8. Making Manual Disbursements

The Mortgages Module of Oracle FLEXCUBE supports the following modes for disbursements:

- Auto

- Manual

If you select the mode ‘Auto’, the system will automatically disburse the mortgages based on the disbursement schedule defined for the product.

In the manual mode, disbursement happens on demand. In this case, disbursement schedules need not be maintained for the ‘PRINCIPAL’ component. Also, you can collect any applicable charges related to the disbursement at the time of making the disbursement. These charges are defined at the product level.

You have to specify the disbursement mode as a preference at the time of setting up a Consumer Lending product in the system.

Note

If a manual disbursal results in a status change for the account, the system will update the current status for the account in the ‘Derived Status’ field. During end-of-day batch processing, it will update the ‘User Defined Status’ for the account with the worst status that is available for all accounts and mortgages for this CIF and post the required accounting entries for the change.

Refer the section titled ‘Disbursement Mode preferences’ in the ‘Defining Product Categories and Products’ chapter of this User Manual for details.

This chapter contains the following sections:

- Section 8.1, "Disburse Mortgage Manually"

- Section 8.2, "Saving and Authorizing a Manual Disbursement"

8.1 Disburse Mortgage Manually

This section contains the following topics:

- Section 8.1.1, "Disbursing a Mortgage through the ‘Manual’ Mode"

- Section 8.1.2, "Verifying the Check List Items "

- Section 8.1.3, "Capturing Values for Event Level UDFs"

- Section 8.1.4, "Viewing the Default Details"

- Section 8.1.5, "Viewing the Charge Details Associated with the Event"

- Section 8.1.6, "Capturing the Advice Related Details"

- Section 8.1.7, "Viewing the Swift Message Details"

- Section 8.1.8, "Viewing Mortgage Manual Disbursement Summary"

8.1.1 Disbursing a Mortgage through the ‘Manual’ Mode

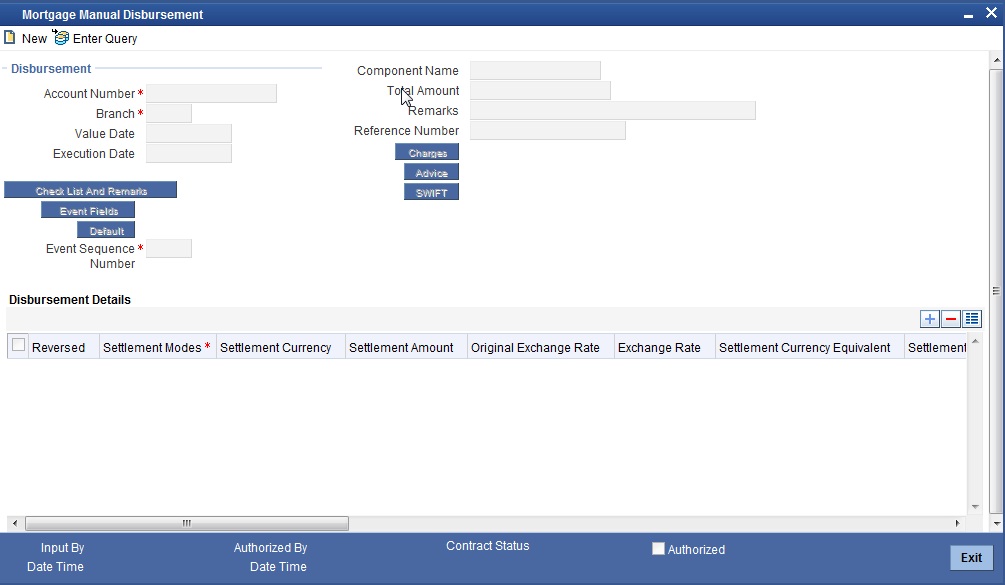

You can initiate a manual disbursement through the ‘Manual disbursement’ screen You can invoke this screen by typing ‘MODMDSBR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To begin the disbursement, click on the New icon in the toolbar of the screen or select ‘New’ from the Actions Menu. The following information gets defaulted to the screen:

Branch Code

The code of the login/sign-on branch is displayed here. However, you can select a different branch from the option list provided. It is the branch where the mortgage account of the customer resides.

Account Number

Select the Mortgage Account of the customer to which the disbursement is made. All valid accounts are available in the option list. Select the appropriate one from this list.

Component Name

All disbursements are made towards the PRINCIPAL component. You cannot change the component.

