify the first pay by date. For instance, if you prefer to have your payment date on 14th of every month, then the first pay by date should be 14th day of the month. Presuming credit days is maintained as ‘10’ at the product level, the first schedule due date will be 4th of that month, i.e., 14th Apr 09 – 10 (first pay by date - credit days)

First Pay By Date |

Credit days |

Schedule due date |

14 Apr 09 |

10 |

4 Apr 09 |

Total Principal Outstanding

Total Principal Outstanding inclusive of the compounded interest or penalty is defaulted here.

MFi Loan

You can indicate where the loan belongs to. It could be any one of the following:

- Client Account

- Group Account

Number of Instalments

Specify the number of instalments for the loan account.

Unit

Enter the instalment unit for the component for the schedule. The units of frequency definition can be Daily, Weekly, Bullet, Monthly, Quarterly, Half Yearly or Yearly. Select the unit of the schedule from the option list.

Frequency

Select the frequency at which payments are made towards the liability. The following options are possible:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Instalment Start Date

Specify the instalment start date for the loan account. Alternatively, you can select the date from the adjoining calendar button.

EMI Amount

The EMI that should be repaid in this schedule is displayed in this field.

Due Date On

This option may be used to schedule an instalment on a particular date of the month.

Maturity Type

Select the Fixed or Call option to specify the type of loan maturity.

Note

The system by default selects the option Fixed. For the Call option, the maturity date will not be computed upfront.

Maturity Date

Select the maturity date in this field using the adjoining calendar.

If you are not sure of the maturity date, enter the tenor of the loan in either days or months or years as say 3M for 3 Months etc. The system automatically calculates the date after you press the ‘Enter’ button.

Alternatively, you can calculate the maturity date by entering certain details in the ‘Maturity’ screen. You need to click the ‘Q’ button to invoke the ‘Maturity’ screen.

Disbursement Occurrence

Select the category of loan disbursed from the adjoining drop-down list. The options available are:

- New

- Repeat

- Repeat and Enhanced

Net Principal

The Net Principal is the actual principal amount financed. It is system calculated and excludes any other funded components. Maintaining the Applicant information

Loan to Value

Specify the loan to value here.

Index Exchange Rate

Specify the exchange rate for index currency here.

Subsidy Customer ID

Specify the unique identifier of the agency or the third party included in the subsidy loan contract.

Calculate Gross Principle

Check this box if you want the system to calculate the gross principal for the loan. If you have checked this box and have entered the amount financed then system takes the amount financed as the gross principal.

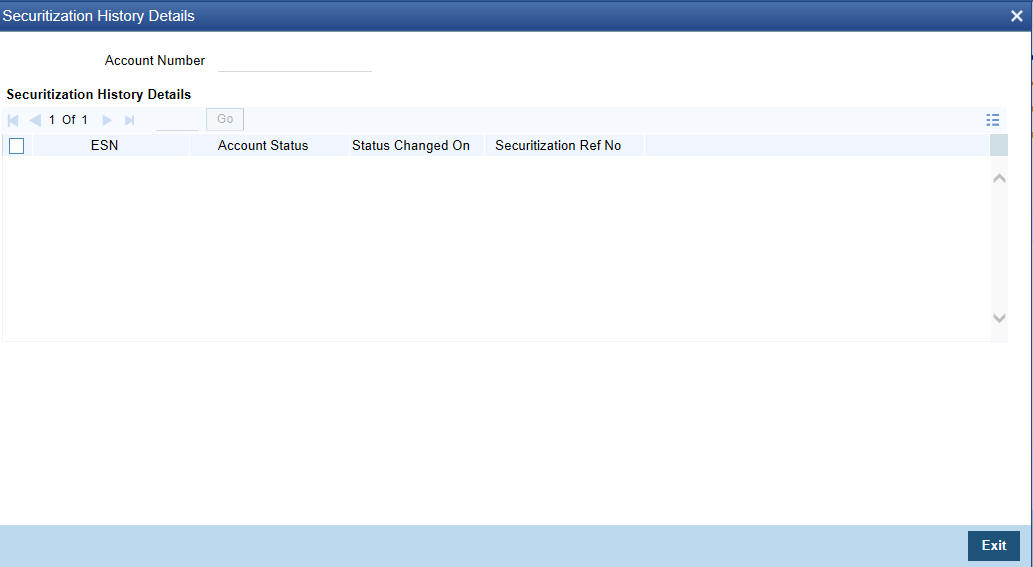

Securitization Status

The system displays the securitization status. The status can be anyone of the following:

- Blank – Indicates account is not involved in securitization, that is it not part of the securitization pool

- Marked for securitized – Indicates loan account is part of securitization contract (on batch); however, the securitization batch is not executed yet.

- Securitized – Indicates the successful completion of batch process.

EMI Frequency Unit

Select the unit of frequency at which the EMI of the customer will change, from the adjoining drop-down list. This list displays the following values:

- Monthly

- Quarterly

- Half-yearly

- Annually

The system derives the first change date by adding the Frequency unit to the value date

Emi Frequency

Specify the frequency in which the EMI of the customer will change.

Minimum EMI

Specify the minimum EMI amount for the customer. If the result of the derived EMI is below the 'Minimum EMI' specified here, the system sets the EMI for the customer to the Minimum EMI amount.

Maximum EMI

Specify the maximum EMI amount for the customer. If the result of the derived EMI is above the 'Maximum EMI' specified here, the system sets the EMI for the customer to the Maximum EMI amount.

Base End Date

Specify the date beyond which the EMI Change (EMIC) will not be processed. Alternatively, you can also select the date from the calendar button.

Collateral Taken Over

This check box is checked if the collateral linked is been taken over. Click 'Takeover Details' button to view details of the takeover.

You can view the following details in this screen:

- Collateral Code – The system displays the collateral code.

- Amount Settled – The system displays the amount settled.

- Date of Take Over – The system displays the taken over date.

- Branch Code – The system displays the branch code.

- Account Number- The system displays the account number.

- Taken over reference – The system displays the taken over reference number.

- Event Sequence Number – The system displays the event sequence number of MLIQ event fired during takeover process.

Effective Date

This field is used to capture the date from which the % interest split among co-applicants of the loan will be taken into consideration. During the initiation of the loan, the value date of the loan will be defaulted as the effective date. During VAMI, the same effective date will be retained, you can however edit it.

Note

The effective date cannot be a date prior to the loan initiation date. It is also necessary that there is one record for the initiation date. The effective date for all the applicants is the same.

User Defined Element Values

The UDE values for each Account are maintained here. After clicking the ‘Product Default’ button, the UDE values default from the UDE values maintenance for the Product, Currency, effective dates combination. The system disables this section. These can be overridden by providing account level UDE values. For this, you need to click the ‘Edit UDE Details’ button. After changing the details, the system re-computes the schedules. On saving the contract, the system prompts the changed details.

However the UDE are only those defined at the product level. No New UDEs can be introduced at the account level.

The system checks whether the UDE values fall within the minimum and maximum limits specified for the UDEs linked to the product. If a UDE value falls outside the permissible limits, the system will throw an error message,

If there are no product level UDE values maintained, the system will default the UDE value to Zero. However, at the time of saving, if UDE values are zero or any invalid value, then an override will be raised with an appropriate error message. If required this can be configured as an error message. In case of an ERROR, you will have to give a valid value. While if it is an OVERRIDE, you can overlook the message and continue and if it is for an ONLINE AUTHORIZATION the parameter should be authorized appropriately.

You can specify the following details for the UDE values:

User Defined Element ID

To select a UDE Id, click the option list. A list of UDE Ids is displayed. Double click to select a UDE Id.

User Defined Element Values

Specify the Actual Value for the UDE based on the effective Date in this field. The value specified here should fall within the minimum and maximum limits maintained for the UDE linked to the underlying product.

Note

Mandatory if a UDE is maintained.

Rate Code

Select the code for the Floating Rates if any and the spread on it applicable in this field by clicking the option list. A list of values is displayed. Double click on a value to select it.

Code Usage

Select the Code usage which can be periodic or automatic in this field.

Resolved Value

This denotes the final value of a UDE.

Resolved value = Rate code value taken from Floating Rate Maintenance + the spread [UDE Value].Account EMI Change

Amount Change in EMI

Specify the fixed amount by which the current EMI amount of the customer is either increased or decreased. This can either be a positive or negative value.

Percentage Change in EMI

Specify the EMI percentage by which the current EMI amount of the customer is either increased or decreased. This can either be a positive or negative value

Effective Date

Specify the date from which the new EMI amount is effective for the customer. Alternatively, you can select the date from the calendar button. The Effective Date for Account EMI Change should always be greater than the value date of the contract.

During value dated amendments, it is possible to change the EMI amount of the customer from the new ‘Effective Date’. However, the ‘Effective Date’ should be greater than the VAMI effective date.

Note

It is mandatory to specify either ‘Change EMI Percent’ or ‘Change EMI Amount’ along with the ‘Effective Date’.

5.2.2 Preferences Tab

Specify the following details in this tab:

Cheque Book Facility

Check this box to indicate that the cheque book facility should be allowed to loan account.

Passbook Facility

Check this box to indicate that the pass book facility should be allowed to loan account.

ATM/Debit Card

Check this box to indicate that the ATM/Debit card should be provided to the account holder.

Liquidate Back Valued Schedules

If this flag is turned on, during initiation, when a loan is input back dated and if there are any instalment dues, then all those schedules with a due date less than the system date will be liquidated on initiation.

Allow Bulk Payment

Check this box to indicate whether the accounts under a commitment should be considered for bulk processing. Various disbursements are allowed for a corporate customer and these are treated as loans with separate products and EMI schedules. Assigning individual payments as Bulk payments provides the facility of viewing multiple loans under a single commitment.

Amend Past Paid Schedule Allowed

This preference determines if you can modify any feature such as interest rate, instalment amount which affects already paid schedules. If you select this option then the paid schedules are recalculated and liquidations on them are recognized as pending as appropriate. Note that this option is applicable only to term loans.

Project Account

Check this box to track the working capital of the project.

Minimum Amount due Calculation Method

Specify the minimum amount due calculation formula name maintained at the product level.On clicking the ‘Default Method’ button in the ‘Product Definition’ screen, the system will display the Min Amount Due Calc Method with the formula name.

For open line loans:

- The schedule due dates of MAIN_INT component will be the billing dates, the date on which the account will be picked for calculating minimum amount due.

- The service branch and service account are mandatory for PRINCIPAL Component to handle the excess payment.

- The Pay By Date is schedule due date plus the credit days maintained at product level.

- On click of the default button, the MAIN_INT schedules will be exploded and the pay by dates will be shown based on the First Pay By Date input by the user. If First Pay By

- Date is not input, then the first Schedule Due Date of MAIN_INT component plus the credit days (product parameter for OLL) will be defaulted as the First Pay By Date.

- Pay by date for bullet schedule (PRINCIPAL and MAIN_INT) will be the maturity date of the open line loan account.

- Holiday treatment will calculate the due date and pay by date respectively

- System will be changed to always ignore holidays while computing the billing dates.

- System will consider the holiday parameter setup in product while computing the pay by date.

Rate Change Action

Select the rate change action from the adjoining drop-down list. The available values are:

- Change Instalments

- Change Tenor

The system defaults Change Instalments as rate change action value. However, you can modify it. The value ‘Change Tenor’ is applicable only for amortized accounts.

Rate Change Action is applicable for ARVN and REVN operations.

Stop Disbursement

Check this box to indicate that the disbursement should be stopped.

Recalculate Annuity on Disbursement

Check this box to indicate that the annuity on disbursement should be recalculated.

Packing Credit

Check this box to indicate the possibility of linking MF Accounts to BC under this product.

For more details on the Packing Credit Sub System and Pre-Shipment Finance refer section ‘Specifying Purchase Details’ in chapter ‘Processing Bills’ of the ‘Bills and Collections’ manual.

Use Guarantor for Repayment

Check this box if you need to consider guarantor account for repayment of loans.

Loan Statement Required

The system defaults this value based on the product preferences. However, you can modify the default value. Check this box to indicate that the loan statement should be generated.

If this field is checked and the loan statement maintenance is not done at product level, the system will display an error at the time of saving the contract.

You need to have linked the ‘CLST_DETAILED’ message to the ‘DSBR’ event (for the product) in order to generate loan advice on each disbursal in the loan account.

For Loan against Salary

The system defaults this value here based on the preferences maintained in the MF product. However, you can modify it at the account level.

Notary Pre Confirmed

Check this box to indicate that you have already got confirmation from the notary, before creation of the loan.

If the value date of the account is on or before the application date, then ‘NCON’ will trigger INIT and DSBR event for auto disbursement product, else user will need to trigger manual disbursement post the notary confirmation. .

If the value date of the loan is beyond the application date, the system will trigger the NCON event online, once the value date is reached the INIT and DSBR events gets fired, if the loan is under an auto disbursement product.

You can also save a loan account with this option unchecked. Once you receive the confirmation, you can trigger the ‘NCON’ event manually using the ‘Manual Notary Confirmation’ screen.

Maximum Renegotiations

Specify the maximum number of renegotiation allowed for the account.

Note

If maximum renegotiation is not maintained, system will perform renegotiation without any restrictions. If the maximum renegotiation value is given as ‘zero’, system will raise override in the first renegotiation itself.

Renegotiation Number

The system displays the renegotiation count. This is the number of renegotiations that are already performed on the account.

Bill Details

Trade Reference

Select the reference number of the export bill against which you want to link the loan, from the option list. The option list displays all active and authorized export bill contracts with non zero positive outstanding amount. You can link multiple loans to as bill. However, the sum total of all loans linked with an export bill should not exceed the outstanding amount for the export bill.

Bill Due Amount

The outstanding amount of the bill selected is displayed here.

Amount Available

Specify the available amount.

