5. Disbursing a Loan

This chapter contains the following sections:

- Section 5.1, "Introduction"

- Section 5.2, "Capturing Loan Disbursement Details"

- Section 5.3, "Preferences for a Loan"

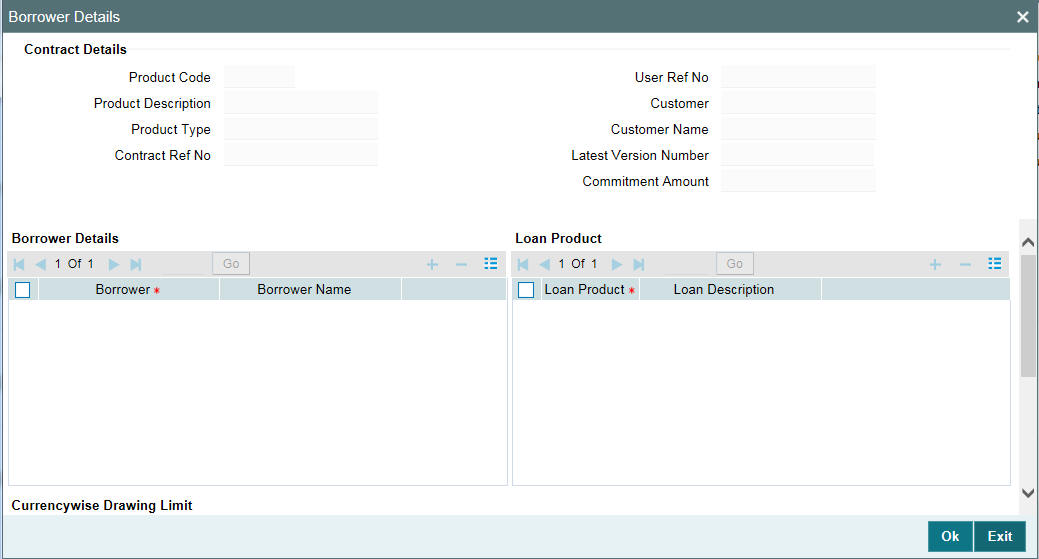

- Section 5.4, "Linking a Loan to Commitments, or Accounts"

- Section 5.5, "Levying Transaction Charges on a Loan"

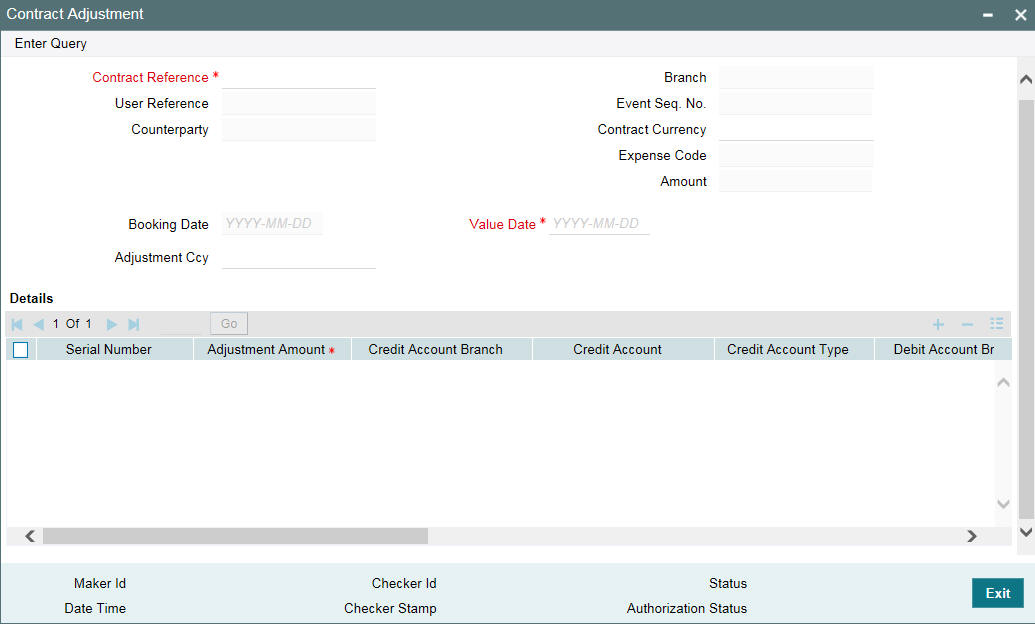

- Section 5.6, "Posting the Manual Journal Entries"

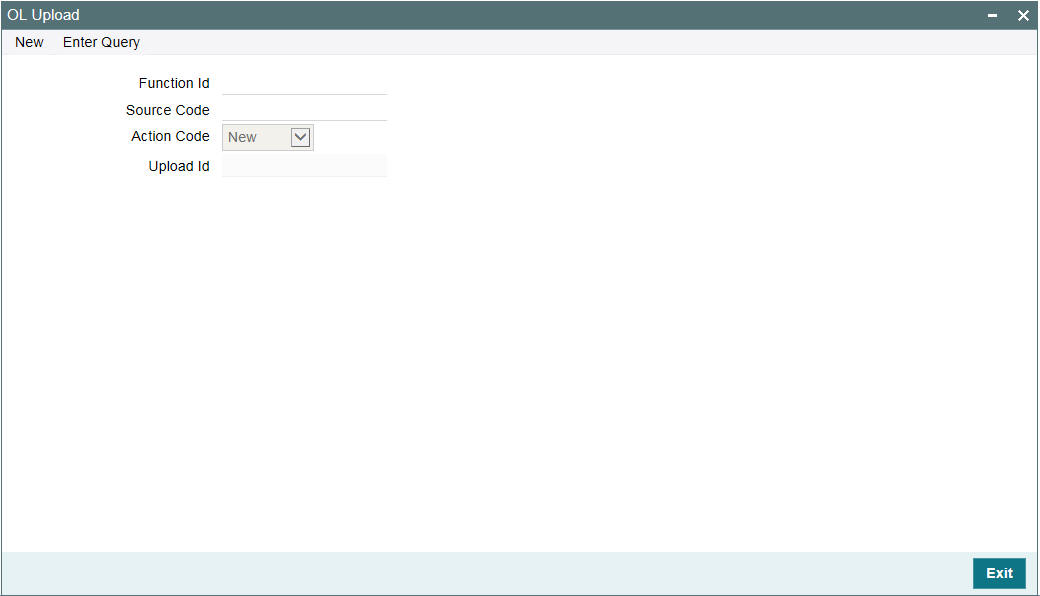

- Section 5.7, "Uploading Loan Contracts through OL Upload Screen"

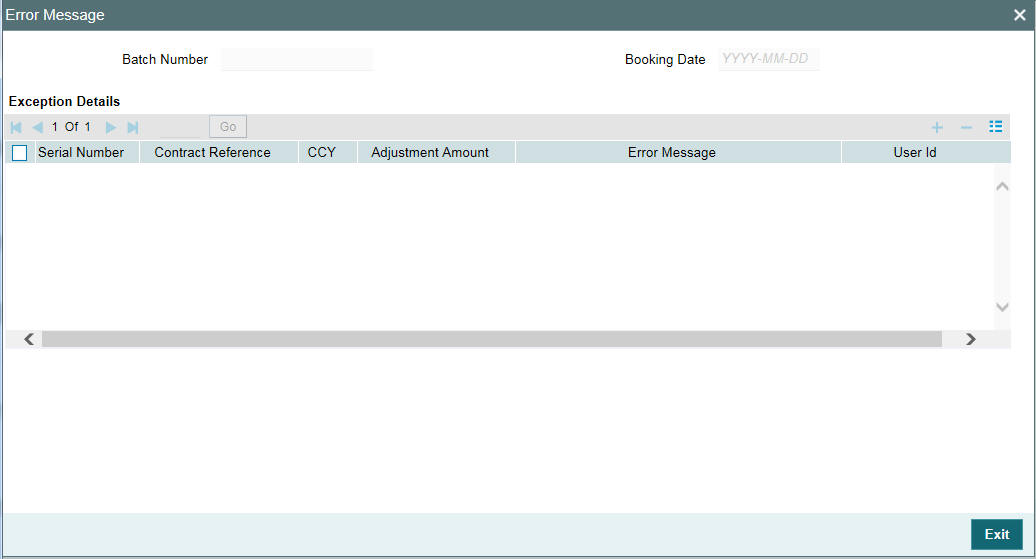

- Section 5.8, "Error Log Details"

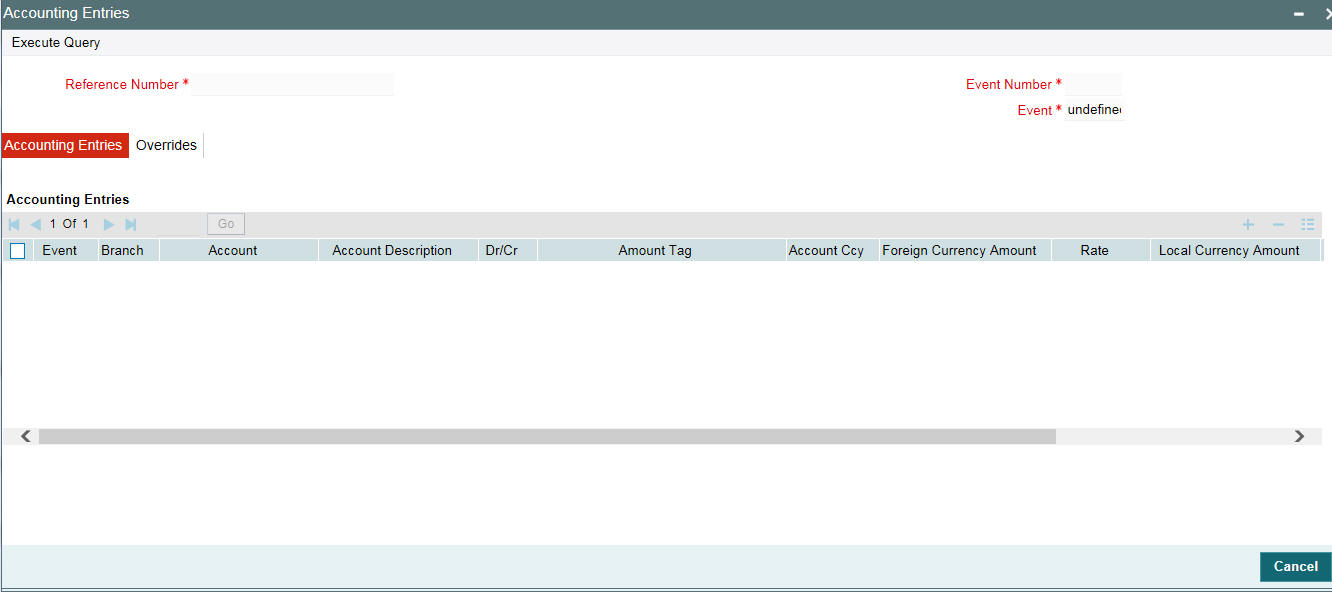

- Section 5.9, "Viewing Event Details"

- Section 5.10, "Levying Tax on a Loan Contract"

- Section 5.11, "Specifying the Interest Details"

- Section 5.12, "Maintaining Transaction-specific MIS Refinancing Rates"

- Section 5.13, "Maintaining Overwrite Settlement Details"

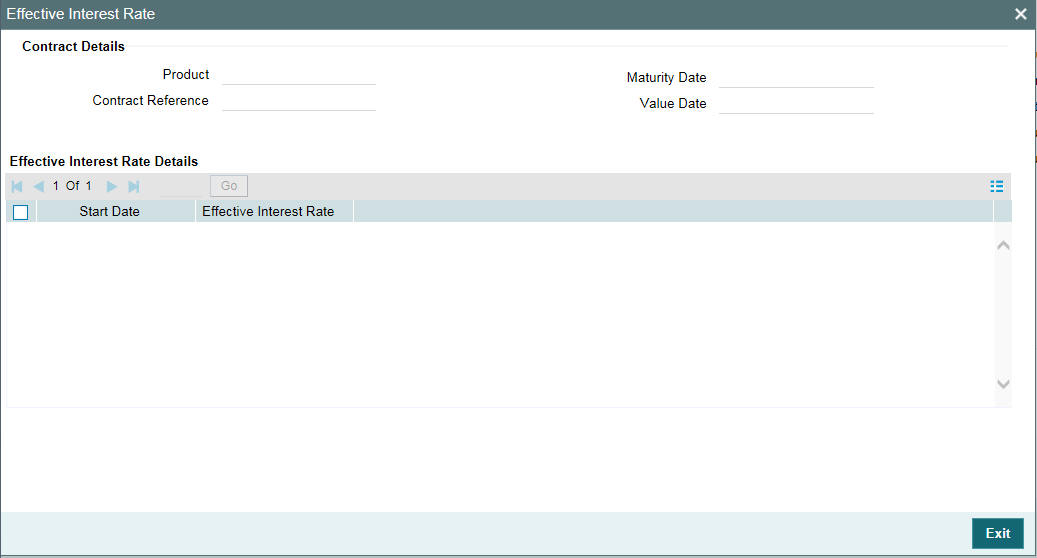

- Section 5.14, "Viewing Effective Rate (ER) of Interest for a Loan"

- Section 5.15, "Changing the Status of a Loan"

- Section 5.16, "Enquiry for Interest and Principal Projections"

- Section 5.17, "Viewing the Settlement Details during Contract Authorization"

- Section 5.18, "Viewing the Different Versions of a Loan"

- Section 5.19, "Viewing the Accrual Fee Details for a Loan"

- Section 5.20, "Viewing Entity Details"

- Section 5.21, "Viewing the Effective Interest Details for a loan"

