7. Branch Transfer of Mortgages

Oracle FLEXCUBE supports transfer of mortgages and commitment from one branch to another. This will be either customer initiated transfer or branch initiated transfer. Customer initiated transfer is single mortgages transfer and branch initiated transfers are multiple mortgages transfer.

This chapter contains the following sections:

7.1 Transferring Mortgages

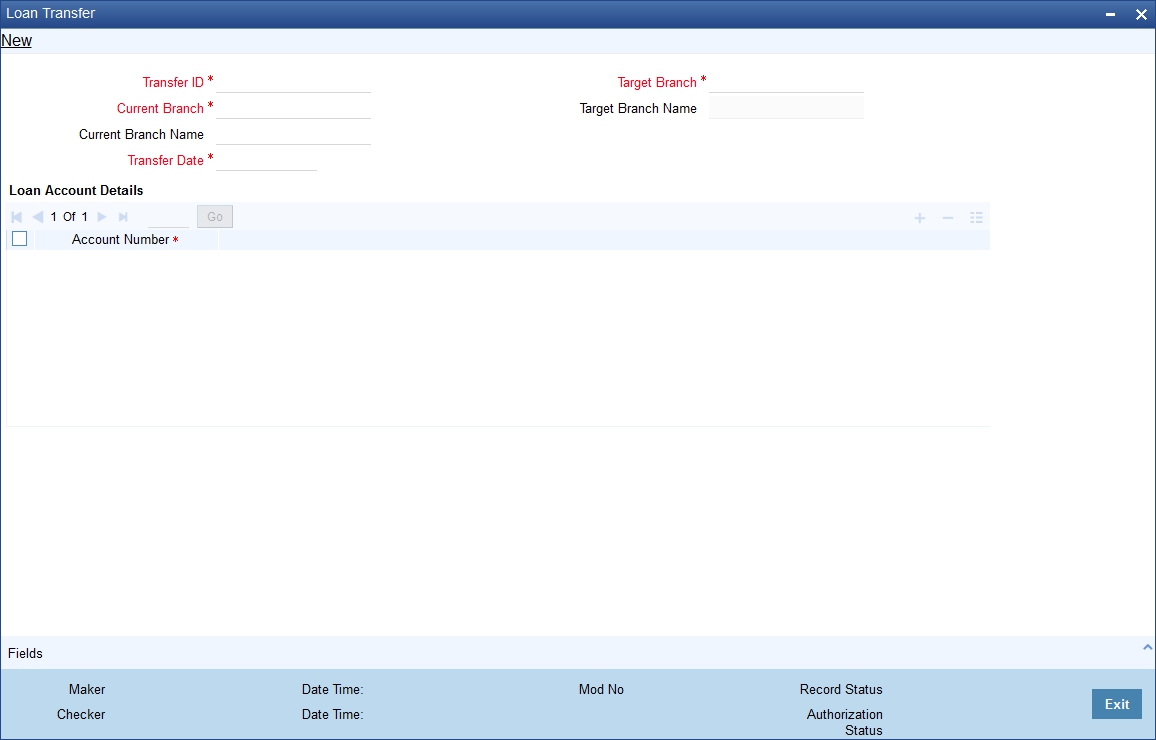

You can capture the mortgages, the branch to which it is transferred and the date the mortgage has to be transferred from Mortgage Transfer screen. You can invoke this screen by typing ‘MODACCTR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in the Mortgage Transfer screen:

Transfer ID

System displays the unique number to identify the transfer on clicking ‘New’.

Current Branch

System displays the Current Branch of the mortgage.

Current Branch Name

System displays the Name of the current branch of the mortgage.

Transfer Date

Select the Date on which mortgage account has to be transferred.

The transfer date for MO contract should be greater than the current system date.

Target Branch

Select the target branch to which mortgage is to be transferred from the adjoining option list.

Target Branch Name

System displays the Name of the target branch of the mortgage.