Value Date

This is the date when the credit entry (for the disbursement amount) is posted to the Cr Settlement Bridge. The current system date is displayed here.

Execution Date

This is the date on which the disbursement is booked in the system. The current system date is displayed here. You may change the date to a date in the future before the maturity date of the mortgage.

Reference Number

This is auto generated and used as a reference to identify the transaction in the system.

Capture the following details in the screen:

Remarks

Capture any additional information about the disbursements, if required.

Total Amount

This displays the sum total of the amount disbursed across the various settlement modes. It gets incremented by the amount settled.

On saving the transaction after entering all the required details in the system, the system validates the value of the transaction amount against the following:

- Product transaction limit

- User Input limit

If the transaction currency and the limit currency are different, then the system converts the amount financed to limit currency and checks if the same is in excess of the product transaction limit and user input limit. If this holds true, the system indicates the same with below override/error messages:

- Number of levels required for authorizing the transaction

- Transaction amount is in excess of the input limit of the user

Specifying Disbursement Details

The following disbursement details have to be captured in the ‘Disbursement Details’ section of the screen:

Reversed

When you reverse a manual disbursement, the system automatically checks this option to denote that the particular settlement mode has been reversed.

For reversing a disbursal, a different event, REVD (Reverse Disbursement) is triggered.

Settle Mode

You can make disbursements either through a single mode or by using multiple modes of settlement, depending on the customer’s requirement.

The settlement details that need to be captured depend on the mode you select. The list of modes and the applicable settlement details are given below:

- CASA

- Settlement Branch

- Settlement Account

- Clearing

- Upload Source

- Instrument Number

- Clearing Product

- End Point

- Routing Number

- Clearing Bank

- Clearing Branch

- Sector Code

- External Account

- Upload Source

- Product Category

- Clearing Bank Code

- Clearing Branch Code

- External Account Name

- External Account Number

- Instrument

- Instrument Number

- Settlement Branch

- Settlement Account

- Cash/Teller

- Upload Source

- Settlement Product

Note

At least one mode is mandatory to make a disbursement.

Settle Ccy

After specifying the settlement mode for the disbursement, select the currency in which the disbursement is to be made. The currencies allowed for the branch are available in the option list provided.

Amount Settled

Here, you have to capture the disbursement amount that is to be settled through the selected mode in the selected currency.

The ‘Total Amount’ gets incremented by the amount settled and displays the sum total of the amount disbursed across the various settlement modes.

Original Exchange Rate

The base or actual exchange rate between the account currency and settlement currency gets displayed here.

Exchange Rate

For a customer availing any Relationship Pricing scheme, the customer specific exchange rate derived by adding the original exchange rate and the customer spread maintained for the relationship pricing scheme gets displayed here.

You can change the defaulted rate provided the change is within the variance level maintained for the underlying product.

If Relationship Pricing is not applicable, Exchange Rate will be the same as the Original Exchange Rate.

Mortgage Ccy Equiv

As mentioned above, if the Mode Currency and Mortgage Currency are different, the system calculates the Mortgage Currency equivalent using the exchange rate applicable for the currency pair.

Settlement Sequence

The system displays the sequence from the loan account based on the principal component settlement details. You can modify this value.

Note

The settlement sequence screen will be enabled for input only if the Payment Mode chosen is ‘Account’ else the settlement account will be defaulted from the Multi Mode Settlement Maintenance (ISDSRCMD).

Default Settlement

Click on this button to display the settlement message details. You can modify the default settlement details populated

Negotiated Cost Rate

Specify the negotiated cost rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the rate only when the currencies involved in the transaction are different. Otherwise, it will be a normal transaction.

The system will display an override message if the negotiated rate is not within the exchange rate variance maintained at the product.

Negotiation Reference Number

Specify the reference number that should be used for negotiation of cost rate in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.

Note

Oracle FLEXCUBE books then online revaluation entries based on the difference in exchange rate between the negotiated cost rate and transaction rate.

Branch Profit for Non Negotiated Transactions

There can be two situations in profit calculation of non negotiated transactions:

- Transaction involves two foreign currencies

- Transaction involves a foreign currency and a local currency

Methods of profit calculation are different based on the currencies involved as discussed in the following examples.