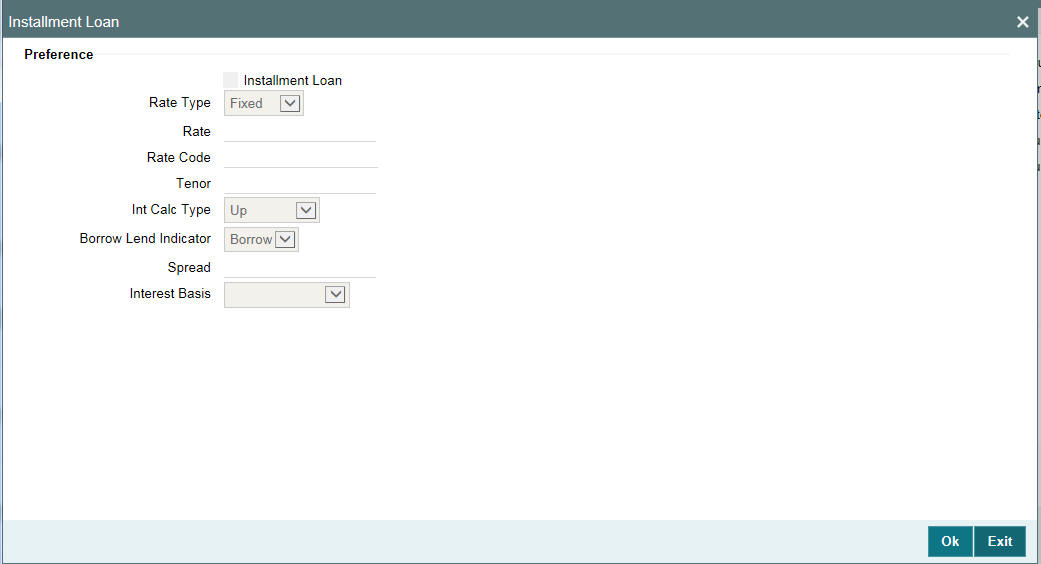

- Section 5.22, "Specifying the Installment Preferences for a Loan"

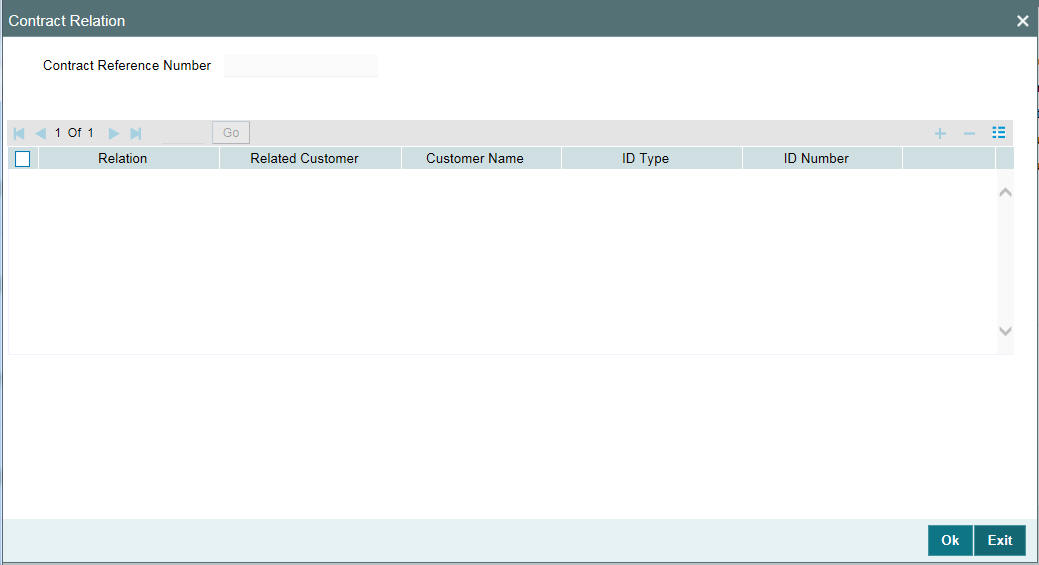

- Section 5.23, "Capturing customer relationships for every loan"

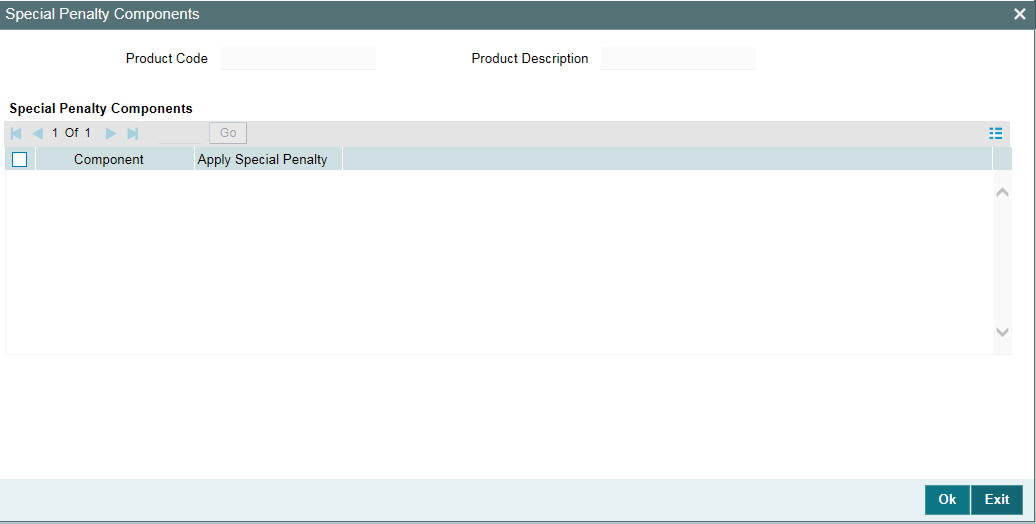

- Section 5.24, "Specifying the Special Penalty Components"

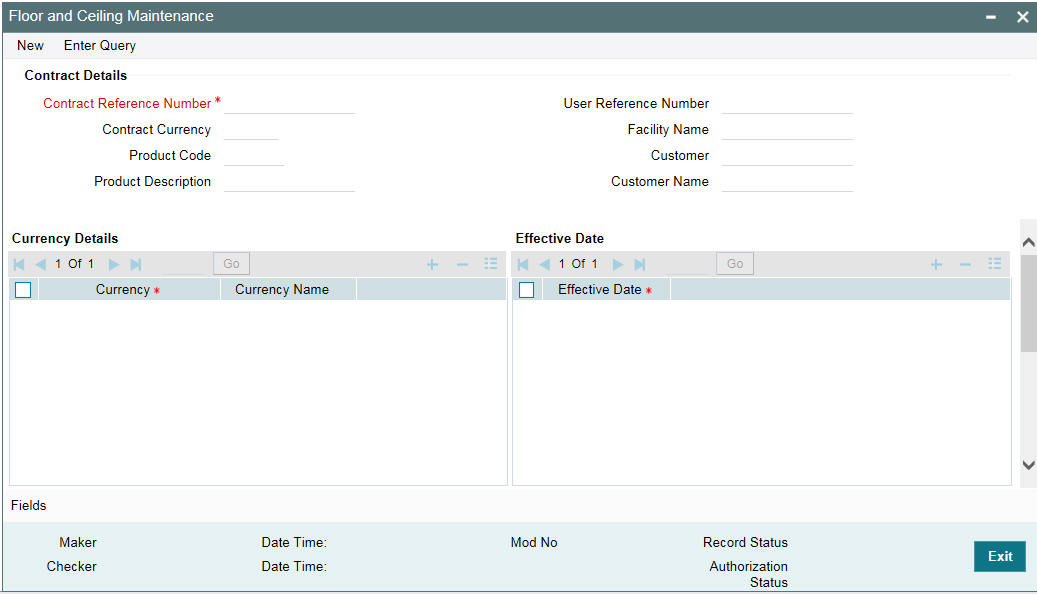

- Section 5.25, "Maintaining Floor and Ceiling Initial Details"

- Section 5.26, "Booking Re-Price Transactions"

- Section 5.27, "Consolidating Re-Price Transactions"

- Section , "For more information, refer to ‘Dual Authorization’" chapter in this User Manual.

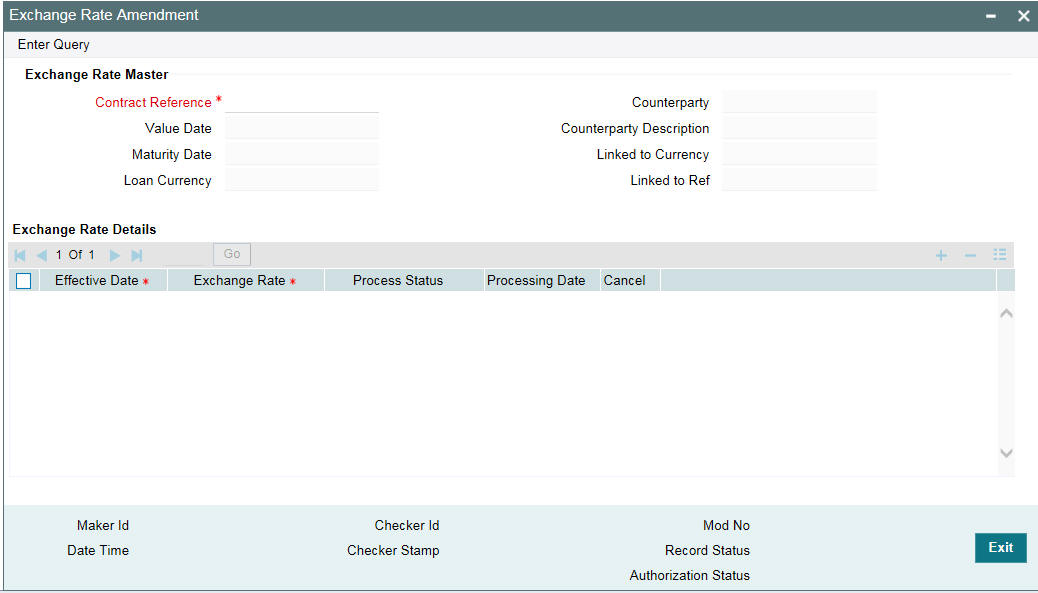

- Section 5.29, "Amending the Exchange Rate"

- Section 5.30, "Classifying LC Sublimit"

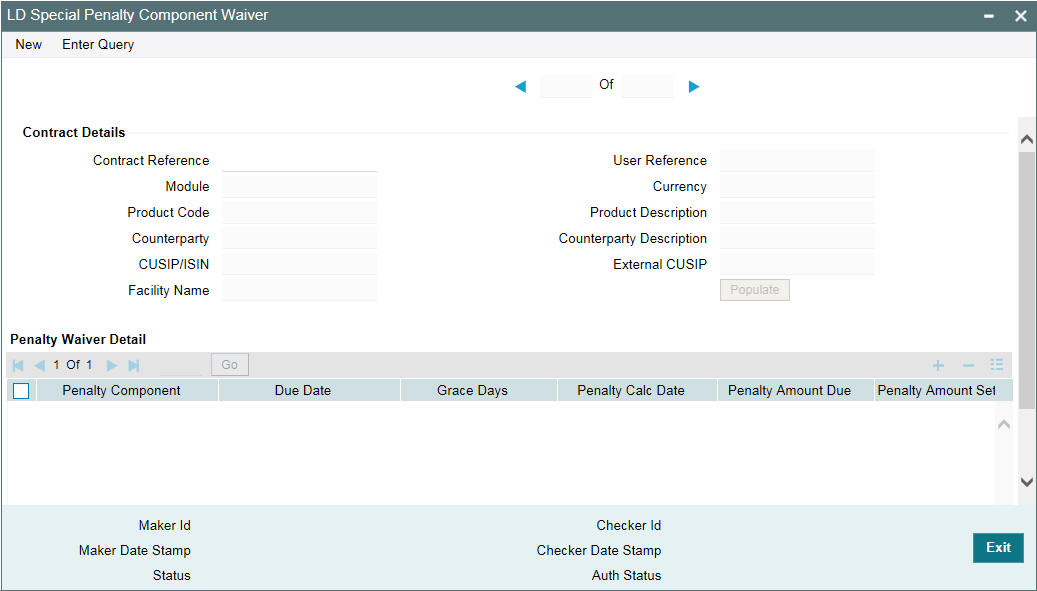

- Section 5.31, "Maintaining Special Penalty Component Waiver Details"

- Section 5.32, "Viewing the Waiver Details of Special Penalty Components"

- Section 5.33, "Maintaining Floor and Ceiling Details"

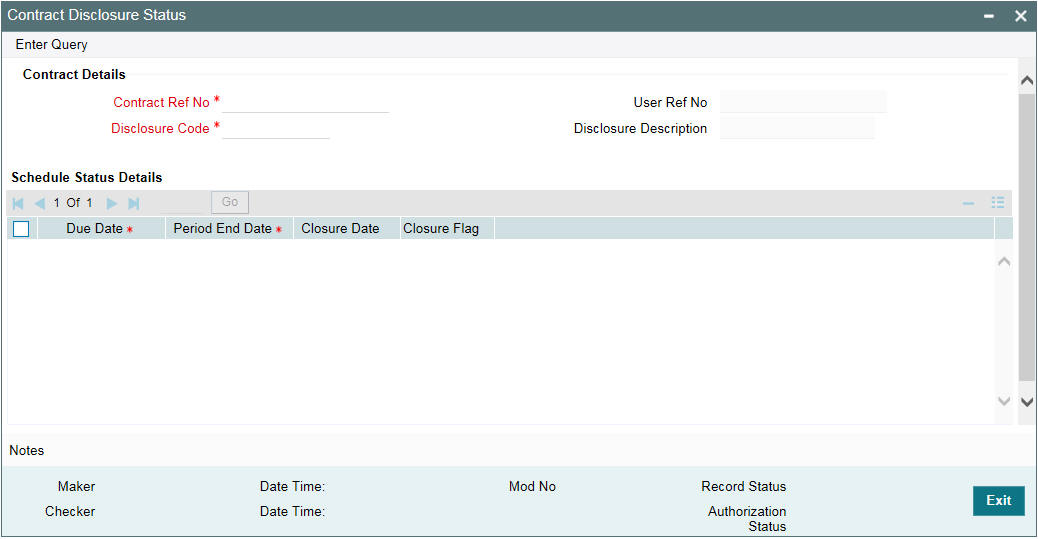

- Section 5.34, "Specifying the Disclosure Schedule Details"

- Section 5.35, "Viewing the Contract Disclosure Schedule Status Details"

