7. Processing Repayments

This chapter contains the following sections:

- Section 7.1, "Repayments"

- Section 7.2, "Defining Schedules for a Product"

- Section 7.3, "Defining Drawdown for a Contract"

- Section 7.4, "Defining Schedules for a Contract"

- Section 7.5, "Processing Repayments Manually"

- Section 7.6, "Processing Prepayments"

7.1 Repayments

When you disburse loans to a borrowing customer through a drawdown against a tranche under a borrower facility, you also define the terms according to which the loan components should be repaid. You can define your own repayment schedules. For instance, you could choose to have the principal repaid at maturity, with the interest component being repaid monthly. You could also define the repayment terms to suit your customer’s requirements.

In Oracle FLEXCUBE, you can define the repayment schedules when you define a product. These default to all contracts processed under the product. However, Oracle FLEXCUBE gives you the flexibility to change the schedules for a specific contract, if required.

Repayments, in the context of a syndication contract, involve liquidation of the following components:

For tranche contracts

- Charges

- Ad-hoc fees

For drawdown contracts

- Loan Principal

- Interest /Charges

- Ad-hoc fees

7.1.1 Reversing a Payment

Currently, in Oracle FLEXCUBE you can reverse a payment only if liquidation is the last event of the contract. However, this process has been amended to allow reversal of payment even if liquidation is not the last event.

System makes the following validations before reversing a payment:

- The last payment is not beyond the last PRAM date for a tranche or drawdown

- The reversal of any Non-Prorata payment is not beyond the last VAMI date

- If Payable/Receivable is populated for a schedule for which payment has already been made, system does not allow reversal of payment.

7.2 Defining Schedules for a Product

You can define the following attributes for repayment schedules, when you define them for a drawdown product:

- The mode of liquidation (automatic or manual)

- Liquidation of schedules due before the date on which a drawdown is initiated

- The type of schedule – Capitalized or Normal

You define these attributes in the ‘Product Preferences’ screen that you invoke by clicking ‘Preferences’ tab in the Loan Syndication - Product Definition (LBDPRMNT) main screen.

If the mode of liquidation specified for a schedule is automatic, it is liquidated by the ‘Automatic Contract Update’ function. If the mode is specified as manual, you must manually liquidate them through the ‘Contract Schedule Payments’ function.

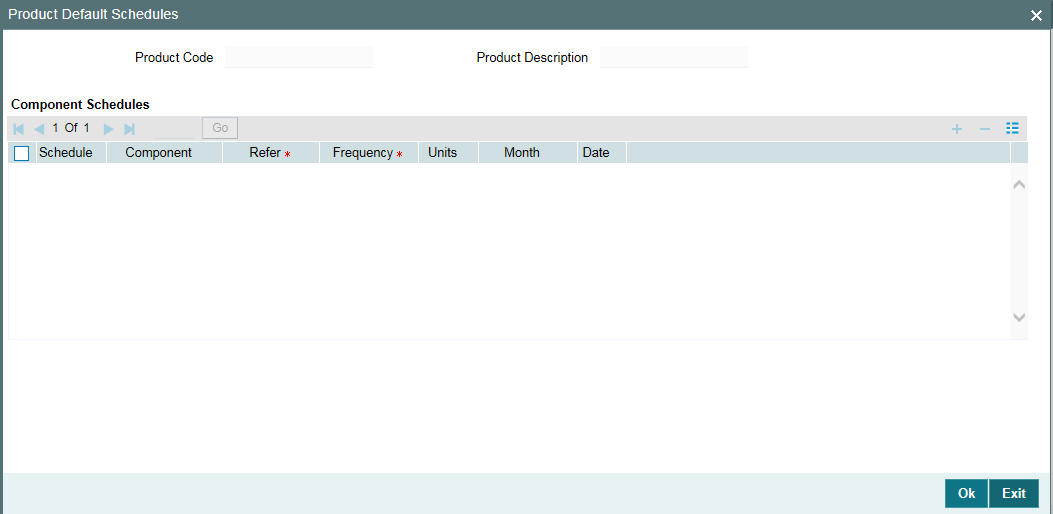

After specifying the attributes for repayment schedules, you can specify the repayment details for each component of a drawdown loan, such as the reference date, the frequency and the month and date, in the ‘Product Default Schedules’ screen.

This screen is invoked when you click the ‘Schedules’ tab in the ‘Product Preferences’ screen.

These are the attributes for repayment schedules that would apply to all drawdown loan contracts involving the drawdown loan product for which they have been specified.

The manner in which you specify the attributes for the repayment schedules for a drawdown borrower or participant product is much the same as for a normal loan product.

For a detailed description, refer to the chapter ‘Processing Repayments’ in the Loans User Manual.

Note

To indicate Forward Processing is applicable to the borrower tranche or drawdown product during the event LIQD, select the option ‘Semi-Auto’ against the field ‘Liquidation Mode’. The systemprocesses the two events, but hold the messages. The messages are held in the ‘Forward Processing Queue’.