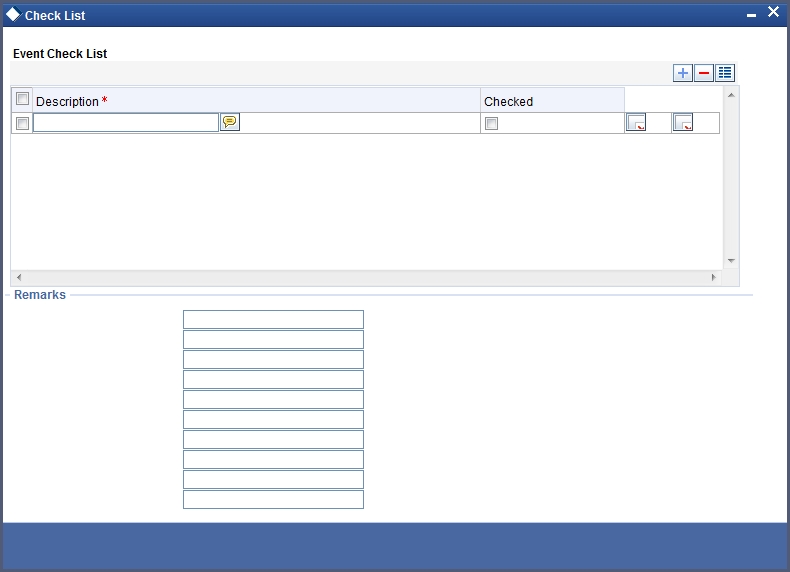

8.1.2 Verifying the Check List Items

To every online event, you can associate check list items through the ‘Event Checklist’ screen. To view the check list items associated with the ‘Disbursement’ event (DSBR), click on the ‘Check List & Remarks’ button.

This screen displays the check list items for DSBR. All check list items have to be verified for successful disbursal of the mortgage. To do this, check the ‘Verified’ box against each check list item.

You may also capture any additional information/remarks, if required.

Click ‘OK’ button to Save and return to the ‘Manual disbursement’ screen.

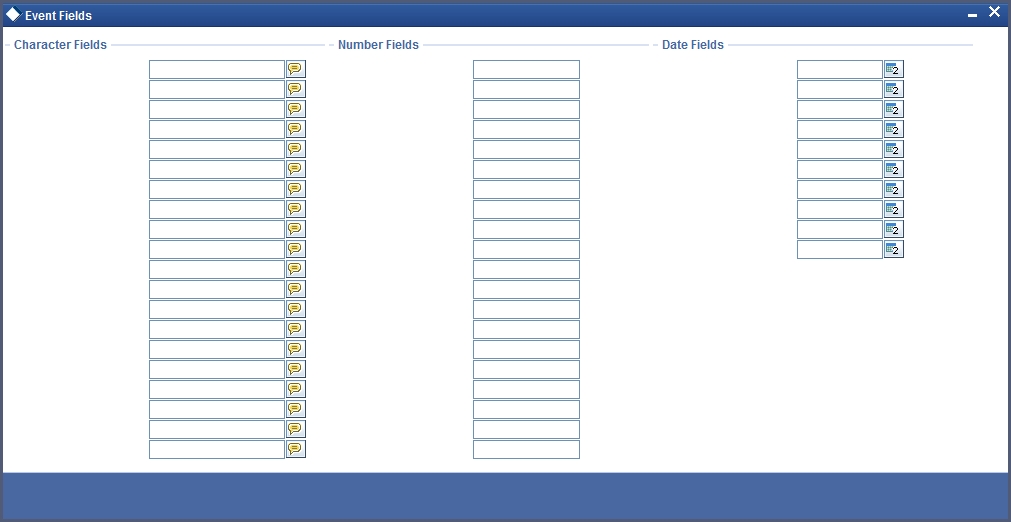

8.1.3 Capturing Values for Event Level UDFs

You can enter values for the UDFs that you have associated with the DSBR event in the ‘Account Event UDF’ screen. To invoke this screen, click ‘Event Fields’ button in the ‘Manual Disbursement’ screen.

The system allows you to enter different values for the same UDF for events that gets repeated for the same mortgage account. For instance, if you have multiple disbursements for a Mortgage Account, you can capture different values for UDFs for different disbursements.

Click Exit button to exit and return to the ‘Manual disbursement’ screen.

8.1.4 Viewing the Default Details

The defaults are maintained by the bank for the account can be viewed by clicking the ‘Default’ button. The defaults primarily are based on product definition and the account but it can be overridden.

If the Payment By is ‘Message’ then the settlement mode is defaulted to CASA and the settlement account , branch and currency are defaulted from the Settlement Instructions maintenance.

