10. Batch Processes

10.1 Introduction

The events that are to take place automatically are triggered off during what is called the Batch Process. The batch process is an automatic function that is run as a mandatory Beginning of Day (BOD) and/or End of Day (EOD) process. During EOD, the batch process should be run after end-of-transaction-input (EOTI) has been marked for the day, and before end-of-financial-input (EOFI) has been marked for the day.

This chapter contains the following section:

10.2 Configuring the Microfinance Batch Processes

This section contains the following topics:

- "Example 10.2.1" on page 2

- "Example 10.2.2" on page 4

- "Example 10.2.3" on page 4

- "Example 10.2.4" on page 4

- "Example 10.2.5" on page 5

- "Example 10.2.6" on page 6

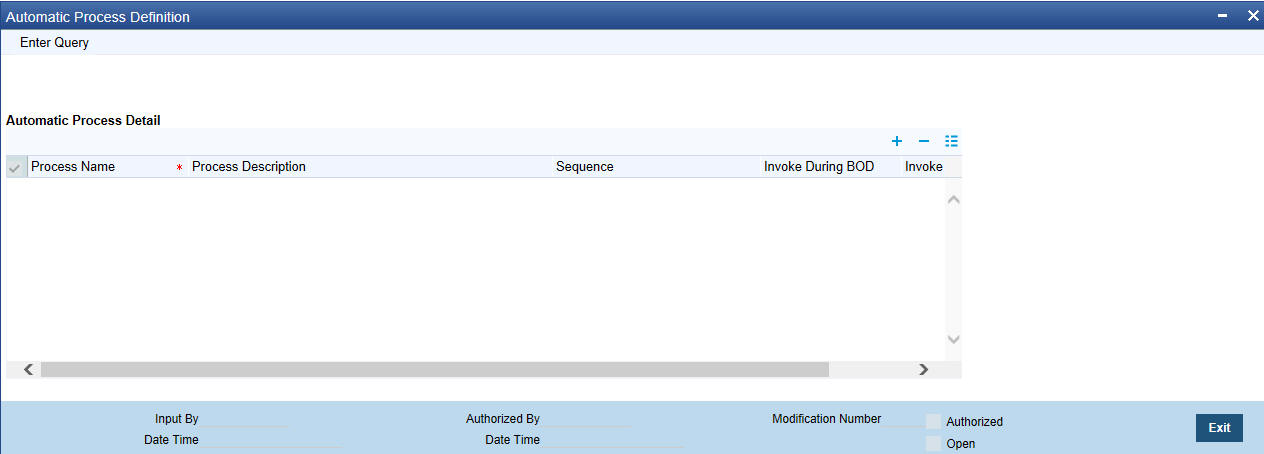

You have the facility to configure the batch processes to be executed either at EOD or BOD or both, as per the bank’s requirement. This is achieved through the ‘Automatic Process Definition’ screen. You can invoke this screen by typing ‘CLDTPROC’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you can amend the order of the various operations in the MF batch and choose to trigger them at EOD or BOD or both.

The default configuration is given below:

Batch Operation |

BOD/EOD |

Forward Init of Microfinance accounts |

BOD |

Calculation |

EOD/BOD |

Accruals |

EOD/BOD |

Auto Liquidations |

EOD/BOD |

Auto Disbursements |

BOD |

Rate Revisions |

BOD |

UDE Cascade |

EOD |

Maturity processing – Rollovers , Auto Closures |

BOD/EOD |

Automatic Status Change Processing |

BOD |

FEES |

BOD |

INTP (Interest Posting) |

BOD |

Billing & Payment Notices |

BOD |

Statements generation |

EOD |

Penalty Computation |

BOD |

Forward VAMIs |

BOD |

Revaluation |

EOD |

Readjustment |

EOD |

These batch processes are factory shipped for your bank.

10.2.1 Defining Batch Processes

The MF batch processes are explained briefly:

Forward Init of Microfinance accounts

Microfinance accounts maintained in the system are classified into two types:

- Active

- Inactive

When microfinance accounts become Active, the BOOK event is triggered for the Loan and you can specify a Value Date for the loan during this event.

This batch identifies all the accounts that are due for initiation on that day, at BOD and the INIT event is triggered for these accounts. The current system date will be taken as the value date for these accounts.

Re-Calculation

Loan parameter alterations directly affect the computation of accruals. This batch identifies such changes made to microfinance accounts, both at BOD and EOD. Further, it recalculates the accruals based on the altered loan components.

Accruals

This batch passes all the recalculated accrual changes required for the components. It is triggered, both at BOD and EOD.

