5. Loan Syndication Contracts - Part 1

This chapter contains the following sections:

- Section 5.1, "Introduction"

- Section 5.2, "A Borrower Facility Contract under Syndication Agreement"

- Section 5.3, "Products for Loan Syndication Contracts"

- Section 5.4, "Processing a Borrower Facility "

- Section 5.5, "Capturing Facility Details"

- Section 5.6, "Viewing Facility Details"

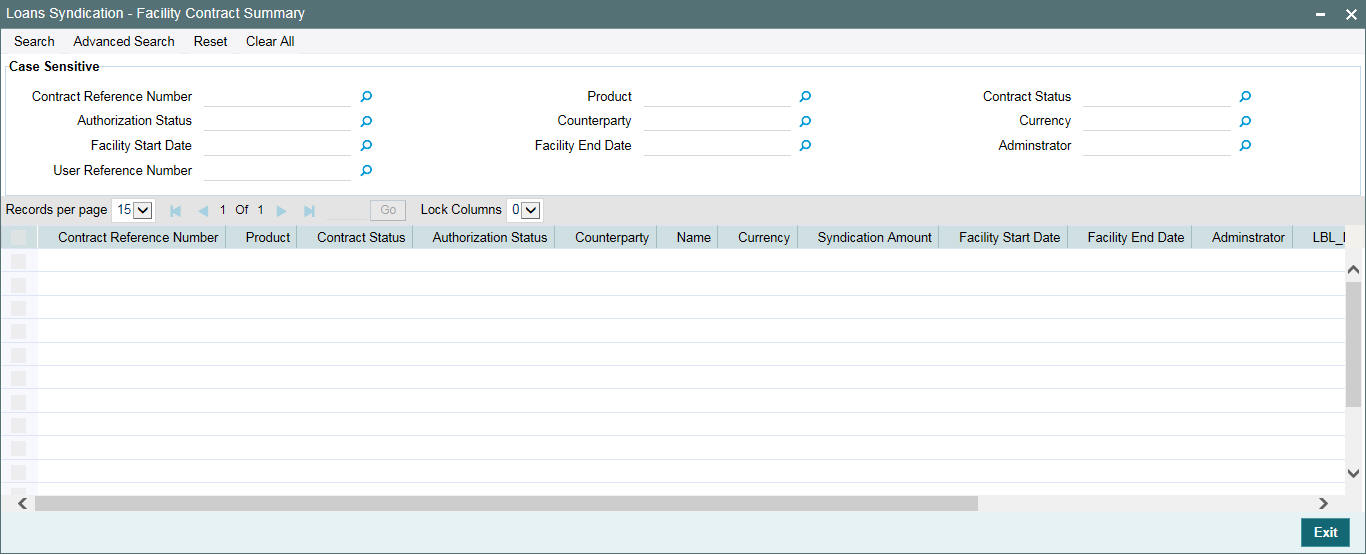

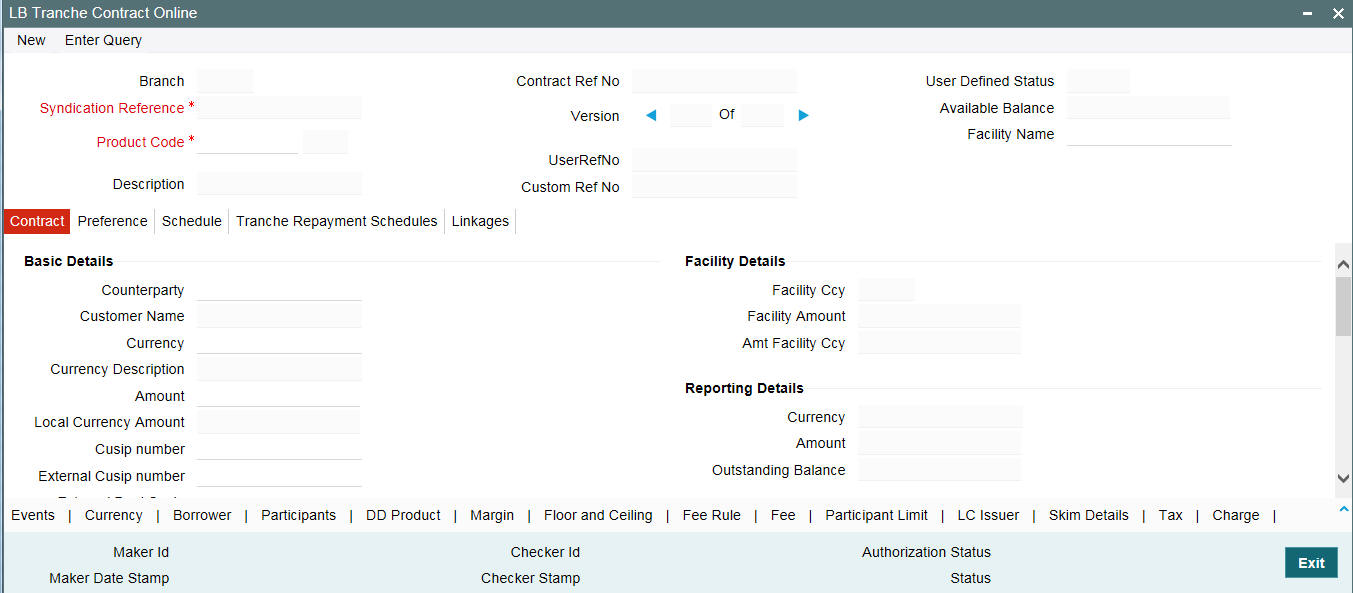

- Section 5.7, "Processing Loan Syndication Contracts"

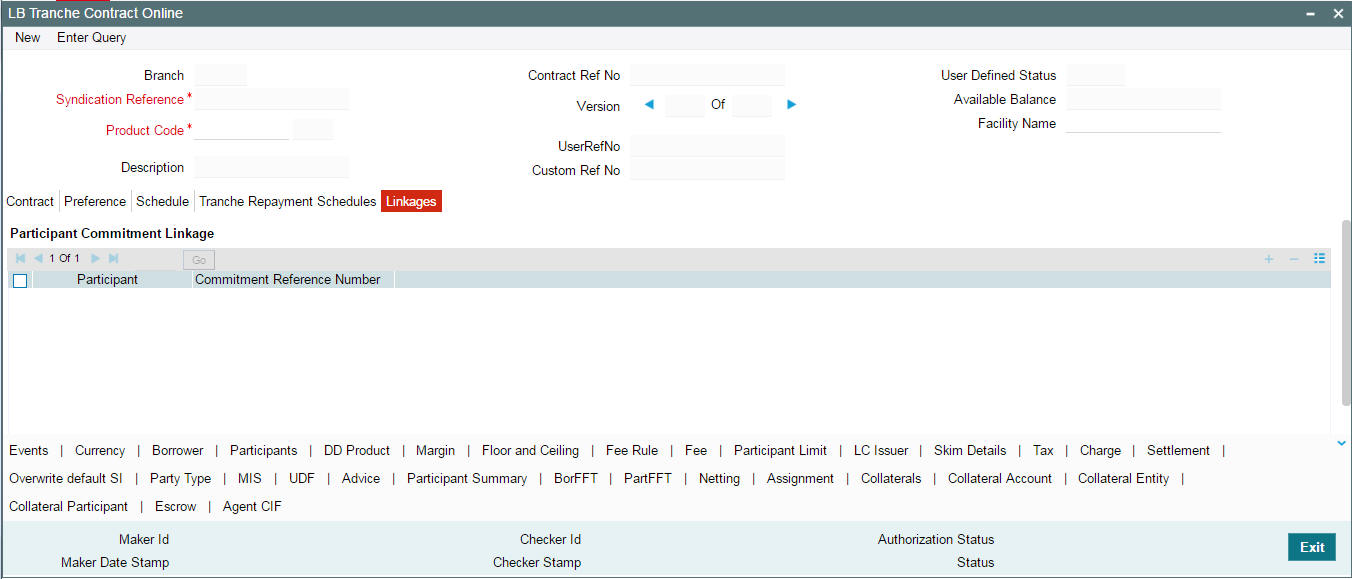

- Section 5.8, "Processing a Borrower Tranche Contract"

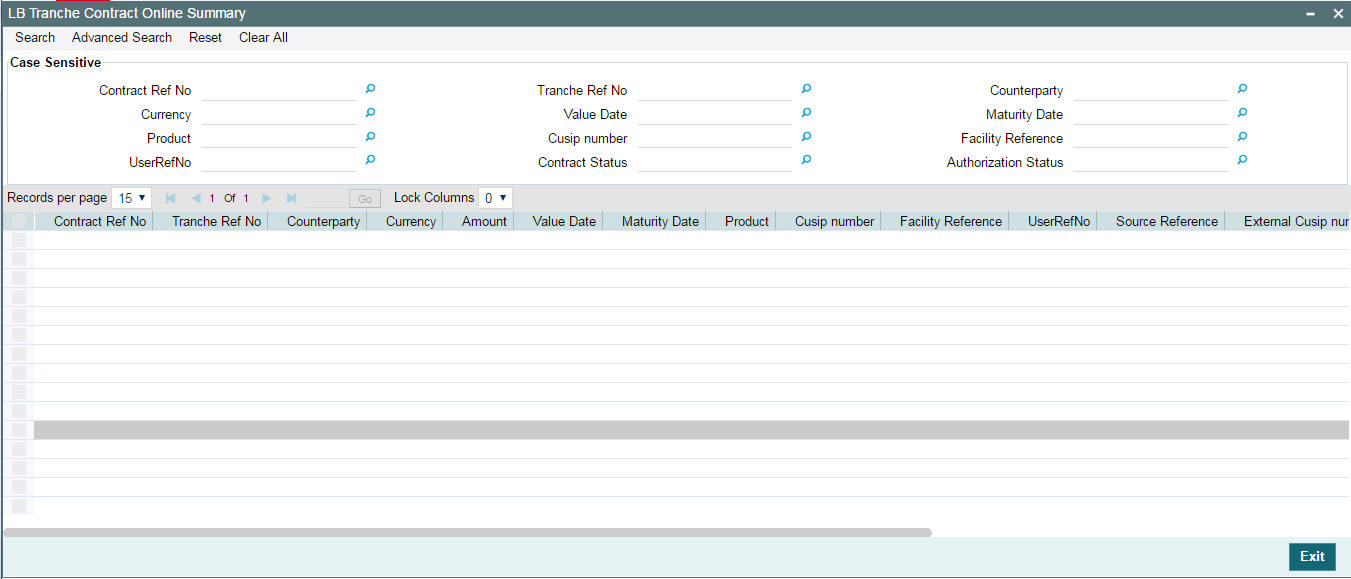

- Section 5.9, "Viewing Borrower Tranche Summary"

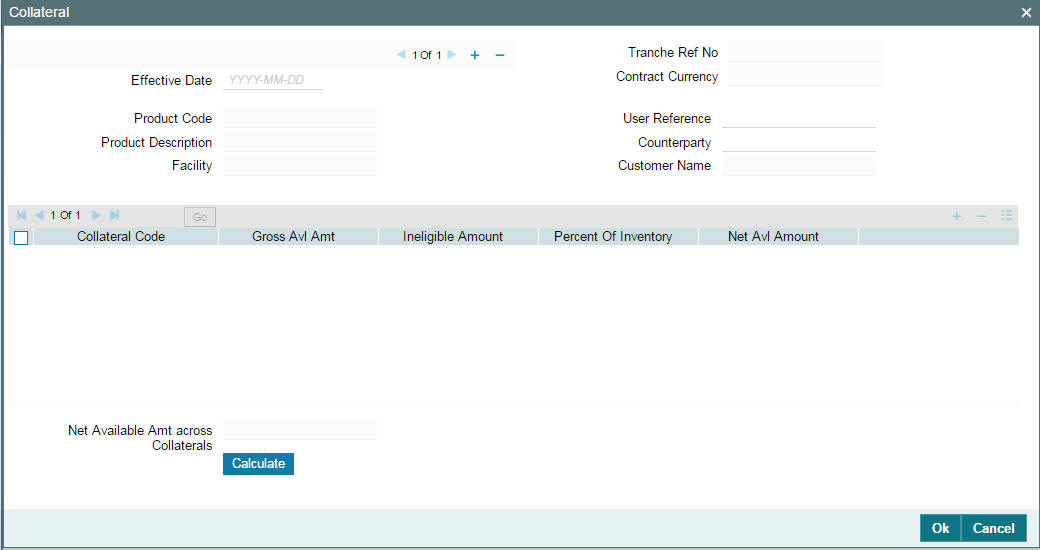

- Section 5.10, "Maintaining Tranche Collateral Details"

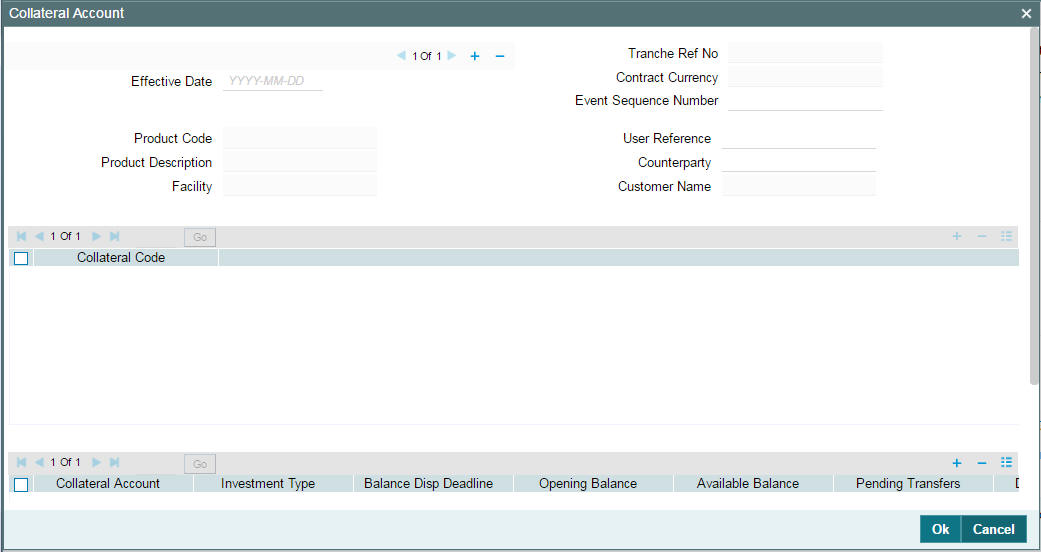

- Section 5.11, "Maintaining Tranche Collateral Account Details"

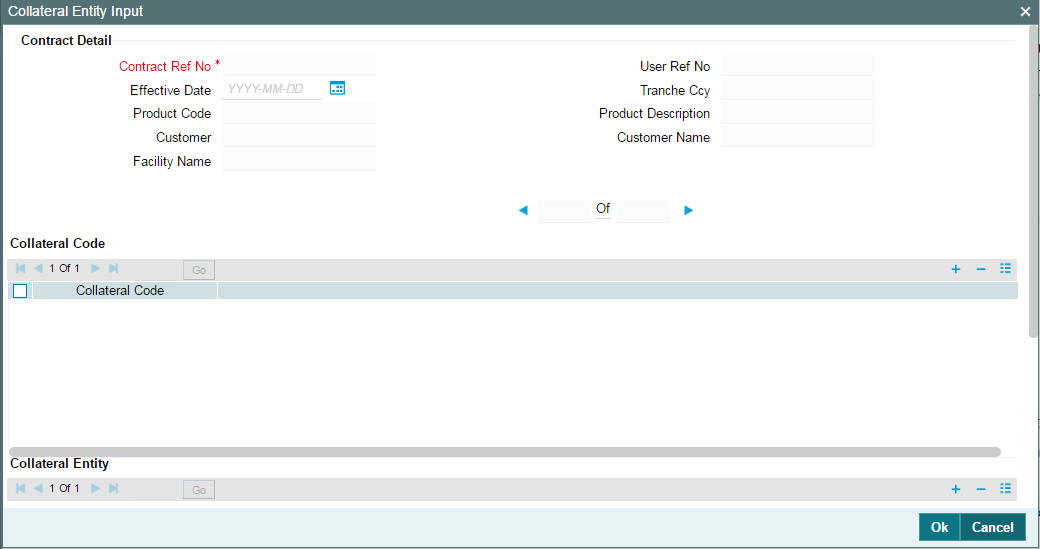

- Section 5.12, "Maintaining Tranche Collateral Entity Details"

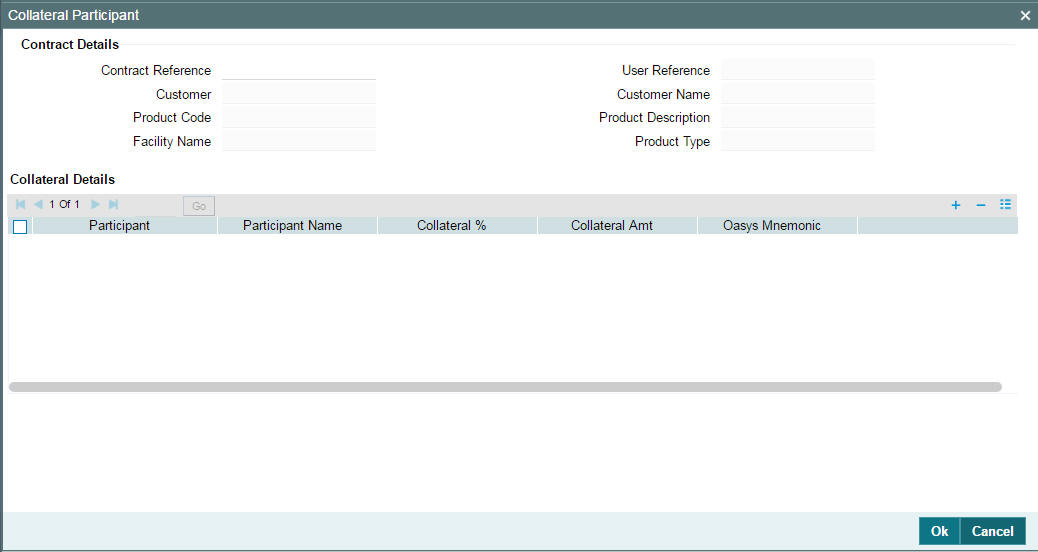

- Section 5.13, "Maintaining Collateral Percentage Details"

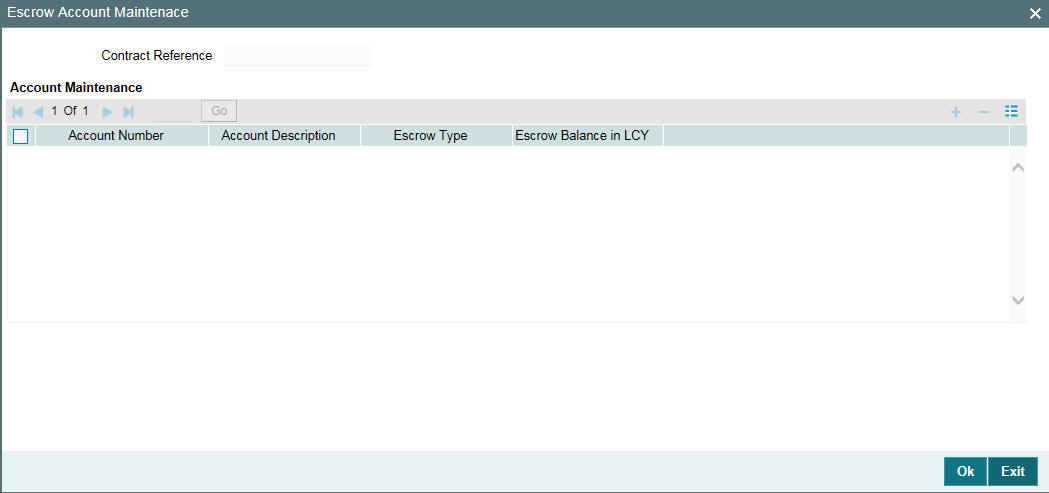

- Section 5.14, "Maintaining Escrow Account Details"

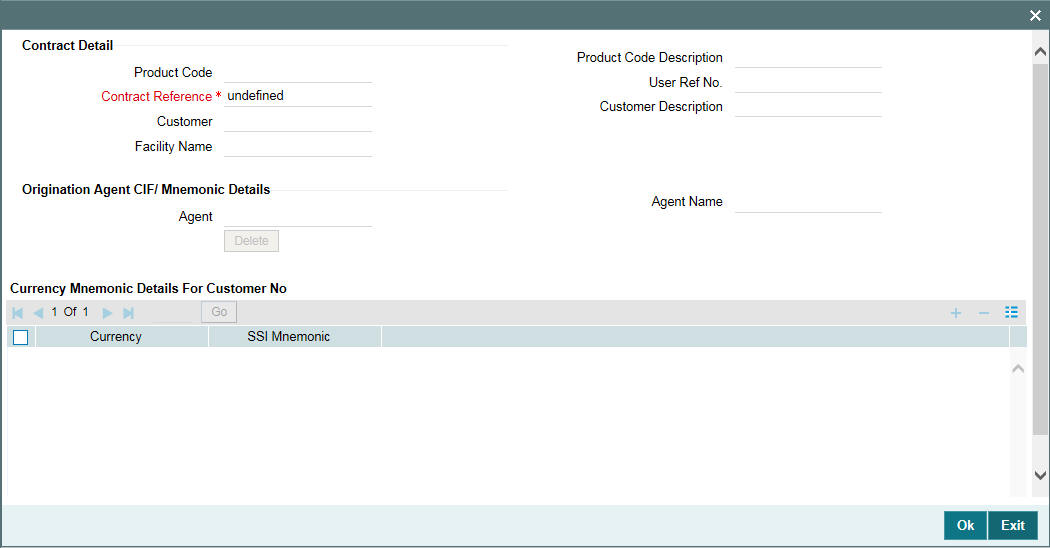

- Section 5.15, "Maintaining Agent CIF and Mnemonic Details"

