5. Securitization Contract

Securitization Contract is a final entity to represent the securitization deal. Each securitization contract is associated with pool of loan contracts (securitization Pool) and a SPV. It allows both Selling/Buyback of previously sold pool.

This chapter contains the following sections:

- Section 5.1, "Securitization Contract"

- Section 5.2, "Contract Details Maintenance"

- Section 5.3, "Handling On-line Payment for Service Charges"

5.1 Securitization Contract

This section contains the following topics:

- Section 5.1.1, "Securitization Contract Life Cycle"

- Section 5.1.2, "Booking a Contract"

- Section 5.1.3, "Contract Initiation / Securitization Loan Sale"

- Section 5.1.4, "Amendment for Addition of Loan Accounts (SAMD – Addition of New Loan Account to Securitization Pool)"

- Section 5.1.5, "Amendment for Removal of Loan Accounts (BAMD – Removal of Loan Account from Securitization Pool)"

- Section 5.1.6, "Amendment for Changing the Contract Details (Amendment without Modifying the Securitization Pool)"

- Section 5.1.7, "Recourse of Loan Accounts"

- Section 5.1.8, "Liquidation of Payments:"

- Section 5.1.9, "Reversal of Payment"

- Section 5.1.10, "Closure of Contract"

- Section 5.1.11, "Accrual of Profit / Loss and Periodic Service Charge"

5.1.1 Securitization Contract Life Cycle

The Securitization Contract Life Cycle consists of the following stages, they are:

- Contract Booking

- Contract Initiation / Securitization Loan Sale

- Amendment for addition of loan accounts

- Amendment for removal of loan accounts

- Amendment for change the contract details

- Amendment for exchange of loan account (Recourse of loan accounts)

- Liquidation of Payments

- Reversal of Payment

- Closure of Contract

- Accrual of Profit / Loss and Periodic Service Charge

5.1.2 Booking a Contract

You can book a new contract based on the Pool information and SPV details. Accordingly the system generates the Securitization BOOK Advice messages.

5.1.3 Contract Initiation / Securitization Loan Sale

Sale is a process of legally transferring the ownership of the loan asset from the bank to SPV as per the agreement. The system carries the following tasks:

- The system initiates the booked securitization contract on the value date of the contract.

It computes the Profit/Loss for the transaction based on the outstanding principal, interest payment as mentioned below:

Profit or Loss of contract =

SALE_AMOUNT

–

Sum of (Simple and Amortized type Loans)

(Outstanding Principal, + Interest Accrued till sale date + Penalty accrued till sale date + overdue components)

+

Sum of (Discounted type Loans)

(Outstanding Principal -- RIA Balance)

- If securitization product is set to realize the profit/loss immediately, then the system posts the calculated profit/loss directly to the bank’s INCOME/EXPENSE GL directly.

- If the securitization product is set to realize the profit/loss over a pre-defined period, then the system computes the profit/loss schedule internally and posts the entries accordingly during the EOD cycle.

- The system generates the Sale Advice Message.

Impact on CL contracts:

- The system triggers the CL status change event and changes the status

from NORM /Status which are supporting continue accrual to SECR for

all underlying contract and pass the below accounting entries:

- It transfers all underlying loan contracts’ outstanding balance, from the bank’s ASSET GL (LOAN_ACCOUNT) to SPV_SETTL_BRIDGE GL.

- The system changes the Accrual GL for the interest and penal interest to BRIDGE GL.

- For all underlying loans Accruals, it calculates till sale date and posts to Income GL. In case of underlying loan contracts where accrual frequency is not daily, then the system performs a force accrual till sale date and post the same to Income GL.

- Post securitization, the system continues the accrual of loan account.

The table below describes the accounting entries for Status change NORM or Status which are supporting continue accrual to SECR:

Simple Loan / Amortized Loan / Amortized Rule 78 |

Principal Component: – Outstanding Principal is moved to SPV_SETTL_BRIDGE GL Interest /Penal Interest Components: –Accrued interest till the sale date, will be transfer to bank’s Income GL –GL for interest , penal interest will be changed to Bridge GL |

Discounted Loan/ True Discounted Loan |

Principal Component: – Outstanding Principal is transferred to SPV_SETTL_BRIDGE GL Interest /Penal Interest Components: – A sum equivalent of accrued interest till the sale date, is transferred from MAIN_INTRIA to bank’s Income GL – The balance interest amount in the MAIN_INTRIA is transferred to Bridge GL account /SPV Account |

5.1.4 Amendment for Addition of Loan Accounts (SAMD – Addition of New Loan Account to Securitization Pool)

During the course of SPV contract, SPV can increase the participating loan contracts in Securitization contract.

- You can amend the contract through ‘Securitization Contract Online’ screen. The system provides you an option to add new loan contracts to the existing Pool.

- You can compute the Profit/Loss for the transaction based on the outstanding principal, interest payment as mentioned below:

Profit or Loss of contract =

INCREASE_IN_SALE

–

[Sum of newly added Loans (Simple and Amortized type Loans)

(Outstanding Principal

+ Interest Accrued till sale date

+ Penalty accrued till sale date

+ Overdue components)

Sum of newly added Loans (Discounted type Loans)

(Outstanding Principal -- RIA Balance)]

- If you set the securitization product to realize the profit / loss immediately, then the system posts the calculated profit/loss directly to the bank’s Income / Expense GL.

- If you set the securitization product to realize the profit/loss over a pre-defined period, system computes a schedule for the profit/loss and posts the accounting entries accordingly, during the EOD cycle.

- You need to maintain the Profit/Loss as a separate slab for each amendment on sale contract and should not merge it with previously calculated profit/loss.

- The system computes separate accrual schedule for profit and loss for that particular amendment based on the schedule defined during the amendment.

- During EOD, the system computes the consolidated profit/loss (Netting is done) on that due date and posts the accounting entries to Banks Income / Expense GL.

- The system generates the Amendment Advice Message.

Impact on CL contracts:

During the amendment (new loan contracts are included in securitization Pool), the system triggers the change status event for the newly added loan contract (changes the status from NORM /Status which are supporting continue accrual status to SECR) and passes the below accounting entries:

- The system transfers the new loan contracts’ outstanding balance from the bank’s ASSET GL(LOAN_ACCOUNT) to SPV_SETTL_BRIDGE GL

- It changes the new loan account’s GL for the interest, penal interest from the bank’s Income GL to the Bridge Income GL.

- Accrual is similar like SALE event.

5.1.5 Amendment for Removal of Loan Accounts (BAMD – Removal of Loan Account from Securitization Pool)

During the course of the SPV contract, SPV can reduce the participating loan contracts in Securitization Contract.

- You can amend the contract through the ‘Securitization Contract Online’ screen.

- The system computes the Profit/Loss for the transaction based on the outstanding principal, interest payment as mentioned below:.

Profit or Loss of contract =

SALE_AMOUNT

–

[Sum of excluded loan (Simple and Amortized type Loans)

(Outstanding Principal

+ Interest Accrued till sale date

+ Penalty accrued till sale date

+ Overdue components)

Sum of excluded loan (Discounted type Loans)

(Outstanding Principal + RIA Balance)]

- If securitization product is set to realize the profit/loss immediately, then the system posts the calculated profit/loss directly to the bank’s Income/Expense GL directly.

- If the securitization product is set to realize the profit/loss over a pre-defined period, then the system computes a schedule for the profit/loss and posts the accounting entries accordingly, during the EOD cycle.

- You need to maintain the Profit/Loss as a separate slab for each amendment on sale contract and should not merge it with previously calculated profit/loss.

- The system computes separate accrual schedule for profit and loss for that particular amendment based on the schedule defined during the amendment.

- During EOD, the system computes the consolidated profit/loss (Netting is done) on that due date and posts the accounting entries to Banks Income/Expense GL.

- The system generates the Amendment Advice Message.

Impact on CL Contracts:

During the amendment, the system triggers the change status event (from SECR status to NORM) for the removed contract from pool and passes the below accounting entries:

- It transfers the removed loan contracts’ outstanding balance from SPV_SETTL_BRIDGE GL to bank’s ASSET GL(LOAN_ACCOUNT)

- It changes the removed loan contracts’ GL for the interest, penal interest from BRIDGE INCOME GL to Bank’s INCOME GL

- Accrual is similar like SALE event.

The table below describes the accounting entries for Status change SECR or Status which are supporting continue accrual to NORM:

Simple Loan / Amortized Loan / Amortized Rule 78 |

Principal Component: – Outstanding Principal is transferred from SPV_SETTL_BRIDGE GL to LOAN ACCOUNT Interest /Penal Interest Components: –Accrued interest till the sale date, is transferred to SPV account or Bridge GL account –GL for interest, penal interest is changed to Bank INCOME GL |

Discounted Loan/ True Discounted Loan |

Principal Component: – Outstanding Principal is transferred from SPV_SETTL_BRIDGE GL to LOAN ACCOUNT Interest /Penal Interest Components: – Interest amount is calculated till the maturity date and it is posted to MAIN_INTARIA GL account and start accrue the interest and post the interest to Bank’s Income GL |

5.1.6 Amendment for Changing the Contract Details (Amendment without Modifying the Securitization Pool)

The system triggers the AMND event and updates the modified contract details. And it generates the Amendment Advice Message.

5.1.7 Recourse of Loan Accounts

During the course of the securitization contract, SPV can replace the existing loan contracts in Securitization Contract with new loan accounts which are not part of securitization.

You can amend the contract through the ‘Securitization Contract Online’ screen with the recourse option.