8.1.5 Viewing the Charge Details Associated with the Event

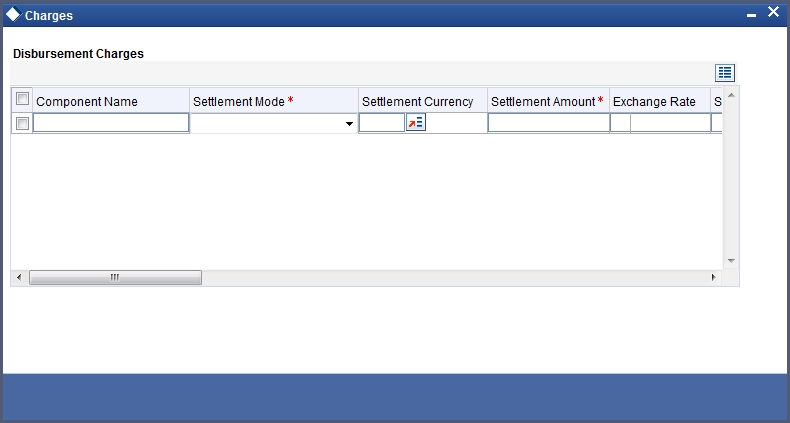

When making a manual disbursement, you can apply the charges applicable for the event. To do this, click ‘Charges’ button and invoke the ‘Manual disbursement – Charges’ screen.

Specify the following details in this screen:

Component Name

Select the charge component from the option list provided. This list displays the components of type ‘Charge’ that were associated with the event at the time of defining the product.

Settle Mode

You can use multiple modes of settlement for charge settlement also. The list of modes applicable is same as the one allowed for mortgage disbursal.

Settle Ccy

After specifying the settlement mode, select the currency in which the charge is to be collected. The currencies allowed for the branch are available in the option list provided.

Amount Settled

If a formula is maintained for charge calculation at the product level, the system calculates the charge on the amount being disbursed using the formula. The same is then displayed in the here.

Exch Rate and Mortgage Ccy Equiv

This information is applicable if the Mode Currency is different from the Mortgage Currency. The exchange rate that is defaulted from the Standard Exchange Rate Maintenance is used to convert the charge amount to the Mortgage Currency equivalent.

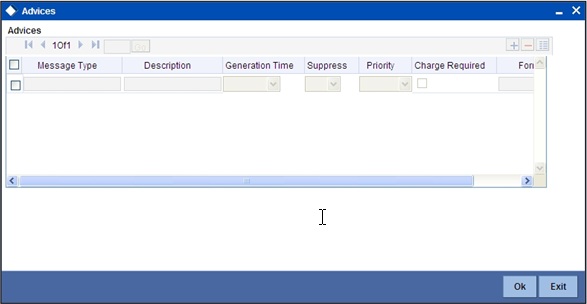

8.1.6 Capturing the Advice Related Details

You can view the advices defaulted which also includes the Payment Message in the ‘Advices’ screen. To invoke this screen, click ‘Advices’ button on the ‘Manual Disbursement’ screen. You can also choose to suppress the messages as required.

You can opt to suppress the Payment Message defaulted in case you do not need a credit through swift message .

The defaulted details can be overridden at this stage and if the settlement mode is changed to anything other than CASA, the swift message is automatically suppressed.

System automatically supresses the payment message under the following conditions:

- If the Principal Credit Settlement account is changed to a GL or if the receiver in Swift Msg Details tab is not valid to receive the message i.e, if the Customer Type of the Receiver party is not a Bank

- If the settlement mode for PRINCIPAL component is changed to anything other than CASA

If the Transfer Type is chosen as blank i.e, neither Customer Transfer nor Bank Transfer and if the Receiver is a bank and the credit settlement account is a current account then the PAYMENT_MESSAGE becomes CREDIT_ADVICE by Swift(MT910).