Mortgage Account Details

Account Number

Select the Account or Commitment number from the adjoining option list.

Note

If a Commitment is linked with the MO contract, then both the entity (MO contract and Commitment) needs to be maintained in the Transfer record maintenance screen.

7.2 Customer Portfolio

This section contains the following topics:

- Section 7.2.1, "Transferring Customer Portfolio"

- Section 7.2.2, "Merging of Branches"

- Section 7.2.3, "Transferring Product Mortgages"

- Section 7.2.4, "Viewing Branch Transfer Details"

- Section 7.2.5, "Transferring Batch"

- Section 7.2.6, "Transferring Event"

- Section 7.2.7, "Transferring Adjustment Event"

7.2.1 Transferring Customer Portfolio

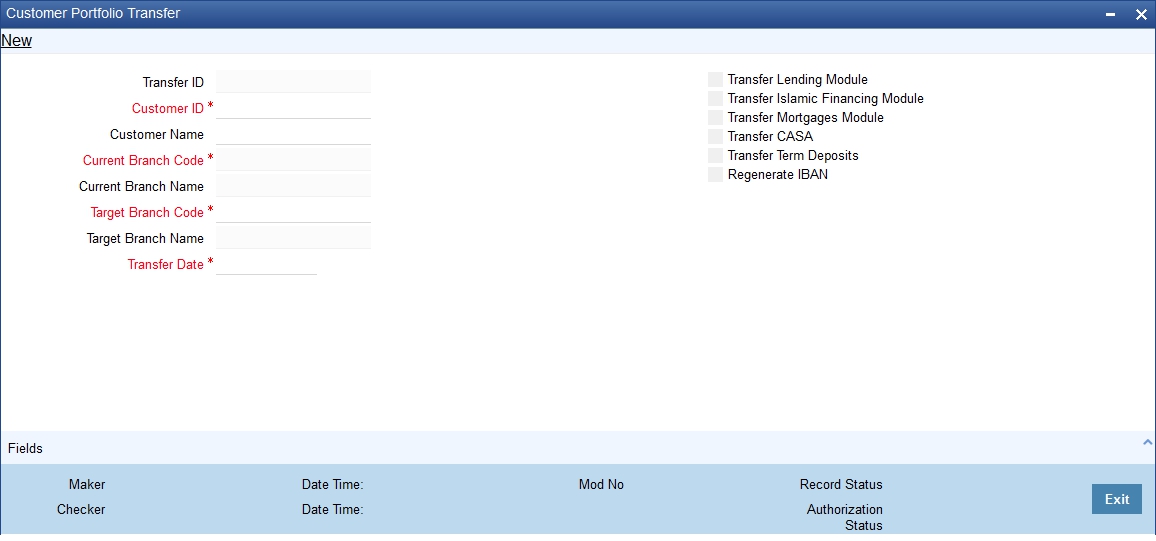

You can transfer mortgages or commitments for all the records with transfer date greater than the current system date from the source branch to a new target branch. This is transferred in the beginning of the day after authorization. ‘Customer Portfolio Transfer’ transfers all the mortgage contracts under the maintained customer ID. You can invoke this screen by typing ‘STDCUSTR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details in the Customer Portfolio Transfer screen:

Transfer ID

System displays the transfer id on clicking ‘New’.

Customer No

Select the customer id from the adjoining option list.

Customer Name

System displays the customer name.

Current Branch Code

System displays the current branch code.

Current Branch Name

System displays the name of the current branch.

Target Branch Code

Specify the Target Branch to which the Customer Portfolio is to be transferred.

Target Branch Name

System displays the name of the target branch of the Customer Portfolio.

Transfer Date

Specify the date on which the Customer Portfolio should be transferred.

Transfer Lending Module

Check Transfer lending Module to specify if Mortgages or commitments should be transferred as part of customer portfolio transfer.