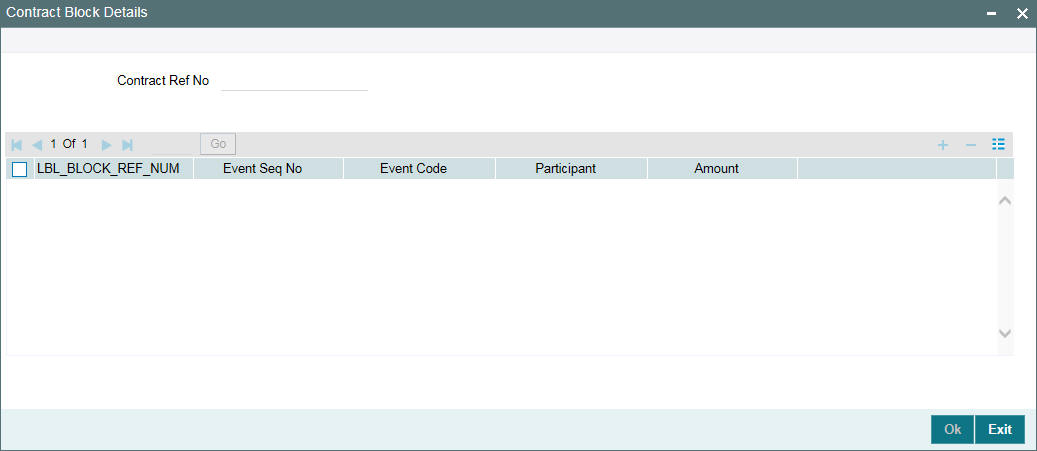

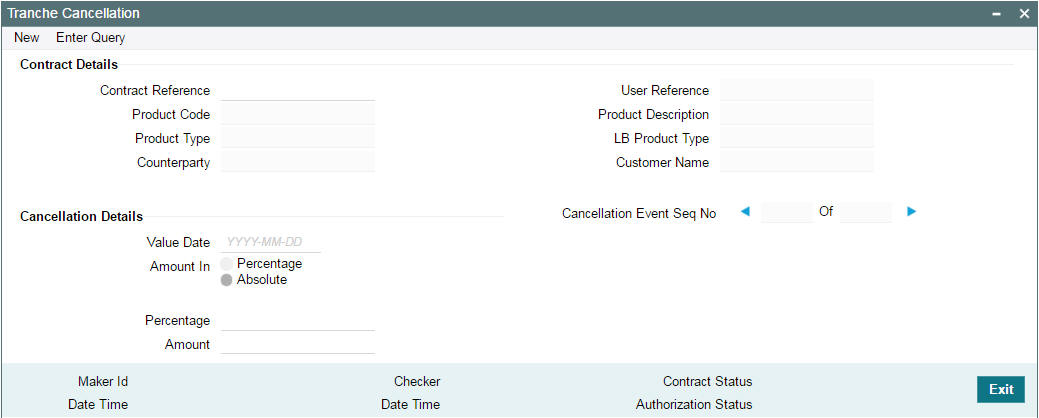

- Section 5.17, "Cancelling Tranche"

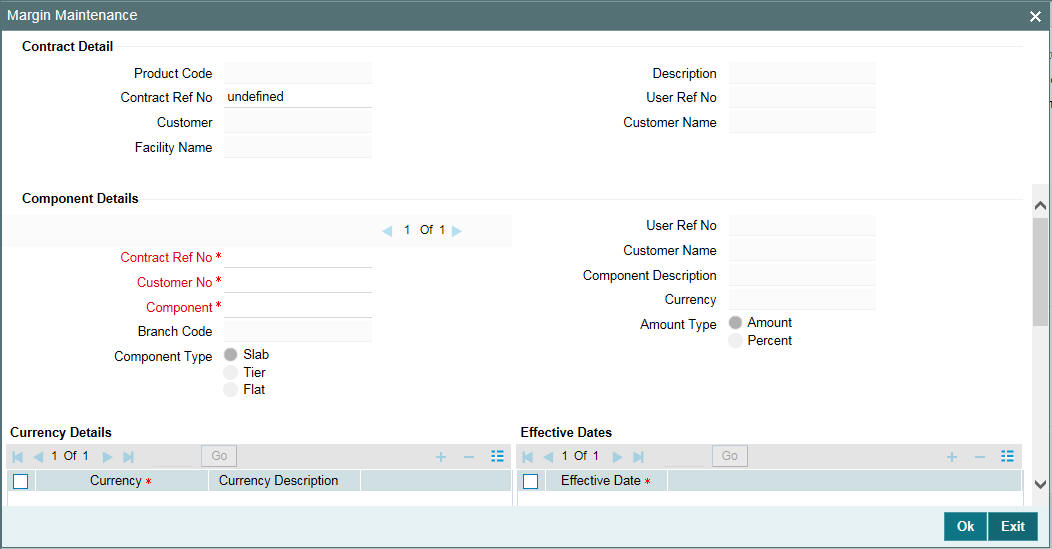

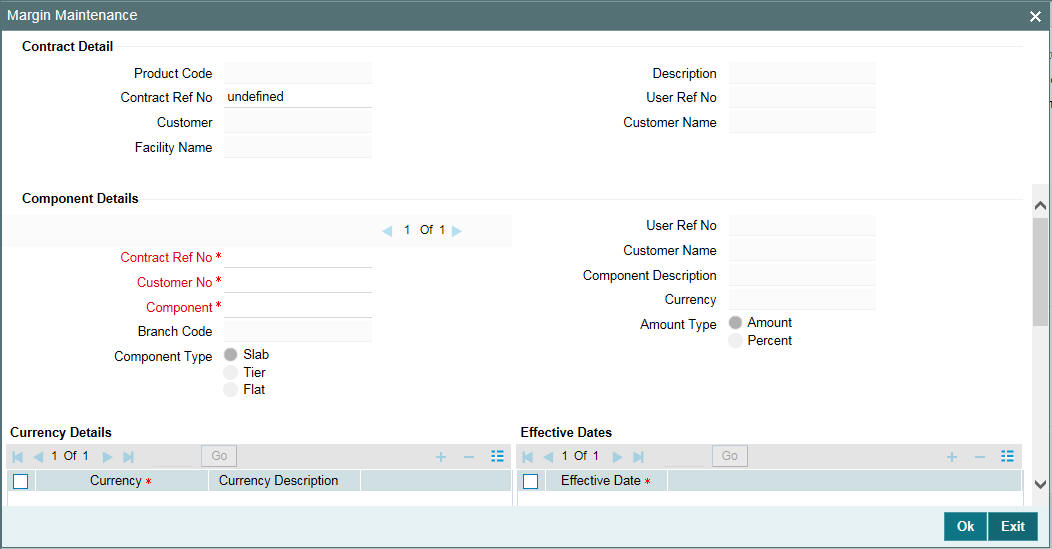

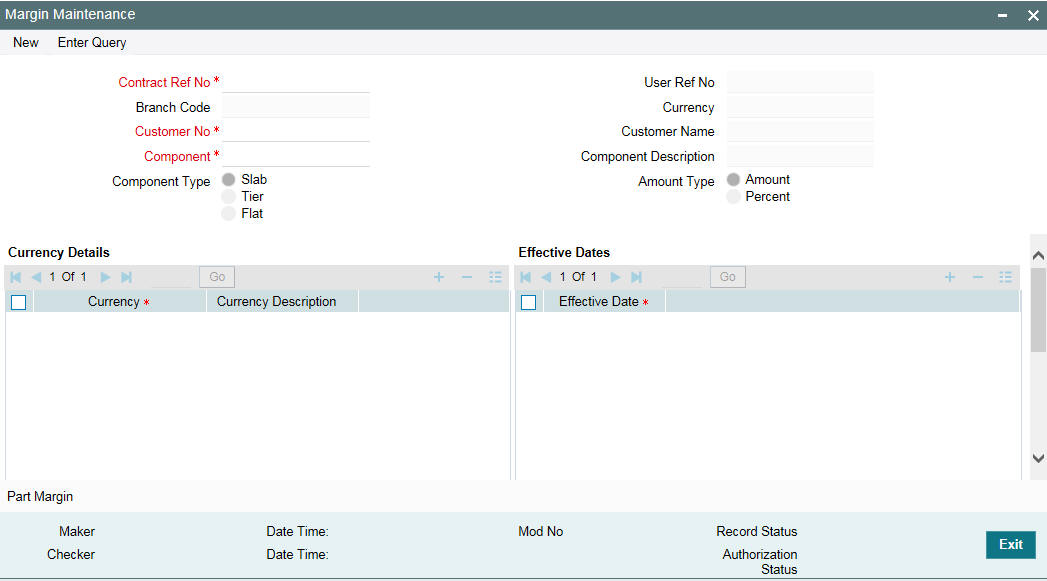

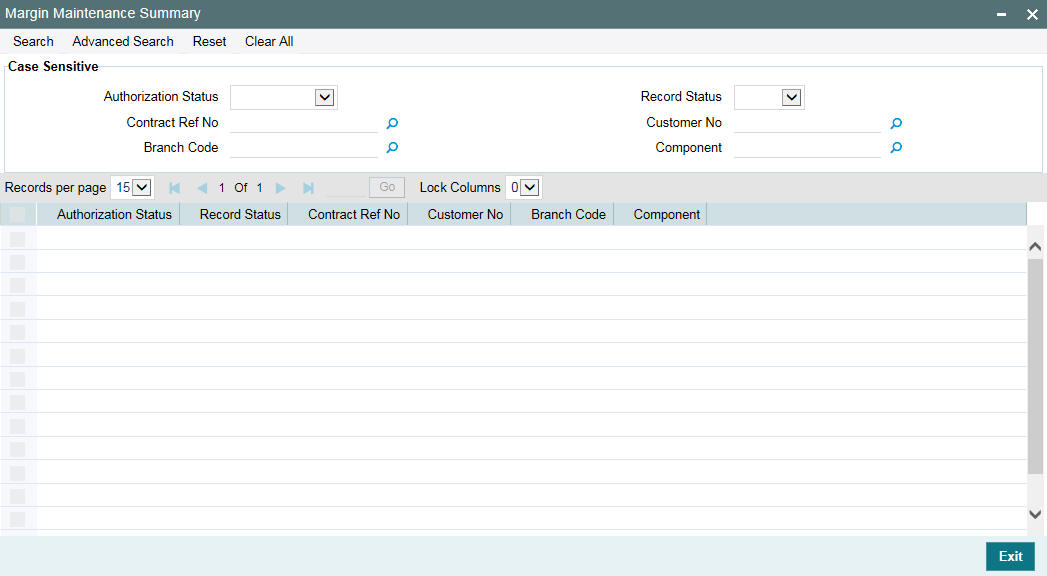

- Section 5.18, "Amending Tranche Margin Details"

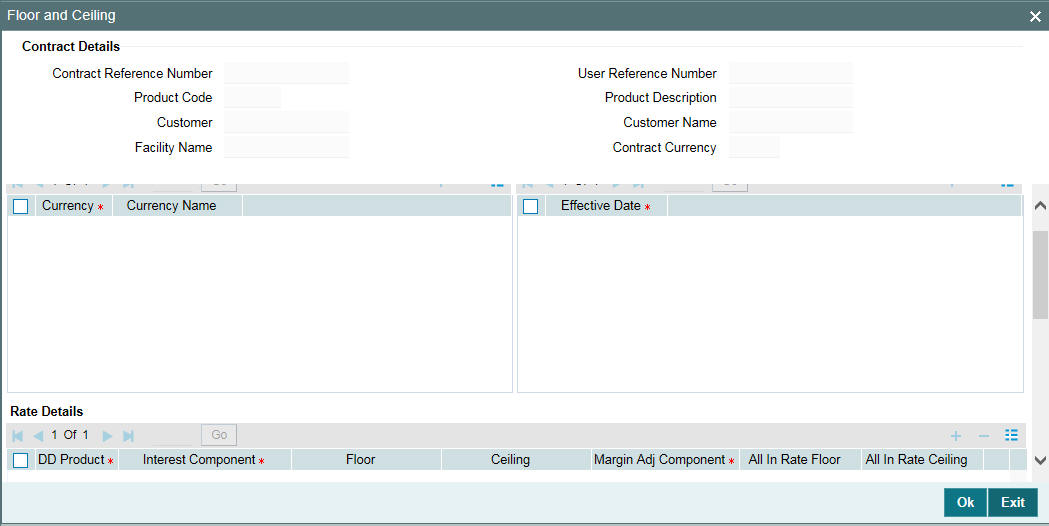

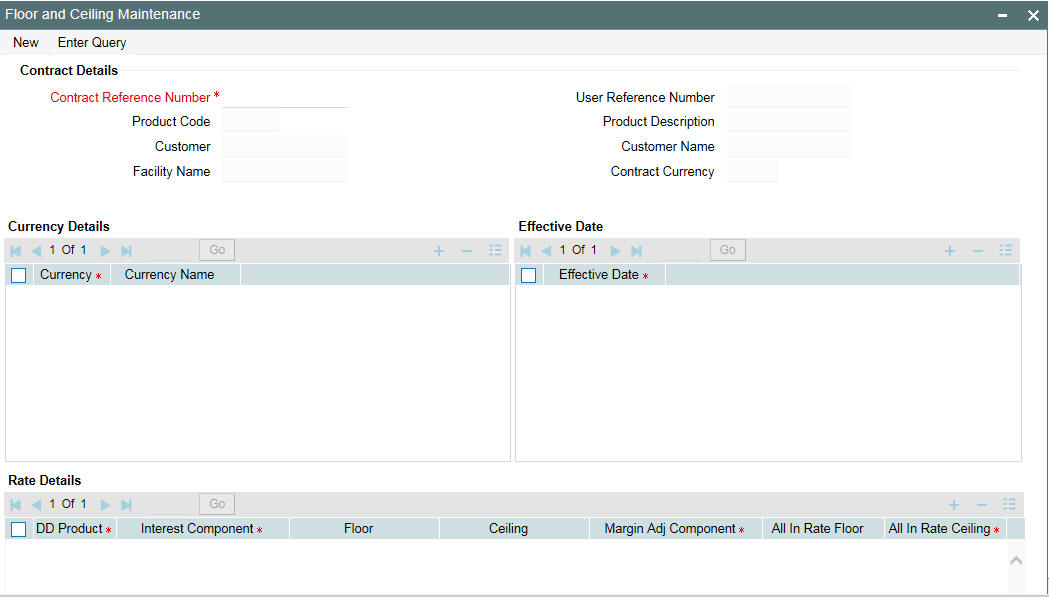

- Section 5.19, "Maintaining Floor and Ceiling Details"

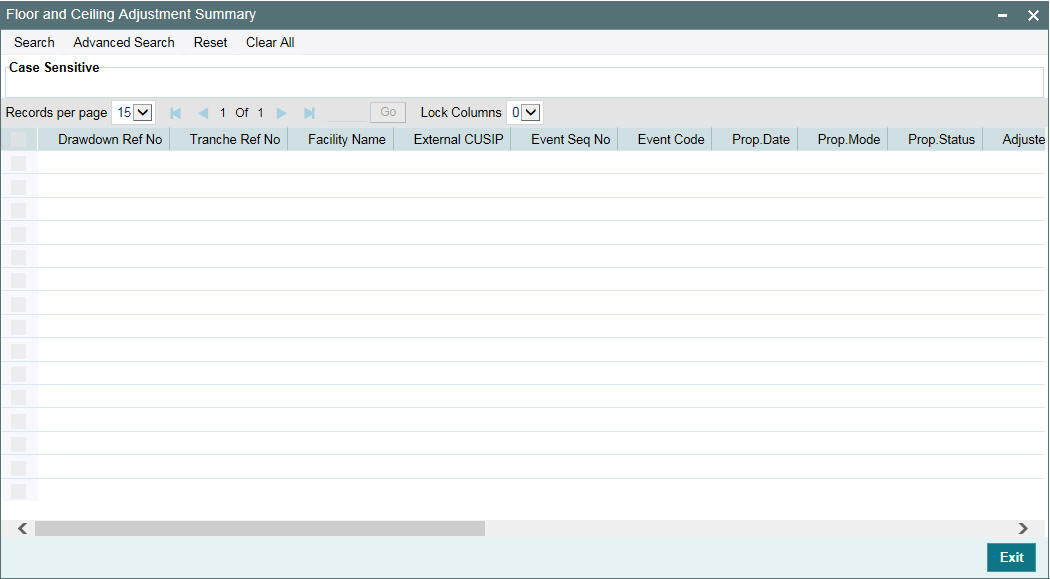

- Section 5.20, "Viewing Floor and Ceiling Adjustment Summary"

- Section 5.21, "Floor and Ceiling for Base Rate Only"

5.1 Introduction

A contract is a specific agreement or transaction entered into between two or more entities. A customer who approaches your bank to avail of any of the services offered by your bank enters into a contract with your bank.

In the case of a syndication facility contract, the entities involved in a contract are the borrowing customers and the participants for any tranche of the agreement.

Similarly, any specific loans (drawdowns) disbursed by your bank under a tranche in the facility contract are also contracts.

5.2 A Borrower Facility Contract under Syndication Agreement

A facility contract is reached between a borrowing customer and a bank (or financial institution), which arranges or provides facility for the syndication. The arranger bank identifies one or more participants who pool funds to meet the borrowing requirements. The arranger bank disburses the loan, after receiving the contributions of the other participants. The participants share the interest and other income accruing from the loan, in the ratio of their participation that was agreed upon at the time of entering the tranche.

The syndication agreement with the borrowing customer is known as a borrower facility contract.

In a borrower facility contract, the borrowing customers receive loans from any of the arms or tranches. Each of the arms would have a set of participants, who would pool in their contributions toward the borrowing requirement in a mutually agreed ratio. The borrowing customer could receive loans towards the borrowing requirement as ‘drawdowns’ from a tranche. Therefore, a single tranche would have a specified number of drawdowns.

Each of the players in a tranche (that is, the borrowing customer and the participants) enters into a commitment contract. The individual loans (drawdowns) under each tranche are loan contracts.

Therefore, a borrower facility contract under a syndication agreement involves the following contracts:

- The main borrower facility contract between the borrowing customers and the facilitating bank. The contract officialises the agreement and makes the terms binding by law on all parties entering into it. (For the main borrower facility contract, contracts are drawn up for each of the participants to mirror the borrower facility contract)

- The commitment contracts at the level of a tranche opened under the main borrower facility contract, for each of the entities – the borrower and the participants.

- The actual loans disbursed to the borrowing customer as drawdowns under a tranche of the main borrower facility contract

The example given below illustrates the concept of syndication and the contracts involved. This example is referred throughout this chapter as a reference contract to illustrate the concept of the contracts.

Example

The main syndication facility contract

One of your customers, Mr. Robert Carr, has approached you for a loan of 100000 USD on 1st January 2000. You enter into a syndicated contract with him on the same date, with a view to meeting his funding requirement by identifying other banks or institutions that can share the load of funding. The agreement is booked on 1st January 2000, and the end date, by which all components of the borrowed amount are repaid, to be 1st January 2001.

The main borrower facility contract is the one under which all subsequent tranche / drawdown contracts will be processed. When you enter this contract (with Mr. Robert Carr) into the system, it saves the contract and generates a unique identifier for it, known as the Facility Contract Reference Number. (that is, the Contract Reference Number of the main borrower facility contract). Let us suppose the Facility Contract Reference Number assigned to this contract is 000SNEW000010001. Whenever you enter a tranche or drawdown contract against this main borrower facility contract, you have to specify this number as reference information.

Getting back to Mr. Robert Carr’s borrowing requirement, let us suppose that he wants to avail of the total loan principal in the following manner:

- Total syndicated loan principal: 100000 USD, in two tranches, with a total tenor of six months.

- Portion of loan desired in the first tranche: 50000 USD. Mr. Carr

desires to completely avail of this amount in this first tranche in the

following drawdown pattern:

- 20000 USD on 30th January

- 15000 USD on 29th February

- 15000 USD on 31st March

- Portion of loan desired in the second tranche: 50000 USD. Mr. Carr

desires to completely avail of this amount in the second tranche in the

following drawdown pattern:

- 20000 USD on 30th April

- 15000 USD on 31st May

- 15000 USD on 30th June

Tranche contracts

Mr. Robert Carr’s total syndicated loan principal is therefore required to be disbursed in two different sets of tranches, as seen above.

The tranche involves a ‘commitment’ from Mr. Robert Carr as the borrowing customer, as well as a commitment from your bank, as the arranger bank in the contract, to disburse the loan after pooling together resources from any willing participants. Each of the participants enters into a commitment contract, committing to provide the funds as agreed.

For the first tranche, wherein a principal of 50000 USD is to be disbursed, your bank has now identified Brinsley Bank and Dayton Commercial Bank as potential sources from whom funding may be obtained, to meet Mr. Carr’s borrowing requirement. The funding load is proposed to be shared in the following pattern, which is known as the ratio of participation:

- Your bank (Participant) : 10000 USD

- Brinsley Bank (Participant) : 20000 USD

- Dayton Commercial Bank (Participant): 20000 USD

When you open the tranche in the system, you input a borrower commitment for Mr. Robert Carr. When the BOOK event is triggered for the borrower commitment contract, the system creates commitment contracts for your bank and for Brinsley Bank and Dayton Commercial Bank, based on the borrower commitment contract.

Let us suppose that the first tranche is booked on 15th January. Let us suppose that the following Contract Reference Numbers are generated by the system for the contracts:

- Borrower (Mr. Carr) Commitment: 000SNBC000150001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the first tranche is being opened, which is 000SNEW000010001.

- Participant (Your Bank) Commitment: 000SNPC000150001. This contract is created by the system when you the BOOK event is triggered for the borrower commitment contract 000SNBC000150001.

- Participant (Brinsley Bank) Commitment: 000SNPC000150001. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC000150001.

- Participant (Dayton Commercial Bank) Commitment: 000SNPC000150002. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC000150001.

For the second tranche, wherein a principal of 50000 USD is to be disbursed, your bank has identified South American Overseas Bank and Banco Milan as funding partners. The ratio of participation is finalized as follows:

- Your bank 10000 USD

- South American Overseas Bank 25000 USD

- Banco Milan 15000 USD

When you open the tranche in the system, you input a borrower commitment for Mr. Robert Carr. When the BOOK event is triggered for the borrower commitment contract, the system then creates commitment contracts for your bank and for South American Overseas Bank and Banco Milan based on the borrower commitment contract.