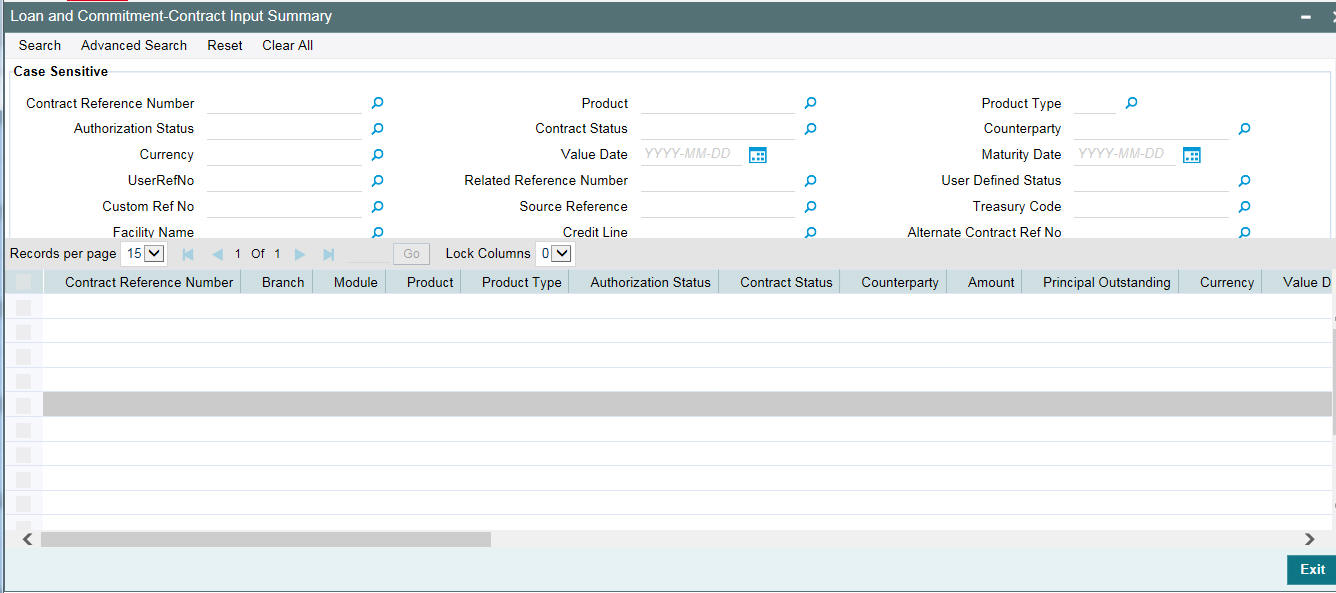

- Section 5.36, "Viewing Summary Details of a Loan"

- Section 5.37, "Dual Authorization"

5.1 Introduction

A product is a specific service that you offer your customers. For example, you may offer loans.

These types of loans are examples of specific services that you offer. In Oracle Lending, you can define a specific type of service as a product.

Defining a loans product, first of all, helps you classify the loans that you issue according to broad groups or categories. Therefore, you can easily retrieve information relating to loans of a specific category.

The other advantage is that, when building a product, you set up it up with attributes generic to loans of a particular type. All loans processed under a product acquire its attributes.

Therefore, when disbursing loans, you do not have to capture these generic details every time; loan disbursement is remarkably automated in Oracle Lending.

Note

The attributes you define for a product default to all loans processed under it. However, to suit the requirements of a loan, you can change these default attributes.

Apart from the general attributes that a loan acquires from a product, you have to capture some information specific to a loan, such as the loan amount, the repayment account, and so on during contract input. You can capture such information in the Loan Disbursement screens.

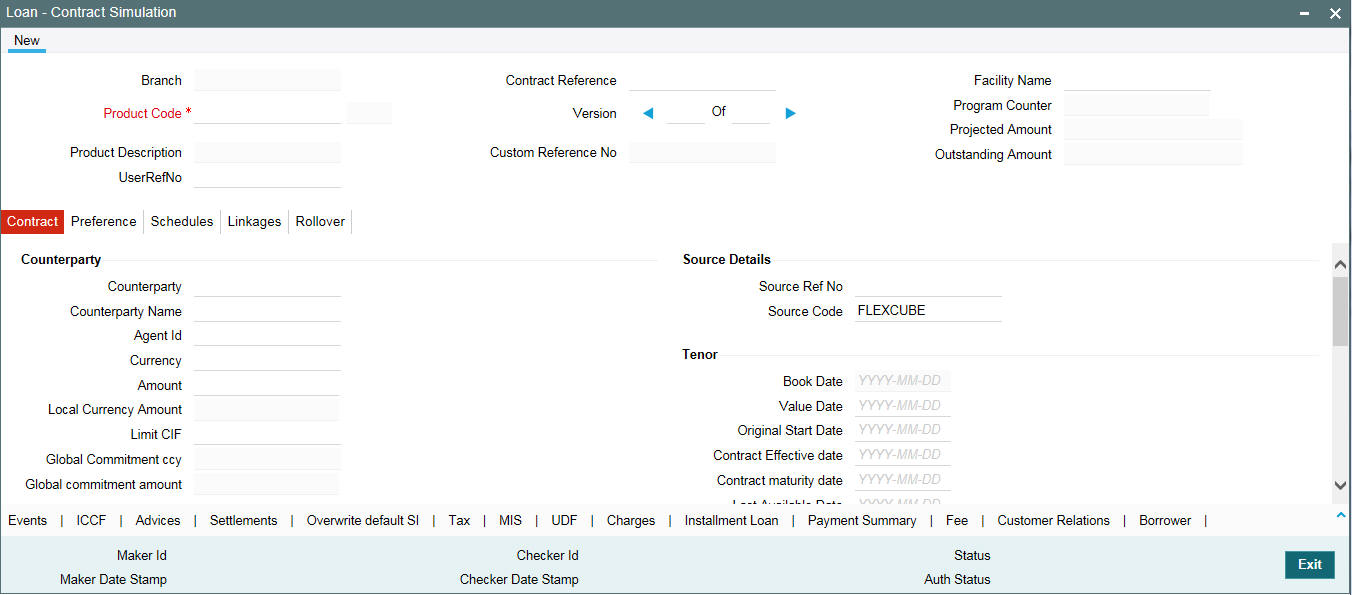

5.1.1 Invoking the Loan Disbursement Screens

You can capture the details of a loan in the following screens:

- Contract details

- Contract Preferences

- Contract Linkage details

- Contract Schedule Definition details

- Contract Rollover details

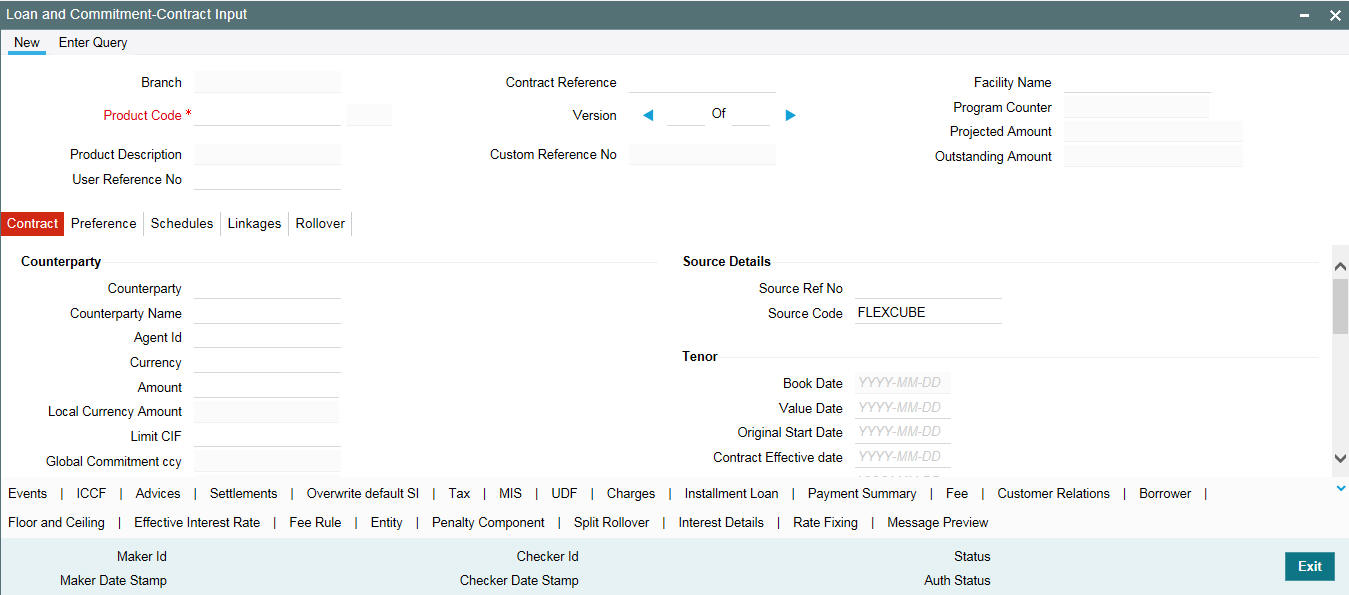

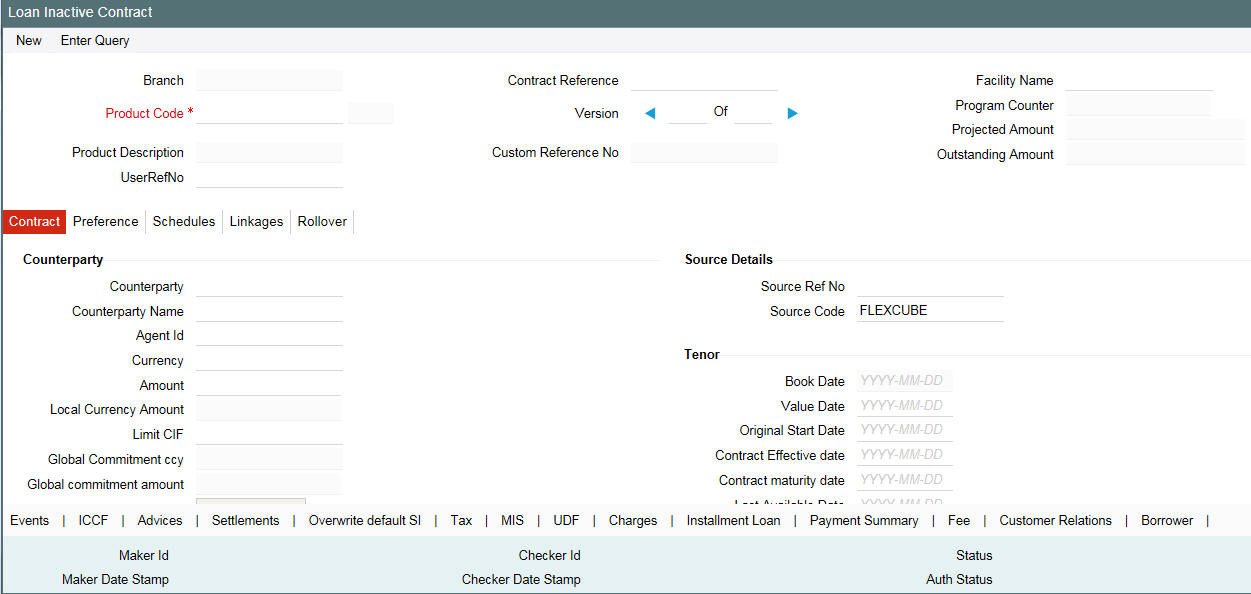

You can invoke the ‘Contract and Commitment - Contract Input’ screen from the application typing ‘OLDTRONL’ in the field at the top right corner of the Application tool bar and click on the adjoining arrow button.

In the Contract and Commitment - Contract Input screen, you can see five tabs, each representing a section:

Tabs |

Screen |

Contract |

Indicates the contract main section |

Preferences |

Indicates the contract preferences section |

Schedules |

Indicates the contract schedule definition section |

Linkage |

Indicates the linkage details section |

Rollover |

Indicates the contract rollover section |

5.2 Capturing Loan Disbursement Details

This section contains the following topics:

- Section 5.2.1, "The Facility Name"

- Section 5.2.2, "Specifying the LC Sublimit Amount"

- Section 5.2.3, "Contra GL Balance Details"

- Section 5.2.4, "Net Outstanding Amt"

- Section 5.2.5, "Current Exposure Details"

- Section 5.2.6, "Specifying the Currency"

- Section 5.2.7, "Specifying the Loan Amount"

- Section 5.2.8, "Specifying the Line Code"

- Section 5.2.9, "Specifying the Settlement Account"

- Section 5.2.10, "Specifying the Related Reference Number"

- Section 5.2.11, "Capturing Details of Amendments to Loan Agreements"

- Section 5.2.12, "Specifying the Tenor"

- Section 5.2.13, "Last Availability Date"

- Section 5.2.14, "Specifying the Loan Status"

- Section 5.2.15, "The Payment Method"

- Section 5.2.16, "Specifying the Maturity Type"

- Section 5.2.18, "Specifying the ICCF Details"

- Section 5.2.19, "Allowing Rollover"

- Section , ""Specifying Industry Code

- Section , ""Specifying the Administrator Details

- Section , ""Pool Funding

- Section 5.2.22, "Identifying an Agency Contract"

- Section 5.2.23, "Rollover Count"

- Section 5.2.24, "Confirming the Status of Loan Products"

- Section 5.2.25, "Tax Scheme"

- Section 5.2.26, "Entering Internal Remarks"

- Section 5.2.27, "Enabling the Reprogramming Counter"

- Section 5.2.28, "Enabling Auto Extension"

- Section 5.2.30, "Indexed Loans"

- Section 5.2.31, "Interpolation"

Using a template to disburse a loan

A template can be described as

a sample contract that has attributes common to many loans in a category (that is, involving a particular product). Once a template is defined, it can be used as a base to enter a loan and only attributes that are specific to the loan you are processing need to be changed. This simplifies the input of disbursement details of a loan.

To use a template you should enter the details of a loan by specifying the template ID of your choice in the LD Contract Details screen.

Entering disbursement details without using a template

If you do not want to use a template, do not specify a Template ID. Enter values into all the mandatory fields and save the loan details.

Whenever a loan is booked and if the UDF ‘RATE-VARIANCE’ is maintained as a non-zero value for a commitment contract to which the loan is linked, dual authorization is required.

For more information on dual authorization, refer to the Dual Authorization in this manual.

The Contract Reference Number

The Contract Reference Number identifies a loan. It is automatically generated by the system for each loan. The Contract Reference Number is a combination of the branch code, the product code, the date on which the loan is booked (in Julian format) and a running serial number for the booking date.

