RELEASE NOTES

This document includes following topics:

- Theme of The Release

- Highlights

- Specialized Corporate Servicing

- Digitized Customer Engagement

- Open Banking

- Enhanced Digital Experience

- New Retail Capabilities

- Enriched Payment Services

- Qualifications

- Browser Support

- Known Issues and Limitations

- OBDX 18.3.0.1.0 Release (March 2019)

1. Theme of The Release

1.1 Introduction

In an environment characterized by the constant introduction of new digital technologies and increasing consumer expectations, it is imperative for banks to come up with means by which to attract and retain customers. The main incentive behind customer loyalty to a bank is good customer service. However, good customer service must be combined with services that add value to the customer in order to enable banks to effectively improve customer retention.

The aim of the OBDX 18.3 release has been to enrich the digital banking experience of business users and at the same time to strengthen its portfolio of online banking services. As part of this release, new features such as Virtual Account Management (VAM), Liquidity Management (LM) and Electronic Bill Payment and Presentment (EBPP) have been introduced to enhance the banking services provided to corporate clients. Dashboards for both VAM and Liquidity Management have been built so as to simplify complex processes of corporates keeping in mind the digital savvy corporate clients of today that are seeking the same experience as they are used to in retail banking. Additionally, steps have been taken to digitize business customer engagement through the introduction of voice activated banking by onboarding the capabilities of Virtual Assistant Alexa, integration with Oracle Live Experience to enable voice and video call assistance and the harnessing of iOS capabilities in enabling users to log into the mobile banking application through Facial ID recognition.

The services specific to retail banking customers have also been enriched through the introduction of UPI Payments on the mobile banking application, enhancements made to the deposit module to provide deposit products that meet the needs of NRI customers and the introduction of Wealth Management to cater to the needs of High Net worth Individuals.

The payments module has been strengthened through the introduction of the Funds Transfer History inquiry screens, India specific enhancements made to the domestic transfer initiation screen to capture the account type of the payee and to enable the system to suggest networks based on transfer details, enhancements to Peer to Peer (P2P) Transfers through the addition of transfer mode - Twitter and transforming the process by which recipients of P2P Transfers claim funds have been made. Additional enhancements made to the payments module involve providing users with the facility to specify third party addresses while defining delivery preferences for demand draft requests, the addition of ad-hoc demand drafts, and enabling users to upload photographs against payee records to facilitate the identification of payees at the time of transfer initiation as well as while performing transfer inquiries.

Open banking capabilities have also been enriched through the introduction of Account Aggregation. Enhancements to administrator maintenances such as Limits, Role Transaction Mapping, Definition of First Time Login Steps and Dashboard Builder along with the introduction of User Segments have been made so as to provide a seamless and improved digital banking experience overall

As a part of 18.3.0.1.0 release, Corporate Banking Module of OBDX have further been enriched through the introduction of Credit Facility Management and Corporate Lending Management features. The modules facilitates the corporate user to originate a request for New Facility/Sub Facility and New Loan Account and to inquire existing Credit Facilities, Collaterals and Loan Accounts. Click Here to know the detailed feature list supported as a part of these modules.

2. Highlights

This section describes in brief, the enhancements made in OBDX in the 18.3 release.

2.1 Specialized Corporate Servicing:

Corporates need better control and visibility over their cash flows and liquidity positions. Moreover, corporate customers of today are digitally savvy and expect the same experience from corporate digital banking applications that they are used to in retail banking.

OBDX has enhanced the corporate banking module in this release to cater to these corporate requirements through the introduction of Virtual Account Management, Liquidity Management and Electronic Bill Payment & Presentment tools.

Virtual Account Management

In light of a corporate’s need for better control and visibility over its cash inflow and outflow and for enhanced liquidity risk management, banks are investing in innovations such as Virtual Accounts Management.

Virtual accounts, also referred to as ‘shadow accounts’ are dummy accounts used to make and receive payments on behalf of physical accounts. OBDX’s Virtual Accounts Management (VAM) offering from OBDX is integrated only with Oracle Banking Virtual Account Management solution and can help corporates to create, manage and monitor virtual accounts through self-service channels. The VAM dashboard has been designed so as to provide the customer with a concise view of the corporate’s accounts and balances encompassing physical as well as virtual accounts along with information pertaining to the mapping structures of these accounts.

Liquidity Management

In times of a highly regulated and globalized economy, liquidity management is the key to a company’s survival.

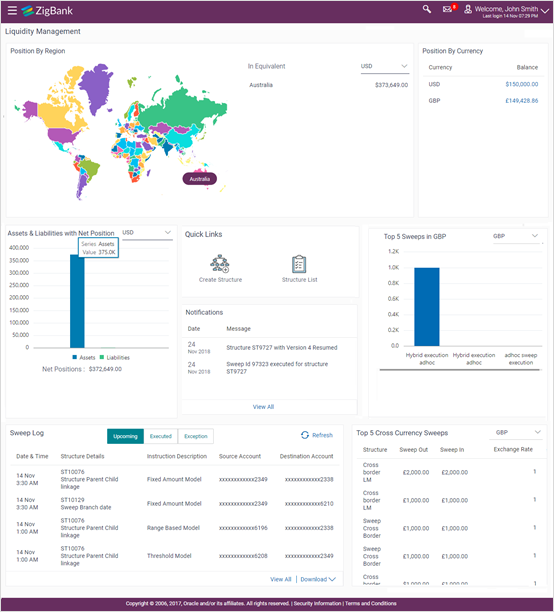

The Liquidity Management solution offered by OBDX is integrated only with Oracle Liquidity Management Solution and is comprehensive and flexible enough to meet the unique requirements of each corporate customer of the bank. The cash and liquidity management dashboard provide a real time, accurate and consolidated view of the corporate’s current asset & liability, and cash position. Widgets are designed to provide information pertaining to the corporate’s cash position on the basis of region and currency along with the position of the company’s assets and liabilities. The highest value of sweeps per currency as well as highest cross currency sweeps are also showcased as widgets on the dashboard. The sweep log monitor widget enables the customer to view the sweeps that have been executed successfully, those that have failed and also to view the sweeps that are upcoming. The Account Structure Maintenance feature enables customers to build new account structures and also view and edit existing account structures. Additionally, customers can also pause account structures for periods of time and initiate the ad-hoc execution of sweeps for specific structures.