Let us suppose that the second tranche is booked on 15th April. Let us suppose that the following Contract Reference Numbers are generated by the system for the contracts:

- Borrower (Mr. Carr) Commitment: 000SNBC001050001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the first tranche is being opened, which is 000SNEW000010001.

- Participant (Your Bank) Commitment: 000SNPC001050001. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC001050001.

- Participant (South American Overseas Bank) Commitment: 000SNPC001050002. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC001050001.

- Participant (Banco Milan) Commitment: 000SNPC001050003. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC001050001.

Since the principal amount in each tranche is scheduled to be made available during a fixed period - between 1st January and 31st March for the first tranche, and between 1st April and 30th June for the second, the participants are reminded to fulfill their commitments just before each schedule is due. This would mean that the approved contributions from each participant would be credited into a common syndication pool before each schedule is due. The schedule dates, according to the agreement, are 30th January, 29th February and 31st March for the first tranche, and 30th April, 31st May and 30th June for the second.

Therefore, the relationship of the tranche contracts under a main facility contract can be seen below, using our example:

Drawdown Contracts

On any date including and following the 31st of January, Mr. Robert Carr can avail of his first drawdown loan of 20000 USD, under the first tranche. Similarly, on any date including and following the 30th of April, Mr. Robert Carr can avail of his first drawdown loan of 20000 USD, under the second tranche.

Accordingly, you have drawn up a drawdown schedule for disbursing the loans, where you have defined details such as the start date of the drawdown, the maturity date, currency, interest rate, and amount. These details are defaulted to the drawdown contract and you cannot change any of them when you enter a drawdown loan on the drawdown date. The drawdown loans are disbursed according to the drawdown schedule.

You can enter each of Mr. Carr’s drawdown loans into the system. The system saves the loan contract with a unique reference number. When the BOOK event for each of the loans is triggered, the system initiates deposit contracts for the participants of the tranche, based on the drawdown loan reference number.

Let us suppose that the following Contract Reference Numbers are generated for the loans and the contracts for the participants:

Tranche One, First Drawdown Loan (31st January)

- Borrower (Mr. Carr) Drawdown Loan: 000SNBL000310001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main borrower facility contract against which the tranche was being opened, which is 000SNEW000010001, as well as the Contract Reference Number of the borrower tranche contract against which the drawdown loan is being entered, which is 000SNBC000150001.

- Participant (Your Bank) Deposit: 000SNPD000310001. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000310001.

- Participant (Brinsley Bank) Deposit: 000SNPD000310002. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000310001.

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000310003. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000310001.

Therefore, the relationship of the drawdown contracts under the first tranche can be seen below, using our example:

The relationship of the drawdown contracts in each drawdown would be similar to the structure depicted above, with the appropriate tranche reference numbers and the drawdown contract numbers.

Tranche One, Second Drawdown Loan (28th February)

- Borrower (Mr. Carr) Drawdown Loan: 000SNBL000590001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the tranche was being opened, which is 000SNEW000010001, as well as the Contract Reference Number of the borrower tranche contract against which the drawdown loan is being entered, which is 000SNBC000150001.

- Participant (Your Bank) Deposit: 000SNPD000590001. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000590001.

- Participant (Brinsley Bank) Deposit: 000SNPD000590002. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000590001.

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000590003. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000590001.

Tranche One, Last Drawdown Loan (31st March)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL000900001 (As explained earlier)

- Participant (Your Bank) Deposit: 000SNPD000900001. (As explained earlier)

- Participant (Brinsley Bank) Deposit: 000SNPD000900002. (As explained earlier)

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000900003. (As explained earlier)

Tranche Two, First Drawdown Loan (30th April)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL001200001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001200001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit: 000SNPD001200002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001200003. (As explained earlier)

Tranche Two, Second Drawdown Loan (31st May)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL001510001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001510001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit: 000SNPD001510002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001510003. (As explained earlier)

Tranche Two, Last Drawdown Loan (30th June)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL001810001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001810001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit: 000SNPD001810002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001810003. (As explained earlier)

5.3 Products for Loan Syndication Contracts

A product is a specific service, scheme or facility that you make available to customers.

For instance, the facility of a syndication agreement between your bank and other banks or financial institutions, for the purpose of pooling funds to disburse loans is a specific service you could offer. This service can be thought of as a product.

Similarly, the facility of availing loans through a drawdown, from any of the tranches under the borrower facility contract, is another specific service that you offer to customers. This could also be thought of as a product.

In Oracle FLEXCUBE, a contract is entered into the system against a product, and is specific to a customer. For instance, a drawdown loan for a borrowing customer under a tranche of a borrower facility contract is entered into the system against a borrower leg drawdown loan product.

Defining a product simplifies the process of entering a contract, since you can define certain attributes for a product that are applied to all contracts entered against the product automatically, saving your effort to specify them afresh each time you input a contract. When Oracle FLEXCUBE processes the contract, it applies all the attributes and specifications made for the product against which the contract was entered.

You can enter more than one contract against a product.

Before you enter any contracts for a facility contract, whether the main contracts or the commitments or loan contracts, you should have already defined the following products:

- A borrower facility product for borrower facility contracts. In addition, participant facility products for the resultant participant facility contracts.

- Tranche-level commitment type of products for borrowing customers, and participants

- Loan products for the borrowing customers for drawdowns under a tranche, as well as deposit products for the participants.

The definition of these products is explained in the chapter Defining Products for Loan Syndication in this user manual.

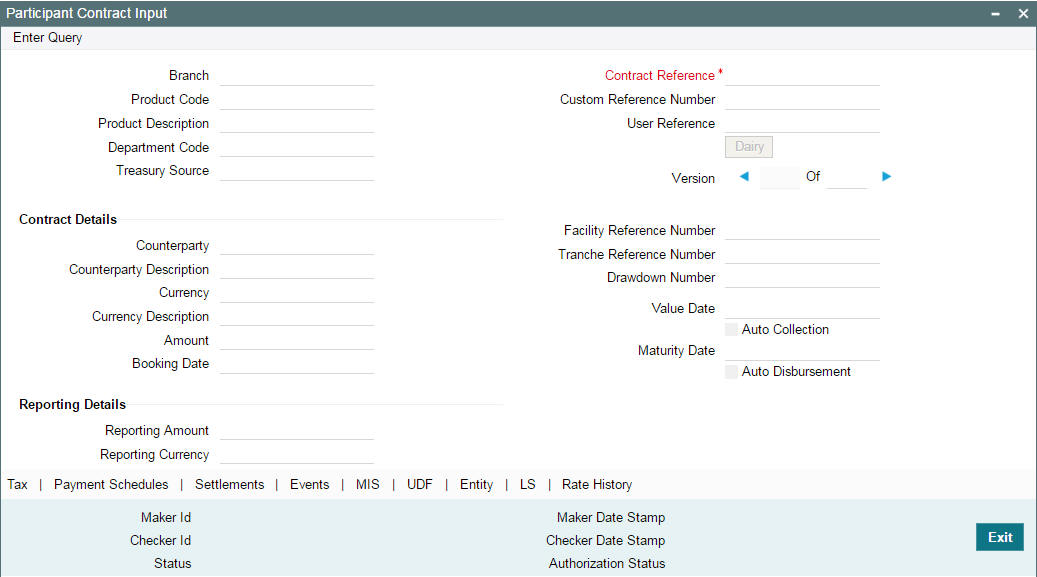

5.4 Processing a Borrower Facility

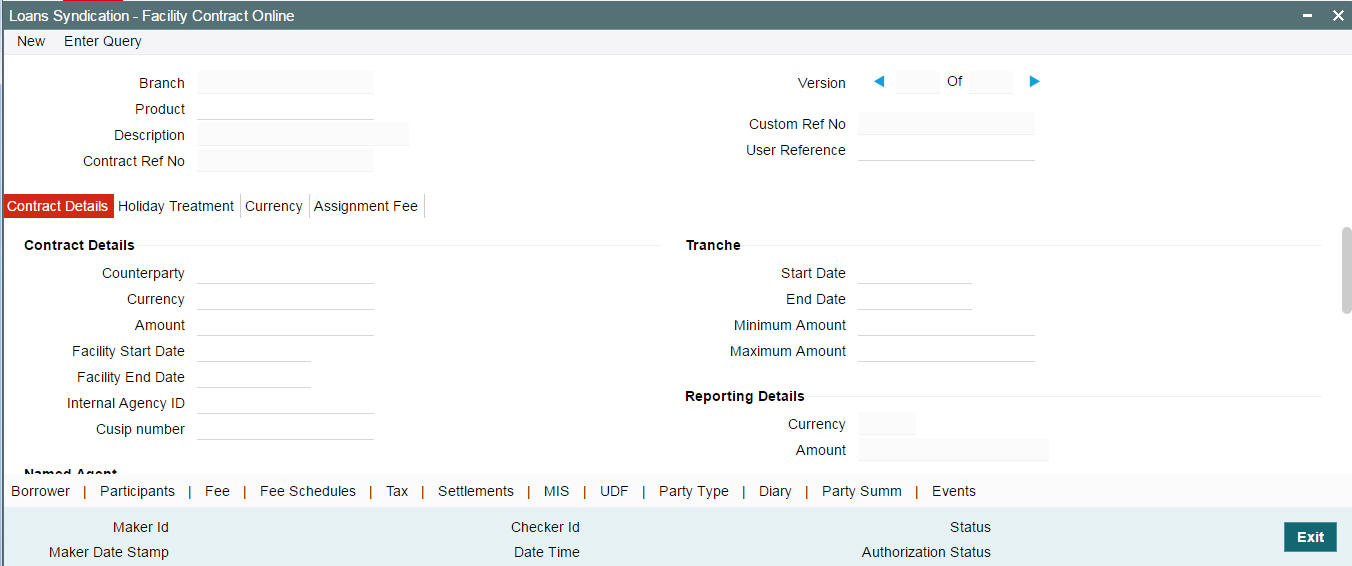

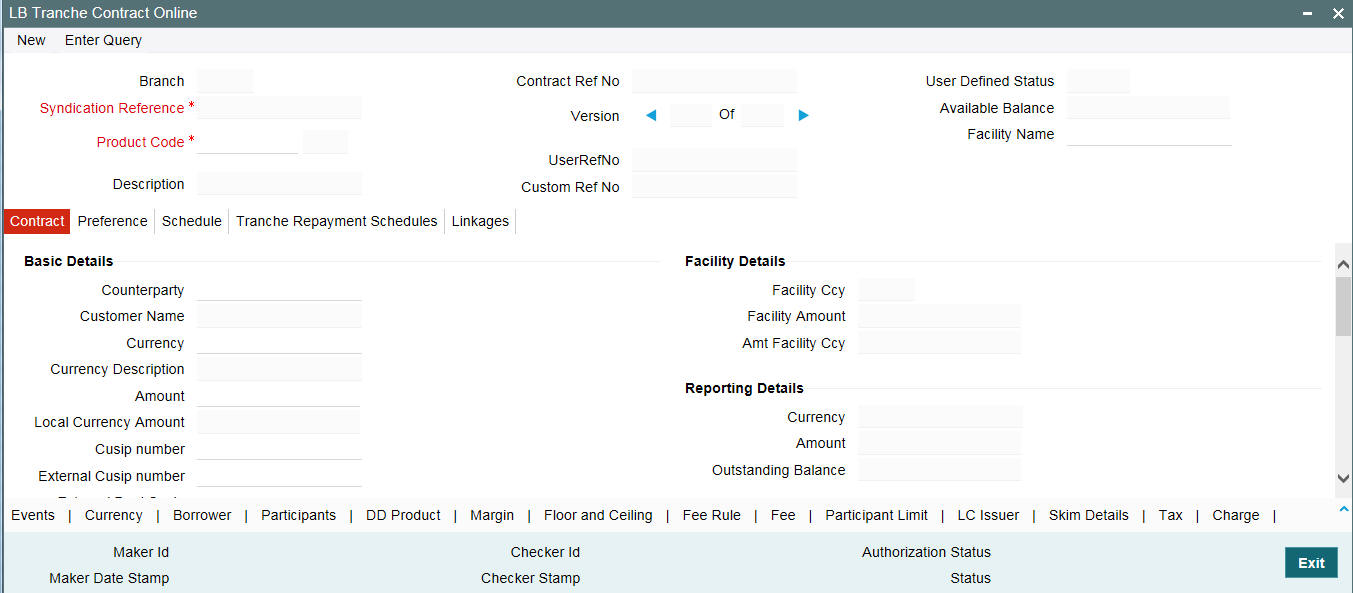

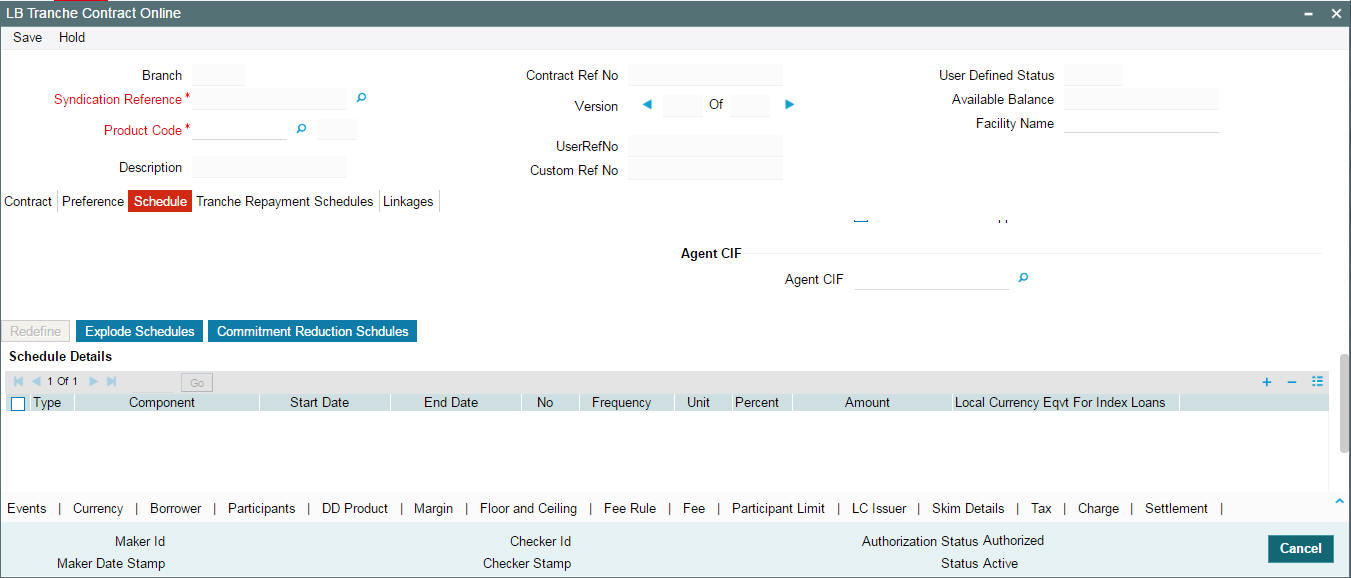

You can capture details for a borrower facility in the ‘Loan Syndication – Facility Contract Online’ screen. The screen is displayed with details of an existing facility.

You can invoke the ‘Loan Syndication – Facility Contract Online’ screen by typing ‘FCDTRONL' in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

To capture a new facility, click ‘New’ from the menu.

You can choose to enter the details of a facility either by:

- Selecting a template that has been created earlier. If you do so,

the details that have been stored in the template are displayed for the

facility. You can change the values in any of the fields except the following:

- Product

- Contract Reference Number

- Copying an existing facility and changing only the details that are different for the facility you are entering.

- Using your keyboard and the option-lists that are provided at the various fields, to enter the details of the facility afresh.

Using a Template to enter a Facility

A template is a sample borrower facility, with details similar to that of many contracts under a category or involving a particular facility product. When a template is created, it can be re-used while entering other contracts and only those options specific to the contract need to be changed. Therefore, the process of specifying all the details for a contract is faster and easier.

To associate a template, you have to select the ‘Template’ from the option list. The details that have been stored for the template are displayed. A new reference number is automatically generated for the contract. After you have changed the values that need to be changed, click ‘Save’ to store the details in the system.

A description of the ‘Facility Contract Online’ Screen

In the ‘Loans Syndication - Facility Contract Online’ screen, you can capture the following details:

- The main borrower facility product under which the contract is being entered

- A unique reference number for the contract

- The counterparty (customer) with whom the borrower facility contract has been finalized

- The currency associated with the customer

- The date of value of the contract

- The date on which the contract matures

- The amount being transacted in the contract

- The purpose for the borrower facility contract

- Any narrative regarding the contract (remarks)

In addition, a vertical toolbar is also provided in the screen. These buttons are used to invoke other sub-systems meant to capture important information for processing a facility contract. These buttons have been described briefly below:

Buttons |

Description |

Currency |

Click on this tab to invoke the ‘Currency Details’ screen. In this screen, you can maintain an allowable list of currencies for the contract. |

Borrower |

Click on this tab to specify the details pertaining to the borrowers of the facility contract. |

Participant |

This tab invokes the ‘Participant Ratio Details’ screen. |

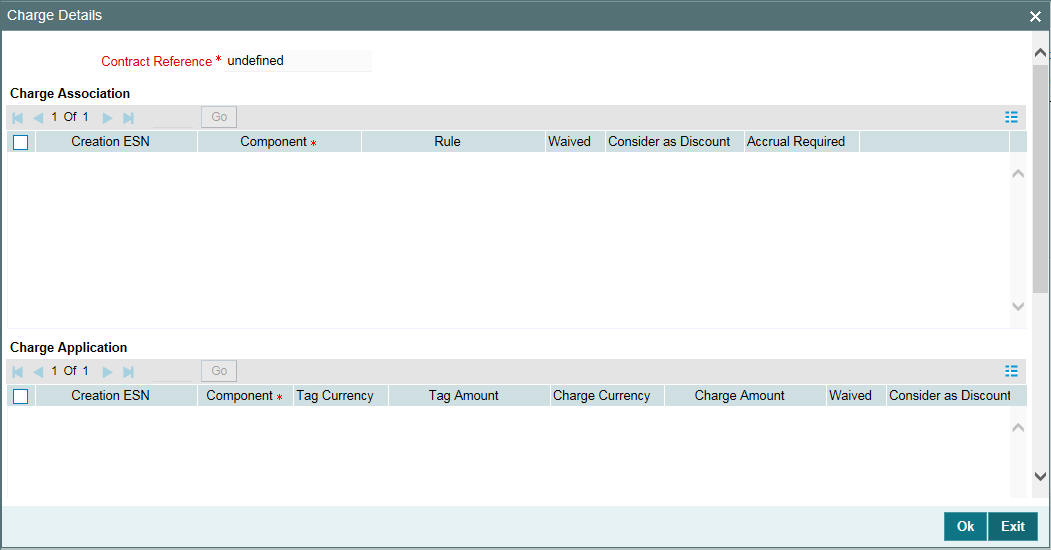

Fee |

This tab displays the ‘Fee Components’ screen where you can view the default fee details for the contract. |

Fee Schedules |

You can view the ‘Fee Schedules’ screen. This displays the payment schedules for the various fee components. |

Tax |

You can view the ‘Participant Tax Details’ screen.

|

Settlements |

You can view the ‘Settlement Message Details’ screen. |

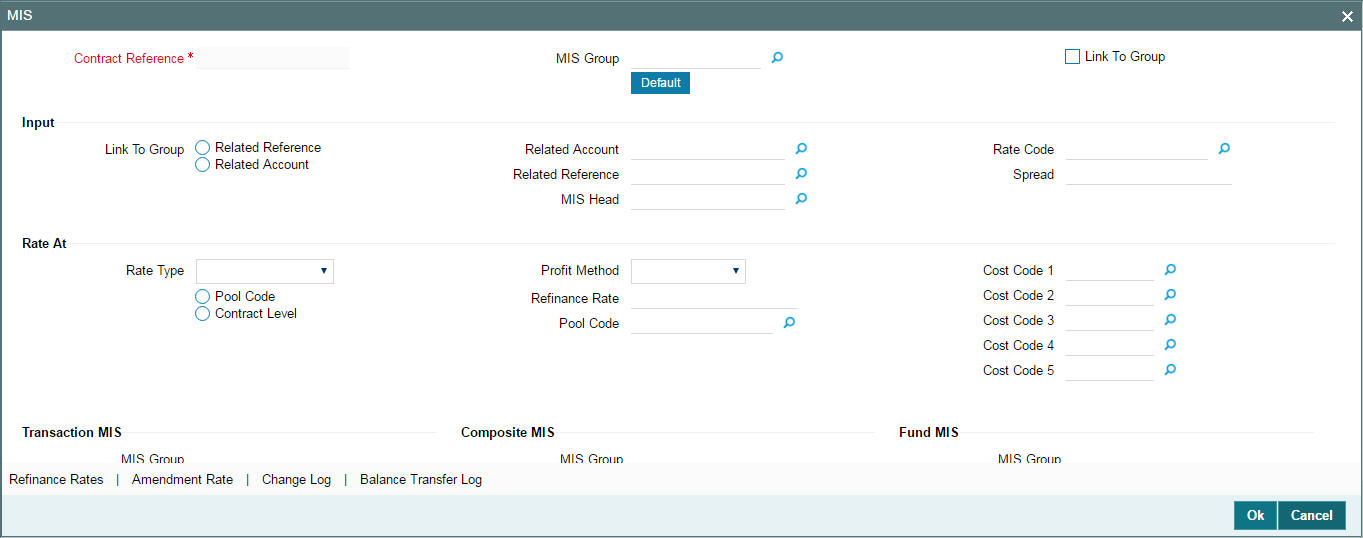

MIS |

Click this tab to define MIS details for the contract. |

UDF |

Click this tab to capture values for the custom/user defined fields associated with the contract. |

Party Type |

Click this tab to invoke the ‘Party Details’ screen. In this screen you can specify the different types of entities or parties that would be applicable for the contract. |

Diary |

Click this tab to invoke the ‘Diary Contracts – Summary’ screen where you can view the event details for the contract. |

Participation Summary |

Click this tab to invoke the ‘Participant Facility Contract Summary’ screen. In this screen, you can view the underlying Tranche and Drawdown contracts for the Facility contract. |