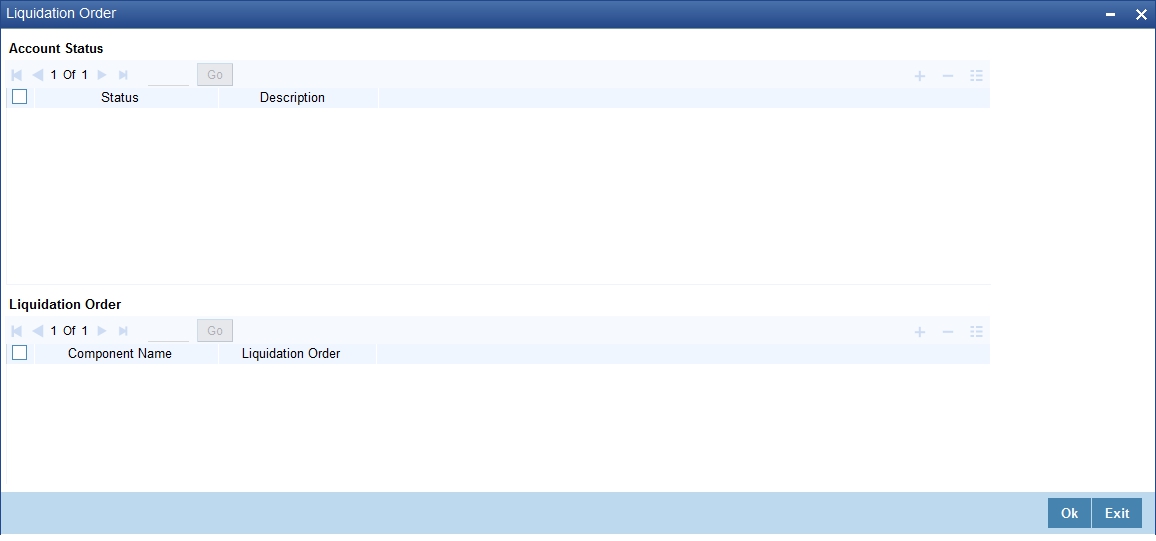

Liquidation

Liquidation Mode

Select the liquidation mode from the drop down list. The options available are as follows:

- Auto

- Manual

- Component

Reset Retry Count for Reversed Auto Liquidation

If auto liquidation has been reversed in an account, it will be retried depending upon the status of this field. If this option is selected, then the auto liquidation is retried.

Partial Liquidation

If you select this option, system will perform partial auto liquidation.

Retries Auto Liquidation

When auto liquidation option is chosen and funds are not available, the number of times the system can retry auto liquidation is determined by this field.

If blank, the number of retries is infinite.

Retries Advice Days

Number of retries for an advice is defaulted here from the product maintenance level; however, you can modify if needed. The value should be less than the value maintained for ‘Retries Auto Liquidation Days’.

Close Collateral

Check this box if you need to close the collateral on full payment, during auto liquidation.

Note

During auto liquidation, the system will check is this check box is checked and closes the collateral automatically.

Track Receivable

If Track receivable option is checked for an account, it tracks the amount to be liquidated as a receivable if funds are not available. So upon any subsequent credit, the receivables are blocked and allocated to the pending liquidation.

Auto Liquidation

Select this option to indicate that the Track receivable option is for Auto Liquidations. You can modify this during VAMI/rollover/renegotiation.

This is defaulted from the product level.

On schedule liquidation if there are insufficient funds in the settlement account to satisfy the liquidation and if both the product and the account are marked for receivable tracking then system initiates tracking of receivable.

If the account is marked for Partial liquidation, then liquidation happens to the extent of available funds, and the remaining amount is tracked.

If the account is not marked for partial liquidation, and the amount available in the settlement account is less than the due amount, then system won’t do any liquidation and starts tracking the full due amount.

Whenever there is a credit to an account, the tracking process checks if the account has any receivable against it and if it does then the relevant amount is blocked as a receivable and the corresponding amount is marked to be used for settlement during subsequent ALIQ for the account. This process happens till the amount needed for liquidation is fully available.

The decision of allocating this credit will be based on the preference order of products that has been specified at an account class level. On the following EOD/BOD, batch liquidation tries to liquidate the schedule. The amount receivable is made available for the liquidation, and liquidation happens to the extent of receivable amount.

Manual Liquidation

Select this option to indicate that the Track receivable option is for Manual Liquidations.

Note

By default, the system selects this option.

UDE Rate Plan Dates

Start Date

The start date from which the rate plan change can be done is displayed here. However, you can modify this value at loan account level.

End Date

The end date till which the rate plan change can be done is displayed here. However, you can modify this value at loan account level.

Note

Based on the product maintenance, the ‘Rate Plan Change’ details are defaulted to the loan account and this can be modified.

Intermediary Details

You can capture the Intermediary Details at the loan account level to keep track of the accounts created through Intermediaries.

Intermediary Initiated

Check this box to indicate that the loan has been initiated by an intermediary.

Intermediary Code

If you have checked the box 'Intermediary Initiated', you need to specify the code of the intermediary who has initiated the loan. The adjoining option list displays all valid intermediary codes maintained in the system. You can select the appropriate one.

Note

- Both the fields are disabled after the first authorization of the loan. The fields cannot be modified during value-dated amendment and rollover operation.

- Adjustment of commission and charge computed for the intermediary (in the past cycle) should be done manually in case of a reversal of any transaction done by the intermediary post the computation.

Intermediary Name

The name of the intermediary is displayed here.

Intermediary Ratio

Specify ratio in which the loan has been initiated by the intermediary.

Holiday Periods

You can specify the following detail here:

Period

Select the period for which repayment holiday is to be given to the customer. The holiday periods maintained in the system are displayed in the adjoining option list. If the selected repayment holiday period exceeds ‘Interest Only Period’ field in the ‘Product’ screen, the system will display an appropriate error message.

Loan Statements

Start Date

Specify the start date from which loan statements need to be generated.

Frequency

Select the frequency at which loan statement are to be generated. The following options are possible:

- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

Frequency Unit

Specify the number of times the loan statement needs to be generated as per the frequency selected.

Loan Statement Notice

The system displays the following loan settlement details based on the values specified at ‘Value Dated Amendments’ level:

- Loan Settlement Request

- Notice Date

- Expected Closure Date

Status Change Mode

Select the status change mode. The options available are:

- Auto

- Manual

The system defaults Auto as the status change mode.

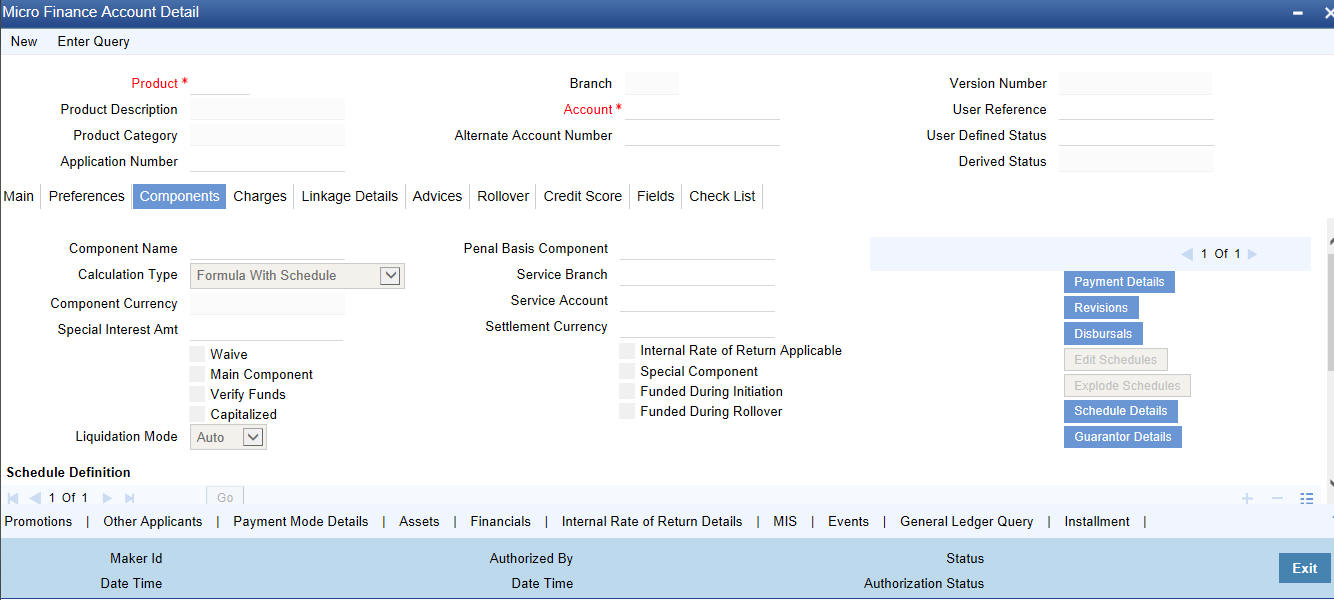

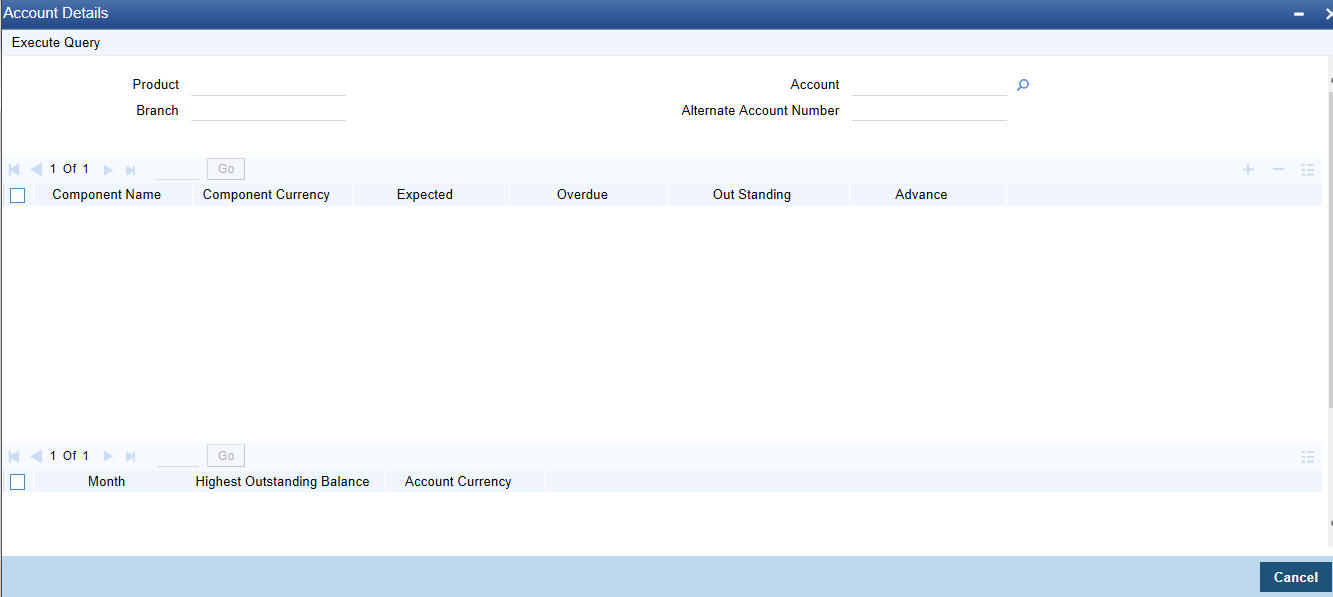

5.2.3 Components Tab

Clicking against the ‘Components’ tab in the ‘Account Details’ screen invokes the following screen:

You can specify the following details for the components:

Component Name

The name of the component is displayed in this screen.

Component Currency

The system displays the currency associated with the component in this field. The value is defined at Product level.

Calculation Type

To specify the manner in which the component should be calculated and liquidated. You can choose one of the following options:

- Formula with schedule (Component Type - Interest)

- Formula without schedule (Charge)

- Penal Interest

- Prepayment Penalty

- Discount

- Schedule without formula (Principal)

- No schedule No formula (Ad Hoc Charges)

- Penalty Charges

Special Interest Amount

Specify the amount for the special interest in this field.

Main component

The system selects the component of the loan designated as main component in the product level in this field

Verify Fund

You can indicate whether the system should verify the availability of sufficient funds in the customer account before doing auto liquidation of the component

Capitalized

Select this option if the scheduled amounts are to be capitalized.

Waive

Select this option to waive the component for the account.

The system does not select it by default.

Liquidation Mode

The system defaults the mode of liquidation from the product level. However you can modify the same to indicate the mode of liquidation of the component from the drop-down list. The following options are available for selection:

- Auto

- Manual

Penal Basis Component

The system displays the Penal basis for calculating penalty component in this field.

Service Branch

Click the option list to select the branch that services the customer account.

Double click on a value to select it.

Service Account

Click the option list to select the account in the service branch. Double click on a value to select it.

All modes except CASA needs service account. Adjustments etc. will be settled through this account.

Settlement Currency

Select the settlement currency for the option list. Click the adjoining option list to choose a settlement currency from the list of currencies. Double click on a value to select it.

In case of a subsidy loan, the system displays the settlement currency based on the subsidy customer ID specified in the ‘Main’ tab. However you can change it. The settlement currency is maintained as a default for both Credits and Debits.

Funded During Inititation

This field indicates if the component can be funded during the INIT event.

Funded during Rollover

Select this option if the component can be funded during the rollover process.