Electronic Bill Presentment and Payments

The Electronic Bill Presentment & Payment (EBPP) feature of OBDX is an all-inclusive solution to bill payments that offers corporate customers the convenience of viewing and paying utility bills in a manner that is quick, hassle-free and secure. Customers can register billers for presentment, payment or both and also register billers for the purpose of making online recharges for prepaid services. Once registered, these billers can also be edited or deleted. Customers can set up auto pay instructions for presentment type of bills and can also initiate one time - same day payments or schedule payments to be made at a later date or even set up recurring payments to be made to billers. Additionally, customers can recharge prepaid service plans and pay bills towards billers that are not registered. Customers can also view details of bills paid and download and print the same from the Payments History screen.

2.2 Digitized Customer Engagement:

Banking customers of today want simplified banking, personalized interactions and to be able to access their banking applications through advanced technology. At the same time voice enabled assistants have become a part of people’s everyday lives and are rapidly gaining in popularity.

In keeping with this theme, the OBDX application has been enhanced so as to offer its business customers constant assistance through voice and video calls, voice banking through Amazon’s Alexa along with Facial ID recognition as a means to login to mobile banking applications.

Facial ID Recognition

Facial recognition is the latest entrant in the space of biometrics adopted by banks in their quest to enhance digital banking user experience. Following on from fingerprint scan or Touch ID to log in to the mobile application, facial ID recognition enables iOS users (with devices supporting Face ID) to login to their mobile banking application by simply looking at their device. OBDX has harnessed this iOS feature to enable users to authenticate their identity and access digital banking on their mobile devices in a matter of seconds. This feature is currently available only on the iOS devices supporting Face ID recognition.

Multi-modal Assisted Banking (Via Voice and Video Call)

Online banking users can now avail of the enhanced assistance tools available on the digital banking channels. In addition to the existing chatbot assistant, OBDX now provides business users with the facility to initiate voice or video calls from within the banking application. This feature enables users to reach out to bank executives as and when they need banking assistance.

Voice Assistant Alexa

Users are increasingly relying on voice-enabled assistants to conduct simple tasks such as placing calls, sending messages or getting directions. In order to enrich user experience, banks and financial institutions have started extending these capabilities to online banking users. As part of this release, the OBDX product has enhanced its virtual personal assistant offerings by enabling Alexa as a touch point to enable business customers to perform various transactions through ‘conversational banking’. Users can inquire about account balances, past transactions and also inquire about when the next installment of a loan is due by conversing with Alexa through Alexa enabled devices.

2.3 Open Banking:

Open banking enables users to access the data of multiple financial institutions through the use of application programming interfaces (APIs). One of the key benefits of introducing open banking in OBDX is the ability to provision business users to access their accounts held across different banking institutions from a single place. The following enhancements, including account aggregation, made in OBDX are listed below.

Account Aggregation

The Account Aggregation feature introduced in this release consolidates the business users account information across savings, term deposits and loan accounts held with multiple banks and financial institutions into a single place so as to provide the user with a comprehensive view of all his assets and liabilities. In order to avail this feature, the user must link his external bank accounts. Once the user has linked external bank accounts, he can view details pertaining to recent transactions undertaken in any account and can also transfer funds within these accounts.

2.4 Enhanced Digital Experience:

Personalizing the digital experience of banking users has been revealed as the key to increased customer engagement. In keeping with this vision, multiple enhancements have been made in OBDX in this release. By creating user segments and enhancing the role transaction mapping function to include role transaction mapping to widgets, the bank can move beyond a one-size-fits all approach to offer customers tailored services. Additionally, enabling users to personalize their dashboards further enhances the digital experience of users.

User Segment

In order to cater to the specific banking needs of customers, banks need to employ a method of segmentation wherein customers sharing certain attributes are grouped together. Segmentation can be done on the basis of many factors such as geography, demography or behavior among others, with the main aim of grouping together customers that share the same needs, wants and expectations from a banking or financial institution. By creating such user segments, the bank can ensure that each segment, and in turn, each user is offered a banking experience that is tailored to them.

As part of this release, a new maintenance is offered to bank administrators that enable them to define and manage user segments. Currently, user segments can be created only for retail users. Some of the maintenances that can be mapped at the user segment level are limits, mailers, product mapping, dashboards, authentication, brands and payee restrictions.

