3. Maintaining Details Specific to SLT

This chapter contains the following sections:

- Section 3.1, "Introduction"

- Section 3.2, "Maintaining SLT Branch Parameters"

- Section 3.3, "Maintaining Settlement Instructions"

- Section 3.4, "Maintaining Desk Details"

- Section 3.5, "Maintaining SLT Position Product"

- Section 3.6, "Maintaining Portfolio Details"

- Section 3.7, "Maintaining Position Identifier Details"

- Section 3.8, "Mapping MCC"

- Section 3.9, "Capturing LIBOR Rate Details"

- Section 3.10, "Maintaining Market Price Details"

- Section 3.11, "Maintaining CUSIP Rating"

- Section 3.12, "Maintaining Credit Rate Mapping"

- Section 3.13, "Maintaining Bid/Ask Factor"

- Section 3.14, "Maintaining Age Factor Details"

3.1 Introduction

You need to maintain certain basic information specific to SLT module, before you start processing any trade deal. The following details need to be maintained:

- SLT branch parameters

- Settlement instructions

- Desk maintenance

- SLT position product details

- Portfolio maintenance

- Position identifier details

- LIBOR rate details

- Market price details for CUSIPs

- CUSIP rating details

- Credit rate mapping

- Bid/Ask factor

- Age factor

3.2 Maintaining SLT Branch Parameters

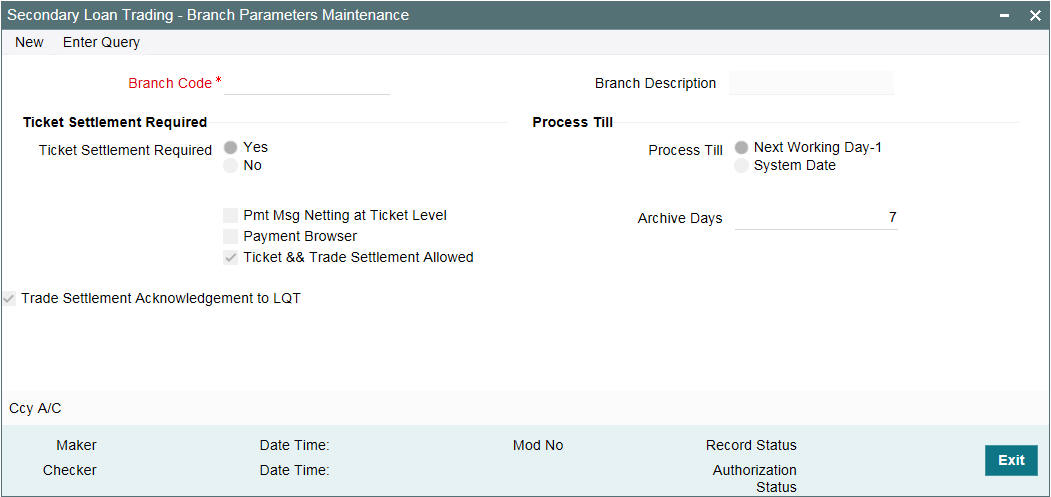

You can maintain the branch parameters specific to the SLT module in ‘Secondary Loan Trading – Branch Parameters’ screen.

You can invoke the ‘Secondary Loan Trading - Branch Parameters Maintenance’ screen by typing ‘TLDBRPRM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can maintain the following details in this screen:

Branch Code

The branch code of the current branch, for which the parameters are being maintained, gets defaulted here. The description associated with the branch code is also defaulted in the adjacent column.

Ticket Settlement Required

Select the option to indicate whether ticket settlement should be enabled or not, for the branch specified.

If you select ‘Yes’, then you can perform the settlement only using the ‘Ticket Settlement’ screen. If you select ‘No’, then ticket settlements can not be carried out for that branch. In this case, all settlements need to be done at trade level, using the ‘Trade Settlement’ screen.

Note

- For ‘Ticket Settlement’ enabled branches, trade level settlement is allowed in exceptional cases where settlement has failed during ticket settlement or for settlement of trade after a trade settlement reversal.

- This check box is disabled only if the 'Ticket and Trade Settlement Allowed' box is selected.

Process Till

Select the option to indicate till which date the automatic processes of your branch should be executed if they fall due on holidays. The options available are:

- Next Working Day-1 - select this option to indicate that the events scheduled for a holiday should be processed on the last working day before the holiday

- System Date - select this option to indicate that all automatic events scheduled till (inclusive of) the current system date need to be processed

Payment Message Netting at Ticket Level

Select this check box to indicate that consolidated payment messages need to be generated at ticket level. Payment messages are generated at trade level if this option is not selected.

‘Payment Message Netting at Ticket Level’ is enabled only if ‘Ticket Settlement required is selected as ‘Yes’.

Payment Browser

Select this check box to indicate that payments that are utilized for secondary loan trading should be processed using the forward processing ‘Payment Browser’.

Archive Days

Specify the number of days till which messages pertaining to secondary loan trading should be retained in the forward processing ‘Payment Browser. Messages whose dates are earlier than the archive days mentioned are archived and can be viewed only from the ‘Outgoing Message Browser’.

Ticket and Trade Settlement Allowed

Select this check box to indicate that both, ticket and trade settlements are allowed for a branch. If this check box is selected, then you can settle all trades for a ticket in the ticket settlement screen or you can settle trades individually in the trade settlement screen.

Note

Ticket settlement is not allowed if atleast one trade under the ticket is settled in trade settlement screen, however the reverse is allowed.

Trade Settlement Acknowledgement to LQT

Select this check box to indicate that settlement acknowledgement message to LQT must be sent at individual trade level. However, if this check box is not selected, then settlement acknowledgement message to LQT is sent at a ticket level.

Note

- Trade level acknowledgement is sent to Loans QT for each trade after it is settled either from ticket settlement or from trade settlement screen.