For details on forwards processing, refer the heading titled ‘Processing events marked for forward processing’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

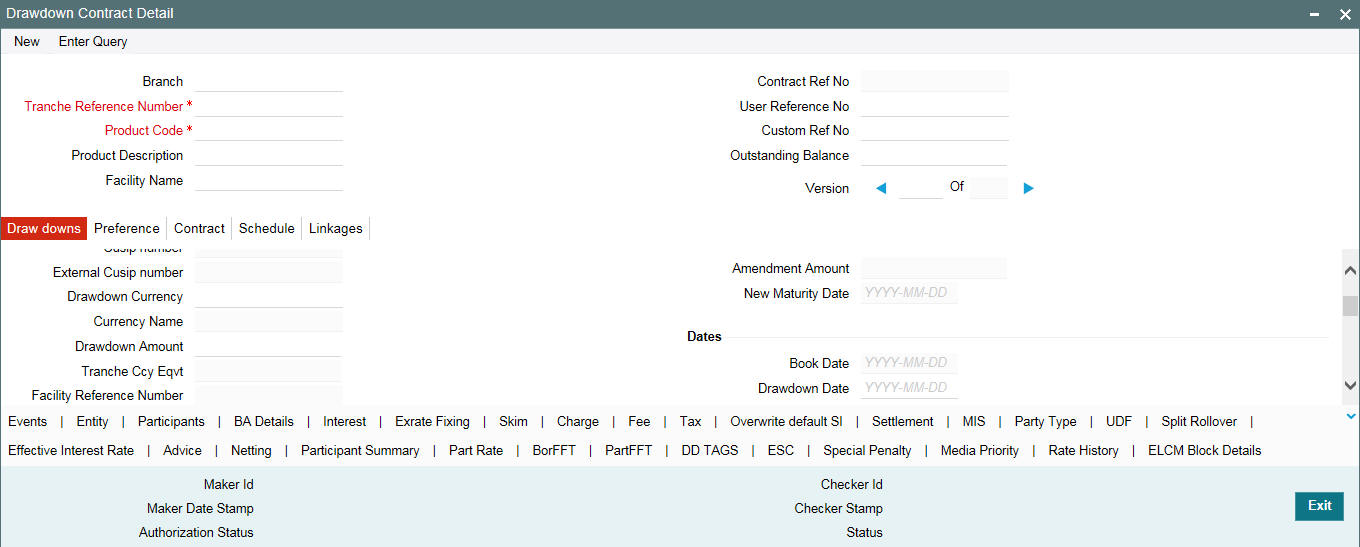

7.3 Defining Drawdown for a Contract

You can capture Drawdown contract details in the in the ‘DRAWDOWN’ tab of the ‘Drawdown Contract Online’ screen.

You can invoke the ‘Drawdown Contract Online’ screen by typing ‘LBDDDONL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Special Amount

Specify the special amount for swing line draw down, in case you want to do a special swing line disbursement.

Note

The value of the special amount can be positive or negative or it can be zero.

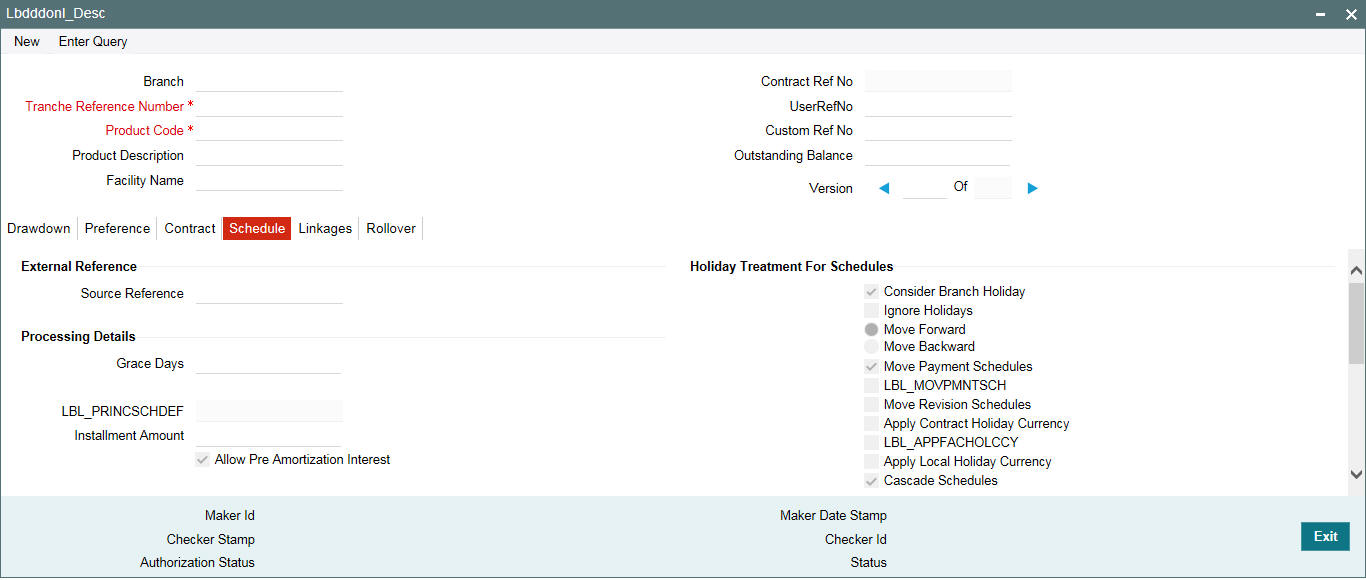

7.4 Defining Schedules for a Contract

The repayment schedules that you define for a drawdown loan product applies to all drawdown contracts involving the product. When you are entering a drawdown in the ‘Drawdown Contract Online’ screen, the schedules defined for the product involving the drawdown are displayed in the ‘Schedules’ tab of the screen.