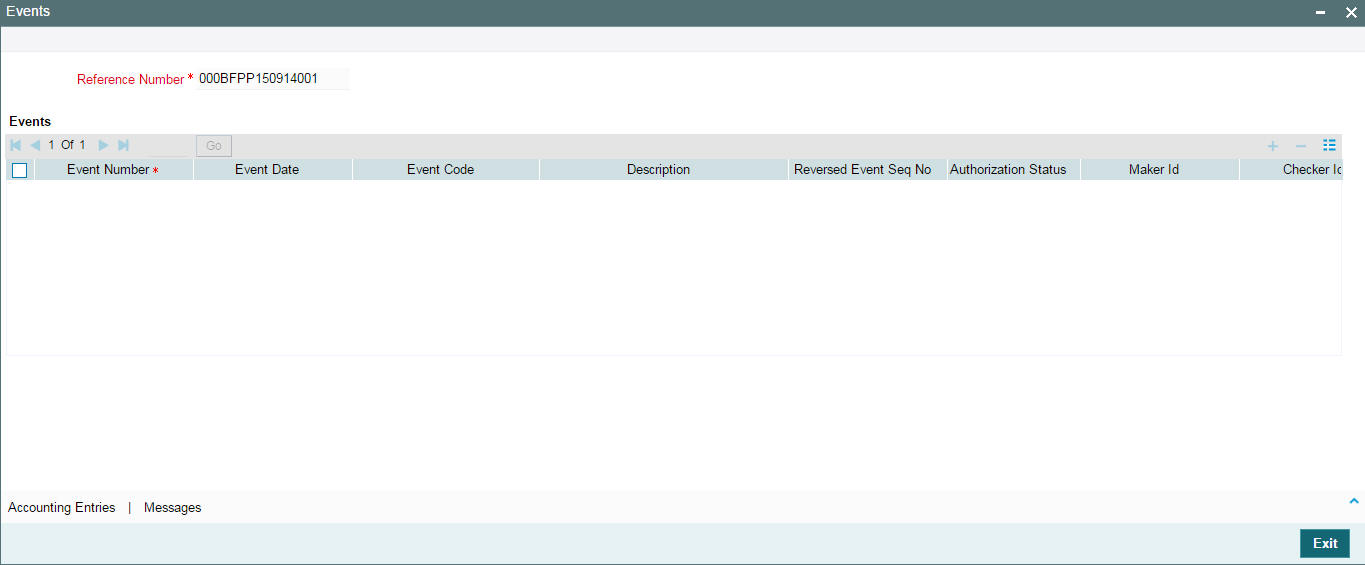

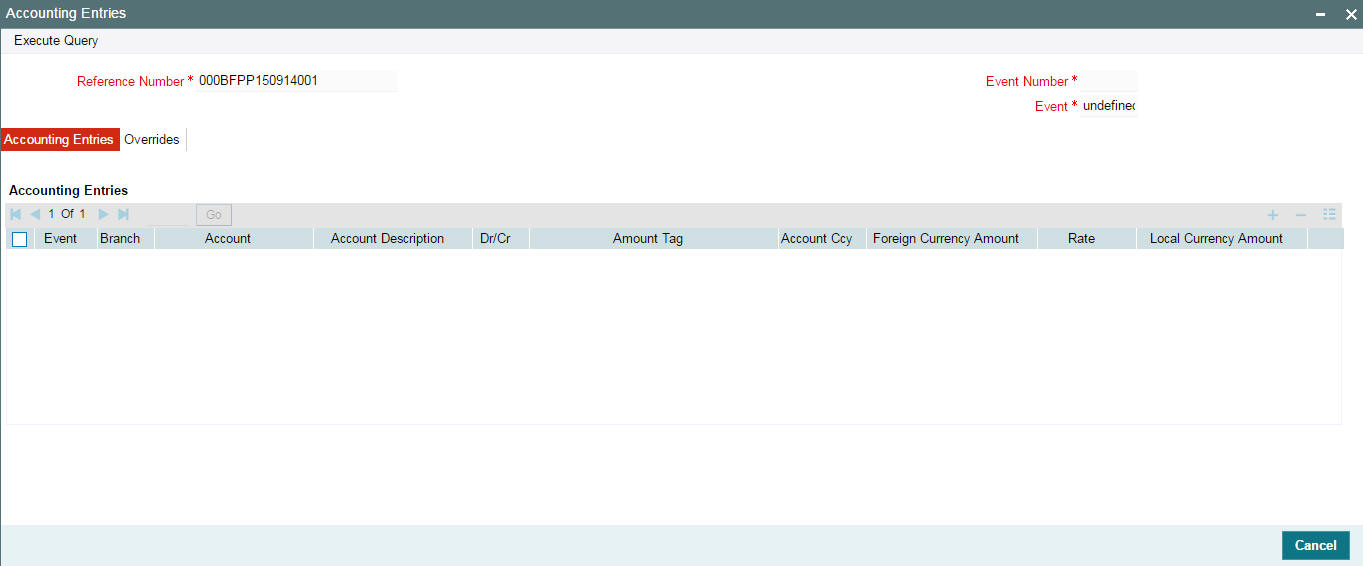

Events |

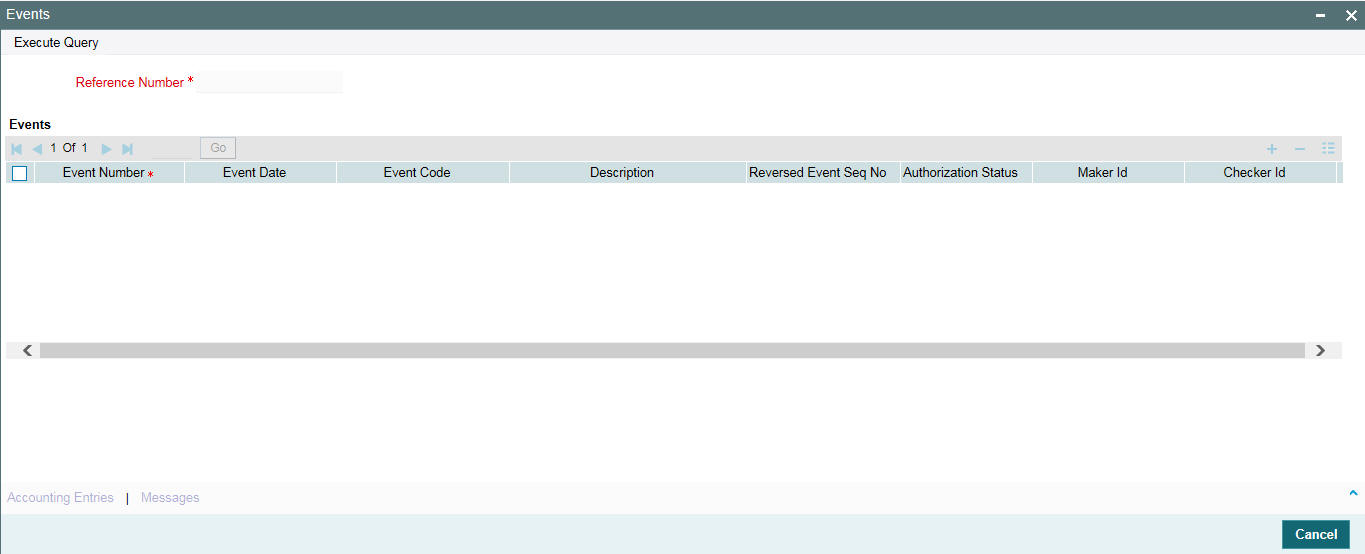

Click this tab to invoke the ‘Event Log Details’ screen. Here, you can view the accounting entries for each event and the overrides encountered, if any. |

Note

Only the specifications exclusive to processing Loans Syndication contracts is explained in this chapter. For information on the generic functionality of the above sub-systems, refer the following Oracle FLEXCUBE User Manuals:

- Products

- MIS

- Interest

- Charges and Fees

- Tax

- User Defined Fields and

- Settlements

5.5 Capturing Facility Details

The following section explains the procedure for capturing the contract by associating it with a facility product. Based on the product code you choose, many of the fields are defaulted. You can overwrite some of these defaults to suit your requirements.

Product

You have to select the appropriate facility product from the option list provided. All authorized products maintained in the ‘Facility Product Definition’ screen is available in the option list provided. After you select a product, the following details will default to the contract:

- Product Type

- Branch

- Department

When you click on the ‘Tab’ key on the keyboard, the system automatically generates the following reference numbers.

Contract Reference Number

The Contract Reference Number uniquely identifies the borrower facility contract in the system. It is generated by the system automatically for every borrower facility contract.

The system combines the following elements to form the Contract Reference Number:

- The branch code (3-digit code)

- The product code (4-digit code)

- The value date of the borrower facility contract (in 5-digit Julian format)

- A running serial number for the booking date (4-digits)

Example

For instance, if you are entering the facility contract with Mr. Robert Carr, as in our previous example, the Contract Reference Number generated by the system was 000SNEW000010001.

- The first three digits are the code of the branch of your bank where the contract was entered into the system.

- SNEW is the code of the borrower facility product that you have set up against which you are entering your facility contract with Mr. Robert Carr.

- 00001 refers to January 1, 2000 (in Julian format) when the contract was booked. (see example given below to understand how the Julian date is interpreted)

- 0001 is a running serial number, incremented by 1 for each contract entered on the booking date for the product code and the booking date combination.

The Julian date is expressed in the following format - YYDDD

Here, YY represents the last two numerals of the year, and DDD, the number of elapsed days in the year.

Example

For instance, 00059, in Julian format, would mean the 28th of February 2000. Here, 00 stands for the year 2000, and 059 would stand for number of elapsed days in the year 2000. The number of elapsed days in January would be 31, followed by 59-31 days in February, which computes to 28.

User Reference Number

The reference number is the identification that you specify for the borrower facility contract. You can specify any identification number. In addition to the Contract Reference Number that the system generates, this number is also used to retrieve information about the contract.

By default, the Contract Reference Number generated by the system is considered to be the User Reference Number for the contract.

You can use the User Reference Number to uniquely identify as well as classify the borrower facility contract for the internal purposes of the bank. For instance, you may want to identify all facility contracts entered into with all customers (borrowers) of a certain net worth; or all customers in a particular nationality, or a particular industry, and so on. In such a case, you can supply a unique prefix to the user reference number to identify and classify the contract.

Custom Ref No

You can capture a unique reference number for the facility. This number is used to identify the facility in the system. You can also query the facility based on this number. The reference number can consist of a maximum of 16 alphanumeric characters. You have to capture the custom reference number as mandatory information for the facility.

5.5.0.1 Specifying Contract Details

In the ‘Contract Details’ section of the screen, you have to specify the following:

Customer

You must specify the customer with whom the facility contract has been finalized. This, typically, is the borrowing customer.

The customers allowed to be counterparty to a facility contract are defined at the facility product level. The customers allowed for the contract are displayed in the option list provided. Select the customer from this list.

Note

A primary entity must be defined for every customer who is allowed to be a borrower of the facility contract, in the ‘Borrower Details’ screen.

Example

When you are entering a borrower facility contract that we saw in the first example, with Mr. Robert Carr, you can select the code assigned to Mr. Carr, in the system, from the option list.

You must also designate a Primary Entity to whom advices and notices related to the contract would be sent.

Currency

You have to specify the currency of the borrower facility contract. The currencies allowed for the facility product are available in the option list provided. Select the currency from this list. This is the currency in which the contract amount is expressed.

Amount

Specify the total principal that is to be lent to the borrowing customer through the borrower facility contract. The value you enter here is taken to be in the currency specified for the borrower facility contract. You can specify T or M to signify thousand or million, respectively. For instance, 10T would mean ten thousand and 5M, five million.

When you specify the contract amount, the system computes and displays the facility amount in reporting currency using the exchange rate maintained between the two currencies (Contract Ccy and Reporting Ccy) for the branch. This is displayed in the ‘Reporting Details’ section of the screen.

Facility Start Date

This is the date on which the contract becomes effective in the system. On any date following this, you can capture the tranche-level commitment contracts and the individual drawdown loans in the system. By default, the current date is displayed here.

However, you can change this date to any one of the following:

- A past date

- The application date

- A future date

To change the date, click the ‘Calendar’ button. The system then displays the following message to seek confirmation for the change:

‘Facility Start Date and Tranche Start Date are defaulted to System Date, Continue?’

Click ‘OK’ in the message window to proceed with the change.

Note

- The facility start date must be later than the ‘Start Date’ defined for the product involving the contract and earlier than the ‘End Date’ of the product.

- All tranche contracts and drawdown loan contracts must be value dated later than the Facility Start Date

Example

For instance, when you enter the borrower facility contract with Mr. Robert Carr, you must enter 1st January 2000 as the Value Date.

The application date on the day you enter the contract could be earlier, later or the same as this value date. For instance, Mr. Robert Carr could approach you on 15th January 2000 and enter into a contract with your bank, wanting that the contract to come into effect on 1st January. The value date in this case is 1st January 2000, and the contract would be backdated.

For backdated contracts, you can enter backdated tranches and drawdowns.

Alternatively, Mr. Robert Carr could approach you on 15th December 1999, and enter into a contract with your bank, wanting that the contract must come into effect on 1st January 2000. This is the value date, and the contract would be future dated.

For future dated contracts, you cannot enter tranches before the contract actually comes into effect (that is, before the value date).

Facility End Date

This is the date on or before which all tranches and drawdowns under the borrower facility contract mature.

You can enter any future date as the facility end date. It must be later than the ‘Start Date’ defined for the product involving the borrower facility contract, and earlier than the ‘End Date’ of the same product.

The ‘Facility End Date’ must be later than the ‘Facility Start Date’ defined for the contract.

Example

For instance, when you enter the borrower facility contract with Mr. Robert Carr, the customer indicates that the tenor of the contract must be a year, that is, the maturity date of the facility contract must be 1st January 2001. This means that all tranches and drawdowns entered must mature on or before that date.

Internal Agency ID

Select the CIF Id of a bank or its entity to play the role of a self participant in the syndicated loan. The id you select for the facility is propagated to the tranche and drawdowns created under it. During STP from LB module to OL module, the id selected here becomes the settlement party of the corresponding commitment/loan contract.

For details on STP, refer to the ‘Straight Through Processing (STP)’ chapter of this User Manual.

CUSIP Number

You have to capture a unique number to identify the tranche. This number is used to identify the loans being traded and to quote the market price. This number gets defaulted to all the drawdowns processed under the tranche and cannot be changed at the drawdown level. You can use a maximum of 16-alphanumeric characters for a CUSIP.

CUSIP also appears in all correspondences under the tranche that is,. advices to both participants and borrowers. CUSIP number is modifiable as part of contract amendment (CAMD).

After authorization of the CAMD event, the internal CUSIP propagates to all the underlying drawdowns, linked commitment, its underlying loans, linked trades and position contract, if any.

The Internal CUSIP cannot be changed as part of CAMD if there exists:

- Any PRAM or Non-prorata VAMI for the corresponding tranche

- Any open position for the existing CUSIP

Note

The Internal CUSIP is mandatory and cannot be made null during contract input or amendment.

Specifying Details for Tranches

You need to specify the following details for tranches borrower facility contract:

Start Date

You have to capture the date on which the tranches created under the facility contract become effective in the system. By default, the current date is displayed here. However, you can change this date provided the new date is not earlier than the facility start date and later than the facility end date.

End Date

Similarly, you have to specify the date on which the tranche contracts processed under the facility contract should mature. You can enter any date as the facility end date provided:

- The new date is not earlier than the facility start date and later than the facility end date

- The new date is not equal to or earlier than the start date specified for the tranche

Minimum Amount

You can specify the minimum amount that must be disbursed through the tranche contracts under the borrower facility contract. This amount is considered in the borrower facility contract currency.

When you enter a borrower tranche contract under the borrower facility contract, you have to specify the drawdown schedules. The system validates that the schedule amount is not be less than the minimum amount you specify here. If the tranche currency is different from the borrower facility contract currency, the amount is converted using the standard exchange rate, for the purpose of validation.

Maximum Amount

Similarly, you have to specify the maximum amount that must be disbursed through the tranche contracts under the borrower facility contract. This amount is also considered in the borrower facility contract currency.

When you enter a borrower tranche contract under the borrower facility contract, the system validates that the schedule amount does not exceed the maximum amount you specify here. If the tranche currency is different from the borrower facility contract currency, the amount is converted using the standard exchange rate, for the purpose of validation.

Specifying Other Details

You have to capture the following detail also for the facility contract:

Named Agent

Select an appropriate named agent from the adjoining option list. The list displays all valid named agents from ‘Named Agent Maintenance’ screen, who are mapped with the proof code that is the same as the department code under which the facility is being booked.

Note

- You must maintain same values for department and proof codes.

- You cannot amend a named agent if any active tranches are associated with the facility.

Primary and Secondary administrators

You have to identify the officer assigned to be the primary and secondary administrator for the borrower facility contract. The administrators maintained through the ‘Administrator Details’ screen are available for selection. Upon selection of the code, the name of the administrator is displayed alongside.

For more details, refer the heading titled ‘Maintaining administrators’ in the ‘Reference Information for Loan Syndication’ chapter of this User Manual.

Agreement Title

A borrowing customer may avail a syndicated loan arrangement for a specific purpose, such as beginning a new venture, or a personal business project. You can capture this information as part of the facility contract.

You can also specify the agreement title in Chinese up to eighty five characters and the same is displayed in the ‘Loans Syndication : Draft - Tranche’ and ‘LS Tranche Contract Online’ screens.

Internal Remarks

You can specify information about the facility contract to be used for reference, within your bank. It is not printed on any correspondence with customers, but it is displayed when the details of the contract are displayed or printed.

You can also specify the internal remarks in Chinese up to eighty five characters and the same will be displayed in the ‘Loans Syndication : Draft - Tranche’ and ‘LS Tranche Contract Online’ screens.

Specifying Watch List Details

You can specify whether you want to keep the facility under watch. The following details related to the watch list can be specified here:

Watch List Facility

Select this check box to indicate that you would like to keep the facility under watch.

Watch List Remarks

Select the reason for including the facility under watch list from the option list available.

Note

This field is enabled only if you select the ‘Watch List’ check box.

The standard reasons for watch list are maintained in the ‘Static Maintenance -Detail’ screen.

The system displays the following override message when you try to perform any activity on existing tranches or drawdowns, or when you enter new tranches or drawdowns under a facility with Watch list. The override message displays the reason for the facility being under Watch List.

The underlying facility is under Watch List, reason being ‘Facility under Watch’

Do you want to continue?

For more details, refer the section titled ‘Maintaining Watch List Details’ in the ‘Reference Information for Loan Syndication’ chapter of this user manual.

Each of the vertical buttons in the screen is explained below in detail.

Indicating Agency Type

You can indicate the agency type of the transaction from the following options.

- Lead - Your bank is the lead agent for the syndication transaction.

- Participation - Your bank is one of participant in the syndication transaction.

Note

You can indicate the agency type during the facility booking and you are not allowed to do any amendments to this at a later stage for this transaction.

5.5.0.2 Specifying Holiday Handling Preferences for Schedules

Schedule dates for a contract could fall on holidays defined for your branch or on holidays defined for the currency of the contract. The holiday handling preferences are defined as part of maintaining preferences for a facility product. These specifications default to any borrower facility contract using the product, and also to underlying borrower tranche or drawdown contracts that are opened under the facility contract.

You can make changes to the specifications defaulted from the borrower facility product.

Ignore Holidays

You have to check this option to instruct the system to ignore the holiday. Payment schedules are processed as per the due date even if the schedule falls due on a holiday.

Include Branch Holiday

If you select this option, the system considers the branch holidays also for handling schedule dates falling due on holidays.

Move Backward or Forward

You can indicate whether the schedule date falling on a holiday must be moved forward to the next working day, or backward to the previous working day.

Move Across Months

If you have indicated either ‘Forward’ or ‘Backward’ movement of a schedule date falling due on a holiday, and the moved schedule date crosses over into a different month, you can indicate whether such movement is allowable; it is allowable only if you select this option.

Cascade Schedules

If one schedule has been moved backward or forward in view of a holiday, cascading schedules would mean that the other schedules are accordingly shifted. If you do not want to cascade schedules, then only the schedule falling on a holiday is shifted, as specified. The other schedules remain unaltered.

Use Facility Currency

If you choose this option, the system checks whether the schedule date falls on a holiday defined for the currency of the facility (borrower) contract. This is applicable if the currency is different from the holiday currency you specify.

Use Local Currency

If you choose this option, the system check whether the schedule date falls on a holiday defined for the local currency, provided this currency is different from the holiday currency and facility currency you have indicated.

Holiday Ccy

By default, the system checks the holiday calendar maintained for the facility currency before arriving at the schedule due date. However, if required, you can include another currency for a similar check.

If you specify another currency, the system checks the holiday calendar for both the facility currency as well as the currency you select here.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a schedule date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

Specifying Holiday Handling Preferences for Maturity Date

Just as you maintain holiday handling preferences for schedules of the facility contract, so also you should maintain the preferences for handling maturity dates falling due on holidays. The preferences available are similar to the ones available for the schedules.

Specifying Status Control

For a new contract, the default status is ‘NORM’ (Normal). It may be required that you change the default status of a contract. To change the status, select the appropriate status from option list provided. The statuses defined for the facility product through the ‘Status Maintenance’ screen will be available in this list.

For details on the ‘Status Maintenance’ screen, refer the heading ‘Maintaining statuses for a syndication product’ in the ‘Reference Information for Loan Syndication’ chapter of this User Manual.