Auto Liquidations

This batch processes the payments that are configured as auto payments and is triggered both at BOD and EOD.

Auto Disbursements

Disbursement schedules are maintained for products. As part of BOD process, the DSBR events for the accounts will be triggered.

This batch processes these schedules at BOD, which enables the DSBR events of the accounts to be initiated.

Rate Revision

As part of BOD program, this batch processes the Floating Rate revision schedules for products.

UDE Cascade

This batch is triggered at EOD in case of UDE value changes. The changes in UDE values are applied to all the affected accounts.

In case, a single account requires a UDE Change/Cascade, it can be performed online for that account alone. Such accounts are then excluded from this batch.

Maturity Processing

Maturity processing of loans is performed if the maturity date falls at BOD of a particular day. This results in either Auto Closure or Rollover of loans.

- Auto Closure: Loans that are liquidated on maturity are subject to Auto Closure, during maturity processing.

- Rollover: Loans that have auto rollover maintained are rolled over during maturity processing.

Status Change Processing

Certain accounts have automatic status changes, wherein the SDEs required for status change are evaluated. In such cases, this batch detects status changes at BOD. Once this is done, appropriate status change activities are triggered.

If you have selected the CIF/Group level status processing option (as part of the preferences for your branch), the status change batch picks up the worst status among all the loans and accounts (savings and current accounts) for a customer within the branch and updates this in all the customer’s loans (in the ‘User Defined Status’ field).

Notice Generation – Billing, Payments

For each loan, the number of days prior to which a Notice is to be generated is evaluated. In case of loans that carry dues, the Notice is generated as specified in the notice days maintained for the product. This batch is processed at BOD.

Statement Generation

At EOD, the statement is generated depending on the statement frequency and other statement based maintenance actions specified.

Forward VAMI

At BOD, this batch processes all value dated amendments that are booked with the date as Value Date.

Penalty

Penalty computations are evaluated at BOD by this batch. Any grace period maintained will have to be considered during this calculation. On completion of the grace period, the penalty components are computed from the due date till the current date.

Revaluation

At EOD, revaluation of assets and liabilities to the LCY are carried out.

Readjustment

This batch is processed at EOD. It is triggered in the presence of Index currencies that are not treated as a part of revaluation. It handles readjustments based on new index rates.

10.2.2 Initiating the Batch Process

If you have opted to trigger the MF batch programs at EOD, the same will be executed as part of the ‘End of Cycle Operations’ after marking the ‘EOTI’ for the day. If the trigger is maintained as ‘BOD’, the programs will be executed before the start of ‘Transaction Input’. However, the programs will be triggered both at EOD and BOD if you opt to trigger it at both the instances.

You also have the option to execute the batch programs through the ‘MF Batch’ screen.

Run Sequentially

Check this box to opt to execute the processes as per the sequence maintained in the ‘Automatic Process Definition’ screen.

Click ‘Run’ button to run the batch process. Click ‘Cancel’ button to cancel the batch execution.

10.2.3 Multi-threading of Batch Processes

The MF Batch process handles multi threading. The number of parallel processes and the interval between processes is maintained as part of ‘Branch Parameters’.

Refer the section titled ‘Maintaining Branch Parameters’ in the ‘Maintenances and Operations’ chapter of this User Manual for details.

The accounts are split into multiple groups which can be processed in parallel for a particular sub process. Hence, all non conflicting parallel groups will complete the sub process after which the next sub process is taken up and so on. There is also an option to run it purely sequentially as shown above.

10.2.4 Excess Amount Allocation Batch

The Excess Amount Allocation batch is run to allocate the transfer amount available for each member against the outstanding balance in the corresponding microfinance accounts.

A member account is owned by a single member, but a microfinance account can be co-owned by several members in a certain ratio. Each member could be a borrower in multiple loans. For these reasons the amount allocations are necessitated.

The allocation process considers the following important parameters:

- % liability of each member in each loan where he is the borrower

- Transfer amount available per member

- Amount due (based on % liability) per member

To enable this fund allocation the rebate batch is run at the bank level. Common Settlement Account maintained in ‘Rebate Account Preferences’ screen is used as the ‘Common Bridge Account’. This will have the combined balance of all the member accounts, which can be utilized for loan re-payment. The Rebate account processing batch will provide the details like the member account number (CASA account), the member (CIF number) and the excess amount for the member. This data will act as the input for this batch program.

The batch does the following operations:

- It will get the due details for the next schedule of each loan, along with the Liability Split %. This will include the overdue amount, if any.