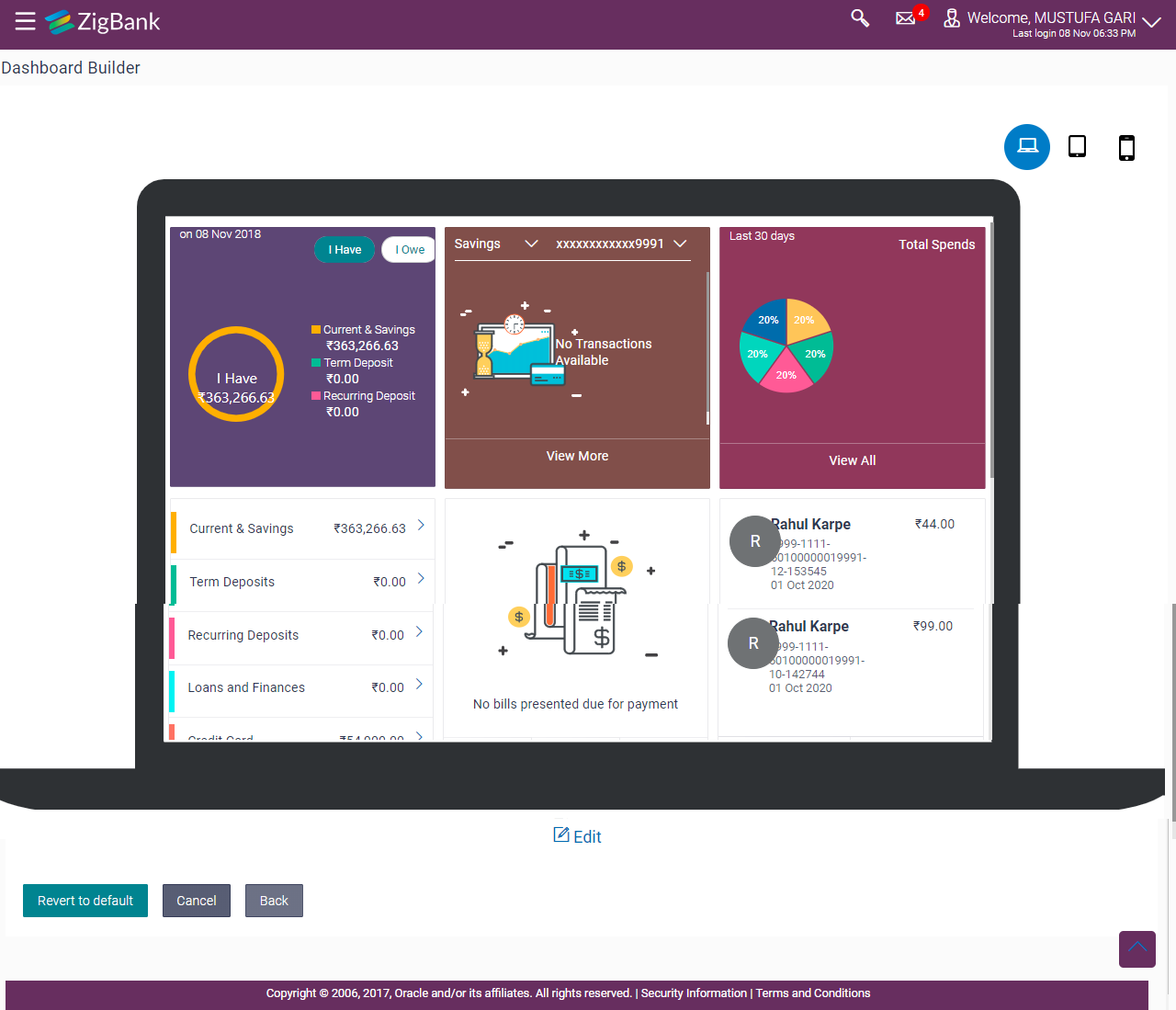

Dashboard Builder

The introduction of user segments has enabled the existing dashboard feature to be enhanced. Administrators can now create specific dashboards for each user segment, thus ensuring that users are provided with dashboards and widgets that best suit their banking needs. Additionally, the dashboard builder maintenance screen has been enhanced to enable administrators to further tailor dashboards to the needs of users by extending role transaction mapping to widgets.

Role Transaction Mapping

The functionality of Role Transaction Mapping has been enhanced to include widgets and menu options as entitlements so that they can be mapped to application roles assigned to users. In doing so, the bank administrator can ensure that business users are able to access only those widgets and menu options for which they are entitled.

Enhancement to First Time Login Steps

Enhancements have been made to this maintenance to enable configuration of the steps involved in which a business user logs in to the digital banking application for the first time. The bank administrator can choose the steps to be included in this process and also define the order in which the steps are to be made available to the users.

2.5 New Retail Capabilities:

The focus of the 18.3 release pertaining to retail banking has been on enhancing and expanding the portfolio of digital banking services offered to customers while maintaining focus on optimizing customer experience. Wealth management services has been added in the retail banking module to cater to the needs of high net worth individuals and enhancements specific to Indian customers have been made by adding UPI payments and NRI specific deposit functionalities.