The below formula explains the calculation related to recourse operation:

Profit or Loss of contract =

SALE_AMOUNT -

Sum of (newly added - Simple and amortized loans)

(Outstanding Principal,

+ Interest Accrued till sale date

+ Penalty accrued till sale date

+ Overdue components)

Sum of (newly added - Discounted type Loans)

(Outstanding Principal, -- RIA Balance) -

Sum of excluded loan (Simple and amortized loans)

(Outstanding Principal

+ Interest Accrued till sale date

+ Penalty accrued till sale date

+ Overdue components)

Sum of (Discounted type Loans)

(Outstanding Principal + RIA Balance)

Amount tags LOAN_OUTSTANDING_CR and LOAN_OUTSTANDING_DR are available for returning the credit or debit balance of replaced loan accounts. The amount tags provide the netted value of newly added loan accounts and removed loan accounts.

- If securitization product is set to realize the profit/loss immediately, then the system posts the calculated profit/loss directly to the bank’s INCOME/EXPENSE GL directly.

- If the securitization product is set to realize the profit/loss over a pre-defined period, then the system computes the profit/loss schedule internally and posts the entries accordingly during the EOD cycle.

- Consolidated balance of newly added/removed loan accounts will be posted to securitization accounts.

- The system generates the Recourse Advice Message.

Impact on CL contracts:

- For all newly added Loan Accounts, the system triggers the CL status

change event and changes the status from NORM /Status which are supporting

continue accrual to SECR for all underlying and pass the below accounting

entries:

- It transfers all newly added loan accounts’ outstanding balance, from the bank’s ASSET GL (LOAN_ACCOUNT) to SPV_SETTL_BRIDGE GL.

- The system changes the Accrual GL for the interest and penal interest to BRIDGE GL.

- For all newly added Loans Accruals, it calculates till sale date and posts to Income GL. In case of underlying loan contracts where accrual frequency is not daily, then the system performs a force accrual till sale date and post the same to Income GL.

- For removal of Loan Accounts, the system triggers the CL status change

event and changes the status from SECR status to NORM and pass the below

accounting entries:

- It transfers the removed loan contracts’ outstanding balance from SPV_SETTL_BRIDGE GL to bank’s ASSET GL(LOAN_ACCOUNT)

- It changes the removed loan contracts’ GL for the interest, penal interest from BRIDGE INCOME GL to Bank’s INCOME GL

- Accrual is similar like BAMD event.

- Post securitization, the system continues the accrual of loan account.

The table below provides details about amount tags maintained for recourse of loan accounts:

Amount Tag |

Description |

LOAN_OUTSTANDING_CR |

Amount tag returns value only when loan account standing balance has Credit balance. Otherwise it will return 0 |

LOAN_OUTSTANDING_DR |

Amount tag returns value only when loan account standing balance has Debit balance. Otherwise it will return 0 |

5.1.8 Liquidation of Payments:

As per the Securitization contract, if any periodic charges are configured, system liquidates the same either automatically or manually based on the configuration. It generates the Debit Advice messages for the liquidation.

5.1.9 Reversal of Payment

The system reverses the payments received from SPV reversed.

5.1.10 Closure of Contract

After maturity of all underlying loan contracts, system closes the securitization contract during the EOD cycle. The system generates the Contract Closure Advice Message to SPV to indicate the closure of securitization contract.

If any of the underlying loan contract’s maturity has been changed and if the maturity date is beyond the maturity date of securitization contract, system will update the maturity date of securitization contract during the EOD cycle and generates the advice message.

5.1.11 Accrual of Profit / Loss and Periodic Service Charge

If the securitization contract is configured to realize the Profit/Loss over a period, during EOD cycle, system will trigger the PLAC event based on the frequency set in securitization contract and accrue the Profit and Loss accordingly. And during EOD cycle, based on the frequency set in securitization contract for service charges, system triggers PRCH event and passes the accounting entries.

Note

During EOD cycle system updates the maturity date of the securitization contract, if the maturity date of any one of the underlying loan contract’s maturity date has exceeded the maturity date of securitization contract.

5.2 Contract Details Maintenance

This section contains the following topics:

- Section 5.2.1, "Invoking the Securitization Contract Details Screen"

- Section 5.2.2, "Main Tab"

- Section 5.2.3, "Advice Tab"

- Section 5.2.4, "Service Charge Tab"

- Section 5.2.5, "Profit\Loss Accrual Tab"

- Section 5.2.6, "Pool Details Button"

- Section 5.2.7, "Pool Addition Button"

- Section 5.2.8, "Pool Deletion Button"

- Section 5.2.9, "Recourse Button"

- Section 5.2.10, "Charges Button"

- Section 5.2.11, "Events Button"

- Section 5.2.12, "Event History"

- Section 5.2.13, "Fields Button"

- Section 5.2.14, "MIS Button"

- Section 5.2.15, "Authorizing Securitization Contract Details"

- Section 5.2.16, "Amending Securitization Contracts"

5.2.1 Invoking the Securitization Contract Details Screen

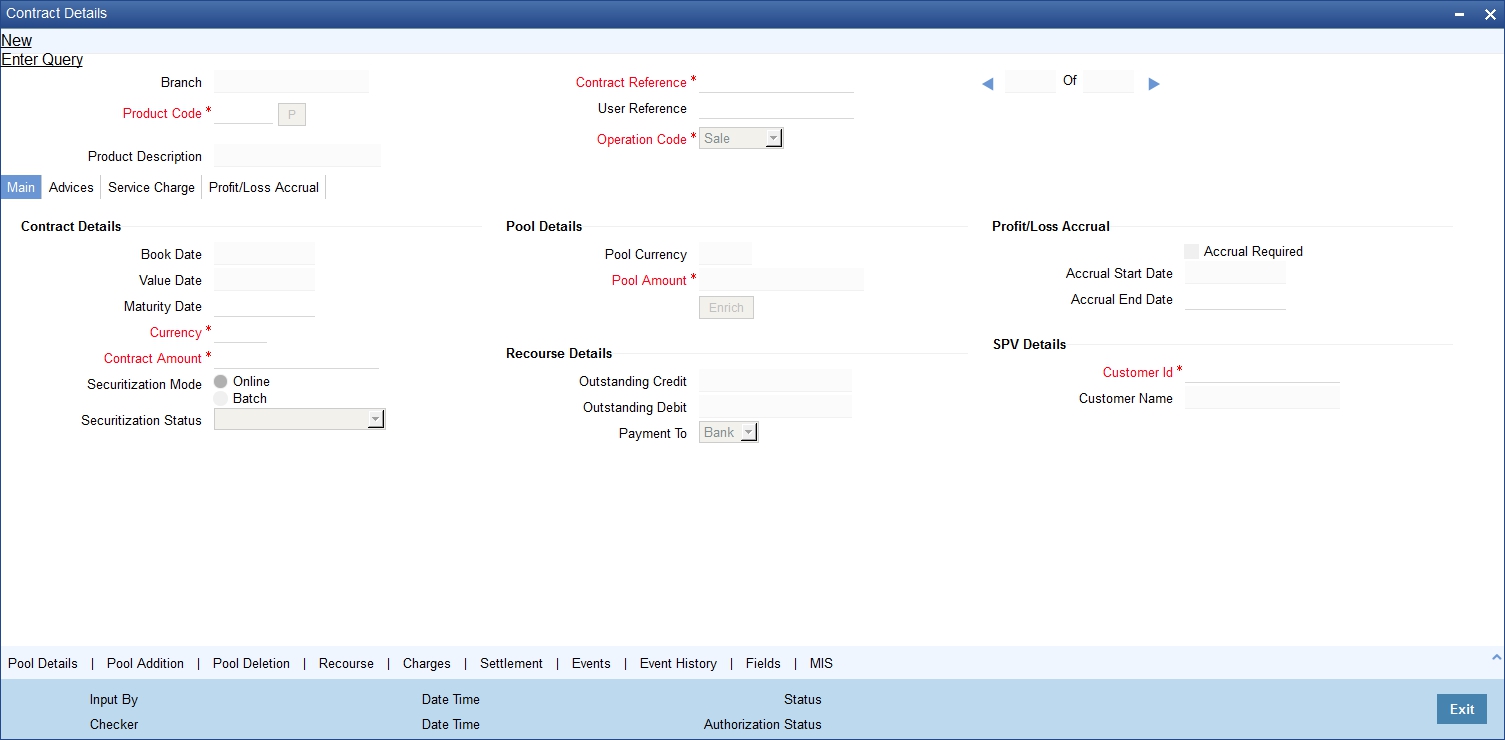

You can capture details of the securitization contract details in the ‘Securitization Contract Details’ screen. To invoke this screen, type ‘SZDTRONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Here you can capture the following details:

Branch

Specify the branch code.

Product Code

Select the appropriate product code for which securitization contract is booked.

Product Description

Specify the product description for the selected product.

Contract Reference Number

The system generates a unique number as contract reference number to identify the contract.

User Reference Number

The system generates a unique user reference number to identify the contract.

Operation Code

Select the appropriate operation that you can perform from the drop down list. The options available are:

- Sale

- Buyback

- Amend

- Recourse

Note

The system defaults ‘Sale’ as the default operation code.

5.2.2 Main Tab

Here you need to capture the main details of the contract.

Contract Details

Book Date

Specify the booking date of the contract.

Value Date

Specify the contract initiation date.

Maturity Date

Specify the maturity date or max maturity date of the underling loan contract.

Contract Amount

Specify the sale/buyback amount of the pool.

Contract Currency

Specify the currency of the transaction.

Securitization Mode

Select the securitization mode from the following option:

- Batch

- Online

Note

- If you select online securitization, the system invokes the securitization process (status change from the current status to ‘SECR’) at the time of authorization of securitization contract.

- If you select batch securitization, the system saves the securitization contract without initiating the securitization process. The system will also change the internal status of the securitization contract and Islamic assets as ‘Marked for Securitization’.