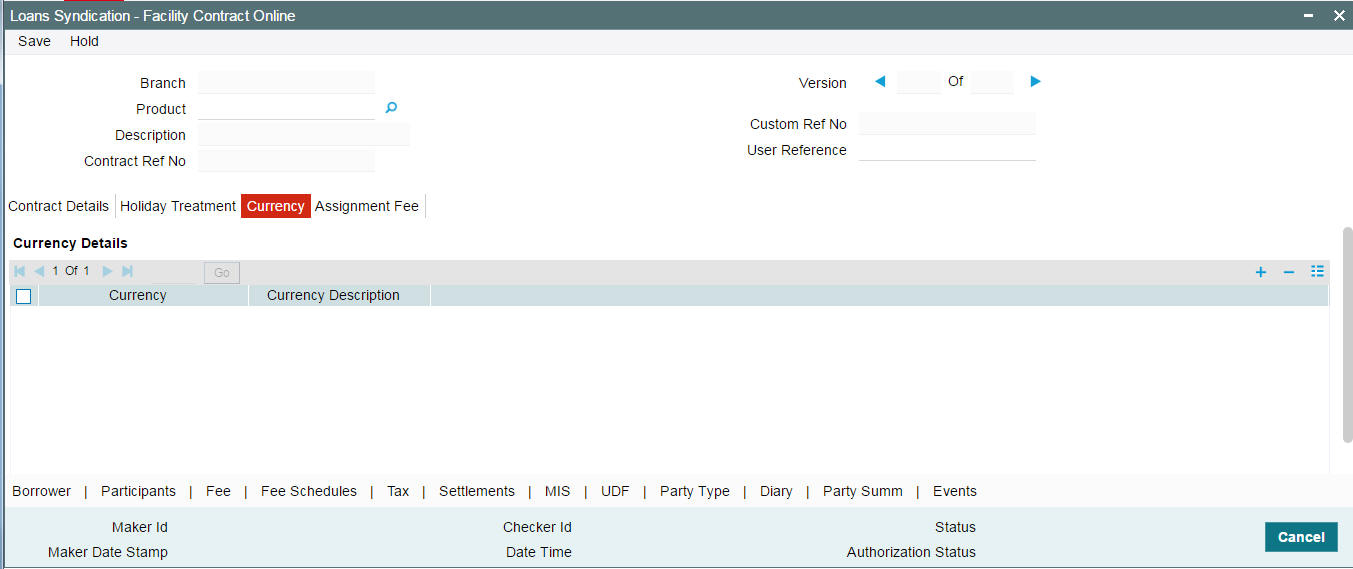

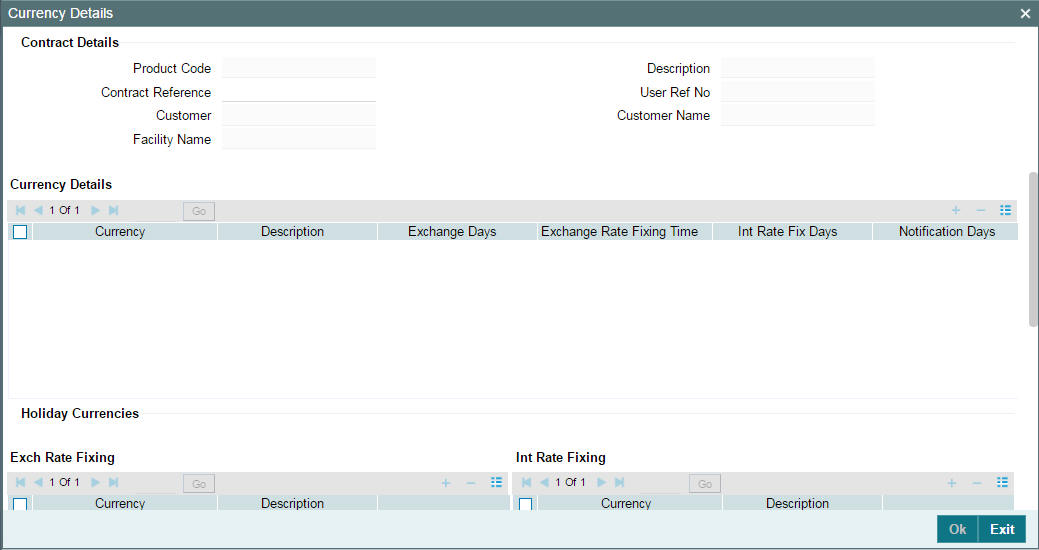

5.5.0.3 Specifying Allowable Currencies under Currency tab

You can specify the different currencies that are allowable for the borrower facility contract, for tranches and drawdowns created under it. It is mandatory to include the facility currency in this list. To specify the allowable currencies, click ‘Currency’ tab in the ‘Facility Contract Online’ screen. The ‘Currency Details’ sub-screen is displayed, where you can specify the required currency list.

To maintain the allowable list of currencies, do the following:

- Select the currency from the option list provided. The description of the currency will be displayed when you select the currency.

- Click ‘Add’ button to insert a row and then select the next allowable currency. Continue this procedure until the required currencies are selected.

- To remove a currency from the allowable list, click the ‘Delete’ button.

- Click the ‘Save’ to save the list.

When you enter a tranche or a drawdown under the facility contract, the allowable currencies are those defined in this list.

Note

It is mandatory to maintain the allowable list of currencies for the facility before you invoke any of the other sub-screens. If not maintained, the system displays the following alert message when you attempt to invoke the other sub-screens:

Currencies are not entered.

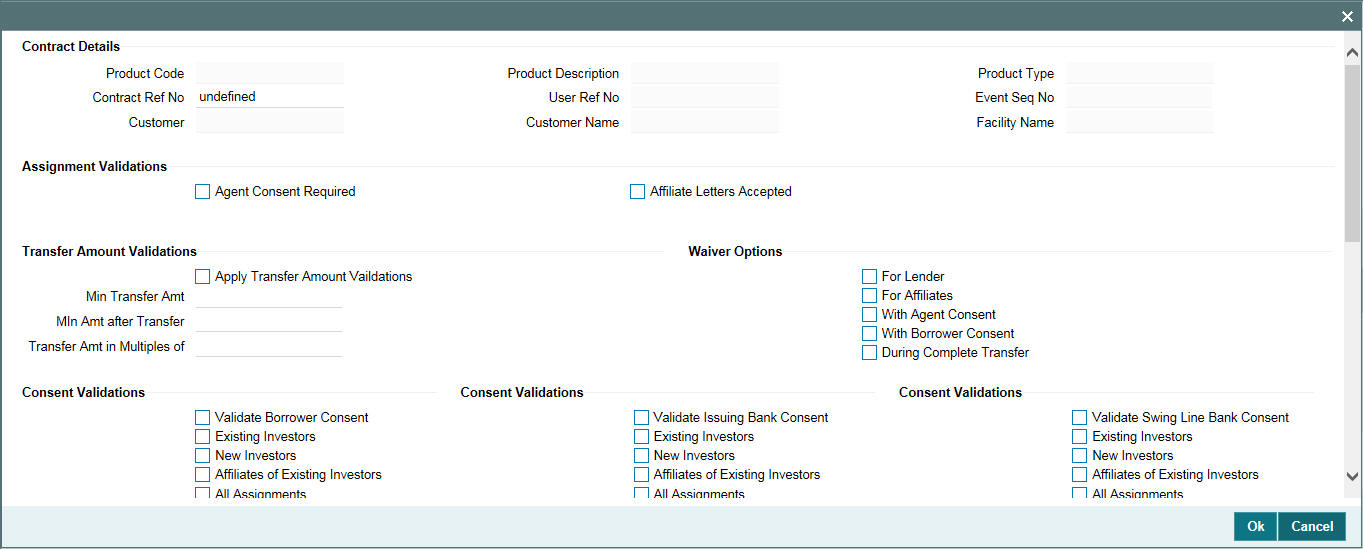

Assignment Fee tab

The system displays the latest assignment fee amount for the facility/product in the tranche currency if it is maintained at the facility/deal level.

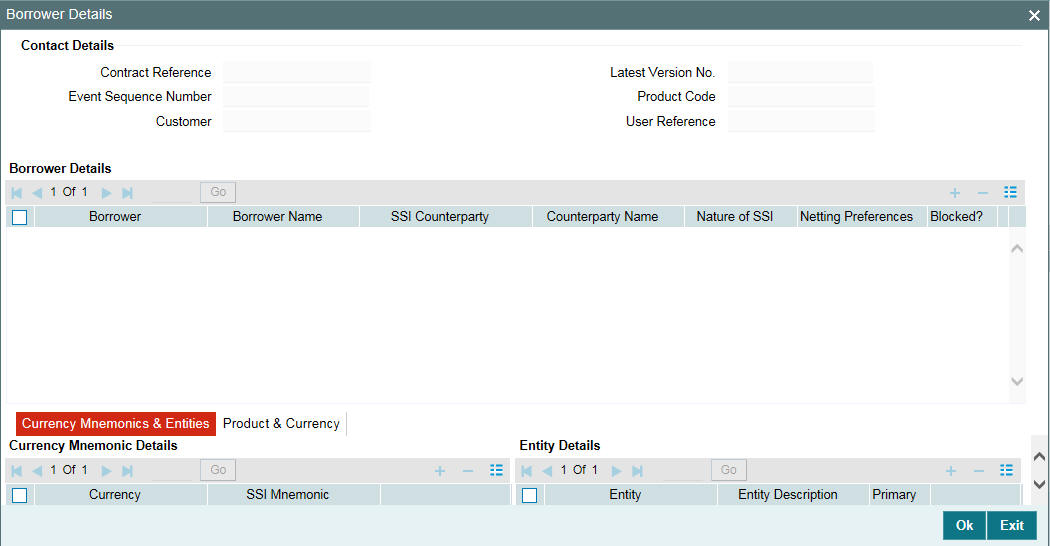

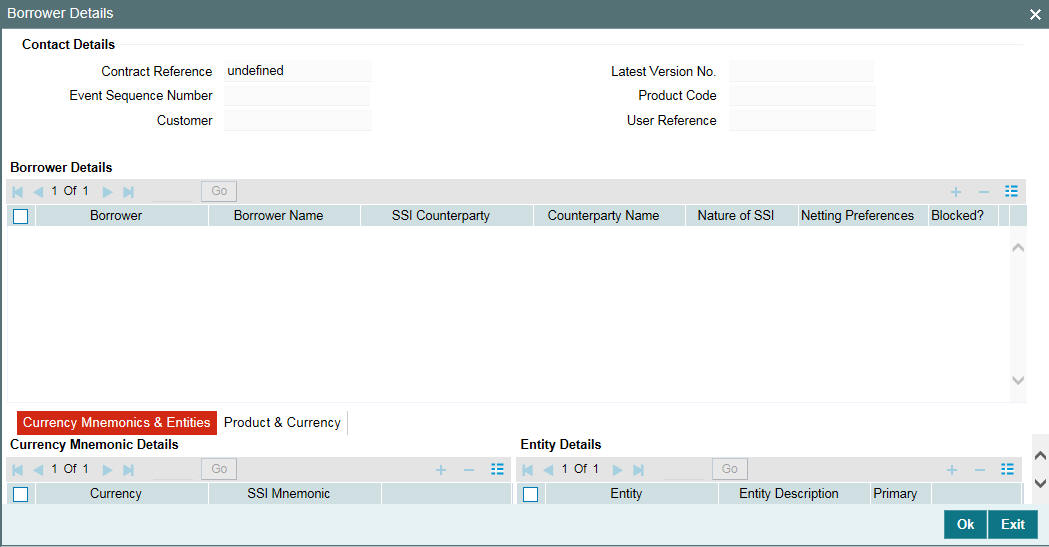

5.5.1 Specifying Borrowers for the Facility

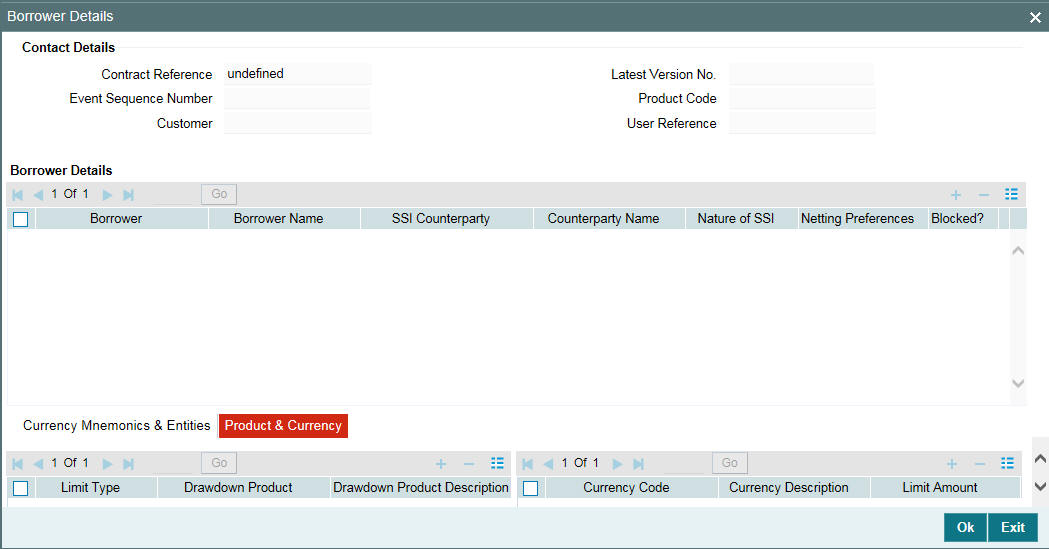

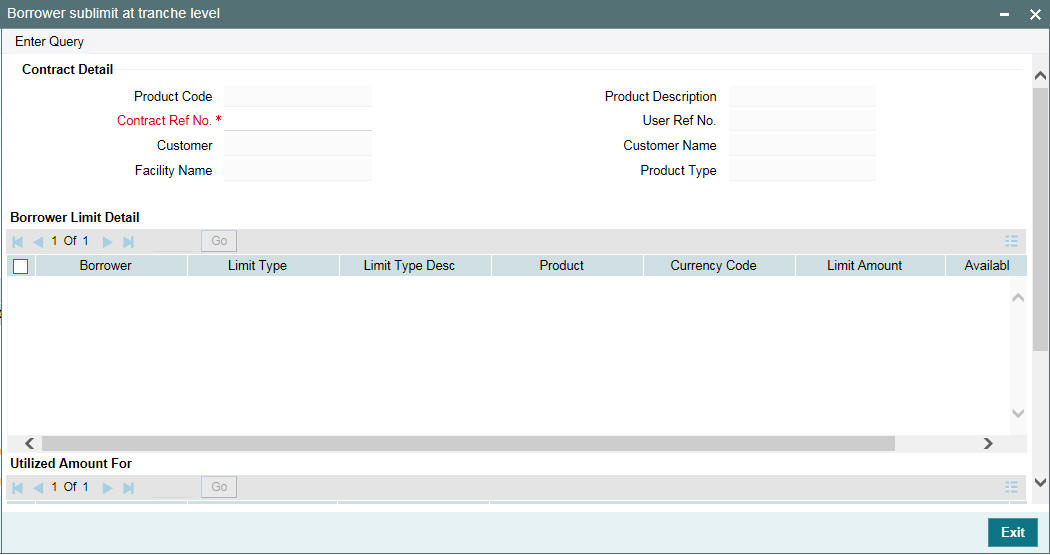

You must specify the borrowers for the facility contract, who actually avail the drawdown loans under the facility contract. Click the ‘Borrower’ tab to invoke the ‘Borrower Details’ sub-screen.

By default, the customer of the facility contract is the borrowing customer. The following details of this customer are displayed in this screen:

- Borrower Code

- Borrower Name

- SSI Counterparty

- Counterparty Name (same as the borrower’s name)

- Entity details of the customer

Note

You can specify more than one borrower for a facility contract.

To add another borrower, do the following:

- Click ‘Add’ button to select a borrower. System displays a message to indicate that the SSI Mnemonic maintained for the counterparty and contract currency becomes applicable for the new borrowers as well. Click ‘OK’ in the message window to continue.

- Select the borrower from the option list provided. The ‘Borrower Name, SSI Counterparty, Counterparty Name and Entity Name’ are displayed when you select the borrower.

- Repeat steps 1 and 2 to add the required number of borrowers for the contract. To remove a borrower from the facility, click the ‘Delete’ button.

Note

You can specify the SSI and Netting Preferences at the tranche level.

The details to be captured for a borrower of the facility contract are discussed below:

Specifying Currency Mnemonic Details

The list of allowable currencies maintained through the ‘Currency details’ screen are displayed in the ‘Currency’ column for each borrower. Here, you are not allowed to add a currency to the list. However, you may specify an SSI (Standard Settlement Instructions) Mnemonic for each of the allowable currency. The SSI selected for the facility contract becomes applicable to the tranches and drawdowns processed under it.

SSI Mnemonic

SSI Mnemonics are maintained in the ‘Settlement Instructions’ screen for a Counterparty, Module, Currency, Product and Branch combination. The same is available for the counterparty/borrower of the facility contract. The option list provided display the following details:

- SSI Mnemonic

- Currency (only SSI applicable for the contract currency/ALL are displayed)

- Counterparty ID and Name

- Debit Account Branch, Currency, and Account

- Credit Account Branch, Currency, and Account

- Sequence Number

The Mnemonics selected here obtains the settlement details for the borrower of the contract.

Note

If you do not associate a Mnemonic with the currencies, the system defaults the SSI Mnemonic for the counterparty and contract currency when you exit the ‘Borrower Details’ screen. The settlement instructions maintained for the counterparty becomes applicable for all the borrowers of the contract.

To return to the ‘Borrower Details’ section of the screen, you have to click ‘Up Arrow’ button.

Maintaining Entity Details for a Borrower

The entities maintained for the counterparty through the ‘Customer Entity Details’ screen defaults to the contract.

Primary Entity

From the list of entities, you can designate one of them as the ‘Primary’ entity. The primary entity will be the recipient of notices and messages for the borrower.

Note

A primary entity must be designated for every customer who is allowed to be a borrower of the facility contract. If not specified, you are not allowed to save the details.

To return to the ‘Borrower Details’ section of the screen, you have to click ‘Up arrow’ button.

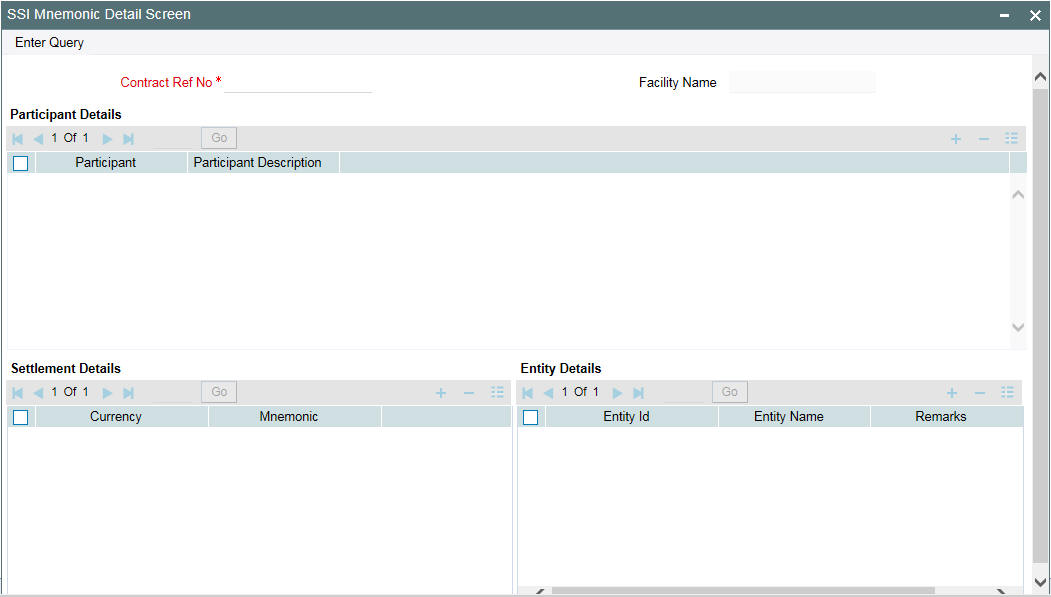

5.5.1.1 Viewing of Settlement Amendment Screen

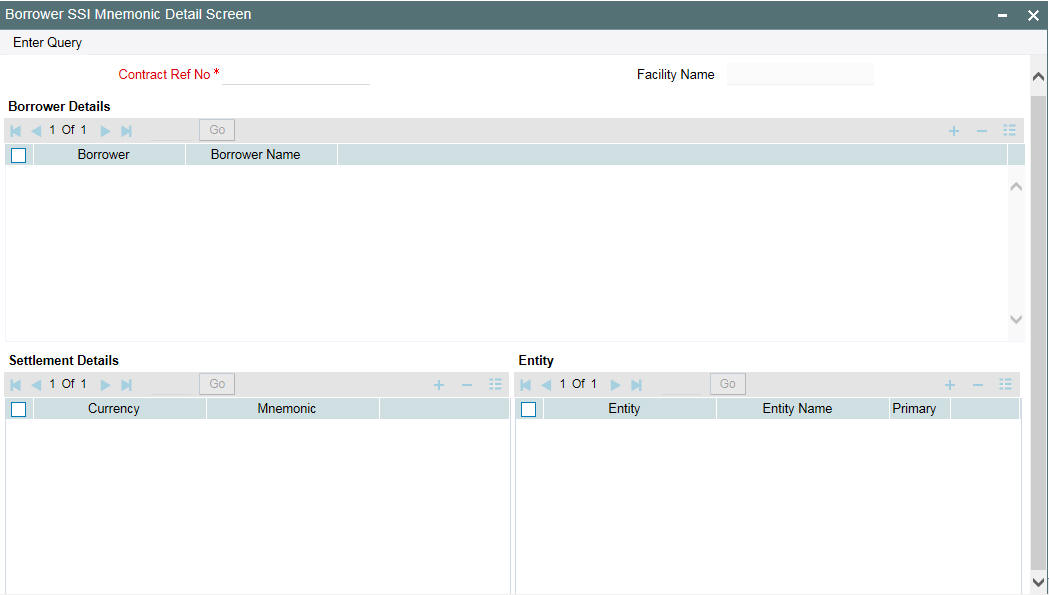

Oracle FLEXCUBE allows you to view the tranche details using the ‘SSI Mnemonic Detail’ screen. You can invoke the ‘SSI Mnemonic Detail’ screen by typing ‘LBDMENMC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can view the details of the participant in this screen.

You can view the details of the borrower in the ‘Borrower SSI Mnemonic Detail Screen’. You can invoke the ‘Borrower SSI Mnemonic Detail’ screen by typing ‘LBDBRMNC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can view the following details in the above screens:

- Contract Ref Number

- Participant Details

- Borrower Details

- SSI Mnemonic

- Entity Details

- Settlement Details

Note

You can click the ’Unlock’ menu and edit the SSI Mnemonic details

In Oracle FLEXCUBE, you can amend the values of both borrower and participant sides made on Loan contracts through the ‘SSI Mnemonic Detail’ screen and then authorize the changes. On authorizing, the system displays the Change Log details along with the old values and new values.