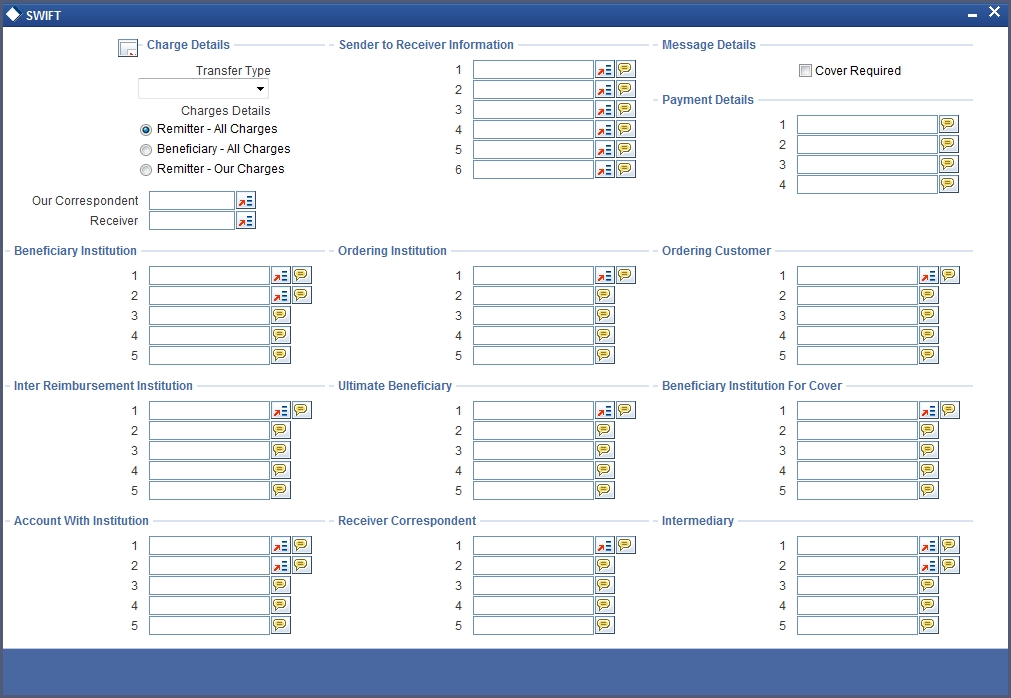

8.1.7 Viewing the Swift Message Details

The swift message details are picked up from the Settlement Instructions maintenance and are displayed in the ‘Swift’ screen. To invoke this screen, click ‘Swift’ button on the ‘Manual Disbursement’ screen.

For more details on Swift message related details refer section ‘Capturing Swift Message Details’ in the chapter ‘Capturing Additional Details for a Mortgage’ in this User Manual.