Pool Details

Pool Amount

Specify the pool amount of the underlying loan contracts which are under the process of Sale or Buyback.

Pool Currency

Specify the currency of the pool.

Recourse Details

You can maintain the following recourse details here:

Outstanding Credit

The system displays the sum of NPV value of loan accounts which are newly included for sale.

Outstanding Debit

The system displays the sum of NPV value of loan assets which are removed from the pool as part of recourse operation.

Payment To

Select net payment direction you need for the recourse operation from the adjoining drop-down list. This list displays the following values:

- Bank – SPV will pay the contract amount to the Bank as part of the recourse operation

- SPV – Bank will pay the contract amount to SPV as part of the recourse operation

SPV Details

Customer Identification

Specify the customer ID of the SVP.

Name

Specify the name of the SPV customer.

Profit/Loss Accrual

Accrual Required

Check this box to indicate whether accrual required or not.

Accrual End Date

Specify the end date of the accrual. Based on the accrual end date, the system populates the schedule to accrue the profit and loss during the EOD cycle.

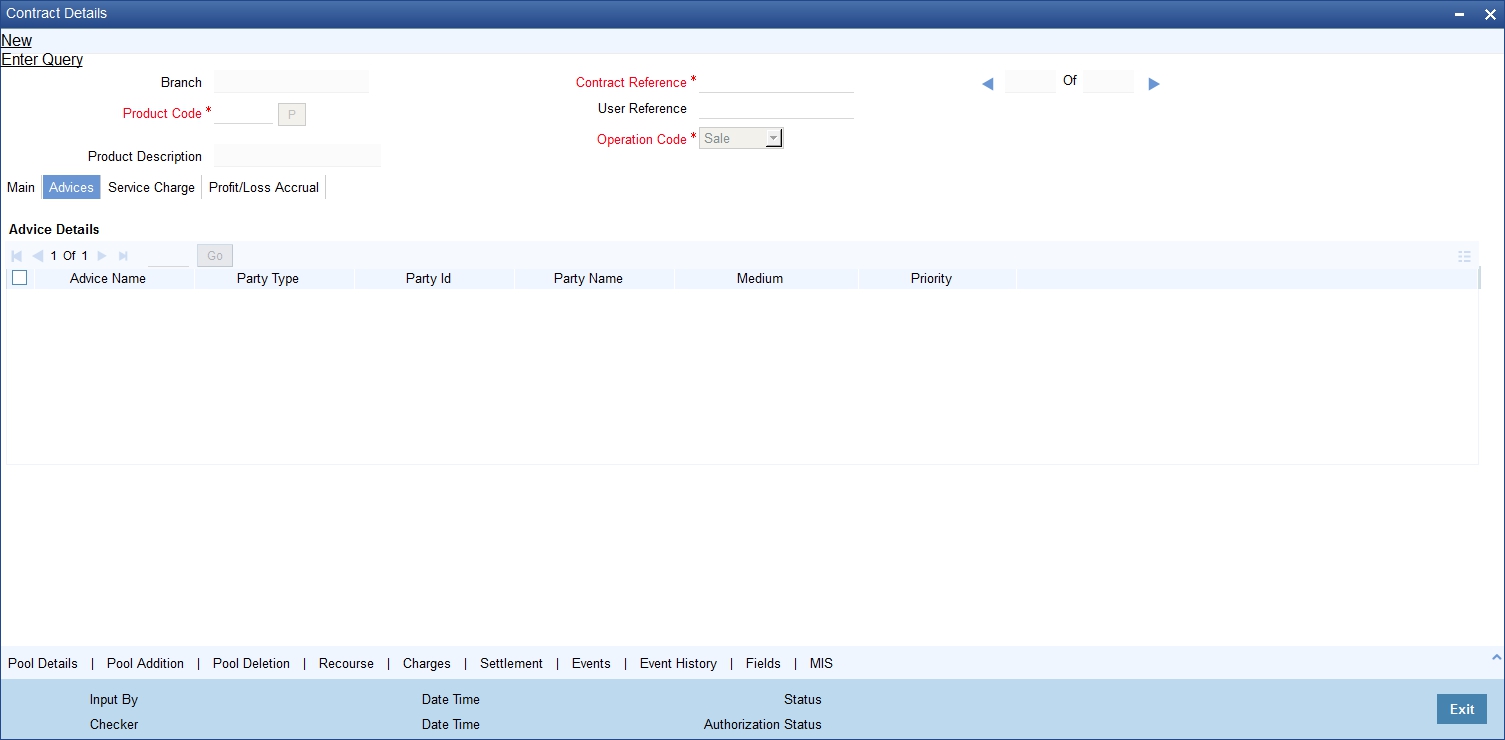

5.2.3 Advice Tab

Click on the ‘Advice’ tab to define the contract advice details.

Here you need to capture the following details:

Advice Details

Advice Name

The system defaults the list of advice reference number which has been generated during the various events of the contract.

Party Type

The system defaults the part type.

Party ID

The system defaults the party ID.

Party Name

The system defaults the party name.

Medium

The system defaults the advice message available medium.

Priority

The system defaults the priority of the advice.

Note

The system displays the latest 25 advices which are generated for the specified contract

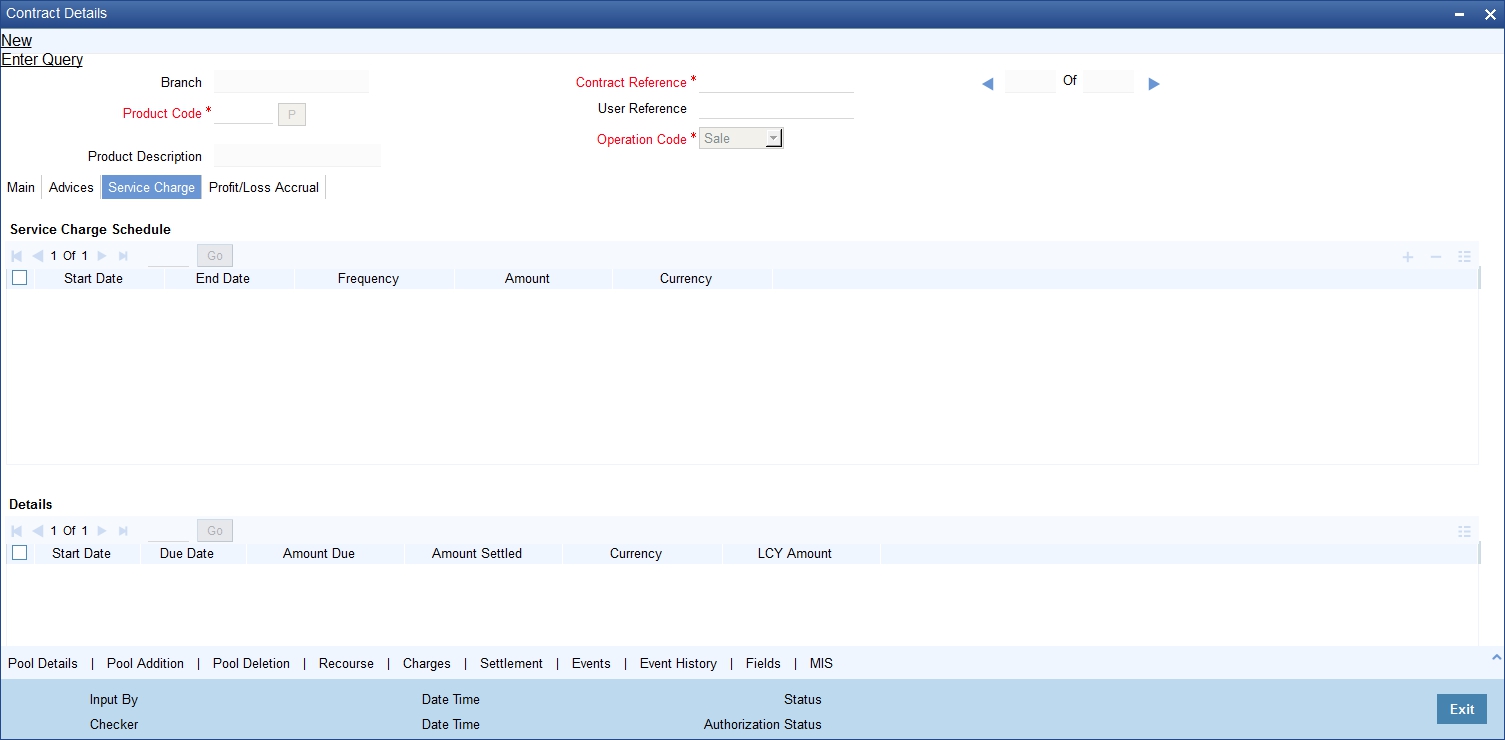

5.2.4 Service Charge Tab

Click on the ‘Service Charge’ tab to define the service charge details.

Here you need to capture the following details:

Service Charge Schedule

Start Date

Specify the start date of the service charge schedule.

End Date

Specify the end date of the service charge schedule.

Frequency

Specify the frequency of the service charge schedule.

Amount

Specify the amount of the service charge.

Currency

Specify the currency of the service charge.

Details

Start Date

Specify the start date of the service charge.

Due Date

Specify the due date of the service charge.

Amount Due

Specify the amount due of the service charge.

Amount Settled

Specify the amount settled of the service charge.

Currency

Specify the currency of the service charge.

LCY Amount

Specify the LCY amount of the service charge.

Note

The system computes the service charge schedule during authorization of the contract.