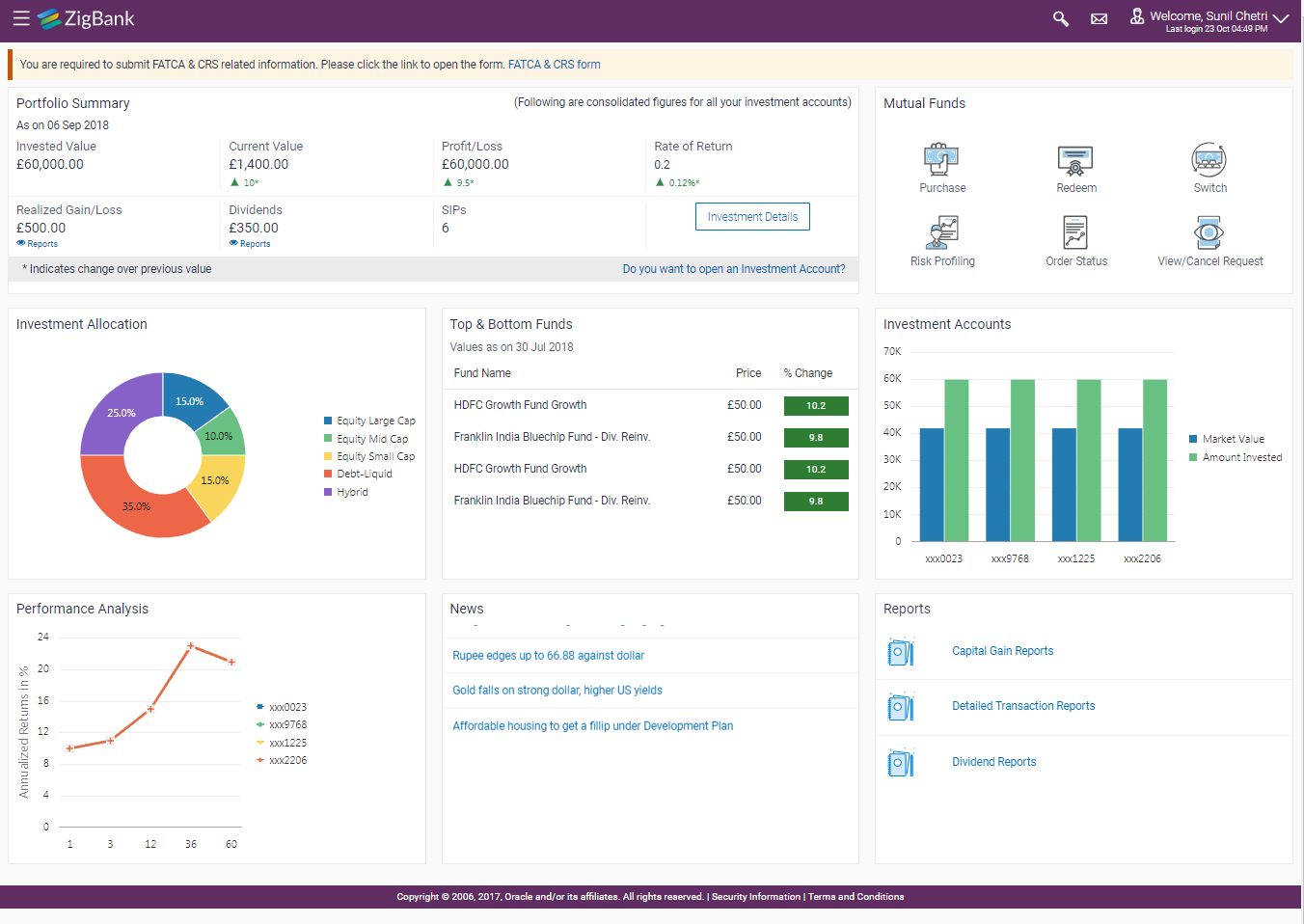

Wealth Management Services

High net worth individuals are increasingly seeking digital capabilities in wealth management that provide sophisticated and customized services in financial planning and advisory options. In times of rapidly changing technology, stricter regulations and evolving customer needs, banks and financial institutions must invest in wealth management services that enhance the overall experience of their customers by harnessing emerging technologies and at the same time meet regulatory and security needs.

The OBDX Wealth Management Services module offers business users an all-inclusive dashboard that gives users a snapshot of their investment holdings with the bank. Users are provided with the facility to open investment accounts with the bank and can place orders to purchase, redeem or switch any listed funds. After purchasing the mutual funds, user can track their performance & regular update on the dividends, fund portfolio composition etc. in the Investment Details screen. User also get multiple reports related to wealth management activity like Portfolio report, Transaction report, Capital gains report etc.

UPI Payments - India Region

Developed by the National Payments Corporate of India (NPCI), Unified Payments Interface (UPI), is an immediate real time interbank payment system that works by instantly transferring funds between two bank accounts through a mobile platform. Some of the advantages of UPI are that it is currently the cheapest means by which to transfer money electronically, is secure, funds are transferred instantly and users do not need to enter extensive account information of the intended recipient.

Owing to the many benefits of this payment system, many banks and fintechs are hosting UPI on their mobile applications and have even created mobile applications specifically for UPI.

As part of this release, UPI Payments are offered to retail users on the mobile banking channel. In order to avail this facility, users need to create a Virtual Payment Address (VPA) and map the same to a current or savings account held with the bank. Once created, this VPA can be used to transfer funds from the mapped account to any VPA or account held within the country.

Deposit Enhancement - India Region

The Deposits module has been enhanced in this release to cater to India region specific requirements. Non-Resident Indian (NRI) customers can now open NRE and NRO term deposits to be held in INR currency. NRI customers can also open Foreign Currency![]() A generally accepted form of money, including coins and paper notes, which is issued by a government and circulated with in an economy. Non-Repatriable (FCNR) deposits. Additionally, customers of Indian origin who have returned to the country can also open Resident Foreign Currency (RFC) deposits so as to avail higher rates of interest on foreign currency funds.

A generally accepted form of money, including coins and paper notes, which is issued by a government and circulated with in an economy. Non-Repatriable (FCNR) deposits. Additionally, customers of Indian origin who have returned to the country can also open Resident Foreign Currency (RFC) deposits so as to avail higher rates of interest on foreign currency funds.

2.6 Enriched Payments:

The key areas of focus for banks while looking to adopt an efficient digital payment solution is that it should be simple, easy to use and fast. Additionally, changes in digital technology are impacting the way people are making payments. Keeping this in mind, the following enhancements have been made in the OBDX payments module to cater to the evolving needs of digital banking users.