You can change the attributes of the schedule for an individual drawdown that it inherits from the drawdown product.

The schedule payment type that is defined for a drawdown product (Amortized, Capitalized, or Normal) is inherited by all drawdowns involving it. This attribute cannot be changed when you enter a drawdown.

The manner in which you specify the attributes for repayment schedules for a drawdown is the same as for a normal loan contract.

For a detailed description, refer to the chapter ‘Processing Repayments’ in the Loans User Manual.

Only those aspects of specifying attributes for repayment schedules that are specific to borrower tranche or drawdown contracts are explained in this chapter.

7.4.1 Specifying Holiday Treatment for Schedules

Schedule dates for a drawdown could fall on holidays defined for your branch or on holidays defined for the drawdown currency. In addition, schedules may also fall due on the other currencies, as per your specification in the ‘SCHEDULE’ tab of the ‘Drawdown Contract Online’ screen.

In the Product Preferences for the borrower facility product, you can specify whether the system should check for schedule dates falling on holidays, and how such schedule dates must be handled. These specifications would default to any borrower facility using the product. It will also default to underlying borrower tranches or drawdowns that are opened under the facility if you specify the ‘Holiday Default Basis’ as ‘Facility’ when maintaining a Borrower/Tranche product (in the ‘Additional Preferences for Loans Syndication’ screen).

You can specify that any of the following:

- Holidays must be ignored

- Checks must be made for schedule dates falling on holidays

You can specify the holiday treatment type for schedules falling due on holidays in the ‘Holiday Treatment for Schedule’ section of the ‘SCHEDULE’ tab of the ‘Drawdown Contract Online’ screen. The Holiday Treatment Type is the parameter that defines how the system checks for schedule dates falling on holidays. You can specify one of the following options:

Ignore Holidays

You have to check this option to instruct the system to ignore the holiday. Payment schedules are processed as per the due date even if the schedule falls due on a holiday.

Include Branch Holiday

Select this option to indicate that you want the system to check whether a schedule date falls on a local holiday defined for the branch.

The system checks the holiday table for your branch. If it encounters a contract entered in your branch, with a schedule date falling on a branch holiday, the holiday is handled according to the holiday-handling preferences you specify.

Holiday Currency

You can also select a currency for the holiday check. The system checks the holiday calendar maintained for the selected currency before arriving at the schedule due date.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a schedule date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

Move Backward or Forward

You can indicate whether the schedule date falling on a holiday must be moved forward to the next working day, or backward to the previous working day.

Move Across Months

If you have indicated either ‘Forward’ or ‘Backward’ movement of a schedule date falling due on a holiday, and the moved schedule date crosses over into a different month, you can indicate whether such movement is allowable; it is allowable only if you check this option.

Cascade Schedules

If one schedule has been moved backward or forward in view of a holiday, cascading schedules would mean that the other schedules are accordingly shifted. If you do not want to cascade schedules, then only the schedule falling on a holiday is shifted, as specified. The other schedules remain unaltered.

Move Payment Schedules

You may check this option to indicate that the holiday processing rule should be applied on repayment schedules as well. This is applicable only to drawdown products.

Move Revision Schedules

You may check this option to indicate that the holiday processing rule should be applied to interest rate revision schedules as well.

Use Tranche Currency

If you choose this option, the system checks whether the schedule date falls on a holiday defined for the currency of the tranche (borrower), if this currency is different from the holiday currency you have indicated.

Use Contract Currency

If you choose this option, the system checks whether the schedule date falls on a holiday defined for the currency of the drawdown contract, if this currency is different from both the holiday currency and the facility currency (if any) you have indicated.

Use Local Currency

If you choose this option, the system checks whether the schedule date falls on a holiday defined for the local currency, if this currency is different from the holiday currency, facility currency and contract currency you have indicated.

The system checks the holiday table for the currencies you have specified. If it encounters a contract using any of the specified currencies, with a schedule date falling on a holiday for any of the currencies, the holiday is handled according to the holiday-handling preferences you specify.

7.4.2 Specifying Holiday Treatment for Maturity Dates/Value Dates

The maturity date for a contract could fall on holidays defined for your branch. In the Product Preferences for the borrower facility product, you can specify whether the system should check for maturity dates falling on holidays, and how such dates must be handled. These specifications would default to any borrower facility using the product. It also defaults to underlying borrower tranches or drawdowns that are opened under the facility if you specify the ‘Holiday Default Basis’ as ‘Facility’ when maintaining a Borrower/Tranche product (in the ‘Additional Preferences for Loans Syndication’ screen).

You can specify any of the following:

- Holidays must be ignored

- The maturity date falling on a holiday must be moved according to the holiday-handling preferences that you specify

The holiday handling preferences for maturity date/value defined at the product level defaults to the ‘CONTRACT’ tab of the ‘Drawdown Contract Online’ screen.

The holiday treatment methods that are explained for a schedule dates are applicable for maturity dates and value dates as well.

7.5 Processing Repayments Manually

The components of a drawdown can be liquidated either manually or automatically, according to the definition you make for the product involving the drawdown, or at time of entering the drawdown. If you have defined automatic liquidation, the Automatic Contract Update function will perform the same on the schedule payment day.