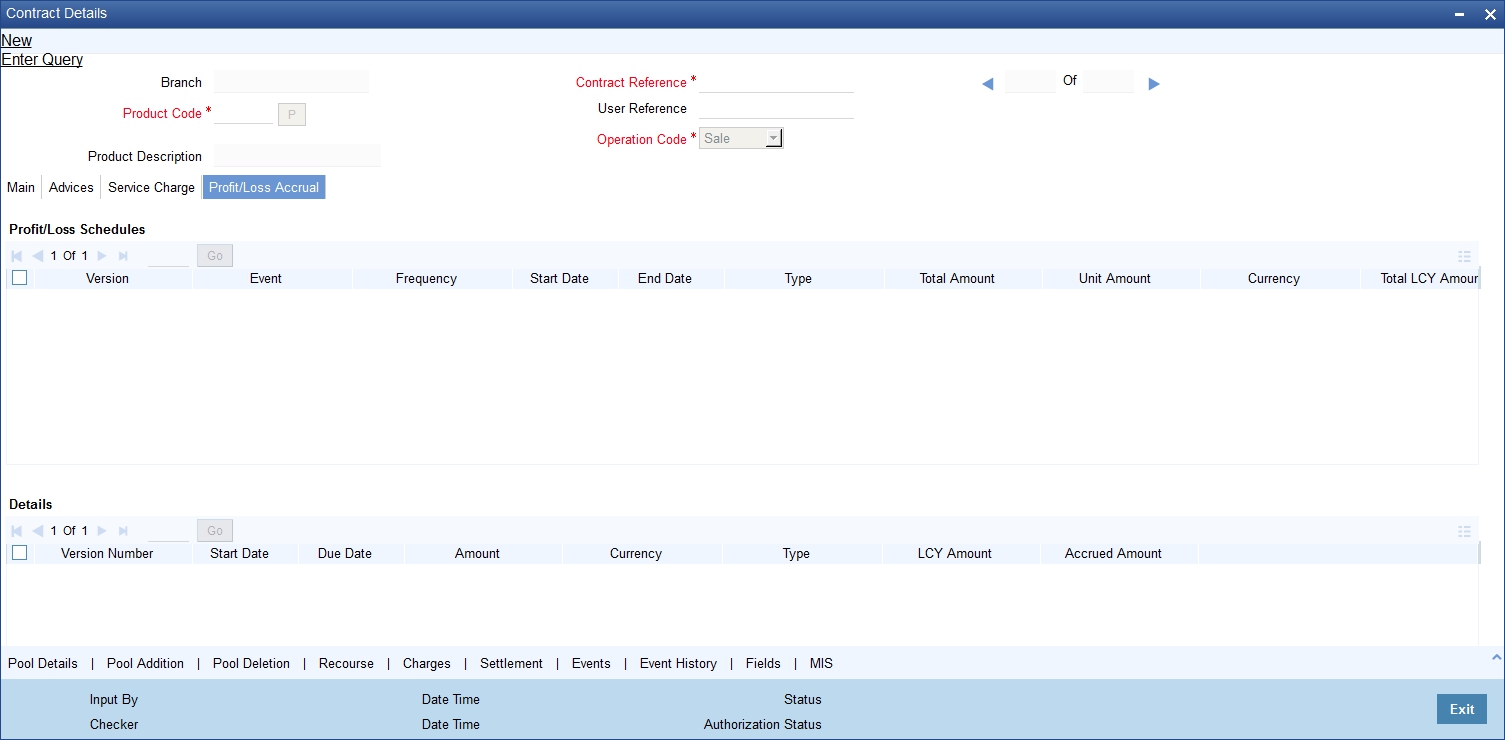

5.2.5 Profit\Loss Accrual Tab

You can define the profit / loss realization period for transactions such as Sale, Sale Amendments, Buyback and Recourse. Based on the schedule definition, system computes the detailed schedules for profit /loss realization. The system triggers the Profit/Loss accrual event during the EOD cycle and passes the accounting entries accordingly.

Click on the ‘Profit/Loss Accrual’ tab to capture the schedule details for the Profit /loss realization.

Here you need to capture the following details:

Profit and Loss Schedule

Version

Specify the version of the profit and loss schedule.

Frequency

Specify the frequency of the profit and loss schedule.

Start Date

Specify the start date of the profit and loss schedule.

End Date

Specify the end date of the profit and loss schedule.

Type

Specify the type of the profit and loss schedule.

Total Amount

Specify the total amount of the profit and loss schedule.

Unit Amount

Specify the unit amount of the profit and loss schedule.

Currency

Specify the currency of the profit and loss schedule.

Total LCY Amount

Specify the total LCY amount of the profit and loss schedule.

Unit LCY Amount

Specify the unit LCY amount of the profit and loss schedule.

Details

Version

Specify the version of the profit and loss schedule.

Start Date

Specify the start date of the profit and loss schedule.

Due Date

Specify the due date of the profit and loss schedule.

Amount

Specify the amount of the profit and loss schedule.

Currency

Specify the currency of the profit and loss schedule.

Type

Specify the type profit and loss schedule.

LCY Amount

Specify the LCY amount of the profit and loss schedule.

Accrued Amount

Specify the accrued amount profit and loss schedule.

Note

The system computes the Profit/Loss accrual schedule during authorization of the contract.

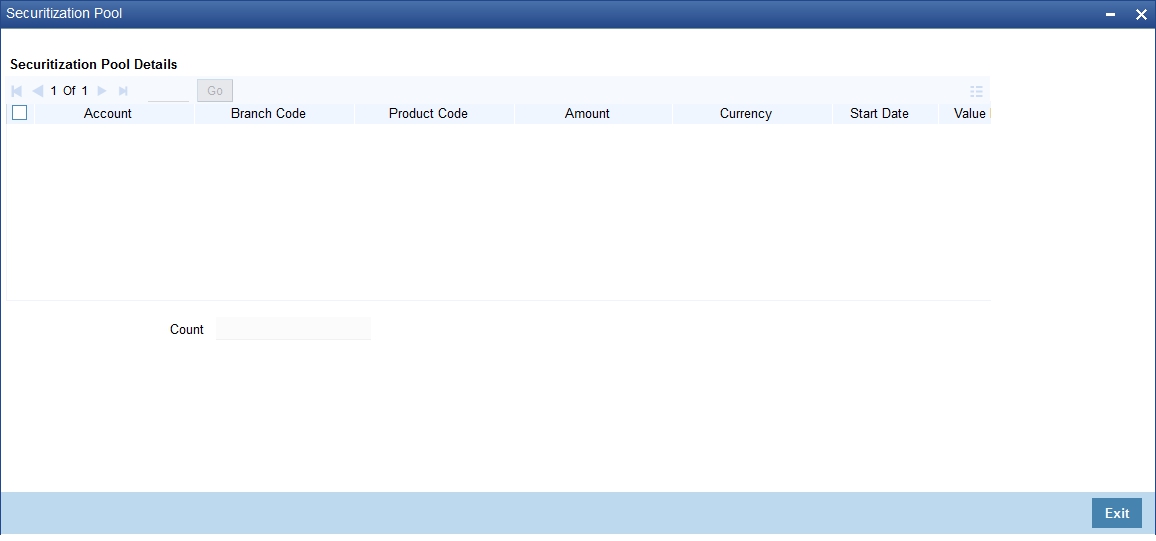

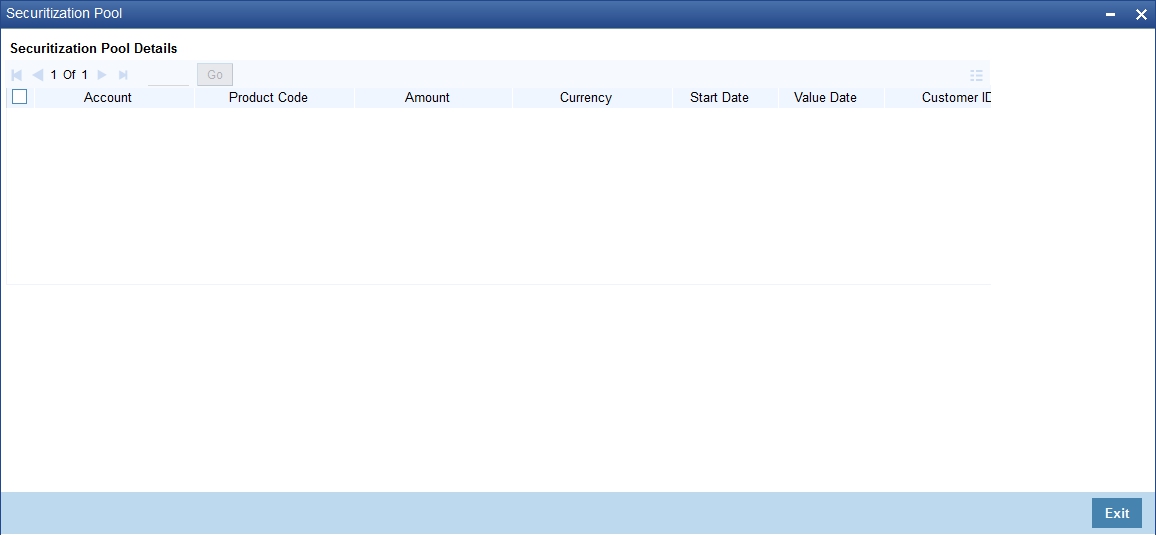

5.2.6 Pool Details Button

Oracle FLEXCUBE provides a facility to view all the underlying loans which have been included as part of the securitization pool. Click on the ‘Pool Details’ button to view the list of loans bundled in securitization pool.