Domestic Transfer Enhancement - India Region

In this release, the feature of network suggestion has been introduced for domestic transfers initiated within the India region. This feature enhances the experience of business users while initiating domestic fund transfers by only enabling those networks (out of IMPS, NEFT and RTGS) that are supported on the basis of factors such as daily cutoff, payee bank support and limits. The system then suggests a network out of the enabled networks on the basis of preference defined by the bank administrator in the Network![]() An electronic funds transfer network, such as PULSE, that links financial institutions and their cardholders to ATMs and merchant point-of-sale (POS) terminals to complete an electronic financial transaction. Preference Maintenance screen.

An electronic funds transfer network, such as PULSE, that links financial institutions and their cardholders to ATMs and merchant point-of-sale (POS) terminals to complete an electronic financial transaction. Preference Maintenance screen.

The domestic transfer feature has also been enhanced through the capture of the payee account type which is required for the processing of NEFT transfers, as per RBI guidelines. This information is now captured in the payee maintenance screens while adding domestic account payees in the India region and is captured in the transfer initiation screen while initiating adhoc domestic transfers

Funds Transfer History

A new feature, by means of which retail users can view the status of transfers initiated from the direct banking channels, has been introduced in this release. Users can search for specific transfers on the basis of transfer type, transfer reference number, etc. and can proceed to view details of the transfer including the current status (success, failure, in progress) as fetched from the host system.

A Funds Transfer History widget is also provided on the dashboard through which users can view the status of the most recently initiated transfers

Enhancement to P2P Payments

One of the main advantages of peer to peer payments to an end user is that it omits the need for the initiator of the transfer to know the account information of the recipient. Users can simply specify the identifier as provided by the recipient, while making the transfer. This identifier can be the recipient’s email ID, mobile number, Facebook ID or as introduced in this release, the recipient’s Twitter Handle. On initiating a transfer towards the recipient’s Twitter ID, a direct message is sent to the recipient via Twitter and the user can claim funds by clicking on the link received as part of the direct message.

The process by which the recipient can claim funds has also been enhanced through the introduction of dynamic links. These links are created by the system specifically for a payment when it is initiated and sent to the recipient. The recipient, in turn can arrive at the Claim Money page by clicking on the link. This link will have the payment identifier linked so as to validate the security code entered by the recipient

Limit Enhancement

The limits module has been greatly enhanced in this release impacting both administrator limit maintenances as well as business user limit packages.

Administrators can now maintain global limit packages and can map the same to specific user segments, parties and users. The module has also been enhanced to enable administrators to view the limits (current available as well as utilized limits) assigned to a specific retail user and can modify these limits as required. Additionally, it is also now possible for administrators to set separate limits for payments (Internal, Domestic and International Transfers) that are initiated towards registered payees and those that are ad-hoc.

Facility has been provided to retail user to view the final available transaction limits while initiating a transaction. These limits are derived based on transaction initiation limit (min-max amount per transaction), cumulative daily/monthly limits, payee cooling period and payee limits set if any by the user. All applicable limits set for a transaction for a specific channel or group of channels are considered for arriving at final available transaction limits.

With the introduction of global limits packages, the screen on which a business user can view limits applicable to him, has also been enhanced so as to now display applicable global limits

Payee Photograph

As of this release, the risk of sending money to the wrong recipient has been minimized through the introduction of payee photographs. Users can now attach photographs against payees so as to promote ease in identifying the intended payee at the time of transfer initiation.

These payee photographs are also displayed against the payee records on the transfer inquiry screens and can be edited or deleted from the payee maintenance screens.

Demand Draft Enhancement

The existing demand draft initiation feature of OBDX has been enhanced so as to enable a business user to opt to have the draft delivered at a third-party address if the user does not want the draft delivered at any of his addresses registered with the bank or at any of the bank’s branches. This feature enables the user to have the bank deliver the draft directly to the recipient by entering the recipient’s address in the provided address fields or to have the draft delivered to any other third-party address as desired. An additional feature built in this release is the provision to business users to initiate adhoc demand drafts. Users can avail this feature to initiate requests for drafts to be payable to recipients that are not registered as payees with the bank.

3. Specialized Corporate Servicing

The following enhancements have been made to Corporate Banking in the 18.3 release.

3.1 Virtual Accounts Management (VAM)

The Virtual Accounts Management module serves as a solution to corporates to reduce the complexity of money management. Virtual accounts help large corporates to reduce the number of real accounts needed and thereby reduces their associated costs. Additionally, virtual accounts provide ease of reconciliation and provides better visibility over deployment of money.

Using this module, a corporate can create and manage multiple virtual entities, virtual accounts and virtual account structures via self-service channels. The user also gains the benefit of an exclusive dashboard view of account information and an option to create virtual account structures to get better visibility of his cash positions.

The following features have been built for the corporate user in Virtual Account Management.

Manage Virtual Accounts

Virtual accounts are notional accounts which represent real accounts and are either linked to real accounts directly or are linked via virtual account structure. In Manage Virtual Accounts corporate user can create virtual accounts (without any ceiling on the number of accounts) , view, edit & delete these virtual accounts. User will identify the virtual entity to which the virtual account belongs and can also link these virtual accounts to real accounts. User can further set the preferences that would guide the behavior of the virtual account – for example are debits & credits allowed, does the virtual account have an IBAN![]() International Bank Account Number etc.

International Bank Account Number etc.