Note

You can click on the ‘Unlock’ menu and edit the SSI Mnemonic details for a particular participant.

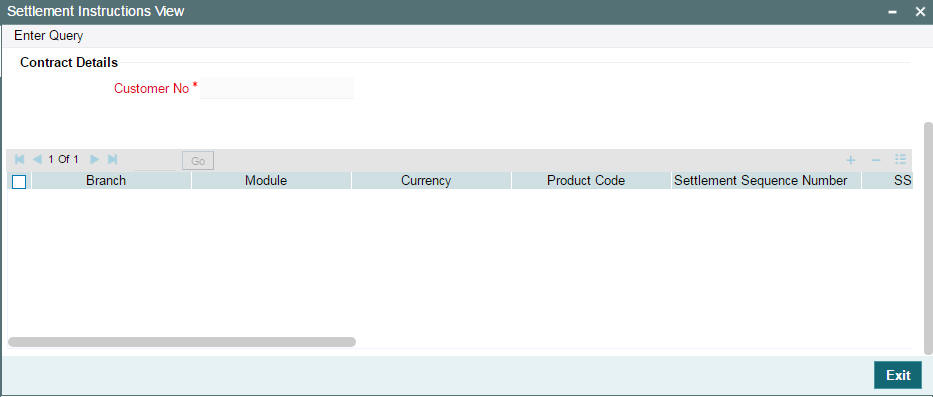

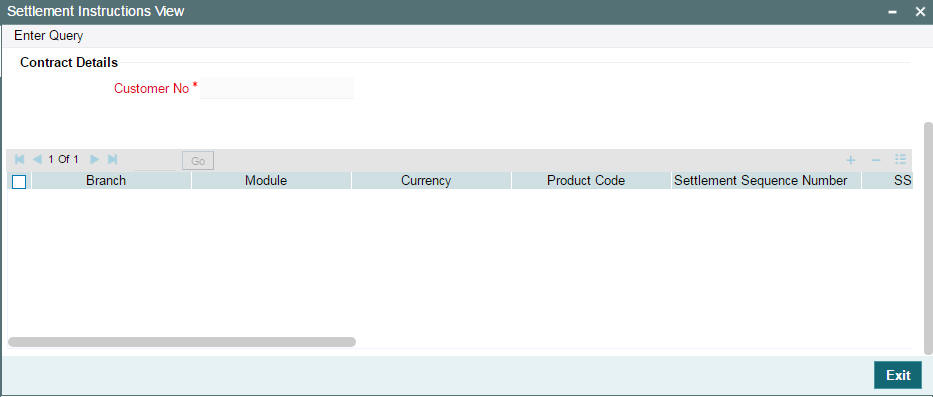

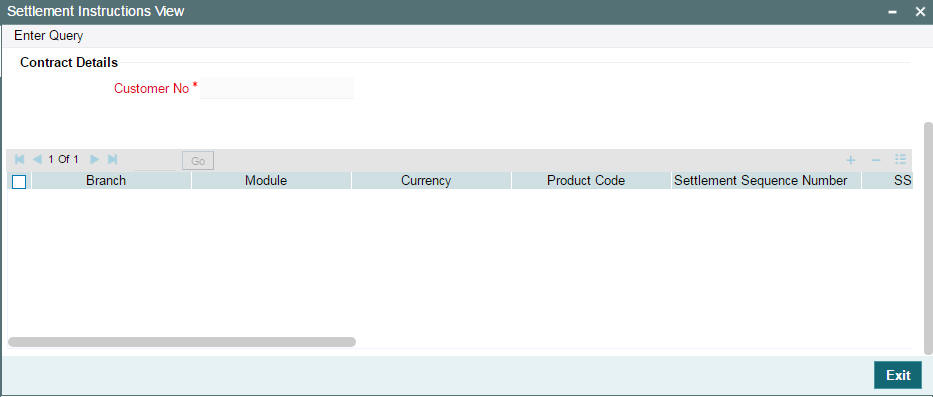

5.5.1.2 Viewing Standard Settlement Instructions for Borrowers

At the facility level, you can view the summary of the standard settlement instructions (SSI) maintained for the borrower and currency combination.

Select the borrower whose SSI details you want to view from Borrower

Details screen and click ‘Settlement

Instructions’ button.

You can invoke the ‘Settlement Instructions View’ screen by typing ‘LBDINSVW’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The details are displayed in the ‘Settlement Instructions’ screen as shown below:

You have to click ‘Exit’ button to exit and return to the ‘Borrower Details’ screen.

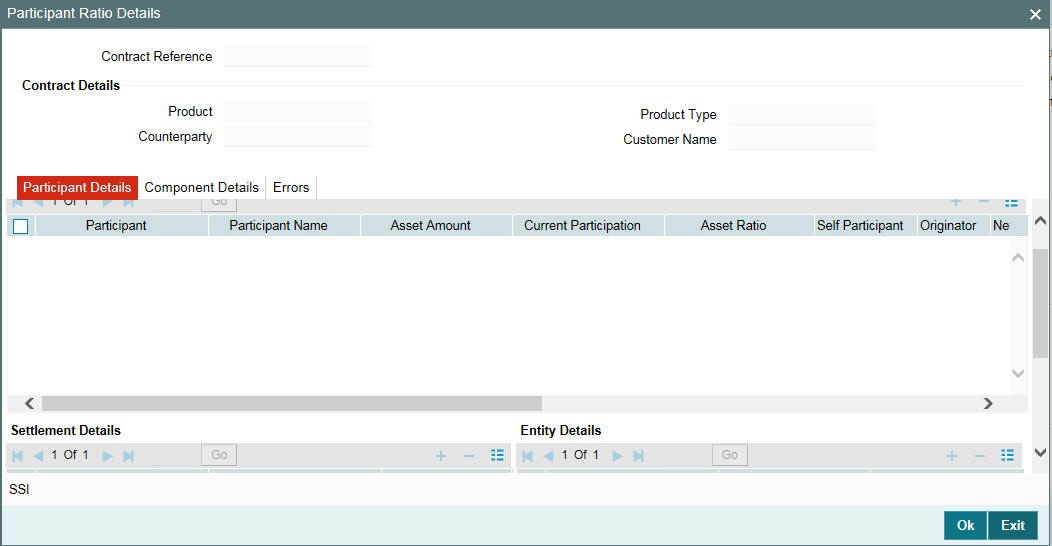

5.5.2 Specifying Participants for the Facility

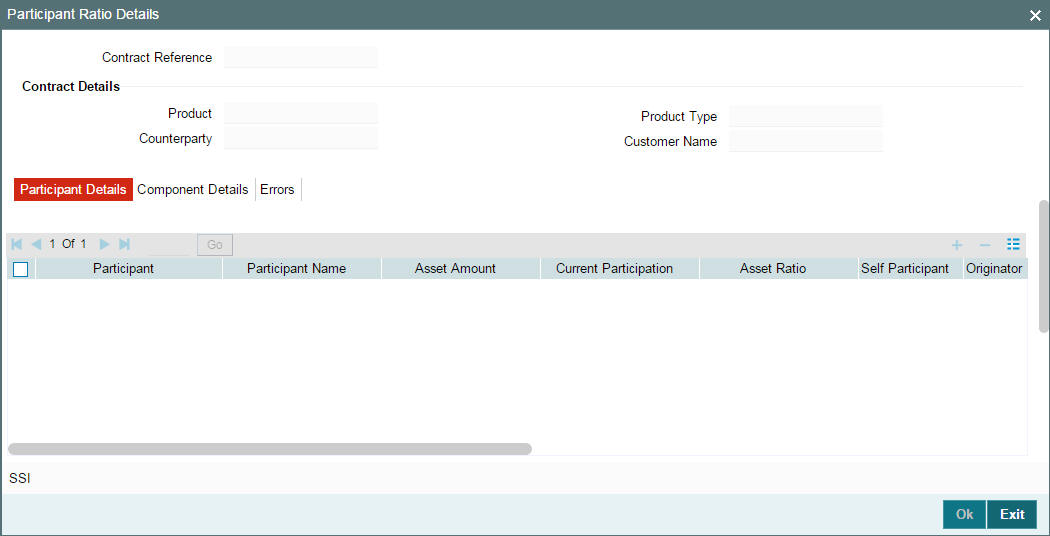

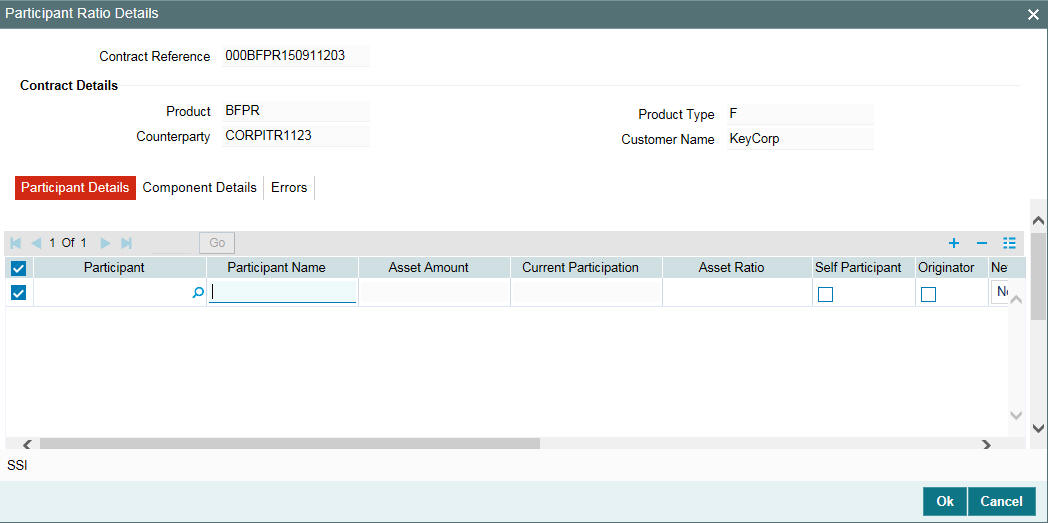

You must also identify the participants who contribute to the syndication agreement for the borrower facility contract. You can do this through the ‘Participant Ratio Details’ screen. To invoke this screen, click the ‘Participant’ tab in ‘Facility Contract Online’ screen.

The following details are displayed in this screen:

- Product Code

- Contract Reference Number

- Customer of the contract

- Participant Name and Code

- Fee components associated with the product (only if the ‘Participant Propagation Required’ option is checked for the component in the Borrower Product – FEE Details’ screen).

- Through this screen, you can select participant details for the contract.

Each of the above procedures is discussed below:

5.5.2.1 Selecting Participants for the Facility

You can select the participants for the contract in the ‘Participant Ratio Details’ screen using Participant Details tab.

You can select participants from the ‘Participant’ option-list.

Note

GFCID is specified at the time of maintaining customer details in the ‘Customer Maintenance’ screen.

In the ‘Participant Ration Details’ screen, you can specify the proportion of income from the interest, charge and ad-hoc fee components (if applicable), which is due to each participant. This is expressed in percentage. System displays the component wise ‘Total’ in the last row.

Note

The component wise total ratio should be 100%. The system displays an error message if the total exceeds or is less than this value.

Additionally, you have to specify the following details for each participant:

5.5.2.2 Maintaining Preferences for the Participant

The following preferences can be defined for a participant:

Self Participant

Select this check box to indicate that the participant is a Self Participant. A self participant is one who is leading the loan contract.

Originator

Select this check box to indicate that the Self Participant is the originator. This is enabled only if the ‘Self Participant’ check box is selected.

You can mark only one self participant as the originator.

SSI Mnemonic

The SSI Mnemonics maintained in the ‘Settlement Instructions’ screen for the Counterparty, Module, Currency, Product, and Branch combination involved in the contract, is displayed in the option list provided. You can select the required value from this list. The value selected here obtains the settlement details for the participants of the contract.

If you do not specify the SSI Mnemonic for all the participants, system displays the following message:

SSI mnemonics for some/all participants have not been entered. It will be defaulted.

Note

You also have the option to select component wise SSI Mnemonic for each participant of the tranche.

For more details on selecting component wise SSIs, refer the heading ‘Changing the SSI for a component’ in this chapter.

Participant Type

Select the type of participant from the drop-down list. Following are the options available in the drop-down list:

- Lender

- Affiliate

- Borrower consent

- Agent consent

Note

The participant type detail should be at the Tranche level.

Entity ID

For each participant, you have to associate an entity(s) to whom copies of the advices related to the contract will be sent. The entities maintained for the participants through the ‘Customer Entity Details’ screen defaults to the contract.

From the list of entities, you can designate one of them as the ‘Primary’ entity. The primary entity is the recipient of notices and messages for the participant.

Note

A primary entity must be designated for every customer who is allowed to be a participant of the facility contract. If not specified, you are not allowed to save the details.

Remarks

You can specify remarks for each entity associated with the participant here. A maximum of 105 characters is allowed.

To select the next participant, click ‘Add Row’ button.

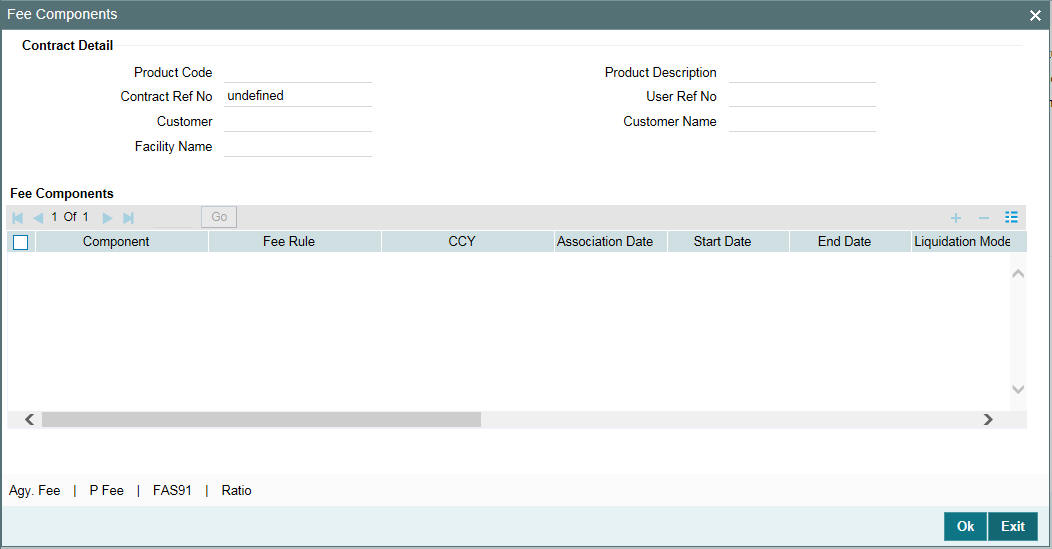

5.5.3 Specifying Facility Fee Details

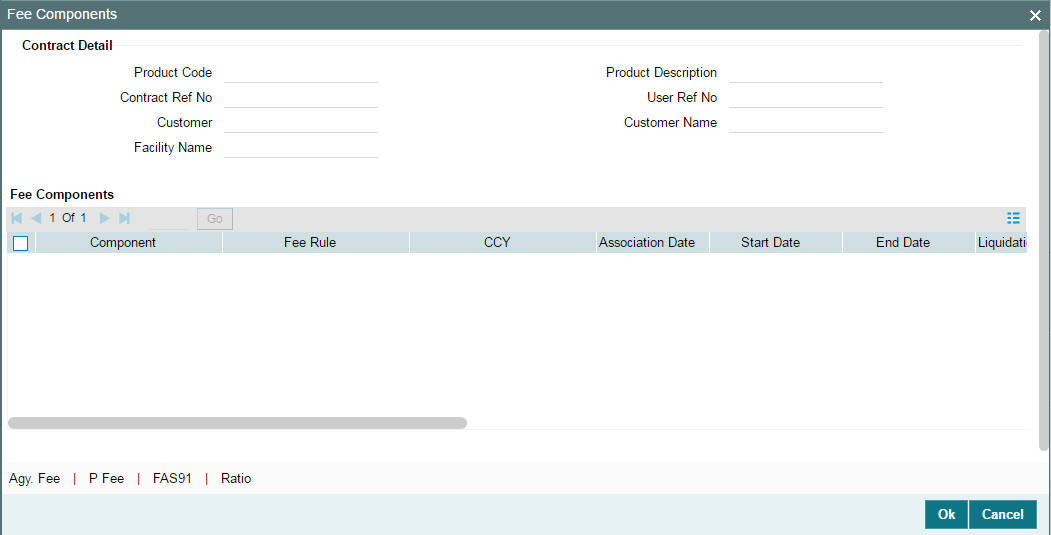

The fee components defined for the underlying facility product becomes applicable to the contract. To view the fee details, click ‘Fee’.

The following details of the components are displayed based on the product used:

- Component name

- Fee Rule, if applicable

- Fee Currency

- Date of Association of the component with the contract. This is equal to the current system date.

- Component Start Date

- Component End Date

- Mode of liquidation, whether ‘Auto’ or ‘Manual’

- Status of the component. On the schedule start date, the status will be ‘Active’. The system automatically updates the status to ‘Liquidated’ when the all the schedules of the component is liquidated.

- The fee basis to calculate the fee amount for schedules. This is defaulted from the product level.

- Whether Billing Notice should be generated for the contract

- Billing notice days required

- Whether this FEE component should be considered for Discount Accrual.

- If the fee end date is less than the current business date, then the ‘Fee Reversed’ box will be checked automatically

Note

The Fee Basis defaults from the product level. However, the system allows you to amend the default value on saving the contract for the first time. Once the contract is authorized, you cannot make any further amendments to the fee basis.

You can modify the following details only:

Start Date

By default, the start date is equal to the ‘Facility Start Date’. This is the date on which the ad-hoc fee component becomes applicable for the facility. You can change the date only if the ‘Allow Start Date Input’ is selected for the component (in the ‘Borrower Product – FEE Details’ screen). If allowed to modify, the new date should be:

- Within the facility start date and end date

- Within the start and end date of the facility product

End Date

By default, the end date will be equal to the ‘Facility End Date’. This date marks the end of the component association period for the facility. You can change this date only if the ‘Allow End Date Input’ is selected for the component (in the ‘Borrower Product – FEE Details’ screen). If allowed to modify, the new date should be:

- Later than the facility start date

- Within the start and end date of the facility product

For more information on ‘Borrower Product – FEE Details’ screen, refer the heading ‘Specifying fee components for a borrower product’ in the ‘Defining Products for Loan Syndication’ chapter of this User Manual.

Liquidation Mode

You can opt to liquidate the components in one of the following ways:

- Auto: The system automatically liquidates the schedule during EOD on the schedule due date of the component

- Manual: If you select this mode, you have to liquidate the fee components through the ‘Fee Liquidation’ screen

Billing Notice Reqd

This value defaults from the product level and indicates whether you want to generate a billing notice for the associated component. You can amend this option, if required.

Note

If the ‘Billing Notice Required’ option is not checked for the product, you can not opt for the same at the contract level. Billing notice is not generated for such contracts.

Billing Notice Days

The billing notice days get defaulted from the product level. You can amend this value if required.

For more details on the manual mode of liquidation, refer the heading ‘Liquidating Fee Components’ in the ‘Processing Charges and Fees’ chapter of this User Manual.

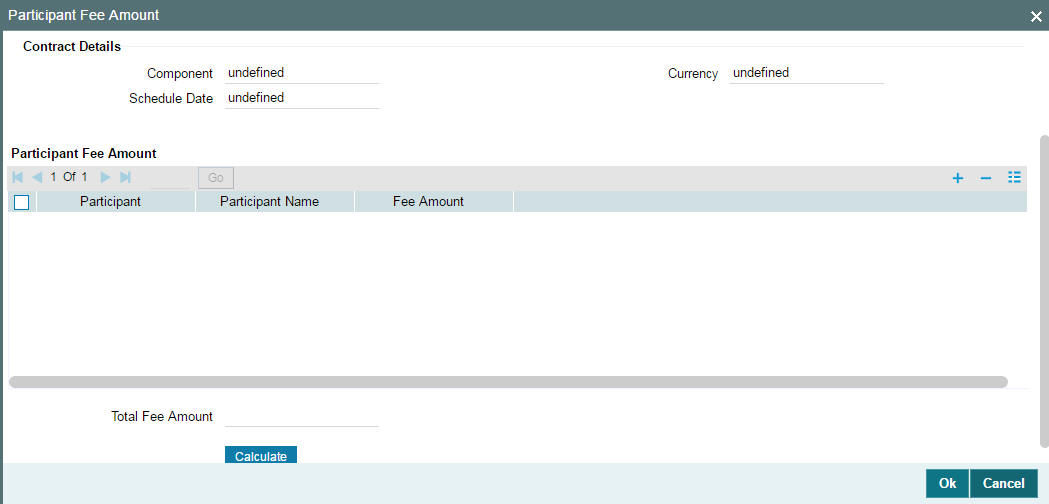

5.5.3.1 Capturing Participant Fee Details

Click ‘P Fee’ in the Fee Components screen to define the fee amount for each participant. This button is enabled only if the fee class is Participant Driven. You can specify the participant fee in the ‘Participant Fee Amount’ screen.

In this screen, click the button to select the participants for whom you want to specify the fee amount. Once you select the participants, the names of the participant’s are displayed. You can specify the amount for each participant in the ‘Fee Amount’ field.

Based on the fee amount you specify here, the participant’s ratio is computed and displayed in the ‘Participant Ratio Details’ screen.

Note the following:

Note

- The individual participant’s fee amount should be greater than or equal to zero

- The Total fee amount should be greater than zero

- As the participants’ ratio is calculated based on the fee amount, you cannot change the participant’s ratio

- You can change the participant’s fee amount for any un-liquidated or overdue schedules during fee amendment

- You can add or remove participants before a schedule is liquidated. This can be done during fee amendment

After changing the details, click the ‘Ok’ to save and exit screen.