Here you can view the following details:

- Account

- Branch Code

- Product Code

- Product Type

- Amount

- Currency

- Start Date

- Maturity Date

- Value Date

- Customer ID

- Customer Name

- Formula

- Condition

- Rule Expression

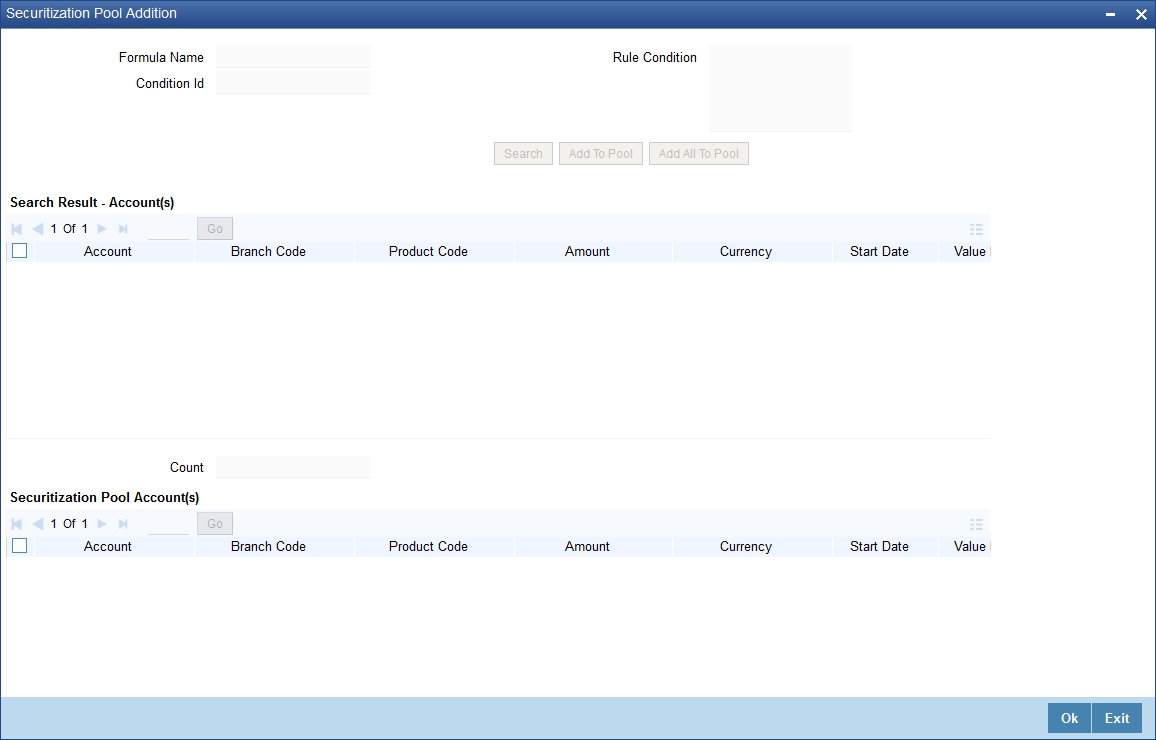

5.2.7 Pool Addition Button

Oracle FLEXCUBE provides a rule based mechanism to add additional loan accounts and remove previously bundled loans from the Pool. You can add new loans to the previously configured pool through ‘Securitization Pool Addition’ screen. Click on the ‘Pool Addition’ button to add new loans to the pool.

You need to capture the following details here:

Formula Name

Select the formula for searching the loan contracts from the option list provided.

Condition ID

Select the condition ID for searching the loan contracts from the option list provided.

Rule Condition

Specify the rule condition.

Click on ‘Search’ button to search for additional non-securitized loan contracts. The rule condition would include the standard set of CL attributes. The system displays the loan accounts which are matching with contract currency.

After searching the details, click on ‘Add to Pool’ button to include the selected loan account for grouping to create the securitization pool. If you want to include all the loan accounts to create the securitization pool, you need to click on ‘Add All to Pool’ button.

To remove the selected loan accounts from the pool, click on ‘Remove from Pool’ button. To exclude all the loan accounts from the securitization pool, click on ‘Remove all From Pool’ button.

Note

The system allows only loans for which ‘Continue accrual’ flag is set to ‘Y’ for the current status to participate in the Securitization pool.

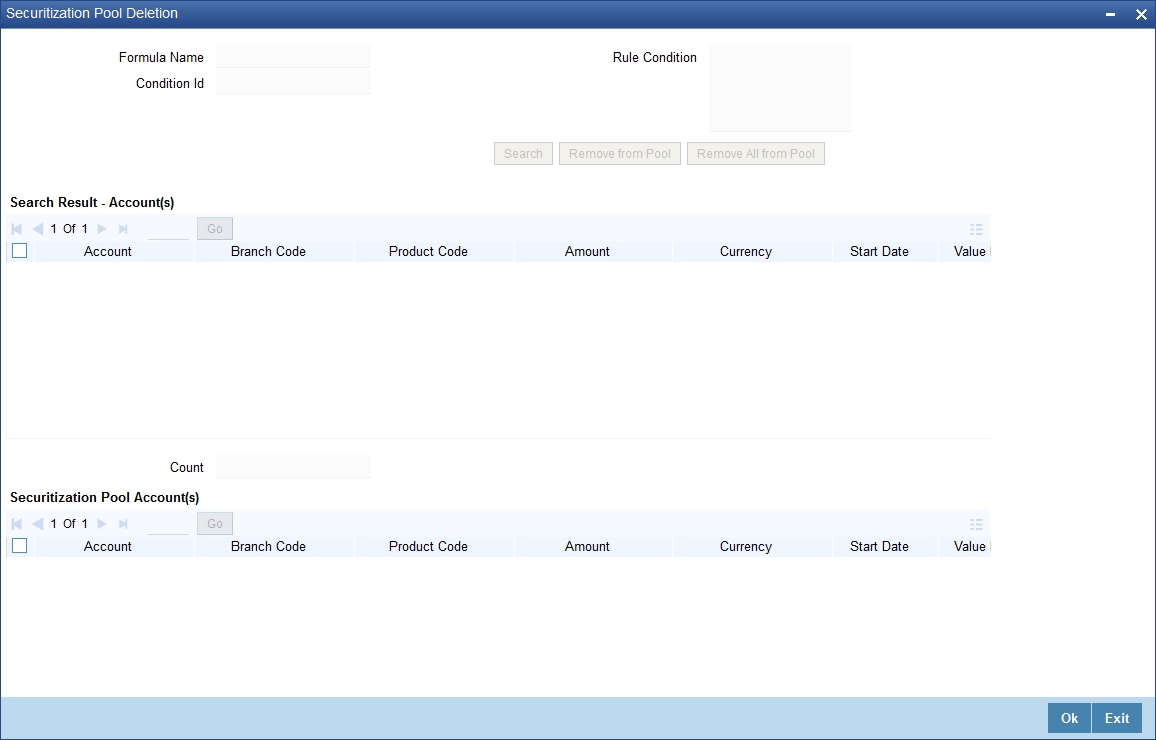

5.2.8 Pool Deletion Button

You can remove loans from the pool through ‘Securitization Pool Deletion’ screen. Click on the ‘Pool Deletion’ button to remove the loans from the pool.

You need to capture the following details here:

Formula Name

Select the formula for searching the loan contracts from the option list provided.

Condition ID

Select the condition ID for searching the loan contracts from the option list provided.

Rule Condition

Specify the rule condition.

The system allows you to select the rule and condition for searching/identifying the loan contracts for excluding from the securitization pool.

To remove the selected loan accounts from the pool, click on ‘Remove from Pool button. To exclude all the loan accounts from the securitization pool click ‘Remove all From Pool’ button.

To include the removed loan account into the pool, click on ‘Add to Pool’ button. To include all the removed loan account into the pool, click on ‘Add All to Pool’ button.

Note

If any of the underlying loan account has been closed or pre-closed, the system does not remove those loan accounts from the pool. It will remain in the pool for future reference.

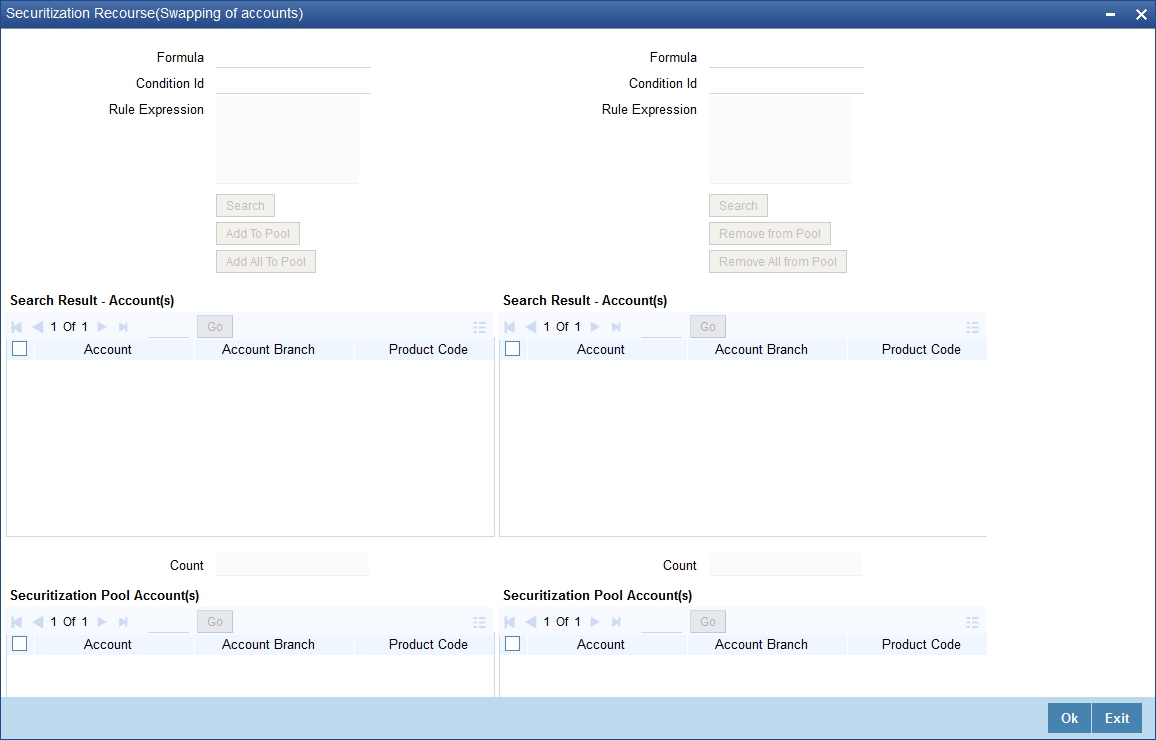

5.2.9 Recourse Button

Oracle FLEXCUBE allows you to replace one or more loan accounts which are not securitized with another loan accounts which are part of the securitized contract in the ‘Securitization recourse (Swaping of accounts)’ screen. To invoke this screen, click on ‘Recourse’ button.