Transfer Islamic Financing Module

Check Transfer Islamic Financing Module to specify if Islamic Mortgages or commitments should be transferred as part of customer portfolio transfer.

Transfer Mortgages Module

Check Transfer Mortgages Module to specify if Mortgage or commitments (MO) should be transferred as part of customer portfolio transfer

Transfer CASA

Check Transfer CASA to specify if Customer Accounts (CASA) should be transferred as part of customer portfolio transfer.

Transfer Term Deposits

Check Transfer Term Deposits to specify if Term Deposits (TD) should be transferred as part of customer portfolio transfer.

Regenerate IBAN

Check this box to regenerate IBAN upon branch transfer. You can check this box only if 'Transfer CASA' is checked.

If you select the ‘Regenerate IBAN’ check box, the system performs the following actions:

- On saving branch transfer record, the system checks whether BBAN Format Mask and related values are available for IBAN regeneration.

- During branch transfer of accounts with IBAN, the system regenerates IBAN based on the IBAN/BBAN parameters of the new branch.

If you do not select the ‘Regenerate IBAN’ check box, the system performs the following actions:

- On saving branch transfer record, the system validates whether the BBAN Format Mask and data type are same for the current and destination branch.

- During branch transfer of CASA accounts, the system retains the original IBAN field value.

Note

By default, system selects all the check boxes. The system displays an error message if at least one of the check boxes is not selected.

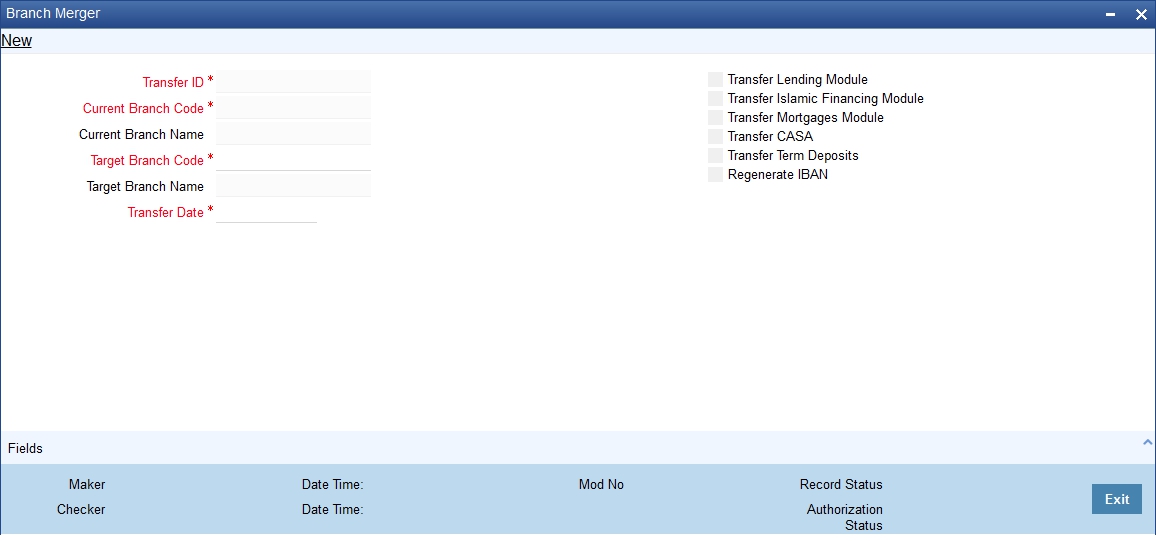

7.2.2 Merging of Branches

You can transfer Mortgage Mortgages or commitments by merging the branch in the Branch Merger screen. You can transfer Mortgage mortgages or commitments for all the records with transfer date greater the current date from the source branch to a target branch. You can invoke this screen by typing ‘STDBRNTR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following in the branch merger screen:

Transfer Id

System displays Transfer ID on clicking ‘New’.