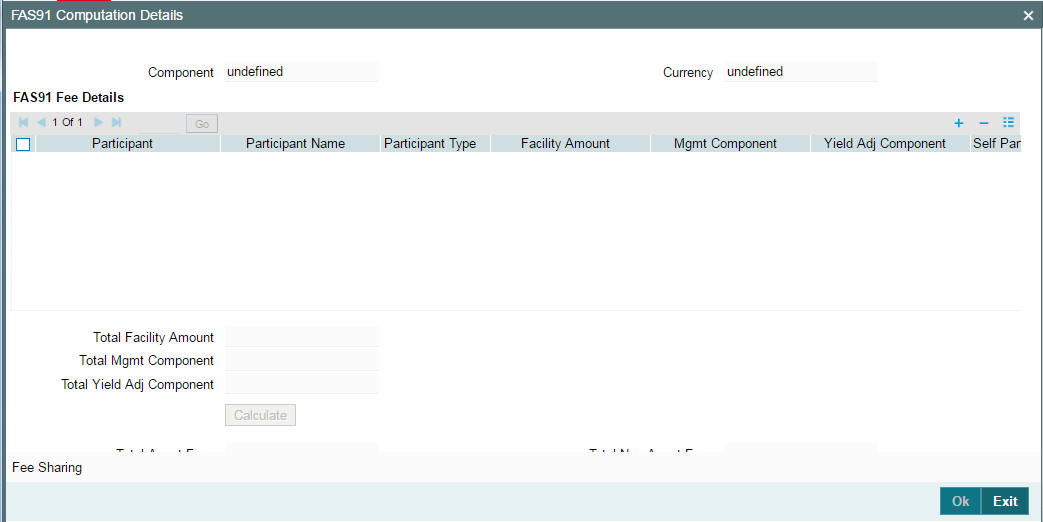

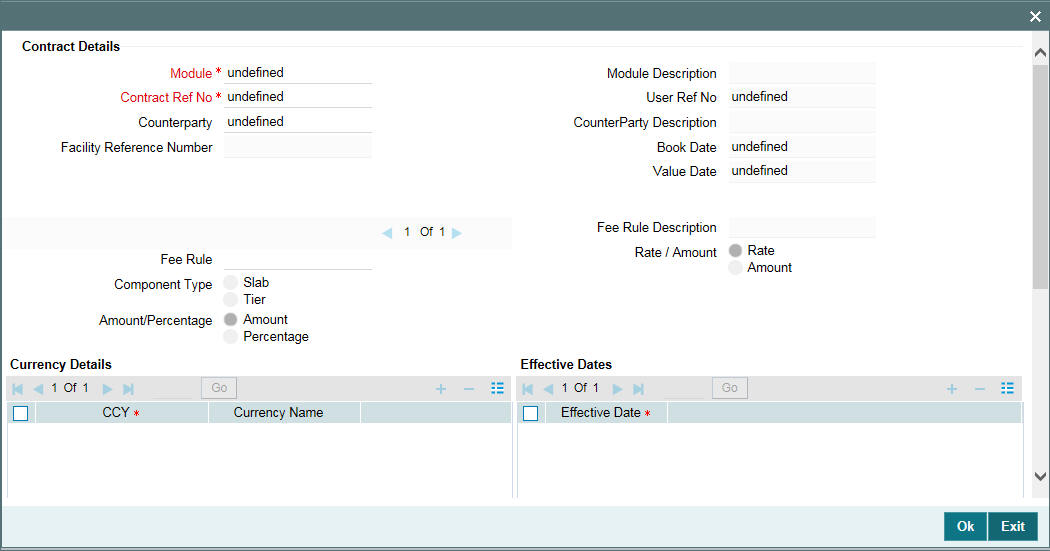

5.5.3.2 Computing FAS91 Fee Details

In the Fee Components screen, you can capture the FAS91 fee details.

On invoking ‘Fee Components’ screen, the following details are displayed:

- Product Code

- Contract Ref No.

- Customer

- Facility Name

- Fee Component

Click ‘FAS91’ to specify information related to FAS91 in the ‘FAS91 Computation Details’ screen. This option is enabled only for components where the FAS91 check box is selected at the product level.

Click to select the participants for whom you want to calculate FAS91 details. A ‘Participant Selection’ screen will pop up with a list of all customers maintained in the system. On selecting the participants, system will display the same under the FAS91 Fee Details section in the ‘FAS91 Computation Details’ screen.

The other details required to be maintained in this screen are as follows:

Participant Type

Select the appropriate participant type from the drop down list. Values in the drop down are:

- Leader

- Co Leader

- Manager

- Co Manager

- Participant

- Others

It is mandatory to specify a type for each participant. However, no validation would be performed on the basis of the participant type.

Facility Amount

Specify the facility amount for each participant. This amount will be used to calculate the weighted average yield for each participant.

Mgmt Component

Specify the management component of the fees. The value you specify here will be used to calculate the Weighted Average Yield. If you do not specify any value, system will default it to zero.

Yield Adj Component

Specify the yield adjustment component of the fees. The value you specify here will be used to calculate the Weighted Average Yield. If you do not specify any value, system will default it to zero. System will validate to ensure that the sum of Mgmt Component and Yield Adj Component does not exceed the facility amount.

Self Participant

Check this box to indicate that a participant is a self participant.

Once you specify the above details, click in the ‘FAS91 Computation Details’ screen. System will compute and display values for the following fields:

Total Bank Fees

This is the sum of the Mgmt Component and Yield Adj Component for all participants for which the ‘Self Participant’ check box was not selected.

Weighted Avg Yield of Part

System displays the weighted average yield of the participant. This is calculated as follows:

Sum (Yield Adjustment Component across all Participants which are not Leaders/Co Leaders and not Self Participant) / Sum (Facility amount across all Participants which are not Leaders/Co Leaders and not Self Participant)

Fees to be Amortized

System displays the fees to be amortized. This is calculated as follows:

Sum (Facility Amount for all self participants) * Weighted Average Yield

Fees to be Recognized

System displays the fees to be realized. This is calculated as follows:

Sum (Mgmt Component + Yield Adj Component of self participants) – (Fees to be amortized)

Pass FAS91 Accounting Entry

Select this check box to indicate that you can pass accounting entries for FAS91.

Note

You can liquidate FAS91 fees with other fee components.

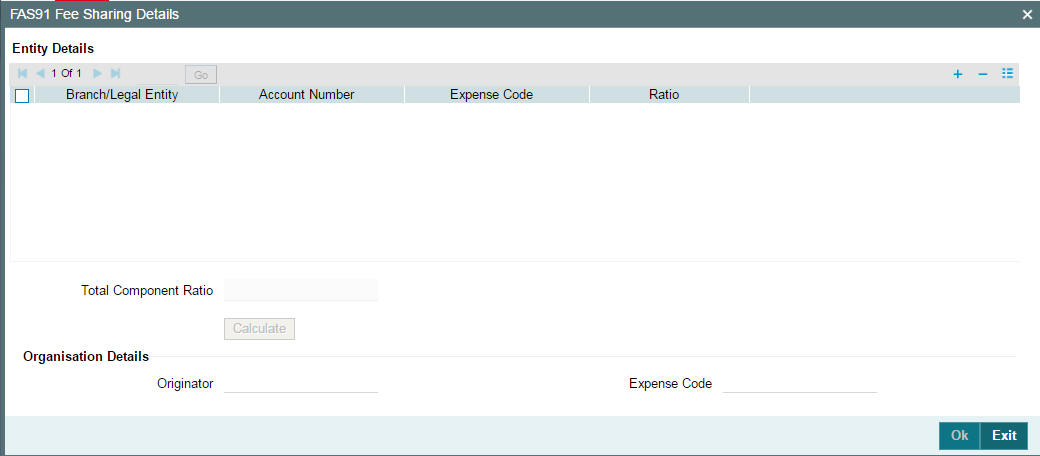

Specifying the FAS91 Fee Sharing Details

You can specify the income sharing between the legal entities for each FAS91 fee using the ‘FAS91 Fee Sharing Details’ screen. Using this screen, you can also capture the branch or legal entity details and the expense code for FAS91 fees.

To invoke the ‘FAS91 Fee Sharing Details’ screen, click ‘Fee Sharing’ in the ‘FAS91 Computation Details’ screen.

Fee Component

System displays the fee for which the fee sharing ratio is calculated. If there are more than one FAS91 fees, system captures the fee sharing ratio for each component.

Branch/Legal Entity

Select the branch or legal entity from the list of options. System displays a list of all the branches maintained in the system in the option list.

Account No.

Select the GL account into which you want to post an entry. System displays a list of all GL leaves for the branch code are displayed in the option list.

Expense Code

Specify the Expense code with which you want to post an entry. System displays a list of all valid MIS codes in the option list.

Ratio

This is the ratio in which the ‘Fee to be Recognized’ is to be split. For example, if the ‘Fee to be Recognized’ is 100,000 out of which 40,000 is to be posted to the Branch, GL, Expense Code, you need to specify 40 in this field.

System validates to ensure that the total ratio is always 100.

Originator

If you have checked the ‘Self Participant’ and ‘Originator’ check boxes against a participant in the Participant Ratio Details screen, the name of the participant is defaulted here.

Expense Code

Select an Expense code of the originator self participant from the option list. System displays a list of all valid Expense Codes in the Branch of the Self Participant. This expense code is used while passing the accounting entries for the Fees to be amortized.

On clicking ‘Ok’ system performs the following validations:

- The total ratio should always be 100.

- You can specify the ratio for a branch/legal entity only once.

- You can amend the fee sharing ratio till liquidation of the fee component.

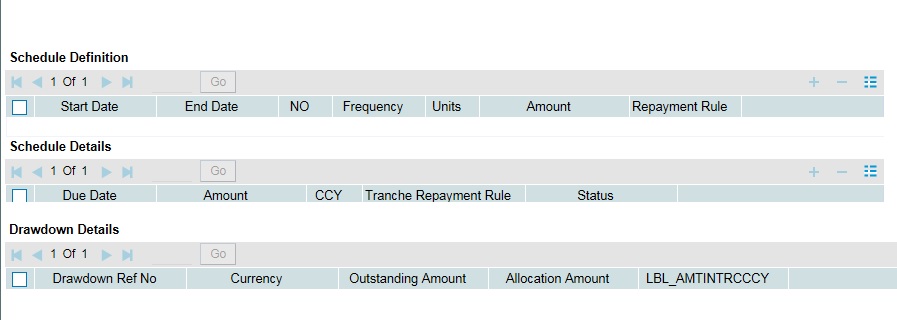

5.5.4 Maintaining Facility Fee Schedules

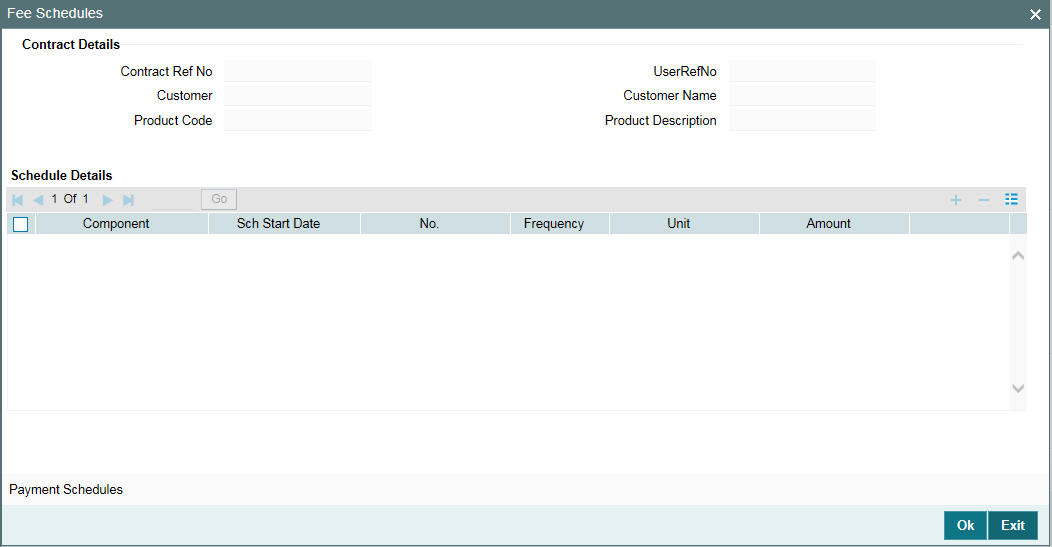

You can specify schedules for fee components through the ‘Fee Schedules’ screen. To invoke this screen, click the ‘Fee Schedules’ button in the ‘Facility Contract Online’ screen.

Capture the following details in this screen:

Component

The fee components that have been associated with the product are available in the option list. Select a component from this list. Upon selection of the component, the ‘Schedule Start Date, Frequency and Unit’ are also displayed. You can change the default values.

Sch Start Date

This is the date on which the schedule for the fee component for the borrower facility begins. By default, this is equal to the fee ‘Association Date’. The first schedule would fall due on this date. You can change the date to any date that falls between the ‘Association Date’ and the ‘Facility End Date’.

No.

You must specify the number of schedules that would apply to the fee component of the borrower contract.

If you define a single schedule (that is, the number of schedules is one), Oracle FLEXCUBE initiates one schedule on the start date mentioned, not taking into account the frequency and the frequency unit.

Note

The Start Date for a single schedule is as follows:

- The Maturity Date if the Fee Collection Mode is ‘ARREAR’

- System date if the Fee Collection Mode is ‘ADVANCE’

If you define more than one schedule, Oracle FLEXCUBE initiates the first schedule on the start date mentioned, and subsequent schedules based on the frequency and the frequency unit specified.

Frequency

Select the periodicity at which the schedules must be initiated, with the first schedule on the start date mentioned. The options available are

- Daily

- Monthly

- Yearly

- Bullet

Unit

You can specify the units in which the specified frequency are reckoned. For instance, consider a contract with the following details:

- Frequency: Monthly

- No: 2

- Unit: 5

This means that the contract will have two schedules, initiated once in five months.

Amount

If the ‘Basis Amount Tag’ of the fee component is ‘User Input’ (as specified in the Borrower Product – Fee Details’ screen), you can capture the amount to be liquidated towards the fee component on the schedule date.

For all other ‘Basis Amount Tags’, the system computes the fee amount based on utilization.

For more details on defining fee components, refer the heading ‘Associating a Fee Class or Fee Rule with a product’ in the ‘Processing Charges and Fees’ chapter of this User Manual.

Note

- For ‘Participant Driven Fee’, only bullet schedules are allowed

- The total fee amount specified in ‘Participant Fee Amount’ is displayed in the ‘Fee Schedules’ screen. You cannot amend the same here. However, you can change the fee amount only in the ‘Participant Fee Details’ screen.

- If an un-liquidated schedule is deleted, the fee amount in the ‘Participant Fee Amount’ screen is also deleted.

- If you change the schedule date of an un-liquidated fee schedule, the fee amount in the ‘Participant Fee Amount’ screen is remapped to the new schedule date.

- For participant fee components, there cannot be more than one un-liquidated schedule

5.5.4.1 Viewing the Payment Schedules

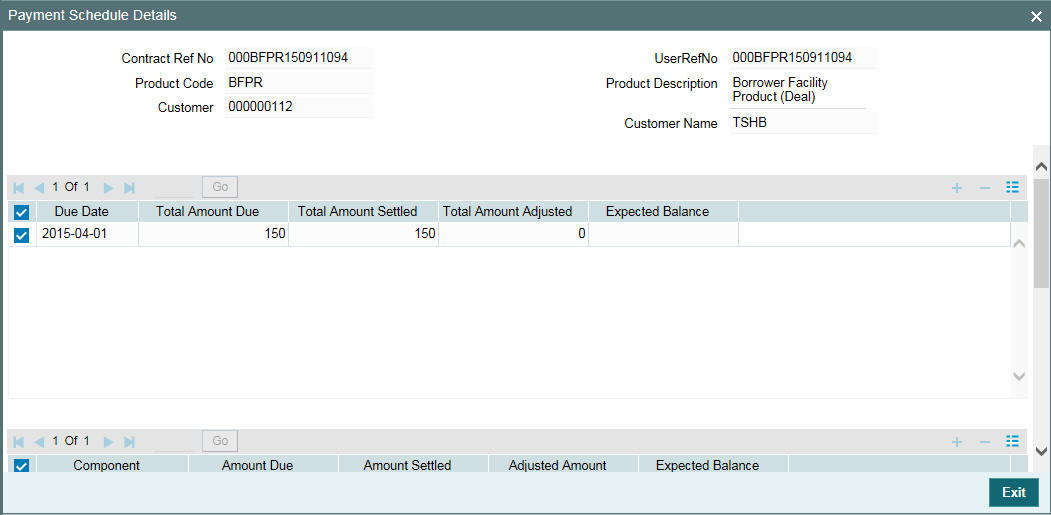

After capturing the schedules for the fee components, you can view the payment schedule details for the contract. To view the details, click the ‘Payment Schedules’ button.

The ‘Schedule Payment Details’ screen is displayed as shown below:

The following details are displayed in this screen:

- Due Date of the fee

- Total Amount Due

- Components due

- Amount due against each component

- As and when settlements are made, the system updates this screen with the following details: Total Amount Settled on the due date

- Total Amount Adjusted, if any

- Expected Balance

For each component, it updates the following details:

- Amount Due

- Amount Settled

- Adjusted Amount

- Expected Balance

- Input Date

- Value Date

- LCY Equivalent

In the ‘Payment Schedule Details’ screen you can view the schedule date changes and schedule history details.

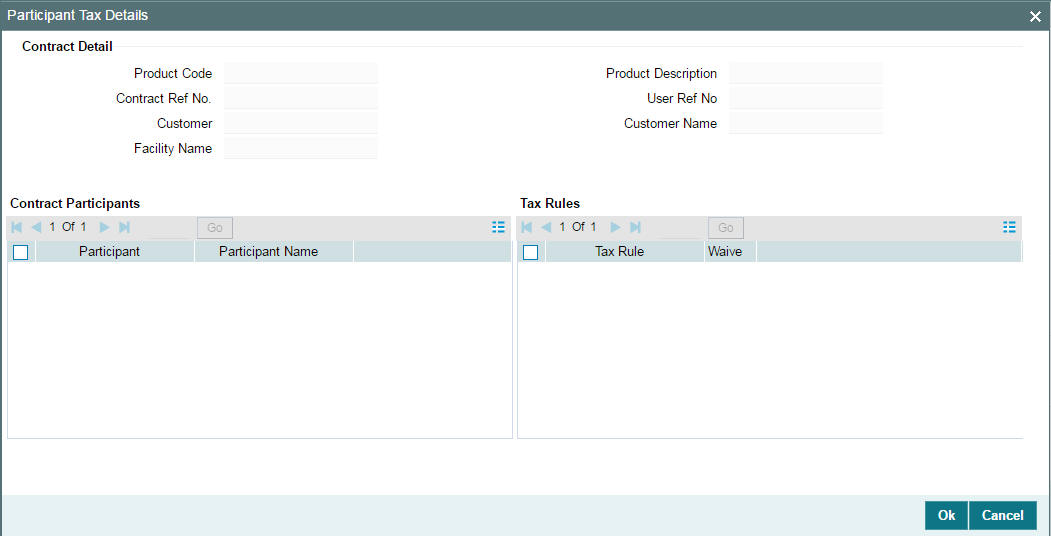

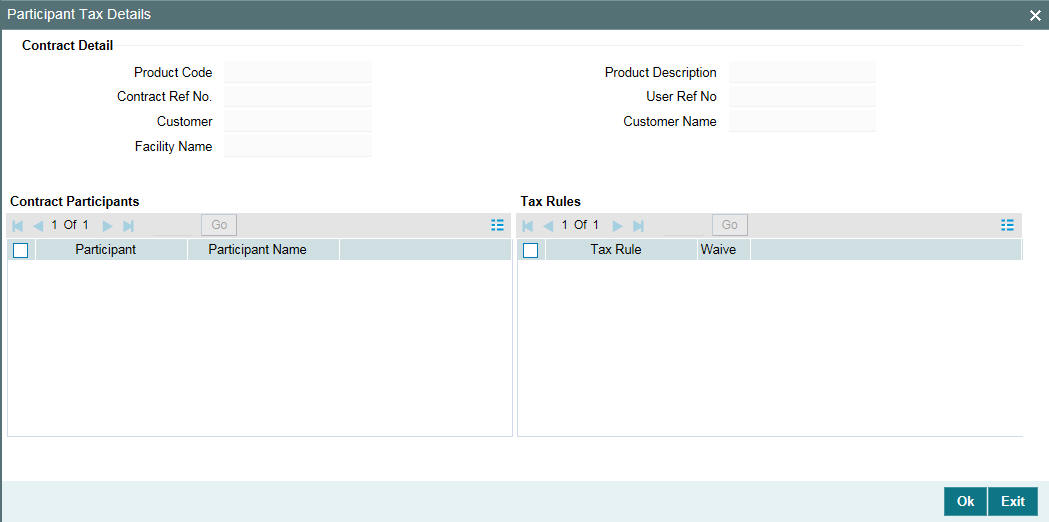

5.5.5 Viewing Tax Details for the Facility

You can collect withholding tax from participants on fee components.

If you have associated tax rules with the participant product linked

with the underlying facility product, the same becomes applicable to

the facility. You can view the tax details for the contract in the ‘Participant

Tax Details’ screen. Click the ‘Tax’ to invoke the screen.

This screen displays the list of participants for the contract and the tax rules associated the contract, if any. This defaults from the facility product. If required, you may cancel the application of tax rule(s) for a participant. To do this, check the ‘Waive’ option against the selected tax rule.

The system passes the entries for tax based on the event you specify in the ‘Product Tax Linkage’ screen. Typically, tax on fee is calculated upon liquidation of the fee (event ‘FLIQ’ will be associated with the rule)

You can view the position identifier description in case the participant is Self Participant.

For details on associating tax with a product, refer the heading titled ‘Specifying tax details for a participant product’ in the ‘Defining Products for Loan Syndication’ chapter of this User Manual.

For more information on the Tax sub-system of Oracle FLEXCUBE, refer the Tax User Manual.