In this screen you can identify the loan accounts from the non-securitized loans to add newly into the securitization pool for swapping the loan accounts. Also you can identify loan accounts which are part of the securitization pool and remove from the securitization pool.

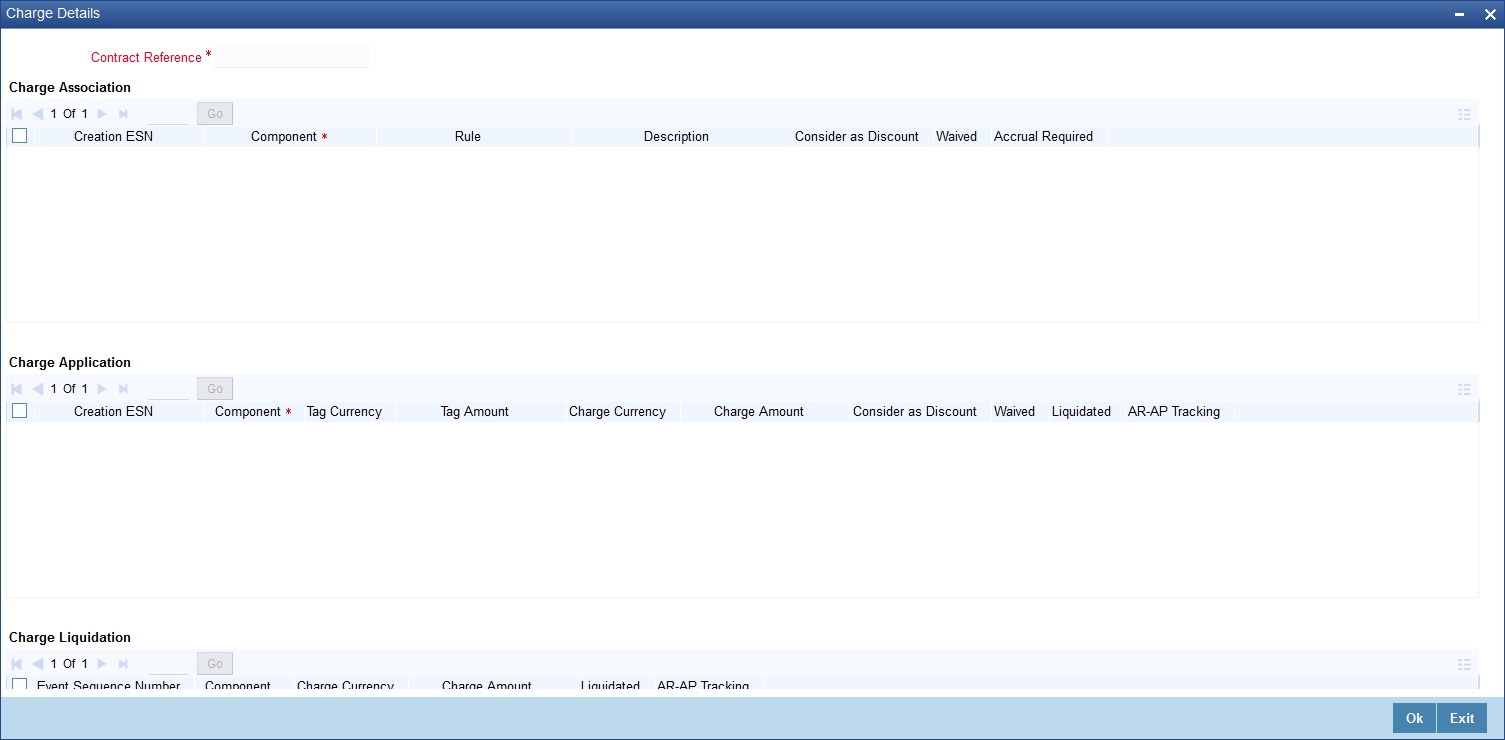

5.2.10 Charges Button

You can view the charges for the securitization contract through ‘Charge Details’ screen. To invoke this screen, click on ‘Charges’ button.

Here you can view the applicable charges for the securitization contract.

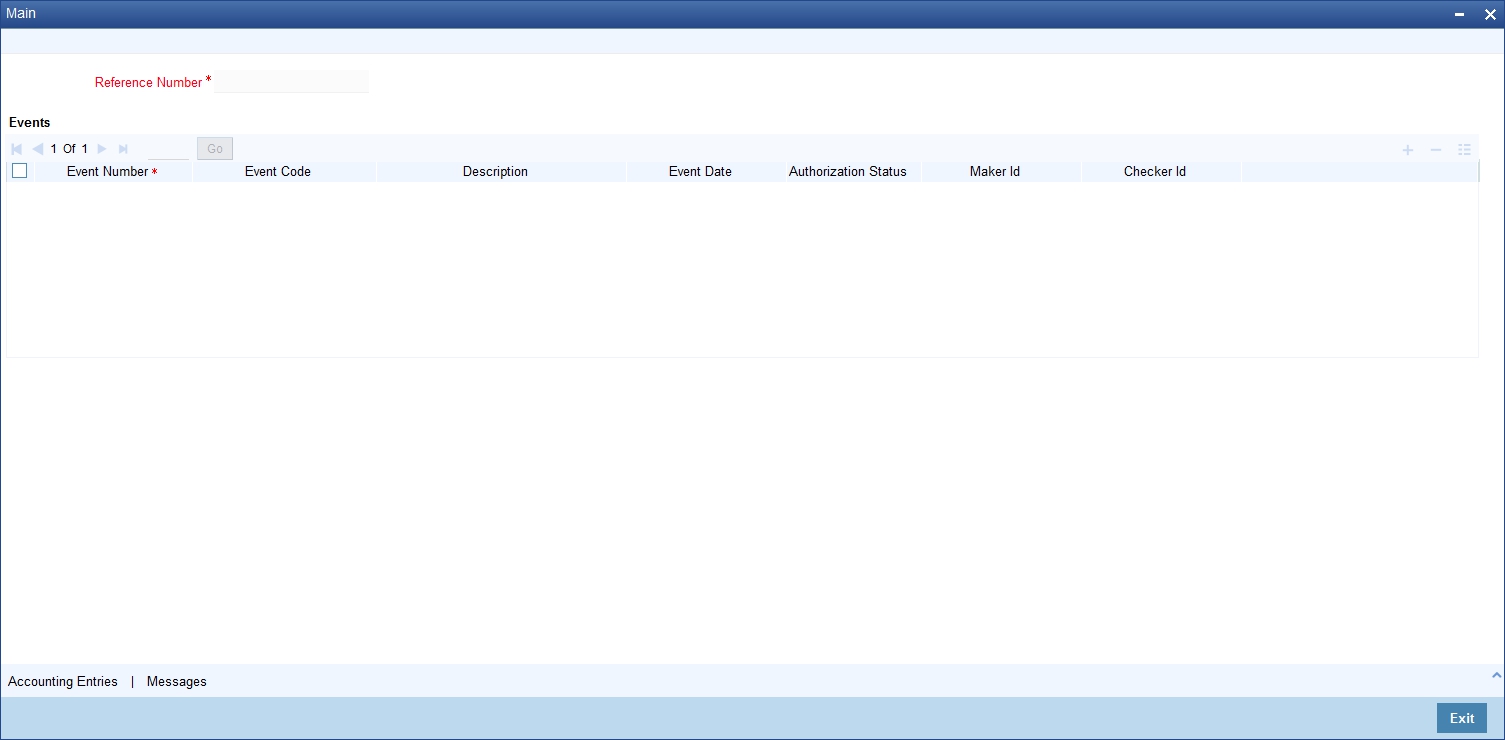

5.2.11 Events Button

You can view the contract event details for the securitization contract through ‘Events’ screen. To invoke this screen, click on ‘Events’ button.

Here you can view the triggered events, corresponding accounting entries and the advice message generated for the securitization contract maintained at the product level.