Current Branch Code

System displays the current branch code.

Current Branch Name

System displays the name of the current branch.

Target Branch Code

Specify the Target Branch with which the current branch is to be merged.

Target Branch Name

System displays the name of the target branch.

Transfer Date

Specify the date on which the Branch should be merged with Target branch.

Transfer Lending Module

Check Transfer lending Module to specify if Mortgages or commitments should be transferred as part of customer portfolio transfer.

Transfer Islamic Financing Module

Check Transfer Islamic Financing Module to specify if Islamic Mortgages or commitments should be transferred as part of customer portfolio transfer.

Transfer Mortgages Module

Check Transfer Mortgages Module to specify if Mortgage or commitments (MO) should be transferred as part of customer portfolio transfer

Transfer CASA

Check Transfer CASA to specify if Customer Accounts (CASA) should be transferred as part of customer portfolio transfer.

Transfer Term Deposits

Check Transfer Term Deposits to specify if Term Deposits (TD) should be transferred as part of customer portfolio transfer.

Regenerate IBAN

Check this box to regenerate IBAN upon branch transfer. You can check this box only if 'Transfer CASA' is checked.

If you select the ‘Regenerate IBAN’ check box, the system performs the following actions:

- On saving branch transfer record, the system checks whether BBAN Format Mask and related values are available for IBAN regeneration.

- During branch transfer of accounts with IBAN, the system regenerates IBAN based on the IBAN/BBAN parameters of the new branch.

If you do not select the ‘Regenerate IBAN’ check box, the system performs the following actions:

- On saving branch transfer record, the system validates whether the BBAN Format Mask and data type are same for the current and destination branch.

- During branch transfer of CASA accounts, the system retains the original IBAN field value.

Note

By default, system selects all the check boxes. The system displays an error message if at least one of the check boxes is not selected.

During branch merger and product transfer Holiday Maintenance and UDE Float rates are same for both the branches. If both the branches have different Holiday Maintenance and UDE Float rates, then during subsequent events like VAMI in the mortgage account, for Product transfer accounts and branch merger records, schedule gets recomputed based on the target branch’s holiday or float rates..