- Allocate the excess amount of each member to his loans, with the earliest unpaid schedule first.

- The due date of the schedule will be considered by the allocation batch for allocating the payments. The batch will ensure that the available amount is used to make advance payment for the immediate next component due before considering the next.

- While allocating the amount for the next schedule, the available amount will be available amount minus the amount already allocated against the previous schedule.

- With this info, MF payment will be triggered for each microfinance account. This will be an advance payment (not Pre payment) for an aggregate amount and will be initiated according to the liquidation order maintained for the components.

- On successful payment, process status will be changed to ‘P’ for all the records with this Microfinance account number.

- Status will be changed to ‘E’, in case of any error during the payment. As per the current functionality, the error details will be available in the exception table.

- After correcting the errors, you can re-initiate the process which will exclude the already processed microfinance accounts.

- Further generation of Payment advice will derive the amount after considering the amount paid through this batch process.

10.2.5 Interest Posting (INTP Event)

You need to make a provision to post an income into a separate GL. This income is the interest which you pay to the customer who has a microfinance account. On the interest posting date, a transaction occurs to move the receivable and the income from one GL to another. This transaction distinguishes between receivables from the income which is due and not due. Also, this interest posting is applicable for the main interest component only.

The INTP event runs at the BOD for a loan product against which it has been defined.

The following points are noteworthy:

- You can pick the INTP event during the loan product definition and maintain the accounting entries against this event. To recall, you need to click on the ‘Events’ tab in the ‘Consumer Lending Product’ screen where you specify the various events which need to be run.

- At the time of microfinance account creation, Oracle FLEXCUBE populates the events diary with one record of the INTP event for each schedule due date. This has the status as ‘Unprocessed’. This is done for the main interest component schedule only.

- The system also creates a record for the end of each calendar quarter during the moratorium period in the case of amortized loan products.

- Any rebuilding of repayment schedules results in the rebuilding of records in the events diary.

- The batch process picks up all the unprocessed INTP records from the events diary having the execution date on or before the current application date. The process is limited to the active accounts belonging to the current branch.

- The amount and date of due for the main interest component is fetched from the component schedule due details.

- The accounting entries get passed on the schedule due date or the calendar quarter end, as defined for the event INTP through the ‘Consumer Lending Product’ screen under the ‘Events’ tab pertaining to a loan product maintenance.

- For term loans, the transaction posting date is the same as schedule due date of the main interest component. The same is followed for amortized loans also.

- For an amortized loan with a moratorium period, the transaction posting date is the end of the calendar quarter and the end of the moratorium period. If the moratorium period is different from the end of the calendar quarter, the entries passed will not tally with the actual amount due. This difference gets passed on the schedule due date of the moratorium period.

- There are no changes in the INTP event execution behaviour in case of a partial pre-payment.

- If a loan is getting pre-closed with a complete settlement, the system does not wait till the schedule due date or calendar quarter end for passing the INTP entries. It posts the interest accrued till the current date on the date of the pre-closure.

- In case of any failures during the INTP batch process, the system logs the error details for the account and processes the subsequent accounts.

10.2.6 Processing the MF Batch

When prioritization rule is maintained for a L/C linked to the microfinance account, then bulk liquidation takes a different route during MF batch processing. Liquidation is triggered based on the preference rule defined for L/C. Preference with respect to ‘ALL’ is considered if a specific preference is not maintained for the corresponding L/C. This is treated as a normal payment once the respective component, schedule of the loan is identified for the payment. During the batch process prioritization for account liquidation takes place.

The batch process for liquidation takes place as follows

- Sub-process named as ‘BLIQ’ is used for Bulk Payment which runs before the ‘ALIQ’ Process. Event code used for this Prioritized liquidation is ALIQ.

- Accounts linked with L/C are grouped and liquidation process is done on the group.

- For the L/C linked to the microfinance account, if a prioritization rule is set, the same is considered for Bulk Payment. If prioritization rule is not maintained, the liquidation happens as part of ‘ALIQ’.

- When the bulk payment happens as part of batch, the prioritization rule determines which account is to be liquidated first. The account is attempted like any other ALIQ except for the component prioritization.

- Liquidation order is as per the prioritization rules defined for L/C.

- Verify funds facility is used as applied as part of loan processing.

- Missed or skipped schedules/accounts during Bulk liquidation due to specified preferences are picked up during ALIQ process and are allowed to succeed individually.

Accounting entry netting is not available as part of Bulk Payment. There are multiple debits to the customer account for different MF account involved in the Bulk Payment.