- Trade level acknowledgement message is sent only for the Loans QT trades which is received from Loans QT and settled in Oracle FLEXCUBE.

- Trade level acknowledgement message will not be sent for Origination line trades and Par line trades

- Trade level settlement acknowledgement message is sent once the trade settlement is authorized successfully

3.3 Maintaining Settlement Instructions

You need to maintain separate sets of settlement instructions for all counterparties involved in a trade transaction. The module name to be associated with the settlement instruction needs to be specified as ‘TL’. The settlement instructions for the agent Id also needs to be maintained with the module as TL’. This is used in trades involving assignment fee.

You can also capture currency-wise mnemonics while specifying settlement instructions. Settlement instructions need to be maintained for each portfolio (Desk, Branch, and Expense code combination) as this is represented by a customer Id.

For each individual SLT contract, you can amend the settlement instructions before the settlement date.

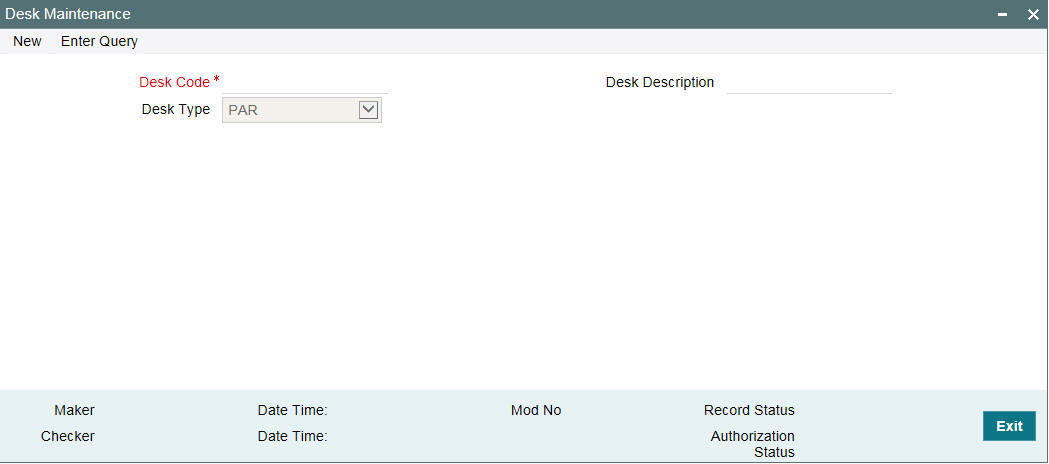

3.4 Maintaining Desk Details

Different types of desks are available for processing the deals at different priorities. You can maintain the details related to desks in ‘Desk Code Maintenance’ screen. You can invoke the ‘Desk Maintenance’ screen by typing ‘LBDDKMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

Desk Code

Specify a unique identification code for the desk and provide a suitable description for the desk code in the adjacent column.

Desk Type

Select the type of the desk from the drop-down list. The following values are provided for selection:

- Par – handles normal trading that happens in the secondary market

- TRS/Swap – cash flows are exchanged between the parties involved, for a set period of time

- Distress – the trades that move to defaulted status are handled by this desk

- Originations – a internal investment trade desk

- ORIGINATION-HFS – internal trade desk for holding ‘Held for Sale’ position

To process transfer of portfolio from HFI to HFS, you need to maintain a desk of the type ‘ORIGINATION-HFS.’

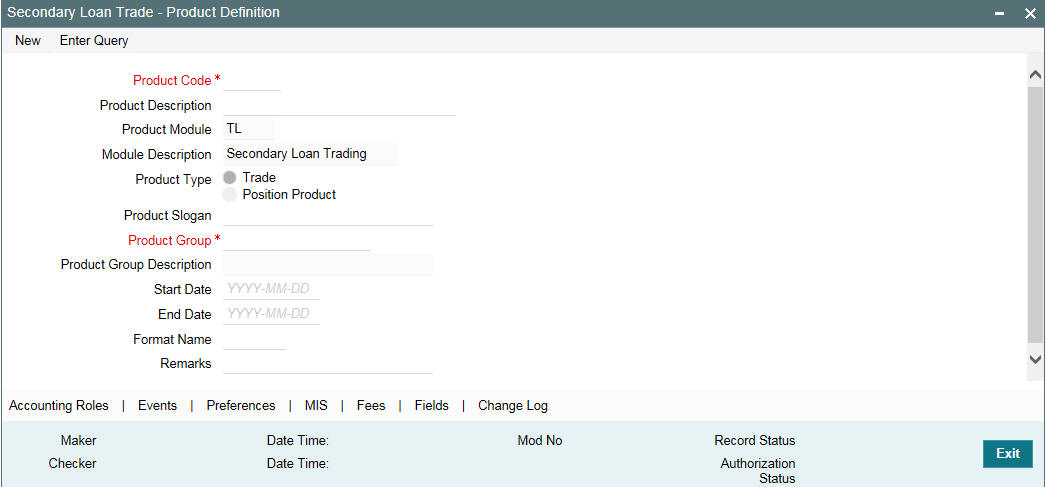

3.5 Maintaining SLT Position Product

You need to maintain a position product to keep track of the position details of the entities involved in a deal. You can maintain a position product in ‘Secondary Loan Trade – Product Definition’ screen. You can invoke the ‘Secondary Loan Trade - Product Definition’ screen by typing ‘TLDPRMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details related to the position product, in this screen:

- Product code, description, type of the product and the module to which the product is attached

- A suitable slogan for the product

- Group to which the product belongs

- Start date and end date of the product

- Format Name to be used for generating the reference number

For more details on this screen, refer ‘Defining Attributes of an SLT Product’ chapter in this user manual.