The Reference Number consists of a three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number.

The Julian Date has the following format:

- YYDDD

Here, YY stands for the last two digits of the year and DDD for the number of day(s) that has/have elapsed, in the year.

Example

January 31, 1998 translates into the Julian Date: 98031. Similarly, February 5, 1998 becomes 98036 in the Julian format. Here, 036 is arrived at by adding the number of days elapsed in January with those that elapsed in February (31+5=36).

You can enter any reference number for a loan that you issue. The loan is identified through this number in addition to the Contract Reference Number generated by the system. Two loans cannot have the same User Reference Number. By default, the Contract Reference Number generated by the system is taken as the User Reference Number. You can use this number, besides the loan Reference Number, to retrieve information relating to a loan.

Every loan that you issue, would involve a specific service that you offer (which you defined as a product). When disbursing a loan, you should specify the product that it involves.

All the attributes of the product that you specify applies to the loan. However, you can change some of these attributes while entering the details of the contract. When you specify the product, the product type, loan or commitment is displayed.

5.2.1 The Facility Name

If you are entering the details of a commitment contract, the field Facility Name will be enabled. You have the option of entering the name of the facility here. When you save the commitment contract, the name that you have entered is displayed alongside the screen name and customer name.

The Facility Name entered for a commitment is also displayed for a loan contract booked under it.

Note

- It is not mandatory that you enter the Facility Name for a commitment contract

- When you carry out a search for a contract using the Summary screen, you can do so with the Facility Name. All commitment and loan contracts linked to the name is displayed.

- You are allowed to amend the Facility Name for a commitment contract and if you do so, all loan contracts linked to the commitment contract carries the new Facility Name.

Potential Available Commitment

The system displays the potential commitment availability balances on the value date of the forward dated loan. This field is applicable for commitment contract only.

The formula for potential available commitment is the actual commitment available balance minus the sum of future dated uninitiated loan contract amount in commitment currency. While booking a new loan the system validates the commitment availability based on potential available commitment.

Note

- As part of new forward dated Loan input, you can link the loan to the commitment in order to identify the reporting commitment and for performing the possible validations.

- However, the system does not trigger the LINK event at the commitment level as part of the Loan Booking (BOOK event) activity on the booking date of the loan. Hence, the Commitment availability balance is not reduced during the Forward dated Loan Booking.

- The LINK event triggers at the commitment level during the Forward dated Loan Initiation (INIT event) activity as part of the BOD batch process on the value date of the forward dated Loan. Hence, the commitment availability balances are updated on the value date of the forward dated loan

- To consider the possible impact of the future dated loan utilizations, which affect the commitment available balances, the system considers the utilization of the uninitiated forward dated loan contracts along with the actual utilization of the already initiated loans for the potential available balance verifications.

- If the future-dated loan contract and the commitment contract are of different currencies, then the system updates the commitment availability, applying the provided exchange rate, from the value date of the loan contract.

Specifying the Customer

When entering the details of a loan, you should specify the customer to whom you are issuing it. The category of customers (or the customers themselves) that can be counterparty to a loan is defined for the product. Specify the code of an authorized customer, who falls into a category allowed for the product.

Specifying the Agent CIF

You can select the Agent CIF from the option list. If, for a contract, you specify the Agent CIF, settlement instructions are taken based on this number instead of the Customer code. If you do not specify the Agent CIF, the Customer code is used during settlement.

Note

- If you select an Agent CIF, you have to specify the Settlement Sequence Number (explained later), based on which the settlement instructions are taken.

- If you do not select an Agent CIF and specify, instead, a Customer, you can either enter the Settlement Sequence Number or the Settlement Account, based on which the settlement instructions are taken. If you specify both, the Settlement Sequence Number and the Settlement Account, the Settlement Account takes precedence.

SSI Mnemonic

The system displays the SSI mnemonic along with settlement sequence number.

Specifying EG Number

The Entitlement Group Number gets displayed here.

Specifying the CUSIP No.

Enter the CUSIP No. for the customer. This number will help track the securities of the customer.

Note

- It is not mandatory that you enter the CUSIP number for a commitment contract.

- You are allowed to amend the CUSIP No. for a commitment contract and if you do so, all loan contracts linked to the commitment contract carries the new CUSIP number.

- You cannot amend the CUSIP number for a loan contract. The field CUSIP No. in the loan contract screen displays the CUSIP No. that you have entered for the commitment contract.

Specifying the External CUSIP/ISIN

Specify the external CUSIP/ISIN of the customer.

Ext Deal CUSIP/ISIN

System displays the external deal CUSIP/ISIN of the customer.

System displays a value for the commitment, only if the commitment was created as part of STP, and the Tranche has external deal CUSIP/ISIN associated with it.

5.2.2 Specifying the LC Sublimit Amount

Specify the LC sublimit amount for the loan in commitment contracts. The system tracks the LC sub limit balance and unused commitment amount based on the LC sublimit amount you specify here.

Note

- You can amend the LC sublimit amount during the contract life cycle.

- The system uses the following logic to arrive at the Change in LC Sub Limit Amount on various activities on the Loans and commitments such as Value dated amendment, Payments, and so on.

- Unfunded Commitment Amount = Total Commitment Amount – (Outstanding Normal loan amount + Outstanding LC loan Amount)

- New LC Sublimit amount = Minimum of ( Unfunded Commitment Amount), (Contractual LC Limit – Outstanding LC amount))

- Change In LC Sub Limit amount = New LC sublimit amount – Old LC sublimit Amount

FAS114 Reserve Amt

The system displays the funded FAS114 Reserve amount for a loan and the unfunded FAS114 Reserve amount for a commitment in this field.

Write off Amount

The system displays the amount written off for the loan.

Recovery Amount

The system displays the amount recovered for the loan.

5.2.3 Contra GL Balance Details

If there is a balance amount in the Contra GL, the same is displayed in the field ‘Contra GL Bal’. The reserve amount is also displayed in the field ‘Reserve Amount’.

Note

- For the Contra GL balance details to be displayed, you should have, for the Product, indicated the applicability of Contra Accounting by selecting the box ‘Contra Accounting Applicable’ and select the Contra GL from the option list against the field ‘Contra GL’ in the Status Maintenance screen.

- If the contract, for which you are entering details, moves from a status other than ‘NORMAL’ back to ‘NORMAL’, the system displays a configurable override.

5.2.4 Net Outstanding Amt

Oracle Lending calculates and displays the net outstanding amount here, based on the commitment available. This commitment is dependent on revolving and non revolving type.

Examples

Current value for revolving commitment is calculated as follows:

Revolving |

Contract Amount |

Commitment Outstanding |

Commitment Available |

Commitment Net Outstanding Amt field in contract online screen |

Commitment 1 |

100,000 |

0 |

100,000 |

100,000 |

Loan1 -- INIT |

10,000 |

10,000 |

90,000 |

100,000 |

Loan2 -- INIT |

9,000 |

19,000 |

81,000 |

100,000 |

Loan1 -- LIQD |

4,000 |

15,000 |

85,000 |

100,000 |

Current value for non-revolving commitment is calculated as follows:

Non Revolving |

Contract Amount |

Commitment Outstanding |

Commitment Available |

Commitment Net Outstanding Amt field in contract online screen |

Commitment 2 |

100,000 |

0 |

100,000 |

100,000 |

Loan1 -- INIT |

10,000 |

10,000 |

90,000 |

100,000 |

Loan2 -- INIT |

9,000 |

19,000 |

81,000 |

100,000 |

Loan1 -- LIQD |

4,000 |

15,000 |

81,000 |

96,000 |

5.2.5 Current Exposure Details

This indicates the sum of commitment availability and the total outstanding amount on active loans under the commitment as on current date. This is applicable for commitment contracts.

You can view the payment details using the ‘Payment Summary’ screen by clicking on the ‘PS’ button on the right hand side of the ‘LD Contract Online’ screen.

5.2.6 Specifying the Currency

You should specify the currency of the loan when issuing it to a customer. You can select any currency that is allowed for the product, which the loan involves.

5.2.7 Specifying the Loan Amount

If a product has bearing or discounted type of interest, you should enter the principal of the loan in this screen. For a loan involving a true discounted product, you should enter the face value (nominal) of the loan. You can enter T or M to indicate thousand and million, respectively. For example, 10T means 10,000 and 10M means 10 million.

Note

The amount, which you enter, would be assumed to be in the currency specified for the loan.

5.2.8 Specifying the Line Code

By default, you can view the loans credit line, defined for the customer. You can change over to another authorized credit line, if you want to track the loan under a different line.

If you are entering a loan contract linked to a commitment, the credit line of the commitment is displayed in the ‘COMM’ field.

Note

If you specify a credit line and then link the loan contract to a commitment, the credit line that you have selected is deleted by the system, and the one linked to the commitment, is displayed in the ‘COMM’ field. The Credit Line field is blank.

5.2.9 Specifying the Settlement Account

You have to specify the settlement account if Settlement Instructions have not been defined for the customer.

The settlement account that you specify, is the account through which:

- The loan disbursement would be drawn down

- The repayment for ALL the components would be done

If Settlement Instructions have been defined for the customer, the settlement accounts are taken from those instructions. While entering the loan disbursement details, you can change the Settlement Instructions for the loan.

If a settlement account has been specified, in the settlement instructions for the customer, and a different account has been specified for the loan, the account specified for the loan takes precedence.

In the Settlement Instruction screen, you would have maintained settlement instructions for a Branch-Product-Currency-Counterparty-Module combination. Each set of instructions for this combination carries a unique sequence number. You can also select the ‘Settlement Sequence Number’ based on which the settlement instructions taken for the Customer or the Agent CIF.

Note

It is mandatory for you to select a Settlement Sequence Number if you select an Agent CIF.

LC Contract

Select this field to identify the loan under commitment as LC Loan (which defaults from the Product). You are allowed to amend this before the first authorization.

5.2.9.1 Cross Currency Settlement

If the contract currency of a loan is different from that of the settlement account, you can specify the exchange rate as well as the spread applicable for the component in the Settlements screen while capturing the contract details.

If you just specify the spread, the System picks the standard currency rate and applies the spread defined here.

The settlement function derives the effective rate by taking into account the exchange rate, spread and pay or receive indicator. When the quotation method for the currency pair is direct, the spread is subtracted from the exchange rate in case of a Pay component. However, for a Receive component, the spread is added to the exchange rate. When the quotation method is indirect, the spread is added to the exchange rate for a pay component and subtracted for a receive component in order to get the effective exchange rate.

5.2.10 Specifying the Related Reference Number

In a scenario where your customer is tracking a loan issued to her, in her system, she would probably assign it, a unique reference number. If she offers the number for reference purposes, it can be recorded in this screen. This reference number is printed on the advices sent to the customer to enable her to identify and track, the loan with ease.

5.2.11 Capturing Details of Amendments to Loan Agreements

You can record whether there has been any amendment to the loan agreement after it was initiated. If you record that there has been an amendment, you have to specify the date on which such an amendment was made.

The details that you specify in these fields are stored as part of that particular version of the contract. You, therefore, need to enter these details afresh each time you amend the contract.

These details are incorporated in the contract confirmation advice and amendment confirmation advice that is sent to the customer.

5.2.12 Specifying the Tenor

5.2.12.1 Booking Date

The date on which the loan disbursement details are entered would be displayed in this screen. This defaults to the system date (today’s date). This date is for information purposes only. The accounting entries are passed as of the Value Date of the loan (initiation date of the loan).

5.2.12.2 Value Date

This is the date on which a loan takes effect. The accounting entries for the disbursement of the loan is passed as of this date. The tenor of the loan begins from this date. Calculations for interest and all the other components based on tenor is from this date onwards.

The system defaults to today’s date. You can enter a Value Date of your choice. The date that you enter can be any one of the following:

- Today’s date

- A date in the past

- A date in the future (you can enter a date in the future only if Future Dating has been allowed for the product)

The Value Date should not be earlier than the Start Date or later than the End Date, defined for the product involved in the loan.

If the liquidation date for any component falls before today’s date, the liquidation entries (as defined by you for the product) are passed if specified to do so, for the product. If the Maturity Date of a loan is earlier than today, maturity entries are also be passed.

Once the loan disbursement details have been stored and authorized, this date can be amended only if the loan has bearing type of interest and NO schedule has been liquidated.

Note

An override is sought if the Value Date falls on a holiday, in the country of the loan currency.

The maturity date of a loan is automatically calculated using the value date and tenor that you specify for the product associated with the loan. If the product to which the loan is associated is defined with a Standard Tenor, it is defaulted here. You have the option to change the defaulted tenor.

If you enter the maturity date, the tenor of the loan is automatically calculated using the value date and the maturity date.

For a loan with Fixed Maturity Type, the tenor can either be extended or brought backward through the Value Dated Changes function, once the loan has been initiated.

Initiating a Loan with a Value Date in the Future

A future-dated loan is one that has a Value Date later than the date on which it is booked. The Automatic Contract Update function initiates the loan on the Value Date of the loan.

A future Value Date falling on a holiday is initiated either on the previous working day or on the next, depending on your definition for automatic processing at your branch.

All the initiation-related entries specified for the product involved in the loan is passed automatically. If currency conversions are involved, the conversion rates as of the date on which the loan is initiated is taken from the Currency Table.

If the loan is linked to a commitment, the commitment utilization is updated. In addition, the contingent entries passed when the commitment was initiated is reversed to the extent of the loan amount linked (provided this entry is defined for the product). If the available balance in the commitment is not enough to cover the entire loan amount linked, the loan is not initiated. This is reported in the Exception Report.

If there is a rate revision applicable for the future dated loan, on the day it is initiated (that is, on the future Value Date), the rate revision is applied on the loan also. This rate revision could either be due a Floating Rate change or a Value Dated Change.

5.2.12.3 Original Start Date

For a loan that has been rolled-over, this is the date on which the loan was originally initiated. If a loan has been rolled-over more than once, this is the date on which the first loan was initiated.

If you are entering a loan that has already been initiated, you should enter the date on which the loan began. In this case, the date is for information purposes only and for all accounting purposes the Value Date is considered as the date on which the loan was initiated.

