8. Processing Charges and Fees

This chapter contains the following sections:

8.1 Introduction

A syndication contract (facility, tranche, or drawdown) could have various components other than the Principal, such as Interest, Charges, Fees, Margins or SKIM components.

Given below is the sequence of steps you need to follow to apply and process fees levied on a syndication contract:

- Maintain a Fee Rule through the ‘Fee Rule – Definition’ screen

- Define the attributes of a Fee Rule through the ‘Fee Rule Maintenance’ screen

- Once you have defined the attributes of a Fee Rule, you have two

options:

- Define a Fee Class through the ‘Fee Class’ screen. If you define a Fee Class, you can associate it with a Product directly (through the ‘Borrower Product – FEE Details’ screen) and the product inherits all the attributes of the Fee Class.

- Do not define a Fee Class, instead, associate a Fee Rule directly with a product and define the other properties through the ‘Borrower Product – FEE Details’ screen.

- The contracts booked under various products, inherit the properties of the product. For each contract, you can add, edit or remove fee components through the ‘Fee Components’ screen.

- Capture fee schedules for a facility through the ‘Fee Schedules’ screen (invoked from the ‘Facility Contract Online’ screen). For tranche and drawdowns, capture the fee schedules in the ‘Schedule Details’ section of the ‘SCHEDULE’ tab in the ‘LS Tranche Contract Online’ screen and ‘Drawdown Contract Online’ screen respectively.

- Liquidate the outstanding fee schedules (if the Liquidation Mode of the component is ‘Manual’) and prepay future schedules through the ‘Fee Liquidation’ screen.

For more information on charges and fees, refer to Charges and Fees User Manual.

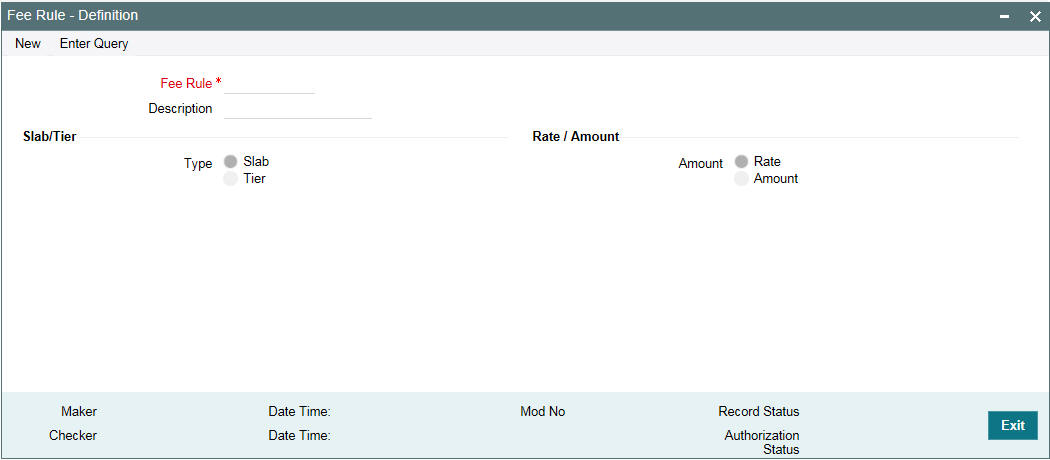

8.1.1 Defining a Fee Rule

You can define a fee rule though the ‘Fee Rule – Definition’ screen. You can attach the fee rule to a Fee Class or directly to a syndication product.

You can invoke the ‘Fee Rule - Definition’ screen by typing ‘LFDFEMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Specify the following details in this screen:

Fee Rule

Every fee rule you define in Oracle FLEXCUBE must be identified by a unique code. Assign a unique code to the rule you are creating. You can define a code comprising of a maximum of nine alphanumeric characters.

Description

Briefly describe the rule you are creating to facilitate identification from a list of similar rules. The description can consist of a maximum of 30-alphanumeric characters.

Slab/Tier

When defining a fee rule, you can specify whether the rule should have a Slab or Tier structure. However, the actual Slab or Tier structure should be maintained in the ‘Fee Rule Maintenance’ screen.

Rate/Amount

You can indicate the basis on which the rule being defined to calculate the applicable fee for the fee component – as a percentage or amount. Accordingly, you can capture the fee rate or fee amount applicable for the various Slabs/Tiers defined for the rule in the ‘Fee Rule Maintenance’ screen.

For more details on this screen, refer the heading ‘Maintaining Fee Rule details’ in this chapter.

8.1.2 Maintaining Fee Rule Details

Once you have created a fee rule, you have to define attributes for the rule through the ‘Fee Rule Maintenance’ screen. You can invoke the ‘Fee Class Maintenance’ screen by typing ‘LFDFEECL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Alternatively, you can also access this screen from the ‘LS Tranche Contract Online’ screen.

For more details on defining fee rules when capturing a tranche, refer the section titled ‘Specifying tranche fee details’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

The details to be maintained for a fee rule are explained below:

8.1.2.1 Specifying Contract Details

The following details have to be captured in the ‘Contract Details’ section of the screen:

Module

You have to select the module for which the fee rule details are being maintained. Choose LS to indicate that the fee rule details are specific to the Loans Syndication (LB) module.

When you select the module, the description associated with it is displayed alongside.

Contract Ref No

You have to select the reference number of the syndication contract (facility/tranche/drawdown) for which fee details have to be maintained. According to the contract you select, the following will default:

- Facility Ref No

- User Ref No

- Book Date

- Value Date

You also have the option to select ‘ALL’ here, to indicate that the rule details can be applied to all contracts processed in the LB Module.

In this case, the following details are displayed:

- Facility Ref No: All Facility

- User Ref No: All Contracts

Counter Party

Selection in this screen depends on your specification in the ‘Contract Ref No’ field. If you choose to maintain the fee details for a specific contract, the option list displays the names of the borrowers maintained for the selected contract and also the ‘ALL CUSTOMERS’ option. If you select a specific customer, the components are applicable for only the selected customer. If you select ‘ALL’, the components are applicable to all counterparties of the selected contract.

If you select ‘ALL’ in the ‘Contract Ref No’, you can select only the ‘ALL’ option here. This indicates that the fee details may be applied to all LB contracts and all counterparties of all contracts.

Fee Rule

You have to select the rule for which you want to maintain details. The fee rules you define through the ‘Fee Rule – Definition’ screen are available in the option list provided. Select a rule from this list. When you select the rule, the following attributes that have been defined through the ‘Fee Rule – Definition’ screen also defaults and you cannot change these:

- Component Type – Slab or Tier

- Fee Type – Rate or Amount

Amount/Percentage

You can define the Slab/Tier structure for the contract, based on which fee will be applicable either in terms of amount or percentage. Select the appropriate option.

Specifying Currency Details

Capture the following in the ‘Currency Details’ section of the screen:

CCY

You have to select the currencies for which the rule details are applicable. If you are maintaining fee details for a specific contract, the contract currency is displayed here. You can select additional currencies, if required. The option list displays all the currencies allowed for your branch.

When you select a currency code, the name of the currency is also be displayed.

Click the ‘Add Row’ button to select the next currency, if required.

Specifying Effective Dates

Capture the effective date in the ‘Effective Details’ section of the screen:

Effective Date

For each currency you select, specify the date from which the fee amount that you specify for an amount Slab/Tier should become effective in the system. Fee is applied to contracts based on the Slab/Tier (specified for the contract currency) from this date onwards. Capture the date in ‘DD-MMM-YYYY’ format.

For each effective date captured for a currency, you have to maintain the Slab/Tier structure in the ‘Fee Details’ section of the screen.

Maintaining the Slab/Tier Structure

You can maintain the Slab/Tier (as specified in the ‘Fee Rule – Definition’ screen) in the ‘Fee Details’ section of the screen. Specify the following for the structure:

Amount From/Percent From

Enter the amount slabs for which you want to specify a fee amount. You can maintain different Slab/Tier structures for each effective date captured for the fee. Depending on the ‘Amount Type’ you select, whether Amount or Percent, the system display zero as the ‘Amount From’ or ‘Percent From’ for the first Slab/Tier. For subsequent slabs, the ‘Amount To’ or ‘Percent To’ of the previous slab is displayed.

Amount To /Percent To

Capture the upper limit for the various Slabs/Tiers here. For type ‘Amount’, the maximum limit allowed is 999,999,999,999.99. The amount/percent specified here becomes the ‘From Amount/Percent’ for the next Slab/Tier.

Fee Amount/Rate

Depending on the fee type you specify (whether Rate or Amount), capture the rate/amount applicable for each Slab/Tier. The rate specified here is applicable on the tranche amount which vary based on the percentage utilization.