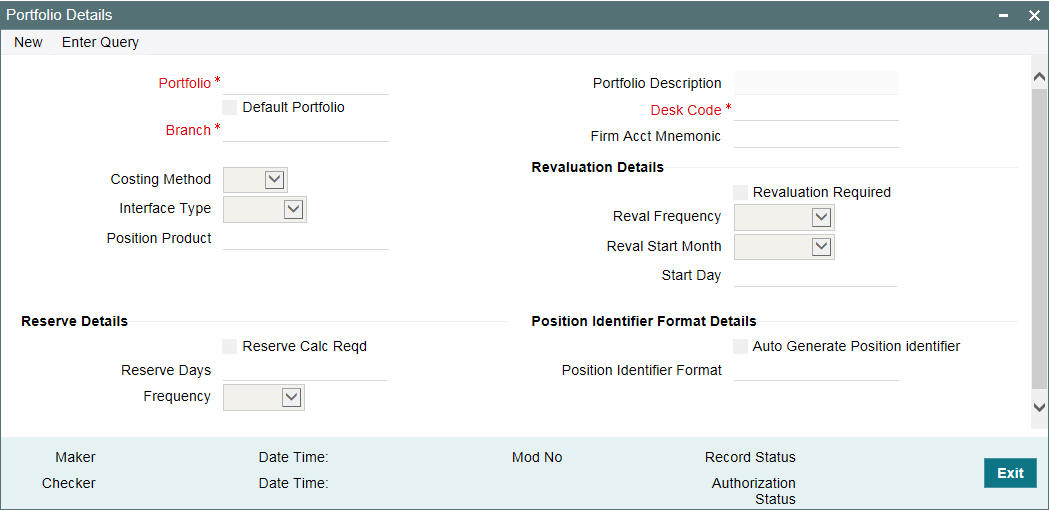

3.6 Maintaining Portfolio Details

Portfolios are maintained for a combination of branch, desk, and expense code. Every branch-desk-expense code combination is uniquely identified as a portfolio in SLT module. For instance, you have to maintain a portfolio for HFS with the Originations-HFS desk. You can maintain the details related to a portfolio in ‘Portfolio Details’ screen.

This section contains the following topics:

- Section 3.6.1, "Creating Portfolio IDs"

- Section 3.6.2, "Creating Position Identifiers"

- Section 3.6.3, "Creating LB - OL Product and Component Mapping "

- Section 3.6.4, "Portfolio Resolution"

- Section 3.6.5, "Specifying Revaluation Details"

- Section 3.6.6, "Specifying Reserve Calculation Details"

- Section 3.6.7, "Specifying Identifier Format Details"

You can invoke the ‘Portfolio Details’ screen by typing ‘TLDPOMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

You can specify the following details in this screen:

Portfolio

Select a unique identification for the portfolio from the option list provided. The option list displays a list of valid customers for the branch, desk, and expense code combination, from which you can select the required value.

Branch

Select the branch code associated with the portfolio whose details are being maintained, from the option list provided.

Desk

Select the desk code associated with the portfolio from the list of options provided. All desk codes maintained in ‘Desk Maintenance’ are displayed.

Firm Account Mnemonic

Specify a firm account mnemonic that is associated with branch code and desk code. The adjoining option list displays a list of valid CFPI firm account mnemonic uploaded through MCC.

Expense Code

Select the expense code to be used for the portfolio from the option list provided. All expense codes maintained under an MIS class gets displayed here.

Costing Method

Select the costing method to be used to arrive at a profitable price at which you can trade, from the options provided in the drop-down list. The following options are available:

- Weighted Average Cost (WAC) - the acquired cost of each security in a portfolio is maintained as an average cost

- Last in first out (LIFO) - in this method of cost accounting, the securities that have been bought last by a portfolio would be sold first

- First in first out (FIFO) - in this case the securities that have been bought first by a portfolio would be sold first

Note

By default, WAC is selected for all desk types.

Position Product

Select the position product to be used to track the position details of the portfolio, from the option list provided. All position products maintained in ‘SLT Product Definition’ screen are displayed in the list.

3.6.1 Creating Portfolio IDs

Oracle FLEXCUBE automatically creates the Portfolio details whenever system receives a new Firm Account Mnemonic from e-sales.

System derives the Portfolio ID and other details using the following logic:

- Based on the MCC received from e-sales, system derives the following

fields that are used to setup the portfolio. For non-CFPI cases too,

e-sales sends MCC, and that MCC is used to compare with the ‘MCC

mapping’ maintenance to derive the following fields:

- Desk Code

- Branch Code

- CFPI (Yes/No)

- Position Product

If the MCC maintenance does not exist, then Portfolio creation is not done and an exception is logged for the same.

- These identified details are used to create a Portfolio.

- System creates a unique customer number for a Portfolio. A new customer is uploaded for every new Portfolio that is created.

- Customer maintenance for this customer number is auto-authorized

- The following basic details are populated for the system created

Customer number:

- Short Name: Firm Account Mnemonic

- Name: Firm Account Mnemonic

- Address Line 1: MCC code

- GFCID will be blank

- MEI code UDF for this portfolio is populated based on the MEI code that is mapped at the branch level for the resolved Branch Code based on the MCC mapping maintenance

- Country, Nationality and Exposure is populated with the country code maintained for the resolved branch code

- Customer Type: I

- Source Code: CFPI

- SIC Code: Firm Account Mnemonic

- US_PAY_ID_TYPE: N

- Once Auth: Y

- FX MANUAL LIQD: N

- Disallow Changes: N

- AML Required: N

- Record Status: O

- Portfolio maintenance is created using the above details

- Portfolio- System generated new Customer Id

- Desk- Resolved based on the MCC mapping (as described above)

- Branch- Resolved based on the MCC mapping (as described above)

- Firm Acct Mnemonic- This is populated with the firm account mnemonic for which the portfolio is being created (For both CFPI and Non-CFPI portfolios)

- The details for the Portfolio for the other fields are defaulted

as below:

- Default Portfolio-Not checked

- Costing Method- WAC

- Interface Type- Internal

- Position Product- Is picked from the MCC maintenance

- Reval Reqd- Yes

- Reval Frequency- Daily

- Reserve Calculation Reqd- No

- Auto Generate Position Identifier- Not checked

- Position Identifier Format- Blank

Portfolio Id Maintenance is auto-authorized with 'SYSTEM' as the user id.