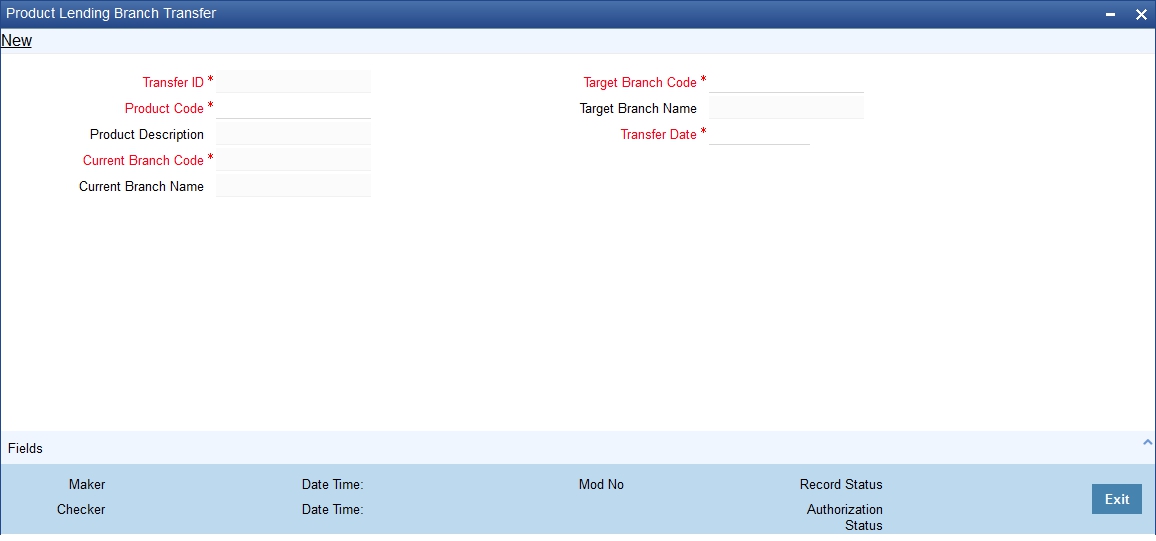

7.2.3 Transferring Product Mortgages

You can transfer mortgage belonging to a product in Product Mortgage Branch transfer screen. You can transfer mortgages or commitments for all the records with transfer date greater the current date from the source branch to a target branch. You can invoke this screen by typing ‘MODPRDTR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following in this screen:

Transfer Id

System displays the transfer ID on clicking ‘New’.

Target Branch Code

Specify the Target Branch with which the current branch is to be merged.

Target Branch Name

System displays the name of the target branch of the mortgage.

Product Code

System displays the product code for which the mortgage accounts are transferred.

Product Description

Specify the description of the product for which the mortgage accounts are transferred.

Transfer Date

Specify the date on which the mortgage should be transferred.

Current Branch Code

System displays the current branch code.

Current Branch Name

System displays the name of the current branch of the mortgage.

Note

During branch merger and product transfer Holiday Maintenance and UDE Float rates should be same for both the branches. If both the branches has different Holiday Maintenance and UDE Float rates, then during subsequent events like VAMI in the mortgage account, for Product transfer accounts and branch merger records, schedule gets recomputed based on the target branch’s holiday or float rates.