Example

The following example illustrates the way in which Oracle FLEXCUBE applies the slab based fee rule details that you have maintained:

Refer to the Fee Rule Maintenance above; the following are the details entered:

Currency – EURO

Effective Date – 1st January 2004

Slab Details:

Amount From |

Amount To |

Fee Amount |

0 |

20,000,000 |

2,000 |

20,000,000.01 |

40,000,000.00 |

4000 |

40,000,000.01 |

60,000,000.00 |

6000 |

60,000,000.01 |

80,000,000.00 |

8000 |

80,000,000.01 |

100,000,000.00 |

10,000 |

Say, for example, the contract amount is 50,000,000 currency units. On the 1st of January 2004, for the contract currency EURO, the fee amount applied is 6000 currency units.

You can enter the Effective Date for various other currencies and the fee amount that should be applied to the contract. If you enter a back value dated contract, the appropriate fee amount is taken.

8.1.2.2 Specifying Media for Message Generation

You can specify the media for the message generation in ‘Media for Message Generation’ screen. You can invoke this screen by clicking ‘Media’ tab. This button is enabled only if the ‘FpML Type’ option is deselected at the contract level and the ‘Media Priority’ option is selected at the product level.

If this button is enabled, then the system displays an override message saying to view the ‘Media for Message Generation’ screen. If not, the system handoffs the message as per the details maintained in the ‘Customer Entity Maintenance’ screen.

For more information on the ‘Media for Message Generation’ screen, refer the section ‘Specifying Media for Message Generation’ in the Loan Syndication Contracts - Part 2’ chapter of this User Manual.

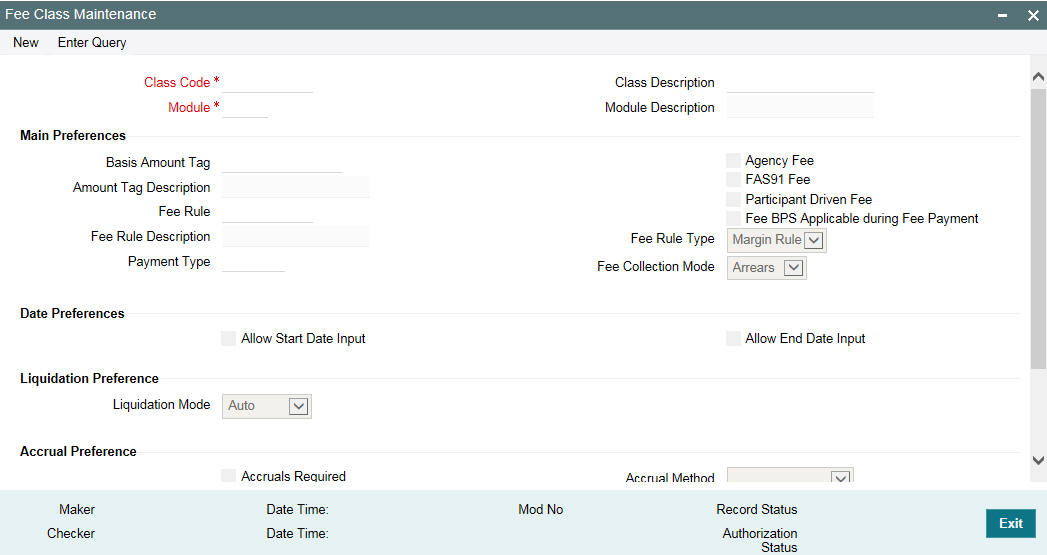

8.1.3 Maintaining a Fee Class

You have the option of defining a Fee Class through the ‘Fee Class’ screen. If you define a Fee Class, you can attach the same directly to a product. The product automatically inherit the attributes of the class.

If you do not define a Fee Class, you have the option of attaching a ‘Fee Rule’ to a product. In this case, however, you have to specify the fee preferences for the product at the time you associate the product with the rule.

You can invoke the ‘Fee Class Maintenance’ screen by typing ‘LFDFEECL’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

The details to be captured in this screen are explained below

Specify Basic Details of the Fee Class

The basic details include the following:

Class Code

When defining a fee class, identify it with a unique code. The code helps you identifying the fee class in the system. You can devise a code consisting of a maximum of 10-alphanumeric characters.

Description

Briefly describe the fee class you are creating to facilitate identification of the same. The description can consist of a maximum of 30-alphanumeric characters.

Module

You have to select the module for which the fee class details are being maintained. Choose LB to indicate that the details are specific to the Loans Syndication (LB) module.

When you select the module, the description associated with it is displayed alongside.

Specifying Class Preferences

In the ‘Main Preferences’ section of the screen, you have to specify the following:

Agency Fee

You may select this option to indicate that the fee income received on a contract is meant for the leading agent alone. It does not get propagated to the other participants of the syndication contract.

If you select this option, you are not allowed to select the ‘Participant Propagation Required’ option.

FAS91

Select this check box to perform FAS91 computations. System validates if:

- The ‘Agency Fee’ check box is selected

- The ‘Basis Amount Tag’ is maintained as USER INPUT

- The ‘Fee Collection Mode’ is ADVANCE

- The ‘Accrual Required’ box is selected

Participant Driven Fee

If you select this check box, system allows you to define an individual fee amount for each participant.

Note

- If you select this option, you are not allowed to select the ‘Agency Fee’ option

- System performs the following validations on checking the ‘Participant

Driven Fee’ box:

- The ‘Basis Amount Tag’ is maintained as USER INPUT

- The ‘Fee Collection Mode’ is ADVANCE

Basis Amount Tag

When defining a fee class, select the basis amount tag on which the fee amount should be calculated. The applicable amount tags are displayed in the option list provided. The description of the tag is displayed when you select the amount tag.

System computes a fee for issuing a letter of credit. This amount is paid only to the banks that have issued the LC. You can define a maximum of 10 such issuer fee components for 10 different issuers. You can associate each fee component with the corresponding basis amount tag.

The following table illustrates the amount tags used at the facility, tranche, and drawdown levels.

Basis Amount Tag |

Facility |

Tranche |

Drawdown |

Utilized |

No |

Yes |

No |

UNUTIL |

No |

Yes |

No |

DD count |

No |

Yes |

No |

User input |

Yes |

Yes |

Yes |

Principal |

No |

No |

No |

Principal-Outstanding |

No |

No |

No |

Tranche-Current-Limit |

No |

Yes |

No |

Tranche Outstanding |

No |

Yes |

No |

ISSUER1_LCOS |

No |

Yes |

No |

ISSUER2_LCOS |

No |

Yes |

No |

ISSUER3_LCOS |

No |

Yes |

No |

ISSUER4_LCOS |

No |

Yes |

No |

ISSUER5_LCOS |

No |

Yes |

No |

ISSUER6_LCOS |

No |

Yes |

No |

ISSUER7_LCOS |

No |

Yes |

No |

ISSUER8_LCOS |

No |

Yes |

No |

ISSUER9_LCOS |

No |

Yes |

No |

ISSUER10_LCOS |

No |

Yes |

No |

COMMERCIAL_LCOS |

No |

Yes |

No |

STANDBY_LCOS |

No |

Yes |

No |

COMPONENT_AMOT |

Yes |

Yes |

No |

COMPONENT_SPLT |

Yes |

Yes |

No |

TRANSFER_AVL |

No |

Yes |

No |

OUTSTANDING |

No |

Yes |

No |

AVAILABLE |

No |

Yes |

No |

Example

For an ‘Advance’ fee component, the following amount tags can be used:

- USERINPUT

- TRANSFER_AVL

- OUTSTANDING

- COMMERCIAL_LCOS

- STANDBY_LCOS

- AVAILABLE

- UNUTIL

- UTILIZED

Fee Rule Type

While defining a class, you can specify the rule type for the fee component. The available options are:

- Margin Rule

- ICCF Rule

For calculating fee on contracts, you have to select ‘Margin Rule’ as the rule type.

Fee Rule

Select the applicable fee rule from the option list. The option list includes the rules that you have maintained through the ‘Fee Rule – Definition’ screen. When you select the rule, the description of the rule is also displayed.

Fee Collection Mode

Select the mode of collecting the fee. The available options are:

- Advance: Typically, an advance fee component is collected on the value date of the contract. However, you can define a schedule for the component if the whole amount is not liquidated upfront. An advance fee component with bullet schedule can have multiple instances ( that is,. you can use the same component multiple times to collect the fee). If the advance component has predefined schedules, you cannot reuse the component.

- Arrears: An arrear fee component cannot have schedules with Start Date equal to the Value Date of the contract.

Note

Fee rate maintenance is done for ‘Advance’ and ‘Arrear’ fee components.

8.1.3.1 Specifying Date Preferences

The following options are available in the ‘Date Preferences’ section of the screen:

Allow Start Date Input

By default, a fee component (if applicable for the product involved in the contract) becomes effective on the ‘Start Date’ of the contract (facility/tranche/drawdown). However, if you select the ‘Allow Start Date Input’ for the fee class (which would subsequently be associated with a syndication product), you are allowed to modify the start date of the fee component in the ‘Fee Components’ screen.

