Appendix E :Usage Based Leasing

E.1 Introduction

The Usage based leasing option extends OFSLL support of lease functionality and facilitates to charge the asset usage fee for the customer not at the time of the Termination/Payoff Quote but based on the actual usage as per the defined Cycle (i.e. Daily, Weekly, Monthly and so on). Also for usage based lease contracts, customer has option to pay the minimum monthly lease payment and the usage fee based on the actual usage.

Whenever customer sends asset usage details to OFSLL, the details are categorized to applicable rate slabs, for tiered and not-tiered types and based on usage methods (i.e. rollover/advance) and charge matrix, the usage fee is calculated and charged on to the account. The same is communicated to the customer through account statement.

In such type of billing, customers would benefit by being charged only when they use a product or service, rather than having to buy something outright.

Consider the following example of a company which leases a photocopying machine. The monthly billing amount consists of two components - a flat rate (rental) that covers the fixed costs and a fee for usage charge (such as 1 cent per copy). Here, Usage is billed based on total number of units utilized from last bill to current billing date and customer pays the following two components:

- Lease Rental Payment

- Usage-based Charge component (included in the monthly bill)

E.2 Pre-requisites

- To support usage based leasing, ensure that all the basic setup of defining Usage Details, Usage Charge Matrix in Asset Types screen is done and the lease Agreement Type is selected appropriately in Products, Pricing and Contract setup screens.

- When usage details are to be processed through File Upload, ensure that the file received from external system contains all the required information for mapping to respective fields in Usage History screen.

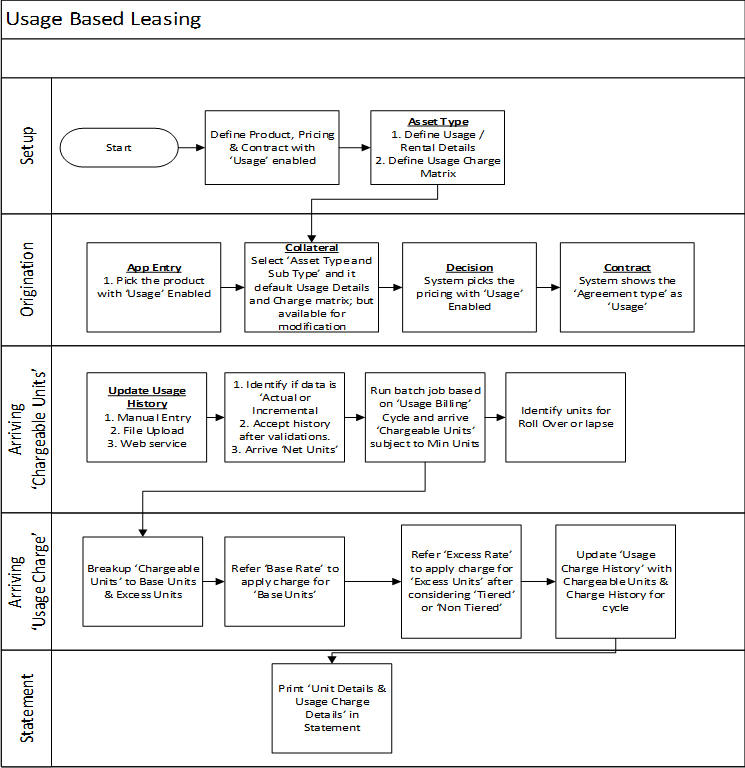

E.3 Usage Based Leasing Workflow

Consider the below image which indicates the complete usage based leasing workflow supported in the system. A brief detailing of the same is provided below.

- The process starts from defining usage based parameter (agreement type) in Setup > Products, Pricing, and Contract screens.

- In Setup > Asset Types screen, you can define the ‘Usage Details’ and ‘Usage Charge Matrix’ which are used to classify the incoming data for charging and billing calculation.

- In Origination > Collateral screen, select the usage based leasing application, select asset type, sub type, and load the usage details from setup. The details are allowed to be modified here. In Decisioning stage, system picks the pricing with Usage details and during Contract, the application is funded with lease usage agreement type.

- In Servicing, the chargeable units for usage is derived from the details populated in Customer Service > Collateral tab > ‘Usage History’ section. The details can be populated by File upload or through web services. The chargeable units are categorized based on Usage Details and Charge Matrix defined in Setup > Asset types screen.