Manage Virtual Entities

Virtual Entities are notional entities representing real business entities. This feature enables a corporate user to create virtual entities, view, edit & delete them. Virtual entities created can be of type individual or a corporate. The user can also indicate the KYC![]() Know Your Customer refers to the activities related to customer due diligence that banks must perform to identify their clients and ascertain relevant information pertinent for doing financial business with them; and bank regulation which governs those activities. status of the virtual entity getting created.

Know Your Customer refers to the activities related to customer due diligence that banks must perform to identify their clients and ascertain relevant information pertinent for doing financial business with them; and bank regulation which governs those activities. status of the virtual entity getting created.

Manage Virtual Account Structure

The implementation of Virtual Account structures provides corporates with better visibility and greater control over cash. It affords corporates the ability to reexamine funds allocation quickly and to look for opportunities to implement a payment or collection.

Manage Remitter Lists

Virtual identifiers are dynamic short identifier based virtual accounts, which consist of corporate identifiers and remitter IDs.

This feature enables a corporate to create and manage his virtual remitter ID list. Since these are unique in nature, a corporate user can track his payments and receivables easily and perform faster reconciliation.

VAM Overview

The VAM Dashboard serves as a visual and informative tool by way of which the user can track and analyze the cash and liquidity position of the corporate. It provides an overall view of all of the corporate’s cash positions, balance trends and crucial account information on real accounts, virtual accounts and virtual account structures. The widgets displayed on the dashboard of each corporate user will be dependent on the roles assigned to the user.

3.2 Liquidity Management :

The Liquidity Management solution, introduced in this release, facilitates corporate customers to manage their liquidity by optimizing interests to offset account balances, reducing interest costs, maximizing net returns and by providing greater visibility over cash positions.

The following functions comprising the liquidity management module, are provided to the corporate customers of the bank.

Liquidity Management Overview

The liquidity management dashboard showcases information regarding the current positions to the corporate with the help of various widgets, as listed below:

- Position of Region/Location

- Position by currency

- Net corporate position along with assets and liabilities information

- Top sweeps in specific currency

Account Structure Maintenance

Account structure is an efficient tool that helps to optimize the working capital of a business. The objective of creating an account structure is to bring together the credit and debit balances of different current and checking accounts into one single concentrated account of the corporate. This enables corporate users to manage the daily liquidity of their businesses in a consolidated fashion and to derive maximum benefits at minimal cost.

OBDX enables the corporate users to maintain account structures by providing sweep or pool instructions.

The following features are supported in the application:

- Build Account Structure

The application enables the corporate user to build new account structures using the digital banking platform. While building a structure, the corporate can perform the following tasks:

- Define Structure Details (Sweep, Pool, Hybrid etc.)

- Define Account Mapping and specify the hierarchies

- Check basic validations

- Set up instructions between each account pair.

- View and Edit

Corporate users can search the account structures maintained between the internal and external accounts of their parties. They can further, see and edit the structure details along with the instructions set between an account pair.

- Pause/Resume and Ad-hoc Execution

Corporate users can pause the processing of a structure for a specific time period and can also initiate an ad-hoc execution of sweeps for specific structures.

Sweep Log Monitor

The Sweep Log Monitor enables corporate users to view the sweep logs of a structure by specific status which are identified below:

- Executed Sweeps

- Upcoming Sweeps

- Exceptions (Failed executions)

3.3 Electronic Bill Presentment & Payment:

Corporates regularly pay various bills for services they use such as utilities, telecom, internet etc. Being able to view these bills and pay them online is an important functionality that the bank can offer to its corporate customers, which in turn, can play a crucial role in enhancing the relationship that the corporate customer has with the bank.

Corporate User Capabilities

As per the general practice amongst corporates, all the EBPP transactions too, go through the maker checker process. Individual functionalities available for a corporate user are as follows:

- Biller Registration: Business users can register billers of presentment type, payment type, presentment and payment type and recharge type by providing the required registration information and defining a nickname for each biller. The registration can go through a validation process, if required, by the biller and on successful registration; the user will start receiving bills from the next cycle from those billers that present bills

- Manage and Delete Biller: Once a biller is registered, users can modify the registration by modifying the biller nickname and can also modify the auto payment or scheduled payments set up for the biller. The user is also provided with the option to delete a registered biller.

- Bill Payments: Users can pay bills using the current and savings accounts that they have access to. Bills can be paid immediately using the ‘Pay Now’ option or can be scheduled for payment at a later date using the ‘Pay Later’ option. Business users can create auto pay instructions for presentment type of bills to have the bills paid automatically on the due dates. An upper limit can be set for auto pay instructions so that, if bill amount breaches the limit, the system will alert the user and await his instructions to pay the bill. For billers who do not present bills, users can pay anytime and also schedule a recurring payment i.e. to have a fixed sum of money paid to the biller at regular intervals.

- Recharges: Users can recharge their pre-paid services using the recharge transaction. After registering the recharge type biller, an existing pre-paid services plan can be topped up or a new plan can be chosen.

- Quick Bill Pay and Quick Recharges: Users can pay bills or carry out recharges for non-registered billers provided the biller accepts such payments

- Payment History: Users can search for and view bill payments of the past and can download or print such bill payments.

4. Digitized Customer Engagement

The following enhancements have been made in OBDX to digitally transform customer engagement:

4.1 Facial ID Recognition:

Biometrics are the physical characteristics unique to every human, and hence these can be used for security purposes. Facial recognition is a type of biometric technology and is the latest entrant in the evolution in the use of biometrics for digital banking.

As part of this release, Face ID has been introduced as an alternate method for authenticated login, in addition to existing features of PIN![]() Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account., Pattern and Touch ID. Instead of logging into the mobile app by using the conventional method of entering user name and password, the user can scan his face to login.