Allow End Date Input

Similarly, by default, a fee component (if applicable for the product involved in the contract) ceases to be associated with a contract on the contract ‘End Date’. However, if you select the ‘Allow End Date Input’ for the fee class (which would subsequently be associated with a syndication product), you are allowed to modify the end date of the fee component in the ‘Fee Components’ screen.

Note

If you do not select the above options, you are not allowed to change the ‘Start Date’ and ‘End Date’ for a fee component in the ‘Fee Components’ screen.

For more details on this screen, refer the heading ‘Specifying facility fee details’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

8.1.3.2 Specifying Liquidation Preferences

In the ‘Liquidation Preferences’ screen, you have to select the following:

Liquidation Mode

Select the mode of liquidating the fee components under this fee class. You have the following options:

- Auto - Select this option to indicate that fee is to be liquidated automatically. The system liquidates the components as per schedule due dates maintained for the contract.

- Manual Liquidation - Select this option to indicate the fee is to be liquidated manually. In this case, you have to liquidate the fee through the ‘Fee Liquidation’ screen.

- For details on this screen, refer the heading ‘Liquidating Fee Components’ in this chapter.

- Semi-Auto – Select this option to indicate the fee is to be liquidated semi-automatically. If you select this option, forward processing is applicable to the fee. The fee liquidation event is processed as on due date, but the message is held in the ‘Forward Processing Queue’.

For more information on forward processing, refer the heading ‘Forward Event Processing’ in the ‘Reference Information for Loan Syndication’ chapter of this User Manual.

Specifying Preferences for Fee Accrual

In the ‘Accrual Preferences’ section, specify the following:

Accrual Required

You have the option to accrue the fee earned on syndication contracts. To do this, you have to check this option.

Accrual Method

If accrual is required, you can specify the accrual method. You can accrue a fee using any one of the following methods:

- Straight Line: In this method of fee accrual, the fee amount is equally spread over the tenor from the fee calculation start date to the fee calculation end date of the loan or commitment.

- Discount Accrual Method: In this method, accruals are done based on the balance and the repayment schedules of the contract.

8.1.3.3 Accrual of FAS91 Fee

You can amortize the portion of the FAS91 fee components and accrual starts from the date of the liquidation of the FAS91 FEE. For amortizing the fees, you should set the Accrual Method to ‘Straight Line’. The amortization amount is calculated based on the end date of the facility or tranche. For example, if the fee is linked to a facility, the facility end date is used as the last day to calculate the amortization amount.

Specifying Other Preferences for the Class

In the ‘Other Preferences’ section, you can opt for the following:

Allow Rule Amendment

You can select this option to allow amendment of the fee rule associated with the contract. If you check this option, you are allowed to change the default fee rule in the ‘Fee Components’ screen.

Allow Amount Amendment

You can select this option to allow amendment of the system calculated fee amount (utilized fee and unutilized fee) at the contract level (in the ‘Fee Schedules’ screen).

For more details on this screen, refer the heading ‘Maintaining facility fee schedules’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

Note

This field is applicable only if you select the ‘Fee Collection Mode’ as ‘Advance’.

Billing Notice Required

You can select this option to instruct the system to send a billing notice to the concerned borrower/participant as a reminder of the payment. The notice is sent predefined days before the due date of the fees.

You can capture the number of days, before which the notice should be generated, in the ‘Borrower Product – FEE Details’ screen.

Participation Propagation Reqd

While entering fee details, you have the option of passing the fee collected from the borrower to the participants of a facility, tranche or drawdown. The participants share the fee received as per the fee sharing ratio for a facility and as per the ‘Asset Sharing Ratio’ for tranche and drawdowns. This information is captured in the ‘Participant Asset Ratio’ screen.

However, you are not allowed to propagate the fee to the participants if you have marked the fee as an ‘Agency Fee’. In this case, only the lead agent is eligible to receive the fee amount.

8.1.4 Associating a Fee Class or Fee Rule with a Product

You can associate a ‘Fee Class’ or ‘Fee Rule’ with a borrower product through the ‘Borrower Product – FEE Details’ screen.

You can go to ‘Loan Syndication - Borrower Product Definition’ (LBDPRMNT) screen and click ‘Fee’ tab.

For more information on this screen, refer the heading ‘Specifying fee components for a borrower product’ in the ‘Defining Products for Loan Syndication’ chapter of this User Manual.

8.1.5 Specifying Fee Components with a Contract

You can specify various fee components with a contract through the ‘Fee Components’ screen.

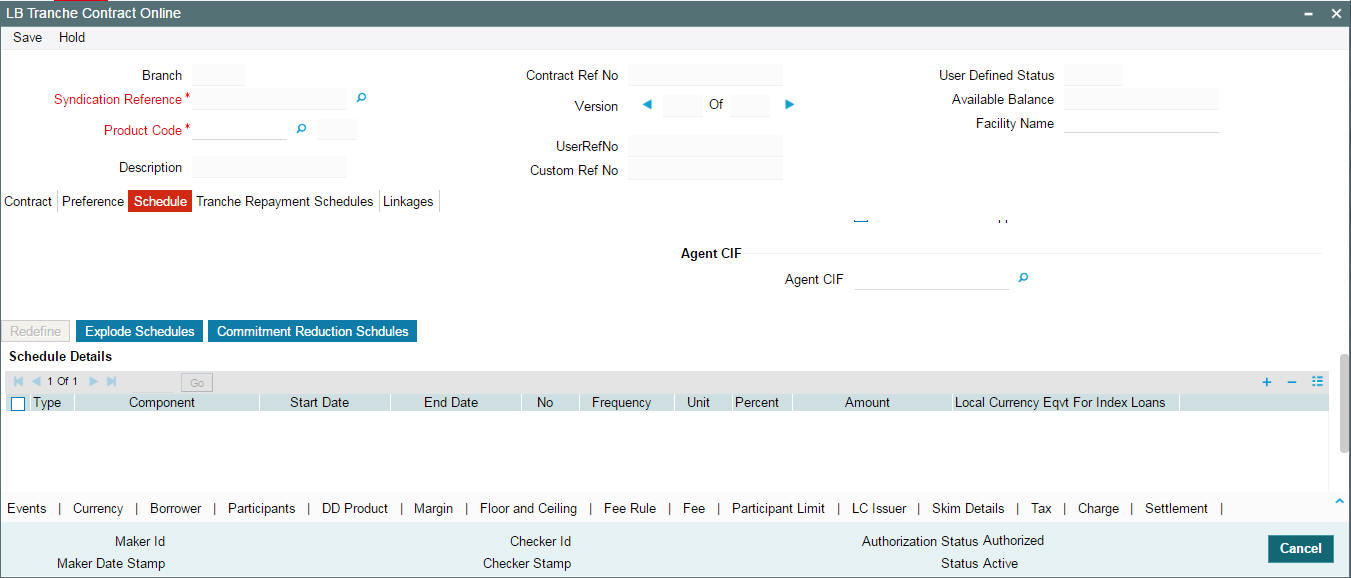

The fee components attached at product is defaulted in this screen. You can go to ‘LB Tranche Contract Online’ (LBDTRONL) screen and click ‘Fee’ tab.

You can modify the fields like ‘Bill Notice Required’ and ‘Billing Notice Days’.

If ‘Fee Type’ is of participant driven fee, then you need to click the ‘P Fee’ tab and enter the amount for participants manually.

If ‘Fee Type’ is of rule based or user input, then you need click the ’Ratio’ tab and click ‘Calculate’ button so that the final ratio is 100.

For more details on this screen, refer the heading ‘Specifying facility fee details’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

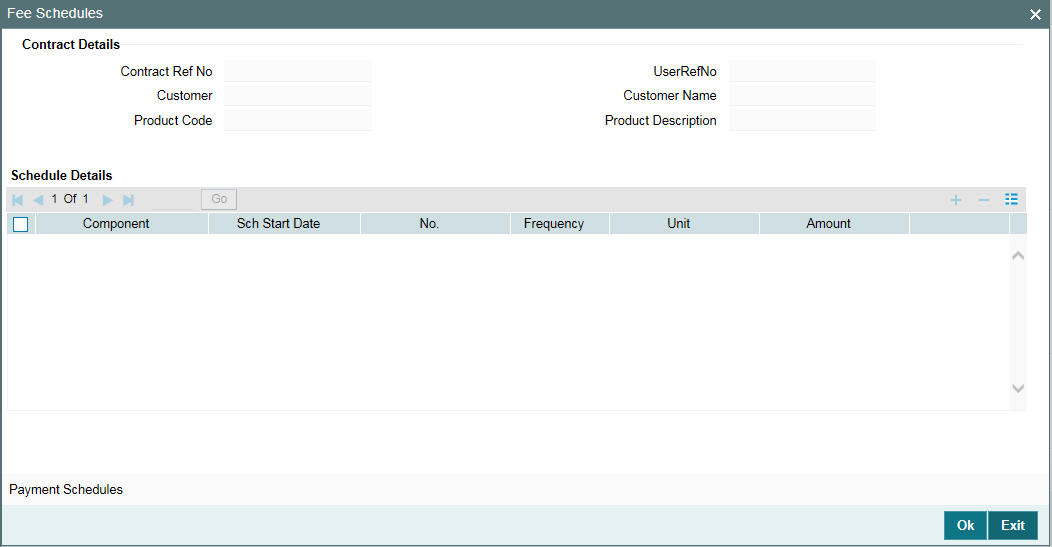

8.1.6 Entering Schedules for Fee Components

You can capture the fee schedules for a contract in the respective contract screen

For a facility

For a borrower facility, you can specify schedules for fee components through the ‘Fee Schedules’ screen. To invoke this screen from the ‘Facility Contract Online’ screen, click the ‘Schedules’ button.