5.2.12.4 Contractual Maturity Date

This field is enabled in the LD Contract Online screen, if the product is a Fed Rate product (if, for the product, you have selected the ‘Rolling Loan’ check box in the Loans and Deposits – Product Preferences screen).

You can enter the Maturity Date of the contract here. The principal schedule is based on the contractual maturity date that you enter here.

A new schedule for a contract booked under a Fed Rate product can be defined by amending and extending the Contractual Maturity Date.

5.2.12.5 Contractual Effective Date

This field is enabled in the ‘Loans and Commitment- Contract Input’ screen, if the product is a Fed Rate product (if, for the product, you have selected the ‘Rolling Loan’ check box in the ‘Loans and Commitment – Product Preferences’ screen).

Enter the date on which a new disbursement has been made to the customer involved in the loan contract.

Note

- Future dated liquidation is not allowed on these loans. Only forward dated value dated amendment is allowed.

- The value date of future dated value dated amendment cannot be beyond the contractual maturity date provided by the user for a contract.

5.2.13 Last Availability Date

The system defaults the contract maturity date as the last availability date. You can specify a new ‘Last availability date’ of the commitment contract to disallow the commitment availability beyond this date.

The last availability date, you specify here, should be later than the value date and on or prior to, the maturity date of the commitment contract.

Note

- You can amend the last availability date as part of contract amendment only before the ‘Last Availability Date’.

- The system does not allow the following activities for this contract,

beyond the last availability date of the commitment:

- Disbursements of new loan contracts

- Value dated amendment for the increase in loan principal

- Value dated amendment for the commitment principal change

- As part of value dated amendment for the commitment, if the maturity

date is extended, then the system displays the message stating the current

value of Last Available date. You should make changes to the Last Available

date as part of contract amendment activity subsequently.

- The commitment availability becomes zero on crossing the expiry date.

5.2.14 Specifying the Loan Status

The status of a loan is indicative of the status of repayments on it. If you have specified automatic status movement for the loan, it is moved automatically to the various statuses as per your definition. However, if you indicated that the status change is made manually on the loan, you can change the status manually in this screen. Even if you have defined a loan with automatic status movement, you can still change the status manually, before the automatic status change is due.

There may be another scenario, where you may have defined a loan with automatic status movement forward and the manual status movement however, in the reverse direction. When the conditions for a loan to be in a particular status no longer exist and, if you have specified manual reverse movement, then you will have to manually move the loan to the appropriate status.

The different status codes applicable to a loan are defined for the product it involves. By default a loan acquires these status codes.

When you are capturing loan disbursement details, the system allots the status of Active by default. You may change it to any of the status codes you have defined.

The following status codes are available:

- Active

- Past Due

- Non-accrual

- Write-off

You can move from one status to the other by bypassing an intermediate status. For instance, you can change the status of a loan from Active to Non-accrual by skipping the intermediate status ‘Past Due’. If a status change has been defined with a change in the GL, the entries are passed for the GL movement.

5.2.15 The Payment Method

The payment method, specified for the main interest of the product (whether bearing, discounted or true discounted), applies to the contract as well. The method defined for the product is displayed here.

Bearing

Interest is liquidated on schedule payment date(s).

Example

You have advanced Mr. Brian Williams a loan of USD 10,000 under the scheme Short Term Loans For Individuals at 10% interest for a year.

Under the bearing type of interest payment method, the nominal (USD 10,000), which becomes the principal in this case, is advanced to Mr. Williams. The interest on it is collected over one year, which is the tenor of the loan.

Discounted

In this interest payment method, the interest is deducted at the time of initiating the loan.

Example

You have issued a loan of USD 10,000, under the scheme Short Term Loans For Individuals, at 10% interest for a year, to Mr. Brian Williams.

Under the discounted type of interest payment, the total interest calculated for the tenor of the loan, (USD 1,000), is deducted from the nominal (USD 10,000) and only USD 9,000 is advanced. This forms the principal of the loan.

True discounted

In this interest payment method, the interest is calculated on the principal of the loan and not on the nominal. All the same, like the discounted method, the interest is deducted from the principal at the time of initiation of the loan.

Example

You have advanced Mr. Brian Williams a loan of USD 10,000 under the scheme Short Term Loans For Individuals at 10% interest for a year.

Under the true discounted type of interest payment, the interest amount in absolute terms is not USD 1,000 but less than that. This is because the interest rate of 10% is not applied on USD 10,000 but on the actual amount disbursed (derived by the system) which is USD 9090.91.

5.2.16 Specifying the Maturity Type

The Maturity Type you have specified for the product is displayed by default, in the screen. However, you can change it to one of the following:

Fixed |

The loan has a fixed Maturity Date. This date should be specified in the screen |

Call |

The Maturity Date is not fixed. The loan can be liquidated any time. It indicates the contract is a demand loan. |

Notice |

The loan will be liquidated after a certain period of notice. The number of days of notice should be specified in the screen |

Fed Rate Loan |

The name of the section is displayed as ‘Rolling Loan (Fixed). The Maturity Date is not displayed. |

For a loan with a Fixed Maturity, this date can either be postponed or advanced, through the Value Dated Changes function.

Maturity Date

If the Maturity Type is fixed (that is, the Maturity Date of the loan is known when the loan is disbursed), specify the Maturity Date when entering the loan. This date should be later than the Start Date of the product. If the product has a Standard Tenor, this date is defaulted, based on the tenor and the From Date of the contract. If this date is changed an override should be given when you store the loan.

For a loan with Call or Notice type of maturity, the Maturity Date should be entered in the screen once it is known. This date should be later than the Start Date of the product. You can unlock the record and add the date.

Oracle Lending maintains an internal parameter ‘Default Fee end tenor’ to indicate the end period for a demand loan fee on a monthly basis. This tenor is used to arrive at the end date for calculation of accrual amount (only for Straight Line method type) of advance type of fees.

When the end date is maintained, the system facilitates you to maintain provision to specify rate revision schedules for a demand loan. You can set up the following demand loans:

- Floating-Auto

- Floating-Periodic-Auto

- Floating-Periodic-Manual

During the life cycle of the loan contract, you are allowed to modify the revision method only for Floating-Periodic type of demand loans.

Note

You are not allowed to amend rate revision method on the day rate revision.

You can define the rate revision schedules in a similar way as defined for normal fixed maturity type of loans. In case if the current revision schedules are over, you can maintain the new revision schedules by means of contract amendment.

If the product has a Standard Tenor, this date will be defaulted based on the tenor and the From Date of the contract. If you change this date, you have to give an override when you store the loan.

If you have specified auto liquidation for the loan, liquidation is done automatically on that date. If manual liquidation has been specified, you have to manually liquidate the loan through the Manual Liquidation function.

For a loan with Fixed Maturity Type, this date can either be extended or brought backwards through the Value Dated Changes function, once the loan has been initiated.

When a contract is booked under an ‘Intra-Day Product’ (a product for which the box ‘Intra-Day Product’ is checked in the Loans and Deposits Product – Preferences screen), the Maturity Date is the system date.

Note

- For a Fed Rate loan, the Maturity Date is not displayed.

- In case of an Intra day loan, the value date and the maturity date is the same and the interest is calculated for one day.

Value Date

This date is displayed only for a contract which is booked under an ‘Intra-Day Product’ (a product for which the ‘Intra-Day Product’ check box is selected in the Loans and Deposits Product – Preferences screen). The Value Date is the System Date.

Notice Days

For a contract maturing at notice, you should enter the notice period (in days). This is for information purposes only. When the notice to repay is issued to the counterparty, you should indicate the Maturity Date of the loan in this screen. You can unlock the record and add the date.

If you have specified auto liquidation for the loan, liquidation is done automatically on that date. If it is manual, you have to manually liquidate the loan, through the Manual Liquidation function.

Extending the maturity date of a contract after expiry

You can choose to extend the maturity date of a contract after the maturity date has passed. In such a case, any penalty accruals for the maturity schedule are reversed. The due date for the bullet schedule is changed to the new maturity date, and any interest that would accrue from the old maturity date to the changed date is added to the total interest. Any penal accruals that have commenced since the maturity date, they are reversed and the status of the contract is changed accordingly.

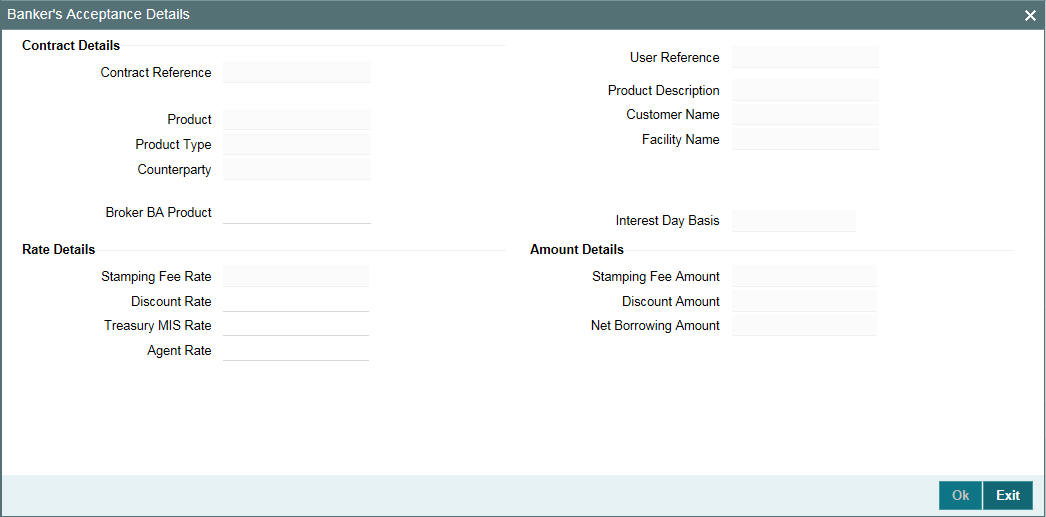

5.2.17 Banker’s Acceptance

You can view or capture banker’s acceptance details only if the Banker’s Acceptance check box is selected at the product level.

Contract Details

The contract details get defaulted from the ‘Contract’ tab.

Broker BA Product

You can select BA broker product from the list of values. These values are maintained the ‘Static Maintenance’ screen.

Interest Day Basis

The interest day basis gets defaulted from the ‘Interest Basis’ of the main interest component.

Rate Details

Stamping Fee Rate

This rate gets defaulted from the ‘Final Rate’ of the main interest component.

Discount Rate

Specify the discount rate.

Treasury MIS Rate

Specify the treasury MIS rate.

This rate gets defaulted to ‘User Rate’ of the MIS screen. You can also modify this rate

Agent Rate

Specify the agent rate.

Amount Details

Stamping Fee Amount

This amount gets defaulted from the ‘Interest Amount’ field of main interest component amount.

Stamping fee amount = loan amount * stamping fee rate * no. of days / day basis.

Example:

- Loan Amount = 2,200,000.00

- Interest / Stamping Fee Rate = 1.37%

- Stamping Fee / Interest amount = 2,200,000.00 * 1.37% * 30 days/365 = 2,477.26

Discount Amount

This amount is calculated automatically, that is, Loan Amount * (1 – Discount Rate)

Example:

- Loan amount = 2,200,000.00

- Discount Rate = 99.96%

- Discount amount = 2,200,000.00 * (1 - 99.96%) = 880.00

Net Borrowing Amount

This amount is calculated automatically, that is, after deducting the discount and stamping fee from the drawdown amount.

Example:

- Original loan amount – stamping fee (main interest) – discount amount

- From the above example:

- Net Borrowing Amount = 2,200,000.00 – 2,477.26 – 880.00 = 2,196,642.74

5.2.18 Specifying the ICCF Details

Numerous interest rates, charges and fees can be defined for a product through the ICCF (Interest, Commission, Charge or Fee) screens. By default, all these are applied on the loan involving the product.

The attributes pertaining to the component defined as the Main Interest (by checking the ‘Main Component’ in the ICCF Product Details screen), is displayed here. If you want to make changes to the Main Interest component only, you can do so through this screen without having to invoke the Contract ICCF screen. If you change the Main Interest details, the changed values will be applied on the loan, along with the specifications for the other components (fee, charge, and so on.). If you want to change the details for any other ICCF component, you have to invoke the Contract ICCF screen by clicking on the ICCF button and then make the changes.

Rate Type

The rate type applicable for the product involved in the loan will be displayed in the respective field in the screen. It can be one of the following:

- Fixed - a fixed rate

- Floating rate - a rate that changes periodically or automatically as per your specifications in the Floating Rate Table

- Special - an amount instead of a rate

For more information on negative interest rate processing, refer to the Interest User Manual.

Floating Rate Code

The Floating Rate Code specified for the product involving a loan is displayed in the screen. You can change it to suit the needs of a specific loan and cannot be amended as a part of contract amendment. However, Float Rate code can be amended by Value Dated Amendment.

Spread

For a loan with a floating interest rate, you can specify the Spread that you want to apply, over the rate maintained in the Floating Rates table.

This Spread should be greater than or equal to the Minimum Spread and less than or equal to the Maximum Spread defined for the product, involved in the loan. If the spread you apply is greater than the Maximum Spread, then the Maximum Spread will be applied on the rate. On the other hand, if it is less than the Minimum Spread defined for the product, the Minimum Spread will be picked up.

For a floating rate, the spread will be applied over the market rate, applicable for the day.

Fixed Interest Rate

If the loan involves a fixed interest rate product, the Default Rate defined in the Product ICCF screen will be displayed here. This rate can be changed if required. The rate can be changed (through this screen), only for the main interest component.

This changed rate should be greater than or equal to the Minimum Rate and less than or equal to the Maximum Rate, defined in the Product ICCF screen.

Example

The minimum and maximum rates defined in the product ICCF screen are 2% and 10% respectively.

The interest rate, which defaults from the product, is 5%. The interest rate you have specified for the loan is 8%. This will be accepted, as it does not exceed the maximum rate of 10%. However, if you want to specify the rate as 1%, this will not be accepted, as this rate is less than the minimum rate of 2%.

Note

You can define a revision schedule for a loan with a fixed rate of interest. The revision schedule can be brought into effect when you change the fixed rate through an amendment.

Special Interest Amount

If the product involved in the loan has been defined with a special interest, the interest amount applicable for the loan is displayed in this screen. You can change this amount.