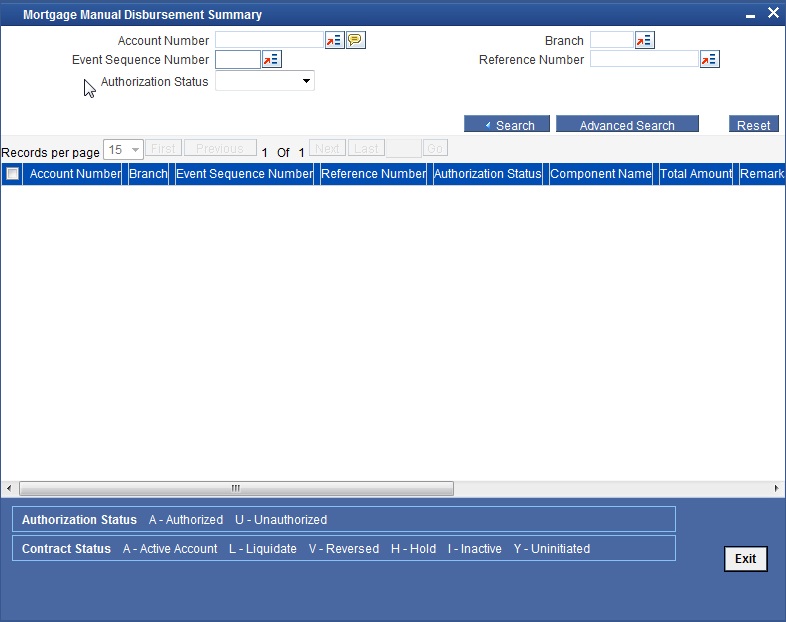

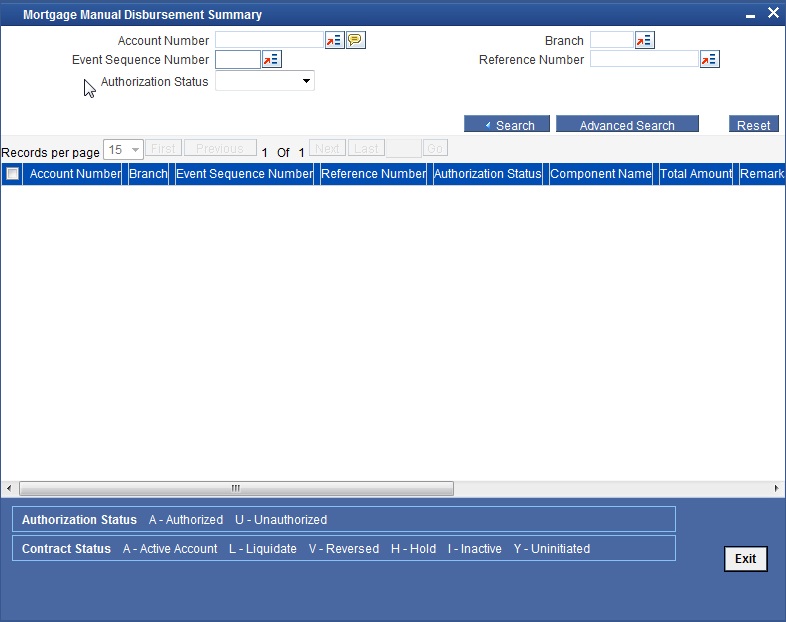

8.1.8 Viewing Mortgage Manual Disbursement Summary

You can view a summary of all Mortgage Manual Disbursements, through the ‘Mortgage Manual Disbursement Summary’ screen. You can invoke this screen by typing ‘MOSMDSBR’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can query based on all or any of the following criteria:

- Account Number

- Event Sequence Number

- Authorization Status

- Branch

- Reference Number

Click ‘Search’ button. The system identifies all records satisfying the specified criteria and displays the following details for each one of them:

- Account Number

- Branch

- Event Sequence Number

- Reference Number

- Authorization Status

- Component Name

- Total Amount

- Remarks

- Value Date

8.2 Saving and Authorizing a Manual Disbursement

After entering the details for manual disbursement in the ‘Manual Disbursement Input’ screen click Save icon to save the details.

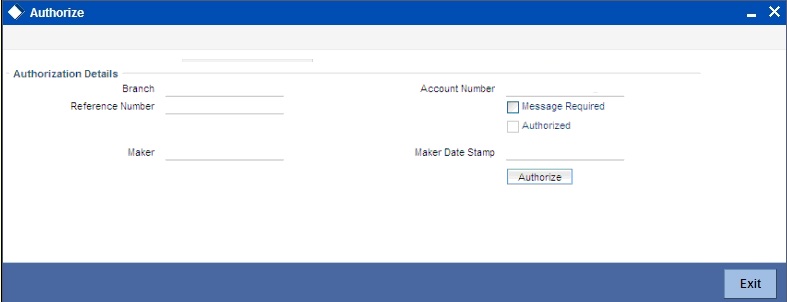

To authorize the manual disbursement, click Authorize icon on the Application toolbar. The account authorization screen is displayed.

The Branch and Account number is defaulted and the Xref number is generated by the system. The following detail needs to be selected as required:

Message Generation

Check this box if you want swift messages to be generatedt either for the customer transfer or the bank transfer along with a cover. The generated message can be biewed in the messages browser. Even if the box is left unchecked you can go to messages browser at a later point of time and generate the message.

If the message generation fails for some reason, the account is authorized and you have to go to the browser to manually generate the swift message.

All other advices related to DSBR event are not generated at this point and you need to go to the message browser to do the same.

After the swift message has been generated, if the mortgage account or the manual disbursement is reversed, no message is sent from CL.

Note

You cannot authorise a transaction from the ‘Mortgage Manual Disbursement’ screen in the following cases:

- the contract has multilevel of authorization pending, the same will be done using the ‘Multilevel Authorization Detailed’ screen

- the level of authorization is greater than or equal to ‘N’

- the ‘Nth’ or the final level of the users authorisation limit is less than the difference between amount financed and sum of the limits of all the users involved in authorizing a transaction, this case holds good when the ‘Cumulative’ field is checked in the ‘Product Transaction Limits Maintenance’ screen

- the transaction amount is greater than the authorizer’s authorisation limit if the ‘Cumulative’ field is unchecked in the ‘Product Transaction Limits Maintenance’ screen

8.2.1 Accounting Entries

During the disbursement event, the Mortgage Account is debited while the credit entry will depend on the settlement mode(s) selected for disbursal.

The entries will appear as follows:

Accounting Role |

Amount Tag |

Cr/Dr |

LOAN_ACCOUNT |

PRINCIPAL |

Dr |

CR_SETTL_BRIDGE |

PRINCIPAL |

Cr |