For details on this screen, refer the heading ‘Maintaining facility fee schedules’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

For a Tranche

For a borrower tranche, you can capture the fee schedules in the ‘Schedule Details’ section of the ‘Schedule’ tab of the ‘LB Tranche Contract Online’ screen.

Schedules are defined for fee components like ‘Advance’ and ‘Arrears’ for tranche using this screen’.

Note

For ‘Advance’ fee component, it is possible to define schedules on the value date of tranche.

For details on this, refer the heading titled ‘Specifying schedule details’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

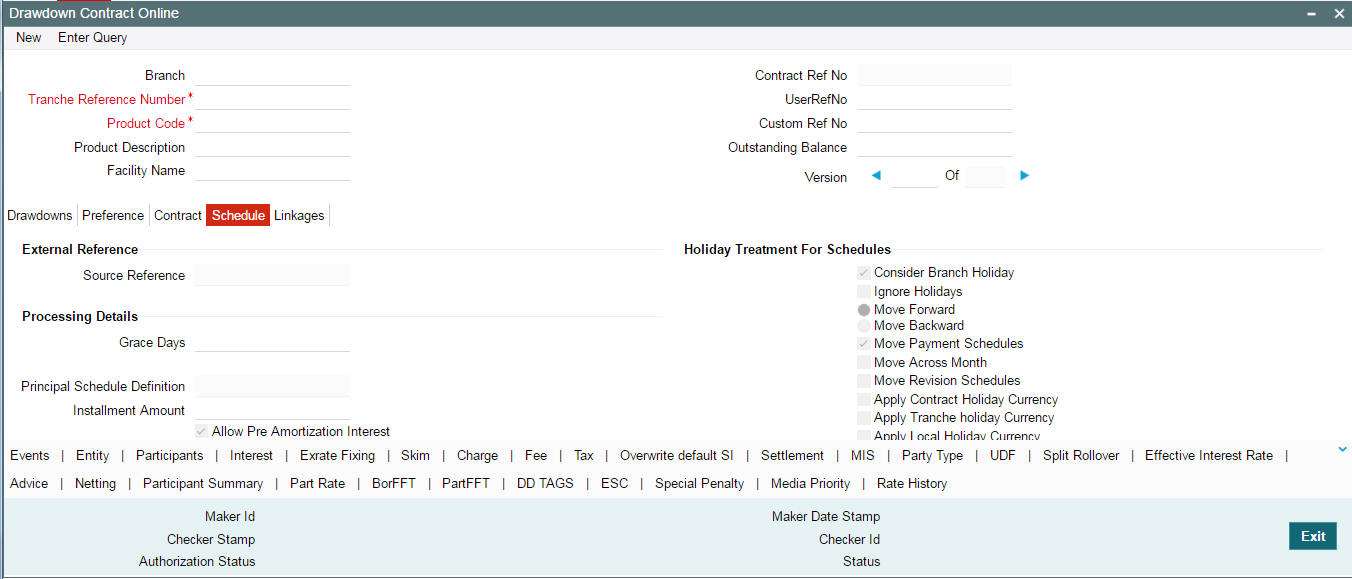

For a Drawdown

For a borrower drawdown, you can capture the fee schedules in the ‘Schedule Details’ section of the ‘SCHEDULE’ tab of the ‘Drawdown Contract Online’ screen.

For details on this, refer the heading titled ‘Specifying repayment schedule details’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

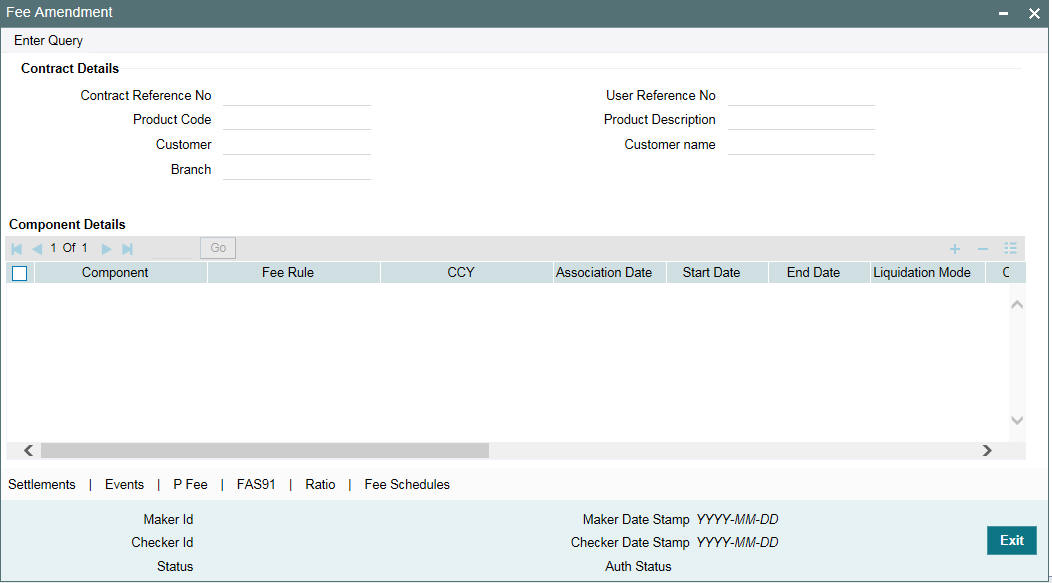

8.1.7 Amending fee Component Details

You may want to amend certain details of a fee component or reverse the fee of a component for a syndication contract (facility, tranche or drawdown). This can be done through the ‘Fee Amendment’ screen. For a fee component which has not been liquidated, is active and future dated, you can:

- Change the fee component amount (if the fee amount has not been computed by the system, but has been entered)

- Change the End Date of the fee schedule

- Add/Remove fee components

- Reverse the fee

You can invoke the ‘Fee Amendment’ screen by typing ‘LBDFEAMD’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

This screen displays the fee component details associated with the selected contract. The following details are displayed:

- Component name

- Fee Rule

- Fee Currency

- Date of Association of the component with the contract

- Component Start Date

- Component End Date

- Mode of liquidation, whether ‘Auto’, ‘Semi-Auto’ or ‘Manual’

- Status of the component whether ‘Active’ or ‘Liquidated’

- The fee basis to calculate the fee amount for schedules

- Whether billing notice should be generated for the contract

To make an amendment, you have to unlock the contract. To do this, click the ‘Unlock’ option from the menu.

Note

- You cannot amend the details of a component with status as ‘Liquidated’

- For existing fee components you cannot change the fee basis as part of amendment. However, you can specify the fee basis for new components

You can amend the fee for FAS91 fee components by clicking ‘FAS91’ in the ‘Fee Amendment’ screen. However, this is applicable only if the ‘Pass FAS91 Accounting Entry’ check box was not checked at the time of booking a contract.

For more details on FAS91 computation, refer the section ‘Computing FAS91 fee details’ in the Loan Syndication Contracts chapter.

In the Fee Amendment screen, you can also change the settlement account of the borrower by clicking the ‘Settlements’ tab.