5.2.18.1 Specifying Rate Fixing Days and Rate Fixing Required

‘Rate Fixing Required’ check box value is selected from the product level interest screen and and ‘Rate Fixing Days’ is selected from Interest Limit screen. However, you can modify these values.

For more information on rate fixing days and rate fixing required, refer to Interest User Manual.

5.2.18.2 Specifying the Interest Period Basis

You can indicate how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of the contract. This preference is inherited from the Interest Limits definition for the product used by the contract, and you can change the default option chosen.

You can choose any of the following options:

Including the From Date

For all schedules, the period considered for interest calculation would include the start date and exclude the end date. Therefore, the value date of the loan is considered for interest calculation and the maturity date is excluded.

Including the To Date

For all schedules, the period considered for interest calculation would exclude the start date and include the end date. Therefore, the value date of the loan is excluded, but the maturity date is included for interest calculation.

Including both From and To Dates

The period considered for interest calculation would include both the value date and the maturity date. This would mean:

- For the first schedule, it would include the Value Date. Interest would be calculated for the Value Date

- For the last schedule, it would include the Maturity Date. Interest would be calculated for the Maturity Date

Excluding both From and To Dates

The period considered for interest calculation would exclude both the value date and the maturity date. This would mean:

- For the first schedule, it would exclude the Value Date. No interest would be calculated for the Value Date.

- For the last schedule, it would exclude the end date. No interest would be calculated for the Maturity Date.

Example

A loan with a value of USD 400,000 is value dated 1st January 2003 and matures on 1st May 2003. The intermediate interest payment schedules are on 1st February 2003, 1st March 2003 and 1st April 2003.

Schedule |

Start Date |

End Date |

1 |

1st January 2003 (Value Date) |

1st February 2003 |

2 |

1st February 2003 |

1st March 2003 |

3 |

1st March 2003 |

1st April 2003 |

4 |

1st April 2003 |

1st May 2003 (Maturity) |

The periods considered for interest calculation for each schedule, for each of the four options, are arrived at as given below:

Include From Date

Schedule |

Days from |

Days To |

Days for Interest Calculation |

1 |

1st January 2003 (including) |

1st February 2003 |

32 |

2 |

2nd February 2003 |

1st March 2003 |

28 |

3 |

2nd March 2003 |

1st April 2003 |

31 |

4 |

2nd April 2003 |

1st May 2003 (excluding) |

31 |

Include To Date

Schedule |

Days from |

Days To |

Days for Interest Calculation |

1 |

1st January 2003 (excluding) |

1st February 2003 |

31 |

2 |

2nd February 2003 |

1st March 2003 |

28 |

3 |

2nd March 2003 |

1st April 2003 |

31 |

4 |

2nd April 2003 |

1st May 2003 (including) |

30 |

Include both From and To Dates

Schedule |

Days from |

Days To |

Days for Interest Calculation |

1 |

1st January 2003 (including) |

1st February 2003 |

32 |

2 |

2nd February 2003 |

1st March 2003 |

28 |

3 |

2nd March 2003 |

1st April 2003 |

31 |

4 |

2nd April 2003 |

1st May 2003 (including) |

30 |

You would notice that consequent to the first schedule, this option would work in the same manner as the Include To Date option.

Exclude From and To Dates

Schedule |

Days from |

Days To |

Days for Interest Calculation |

1 |

1st January 2003 (excluding) |

1st February 2003 |

31 |

2 |

2nd February 2003 |

1st March 2003 |

28 |

3 |

2nd March 2003 |

1st April 2003 |

31 |

4 |

2nd April 2003 |

1st May 2003 (excluding) |

29 |

You would notice that consequent to the first schedule, this option would work in the same manner as the Include From Date option.

5.2.18.3 Specifying the Currency Rounding Logic for Interest Components

A Loans contract or Money Market deal inherits the currency-wise rounding rules defined for interest components, in the interest class associated with the product used by the contract.

Such inherited rounding rules can be altered, if required, when the contract is entered. For the main interest component, the applicable rounding rules can be altered in the main Contract Online screen.

The following rounding rules can be specified:

- How the interest amounts in respect of the interest component in the specified currency are to be rounded – truncated, rounded up, rounded down, or rounded near.

- If truncation is opted for, the number of digits after the decimal place, to which interest amounts in respect of the interest component in the specified currency, must be truncated. The number of digits specified for truncation cannot exceed the allowed decimal places for the specified currency. If not specified, the number of decimals indicated in the Currency Definition for the specified currency is picked up by the System.

- For the Round Up, Round Down and Round Near options, the rounding unit, which is the lowest possible measure in which the interest amounts in respect of the interest component in the specified currency, can be considered. This value cannot be less than the rounding unit for the specified currency in the Currency Definition. If not specified, the rounding unit indicated in the Currency Definition for the specified currency is picked up by the System.

The rounding rules so defined would also be applicable for any special interest and / or rollover special interest amount in respect of the contract.

The rounding rules for any of the interest components applicable for the contract can be specified in the ICCF Details screen, which can be invoked by clicking on the ‘I’ button in the Contract Online screen.

Application of Rounding Rules during Interest Processing

When the System processes any of the following events in respect of a Loans contract, the rounding rules defined for the interest component applicable for the contract are picked up:

- Interest Schedule Calculation

- Interest Accrual

- Manual Liquidation.

- Contract Rollover (if a partial liquidation is done, the rules are applied on the interest liquidation amount, and any differential amount arising from this is adjusted. An override is sought in such a case)

- Auto Liquidation (If the Verify Funds and Partial Liquidation Allowed options are applicable, the rules are applied on the interest liquidation amount, and any differential amount arising from this is adjusted)

If the rounding rules are not available from the contract details, the rounding rules specified in the Currency Definition are used.

5.2.18.4 Choosing the Applicable Rate from Historical Rates

For contracts involving a fixed rate primary interest component, your bank may require choosing the applicable rate from historical floating rates for a floating rate code that has been maintained for a treasury source. For such requirements, select the TREASURY option in the Fixed Rate Type field in the main Contract Online screen.

To select the applicable floating rate from those available for the

rate code maintained for the designated default treasury, click ‘Floating Rate’ button alongside

the User Rate field. The Treasury Floating Rates Maintenance screen is

opened, with the historic floating rates for the rate code displayed.

You can choose the required rate for the desired effective date, in this

screen. The rate you select is displayed in the Rate field in the main

Contract Online screen. You can also specify an appropriate spread.

For all future interest computations, fixed rate contracts for which such historic floating rates have been specified are processed as fixed rate contracts for which the applicable rates are derived from the user rate and the specified spread.

System updates and tracks the adjustment rate for each interest component associated with the loan contract for which floor and ceiling propagation is done.

If loan contract all-in rate (Base Rate + Spread) of the interest component is less than the floor value of all-in rate, then

- Adjustment Rate = Floor value – Computed all-in rate

- Revised All-In Rate = Floor Value

- In this case, the “Adjustment Rate” will be positive

If loan contract all-in rate (Base Rate + Spread) of the interest component is greater than the Ceiling value of all-in rate, then

- Adjustment Rate = Ceiling value – Computed All-In rate

- Revised All-In Rate = Ceiling Value

- In this case, the “Adjustment Rate” will be negative

History of propagation details are not available for the loan contract, and system always display the latest adjustment rate which is updated as part of the latest floor and ceiling propagation.

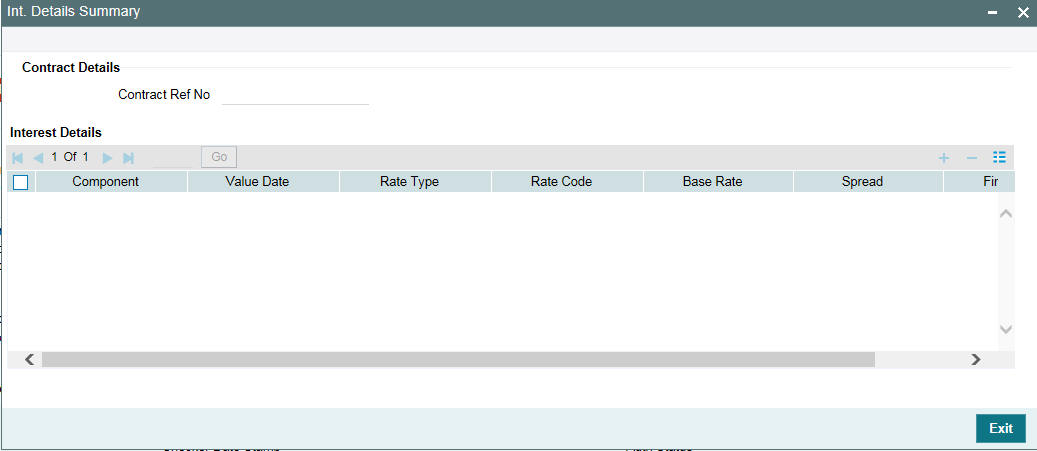

5.2.18.5 Viewing Interest Details

The ‘Rate’ displayed in the ‘ICCF Details’ screen is the current rate as of today.

For history of rates, click ‘Interest Details’ tab in the ‘Loan and Commitment -Contract Input’ screen. The ‘Interest Details Summary’ screen displays history of rates.

5.2.19 Allowing Rollover

While setting up a product, if you have specified that loans involving the product should be automatically rolled-over, then all loans involving the product are rolled-over on their respective Maturity Dates. This feature is called auto rollover. If auto rollover is specified for the product the loan involved is indicated on this screen.

However, if you do not want the loan, whose disbursement details are being captured to be rolled-over, you can disallow rollover for the particular loan. If rollover has been disallowed for a product, you cannot rollover loans involving the product.

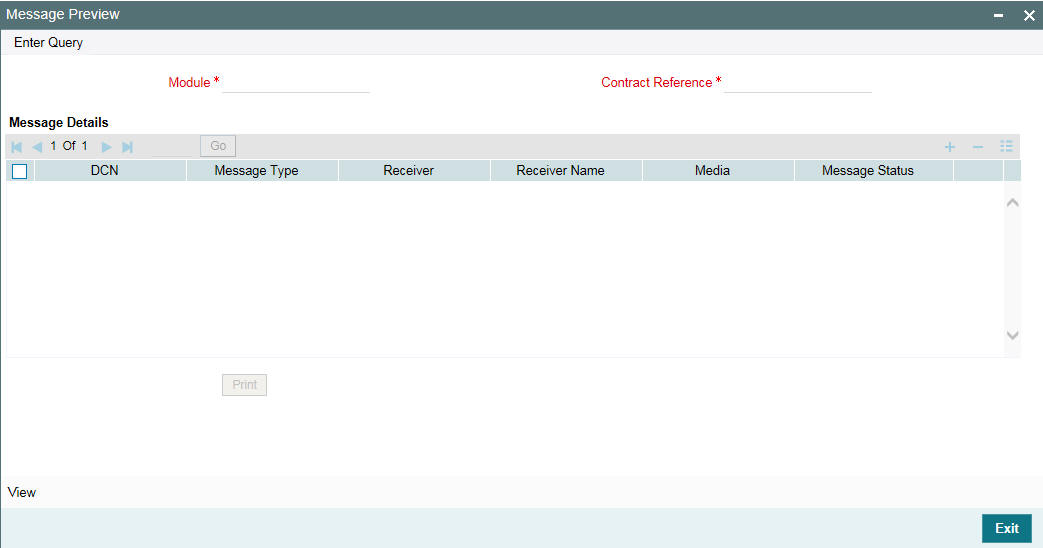

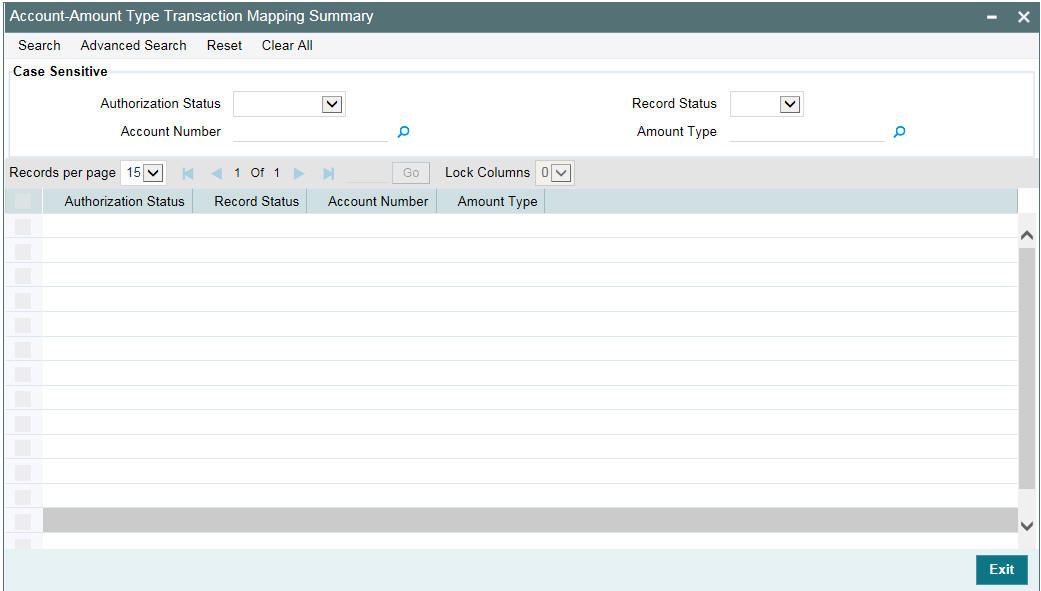

5.2.20 Viewing Messages using Message Preview

The 'Message Preview' screen allows you to preview the messages/advices generated for unauthorized contracts. By saving the contract, you can preview the messages/advices generated.

From ‘Loan and Commitment - Contract Input’ screen, click ‘'Message Preview' tab to view the ‘Message Preview’ screen.

In addition, you can take print of the messages/advices generated from the 'Message Preview' screen.

Instead of going to 'Message Preview' screen (OLDMSPRV), you can preview the messages/advices generated in the 'Message Preview' tab.

- Contract Reference - The current contract reference number appears.

- DCN - The generated DCN number of the particular message/advice appears.

- Message Type - The type of message generated for that event appears.

- Receiver - The customer ID (Receiver) of the particular message/advice appears.

- Name - The name of the receiver of the particular message/advice appears.