- On receiving the usage data from external system, the same is validated if it is Actual or Incremental data and also accounts for Rollover - yes/no and Advance - yes/no type of combinations supported to derive the net chargeable units (subject to minimum units consumed). The same is discussed in subsequent section.

- The chargeable units are further classified into Base and Excess consumed units, and charge is applied based on Charge Matrix as per TIERED and NON TIRED category. This data is populated into Servicing > Collateral >Usage Summary tab.

- Based on 'Usage / Rental Cycle', system runs the Usage billing batch job to calculate and post the usage fee on the account as per the billing cycle. While generating the account statement, the usage details are explicitly indicated along with charges of the same.

E.3.1 Lease Usage Calculation

- Min Usage - indicates the minimum units to be considered as 'Chargeable Units'. During calculation, the Chargeable Units = Net Units, subject to 'Min Usage'.

- Max Usage - indicates that usage is to be charged as 'Base' value for the given billing cycle. Any usage units beyond 'Max Usage' should be charged based on 'Calculation Method' as either Tiered (based on multiple rate slabs) or Non-Tiered (applicable slab at total usage volume).

- Discount % - based on discount %, system calculates the applicable discount units on 'Gross - Non chargeable Units' to arrive Net Usage' in 'Usage History' tab.

E.3.2 Lease Usage Methods

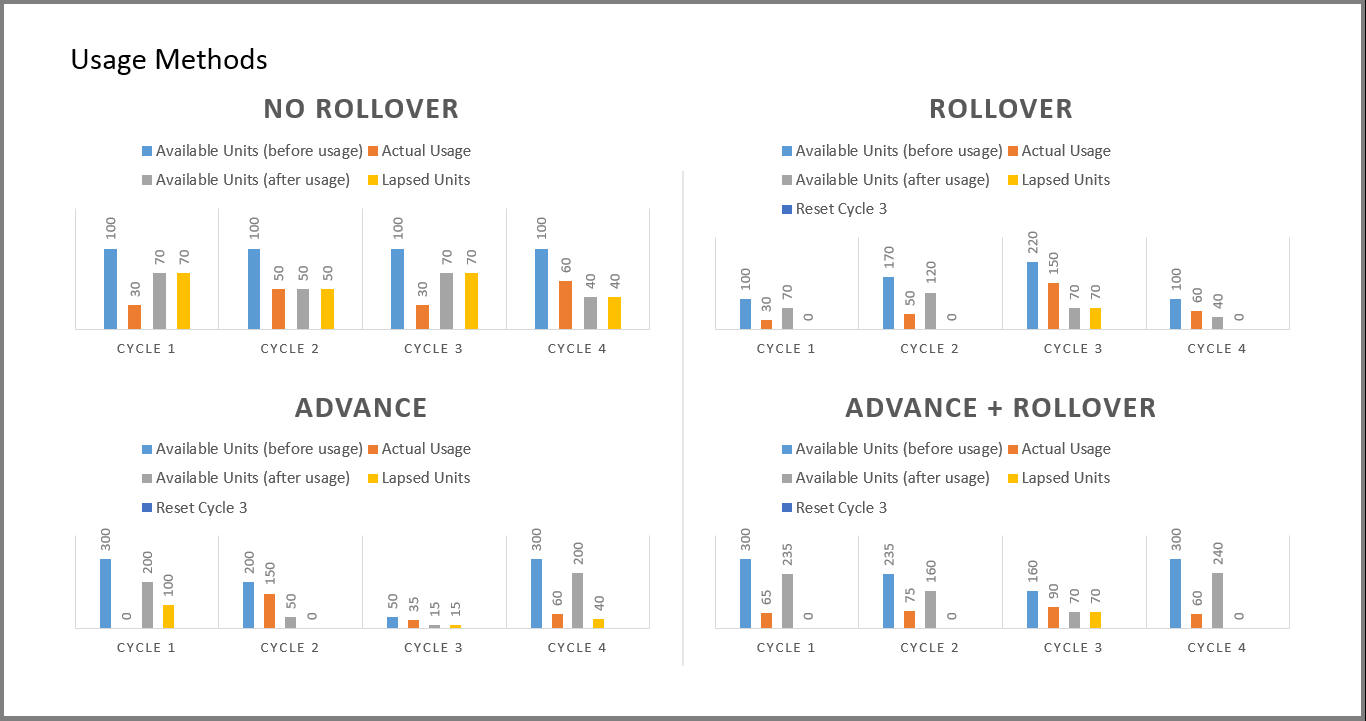

Following image indicates four types of asset usage lapse / rollover combinations supported:

As per the above usage methods, usage units billing is accounted as indicated below:

Note

The usage lapse / rollover is subject to maximum usage as defined for a Collateral.