Note

- Portfolio creation happens only if the Firm Account Mnemonic is being received for the first time to Oracle FLEXCUBE

- If it’s an existing Firm Account Mnemonic and updated details are received for the same, then no action is taken in Oracle FLEXCUBE for such cases

- The Portfolio Id’s once created systematically reside in the system. No systematic updates happen on these Portfolio Id’s for any subsequent updates.

- If the portfolio has to be closed/amended, user should initiate it from the Portfolio Id maintenance screen, as per existing functionality

- The existing functionality for user to create portfolio, maintain firm account mnemonic – expense code mapping, create new customer, and so onall continue to function as it is, with only the automation process newly added as summarized in the approach

- While creating a new position, system populates the firm account mnemonic. For existing positions, one-off conversion script to link all the existing positions with a firm account mnemonic is taken up as an implementation exercise

3.6.2 Creating Position Identifiers

Position Identifiers are automatically created by the system.

- For each new Portfolio that is created, automatic Position Identifier is generated.

- Position Identifier is defaulted with the Portfolio

- Position Identifier type is Self

- The newly created portfolio is linked to this Position Identifier

- The following details are blank/not checked for this Position Identifier

record,

- Silent Participant– Not Checked

- First Buy Participant– Not Checked

- Collateral Online Mnemonic– Blank

- Collateral Settlement Mnemonic– Blank

- The Position Identifier maintenance is auto-authorized with SYSTEM as the user id.

3.6.3 Creating LB - OL Product and Component Mapping

A new LB OL Product and Component Mapping is created when a new portfolio is created either for CFPI and non-CFPI instances.

3.6.3.1 Maintaining Default Portfolio

System performs the following processing for maintaining the default portfolio:

- The ‘Default Portfolio’ field in the ‘MCC Mapping’ screen is used to maintain the default portfolio during the automatic creation of LB OL Product and Component mapping

- You can maintain the ‘Default Portfolio’ with New/Unlock options.

- All available portfolio ids for which LB OL Product and Component mapping is maintained for the selected branch code as the OL branch, are listed so that you can select the default portfolio

3.6.3.2 Creating LB OL Product and Component Mapping

System performs the following processing for creating LB OL product and component mapping:

- Based on the ‘MCC mapping’ screen, the Default Portfolio and Branch code is resolved for the MCC

- All LB OL product and component mapping maintained for the resolved default portfolio and branch code are replicated for the new portfolio

- All details pertaining to the LB OL product and component mapping remains the same, with only change in the portfolio, as a result of this replication

- The LB OL Product and Component mapping is auto-authorized with SYSTEM as the user Id

- If the ‘Default Portfolio’ is not maintained at the ‘MCC mapping’ level, then the LB OL Product and Component mapping is not created for the new portfolio.

3.6.4 Portfolio Resolution

System derives the expense code and the desk code, and then fetches the portfolio which is mapped to the expense code, resolved desk code, branch code, and firm account mnemonic

- System then performs the following validations/processing:

- Once the expense code is derived, system fetches the Position Identifier from the SLT Position balance screen, based on the CUSIP, Expense code and Firm account mnemonic

- System checks if the position (settled or unsettled) is non-zero for any of the mapped position identifiers, then that position identifier is used to resolve the trade Portfolio, and further processing is done

- If no position is found or the position (settled and unsettled) is zero, then system

- Fetches the portfolio which is mapped to the expense code, resolved desk code, firm account and the branch code, then the same is taken as trade portfolio and further processing is done

This processing is performed only for non-CLP trades so that trades do not go for manual enrichment. However, there are no changes for CLP trades, so manual enrichment is required.

3.6.5 Specifying Revaluation Details

You can specify the following details related to the revaluation of the positions associated with the portfolio.

Reval Frequency

Select the frequency at which you need to perform a revaluation of the portfolio position, from the drop-down list provided. The following options are available:

- Daily

- Monthly

- Quarterly

- Half Yearly

- Yearly

Reval Start Month

Select the month in which the revaluation has to begin, from the drop-down list provided.

This is applicable if you specify any revaluation frequency other than daily or monthly.

Start Day

Specify the date on which the revaluation should be done during the month. For example, if you specify the date as ‘20’, revaluation will be carried out on that day of the month, depending on the revaluation frequency.

3.6.6 Specifying Reserve Calculation Details

Reserve calculation is applicable for buy trades that have not been sold for a period that exceeds a pre-defined number of days. You can specify the following preferences for reserve calculation for a trade deal.

Reserve Calculation Reqd

Select this check box to indicate that reserve calculation needs to be performed for the portfolio, if the number of days up to which a buy deal remains un-sold exceeds the ‘Reserve Days’ specified.

Reserve Days

Specify the number of days up to which a buy deal can remain un-sold, exceeding which reserve calculation for the trade gets initiated.

Frequency

Select the frequency as ‘Daily’ or ‘Monthly’ at which reserve calculation needs to be performed for trades that are marked for the same.

3.6.7 Specifying Identifier Format Details

You can specify the following details related to the position identifier.

Auto-generate Position Identifier

Select this check box to indicate that position identifier needs to be generated automatically during trade creation.

This is applicable only for ‘TRS’ desk types.

Position Identifier Format

Select the format in which position identifier needs to be generated, from the option list provided.

Note

This is applicable only if ‘Auto-generate Position Identifier’ is selected.