- Media- The media through which the particular message/advice is transmitted. For example, SWIFT or mail.

- Message Status - The status of the particular message/advice appears.

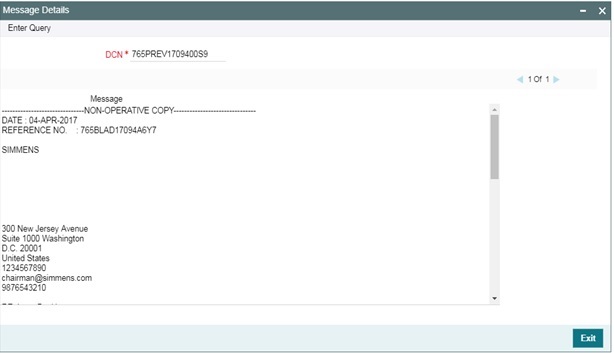

Click 'View' to open 'Message Details' screen. The DCN and the message format is displayed in this screen.

You can also click 'Print' to print the generated messages/advices.

5.2.21 Specifying Preferences Tab

Specifying Industry Code

Specify the industry code here. The adjoining option list displays all industry codes maintained in the system. You can choose the appropriate one.

Specifying the Administrator Details

Select the administrator code from the adjoining option list. This list displays admin details maintained in the Admin Maintenance screen.

Pool Funding

Pool Funding Reference No.

Specify the pool funding Reference number from the adjoining option list. The option list displays all open and authorized pool funding reference numbers where branch code and currency match the commitment contract.

It is mandatory to specify this value, if you have checked the ‘Master Funding Required’ check box at the product level.

Master Funding Reference No

Specify the master funding reference number from the adjoining option list. The option list displays all open and authorized master funding reference numbers where branch code and currency match the commitment contract.

It is mandatory to specify this value, if you have checked the ‘Pool Funding Required’ check box at product level.

Pool and Master Funding linkages are applicable only to commitment contracts in the LD module. These fields will be disabled for contracts using other product types.

You can specify the funding reference Number for a commitment contract either during contract input or contract amendment operation.

After the funding reference number is selected in the Loan Contract Input screen, system validates the available balance in the pool is sufficient for the commitment contract amount.

If pool balance is insufficient, system displays the error message ‘Commitment amount exceeds available balance of Pool/Master Fund’. You cannot proceed with booking the commitment contract under the given Pool/Master fund reference.

These validations will be performed for the following scenarios:

- Funding reference number is selected during new contract input /contract amendment

- Funding reference number is changed during contract amendment

- Commitment amount is increased using Value Dated Amendment (VAMI) operation

You can link commitment contracts using different product codes to the same funding reference.

You can also link revolving/non revolving commitments to a Pool/Master funding regardless of whether the Pool/Master funding is revolving/non-revolving.

You can also add or modify a funding reference number for a contract using contract amendment operation. While adding a funding reference number to a commitment contract, system validates if any active loans under the commitment should be in the same currency as the commitment. If the loan currency differs from commitment currency, system displays an error message stating that such commitments cannot be linked to a funding reference number.

When you amend the contract, and select a new funding reference number, system validates that the available balance in the new pool is sufficient for the commitment amount. If yes, then you can proceed with the contract amendment operation. If the available balance in the pool is insufficient, then you cannot proceed with the amendment.

For commitment contracts reversed or deleted before authorization, the available amount under pool reference number will be reinstated to the extent of the commitment contract amount for both revolving and non-revolving types of pools.

5.2.21.1 Processing Pool Funding

System calculates the available balance of a pool/master fund during new contract input/contract amendment

When a funding reference number is attached to a commitment contract, system validates the contract amount against the available (un-utilized) amount of that pool/master funding reference.

For such commitments, system validates the currency of any loans booked under them should be the same as the commitment contract currency. The commitment contract currency is always the same as that of the funding reference.

If both Pool and Master funding codes are linked to a commitment contract, then contract booking amount is validated against the minimum available amount of the Pool and Master Funding Reference.

When a commitment contract is linked to a Funding Reference Number, system derives the available Funding Amount (for both Pool and Master Funding) as follows:

Available Funding Amount for Revolving Funding

Fund Utilization = Sum of contract amount (latest version) of all revolving commitments booked

+ Sum of principal Available balance of all non revolving commitments booked

+Sum of principal outstanding balance of Loans linked under the non revolving commitments

Available Fund Amount = Fund Amount – Fund Utilization

Available Funding Amount for Non-Revolving Funding

Fund Utilization = Sum of contract amount (latest version) of all revolving commitments booked

+ Sum of contract amount (latest version) of all non revolving

+ Sum of Principal Decreases of all revolving commitments booked

+ Sum of Principal Decreases of all non-revolving commitments booked

Available Fund Amount = Fund Amount – Fund Utilization

Note

- The available amount or utilization of Pool and Master Funding are not stored in system, but derived at run time during commitment input and during any principal increases of commitment through VAMI operation.

- If the commitment contract amount is increased using value dated amendment (VAMI), the new contract amount is validated against the available amount in the pool or the master funding attached to the commitment.

- System does not check available Funding Amount if commitment amount is reduced using VAMI.

5.2.22 Identifying an Agency Contract

Oracle FLEXCUBE allows Straight Through Processing from LB module to OL module to track bank or any of bank entities (playing the role of a self participant) share in a syndicated loan. For the tranche/drawdown booked for the self participant on the agency side, Oracle FLEXCUBE automatically creates the corresponding commitment/loan on the originations side (in the OL module).

The system checks the ‘Agency Contract’ box to indicate that the loan is created as a result of STP. However, you can deselect this check box, if required. To do this, you have to first unlock the record. If deselected, the contract becomes a normal loan contract. Further, the system stops tracking the bank details or its entities share in the syndication. If you select this option at the commitment contract level then the system does not allow you to deselect the option at OL contract level. But if you deselect the option at the OL contract level then the system allows you to check this option at the commitment contract level.

Note

This field is enabled only for products where the agency contract flag is set to ‘NO’.

- You cannot edit this field after first authorization (as part of CAMD, the field cannot be edited).

- Based on the contract level flag, the system changes the main interest component rate type to ‘Fixed’ and fixed rate type as ‘Agency’.

- The system does the Interest re-pickup, if the agency contract flag is set back to ‘NO’.

- For agency types of loans, you should handle the changes in the agency rates through the ‘Agency Rate Revision’ screen. You are not allowed to change Agency rate as part of VAMI. In addition, you are not allowed to maintain the Agency rates for future dates

- You can select a Loan contract for Agency Contract Type only if the reporting commitment also is of Agency Contract type.

- If you modify the following UDF values for the contract wherein ‘Agency

Contract’ box is checked, the system will send an amendment feed

to Intellect system provided the box ‘Intellect Feed for UDF Change’

is checked in the ‘Loan Parameters’ screen:

- CUSTOMER RATE

- DEALER LIBOR RATE

- LATE TRADE

- RA COST

This feed contains the updated UDF values.

The Base rate and the spread can be in negative. All in rate will become zero if all in rate is negative.

5.2.23 Rollover Count

You will see the rollover count in this screen. For a loan that has been rolled-over, this count indicates the number of times it has been rolled-over.

Note

For rollover to be applicable for the loan, it has to be defined for the product.

5.2.24 Confirming the Status of Loan Products

System defaults the maintenance done for the ‘Confirm’ check box from the product level. If this box is checked at the product level, then system defaults the same to the contract booked under that product and you cannot amend at the contract level. If this box is deselected at the product level, then you can amend this box only during the life cycle of the contract.

System re-defaults the maintenance done for 'Confirm' check box from the product level during actual initiation of value dated amendment and processing of normal rollovers. During payment, system does not re-default the maintenance for 'Confirm' check box from the product. This check box will continue to have the same value as maintained at the contract level.

System does not generate the intellect message if only the 'Confirm' box is amended. There is no impact on Initiation, Liquidation, Rollover, Re-price and generation of payment messages due to the 'Confirm' check box.

5.2.25 Tax Scheme

The tax scheme, which has been specified for the product is displayed in this screen. The tax scheme cannot be changed at the time of loan processing. You can however, waive the tax applicable on the contract.

5.2.26 Entering Internal Remarks

You can enter information describing the loan that you are processing. This is available when you retrieve information on the loan. However, this information is not available on any advice printed for the customer’s benefit. This information is displayed whenever you retrieve information on the loan, either as a display or in print.

5.2.27 Enabling the Reprogramming Counter

Whenever any event (loan disbursement, value dated amendment, schedule changes, and so on.) in the life-cycle of a loan contract results in a negative cash flow for a bank, you have to enable the reprogramming counter by selecting the check box positioned next to the Reprogram Counter field.

5.2.28 Enabling Auto Extension

Select this check box to define the interim interest schedules for the contract. It ensures that schedules are created in advance to facilitate billing notice generation. Accordingly the system creates the schedules when the schedule date is crossed. It is essential for the schedules to be generated for billing details in future.

Note

- This field is enabled only if you select the call type of loans (demand loans). If the auto extension flag is enabled, the number of schedules is defined based on the internal parameter AUTO_EXTENSION_SCHEDULES from CSTBS_PARAM.

- The frequency is determined based on the product level definition. At the product level, if there is a frequency as bullet for main interest component, then there is no interim interest schedules for the main interest component using AUTO_EXTENSION/AUTO_EXTENSION_SCHEDULES.

- Auto extension flag is checked or unchecked only at the time of booking demand loans. It cannot be amended as part of CAMD.

- While defining schedules the number of schedules is specified. However, these contracts are not considered for Auto Extension.

The system creates the schedules based on the internal parameter for number of schedules of demand loan, provided the ‘Auto Extension’ flag is checked. For instance, if the internal parameter for number of schedules for demand loan is set as 2 with the monthly interim schedule, then it will always have two monthly future interim schedules for the interest component. When a particular schedule date is reached for such demand loan, the system creates additional future schedule.

5.2.29 Enabling Residual Amount Liquidation

Residual Required check box

Select this check box for loan payment transaction for residual. If this check box is selected at ‘Contract and Commitment - Contract Input’ screen (OLDTRONL), then the system defaults it to ‘Manual Payment’ screen (OLDPMNT). However, this check box can be superseded at ‘Manual Payment’ screen.

Note

- While creating a contract if residual threshold for a currency is not maintained, then an error message appears.

- This option is available in ‘Payment Simulation’ screen.

Residual Amount

In OLDTRONL, the residual amount will be shown in 'Accounting Entries' of Event tab once the residual accounting entries are passed.

Residual Amount Liquidation is supported for the following:

- Principal, Interest and penalty components

- Current, Back Dated and Future Dated payment

- Manual or Auto loan liquidation

Positive and negative residual amount is supported for

- Bearing, Discounted and True Discounted loans

- Normal, Amortized and Capitalized Schedule type

Computation of Residual amount

Residual amount is computed as amount due less amount paid. If the resultant amount comes as a positive value and lower than the positive threshold maintained at product level, then the residual amount is considered as 'Positive Residual' amount.

Example

When payment is done as below:

- Schedule due amount: 10000

- Residual threshold: 50

- Payment made with residual as Y: 9980

- Here payment made amount is less than the schedule due amount, so entry is passed for 20. So residual entry is passed for 20, along with the payment amount.

If the resultant amount come as a negative value and lower than the negative threshold maintained at product level, then the residual amount is considered as 'Negative Residual' amount.

Example

When payment is done as below

- Schedule due amount: 10000

- Negative Residual threshold: 50

- Payment made with residual as Y: 10030

Here payment made amount is greater than the schedule due amount, so entry is passed for 30. So residual entry is passed for 30, along with the payment amount.

5.2.30 Indexed Loans

To guard against the fluctuations in the value of money in the economy due to inflation, you can maintain loans in a separate imaginary currency called the index currency. (The index currency is maintained in the Currency Maintenance screen of the Core Services module.)

Note

Since the index currency is linked to the local currency of your branch, you can only mark loans quoted in the local currency as indexed loans.

The fluctuations in the inflation rate is effected by the fluctuation in the exchange rate between the Index currency and the LCY.

Example

You have advanced Mr. Brian Williams a loan of USD 10,000 under the scheme ‘Short Term Loans for Individuals’ at 12% interest for a period of five months.

As a consequence of inflation the price index has gone up from 50 to 55 as of the date of loan repayment.

Now what Mr. Williams has to pay you is computed as follows:

P = 10,000 x 55/50 = USD 11,000

The interest will be calculated on the new principal amount.

To index a loan you have to choose the index currency as the loan currency while maintaining the contract details of the loan. However, you have to specify the LCY equivalent of the contract amount. The system computes the amount in index currency based on the exchange rates maintained in the Currency Rates Maintenance screen.

The Impact

As a consequence of maintaining indexed loans the following functions is affected:

- Interest accruals are reflected in the index currency

- Payment advices for customers are generated in the index currency. Even if the advice has the local currency equivalent, the conversion will be based on the rate as of the generation date rather than the payment date.

- Repayment schedules are maintained in the index currency

- In the central bank report, this loan is identified as a local currency loan

- If the loan is pre-paid during the course of the month the exchange rate for the particular deal has to be calculated manually and entered into the system.

- When payments are overdue, the dues continue to remain in the index currency. Upon liquidation the prevalent exchange rate between the index currency and the local currency is applied.

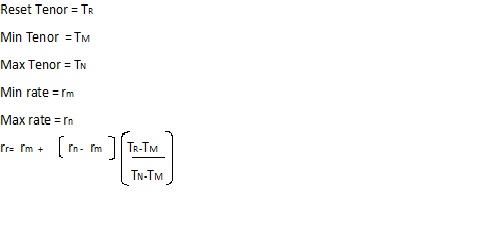

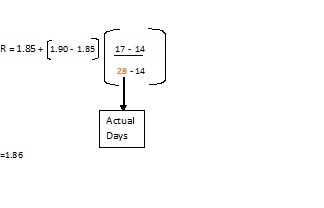

5.2.31 Interpolation

Interpolation is used to determine interest rates for a period of time that are not available.

In this case, the interest rate is the dependent variable, and the length of time is the independent variable. To interpolate an interest rate, you need the interest rate of a shorter period of time and a longer period of time.

In Corporate Lending, changes are made to standard interpolation formula so that the system picks the actual days for a month instead of directly picking the tenor available in the ‘Floating Maintenance’ screen.