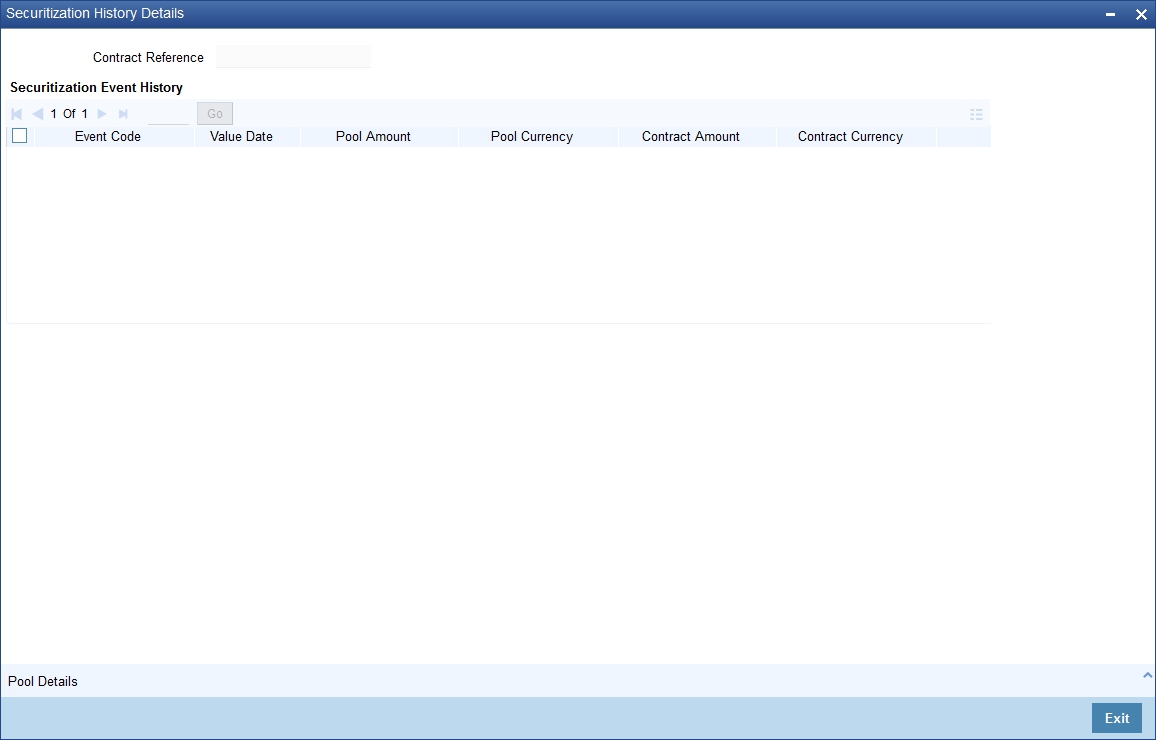

5.2.12 Event History

You can view the securitization contact history details through ‘Securitization History Details’ screen. To invoke this screen, click on ‘Events History’ button.

Here the system displays the events triggered, effective date, execution date of the Event, Pool Amount, Contract Amount and Profit/Loss of the transaction.

Oracle FLEXCUBE provides an option to view the underlying loan contracts when sale, amendment and buyback transactions are processed (for the amendment event, system displays the newly added/removed loan accounts from the pool).

The table below details the list of fields which are supported in the event history screen:

Securitization Event History |

|||||||||

Event |

Value Date |

Pool Amount |

Pool Currency |

Contract Amount |

Contract Currency |

Profit |

Loss |

Profit Accrued |

Loss Accrued |

INIT |

5/5/2009 |

120000 |

USD |

115000 |

USD |

5000 |

0 |

0 |

0 |

SALE |

5/5/2009 |

120000 |

USD |

115000 |

USD |

5000 |

0 |

2500 |

0 |

AMD |

8/3/2009 |

123000 |

USD |

121000 |

USD |

2000 |

0 |

800 |

0 |

AMD |

9/12/2009 |

110000 |

USD |

112000 |

USD |

|

2000 |

|

200 |

You need to select the event checkbox and press the ‘Pool Details’ button to view participating loan accounts.

Here the system displays the participating loan accounts for the securitization contract.

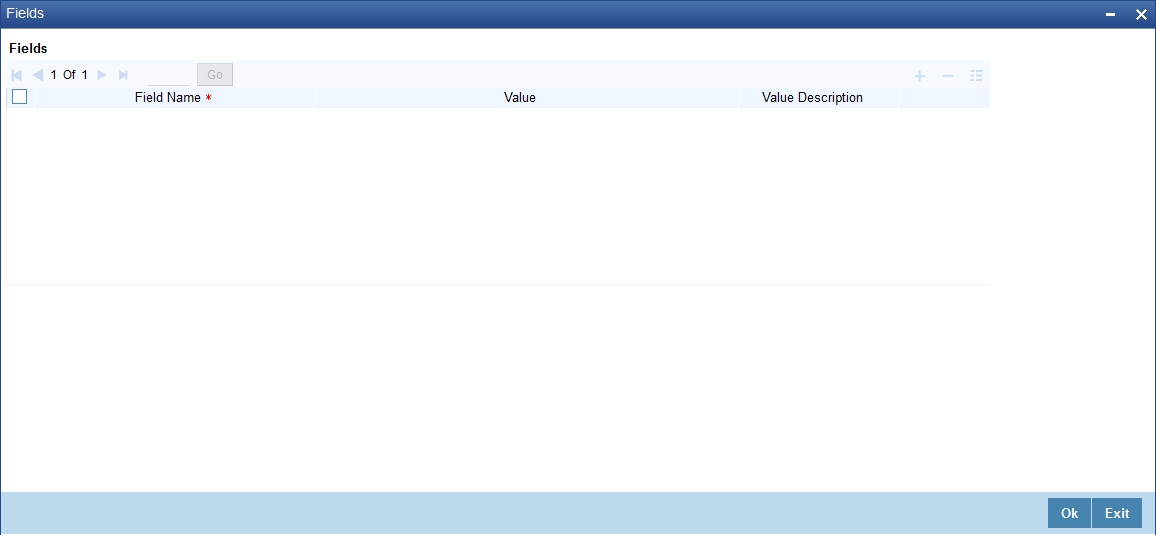

5.2.13 Fields Button

You can view the Fields details through ‘Fields’ screen. To invoke this screen, click on ‘Fields’ button.

Here you can view the Fields details for the securitization contract maintained at the product level.

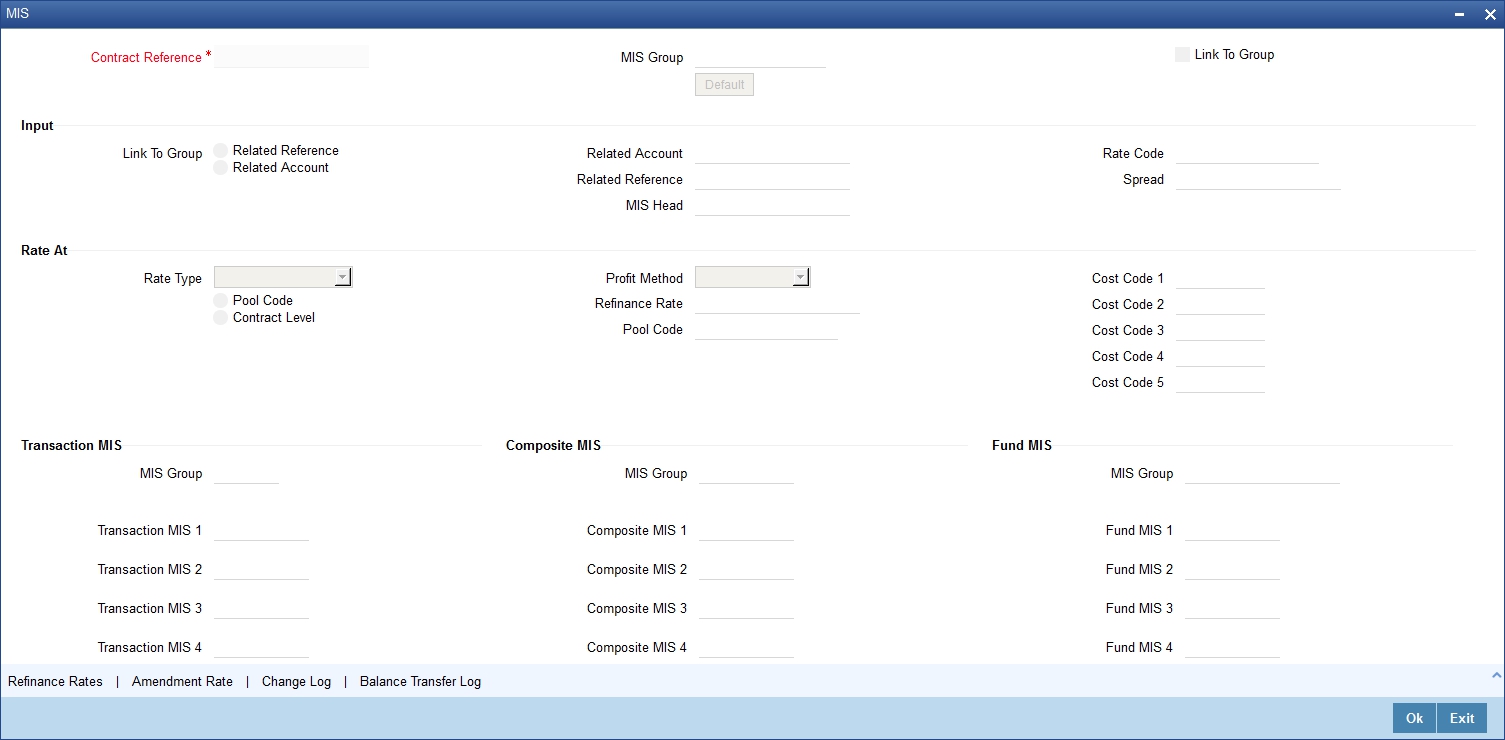

5.2.14 MIS Button

You can view the MIS details through ‘MIS’ screen. To invoke this screen, click on ‘MIS’ button.

Here you can view the MIS details for the securitization contract maintained at the product level.