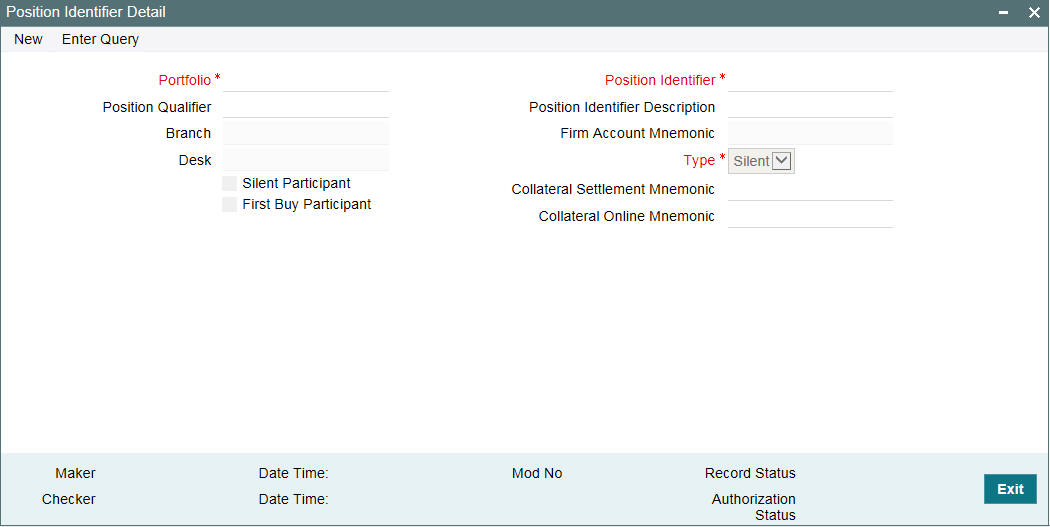

3.7 Maintaining Position Identifier Details

Position Identifier indicates the level at which position needs to be maintained for a portfolio. You can maintain settled and unsettled positions at position identifier level. You can maintain the details related to position identifier in ‘Position Identifier Detail’ screen.

You can invoke the ‘Position Identifier Detail’ screen by typing ‘TLDPIMNT’ in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.

Position Identifier

Specify a unique identification for the position identifier to be used for tracking the position of the portfolio selected.

Position Description

You can also provide a description for the identifier in the adjoining column.

Type

Select the type of the position identifier from the drop-down list. The following options are provided:

- Swap

- Silent

- Self

Note

For TRS trades, you need to specify the type as ‘Self’ in case of parent trades, and for corresponding swap trades the type gets defaulted as ‘Swap’.

Portfolio

The portfolio number specified in the ‘Position Details’ screen gets displayed here. The branch, desk, and expense code details associated with this portfolio are also defaulted.

Position Qualifier

Select the position qualifier from the option list provided, for identifiers of type ‘Silent’. The option list displays the list of existing customers in Oracle FLEXCUBE.

If type is ‘Swap’, the position qualifier indicates the Swap ID.

Note

Position qualifier is disabled for ‘Self’ identifier types.

Branch

Select the branch code associated with the position qualifier.

Desk

Select the desk code associated with the position qualifier from the list of options provided. All desk codes are maintained in ‘Desk Maintenance’ are displayed.

Firm Account Mnemonic

The system displays the firm account mnemonic maintained in the ‘Portfolio Maintenance’ screen. this displays only the valid CFPI firm account mnemonic uploaded through MCC and not the existing firm account mnemonic.

Silent Participant

Select this check box to indicate that the specific position identifier is a silent participant. If this option is selected, the position identifier type should be selected as ‘Self’ and the desk type as ‘Par’ or ‘Distress’. A single silent participant represents all the external participants who have bought the Participation from the bank.

You can mark a specific position identifier as a ‘silent participant’ across the branches and desk. If the position identifier for the Silent participant is not maintained, SLT-LB Handoff is in ‘Failed’ status in SLT-LB Interface browser for Participation sell.

During SLT-LB handoff, a new wrapper contract is created for all the silent participation sold across the bank entities.

Collateral Online Mnemonic

Specify the collateral online mnemonic to the margin desk account. The adjoining option list displays all mnemonics that are maintained for the collateral online customer in the system.

Collateral Settlement Mnemonic

Specify the collateral settlement mnemonic to the margin desk account. The adjoining option list displays all mnemonics that are maintained for the collateral settlement customer in the system.

First Buy Participant

Check this box to indicate that the position identifier is a first time buy investor. Only one such position identifier can be marked as first time buy investor across branches and desks. This is applicable only for non-lead agency contracts.

Tranche/DDs for the first-time buy trade CUSIP has to be created manually before the expected settlement date of trade with 100% participation from the first-time buy investor. When such tranche contracts are created, the delayed compensation fee (DCF) is calculated for the first-time buy trades between the committed settlement date and the actual settlement date.

Note

- When a bank entity is selling the participation, and if the CUSIP exists in the system, during SLT to agency handoff, the external counterparty is replaced by the silent participant maintained in the ‘Position Identifier Detail’ screen.

- As part of the Agency handoff, the bank position is reduced and the position of the Silent Participant position identifier which is representing all the External parties in the sell participation is increased to the extent of sell participation.

- System fires PRAM (Participant transfer) on the agency contract transferring the participant amount between bank entity and Silent participant.

- A new commitment contract is created to the extent of the trade amount in tranche currency, and Tranche maturity date as the commitment maturity date. This is done as part of STP to Originations for the Silent participant.

- The expense code of the bank entity who sold the Participation to the external party is used as the expense code for the new commitment contract.

- System STP further PRAM events from agency to newly created commitment for the silent participant, if there is subsequent sell of Participations by the same bank entity.

- For every Sell of Participations by another bank entity, another new commitment gets created for the silent participant to the extent of trade amount.

- System does not create loans for the underlying draw-down contracts for these silent participants.