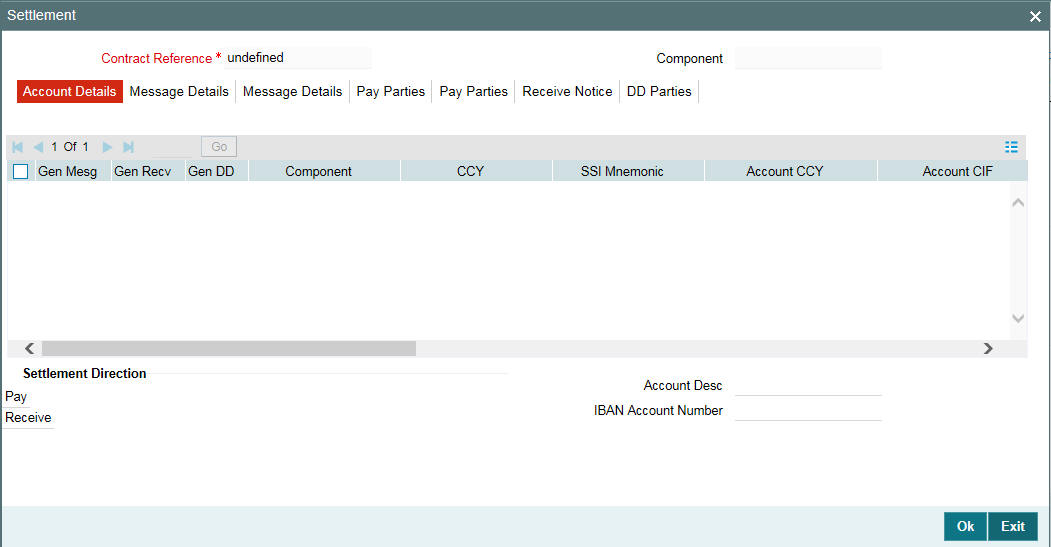

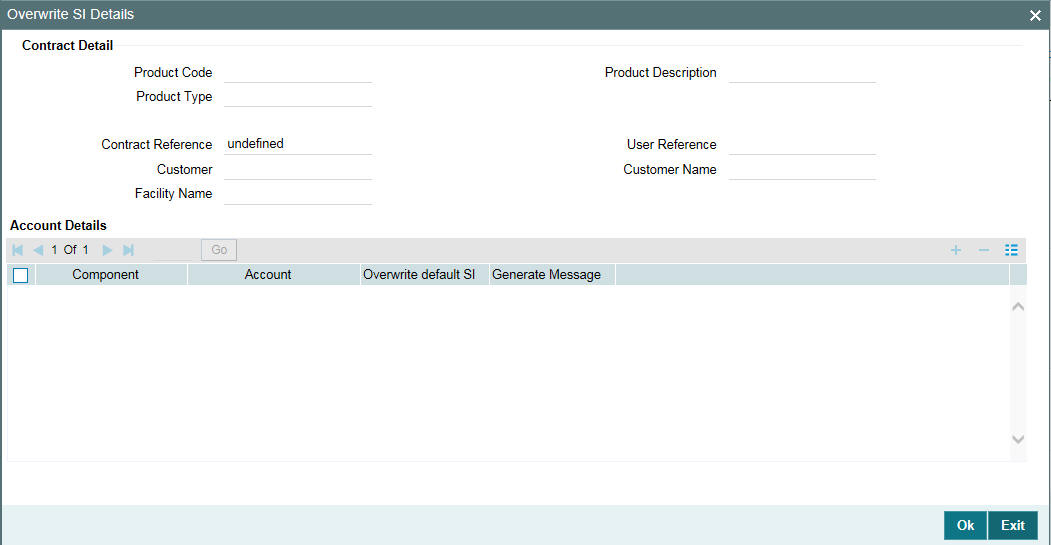

5.5.6 Specifying Settlement Instructions

You can view the settlement instructions for each borrower of the contract. You can use the ‘Settlement Message Details’ screen to do this. Click ‘Settlements’ in the ‘Facility Contract Online’ screen to access it.

The system obtains the settlement details based on the SSI Mnemonic for each borrower.

Note

When you are entering a contract in the ‘Facility

Contract Online’ screen, and you click the ‘Settlements’ tab to invoke the ‘Settlement

Message Details’ screen, the first line in Field 72 of the message

generated will be replaced by the name of the customer (or borrower)

involved in the contract. The second line will be replaced by the ‘User

Reference Number’ of the tranche contract. Once the SWIFT message

is generated, the customer name and the user reference number will be

displayed in the section titled ’72: Sender to Receiver Information’

in the second ‘Msg Details’ tab. This is shown below:

If the ‘Chinese Characters in Payment’ box is checked in the ‘Loan syndication- Branch Parameters’ screen, then only you can enter the Chinese characters in the field 57, 59, and 70 for foreign currency and local currency settlement instructions / accounts and there will not be any validations in the system. You need to operationally control it.

You are allowed to enter the information in Chinese or English or a combination of both in this field. If it is a combination, then the system will consider it as Chinese and allow up to 35 characters.

Note

This is applicable only for ASPAC region.

For more details about the ‘Settlement Message Details’ screen, refer the Settlements User Manual.

Click the ‘Exit’ button to exit the screen.

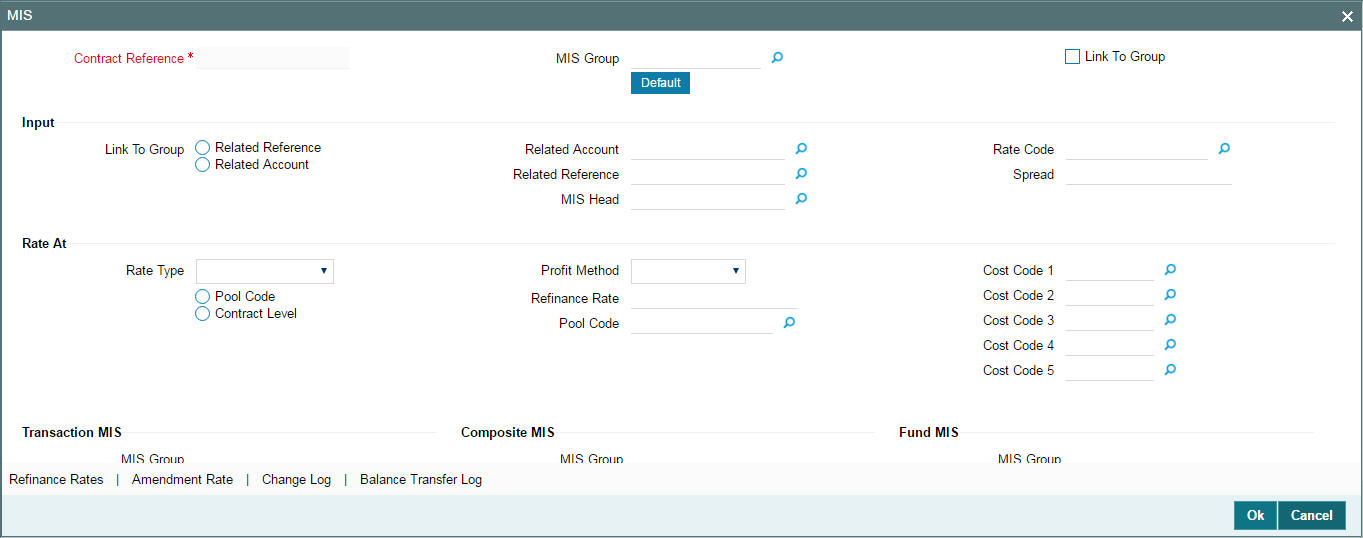

5.5.7 Viewing the MIS Details

You can view the MIS (Management Information System) details in the ‘MIS Details’ screen. To invoke this screen, click the ‘MIS’ in the ‘Facility Contract Online’ screen.

For details on the ‘Transaction MIS Details’ screen, refer the MIS User Manual.

5.5.7.1 Validating Expense and Proof Codes

While booking a new facility, upon selection of named agent, the system defaults expense code and proof code in Transaction MIS maintenance sub-screen in facility contract online screen.

While booking a new tranche, Expense code and proof code from facility contract are defaulted in MIS sub-screen in tranche online screen.

Similarly, while booking a new Drawdown, Expense code and proof code from tranche contract are defaulted in MIS sub-screen in Drawdown online screen

System allows you to change the values of the expense code and proof code in the MIS screen, while booking a facility, tranche, or a drawdown. However, if the validation fails, system displays appropriate error messages if the following validations are not met:

- The proof and expense codes must have proper mapping in named agent maintenance screen for the named agent associated in facility, tranche, and drawdown.

- The named agent at facility, tranche, or drawdown level should be the same as the named agent mapped for the expense code / proof code being selected

- Tranche contract proof code / expense code must be same as the proof code / expense code of the associated facility

- Similarly, the Drawdown contract proof code / expense code should be same as the proof code / expense code of the tranche

- Proof code or expense code should not be blank for the named agent facility, tranche, and drawdown contracts

- System allows you to book a tranche with expense code / proof code values different from the expense code / proof code of the underlying facility. The expense code and proof code for the tranche / drawdown will be same as facility if the facility is for a named agent. System will default the expense code / proof code from the facility while booking the tranche and defaults from tranche while booking the Drawdown.

Note

- You must ensure that the values for the Department Code and Proof Code maintained in the system are the same.

You cannot amend the proof code and expense code in the respective MIS screens after the tranche/drawdown is authorized.

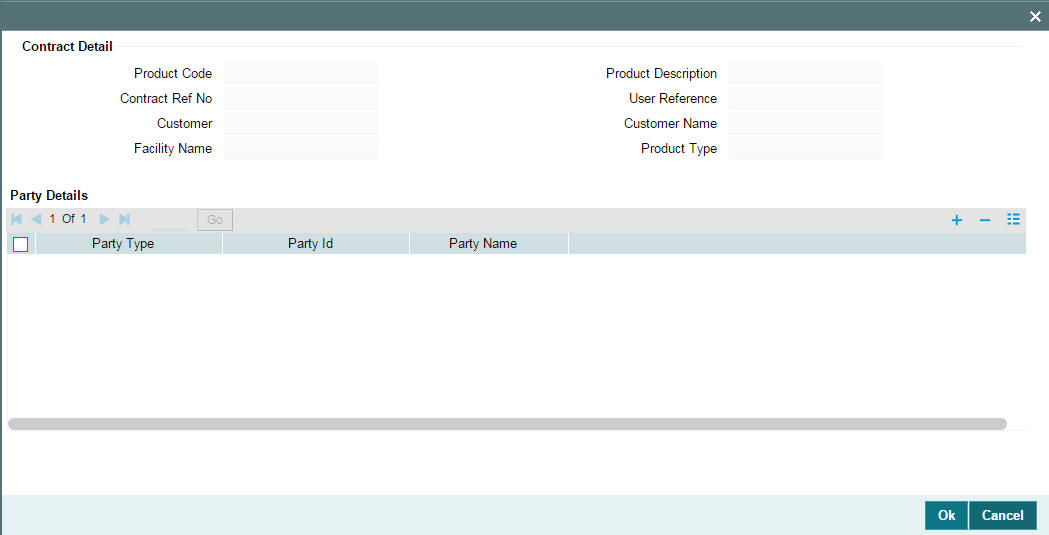

5.5.8 Specifying Parties for the Facility

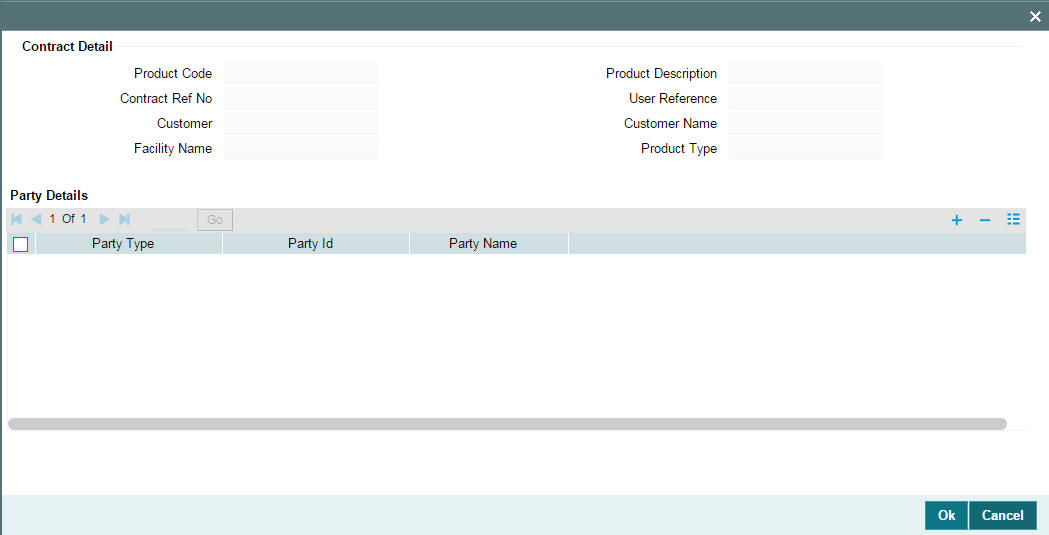

You can also specify the different types of parties that would be applicable for the borrower facility contract, as well as the applicable parties belonging to the selected type, in the ‘Party Details’ screen.

Too invoke the ‘Party Details’ screen, click ‘Party type’ button in the ‘Facility Contract Online’ screen.

Capture the following in this screen:

Party Type

The party types associated with the borrower facility product is applicable for the contract. The option list displays the same. Select a type from this list.

Party ID

For the chosen party type, you have t select a party from the option list. This list displays all the customers maintained in the system. Upon selection of the ID, the ‘Party Name’ is displayed alongside.

Note

- You can specify multiple parties for a selected ‘Party Type’, if the option ‘Repeating’ is set to ‘Yes’ at the product level. If multiple parties are not allowed, you can specify only one party for the selected type.

- If a ‘Party Type’ is set as ‘Mandatory’, you must specify at least one party for the party type at the contract level

For more details on this, refer the heading ‘Associating appropriate party types for borrower facility products’ in the ‘Defining Products for Loan Syndication’ chapter of this User Manual.

5.5.9 Saving the Facility

After capturing the required details, you have to save the contract and have it authorized by your supervisor.

For more details on ‘Save’ and ‘Authorization’, refer the Common Procedures User Manual.

After the facility is saved and authorized, the following details will be displayed in the audit trail section at the bottom of the screen:

- Entry By: Login ID of the person who has performed the save operation

- Entry Time: The date and time when the facility was saved in the system

- Auth By: Login ID of the person who authorized the facility

- Auth Time: The date and time when the facility was authorized in the system

- Contract Status: Active

- Auth Status: Authorized

- Participant Processing Status: Processed

After you save the contract, you can view the following details of the contract:

- Diary Events for the contract

- Participant Summary details

- Events

These details are discussed below.

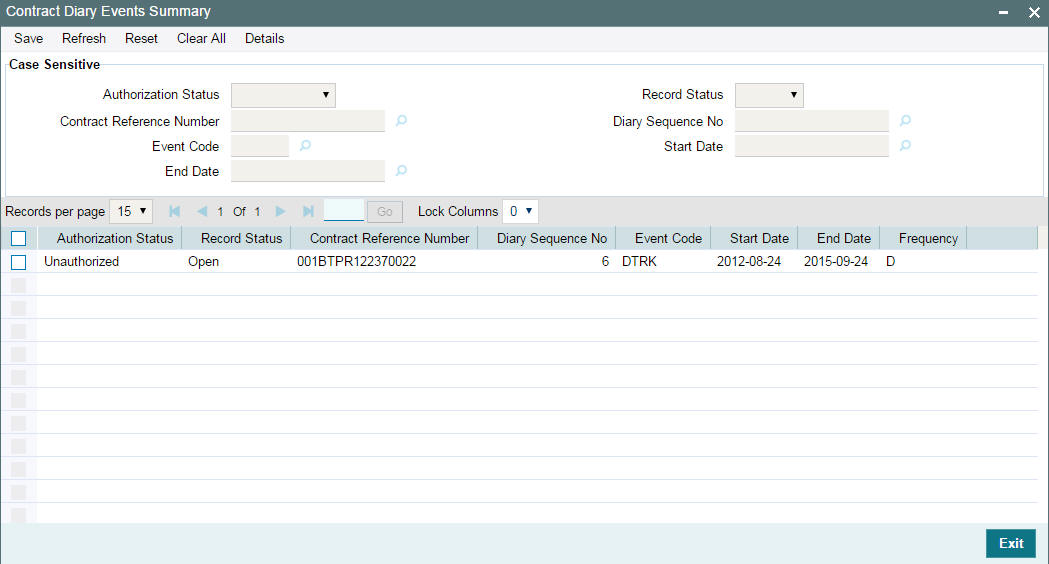

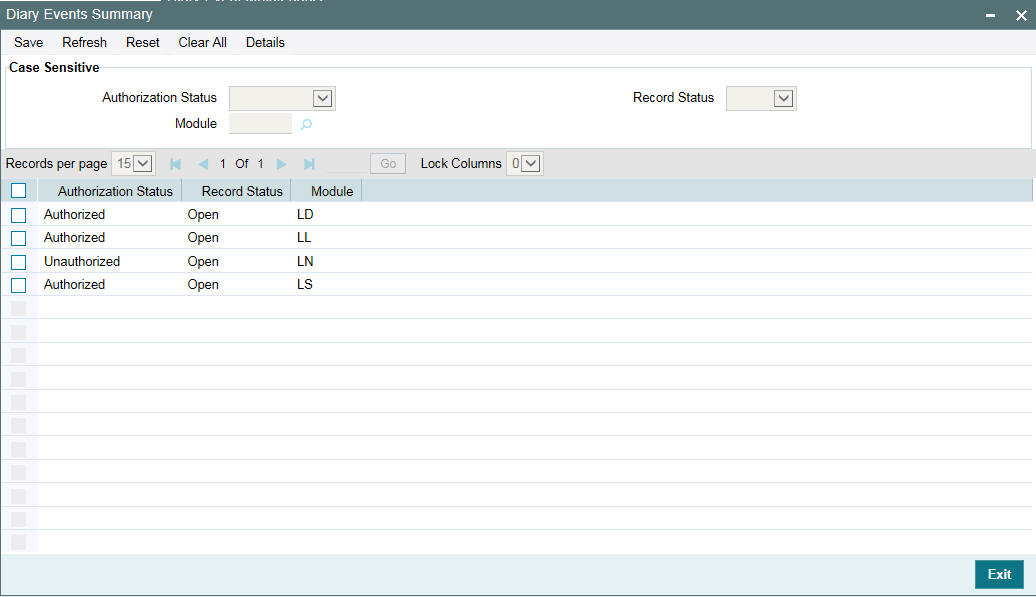

5.5.10 Viewing Facility Diary Events

You can view the diary events defined for the contract in the ‘Diary Contracts – Summary’ screen. To invoke this screen, click ‘Diary’.

Diary events are user defined events which are maintained at a module level through the ‘Diary Event Maintenance’ screen. You can associate the required diary events with a product in the ‘Diary Event Association’ screen.

The system allows you to perform a case-independent query (upper, lower, or mixed case) using the following fields:

- Contract Ref No

- Branch

- Event Code

Note

You can perform a case independent search only if the parameter, ‘CASE_SENSITIVITY’ in cstb_param, is set to ‘Y’

For more details on this screen, refer the heading ‘Maintaining diary events’ in the ‘Reference Information for Loan Syndication’ chapter of this User Manual.

For a borrower facility, tranche or drawdown contract, you can specify diary events that needs to be processed through the ‘Contract Diary Events’ screen.

Refer the heading ‘Specifying diary events for a borrower syndication contract’ in this chapter for details on the ‘Contract Diary Events’ screen.

5.5.11 Viewing Participant Summary Details

The ‘Participant Facility Contract Summary’ screen will give you a summary of the participant facility contracts created under a facility contract. To view the details, click the ‘Part Sum’.

In this screen, the following details are displayed:

- Authorization status of the contract: The possible values are:

- A – Authorized

- U – Unauthorized)

- Contract Status: The possible values are:

- A – active

- L – Liquidated

- H – Hold

- Y – Yet to be initiated

- V – Reversed

- Contract Reference Number: The reference number of the participant contracts created under the facility contract

- Reference Number of the Borrower Facility Contract

- Product used to create the participant contract: The system picks the offset participant facility product maintained for the facility product (in the ‘Facility Product Preferences’ screen) for the resultant participant facility, tranche and drawdown contracts.

- Currency: The currency for each participant contract will be same as that of the facility contract.

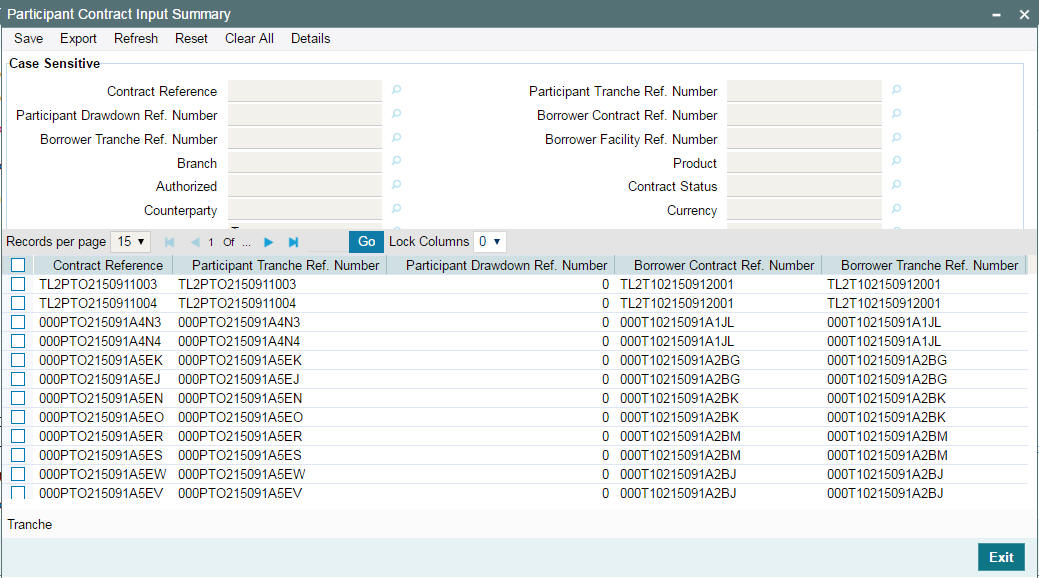

- Customer: The participants selected for the facility contract