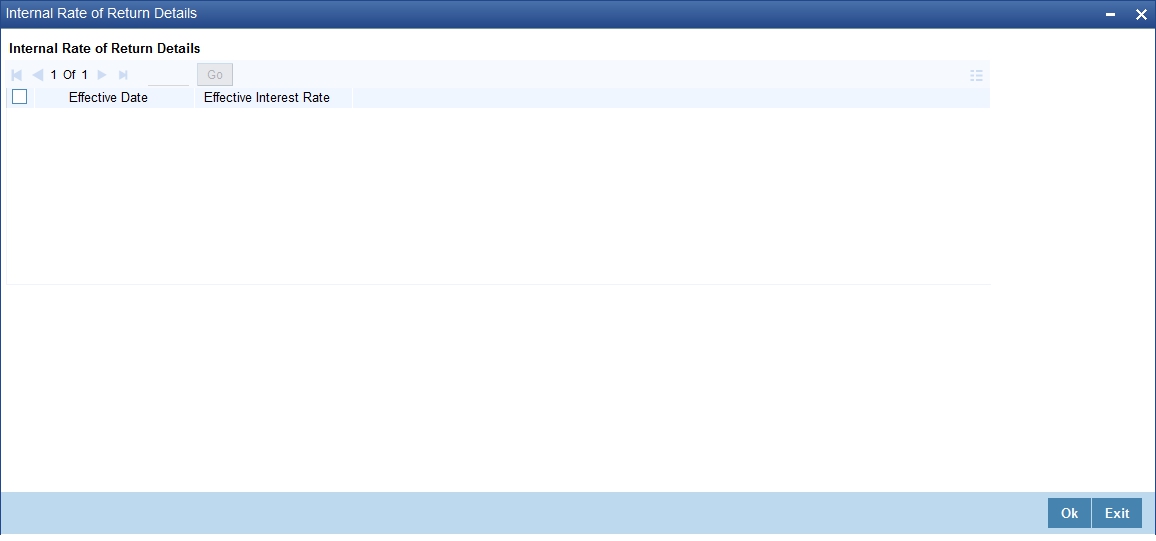

Internal Rate of Return Applicable

Check this option to indicate that the component is to be considered for IRR calculation for the account. This field is applicable to interest, charge and fee components. For adhoc charge, charge, penalty and prepayment penalty components, the value will be defaulted from the product level and you will not be able to modify it.

This field will not be available for input if ‘Accrual Required’ and ‘IRR Applicable’ are left unchecked at the product level.

Note

- For bearing type of component formula this option will be enabled only if ‘Accrual Required’ is checked for the component at the product level

- For discounted or true discounted type of component formula this option will be allowed irrespective of whether the ‘Accrual Required’ option is checked or not at the product component level

- If the option ‘Accrual Required’ is unchecked and ‘IRR Applicable’ is checked, then discounted component will be considered as a part of total discount to be accrued for Net Present Value (NPV) computation

- If both ‘Accrual Required’ and ‘IRR Applicable’ are checked, then discounted component will be considered for IRR computation

- Upfront Fee component will be considered for IRR only when ‘Accrual Required’ and ‘IRR Applicable’ both are checked

- For upfront fee component, if ‘IRR Applicable’ is checked, then ‘Accrual Required’ has to be checked

- Post securitization, the accrual event’s credit and debit GL account will be pointing to the same SPV Bridge GL, so that the accrual is nullified.

Special Component

Select this option to denote if the component is a special Interest type. This implies that the computed value of the component can be overridden with the entered value.

Special Interest option

Select this option to denote if the component is a special Interest type. This implies that the computed value of the component can be overridden with the entered value.

5.2.3.1 Maintaining Schedule Details

This section is disabled both on product defaulting and enriching. You can modify any component details by clicking ‘Edit Schedules’ button.

The following details are captured here:

Schedule Type

Select the type of schedule from the option list. Schedule can be a payment, a disbursement or a rate revision schedule.

Schedule Flag

Select the option for the Schedule flag from the option list.

The options are Normal or Moratorium.

Select the option Moratorium if there are no scheduled repayments for the component for the Moratorium period. However the component is accrued for a certain Moratorium period.

Formula

Enter the formula used to compute the component for that schedule.

First Due Date

Enter the first due date for the schedule for the component. The first due date can be defined based on the value date for the loan or a calendar date.

Number of Schedules

Enter the number of times the schedule is repeated for a chosen frequency for the schedule. If the Frequency is Monthly and Number is 1, it implies once a month.

Frequency

This implies the number of times the schedule will repeat for a Unit. If it is 2 and the Unit is Monthly, it implies twice a month.

Unit

Enter the instalment unit for the component for the schedule. The units of frequency definition can be Daily, Weekly, Bullet, Monthly, Quarterly, Half Yearly or Yearly.

Select the unit of the schedule from the option list.

Due Date On

This option may be used to schedule an instalment on a particular date of the month.

End Date

End date for the component for the schedule will be computed from the start date, frequency, unit and number for the schedule.

Amount

The amount of payment done (whether disbursement or repayment) is displayed in this field.

EMI Amount

Specify the EMI amount that should be paid during the schedule.

Compound Days

Specify the number of compound days.

Compound Months

Specify the number of compound months.

Compound Years

Specify the number of compound years.

Days in Month

Specify the number of days that would constitute a month for calculation. You can have 30 or 31 days in a month for this purpose.

Days in Years

Specify the number of days that would constitute a year for calculation.

Capitalize

Select this option if the schedule amounts are to be capitalized.

Waive

Select this option to specify if you need to allow a waiver of the component payments for the schedule. The system by default does not select this option.

A schedule can be either applicable or capitalized or waived. After making necessary changes click ‘Explode Schedule Details’ button to re-compute the schedules. You can view the following details:

Schedule Number

The system generates and displays a sequential schedule number for instalments

Due Date

The system displays the due date of the payments and disbursements in this field

Pay By Date

The system will display the pay by date.

Pay by date = (Schedule due date) + (Credit days maintained at product level)

On clicking the ‘Default Method’ button in the ‘Product Definition’ screen, the MAIN_INT schedules are exploded and the system will display the pay by dates based on the value of the First Pay By Date. If you have not entered the first pay by date details then the system will calculate the first pay by date as follows:

(First Schedule Due Date of MAIN_INT component) + (Credit days (product parameter for OLL))

Pay by date for bullet schedule (PRINCIPAL and MAIN_INT) will be the maturity date of the open line loan account.

Amount Settled

The system displays the settlement amount for the schedule in this field

Amount Due

The system displays the amount due for the schedule in this field

EMI Amount

The EMI that should be repaid in this schedule is displayed in this field

Capitalize

The flag is used to display that the schedule instalment is capitalized

Waive

Select this option to indicate if this particular amount which is due will be waived or not.

5.2.3.2 Specifying Guarantor Details

Click ‘Guarantor Details’ button under the ‘Components’ tab in the ‘Account Details’ screen, to invoke ‘Guarantor Details’ screen

Note

If you check the ‘Use Guarantor for Repayment’ box and not specify the guarantor details, then the system will display an error message.

You can specify the Guarantor Details here:

Account

Account number for which repayment is due is defaulted here, from the ‘Account Details’ screen.

Component Name

Name of the component for which repayment is computed is defaulted here, from the ‘Component’ tab in the ‘Account Details’ screen.

Guarantor Customer

You can specify customer details of the guarantor here.

Sequence Number

Serial number of the guarantor account is defaulted here. If multiple guarantor accounts are provided, then the system follows sequence number for the liquidation order.

Customer Number

Select a valid customer id for the guarantor from the adjoining option list.

Customer Name

The customer name of the selected customer id is defaulted here.

Guarantor Customer Account

You can specify account details of the guarantor here.

Sequence Number

Serial number of the guarantor account is defaulted here. If multiple guarantor accounts are provided, then the system follows sequence number for the liquidation order.

Account Number

Select a valid account number for the guarantor from the adjoining option list. This adjoining option list displays all valid accounts for a selected customer id maintained at the guarantor customer level.

Note

If the selected account number is already a guarantor to another primary settlement account, then the system will display an override message indication the same. If the guarantor and primary settlement account are interchanged for a different loan account, then the system will display an error message.

Account Branch

The current branch code of the selected guarantor account is defaulted here.

Currency

The currency of the guarantor account is defaulted here.

Note

Guarantor currency type can be different from component currency type.

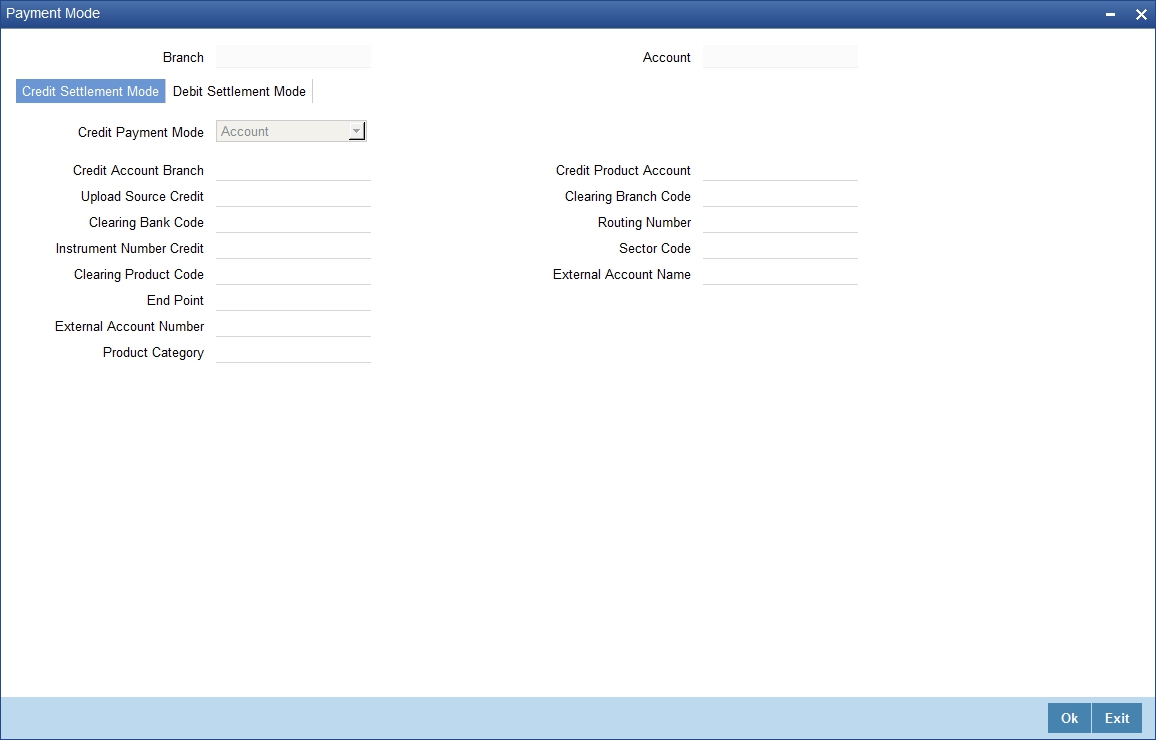

5.2.3.3 Specifying Payment Mode Details

You can specify the details of payment mode in the ‘Settlement Mode’ screen. To invoke the screen, click ‘Payment Mode Details’ button under ‘Components’ tab in the ‘Account Details’ screen.

In Payment Mode Details screen, you can specify the following details:

Branch

This field is defaulted from the Main tab of the ‘Micro Finance Account Detail’ screen.

Account

This field is defaulted from the Main tab of the ‘Micro Finance Account Detail’ screen.

Credit Settlement Mode Tab

You can specify the credit settlement details under the ‘Credit Settlement Mode’ in the ‘Settlement Mode’ screen.

Credit Payment Mode

Select the credit payment mode from the adjoining drop-down list. The list displays the following values:

- CASA

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic Pay Order

- GIRO

- Internal Cheque

- Instrument

- Cash/Teller

Credit Product Account

Specify the account number of the credit product.

Credit Account Branch

Specify the name of the branch in which the credit account should be maintained.

Instrument Number Credit

Specify the instrument number that should be used for credit payment.

Upload Source Credit

Specify the upload source that should be used for credit payment.

End Point

Specify the end point maintained in the clearing system. The adjoining option list displays all valid end points maintained in the system. You can choose the appropriate one.

External Account Number

Specify the external account number.

External Account Name

Specify the name of the beneficiary who is holding the external account.

Clearing Bank Code

Specify the code of the external bank that should be used for clearing maintenance. The adjoining option list maintains all valid banks maintained in the system. You can choose the appropriate one.

Clearing Branch Code

Specify the branch code of the specified external bank that should be used for clearing. The adjoining option list displays all valid codes maintained in the system. You can choose the appropriate one.

Product Category

Specify the category of the product. The adjoining option list displays all valid products maintained in the system. You can choose the appropriate one.

Routing Number

Specify the routing number of the specified branch for clearing.

Clearing Product Code

Specify the product code that should be used for clearing. The adjoining option list displays all valid code maintained in the system. You can choose the appropriate one.

Sector Code

Specify the code of the sector that should be used for clearing. The adjoining option list displays all valid codes maintained in the system. You can choose the appropriate one.

Giro Number

Specify the GIRO number of the corporate customer.

Payer Account

Specify the account from which the amount should be paid.

Payer Bank Code

Specify the code of the payer’s bank that should be used for the payment of amount.

Payer Branch

Specify the branch of the specified payer’s bank that should be used for the payment of amount.

Payer Bank Address 1-4

Specify the address of the bank that should be used for the payment of the amount.

Bank GIRO

Indicate the type of bank GIRO that should be used for corporate customers. You can select one of the following:

- Bank GIRO

- Plus

Auto GIRO

Indicate the type of the Auto GIRO for automatic direct debit. You can select one of the following values:

- Auto

- Manual

Exchange Rate

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme gets displayed here.

You can change the defaulted rate provided the change is within the variance level maintained for the underlying product.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

For more details on customer specific exchange rates, refer the section titled ‘Specifying Pricing Benefit Details’ in Relationship Pricing user manual.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

Negotiated Reference No

Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Oracle FLEXCUBE books the online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Original Exchange Rate

The base or actual exchange rate between the account currency and settlement currency gets displayed here.

Debit Settlement Mode Tab

You can specify the debit settlement details under the ‘Debit Settlement Mode’ in the ‘Settlement Mode’ screen. In this screen, you can specify the following details:

Debit Payment Mode

Select the Debit payment mode from the adjoining drop-down list. The list displays the following values:

- CASA

- Credit Card

- Clearing

- Debit Card

- External Account

- Electronic Pay Order

- GIRO

- Internal Cheque

- Instrument

- Cash/Teller

- PDC

Note

If the Debit Settlement mode is selected as PDC, then the other debit settlement details are not maintained. If the debit Settlement is PDC then the liquidation mode of the component should be manual. The Debit Settlement can be chosen as PDC only when contract is amortized.