If you have defined auto liquidation for the drawdown, you can manually liquidate the components before the liquidation schedule falls due. In addition, if, for reasons of non-repayment, the liquidation does not take place, you can manually liquidate the components when the repayment is made.

If you have defined manual liquidation for the drawdown, then you must manually liquidate the components a day before the schedule date.

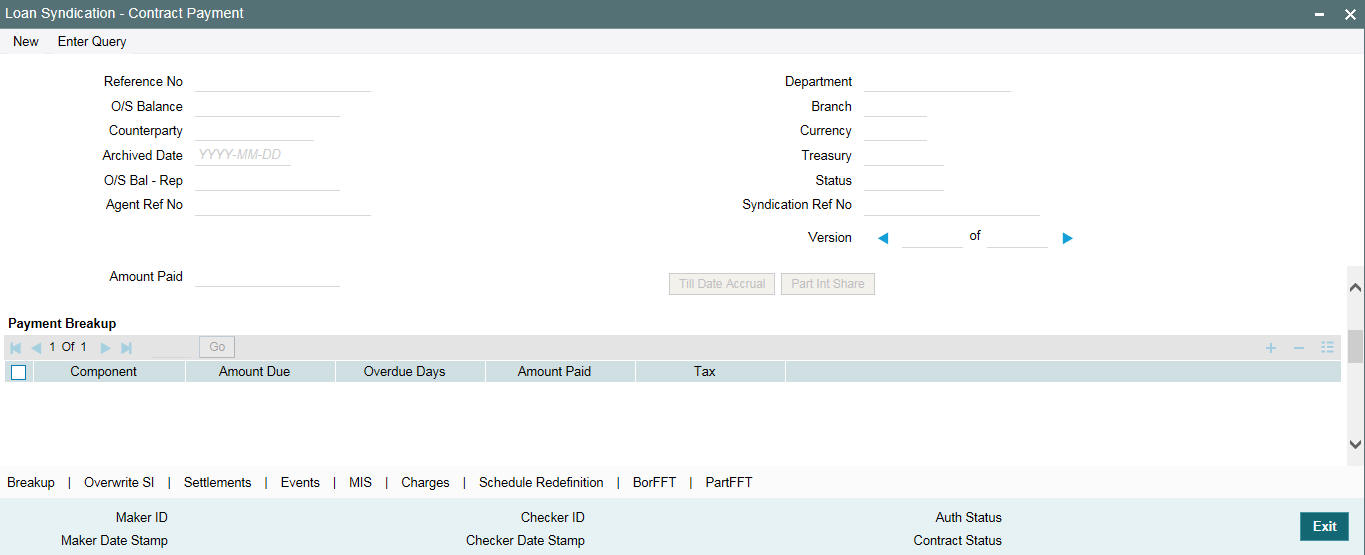

If you select liquidation mode as manual, then on schedule date you can liquidate amount using LBDPYMNT screen. If you liquidate the amount before schedule date then that payment is treated as pre-payment.

You process payments through the ‘Contract Payment’ screen.

You can invoke the ‘Loan Syndication - Contract Payment’ screen by typing ‘LBDPYMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The manner in which you perform manual liquidation for a drawdown in the ‘Contract Payment’ screen is the same as for a normal loan contract.

Special Amount

Specify the special amount in case you want to do a special payment or to facilitate the special amount disbursal. The value of the special amount can be positive or negative or it can be zero. You are allowed to make special payment even for future value dated payments.

Note

- Accounting entries for this special swing line disbursement / payment are routed through the borrower’s internal cash collateral DDA account that is defined at the Tranche contract level.

- Special swing line disbursement / payment are allowed only if the borrower’s internal cash collateral DDA account is defined at the Tranche.

- Value dated Amendment are not allowed for special amount.

Principal Funding Amount paid

Specify the principal (funded) amount to be liquidated.

Based on this amount and the total funded amount for the contract, the system arrives at the actual amount to be liquidated. This actual amount is used for the subsequent payment processing.

Example

The logic to arrive at the actual amount for which the payment is being processed has been explained below:

Consider a contract booked with amount of 2M with participants P1, P2, and P3 having asset sharing ratios as 30, 20 and 50 respectively.

Participant |

Asset Sharing ratio (%) |

Amount (million) |

P1 |

30 |

0.6 |

P2 |

20 |

0.4 |

P3 |

50 |

1 |

Assume P1 has not funded and P2 and P3 have funded completely.

Participant |

Asset Sharing ratio (%) |

Funded Amount (million) |

Unfunded Amount (million) |

P1 |

30 |

0 |

0.6 |

P2 |

20 |

0.4 |

0 |

P3 |

50 |

1 |

0 |

Total funded amount for the contract is 1.4 M and Total unfunded amount for the contract is 0.6 M

For a borrower repayment of 1M, 1M should be entered in the new field ‘Funding amount paid’ in the manual payment screen.

Actual amount to be liquidated = Funding amount paid * Contract Outstanding amount /Total Funded amount

In this case, actual amount = (1M * 2M) / 1.4M = 1,428,571.43M

This amount is used for all the subsequent payment processing.

Note

- This field is enabled only for those contracts where ‘Sighting Funds’ option is applicable.

- The amount you specified here cannot be greater than the total funded amount for the contract.

- If Main interest component is due for payment and if it is identified for liquidation, the compensatory component also is defaulted along with the main interest component and you can not change the compensatory interest amount being liquidated.