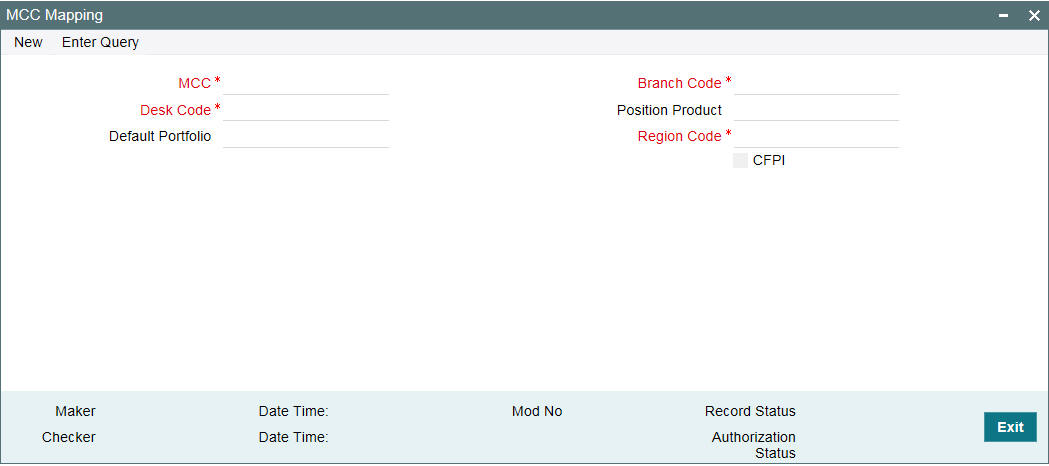

3.8 Mapping MCC

You can map strategy codes to region codes and branch codes using the ‘Strategy Code Mapping’ screen.

You can invoke the ‘MCC Mapping’ screen by typing ‘TLDSTRCM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Specify the following details:

MCC

Specify the MCC which you want to map to the region code and branch code. The adjoining option list displays all strategy codes maintained in the system. Choose the appropriate one. The combination of portfolio, branch desk code and Firm account mnemonic should be unique.

Note

- MCC captured in this screen is not restricted to the MCCs that are uploaded from e-sales. A pick-list lists the available MCCs uploaded from e-sales.

- Using this screen, only one record can be maintained for each MCC.

- MCC is one level higher than the Strategy Code, and hence multiple strategy codes can be mapped to one MCC.

Region Code

Specify the region code that needs to be mapped to the strategy code. This is not a mandatory field.

Branch Code

Specify the branch code that needs to be mapped to the strategy code. The adjoining option list displays all branch codes maintained in the system. Choose the appropriate one. This is not a mandatory field.

CFPI

Select this check box to indicate the branch falls under CFPI account.

Desk Code

Select the desk code from the adjoining option list. The list contains all valid Desk codes maintained in system.

Position Product

Select the position product from the adjoining option list. The list contains all valid position products maintained in system.

Default Portfolio

Specify the default portfolio that is used during the automatic creation of LB OL Product and Component mapping.

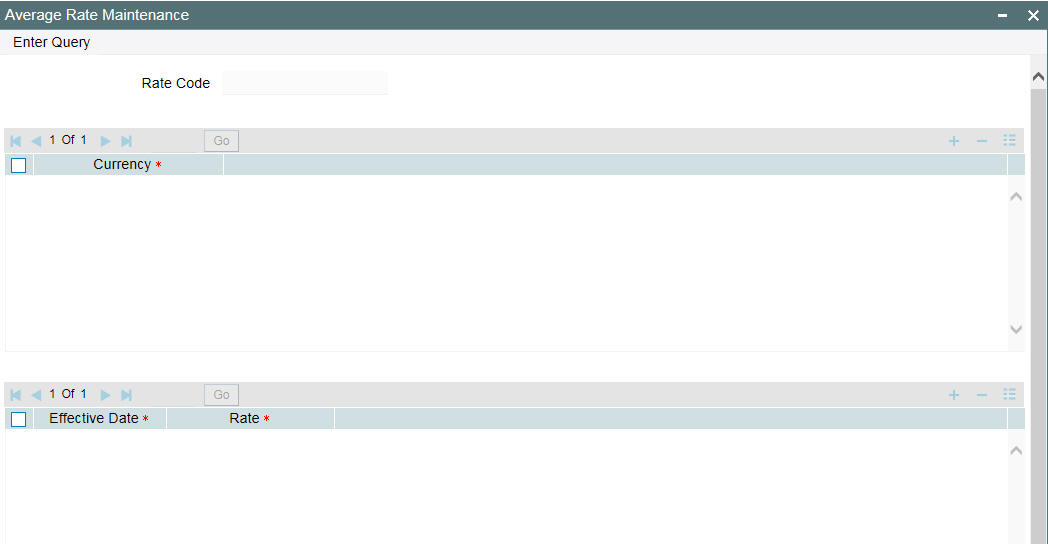

3.9 Capturing LIBOR Rate Details

You can capture the LIBOR rate to be used for computing ‘Cost of Fund’ and ‘Cost of Carry’ components of delayed compensation fee, in the ‘Average Rate Maintenance’ screen.

You can invoke the ‘Average Rate Maintenance’ screen by typing ‘TLDRTMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

Rate Code

The rate code defaults to ‘LIBOR’. You cannot modify this value.

Ccy

Select the currency to be linked to the LIBOR rates, from the option list provided.

Effective Date

Specify the date on which the LIBOR rate specified becomes effective.

Rate

Specify the LIBOR rate in terms of the selected currency.

Note

The LIBOR rate information is obtained from the website ‘averagelibor.com’.