Debit Product Account

Specify the account number of the debit product.

Debit Account Branch

Specify the name of the branch in which the debit account should be maintained.

Instrument Number Debit

Specify the instrument number that should be used for debit payment.

Upload Source Debit

Specify the upload source that should be used for debit payment.

End Point

Specify the end point maintained in the clearing system. The adjoining option list displays all valid end points maintained in the system. You can choose the appropriate one.

External Account Number

Specify the external account number.

External Account Name

Specify the name of the beneficiary who is holding the external account.

Clearing Bank Code

Specify the code of the external bank that should be used for clearing maintenance. The adjoining option list maintains all valid banks maintained in the system. You can choose the appropriate one.

Clearing Branch Code

Specify the branch code of the specified external bank that should be used for clearing. The adjoining option list displays all valid codes maintained in the system. You can choose the appropriate one.

Product Category

Specify the category of the product. The adjoining option list displays all valid products maintained in the system. You can choose the appropriate one.

Routing Number

Specify the routing number of the specified branch for clearing.

Clearing Product Code

Specify the product code that should be used for clearing. The adjoining option list displays all valid code maintained in the system. You can choose the appropriate one.

Sector Code

Specify the code of the sector that should be used for clearing. The adjoining option list displays all valid codes maintained in the system. You can choose the appropriate one.

Payer Account

Specify the account from which the amount should be paid.

Payer Bank Code

Specify the code of the payer’s bank that should be used for the payment of amount.

Payer Branch

Specify the branch of the specified payer’s bank that should be used for the payment of amount.

Payer Bank Address 1-4

Specify the address of the bank that should be used for the payment of the amount.

GIRO Number

Specify the GIRO number of the corporate customer.

Bank GIRO

Indicate the type of bank GIRO that should be used for corporate customers. You can select one of the following:

- Bank GIRO

- Plus

Auto GIRO

Indicate the type of the Auto GIRO for automatic direct debit. You can select one of the following values:

- Auto

- Manual

Exchange Rate

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme gets displayed here.

You can change the defaulted rate provided the change is within the variance level maintained for the underlying product.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

For more details on customer specific exchange rates, refer the section titled ‘Specifying Pricing Benefit Details’ in Relationship Pricing user manual.

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

Negotiated Reference No

Specify the reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Oracle FLEXCUBE books the online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Original Exchange Rate

The base or actual exchange rate between the account currency and settlement currency gets displayed here.

5.2.3.4 Schedule- wise Split Settlement for Auto Disbursement

Oracle FLEXCUBE allows you to maintain split details for schedule-wise auto disbursement in a loan account, only if you have set the disbursement mode to ‘Auto’ in the account preferences tab of the Product Maintenance screen (MFDPRMNT).

In the Account Details (MFDACCNT) screen, click ‘Product Default’ button after entering product code, customer ID, currency and the amount. The system defaults the product level component and schedule details of the selected product in the component tab of the account details screen After you click ‘Product Default and ‘Enrich’ buttons, the system disables the schedule definition section in the component tab. However you can modify the disbursal amount and the number of schedules for the disbursal by clicking ‘Edit Schedules’ button.

You can view the disbursement schedule and maintain the schedule-wise MF split details for auto disbursement in the Disbursal screen. To do this, first select the principal component in the component tab and then click on ‘Disbursals’ button.

The system displays the list of Schedules for the disbursements and their corresponding Disbursement amounts.

Schedule Date

The system displays the due date of the schedule.

Total Disbursement Amt

The system displays the total disbursement amount for the specified MF account.

Amount to Disburse

The system displays the amount to be disbursed.

Already Disbursed Amt

The system displays the amount which has been disbursed.

Note

Oracle FLEXCUBE allows auto disbursal only for the principal component.

Split Details

You can maintain the following split details:

Percentage

Specify the split percentage of the disbursement amount.

Amount

Specify the split amount for the schedule. Split amount is calculated based on the percentage and the disbursal amount.

If you specify only the amount and not the percentage, the system calculates the percentage of the amount to be disbursed and displays it in the percentage field during save.

Note

- The system validates if the amount and percentage are not entered and if split for the same disbursement schedule is available

- If one disbursement schedule maintains one split with percentage and other split with amount, system maintains either amount or percentage for the disbursement schedule.

- If the total amount is less than the amount to disburse for the schedule, system adjusts the rest of the amount in last split of the particular schedule and percentage gets calculated based on the amount.

- The system displays an error, if you specify an amount greater than that of the disbursement schedule

- The system displays an error, if the total amount or total percentage maintained exceeds the amount to disburse or 100 percent.

Settlement Account Branch

Specify the branch of the customer account. The adjoining option list displays the list of valid open branches maintained in the system. You can choose the appropriate one.

Settlement Account Number

Specify the settlement account number. The adjoining option list displays the valid accounts maintained for the given branch. You can choose the appropriate one.

The system displays the following split details:

Split sequence number

The sequence number for each split is auto generated by the system on save.

Payment Mode

The system displays ‘ACC’ as the payment mode for disbursal.

Settlement Account Currency

The system defaults the currency of the specified settlement account based on the details maintained in the system.

Customer

Once you choose the account number, the customer id gets defaulted.

It is mandatory to re-enter the split settlement details during VAMI, if there is a change in the disbursement schedule. For the disbursed schedules, the split settlement amendment would be ignored during VAMI.

During BOD, the system checks the MF split settlement details before taking the Credit Settlement details of the principal component. The credit settlement details of the principal component /Service account would be considered only in the absence of split settlement details for that particular schedule.

5.2.3.5 Viewing Disbursals

Select the Principal Component. Click ‘Disbursals’ to see the Disbursal schedule. This gives the list of Schedules for the disbursements and their corresponding Disbursement amounts.

You can check the details of the due date of the schedule and the Amount to be disbursed from the Schedule Due date field and the field respectively.

Note

If any disbursal results in a status change for the account, the system will update the current status for the account in the ‘Derived Status’ field. During end-of-day batch processing, it will update the ‘User Defined Status’ for the account with the worst status that is available for all accounts and loans for this CIF and post the required accounting entries for the change.

During Amendments/Disbursements, post securitization the system raises an alert message saying ‘The loan account has been securitized’.

Note

In such cases, you need to perform the amendments or disbursements after getting the approval from SPV.

5.2.3.6 Viewing Rate Revisions

Select a component which has rate revision defined. To view the details of the Rate revision schedule, click the ’Revisions’ button. This lists the details of the revisions done on the Components.

This lists the revision date against the component name. This also has an application option which displays if the revision was applied or not. You can check the details of the name of the component that is revised and the date when it has been revised from the field Component name and Revision date respectively.

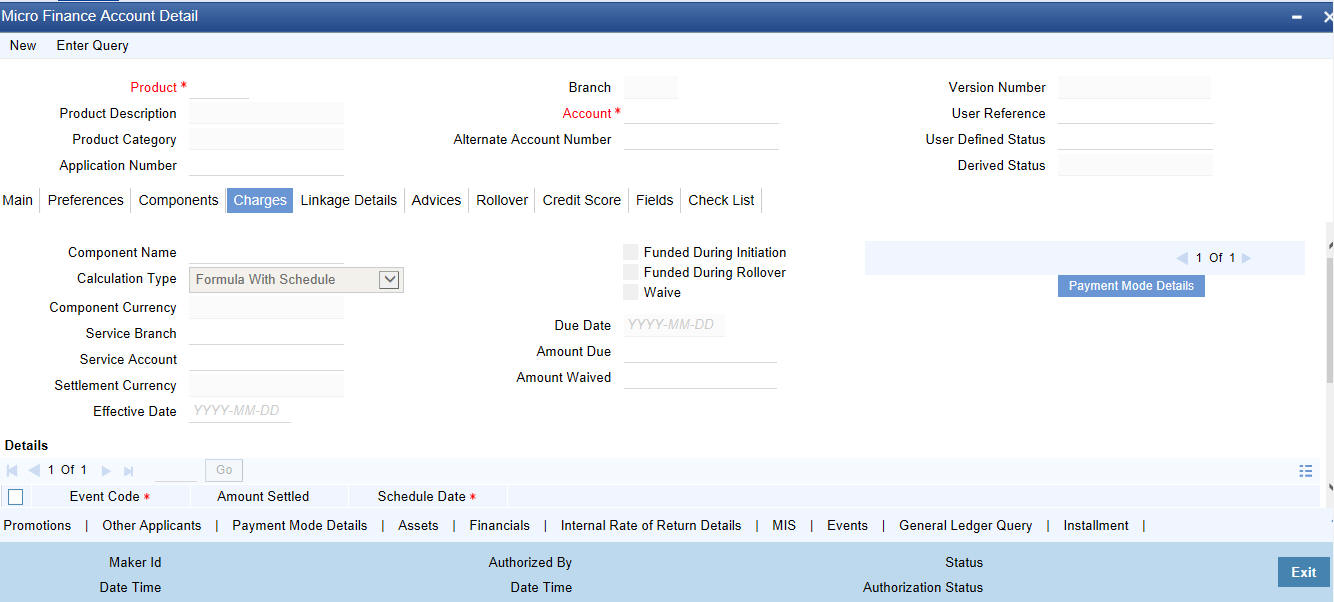

5.2.4 Charges Tab

This module is used for calculating and applying charges on an account. To calculate the charges that we would like to levy on an account, we have to specify the basis on which we would like to apply charges. For example, we may want to apply charges on the basis of the debit turnover in an account. When we define a Charge product, we have to specify the Charge basis.

When we apply the charge product on an account or an account class, charges for the account will be calculated on this basis.

The following details are captured:

Component Name

The component name is displayed in this field.

Calculation Type

To specify the manner in which the component should be calculated and liquidated. You can choose one of the following options:

Formula with schedule (Component Type - Interest)

- Formula without schedule (Charge)

- Penal Interest

- Prepayment Penalty

- Discount

- Schedule without formula (Principal)

- No schedule No formula (Ad Hoc Charges)

- Penalty Charges

Component Currency

The system displays the currency associated with the component. The component currency is defaulted from the Product level.

Service Branch

The branch that services the account - Any Valid, Open Branch

Service Account

This field denotes the account in the service branch. The service account is needed for all modes apart from CASA. The adjustments etc will be settled through this account.

Settlement Currency

Click the option list to choose the details of the currency in which the payments are to be made in this field. A list of currencies is displayed. Double click on a value to select it.

Effective Date

Enter the details of the date from which the charge is applicable in this field.

Funded during Initiation

Select this option if the component can be funded during loan initiation.

Funded during Rollover

Select this option if the component can be funded during the rollover process

For each component, the following details are displayed:

- Event Code

- Component Name: A component will be of type ‘Charge’

- Amount Due: The amount due for repayment in this field

- Amount Settled: The settled amount in this field

- Schedule Due Date: The scheduled date for repayment in this field

Waive

If this option is checked, the charge defined for event is waived off.

Due Date

Specify the date on which the charge was applied.

Amount Due

Enter the details of the amount due for repayment in this field.

Amount Waived

Specify the waived amount in this field.

For each component, the following details are displayed:

- Event Code

- Amount Settled: The settled amount in this field

- Schedule Date: The scheduled date for repayment in this field

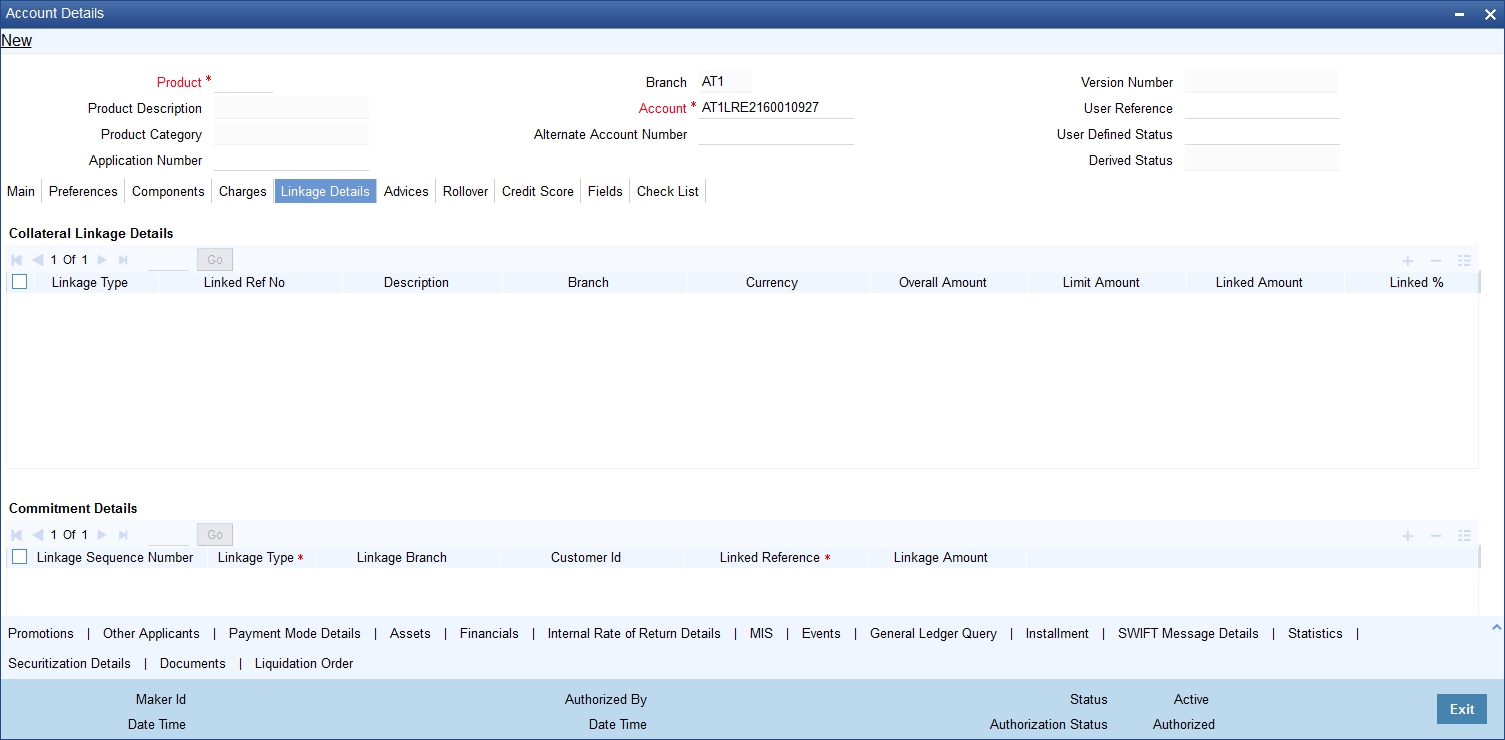

5.2.5 Linkages Tab

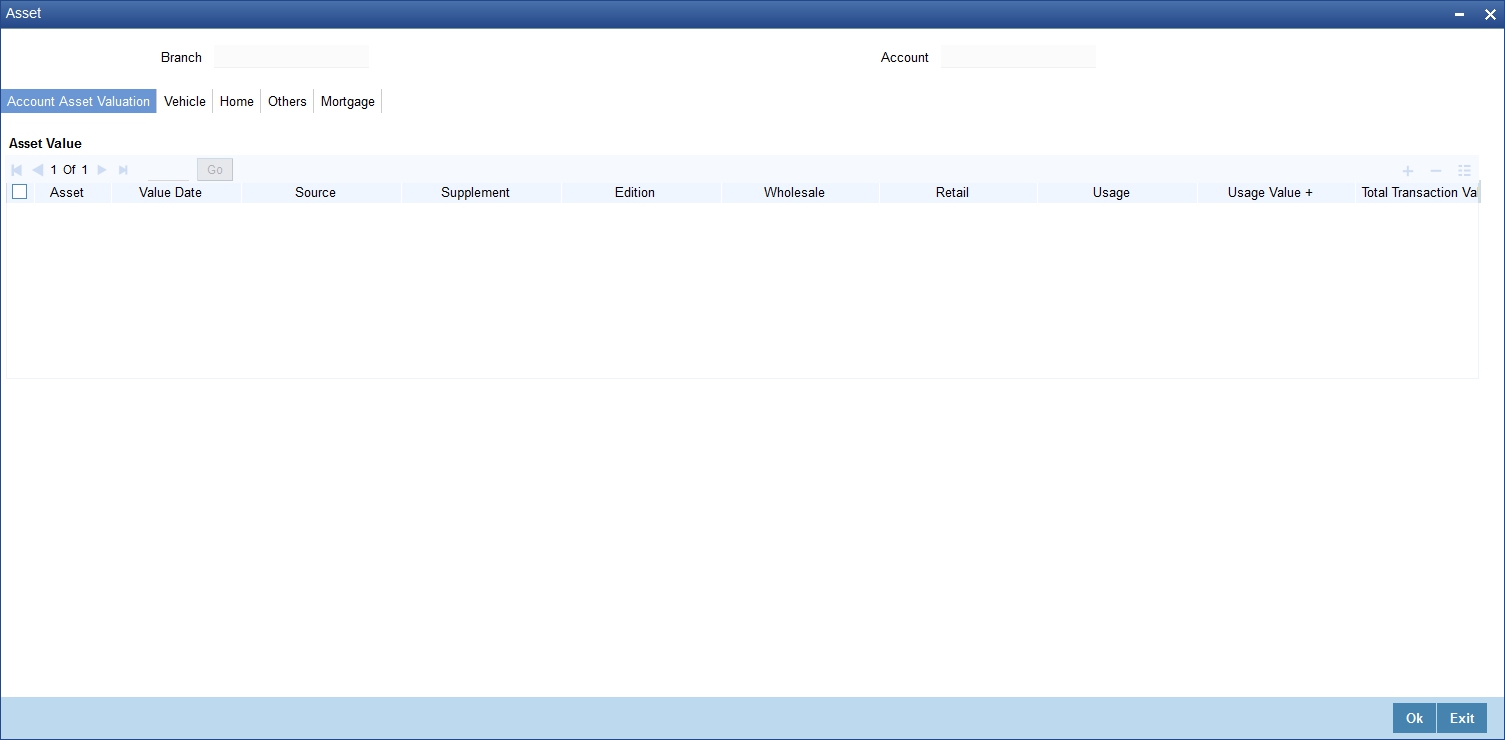

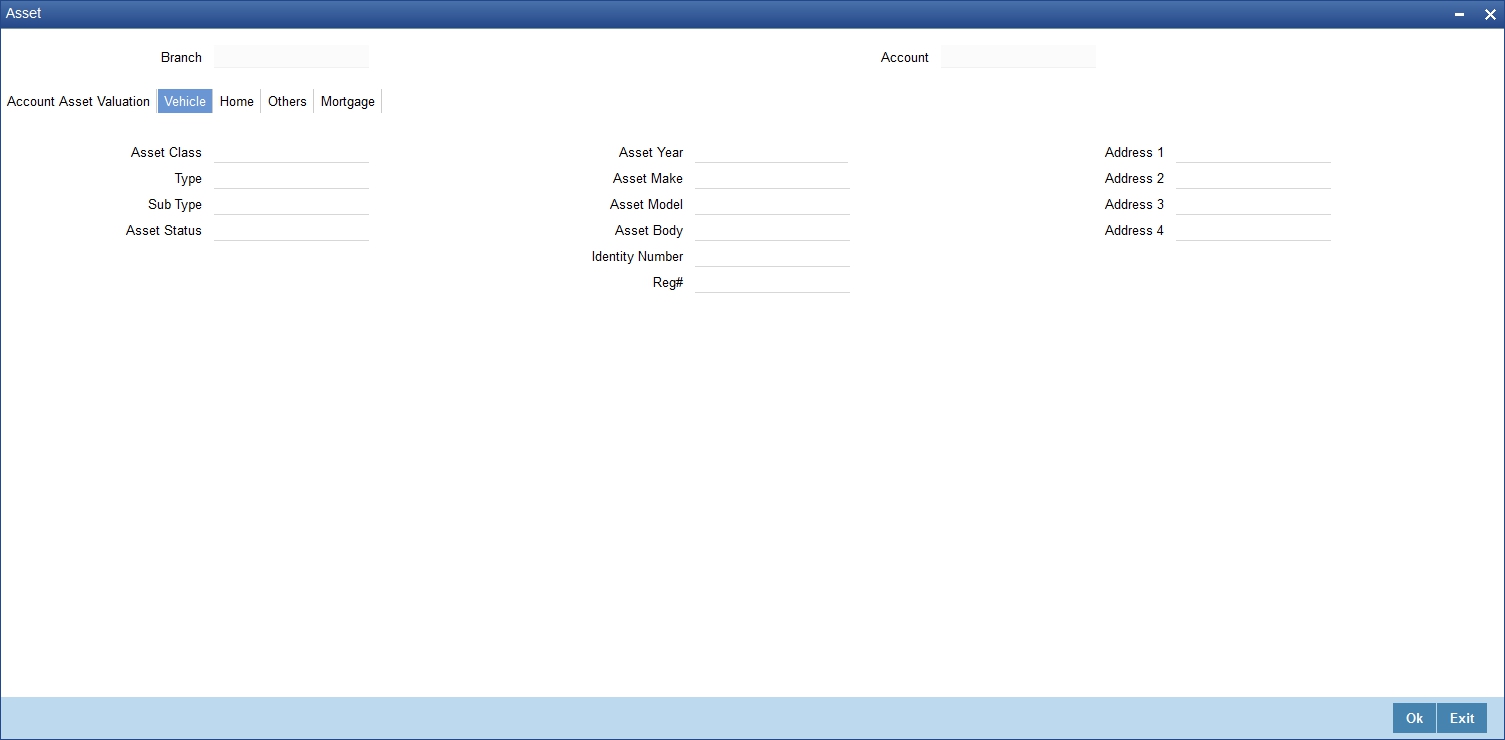

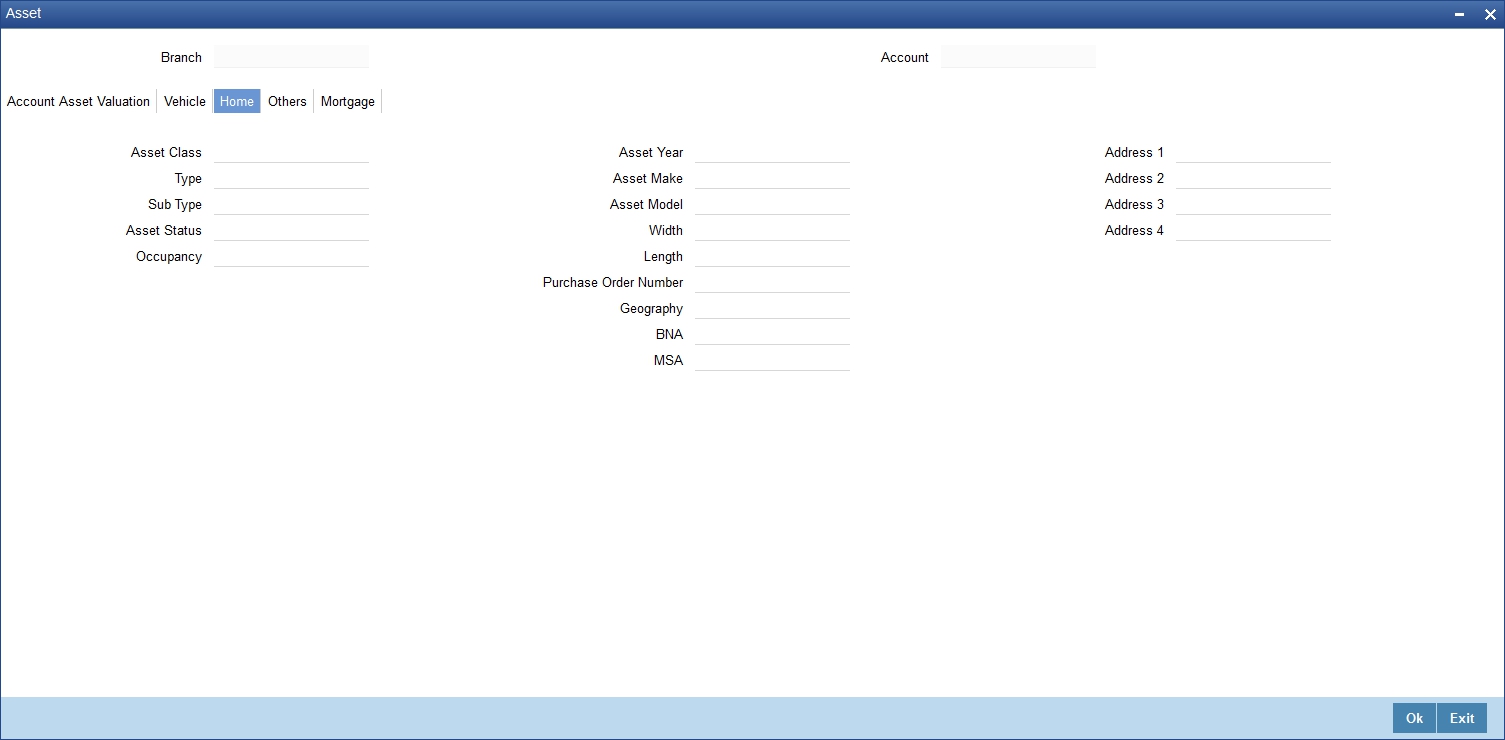

At the time of Loan account capture, the Linkages to securities backing the loan is captured. They include:

- The reference number of the Local Collateral , , Line , Account , Amount block, Commitment, Guarantee Collection Bill is linked

- The amount which is attributed to the particular reference number is also captured

- The account input screen captures the Linkages as shown below.

Collateral Linkage Details

You can specify the following Linkage details:

Linkage Type

Click on the list item to choose the details of the linkage type. A list of values is displayed.

Linkage Ref No

Select the linkage reference number be used for corresponding field, from the adjoining option list.

Description

Specify a description of the linkage type.

Branch

Select the branch from the adjoining option list. All valid branches maintained in the system are displayed here.

Currency

Select a currency code from the adjoining option list. All valid currency codes maintained in the system are displayed here.

Overall Amount

Specify overall amount of the collateral if you have selected ‘Linkage Type’ as ‘New Collateral’. The system displays values of different parameters based on the linkage type.

- If the linkage type is ‘New Collateral’, then the system displays the new collateral value as the overall amount.

- If the linkage type is ‘Local Collateral ’, then the system displays the local collateral amount as the overall amount.

- If the linkage type is ‘Facility’, then the system displays the effective line amount as the overall amount.

Collateral Category

Category of the collateral is displayed here, if the ‘Linkage Type’ is maintained as ‘Local Collateral’; however, you need to specify collateral category if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Hair Cut %

Percentage of hair cut for the collateral is displayed here, if the ‘Linkage Type’ is maintained as ‘Local Collateral’; however, you need to specify Hair Cut %, if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Limit Amount

The system displays the following as limit amount based on the selected linkage type, on saving the loan account:

- If the ‘Linkage Type’ is ‘New Collateral’, then the system displays the value computed after applying Hair Cut percentage on the amount.

- If the ‘Linkage Type’ is ‘Local Collateral’, then the system displays the limit amount of the selected collateral as the limit amount of the account.

- If the ‘Linkage Type’ is ‘Facility’, then the system displays the overall amount as the limit amount of the account.

Linked Amount

You can specify either the linked amount or linked percentage. If you specify the linked amount, the system updates and displays the linked percentage of the amount financed. If you specify the linked percentage, the system will update and display the linked amount. You need to specify the linked percentage based on the amount financed.

Linked%

You can specify either the linked amount or linked percentage. If you specify the linked percentage, the system will update and display the linked amount. You need to specify the linked percentage of the amount financed.

If you specify the linked amount, the system updates and displays the linked percentage of the amount financed.

Utilization Order Number

Specify a valid order in which you need to utilize the linkage linked to the account. The system utilizes the linkage in an ascending order.