- For prime contracts with liquidate interest on prepayment as ‘Y’, the compensatory component is calculated based on the total unfunded amount and not the unfunded portion of the principal being liquidated.

- If compensatory interest exceeds the main interest amount being liquidated, then compensatory component is liquidated only to the extent of the main interest amount (effectively the net interest being paid to the borrower/investor will be zero). The residual amount is stored and liquidated as part of subsequent prepayment.

- Liquidation date cannot be beyond the earliest borrower payment date for the contract.

Tranche Repayment Rule

Select the redefinition rule for tranche repayment schedule applicable for the prepayment amount. The possible options are LIFO, FIFO, and PRO-RATA.

At the time of manual payment of schedules, a borrower may want to prepay a part of the payment to the participants involved in the drawdown. Occasionally, in such a scenario, one or more participants may refuse to accept the prepayment.

Hence, the prepaid amount have to be:

- Distributed among the other participants or

- Returned to the borrower

If the prepaid amount is distributed among the remaining participants, the asset sharing ratio at the drawdown level need to be modified. This in turn affect the availability amount at the tranche level. This is applicable only if the tranche is of revolving type.

If payment is done without sending the participant faxes system displays the following override message:

Participant Share amount not matching with the fax send. Do you want to continue?

Click OK to proceed with the repayment. On authorization of the contract the following error message will be displayed:

Contract authorization possible only after authorizing the overrides

You are allowed to authorize the repayment of the contract only if you authorize the override in the ‘Credit Authorization Outstanding’ screen.

After specifying the Limit Date and Value Date, click ‘Pop till Dt Accrual’ and the following details get displayed. The system displays the interest amount accrued till the least of value date and limit date in the ‘Amount Due’ column. Only main interest component is displayed in the ‘Payment Breakup’ screen.

Note

Principal and non main interest components cannot be paid along with main interest component when this button is pressed. You can specify the borrower ‘Amount Paid’ which can be lesser than or equal to the ‘Amount Due’.

7.5.1 Specifying Payment Breakup for Participants

From Loan Syndication Contract -Payment screen (LBDPYMNT), click ‘Part Int Share’ button to invoke the screen, ‘Payment Breakup for Participants’ with details of all the participants under the drawdown and outstanding interest (Cash Interest) for each participant under the field ‘Amount Due’.

Amount Paid

Specify the individual participant share amount for the interest being paid.

While saving the record and on click of ‘ok’ button in the Payment Breakup for Participants’ screen, the system validates if the total sum of the entire participant interest share amount entered in ‘Amount Paid’ matches with the borrower ‘Amount Paid’.

Amount Paid entered by user for each participant level is used for :

- Propagating interest to the respective participant contract

- Tax calculation for the participants

- Participant advice generation

Note

Cash interest paid cannot be greater than amount due for borrower; the same validation is applicable for participants as well.

7.5.2 Specifying Future Value Date for Payments

You can specify a future date as the value date of the payment, if required. The future value dated payment can be a normal payment or prepayment. For non-Prime contracts you can liquidate interest for the prepaying principal by checking ‘Liqd of Int on Prepaid Principal’ option. The interest is computed till the value date of the captured future dated payment.

The System recalculates the interest on the prepaid principal on the value date of the payment. This result is compared with the earlier calculations performed during instruction capturing. The System logs an exception and aborts the payment process if there is any mismatch.

Note

- For Prime contracts, ‘Liqd of Int on Prepaid Principal’ check box value is defaulted from contract preferences and it is disabled.

- For prepayments, the future value date can not be greater than the next schedule date if the liquidation mode is Auto.

When you book a future dated payment, events are fired, but there are no accounting entries for these booking events. The outstanding balances are updated when you perform the booking. You can generate payment FFT advices after authorization of future dated liquidation, by tagging suitable advices to the instruction booking event in the FFT Generation screen. After the prepayment is done for partial amount, billing notice generated have the interest amount calculated on the remaining principal amount and not the original principal amount. If the drawdown is completely paid ahead of the maturity date, then the maturity date is automatically be changed to the date of the drawdown paid.

You can reverse a future dated payment instruction, if required. Events are generated and the balances at the Tranche are reinstated during the reversal of future dated payment instruction.

The following are the events generated while booking a future value dated payment and reversing the same:

Event Code |

Event Description |

Sequence of Occurrence |

BLIQ Drawdown Products |

Booking of Future dated Principal and Interest Liquidation |

Triggers while booking the future value dated Principal and Interest Liquidation. BLIQ event is fired in drawdown on booking future dated liquidation |

RLIQ Drawdown Products |

Reversal of Future dated Principal and Interest Liquidation |

Triggers while reversing the future value dated Principal and Interest Liquidation |

LIQD Drawdown Products |

Future dated Principal and Interest Liquidation |

LIQD event will be fired after liquidation batch is run |

When you initiate the batch for processing the future dated payment instructions, accounting entries are passed based on the settlement accounts prevailing at the value date of liquidation.

Note

- The system does not populate the schedule captured for a future dated liquidation to the next future dated liquidation.

- You can perform future dated liquidations only for Pro-Rata draw downs. You cannot do partial liquidations, except for the principal component.

- For future dated liquidations having Auto liquidation mode, you can not specify a value date greater than or equal to the next schedule date.

- You cannot perform reversal of a captured FD payment if underlying reprice is going to be overdue due to reversal of the captured FD Payment instruction.