- Non-Rollover Usage - This option indicates that non utilized units in current cycle will be lapsed.

- Rollover Usage - This option indicates that non utilized units from previous cycle is carried over and added as 'base' units to next cycle incrementally.

- Rollover & Advance Usage - This option indicates that system bills the customer at the base rate, considering the usage available for the life of account and includes the non utilized units from the previous cycle.

- Advance Usage - This option indicates that system bills the customer at the base rate, considering the usage available for the life of account. Here non utilized previous units will be lapsed.

The Rollover / Advance is accounted for fixed reset period. For example, if Contract starts at Jan and rollover is set to 3 months for a monthly usage billing cycle, the rollover resets at end of 3rd month and from April new rollover set starts.

E.3.3 Tiered and Non Tiered Usage Calculation

Consider the following type of charge matrix defined:

Rate Chart |

From Units |

To Units |

Base |

0 |

1 |

Base |

30 |

2 |

Base |

75 |

3 |

Cycle Excess |

0 |

4 |

Cycle Excess |

50 |

5 |

Life Excess |

0 |

6 |

Life Excess |

50 |

7 |

On receiving the following type of usage data from customer, the chargeable units are derived based on lapse and rollover rules. The chargeable units are charged based on Tiered and Non Tiered preference indicated for a collateral. The sample usage calculation is as indicated below:

Base Units:76, Cycle Excess:51, and Life Excess=65

Tiered Calculation

Base Charge = (29*1)+(45*2)+(2*3) = 125

Cycle Excess Charge=(49*4)+(2*5)=206

Life Excess Charge=(49*6)+(16*7)=406

Total Charge=125+206+406=737

Non Tiered Calculation

Base Charge =(76*3) = 228

Cycle Excess Charge=(51*5)=255

Life Excess Charge=(65*7)=455

Total Charge=228+255+455=938

E.3.4 Lease Usage Batch Jobs

Following two batch jobs are provided for usage based leasing:

To upload usage details

Batch job set - SET-IFP (INPUT FILE PROCESSING)

Batch job - IUHPRC_BJ_100_01 (ASSET USAGE HISTORY FILE UPLOAD)

This process uploads asset usage details into the system. To do so, place the usage details file in ‘iuh’ folder available under input > ifp > iuh directory and run the batch job.

For billing usage details

Batch job set - SET-TPE (Transaction Processing Engine)

Batch job - TXNUSG_BJ_100_01 (Usage Charge Processing)

This process is used to derive the billing amount to be charged for Lease Usage/Rental based asset for consumed units which is calculated by the applicable charge matrix and posts lease usage/rental fees on account.

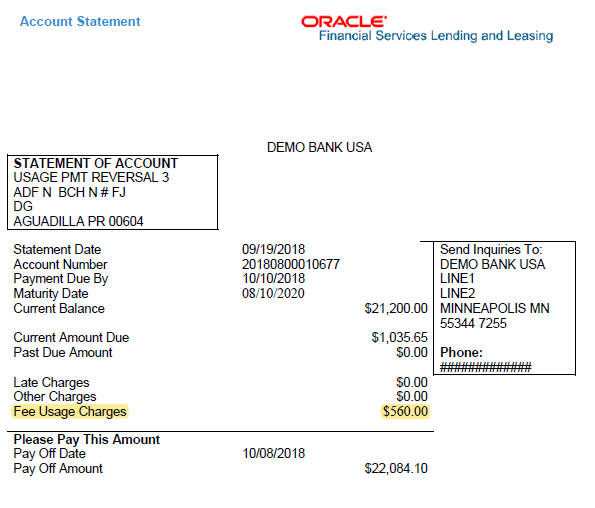

E.3.5 Lease Usage Account Statement

The Statements tab in Customer Service > Account Details tab displays the ‘Fee Usage Charge(+)’ that is posted to lease usage account. On generating a report of lease account, the Fee Usage Charges are indicated as separate line item.

E.3.6 Elastic Usage Term

The Elastic Usage Term in OFSLL refers to a system predicted value to indicate customer about the remaining term to reach the asset usage life as per current usage pattern. The Elastic Usage Term is available in Collateral > Usage Summary tab and is calculated by the following methods:

- Actual Usage - Elastic Term is calculated based on Usage Factor

- Average Usage - Elastic Usage Term is calculated based on Average Usage