Utilization Amount

Utilized amount of the account is displayed here.

Commitment Product

Commitment product of the selected collateral is displayed here, if the ‘Linkage Type’ is maintained as ‘Local Collateral’; however, you need to specify a valid commitment product, which is open and authorized if the ‘Linkage Type’ is ‘New Collateral’, from the adjoining option list.

Taken Over

The system displays the taken over collateral as ‘Yes’ if the collateral is taken over. The system defaults the status as ‘No’ if the collateral is not taken over.

Note

- The system generates a unique collateral code for the collateral, automatically created. This unique code is the loan account number concatenated with a three digit unique number.

- If the ‘Linkage Type’ is ‘New Collateral’, then the system creates and authorizes the collateral with ‘Collateral Type’ as ‘Normal’ and assigns the Liability ID of the customer. However, you can manually create collateral with different type and link it to the account.

- The system validates if the Amount Financed is greater than the Linked Amount of the Collateral Linkage Details Block. If the Amount Financed is greater, then the system will auto track the remaining amount against the Liability ID of the customer.

- If the Liability ID does not have sufficient available balance, then the system displays the override message as ‘The liability does not have enough available balance. Do you want to continue?’

- When an account is deleted, the system re-instates the collateral if it is utilized by the account and closes the collateral that was created new, automatically.

Commitment Details

You can specify the following details:

Linkage Sequence Number

Enter the sequence number for the linkage that you are specifying. The valid values are Line, Deposit, Guarantee, Amount Block, CASA Account, Commitment and Local Collateral

Linkage Type

Click on the list item to choose the details of the linkage type. A list of values is displayed.

Linkage Branch

Select the branch of the linkage type

Linked Reference

Select the linkage reference number be used for corresponding field, from the adjoining option list.

Linkage Amount

Enter the linkage amount in this field.

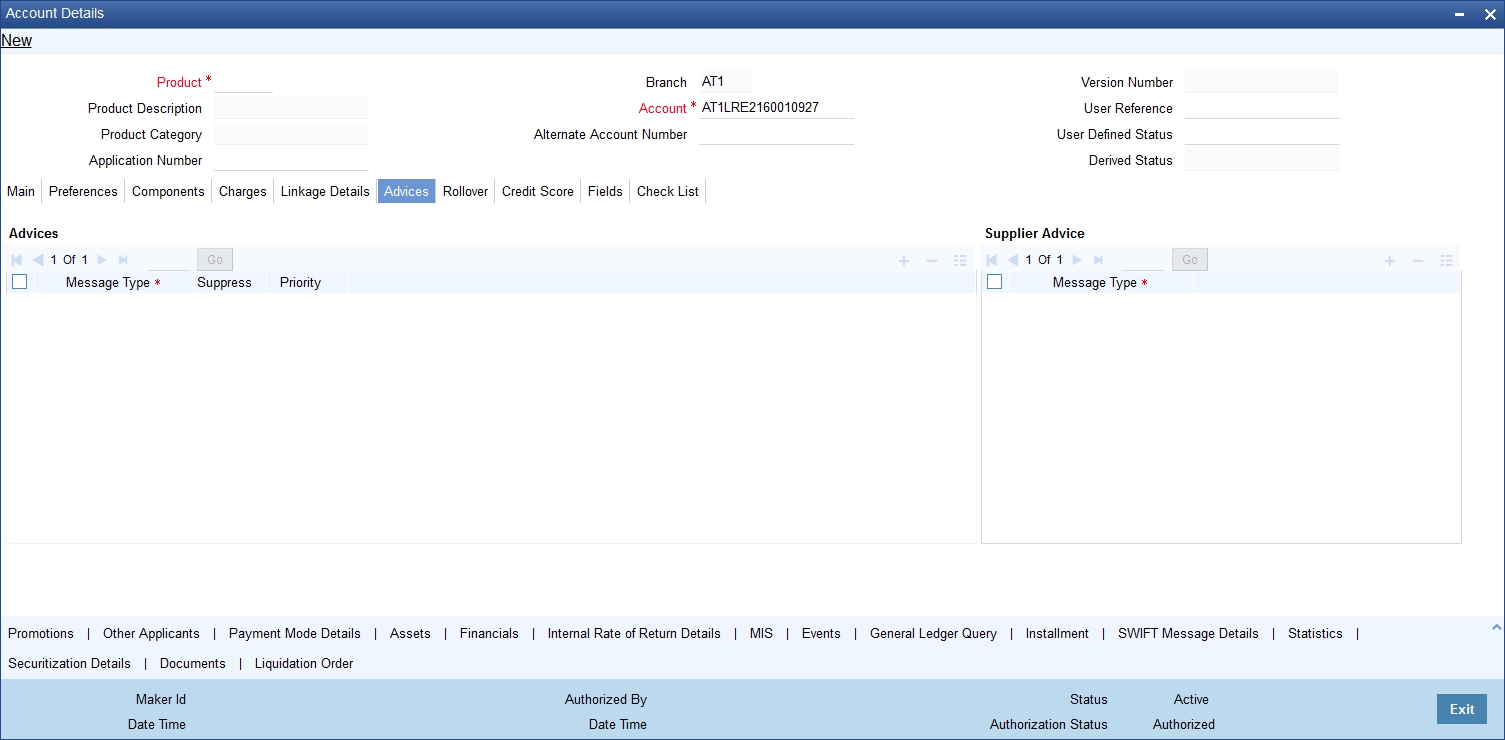

5.2.6 Advices Tab

Advices that may be generated whenever the account level status changes or whenever a particular event is fired can be linked at the Product level. Priorities of the advice can be changed and also a particular advice for an event can be suppressed.

Generation of an advice across the life of the account can also be suppressed.

You can specify the following Advice details:

Message Type

The system displays all the advices for all the events for the account. The list will include all the advices that are defined at the product level

Suppress

This field allows the user to suppress the generation of the advice for a particular event. The options are Yes or No.

Priority

Click the option list to select the priority of generation. A list of values is displayed. Double click on a value to select it.

The options are High, Medium or Low.

5.2.6.1 Supplier Advices across the Account

The generation of an advice across the life of the account can be suppressed.

Message Type

Click the option list to select the type of advice, the generation of which can be suppressed across the account. A list of values is displayed. Double click on a value to select it.

The list includes advices defined at the product level

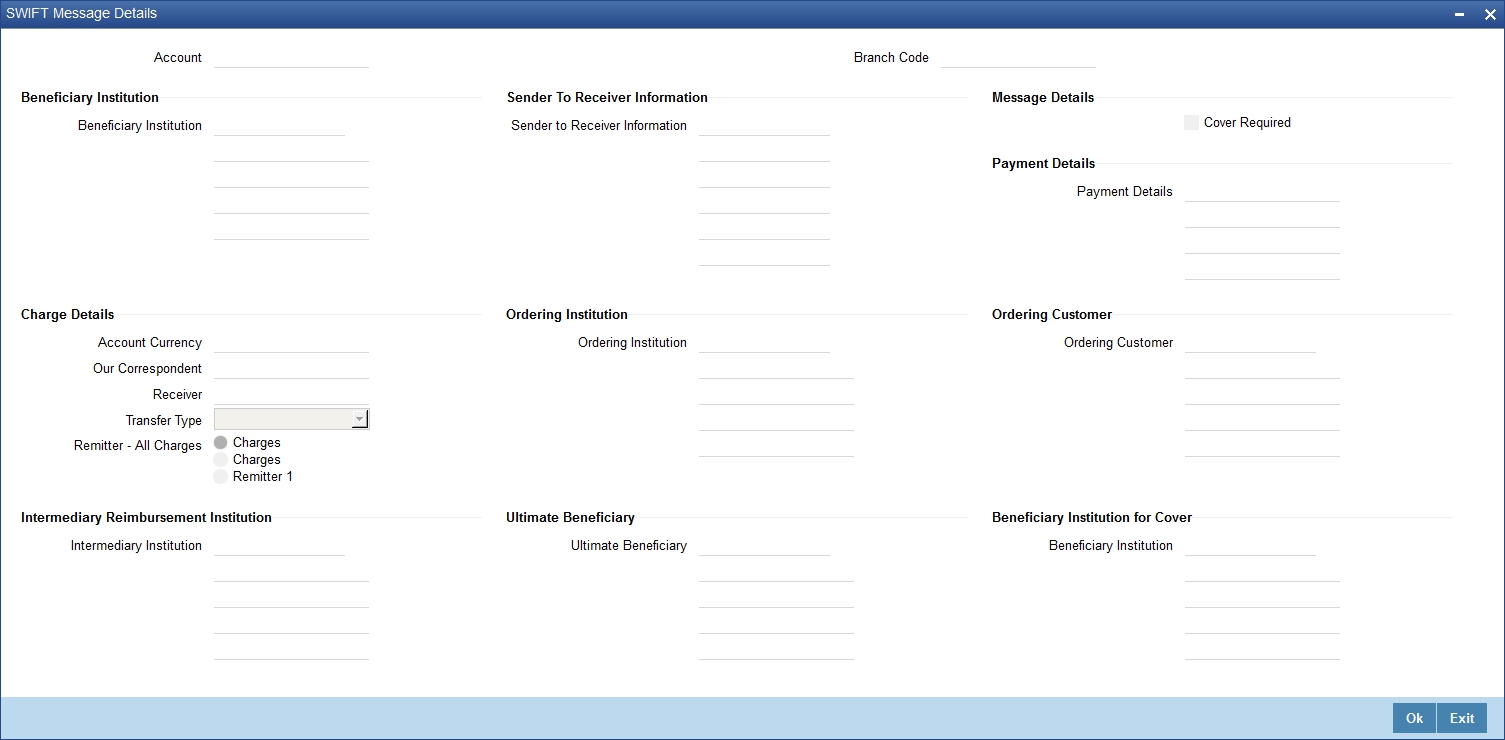

You can suppress the Payment Message defaulted in case you do not need a credit through swift message.

The message is automatically suppressed if the Principal Credit Settlement account is changed to a GL or if the receiver in ‘Swift Msg Details’ screen is not valid to receive the message i.e, if the Customer Type of the Receiver party is not a Bank.

Also, if the settlement mode for PRINCIPAL component is anything other than CASA, the swift message is automatically suppressed.

If the Transfer Type is chosen as blank i.e, neither Customer Transfer nor Bank Transfer, then PAYMENT_MESSAGE will become CREDIT_ADVICE by Swift(MT910) if the Receiver is a bank and the credit settlement account is a current account

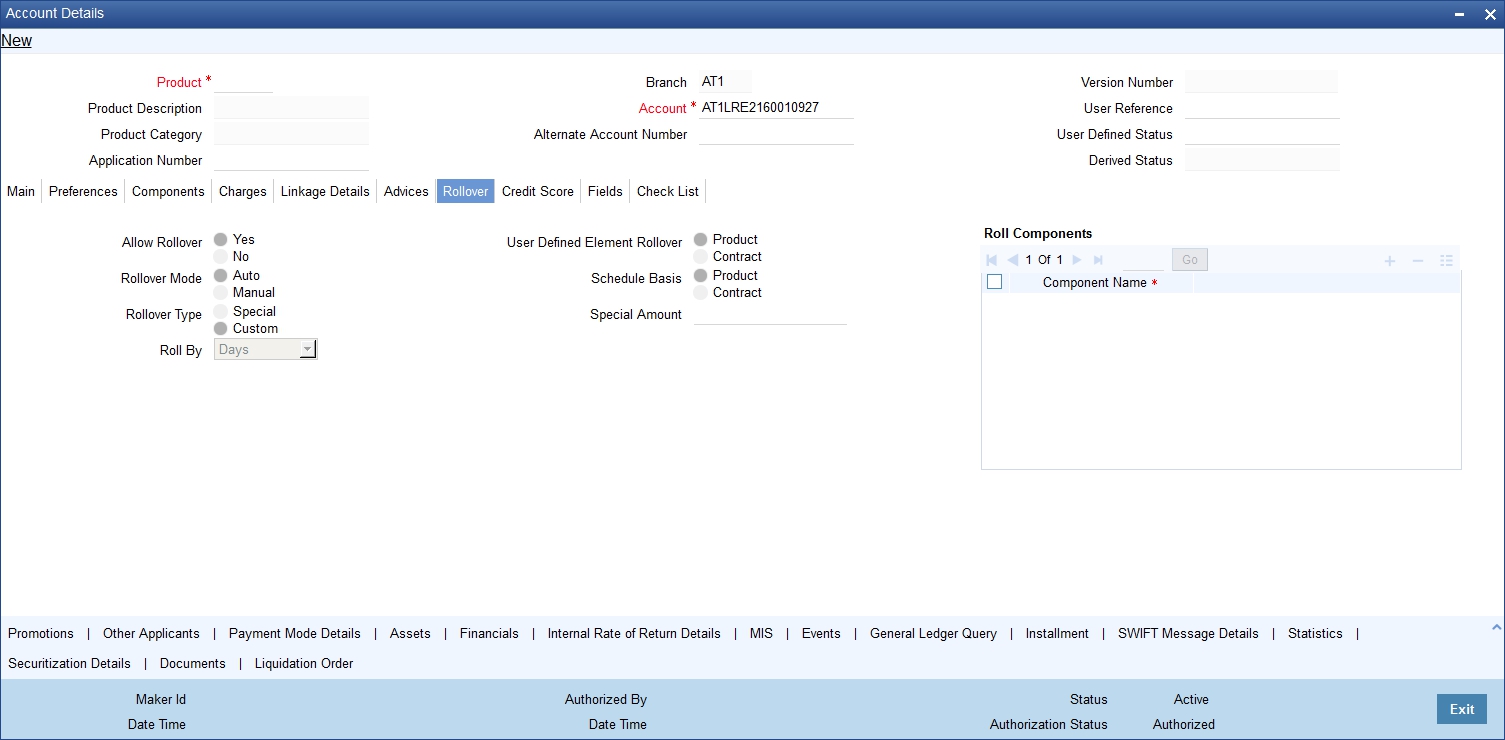

5.2.7 Rollover Tab

Click ‘Rollover’ tab to maintain rollover details.