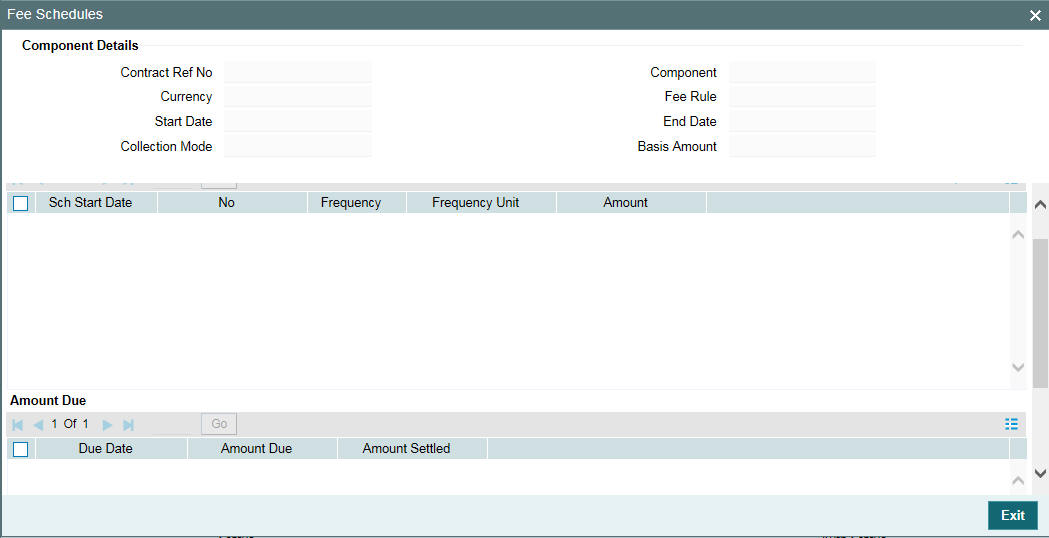

To amend the fee schedules defined for a component, select the component

and then click the ‘Fees Schedules’

button in the ‘Fee Amendment’ screen. The schedules maintained

for the selected component is displayed in the ‘Fee Schedules’

screen.

The following details will default to the ‘Component Details’ section of the screen:

- Contract reference number

- Name of the fee component

- Currency in which the fee is expressed

- Component start date and end date

- Collection Mode

- Basis Amount

In the ‘Schedule Details’ section of the screen, you can amend the following for an ‘Active’ component:

- Frequency

- Number

- Unit of frequency

- Amount: You can amend the fee amount only if the ‘Basis Amount Tag’ for the component is defined as ‘User Input’.

In the ‘Amount Due’ section of the screen, the system displays the ‘Due Date’ and the ‘Amount Due’ for each schedule.

After making the required amendments, click the ‘ok’ button to save and exit the screen.

Similarly, select the next component and change the schedule details, if required.

8.1.7.1 Amending the Settlement Account

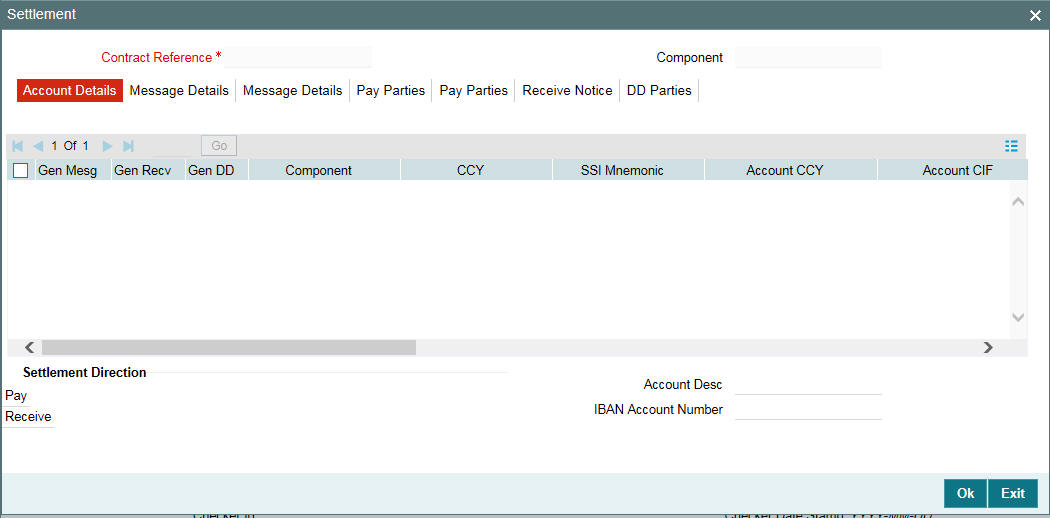

To view the settlement details for the fee components, click the ‘Settlement’ tab in the ‘Fee Amendment’ screen.

In this screen, you can change the settlement account for a fee component, if required.

8.1.7.2 Viewing Participant Ratio Details

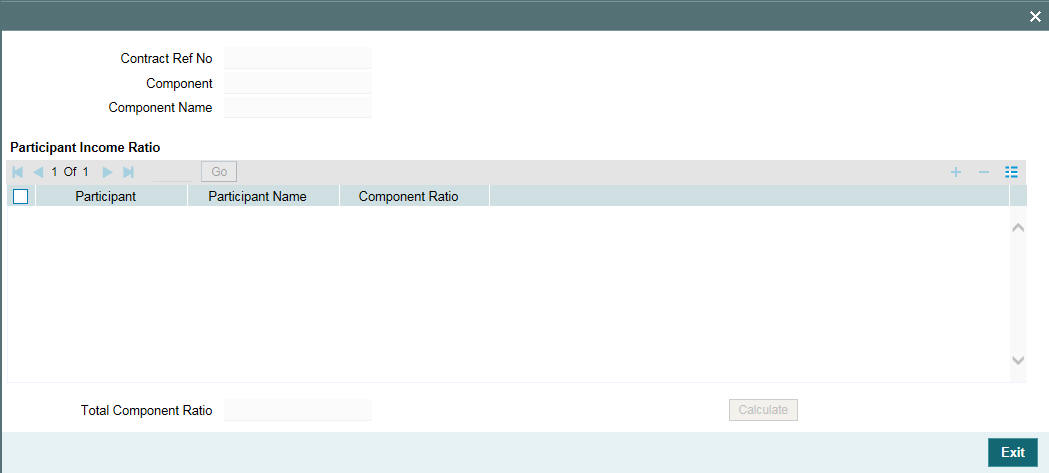

You can view the ratio in which a fee component is shared among the participants of the contract. To do this, select the fee component and then click the ‘Ratio’ tab .

The ‘Fee Component Sharing Ratio’ screen is displayed, as shown below:

In this screen, you can view the following:

- The names of all participant associated with the contract

- The component-wise income sharing ratio for each participant

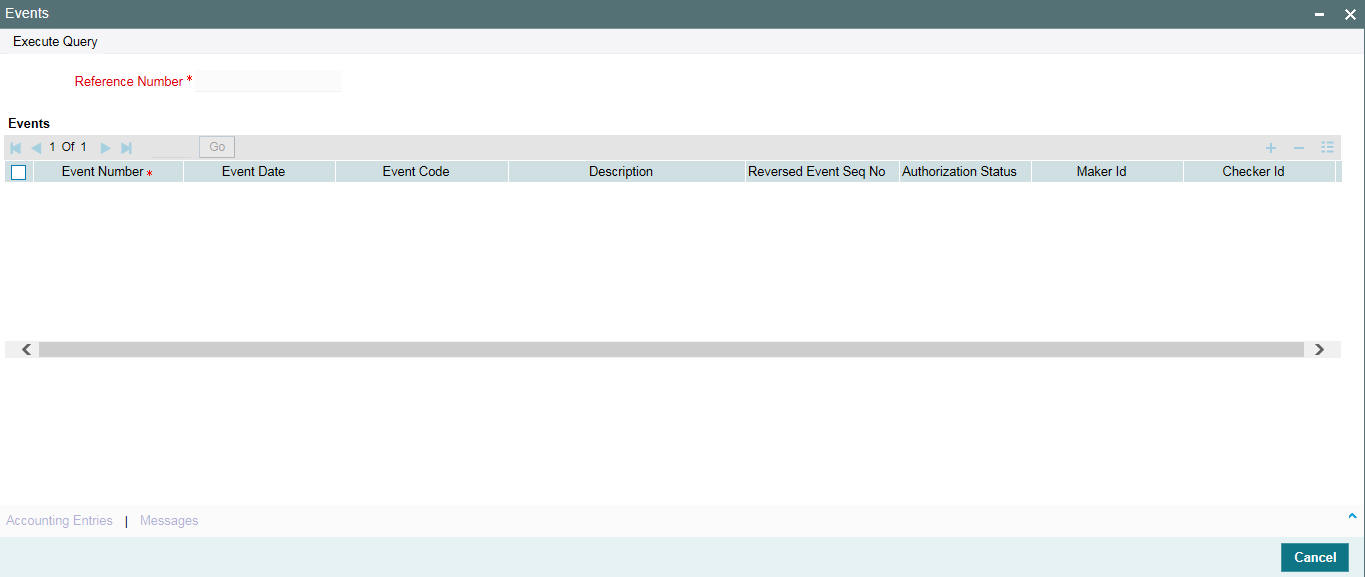

8.1.7.3 Viewing Events for the Contract

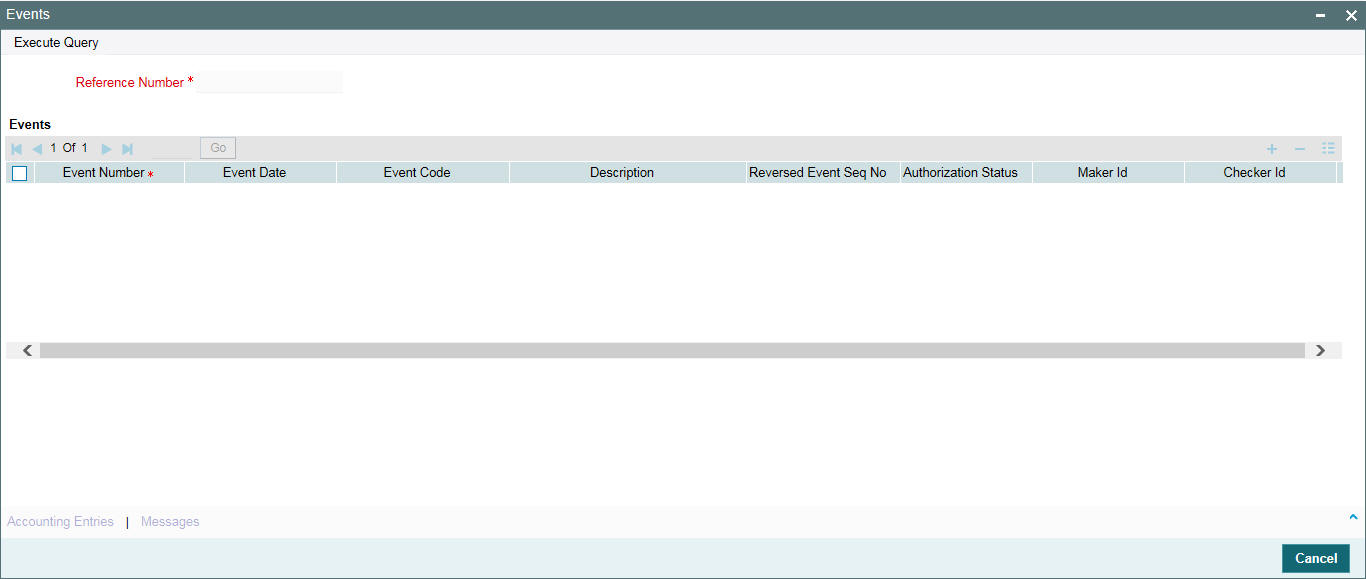

You can view the events triggered for the contract only after you save the amendment.

The CAMD event will be triggered for the contract. To view the event details, click the ‘Events’ tab in the ‘Fee Amendment’ screen.

The ‘Events’ screen is displayed, as shown below:

For more details on this screen, refer the section titled ‘Viewing events for the facility’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

8.1.7.4 Adding a New Component to the Contract

By default, all the fee components defined for a borrower product will become applicable to contracts processed under it.

Example

The ‘Advance’ fee component is attached at the Borrower Tranche product level, which is then defaulted to the tranches under this product.

However, you may add new components to a product after having processed contracts under it. The new component will be automatically associated with the contracts processed under the product after the addition of the fee component.

Oracle FLEXCUBE allows you to include the new component for the existing contracts as well. You can do this through the ‘Fee Amendment’ screen.

Follow the steps given below to include a new component:

- Unlock the ‘Fee Amendment’ screen

- Click on the add button - ‘Add Row’ to add the new component

- Select the component from the option list provided. This list will display all the components that are not yet associated with the contract.

- Upon selection of the component, the Fee Rule, Ccy, Association Date (current system date) will from the product. You are not allowed to amend these values.

- Specify the ‘Start Date’ and ‘End Date’ of the period for which the component will be applicable for the contract. This date should be within the ‘Value Date’ and ‘Maturity Date’ of the contract.

- Invoke the ‘Fee Schedules’ screen and define the schedule for the new component. Based on the schedule you define, system will explode the same and display the ‘Due Date’ and ‘Amount Due’ for each schedule defined.

- In the ‘Settlement Message Details’ screen, change the default settlement account, if required.

- In the ‘Fee Component Sharing Ratio’ screen, specify the ratio in which the component will be shared amongst the participants of the contract.

- After capturing the necessary information, click the ‘Save’ from the menu.

- The component will become effective after the details are authorized by your supervisor/manager.

8.1.7.5 Reversing a Fee Component

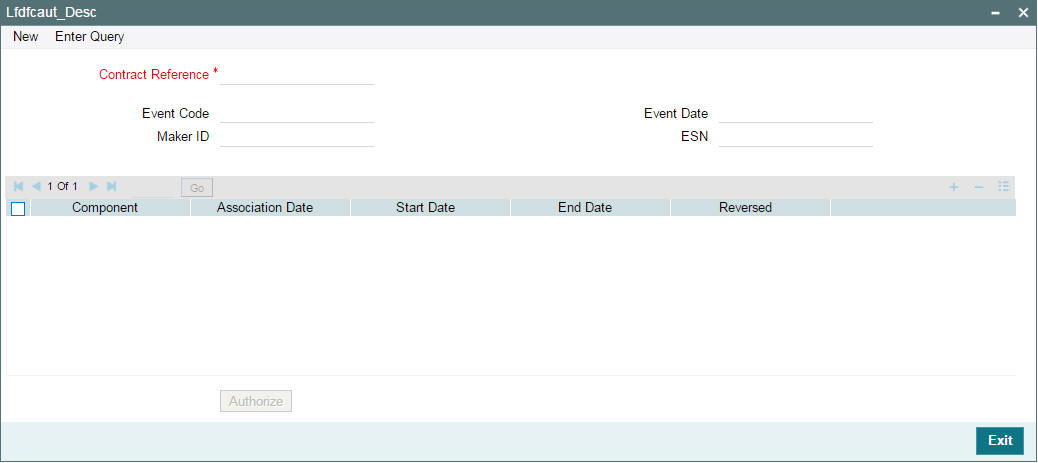

You can reverse a fee component through the ‘Fee Reverse’ screen. To do a reversal, select the contract for which you want to reverse a fee component in the ‘Fee Amendment Reversal’ (LFDFCAUT)screen. Then, click the ‘Reverse’ from the menu.

The ‘Fee Amendment Reverse ’ screen is displayed.

The following details are displayed in the ‘Component Details’ section of the screen:

- Names o f all the components associated with the contract

- Association Date

- Start Date and End Date of the component

Select the component you want to reverse and check the ‘Reverse’

option. Then, click the ‘Ok’

button. Oracle FLEXCUBE reverses all the liquidation entries posted

for the component.

Note

You cannot reverse an ‘Active’ component. A component moves to the ‘Liquidated’ status only after all the schedules of the component are liquidated.

8.1.8 Liquidating Fee Components

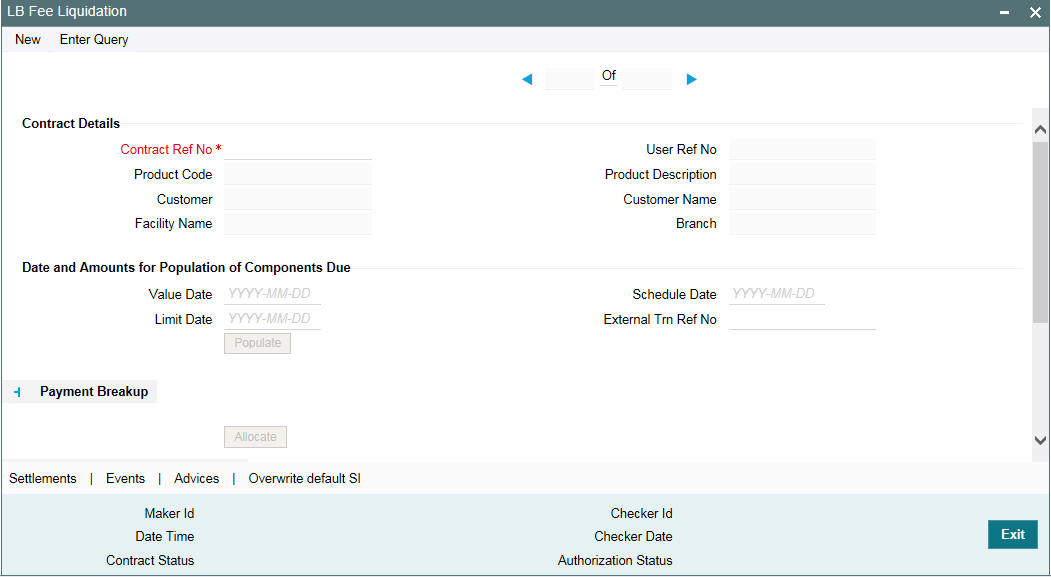

You can manually liquidate the fee schedules defined for fee components in the ‘Fee Liquidation’ screen. You can liquidate even future dated schedules through this screen. You can invoke the ‘Fee Liquidation’ screen by typing ‘LBDFEELQ’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

To liquidate a fee component schedule, do the following:

- Select the contract for manual liquidation

- Click on the new button - Click ‘New’ from the menu. The ‘Value Date’ and ‘Limit Date’ displays the current system date. The accounting entries for liquidation will be passed as of the value date.