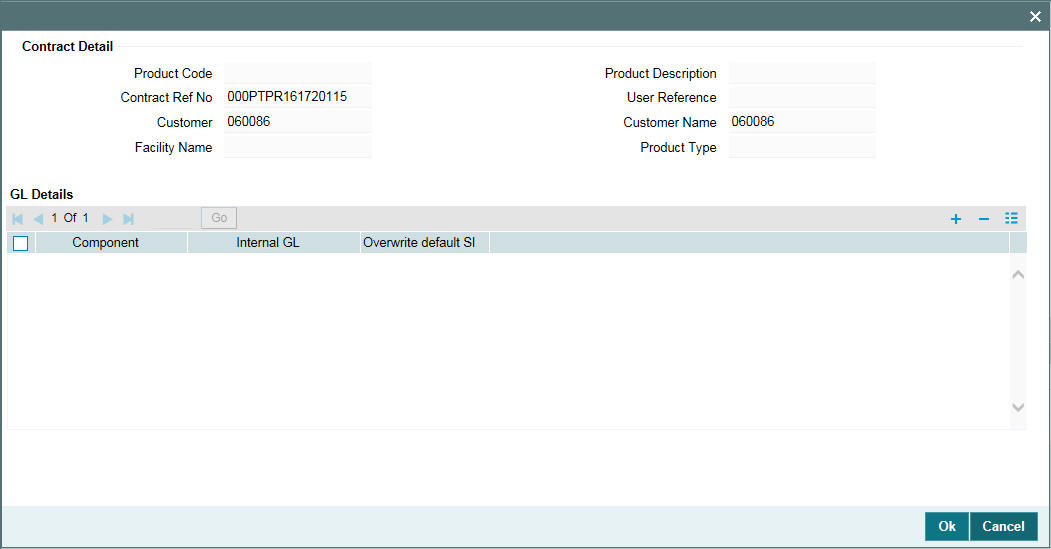

7.5.3 Capturing Overwrite Settlement Instructions

You can maintain settlement instructions for various components such

as fees, charges, tax, principal, interest, and so on, using the ‘Overwrite

Settlement Instruction Details’ screen. Using this screen, you

can post liquidation entries into an Internal GL account instead of the

customer account at the time of rollover. Click ‘Overwrite SI’ in the ‘Loan Syndication - Contract

Payment’ screen to invoke the following:

Component

This screen displays the all the components displayed in the Settlement Message Details screen that is, fees, charges, principal, interest, and so on.

Internal GL

Specify the Internal GL accounts into which you want to post the liquidation entries for the components.

Overwrite Default Settlement Instruction

Select the ‘Overwrite default settlement instruction’ box to confirm that the liquidation entries should be posted into the Internal GL account. System posts the entries to the Internal GLs only if you check this box. Otherwise, the system posts the entries as per the settlement instructions specified for the component of the contract.

Note

You can maintain the Internal GL account anytime during the life cycle of the contract.

7.5.4 Processing Non-Prorata Payments

The system also allows you to process non-prorata payments on the maturity date of the drawdown if the drawdown is not a ‘Prime’ loan. In the ‘Contract Payment’ screen, click ‘NonProrata’ button to invoke the ‘Participant Ratio Details’ screen.

In this screen, you can maintain the following details:

- Select the participant who is not maintained at the tranche level

- Add participant amount

- Provide asset ratio/participation amount of VAMI amount

- Maintain settlement currency, mnemonic and entity for the new participant

- Provide settlement details for new participants for all currencies maintained in the tranche.

For existing participants, system displays the displays the settlement details for all currencies maintained at the tranche level. Note that you cannot modify these details.

Note

If ‘Propagate Ratio to Drawdown’ box is checked, then on save of the tranche amendment, system triggers the VAMI event at the tranche contract level. In addition, system increases the tranche amount and updates the new asset ratio at the tranche contract. System triggers the PRAM event at the underlying drawdown contracts for propagating the new asset ratio.

To select the participants for processing the payment, click ‘Participant

Selection’ button in the above screen. In the ‘Participant

Selection’ screen that is displayed, the names of all the participants

of the drawdown are listed. Select the participants you want to include

for payment processing. Click ‘Ok’ button to save the details and return to the ‘Participant

Ratio Details’ screen. The system displays the selected participants’

names and the relative payment distribution ratio (in the ‘Component

Ratio’ field of the screen) arrived at based on the asset sharing

ratio of each participant. You cannot amend the ratio that is displayed

here.

Click ‘Ok’ button to return to the ‘Contract Payment’ screen. In this screen, you have to specify the ‘Amount Paid’ which is distributed amongst the selected participants as per the relative distribution ratio.

When you save a non-pro rata payment for a drawdown under a pro-rata type of tranche (the ‘Cascade Participation’ box is selected in the ‘LS Tranche Contract Online’ screen), the system converts the tranche into a non-pro rata type (the ‘Cascade Participation’ option is unchecked). The system also recalculates the asset ratio for the drawdown.

For information on non-prorata rollover, refer the section titled ‘Processing Non-Prorata Rollovers’ in the ‘Rolling over a drawdown’ chapter of this User Manual.

Note

ORACLE FLEXCUBE does not allow participants to contribute an amount more than the asset amount maintained at the tranche level.

Refer the chapter ‘Loans Syndication Contracts’ in this manual for more information on computing Participant Ratio based on non pro-rata basis.