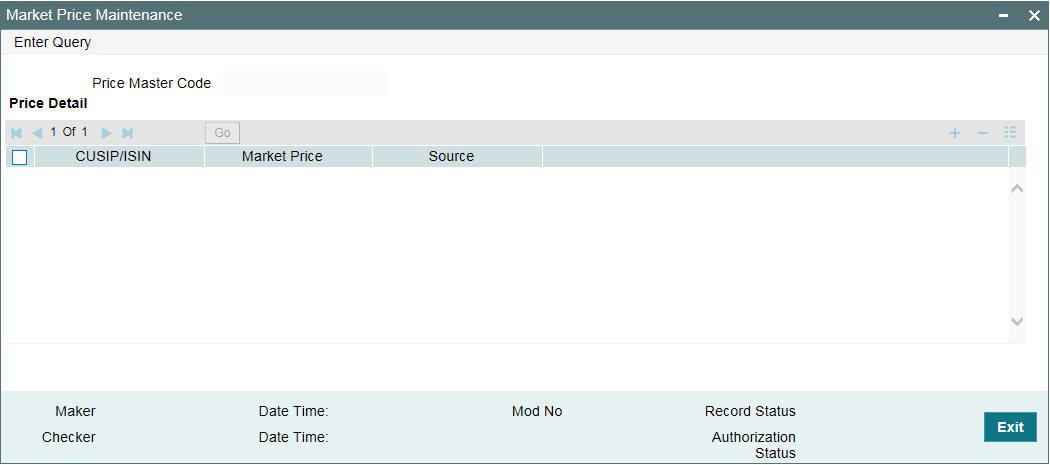

3.10 Maintaining Market Price Details

You can maintain market price ratings for all CUSIPs involved in trade, which can be used for the revaluation of the positions associated with the CUSIP.

You can capture the market price details for CUSIPs in ‘Market Price Maintenance’ screen. You can invoke the ‘Market Price Maintenance’ screen by typing ‘TLDPRCMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following details are displayed in this screen:

CUSIP/ISIN

Specify the CUSIP for which you need to maintain the market price details.

Market Price

Specify the market price associated with a CUSIP.

Source

Specify the source from where the market price for the CUSIP was obtained.

If the market price gets revised, the old value is retained in the history.

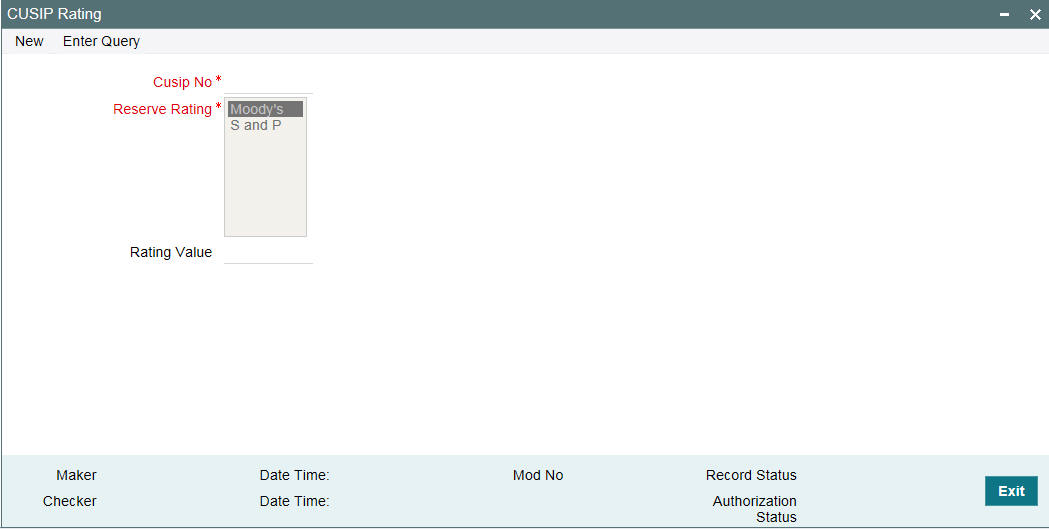

3.11 Maintaining CUSIP Rating

You need to maintain reserve ratings for all CUSIPs available at agency level to facilitate reserve calculation for a trade.

You can maintain ratings for the CUSIPs in the ‘CUSIP Rating Maintenance’ screen.

You can invoke the ‘CUSIP Rating’ screen by typing ‘TLDCUMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

CUSIP/ISIN

Select the CUSIP for which you need to maintain reserve rating from the option list provided. All CUSIP available at the agency level are displayed in the list.

You can also modify the rating for a CUSIP in this screen.

Reserve Rating

Select the external rating agency from where the credit rating for the CUSIP selected, should be obtained. The following options are possible:

- Moody’s

- S & P

Rating Value

Specify the rating value obtained for the CUSIP from the external credit rating agency.

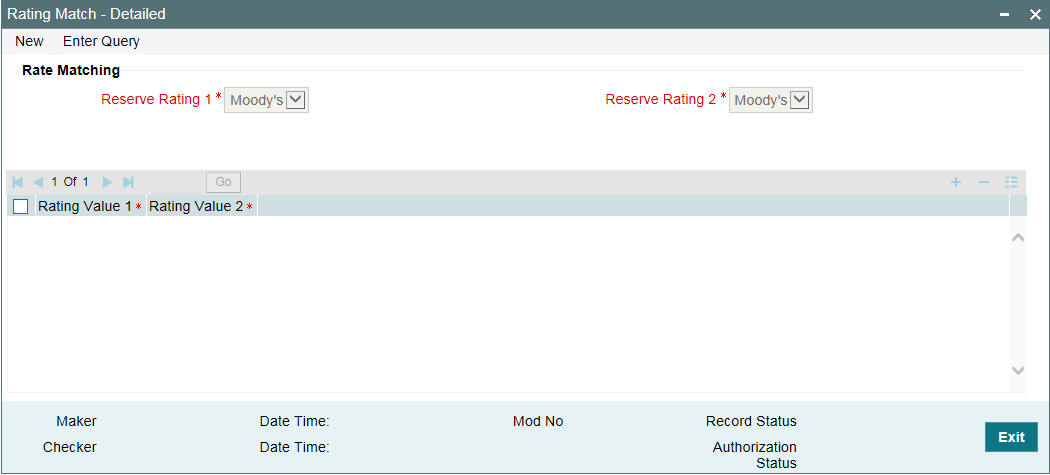

3.12 Maintaining Credit Rate Mapping

You can maintain a mapping of the credit rating values obtained from Moody’s and S&P’s in the ‘Rating Matching – Detailed’ screen.