Personal identification number (PIN) is a secret number given to an account holder to be used when they put their credit card or cash card into an automatic teller machine (ATM). If the number they use is correct they will be allowed to access their account., Pattern and Touch ID. Instead of logging into the mobile app by using the conventional method of entering user name and password, the user can scan his face to login.

In order to use this feature, the user’s device must have a Face ID recognition capability which is currently supported only in iOS devices.

4.2 Multi-modal Assisted banking (Via Voice and Video call):

In this release, the option by which business users can initiate video or voice calls from the channel platform has been introduced. This features also enables users to share their screen with the bank user, which comes in handy if the user is facing an issue while performing a transaction and is in need of assistance from the bank.

Integration with Oracle Live Experience has been done to provide assistance to business users on desktop. This involves passing transaction attributes such as the user’s User ID, First Name/Last Name, Module and Screen Name of the transaction being performed, so that the call can get assigned to the designated bank user, on the basis of the attributes received.

The facility to configure this feature for a particular user type such as Retail or Corporate is available to bank administrators. An assisted banking icon is displayed across the application of business users for which this feature is enabled. By clicking on this icon on any screen, the business user can initiate a call to bank.

4.3 Voice Assistant Alexa:

Conversational user interface is a new paradigm to connect with banking applications, helping customers access various banking products and services. Consumers have become increasingly accustomed to using voice commands to perform simple day to day tasks such as getting directions or placing a call.

Banks and financial companies have started to offer banking services through such virtual assistants which allows customers to check their account balances, pay bills and even carry out fund transfers on voice command.

As part of this release, Alexa as a virtual assistant has been enabled as a Touch Point in the product that can allow customers of the bank to perform the following inquiries:

- Balance inquiry for CASA, TD and Loan accounts

- Last 5 transactions of CASA account

- Next installment amount of Loan account

5. Open Banking

The following open banking features have been built in OBDX as part of the 18.3 release:

5.1 Account Aggregation:

The Account Aggregation feature enables retail users to link their external bank accounts to OBDX and provides them with an ability to view and access all their savings, term deposits and loan accounts information anytime and anywhere using a single digital platform.

The benefit of account aggregation is that the business users can get a snapshot of all their financial accounts and can easily retrieve account details, such as recent transactions, with a single login. They can also make quick payments between their accounts across banks.

As a part of this module, the following functions are provided to the bank user and business users of the Bank.

Administration Maintenance

The feature ‘External Bank Maintenance’ has been introduced as a part of the Account Aggregation module. This enables the bank administrator to add external banks using which retail customers can link their external accounts held at these banks to manage their money in an easier way. Multiple external APIs can be enabled to facilitate access of data, which will then be available for the perusal of the customer.

Customer Functions

A facility has been provided to logged in retail customers to link their external accounts using the Account Aggregation platform. A screen presents the highlights of the account aggregation and provides customers with a link, to link their accounts. Retail users can also login using external bank credentials to link the accounts held at that bank.

An exclusive dashboard has been designed for Retail Users that enables them to track their net worth, view transactions of other bank accounts and to manage accounts across banks.

6. Enhanced Digital Experience

The following features have been built in OBDX to enhance the digital experience of banking customers:

6.1 User Segments:

In order to offer products and services to customers that best suit their banking needs, banks need to employ some method of segmentation. Banks can group customers into different segments on the basis of different attributes of the customer, which could be demographic, geographical, behavioral etc. Banks can have different communication mailers, authentication mechanisms, transaction limits or branding aspects on the basis of customer segmentation.

As part of this release, a new maintenance has been created to define and manage user segments. User Segments are associated to a user type and has currently been enabled only for user type ‘Retail’. Each segment can optionally have application roles mapped so that in case of association of a segment to users, those application roles are by default available to the users.

Some of the maintenances which can be defined for a User Segment, in addition to the existing definition at user type level are:

- Limits

- Mailers

- Product Mapping

- Authentication

- Dashboard Builder

- Payee Restrictions

- Manage Brand

6.2 Dashboard Builder:

Bank users can now create different dashboards for different business users depending upon the segment that they belong to. Each customer’s relationship with the bank is unique and can, hence, have different requirements pertaining to frequently accessed transactions and inquiries.

As part of this release, the dashboard builder maintenance has been enhanced to make widgets of a dashboard available to users based on the role to widget mapping. The created dashboard can also be applied to a user segment. Additionally, if there is a need to have the same dashboard available to all the users of a specific user type e.g. for all retail users and across user segments, then the dashboard can also be applied at a user type level.

6.3 Role Transaction Mapping Enhancements:

Role Transaction Mapping enables the bank user to define an Application role and to map entitlements for various Access Points. A user can perform only those transactions which are mapped to the application roles assigned to the user. In the current release, the following enhancements have been made in the existing Role Transaction Mapping function:

- Availability of widgets as entitlements to be mapped to Application Roles

- Menu options and widgets displayed on the basis of the entitlements mapped to application roles assigned to a user. For e.g. If a user with the application role ‘Retail’ does not have access to transactions and widgets related to the Wealth Management module, then those transactions and widgets will not be displayed on the UI to user.

6.4 Enhancements to First Time Login Steps:

The process by which a business user would log in to the channel banking application for the first time used to comprise of a pre-defined set of steps (Accept Terms and Conditions and Set Security Questions). These steps have now been made configurable, which not only enables the bank user to choose the steps (from a predefined list of steps) but also to decide the sequence in which they should be displayed to business users.