For a detailed description on processing manual repayments, refer to the chapter ‘Processing Repayments’ in the Loans User Manual.

7.5.4.1 Processing Non-Prorata Payments for Sighting Fund enabled Tranches

For non-prorata VAMI for the sighting fund enabled tranches, system checks the drawdown outstanding does not exceed the tranche availability.

System allows to 'Propagate VAMI to Drawdown' as well as ‘Propagate Ratio to DD’ for existing investors based on the following validations:

- Participants who are unfunded with ‘No Fronting’ for past events are not allowed

- Participants are not allowed beyond the latest actual receipt date for any of the underlying drawdowns for the investors involved in the transfer.

Note

- System does not allow NPVAMI decrease with a new investor.

- System populates the new investor details in the SF payment browser with event as VAMB for which fronting details need to be captured, only after triggering the PRAM and VAMI events.

- System updates the new ratio/adds the new participant for future dated drawdowns if NPVAMI is done when the ‘Propagate Ratio to DD’ box is checked.

- ‘Non-Prorata’ button is disabled if the amendment date is beyond the last VAMI/PRAM/Liquidation date.

- Back valued activities which are possible under the Pro Rata Tranche till the value date of the NPVAMI are listed in ‘Back Valued Scenarios’ tab

- System does not allow you to change participation for existing participant and adding new lender as part of same NPVAMI.

7.5.5 Marking Contracts as Liquidated

You can select active tranche and drawdown contracts and change the status to ’Liquidated’, if the contract satisfies all criteria for liquidation status. This can be done through the ‘Mark Liquidated’ screen.

You can invoke the ‘Mark Liquidated’ screen by typing ‘LBDMKLIQ’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.Specify the following in this screen:

Contract Ref No

Specify the contract reference number. Alternatively, you can also select it from the option list. The list displays borrower tranche and drawdown contracts.

Note

- When tranche or drawdown contract is marked as liquidated then the corresponding participant contracts also gets marked as liquidated, if the individual investor balance is zero.

- When tranche contract is marked as liquidated, the linked collateral online and settlement contract also gets marked as liquidated, if the collateral online and settlement contract balances are zero.

Facility Name

System displays the facility name once the contract reference number is chosen. You cannot modify this field.

Branch

System displays the branch once the contract reference number is chosen. You cannot modify this field.

Department

System displays the department name once the contract reference number is chosen. You cannot modify this field.

Principal Outstanding

System displays the outstanding principal amount once the contract reference number is chosen. You cannot modify this field.

Contract Amount

System displays the contract amount once the contract reference number is chosen. You cannot modify this field.

Counterparty

System displays the counterparty once the contract reference number is chosen. You cannot modify this field.

Value Date

System displays the value date once the contract reference number is chosen. You cannot modify this field.

Mature Date

System displays the maturity date once the contract reference number is chosen. You cannot modify this field.

Remarks

You may add remarks if you wish to, in this field.

Note

You can only change status from ‘Active’ to ‘Liquidated’; no other status change can be done from this screen.

The following operations can be performed through this screen:

- New - This operation initiates contract status change for a contract. When you click on ‘New’ button, the ‘Contract Ref No’ is enabled and you can select the required contract to be liquidated.

- Save - During this operation, system performs the contract lock check

and if the selected contract is locked by any other user, save operation

fails.

- When there is no contract lock, system validates whether the status of the contract can be changed to ’Liquidated’. Once all validations are successful, the following override message is displayed:

Contract will be liquidated. Proceed?

- If the override is selected as ’Yes’, the contract status is changed from ‘Active’ to ‘Liquidated’ and LIQD event is registered. If the override is selected as ‘No’, save operation fails.

- Authorization - During this operation, LIQD event is authorized.

- Delete - During this operation, saved and unauthorized status change of the contract is deleted.

Note

The branch and department code restrictions and maker and checker functionality is applicable to this screen.

The sequence for marking a tranche contract as liquidated is as follows:

- Mark the loan as ‘Liquidated’. For self participant, drawdown cannot be liquidated if any underlying loans are active.

- Mark the commitment as ‘Liquidated’. For self participant, tranche cannot be liquidated if any linked/STP commitments are active.

- Mark the underlying drawdowns as ‘Liquidated’.

- Mark the tranche as ‘Liquidated’.

7.5.5.1 Validations

The system performs the following validations during the save operation in ‘Mark Liquidated’ screen.

- Validation for drawdown contracts:

- Contract should be in ’Active’ and authorized status.

- There should be no outstanding amount of any Principal and Interest/Fee component.

- All Escrow customer and General Ledger (GL) accounts linked to the drawdown contract should have zero balance.

- The origination loans contracts that are linked to the self-participants in the drawdown should be in ‘Liquidated’ or ’Reversed’ status.

- For sighting funds enabled drawdowns, there should not be any pending transaction in sighting funds browser.

- Validation for tranche contracts:

- Contract should be in ‘Active’ and authorized status.

- Tranche cannot be liquidated if any underlying drawdowns are in ‘Active’ or ‘Uninitiated’ or ‘Hold’ status.

- There should be no outstanding amount of any Principal and Fee components.

- All underlying commitments of self participants in the tranche should be ‘Liquidated’ or ‘Reversed’ status.

- All Escrow customer and GL accounts linked to the tranche contracts and underlying drawdowns should have zero balance.