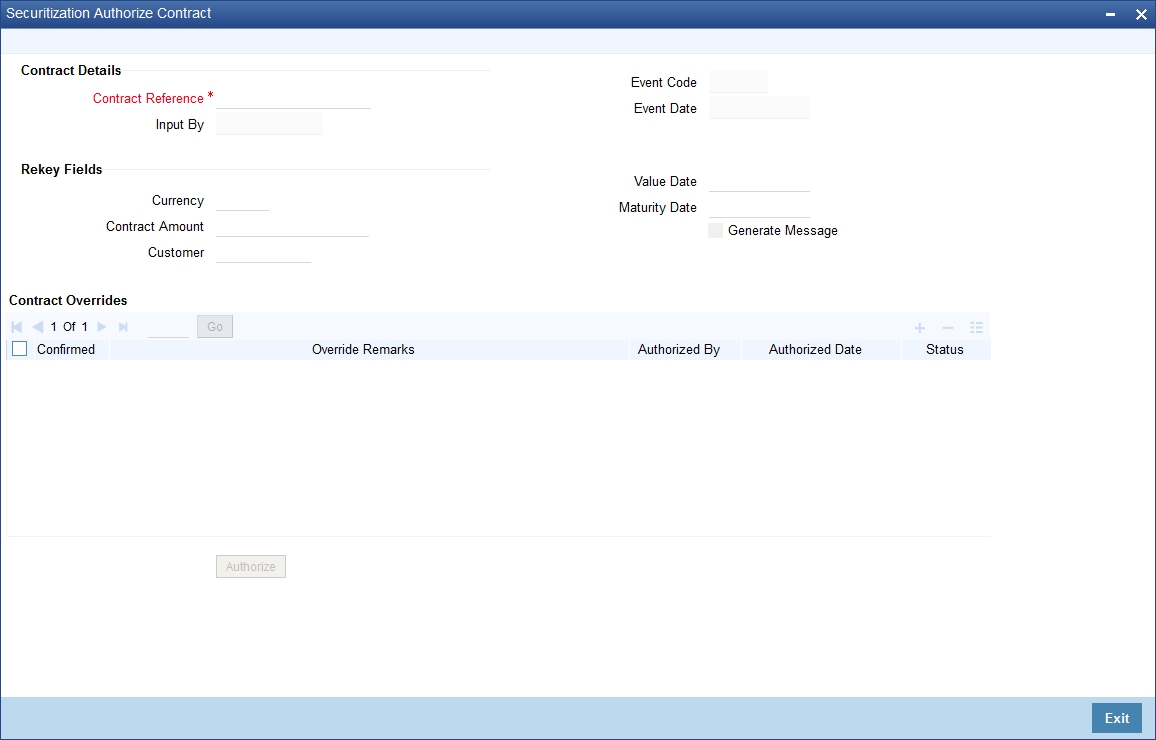

5.2.15 Authorizing Securitization Contract Details

You can authorize contracts in the ‘Securitization Authorize Contract’ screen. You can invoke this screen by typing ‘SZDTRAUT’ in the field at the top right corner of the Application Toolbar and clicking the adjoining arrow button.

You need to specify the following details here:

Contract Reference

Specify the contract number which you are authorizing.

Maker

Specify the maker.

Event Code

The system displays a code for this authorizing event.

Event Date

The system displays the current system date.

Rekey Fields

Rekey the following details for authorizing a contract.

Currency

Specify the currency as part of the re-key requirements for authorizing a contract.

Contract Amount

Specify the amount as part of the re-key requirements for authorizing a contract.

Customer

Specify the customer as part of the re-key requirements for authorizing a contract.

Value Date

Specify the value date as part of the re-key requirements for authorizing a contract.

Maturity Date

Specify the maturity date as part of the re-key requirements for authorizing a contract.

Generate Message

Check this box to generate the messages.

Contract Overrides

Here the system displays the following override details of the contract for all operations:

- Confirmed

- Override Remarks

- Authorized By

- Authorized Date

- Status

- Remarks

5.2.16 Amending Securitization Contracts

Oracle FLEXCUBE supports amendment of securitization contracts after authorization (including or excluding of loan contracts to/from the securitization pool). SPV (Special Purpose Vehicle) may approach the financial institution to buy addition loans/drop bad dept loans from the securitization pool contract (as per the sale agreement). This may lead to addition/removal of loan contract in the securitization pool.

The system also facilitates replacement of one or more loan accounts which are not securitized with another loan accounts which are part of the securitized contracts.

You can amend a securitization contract in the securitization contract screen itself. During the amendment system allows you to update the sale amount and pool contracts alone. During amendment, the system triggers the AMND/BAMD/SAMD/RECR event based on the amendment type selected.

The system allows you to capture the following type of amendments when you press the ‘Unlock’ button and trigger the events as per the below table:

SL. No |

Amendment Option |

Event triggering |

1 |

Amendment type is “SALE” (addition of new loan accounts to Pool) |

System will trigger the ‘SAMD’ event while saving the contract |

2 |

Amendment type is “BUYBACK” (removal of loan accounts from Pool) |

System will trigger the ‘BAMD’ event while saving the contract |

3 |

Amendment type is ’AMND’ (Contract Modification other than Pool modification) |

System will trigger the ‘AMND’ event while saving the contract |

4 |

Amendment type is ‘RECOURSE’ (Replacement of loans in the Pool) |

System will trigger the ‘RECR’ event while saving the contract |

Note

The system enables the subsystem Pool addition and Pool deletion based on the amendment type.

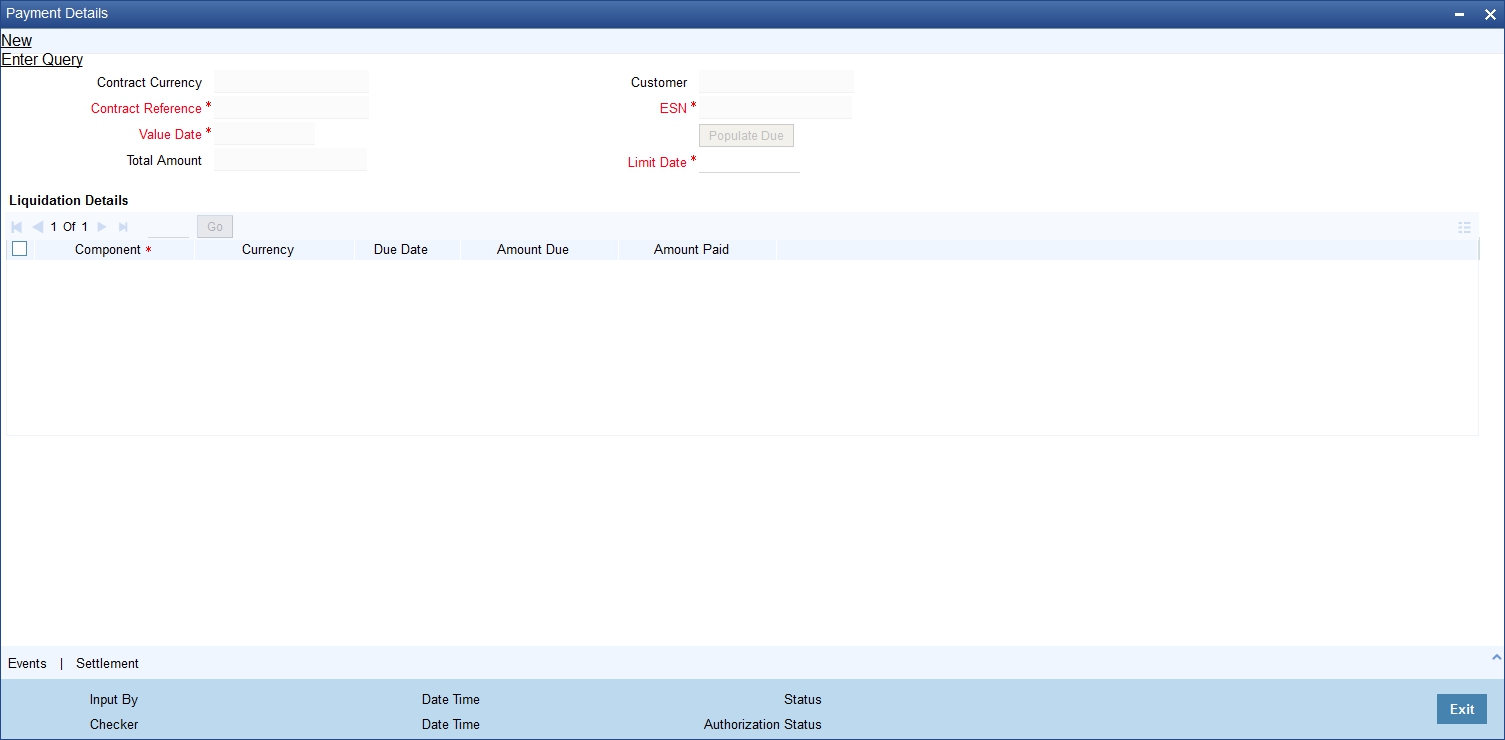

5.3 Handling On-line Payment for Service Charges

This section contains the following topics:

5.3.1 Handling On-line Payment for Service Charges

Oracle FLEXCUBE provides a facility to handle payment of service charges from SPV (Special Purpose Vehicle) through ‘Securitization On-line Payment Detailed’ screen. You can invoke this screen by typing ‘SZDPYMNT’ in the field at the top right corner of the Application Toolbar and clicking the adjoining arrow button.

Here you need to capture the following details:

Contract Currency

The system defaults the currency of the contract which is used for the service charge payment. It will be always the contract currency

Contract Reference Number

Specify the securitization contract reference number to which the payment is made.

Value Date

Specify the value date of the payment. The system defaults it to application date. However you can amend it.

Total Amount

The system calculates and displays the total payment amount which is the sum of the individual component amount paid during the payment.

Customer

Specify the associated SPV customer name.

Event Sequence Number

Specify the event sequence number for the payment.

Limit Due

Specify the limit date for the payment. You can do a prepayment through selecting future dated schedule.

Click ‘Populate Due’ button, the system lists the payment overdue/dues till the specified limit due date in the Liquidation details.