- You can change the value date, if required. However, if you specify a back valued date, it cannot be earlier than the last schedule that was paid. The date you capture here is the date on which liquidation occurs.

- You can also change the limit date. This date indicates the date upto which you want to make the payment. This may include future schedules as well as unpaid past schedules. Again, a back valued limit date should not be earlier than the last liquidation date. Also, you can specify a limit date beyond the contract maturity date.

- After capturing the value date and the limit date, click

the

‘Populate’ button. The system will display all the components which are due till the limit date (both unpaid past and future schedules till the limit date). The following details are displayed in the ‘Payment Breakup’ section of the screen:

- Component

- Currency

- Mode of liquidation

- Amount Due

- The ‘Payment Breakup For –‘section of the screen will display the component-wise schedule breakup. The following details are displayed here:

- Due Date of each schedule defined for the component (upto the limit date)

- Amount Due for each due date

- Pending Amount Due (= Amount Due)

- Select ‘Cash Prop’ box to indicate that the below component is for cash payment during fee liquidation:

- Facility Fee

- Commitment Fee

- Stand by LC Fee

- Commercial LC fee You can check the ‘Cash Prop’ flag only if the fee component which is getting liquidated is maintained in the static table. Otherwise the flag is not allowed to be selected.

- Capture the amount you want to pay for a component in the ‘Amount Paid’ field. This amount may be less than or equal to the ‘Amount Due’.

- After capturing the ‘Amount Paid’, click the ‘Allocate’ button. The system allocates the amount against each schedule and update the ‘Amount Paid’ against each schedule in the ‘Payment Breakup For – (Component Name)’ section of the screen.

- For fee components of ‘User Input’ type (Basis Amount Tag = User Input), you can capture the component-wise sharing ratio for each participant. Click the ‘Fee Ratio’ button to do this. The system will display the names of the participants in the ‘Participant Ratio’ details screen.

- Specify the ‘Component Ratio’ for each participant. The sum of the sharing ratio for each component should be equal to 100%. The system computes the amount for each participant based on the ratio mentioned and also display the total amount shared amongst the participants.

- In the case of system calculated fee components (Util Fee and Un-util Fee etc), you can only view the component sharing ratio. You cannot amend the same.

- Specify the ‘Fee BPS Rate’.

- Specify ‘Remarks’ about the Fee BPS Rate, if any.

- Click ‘Populate’ to default Fee BPS Rate for participants.

- Check the ‘Fee BPS Rate Applicable’ check box for the respective participant.

Note

Click the ‘Save’ from the menu.

- You can specify the sharing ratio only if the ‘Participant Propagation Required’ option is checked for the component in the ‘Borrower Product –FEE Details’ screen.

- System does not allow partial liquidation for ‘Participant Driven Fee’

- You cannot amend the component ratio for ‘Participant Driven Fee’

- You can liquidate FAS91 fee components at the time of contract booking or contract FEE amendment by selecting the ‘Pass FAS91 Accounting Entry’ check box.

- For auto liquidation, the liquidation mode should be set to ‘Auto’ in the ‘Fee Components’ screen. Otherwise, you need to manually liquidate the fee components in the ‘Fee Liquidation’ screen.

- ‘Component Amount’ and ‘Component Ratio’ fields are disabled for components where ‘Fee BPS Rate Applicable’ option has been selected.

You can perform selective liquidation of the fee components as the payment happens, if required. For this, you need to specify the amount in the Amount Paid field for the fee component which needs to be liquidated. The System liquidates only those components for which Amount Paid value is the same as Amount Due. You cannot perform partial payments here.

For those components which are not part of the current fee liquidation, you need to specify the Amount Paid as zero.

8.1.8.1 Liquidating and Processing ‘Advance’ Fee Component

Fee amount to be collected from the customer in advance is calculated based on the balance type defined for the fee component.

Any ‘Fee Rate’ or ‘Basis Amount’ or ‘Fee Basis’ changes update the fee amount due only for the next unpaid schedules on or after the effective date of the change for the ‘Advance’ fee component. The accrual for the current period is not affected with this change and is applicable only for the future unpaid schedules.

Note

- For ‘Advance’ fee component the fee calculation/accrual happens with the actual details as of fee inception date, based on the liquidation amount.

- The fax tag ‘ADV-FEE-DLY-ACCR-AMT’ is used for the daily fee accrual amount for tranche ‘Advance’ fee component.

Updation of the fee amount due happens as part of the below mentioned events, provided the unpaid fee schedule due date is equal or greater than the below event’s effective date.

- FRFX Event triggered for Fee Rate change of Tranche.

- LIQD Event Triggered for Principal changes of Drawdown.

- VAMI Event Triggered for Principal Increase of Tranche and Drawdown.

- VAMI Event Triggered for Principal Decrease of Tranche.

- FAMD Event Triggered for Fee Basis change of Tranche.

- New Drawdown Booked under the Tranche.

- Reversal of an Existing Drawdown under the Tranche.

- Reversal of liquidations on drawdown under the Tranche

8.1.8.2 Specifying Future Date for Fee Liquidation

You can specify a future date as the value date for fee liquidation, if required. When you book a future dated Fee payment, events are fired, but there is no accounting entries for these booking events. You can generate Fee advices when you save a future dated fee liquidation by tagging suitable advices to the instruction booking event.

You can reverse a future dated Fee payment instruction, if required. Events are generated during the reversal of future dated payment instruction.

The following are the events generated while booking a future value dated Fee payment and reversing the same:

Event Code |

Event Description |

Sequence of Occurrence |

BFLQ |

Booking of Future dated Fee liquidation |

Triggers while booking the future value dated Fee liquidation |

RFLQ (Facility, Tranche & Drawdown Products) |

Reversal of Future dated Fee Liquidation |

Triggers while reversing the future value dated Fee liquidation |

Batch process created for processing forward dated Principal and Interest payment instructions will be enhanced to process the future dated Fee payment instructions on the value date of the instruction. When you initiate the batch, accounting entries are passed based on the settlement accounts prevailing at the value date of liquidation.

Note

- If the Utilized or Commitment Fee amount has changed between the booking date and the Fee payment value date, system will log an exception due to the mismatch in the amounts and Fee payment will not be processed.

- If you try to amend the Participant Ratio (PRAM) between the book

date and value date of future dated Fee liquidation, an override message

is displayed informing about the existence of the underlying Future dated

Fee liquidations. In such cases you can perform any of the following

actions:

- Reverse the Future dated Fee liquidation and re-input the same which would generate an advice having the latest ratios

- Send a revised free format advice stating the ratio changes for the underlying Future dated Fee liquidation

- Schedule amendments, as part of Contract Amendment or Fee Amendment, is allowed only for those schedules for which future dated payment instructions are not captured.

- A schedule captured for a future dated liquidation, does not get populated to the next Future dated Fee liquidation.

- You can not perform partial Future dated Fee liquidations

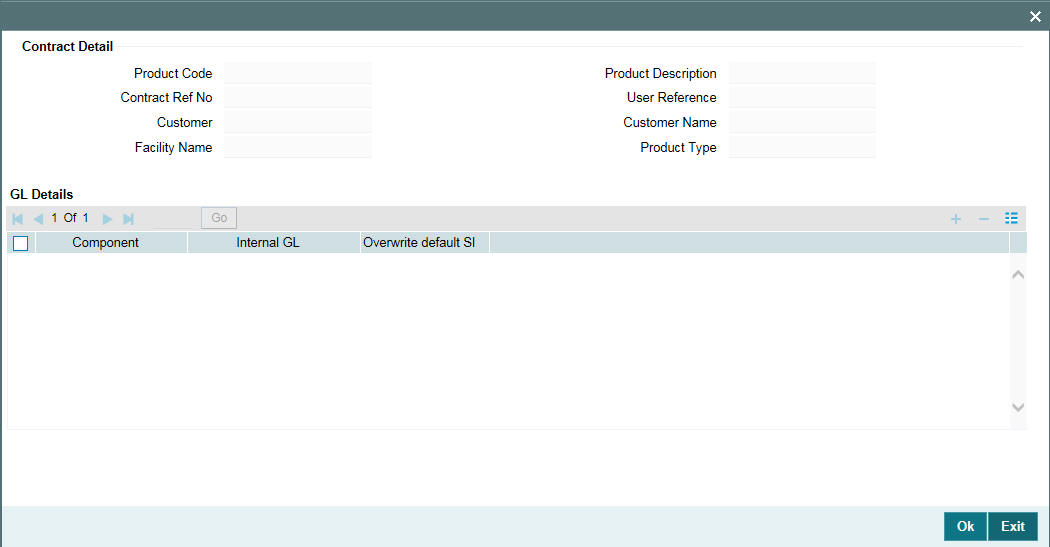

8.1.9 Viewing Overwrite Settlement Instruction Details

You can maintain settlement instructions for various components such as fees, charges, tax, principal, interest, and so on, using the ‘Overwrite Settlement Instruction Details’ screen. Using this screen, you can post liquidation entries into an Internal GL account instead of the customer account at the time of rollover. Click ‘Overwrite SI’ in the Fee Liquidation screen to invoke the following:

Enter the details specified below:

Component

This screen displays all the components displayed in the Settlement Message Details screen.