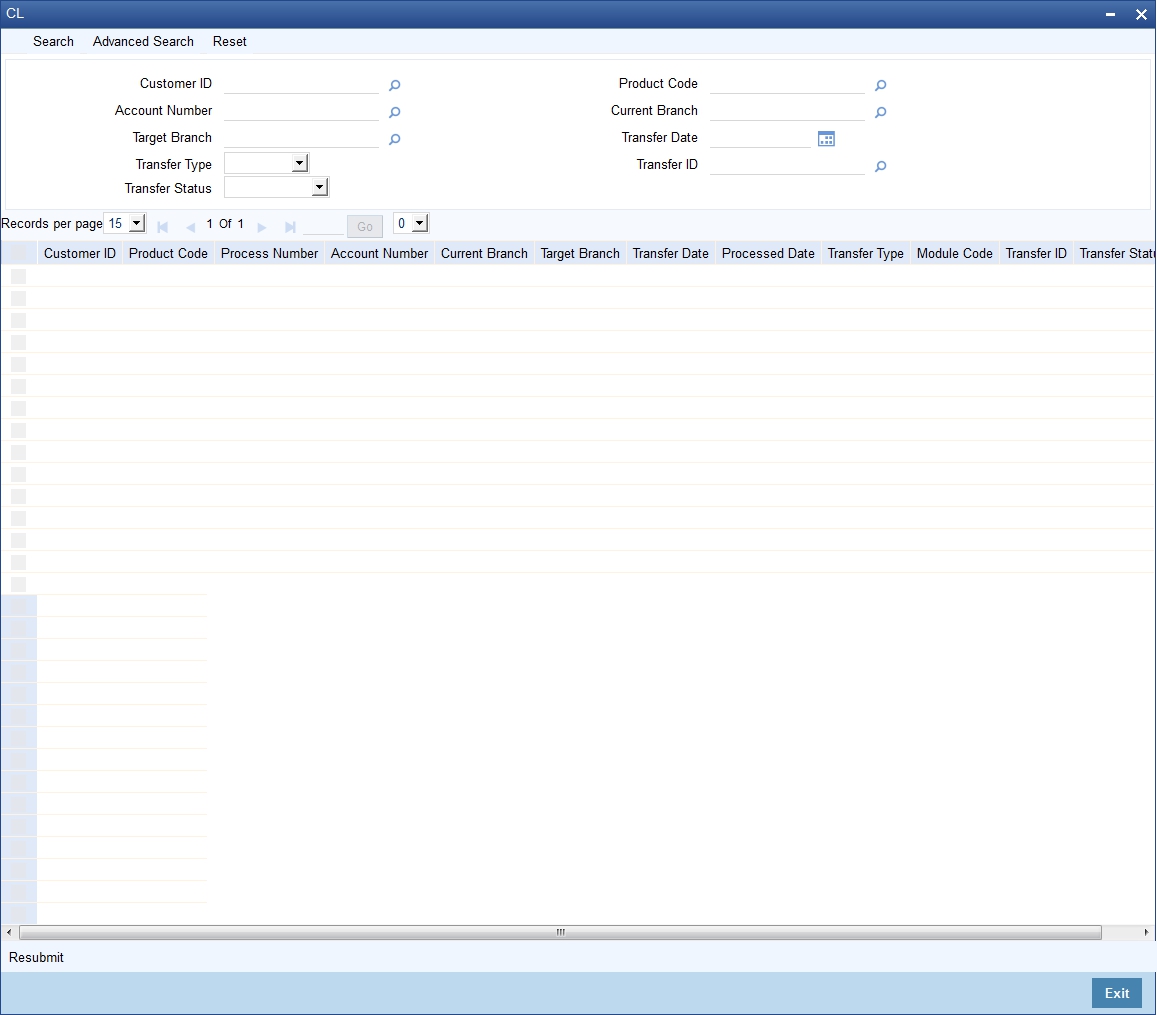

7.2.4 Viewing Branch Transfer Details

If the single mortgage, customer portfolio, branch merger and product transfers fails, then the status of the transfer is updated as ‘error’ along with the failure reasons. The Mortgage Transfer Log screen allows viewing and re-submitting such failed transfers. You can also view successful transfer records in this screen. You can invoke this screen by typing ‘MOSTRLOG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can View or Re-submit failed transfer in this screen.

Account Number

Select the Mortgage Account Number from the adjoining option list.

Source Branch

Select the current branch from the adjoining option list.

Transfer Date

Select the date of transfer for the Mortgage account.

Target Branch

Select the target branch of the mortgage account from the adjoining option list.

Customer No

Select the customer number of the mortgage account from the adjoining option list.

Status

Choose the status of the transfer record from the drop down list. The options available are:

- Success

- Error

- Unprocessed

- Rerun

Product Code

Select the product code of the mortgage account from the adjoining option list.

The following are displayed in this screen:

- Customer ID

- Product Code

- Process Number

- Account Number

- Current Branch

- Target branch

- Transfer Date

- Process Date

- Transfer Type

- Module Code

- Transfer ID

- Transfer Status

Resubmit

Clicking on the resubmit button marks all checked failed records for retry during the BOD batch.

View Error Details

Select a record to view the reason for failure of contracts in MODTRLOG screen, which failed to transfer.

7.2.5 Transferring Batch

If the transfer event is initiated for CL, CI or MO Product and transfer date is on the current date, then the in BOD batch system processes transfer of all the mortgages or commitments marked for the day.

7.2.6 Transferring Event

The transfer event TRFR for mortgage transfer triggers:

- All the mortgage tables for the mortgage account to be updated with new branch.

- Transfer of mortgage outstanding to a suspense or bridge GL from old branch to the new branch.

7.2.7 Transferring Adjustment Event

The transfer adjustment event ‘TADJ’ adjusts the income in the old branch in case of reversal of pre-transfer events and for back-dated events beyond the transfer date.

7.2.7.1 The following remains active even after the transfer of mortgage accounts:

- Penalty or Overdue Compounding

- Status Change

- Provisioning

- Partial Write-Off

- Group Status Change

- Auto Rollover

- Revolving mortgages

- Promotions or Relationship Pricing

- Accounts Linked to Salary

- MIS

- Settlement Account

- Limits Utilization