You can maintain the following details here:

Allow Rollover

Select the required option to indicate if rollover should be allowed for the loan or not. The options are:

- Yes

- No

Rollover

This option is used to determine if the Rollover is system driven or not .You can select either of the following options:

- Auto - If you select the option Auto Rollover, then upon maturity, the Account will be rolled over automatically by the system Rollover batch run in BOD.

- Manual - If you select the option Manual roll over, then the system does not perform the auto rollover and you can perform a manual rollover.

By default, the system selects the ‘Auto’ option

Rollover Type

Select either of the following options:

- Special Amount: If your rollover is a special amount, select this option and capture the amount that has to be rolled over

- Custom: If the rollover type is ‘Custom’, then select the ‘Component Names’ that have to be rolled over

UDE Rollover

Select the required option to determine if at the time of rollover the UDE value would be defaulted from the product or from the account /Contract

Note

The system by default does not select the option Contract.

Schedule Basis

This flag will determine if at the time of rollover the schedule would be defaulted from the product or from the account/Contract

Note

The system by default does not select the option Contract.

Roll By

Specify the basis for rollover. It could be any of the following:

- Days

- Months

- Years

Rollover Components

You can maintain the following detail here:

Component

This option is applicable when Rollover Type is Custom. The option list provided will display the components relevant to the account from which you can choose the components that are to be rolled over.

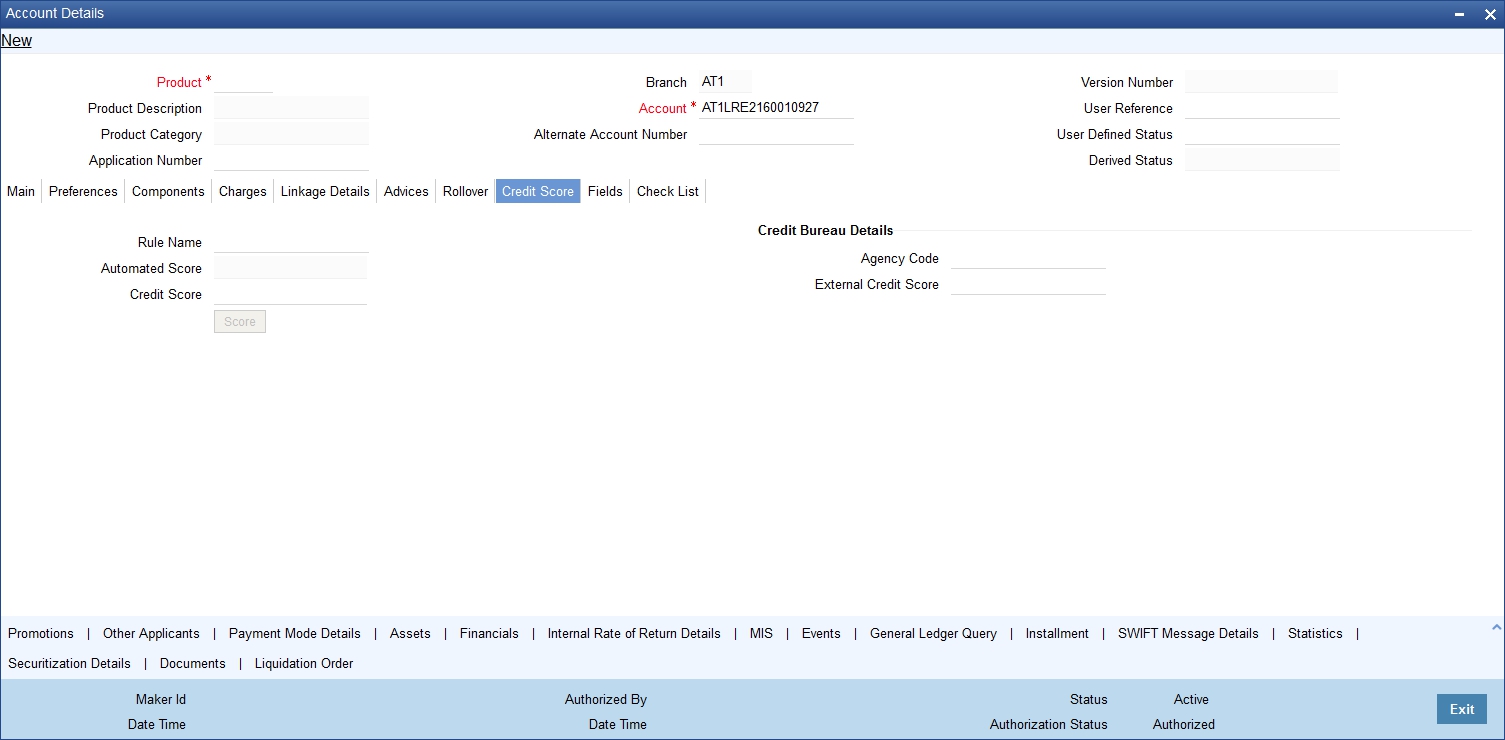

5.2.8 Credit Score Tab

Click ‘Credit Score’ tab to specify the details for calculating the credit score.

You need to specify the following details here:

Rule Name

The rule associated with the loan product gets defaulted here. You can modify this, if required.

Credit Score

Specify the credit score associated with the customer.

Automated Score

The credit score calculated by the system based on the rules maintained at the product level gets displayed here.

Agency Code

Select the code of the external agency, to be approached for calculating the score.

External Credit Score

The score as calculated by the external agency is displayed here. Click ‘Score’ to auto-generate the credit score for the customer.

Click ‘Score’ to auto-generate the credit score for the customer. Click ‘External Score’ to auto-generate the credit score for the Bureau.

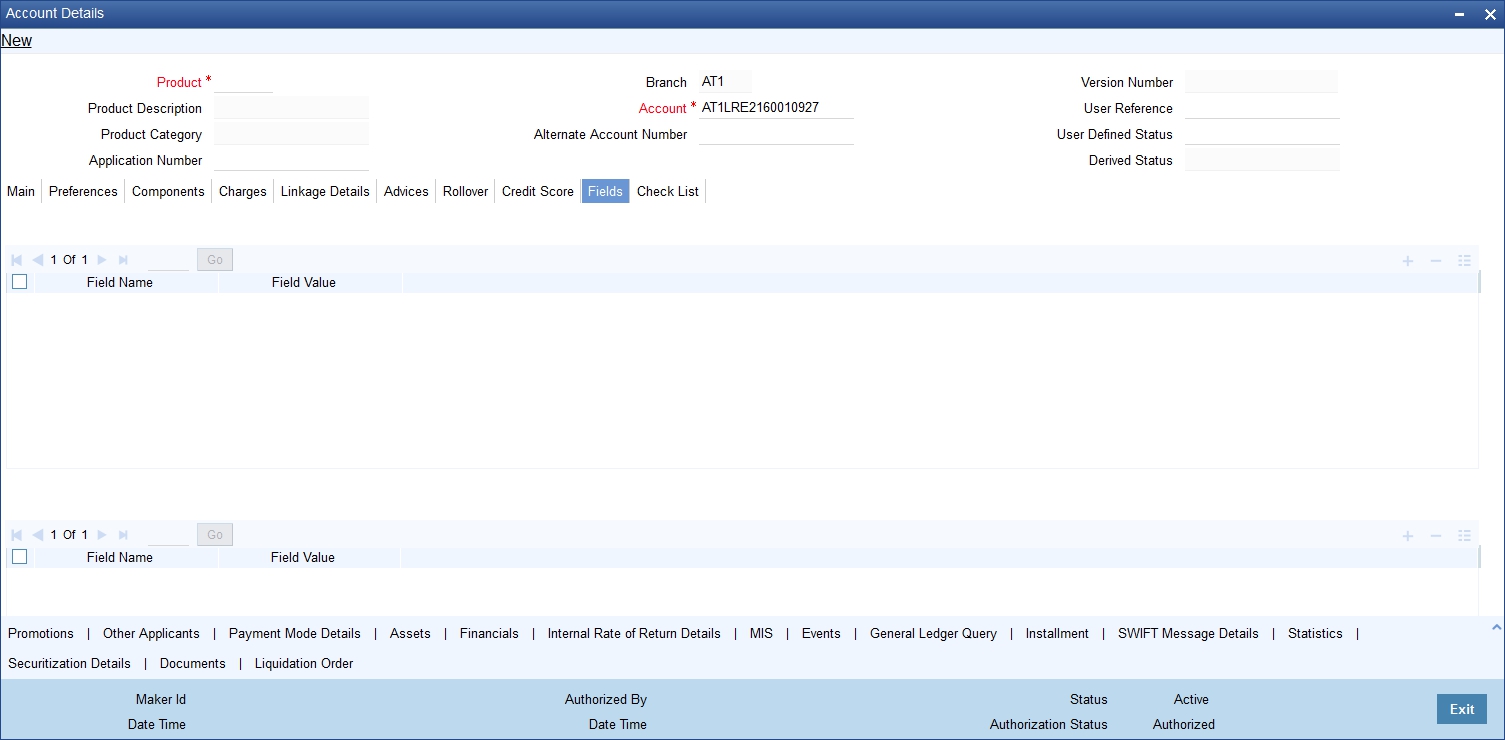

5.2.9 Fields Tab

The User Defined Fields are defined at the Product level. These fields are available in the UDF button at the time of account creation.

The following details are displayed or captured here:

Field Name

The UDF descriptions defaulted from the Product screen are displayed. The system displays all the UDF descriptions defined at the Product level

Field Value

Specify the UDF value in this field. This is applicable only if the user input or list of values is defined at the time of creation of the UDF

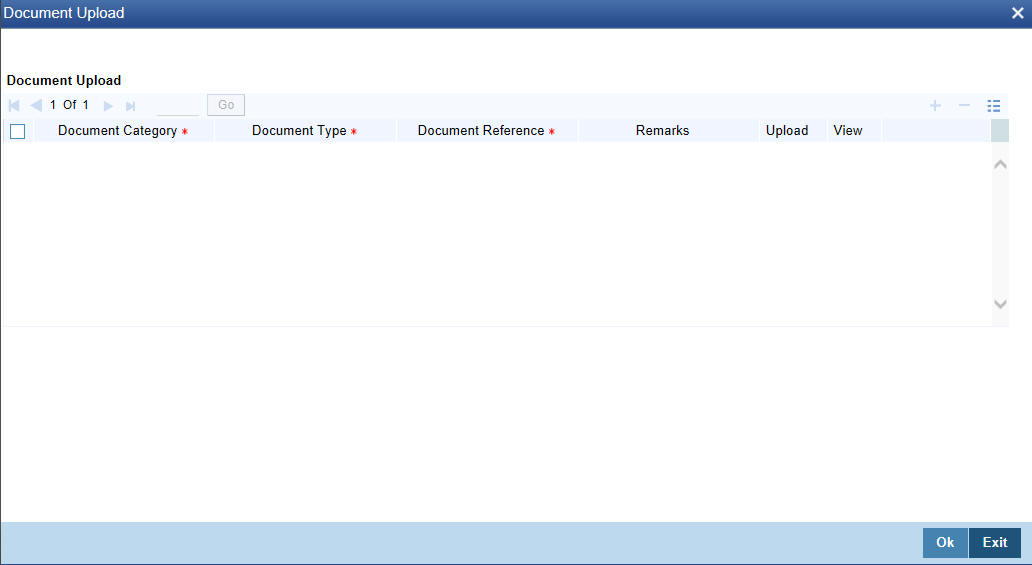

5.2.10 Check List Tab

The Check lists are maintained in the ‘Check List Maintenance’ screen and are linked to different events of the contract. The checklist maintained for the BOOK event is available in the Checklist tab at the time of account creation.

Check List

The following details are captured here:

Description

The description of the check list maintained for the BOOK event is displayed here.

Checked

Check this box to indicate that the check list item has been verified.

Remarks

Specify any additional remarks about the check list or the account in this free format text field.

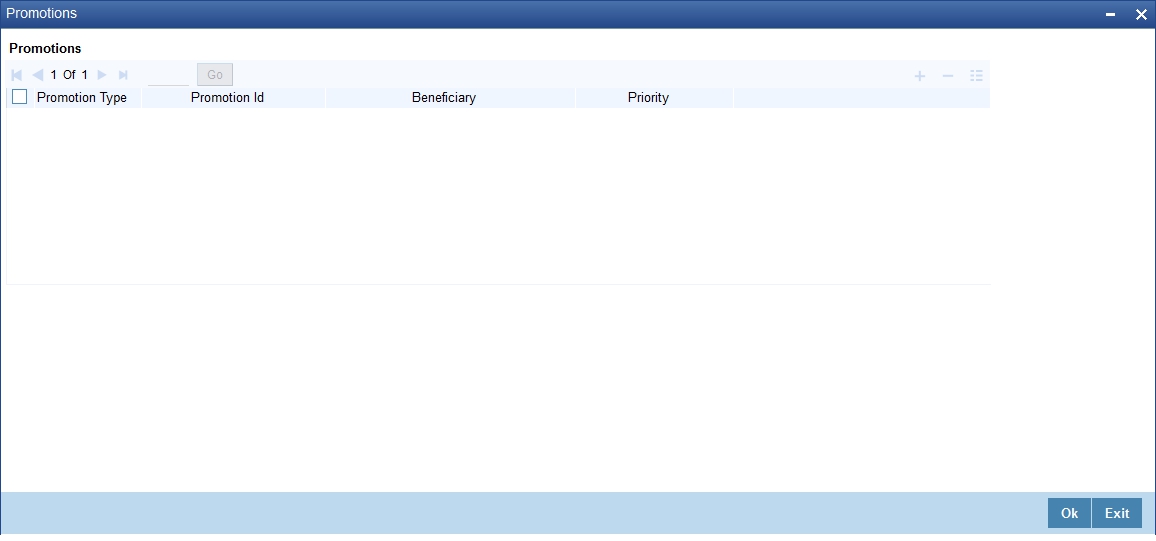

5.2.11 Specifying Promotions

Invoke the ‘Promotions’ screen by clicking the ‘Promotions’ button in the ‘Account Details’ screen:

The following details are captured here:

Promotion Type

The system displays the Promotion type to which the original loan is linked. It could be any of the following:

- CONVENIOS

- PROMOTION

- CORFO

- FOGAPE

Promotion ID

The system displays the promotion ID in this field

Beneficiary

The system displays the beneficiary CIF in this field

Priority

The system displays the priority assigned to the promotion.