For example:

Floating rates are maintained in the following format.

Currency - USD

Tenor |

Rate |

0 |

2.1 |

7 |

1.78 |

14 |

1.85 |

30 |

1.90 |

60 |

2.1 |

90 |

2.03 |

180 |

1.85 |

360 |

1.7 |

999 |

1.89 |

Schedule Date is 4-2-2015 and reset tenor is 17.

5.3 Preferences for a Loan

Preferences are options. For instance, for a product, you have the following options:

- Making liquidation automatic or manual or component based

- Allowing or disallowing rollover

- Applying tax or waiving it

- Applying prepayment penalty or waiving it

- These are your product preferences. For a contract, you have the option (preference) of specifying the following in the ‘Contracts’ tab of the Contract Online screen.

- Liquidating back valued schedules

- Applying Back Valued Schedules

- Suppressing Back Value Payment Messages

- Residual Liquidation Entries

You cannot however, change the schedule payment type (amortized, capitalized or normal) for specific contracts. By default, the payment type, which you have defined for the product, applies to all loans involving the product.

This section contains the following topics:

- Section 5.3.1, "Setting Loan Schedule Preferences"

- Section 5.3.2, "Re-computing Late Payment Charges Online"

- Section 5.3.3, "Processing the Late Payment Charges"

- Section 5.3.4, "Maintaining System Derived Schedules"

- Section 5.3.5, "Maintaining User Input Schedule Amounts"

- Section 5.3.6, "Maintaining Schedule Adjustments on Interest Rate Revision"

- Section 5.3.7, "Maintaining previous interest rate"

- Section 5.3.8, "Maintaining Schedule Adjustments on Prepayment"

- Section 5.3.9, "Re-Amortization"

5.3.1 Setting Loan Schedule Preferences

Schedule preferences are the attributes of the repayment schedules, defined for the loan in the Schedules tab of ‘Loans and Commitment-Contract Input’ screen

When you are entering a loan for the first time, you can define certain attributes for it. They include:

- The amortization type, if the loan has been specified with amortized schedules

- Whether holidays are to be ignored at the time of drawing up repayment schedules

- The behaviour of schedules when they fall due on the holiday

Types of repayment schedules

When creating a product, you specify the type of repayment schedule - amortized, capitalized or normal (periodic). All loans involving the product acquires the repayment schedule type, defined for the product. When processing a loan you cannot change the repayment schedule type that the loan has acquired.

For example, if you have specified an amortized, repayment schedule for a product, it applies to all loans involving the product. This cannot be changed.

By specifying that payment schedules have to be amortized over the period of repayment, you indicate that all the repayments should be in Equated Instalments. These repayment schedules are drawn up taking the Principal and the Main Interest. While defining the attributes of interest applicable on a product, you can designate one interest component as the main interest.

If you specify amortized schedules, the system automatically do the amortization according to the frequency that you have defined.

Note

If a loan is to be amortized, it should have a fixed type of interest and a Bearing interest payment method.

You can also specify Capitalization and define schedules for the various components of the loan. If the repayments of principal or interest are not made on a particular schedule date, they are capitalized for the next schedule. If a partial payment has been made, the unpaid amount is capitalized (the unpaid interest is added to the unpaid principal and this becomes the principal for the next schedule).

If you have specified Normal type of schedules, you can define your own schedules for loans involving the product.

Specifying the amortization type

You need to specify the amortization applicable to the loan only if the schedule type is amortization.

The following options are available:

- Reducing Balance: The reducing balance method is used for calculating interest on the reduced principal/outstanding balance for each repayment schedule. The principal repayment would be the difference between the equated monthly installment and the interest, for each schedule. The following example illustrates principal and interest calculation using this method.

Example

Assume that you have disbursed a loan with the following details:

- Principal – 10,000 USD

- Interest Rate – 10%

- Interest Calculation Method – Actual/360

- Loan Start Date - 12/1/2000

- Loan End Date - 11/30/2001

- Days in the year – 364

Based on the reducing balance method, the interest, principal and the EMI are as follows:

Sl. No |

Interest |

Principal |

EMI |

Outstanding Bal |

1 |

86.11 |

$793.05 |

$879.16 |

$9,206.95 |

2 |

79.28 |

$799.88 |

$879.16 |

$8,407.07 |

3 |

65.39 |

$813.77 |

$879.16 |

$7,593.30 |

4 |

65.39 |

$813.77 |

$879.16 |

$6,779.53 |

5 |

56.50 |

$822.66 |

$879.16 |

$5,956.88 |

6 |

51.30 |

$827.86 |

$879.16 |

$5,129.02 |

7 |

42.74 |

$836.42 |

$879.16 |

$4,292.60 |

8 |

36.96 |

$842.20 |

$879.16 |

$3,450.40 |

9 |

29.71 |

$849.45 |

$879.16 |

$2,600.95 |

10 |

21.67 |

$857.49 |

$879.16 |

$1,743.46 |

11 |

15.01 |

$864.15 |

$879.16 |

$879.31 |

12 |

6.11 |

$873.05 |

$879.16 |

$6.26 |

The interest for the first schedule is computed on the loan principal (10,000) for the first month (31 days) using the following formula:

(10000 * 10 * 31) / (100*360)

Interest for the subsequent schedules are computed on the outstanding principal for each schedule.

- Rule of 78: A method of amortization, the Rule of 78 is also a way of determining how much of each monthly payment is paid towards interest and how much is paid towards the principal component. First, you need compute the total interest on the original principal amount. Then, you need divide this interest amount equally into n parts, where n is the number of schedules and divide the loan principal amount also into n equal parts, so that each equal installment is basically a sum of the two. Subsequently, you need apply the rule of 78 to calculate how much of the EMI goes towards interest and principal. The following example illustrates this:

Example

Consider the loan details mentioned in the above example:

Total interest on the loan = (10000 * 10 * 364)/(100*360) = 1011.11

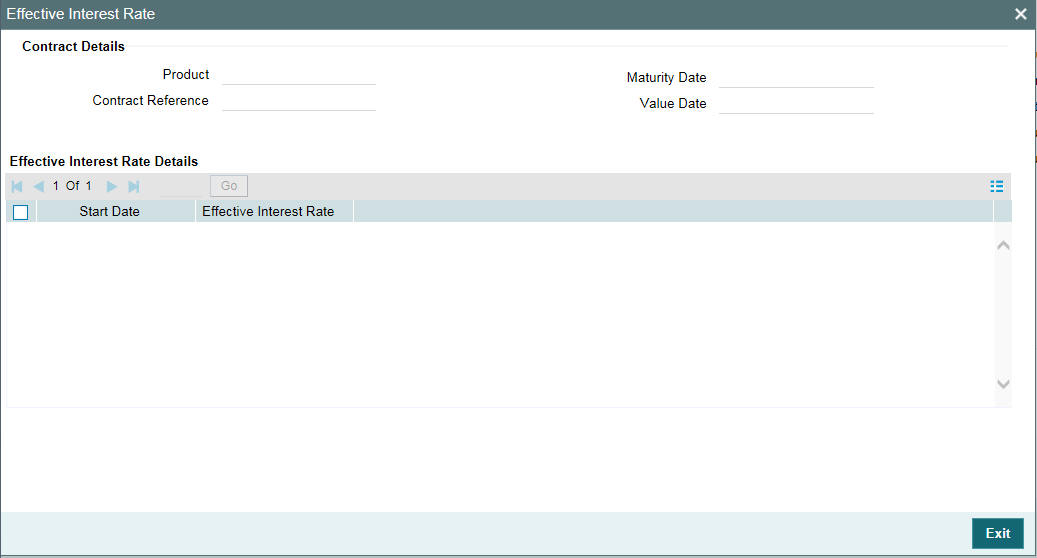

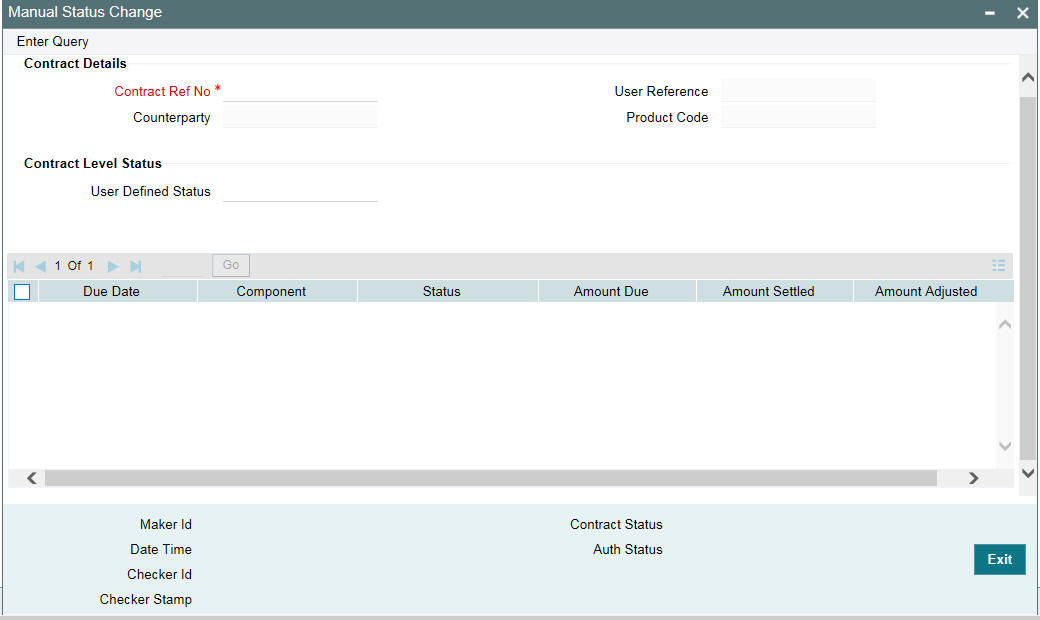

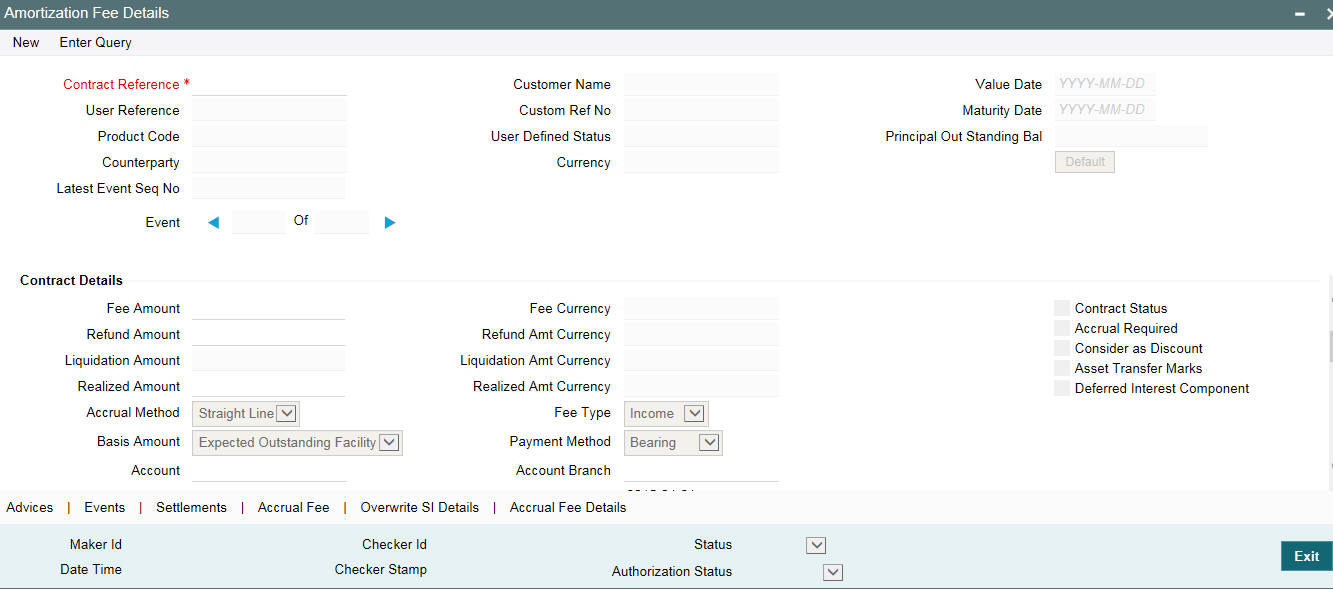

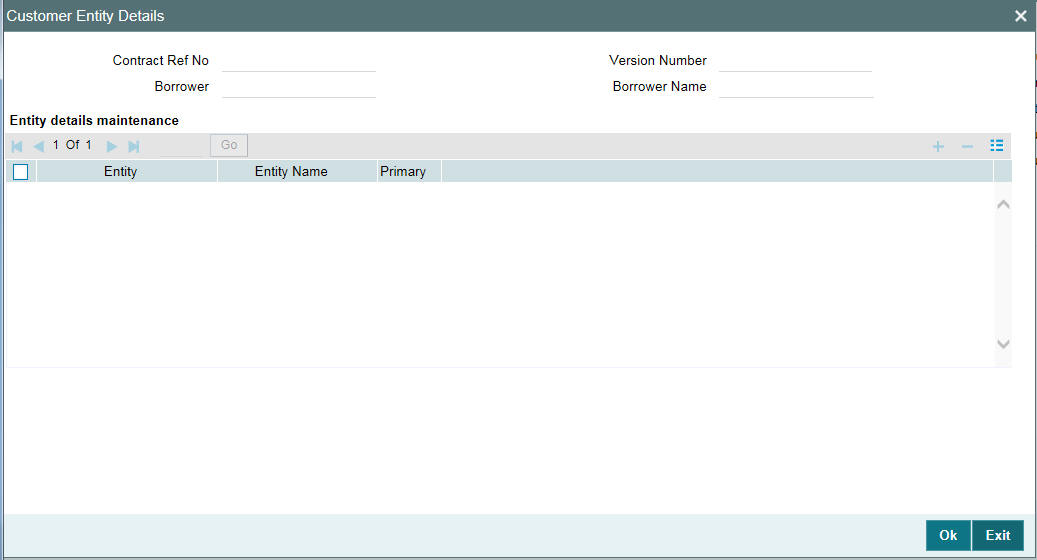

Interest for each schedule = 1011.11/12 = 84.26