You can invoke the ‘Rating Match -Detailed’ screen by typing ‘TLDRTMCH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

Reserve Rating 1

Select the first credit rating agency to be considered for finding the rate match. The following options are provided:

- Moody’s

- S & P

Reserve Rating 2

Select the second credit rating agency to be considered for finding the rate match. The following options are provided:

- Moody’s

- S & P

Note

You cannot select the same value for ‘Reserve Rating 1’ and ‘Reserve Rating 2’.

Rating Value 1

Select a rating value associated with the rating agency specified in ’Reserve Rating 1’.

Rating Value 2

Select the rating value associated with the rating agency specified in ’Reserve Rating 2’.

You can maintain a mapping for all the credit values obtained from the two credit rating agencies.

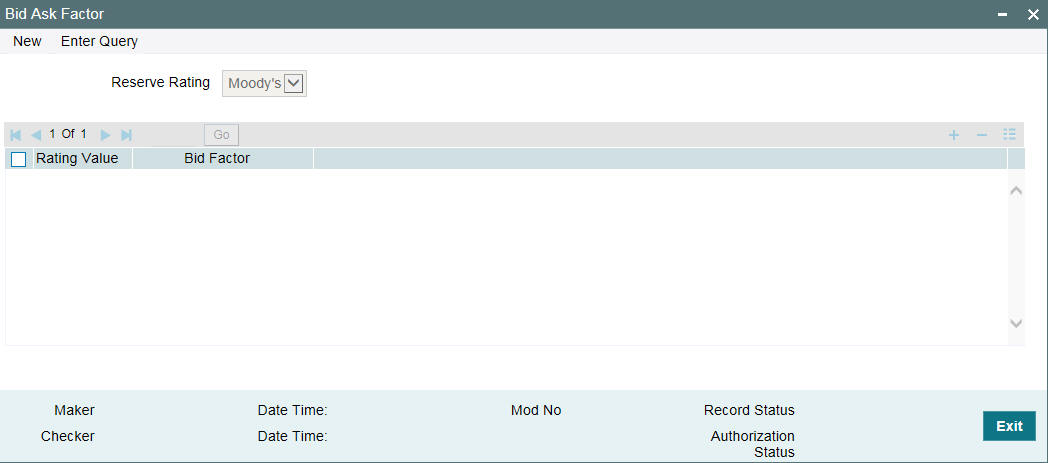

3.13 Maintaining Bid/Ask Factor

Bid price is the highest price that a buyer is willing to pay in a trade deal whereas ask rate is the lowest price that the seller is willing to accept. The ratio of the bid price to the ask price is termed as Bid/Ask factor.

You can maintain the Bid/Ask factor for the credit rating values available from S&P in the ‘Bid/Ask Factor Maintenance’ screen. You can invoke the ‘Bid Ask Factor’ screen by typing ‘TLDBDMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details in this screen:

Reserve Rating

Select the credit rating agency for which you need to maintain Bid/Ask factor for the associated rating values. The following options are available:

- Moody’s

- S & P

Rating Value

Specify the rating value obtained from the rating agency selected.

Bid Factor

Specify the Bid/Ask factor corresponding to the reserve rating obtained from the rating agency.

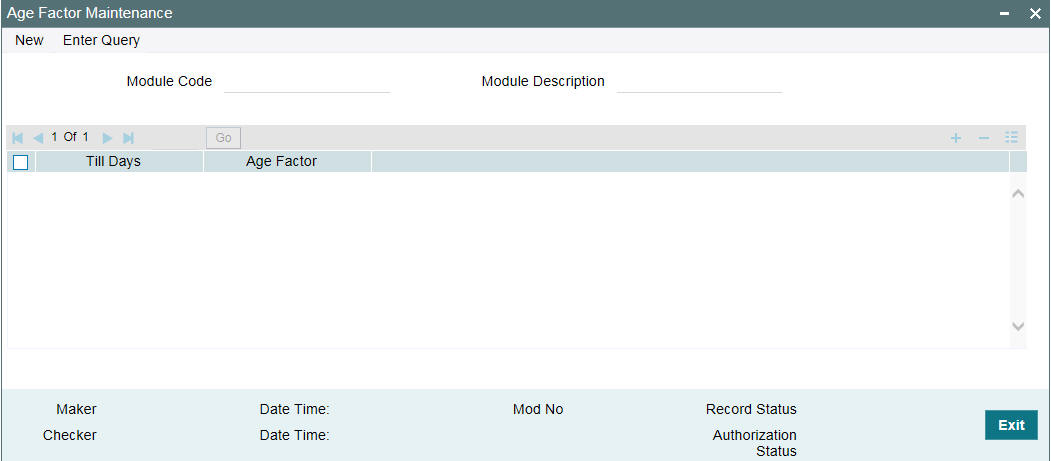

3.14 Maintaining Age Factor Details

Age factor is a value that is used for reserve calculation for trade deals. You can maintain the age factor details in the ‘Age Factor Maintenance’ screen. You can invoke the ‘Age Factor Maintenance’ screen by typing ‘TLDAFMNT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following details here:

Module Code

Select the module to which you want to associate the age factors.

Module Description

The module description appears once the module code is selected.

Till Days

Specify the till days for which you want to maintain the age factor.

Age Factor

Specify the age factor associated with the till days specified.