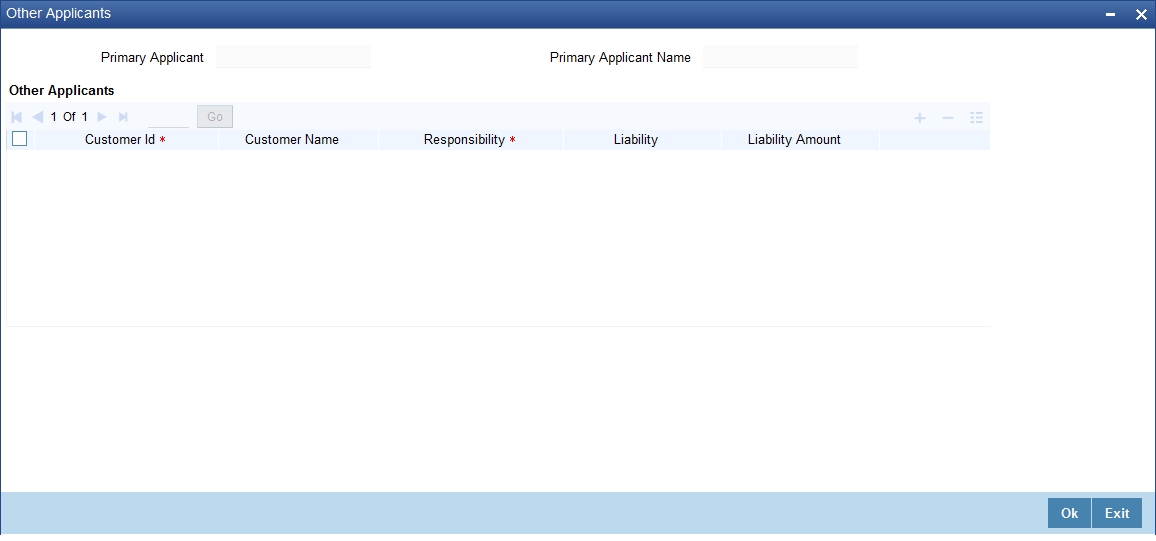

5.2.12 Specifying Other Applicants Details

You can maintain the primary and other applicants details in the ‘Other Applicants’ screen. Click the ‘Other Applicants’ button to invoke the screen:

You can maintain the following details of the Primary applicants:

Primary Applicant

This detail is defaulted from the main screen. Enter the Customer ID of the primary applicant in this field.

Primary Applicant Name

After you enter the Customer ID, the system displays the Name of the primary applicant in this field.

Other Applicants

The details of the liability parties to the account are maintained in this field. Other Applicants of a loan include Co-signers and Guarantors.

You can specify the following details of the Co-applicants:

Customer ID

To select the customer ID of the co-applicant, click the option list. A list of customer IDs is displayed. Double click to select the customer ID of the co-applicant.

Customer Name

After you enter the name of the Customer, the system displays the name of the customer in this field.

Responsibility

Select the details of the co-applicants and their responsibility as a Co-signer or as a guarantor from the option list. You can enter the details like the guarantor, co-signer, main addressee, advice notice receiver, and borrower etc., who is relevant to a joint account relationship. During initiation of the account, the primary customer is defaulted to ‘Borrower’ with 100% Liability and value date as the effective date. You are allowed to maintain multiple applicants (customer id) for a loan with the same responsibility (Borrower).

Note

While there is no processing impact, the difference will become important when the original debtor is absconding and the loan is unpaid etc.

Liability

Specify the contribution of the co-applicants to the Loan. You can specify the Liability of the co-applicant if any, in case of a Loan default. You can also specify the percentage of interest split among different co-applicants. It is not made mandatory to maintain ‘Liability %’ for the responsibility ‘Borrower’. There could be borrowers with 0% liability.

Note

The sum of ‘Liability %’ for all the customers of a loan to be equal to 100%

Liability Amount

The system calculates and displays the upper limit of the liability in terms of the amount in this field. You may override the computed value.

5.2.13 Maintaining Payment Mode Details

The debit and credit settlement mode details for the account can be maintained in the ‘Settlement Details’ screen. You can invoke this screen by clicking the ‘Payment Mode’ button in the ‘Main’ tab.

The options for debit mode are CASA, Credit Card, Debit Card, Clearing, External Account, Electronic Pay Order, Internal Check, Instrument, GIRO and Cash/Teller. The options for credit mode are CASA, Clearing, External Account, Instrument, and Cash/Teller.

You can maintain the following details here:

- CASA:

- Branch: Click the option list to choose the branch in which the customer account resides. Double click on a branch to select it

- Account: Click the option list to choose the account in the branch

selected. Double click on an account to select it. Credit Card / Debit

Card

- Card Number: This field captures either the Credit No or the Debit No details based on the selection.

The card must be a valid card whose number can be checked with a modulo logic or maintenance file.

- Clearing Network

- Clearing Bank Code: Click the option list to select the bank code as per clearing maintenance. Double click on a bank code to select it

- Clearing Branch Code: Click the option list to select the clearing bank branch. Double click on a branch code to select it

- Instrument No: Enter the number on the instrument presented for clearing in this field. Double click on a value to select it

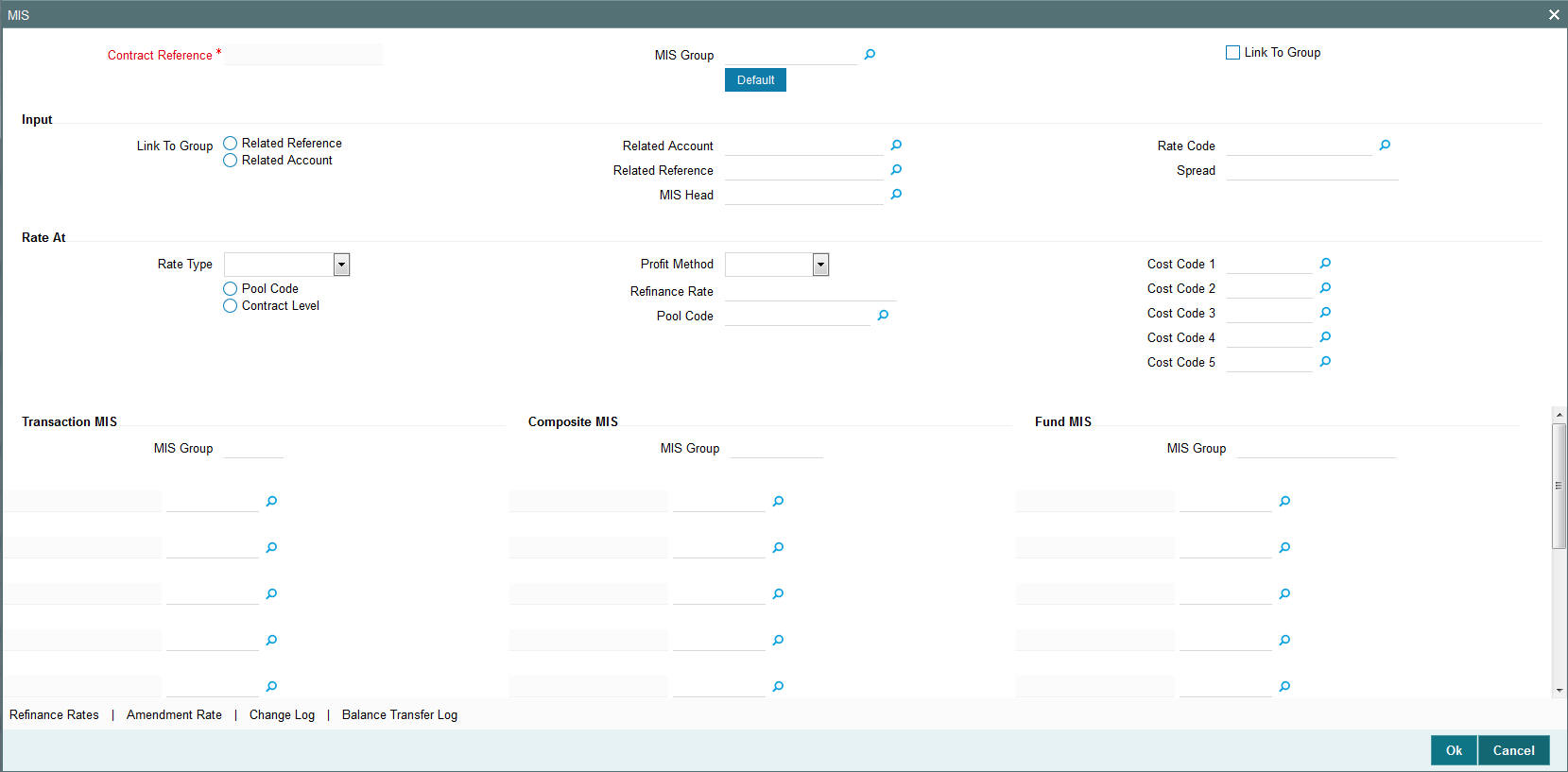

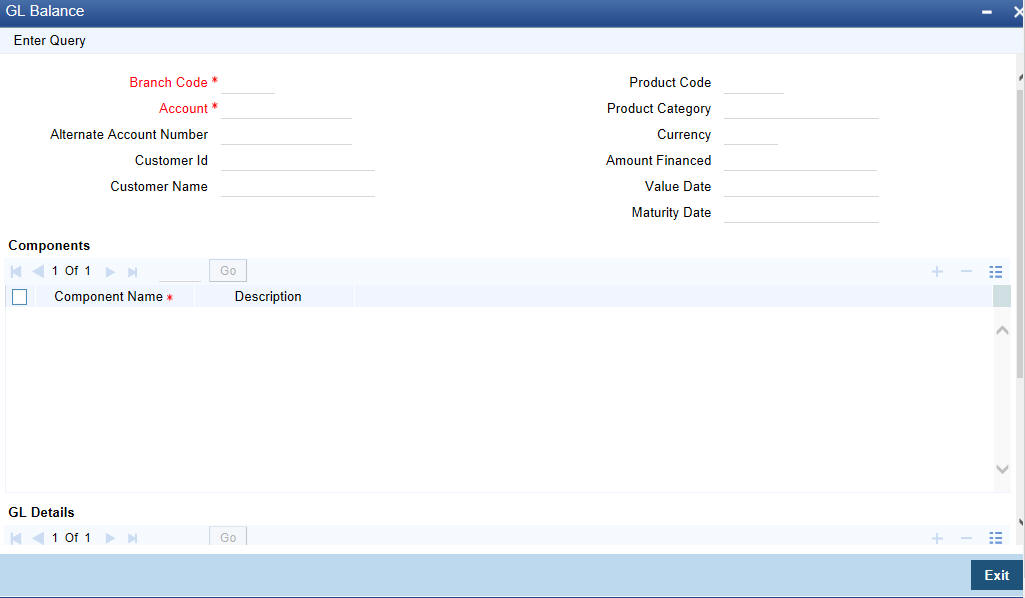

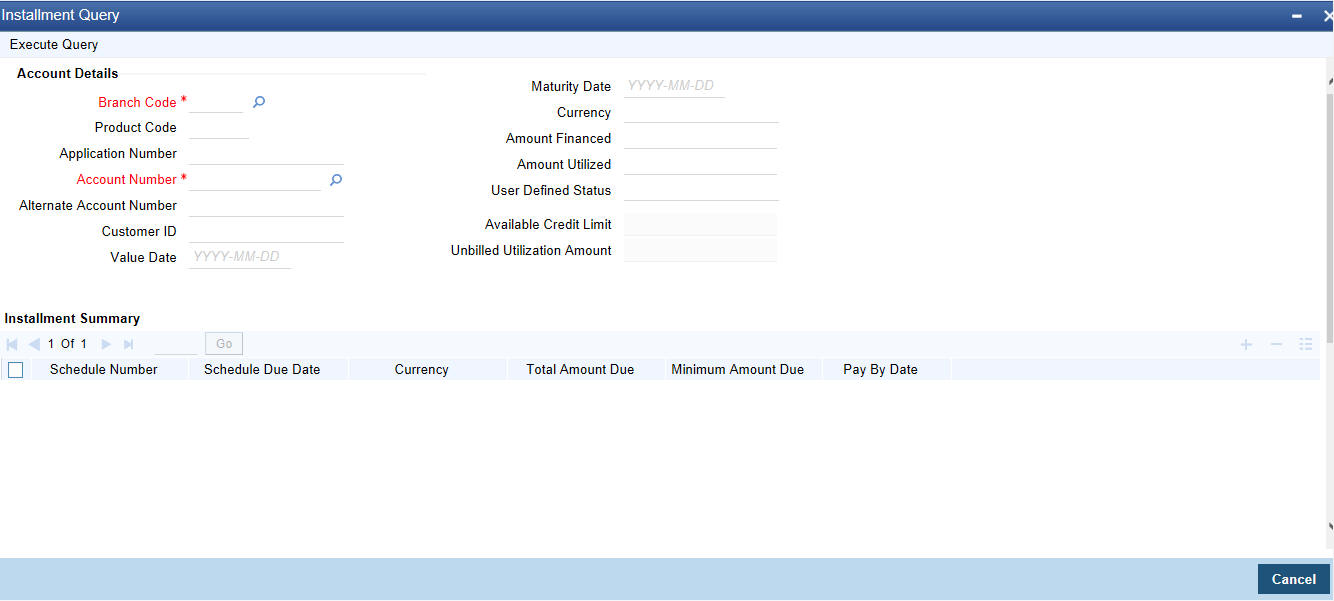

- Routing No: Enter the routing number of the branch selected for clearing in this field