- For sighting funds enabled tranches, there should not be any pending transaction in sighting funds browser.

- Maturity date of the tranche should be less than or equal to application date.

- There should be no individual investor balance of the participant contracts for the Borrower tranche or drawdown contract.

- There should be no collateral online and settlement contract balances.

7.6 Processing Prepayments

Prepayments are repayments of principal before it falls due to be repaid. Typically, a penalty is imposed on prepayments, since there is a violation of the contract.

When you define products for borrower leg contracts, you can choose to specify levying a penalty on prepayments, in the Product Preferences screen. You can also specify that the interest on any future schedules must be recomputed when a prepayment is made. The system considers the margin rates maintained for individual participants while recalculating interest.

You specify the prepayment penalty as a percentage, in the ‘LS Schedule Payment’ screen, when you enter the prepayment.

Interest is calculated on the prepaid portion of the principal, from the value date of the last liquidated schedule till the value date of the prepayment. The penal percentage is also applied on the prepaid principal after adjusting the interest due.

When the borrower makes a prepayment for a drawdown, the redefinition of the tranche repayment schedule takes place as follows:

- ‘Tranche Repayment Rule’ provided in the ‘Contract Payment’ screen captures the redefinition rule for tranche repayment schedule, on applying the prepayment amount.

- ‘BorrFFT’ and ‘PartFFT’ buttons invoke the Free Format advices screens for borrower and participants. You need to use a new template for prepayment advices.

- Redefinition of the tranche repayment schedule takes place as part of end of day process irrespective of their allocation, using the rules tagged with the prepayment instruction.

Note

You can capture prepayment on the tranche repayment schedule date provided there is no repayment schedule for the same drawdown captured for that day.

Redefinition of tranche repayment schedule takes place based on the repayment rule mentioned when the actual liquidation amount across drawdowns is greater or lesser than the tranche repayment schedule amount for a given schedule date. The future schedules are adjusted based on the repayment rule (LIFO/FIFO/PRO-RATA) specified for the respective schedule date in the following cases:

- Prepayment/payment redefinition follows the repayment rule in the ‘Manual Payment’ screen

- For unscheduled payment processing, system follows the repayment rule in the ‘Unscheduled Repayment’ screen which is defaulted from ‘Repayment Rule’ provided in the ‘Manual Payment’ screen

- For drawdown booking, if there is no tranche repayment schedule defined for drawdown payment schedules, the system defaults the repayment rule as specified in tranche online schedule tab.

- For payment reversal, system follows the repayment rule specified for the respective schedule date.

- For tranche value dated amendment redefinition, system follows the repayment rule specified in tranche online schedule tab.

Note

- For auto/manual liquidation for the current day, redefinition of tranche repayment schedule takes place as part of current end of day process. As the redefinition happens in current end of day process, if there are multiple drawdown payments with different rules for the same schedule date, then redefinition for each of the drawdown paid amount is done based on the repayment rule defined in payment screen for each drawdown.

- In case of tranche value dated amendment redefinition, redefinition of tranche repayment schedule takes place along with VAMI.

- You can redefine the tranche repayment schedule based on differential global amount resulted and update the outstanding amount and allocation amount in 'Tranche Repayment Schedules' screen for the respective drawdown as part of Global Amount Amendment authorization.

You can liquidate interest on the principal prepaid in the ‘Contract Payment’ screen. To do this, click ‘Pop PL Interest’ button after specifying the principal amount. Subsequently, system displays the interest applicable for the specified principal.

Note

The ‘Pop PL Interest’ button is displayed in the ‘Contract Payment’ screen only for contracts that uses a prime loan product.

The system uses the amount tag INTEREST_ADJ to post interest accounting entries due to prepayment.

Example

Let us suppose that for a drawdown under a tranche of a syndication contract has the following schedule for repayment:

Total Loan Principal: 100000 USD

Value Date of the contract: 1st December 1999

Schedule:

- 1st January 2000 20000 USD

- 1st February 2000 20000 USD

- 1st March 2000 20000 USD

- 1st April 2000 20000 USD

- 1st May 2000 20000 USD

Let us suppose that the interest percentage applicable on the loan is 5%, and the penalty rate for prepayment is 2%.

Let us suppose a prepayment of 30000 USD is made on 15th February 2000. The two previous schedules, for 1st January and 1st February, have been liquidated)

- Interest payable would be computed at 5 % for 14 days (from 1st of February 2000 till the 15th February 2000), on the schedule amount = (20000 * 14/365* 5) / 100 = 38.4 USD. This interest would be adjusted against the repaid amount.

- Penalty amount for prepayment (at 2 %) = (2/100 * (30000 – 38.4)) = 599.23 USD

The interest component that has been adjusted against the repaid amount is booked under the amount tag INTEREST_ADJ.

7.6.1 Prepayment Processing for Value-Dated Amendments

Redefinition of tranche repayment schedule takes place online for tranche value dated amendments as follows.

- In case of current dated tranche amendments for principal, system redefines the current and future schedules based on the differential global amount and the tranche repayment redefinition rule available in tranche online screen.

- In case of decrease in maturity date of the tranche, sum of the tranche repayment amount available on/after the new maturity date is allocated to the new maturity date.

- In case of increase in maturity date of the tranche, tranche repayment schedule available on the old maturity date is allocated to the new maturity date.

- The redefinition of tranche repayment schedule is based on the differential global amount and not the differential tranche amount.