Internal GL

Specify the Internal GL accounts into which you want to post the liquidation entries for the components.

Overwrite default settlement instruction

Check the ‘Overwrite default settlement instruction’ box to confirm that the liquidation entries should be posted into the Internal GL account. System will post the entries to the Internal GLs only if you check this box. Otherwise, system will post the entries as per the settlement instructions specified for the component of the contract.

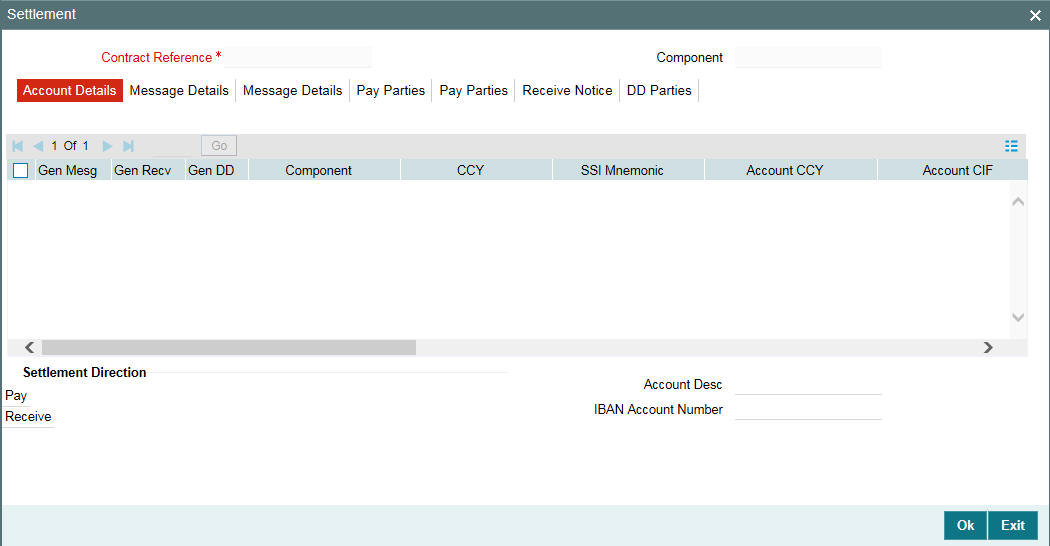

8.1.9.1 Viewing the Settlement Details

You can also view the settlement account details for the fee component in the ‘Settlement Message Details’ screen. Click the ‘Settlements’ tab to view the details.

8.1.9.2 Viewing Event Details

You can view the events triggered for the contract only after you save the details. Click the ‘Events’ tab to view the details in the ‘Event Log Details’ screen, as shown below.

For more details on this screen, refer the section titled ‘Viewing events for the facility’ in the ‘Loan Syndication Contracts’ chapter of this User Manual.

8.1.9.3 Previewing the Message

If you are liquidating a fee component for a borrower drawdown, you can preview the message associated with the contract in the ‘Message Preview Window’. You can preview the message only after saving the details and before authorizing the same.

- From the Fee Liquidation screen, click ‘Events’ tab. Select an event and click ‘Messages’. The Advice Message screen appears. It displays all the messages which are generated against that event.

- Select a message and click 'Message Details'

8.1.10 Refunding Tax for Interest and Fees

In the product tax linkage of Tranche and Facility maintenance, you can add tax components for various Fee components. And the contract level, you can either withheld or waive of the tax for these components. You can maintain tax rate for a combination of individual tax component and a investor or for the combination of individual tax component which is common for all investors.

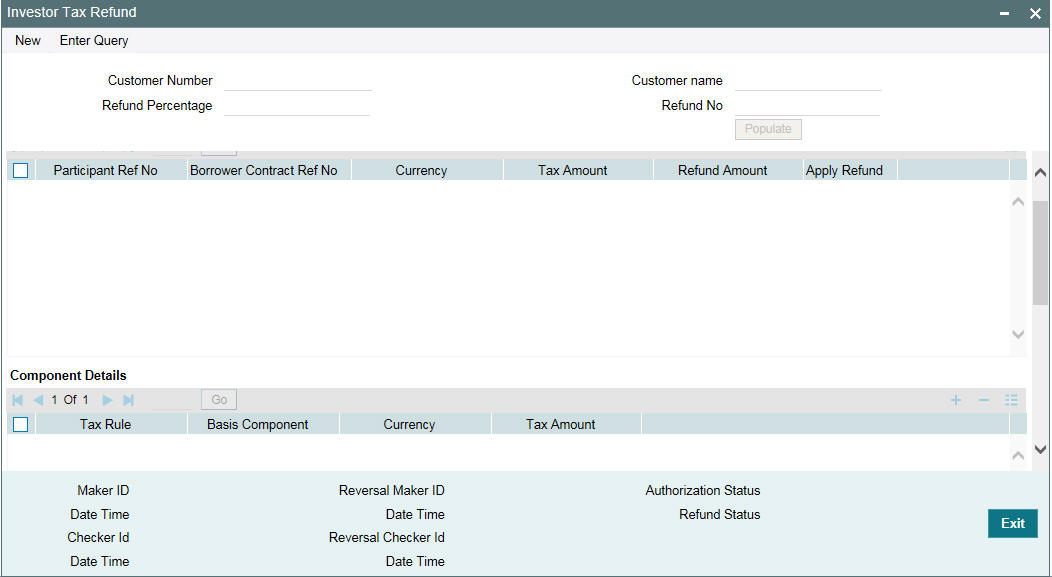

Oracle FLEXCUBE enables you to refund tax for a specific investor for all contracts or specific contract using ‘Investor Tax Refund’ screen. You can invoke the ‘Investor Tax Refund’ screen by typing ‘LBDTXRFC’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details here:

Customer No

Select the customer for whom you want to refund the tax from the investor list provided.

The name of the customer gets displayed in the adjacent field. The investor refund generates a unique refund number for the investor.

Note

Tax refund can be processed only for those contracts for which the ‘Tax Remittance’ is yet to be processed.

Refund Percentage

Specify the percentage of tax refund for the withheld Tax Amount. This percentage gets applied on the tax amount eligible for refund and displays the refundable amount from all the contracts of the investor.

Apply Refund

Select this check box to specify tax refund for the displayed contract of the investor.

Note

You cannot amend the refund amount, component and the tax schedules.

8.1.10.1 Reversal of Investor Tax Refund

You can do the reversal of refund against each refund number. To query a specific refund record of an investor you have to provide the customer number and refund number. The two events which are triggered for Investor Tax Refund and Investor Tax Refund Reversal are:

- PTRF – Participant Tax Refund

- PTRV – Participant Tax Refund Reversal

Every Investor Tax Refund and Refund Reversal will have the following events in all LS contracts for which Apply refund is refined:

- TXRF – Tax Refund

- TXRV- Tax Refund Reversal

8.1.11 Processing Servicer Fees

Agent collects servicer fee from borrower for the rendered syndication agent services. The UDF ‘COMPONENT-TYPE’ should be maintained at the interest class level to identify the Servicer fee interest component. The option list for this UDF displays the value ‘SERVICER-FEE’.

You should define a tranche basis margin component in the ‘Margin – Definition’ screen and create an interest class with the value of the UDF ‘COMPONENT-TYPE’ as ‘SERVICER-FEE’.

The interest component should be maintained at the Borrower Drawdown product level for servicer fee and the new margin component should be attached with the interest component. The servicer fee interest component should not be maintained as main interest component

While booking a tranche contract, margin rate (service fee rate) should be captured for the new margin component created for servicer fee processing. The margin rate for servicer fee margin component can be captured in the standalone margin maintenance screen as well, after the tranche is authorized

While booking a new drawdown, servicer fee margin component will be defaulted to the new drawdown level Interest component that has this margin attached, The other interest components should not have this margin attached

If the servicer fee margin rate is changed at the tranche level, then the propagation of the servicer fee margin rate to the underlying drawdowns will happen as part of end of day batch process.

During liquidation of the new interest component associated with the servicer fee margin component, the interest amount should be credited to income GL and this should be achieved by defining appropriate accounting entries for the liquidation (LIQD) event at the Borrower Drawdown Product level.

During liquidation of the new interest component associated with the ‘servicer’ fee margin component, the interest amount should not be credited to the participants, as ‘servicer’ fees should be received by the agent only. To achieve this, accounting entries should not be maintained for servicer fee interest component for participant drawdown products for LIQD event.