7. New Retail Capabilities

The following features have been added in this release to further enhance the retail banking module of OBDX:

7.1 Wealth Management Services:

Wealth Management or Investment Management is an important offering in a bank's product bundle. It facilitates the bank customer to invest in instruments such as equity mutual funds, shares, bonds, insurance etc. From a customer's point of view - being able to view his investments regularly, being able to place orders and to communicate with the bank are of high importance. Therefore, self-service channels/channel banking plays a critical role in wealth management.

The Wealth Management Service functionality introduced in 18.3, enables business users to transact in mutual funds. OBDX relies on a mutual fund processor to supply the relevant data and details, which the customer can view and act on in the self-service channel. Following are the features available in WMS.

Overview

WMS Overview gives the customer an aggregated overview of his investments. Multiple widgets provide both pictorial and numeric details about the investments made in mutual funds, their current market value, rate of return earned etc. News and advertisements related to investments can also be viewed. The overview screen also acts as a navigation center with links to various WMS transactions available to the user.

Starting Investments

OBDX has the facility to enable customers to invest by opening an Investment Account which holds the customer’s mutual fund investments. The account opening is initiated in OBDX and resides in the mutual fund processor. Provisions to perform FATCA check and risk profiling of customers is provided. In risk profiling, the customer is posed a set of questions and based on the answers chosen, his risk profile is determined. With each risk profile comes a recommended asset allocation for the customer.

Placing Orders

Customers can place Purchase, Redemption or Switch orders for any of the listed funds. These orders can be for lump sum orders or for recurring orders i.e. Systematic Investment Plan, Systematic Withdrawal Plan and Systematic Transfer Plan. Mutual fund orders can be placed for the same business day or a future date from any of the customer’s current or savings accounts. Customer can also place multiple orders in one go. Orders placed can be viewed from the Order Status screen and if needed, can also be deleted.

Investment Details

Once the customer purchases mutual funds and creates holdings, they can be viewed in the Investment Details screen where they can be tracked for their performances, dividend details, units held etc. for each of the funds, recurring orders currently underway etc. These details are logically grouped on the screen based on their category. The customer can even view the details of mutual funds he had held in the past.

Reports

Multiple reports are available to customers, by which they can gain information regarding their wealth management activities. The reports available are as follows:

- Transactions Report

- Dividends Report

- Capital Gains Report

7.2 UPI Payments – India Region:

Unified Payments Interface (UPI) is an immediate real time payment system that enables the transfer of funds between two bank accounts through a mobile platform. This payments interface has been developed by the National Payments Corporation of India (NPCI), which is regulated by the Reserve Banking of India (RBI).

In order to transfer and receive funds through UPI, users need to create a Virtual Payment Address (VPA). A VPA is in the format of unique name@bankname and needs to be mapped to the user’s current or savings account. This VPA can be used by others to transfer funds to the user. Hence, users need not know or remember the account numbers and IFSC codes of their intended recipients.

Retail users can now initiate UPI transfers through the mobile application channel of OBDX. The ‘Manage VPAs’ feature enables users to create VPAs and to edit or delete a VPA. By means of VPA transfers, users can transfer funds by selecting a VPA from which the funds are to be transferred and can initiate ad-hoc transfers towards other VPAs or towards domestic bank accounts. Additionally, users can create VPA payees and also initiate VPA transfers towards payee VPAs and domestic account payees.

7.3 Deposit Enhancements – India Region:

In this release, the deposits module has been enhanced so as to cater to the specific needs of NRI customers. The enhancements include the facility to enable NRI customers to open and manage NRO and NRE deposits to be held in INR currency and to open and manage FCNR deposits. Additionally, NRIs who have returned to India can also open RFC deposits.

These enhancements enrich the banking experience of NRI customers by enabling them to open deposits in INR as well as in foreign currencies, subsequently helping them to manage their taxes properly and to earn higher returns of interests with the option to also hold deposits in foreign currency.

8. Enriched Payment Services

As part of this release, the payments module has been enhanced with the following features:

8.1 Twitter Payments:

Retail users can now initiate peer to peer transfers using Twitter handles. An additional option ‘Twitter’ has been added under the ‘Transfer Via’ options on the Transfer Money – New Payee page. Once the user selects this option, the system will display the Twitter login page. Once the user logs in to his Twitter account, he will be able to select the Twitter handle towards which funds are to be transferred. Only a handle that follows the user’s Twitter handle or that has enabled the option to receive direct messages from everyone (This option can be switched on through Twitter settings), can be selected as a recipient.

Once a transfer is initiated successfully, a direct message will be sent to the recipient on his/her Twitter account. The recipient can claim the funds by selecting the link provided in the message and following the claim money flow. The claim money screen has also been enhanced so as to enable users to select the option ‘Twitter’ by which to claim funds.

8.2 Funds Transfer History:

A new Funds Transfer History feature has been introduced to enable users (both retail and corporate) to view the status of payment transactions initiated from the internet and mobile banking channels. All the transfers initiated over a period of time are listed down with the current status fetched from the host system. The user can view additional details of each transfer by selecting the provided option and can also re-initiate the transfer, if so desired. Additionally, search criteria are provided to enable the user to search for a specific transfer. The download option is provided on both the funds transfer history summary as well as the details page so that the user can opt to download or print the funds transfer history records or details of a specific transfer, if required.

A widget, by which users can view the status of the most recent transfers initiated, is also provided on both retail and corporate dashboards. This widget enables users to view the status of the most recent transfers and also provides the options to view details of a specific transfer record or to re-initiate a transfer. Users can also navigate to the funds transfer history screen by selecting the option provided on the widget.

8.3 Limit Enhancements:

The Limits module has been enhanced to support the following features:

Administrative Enhancements

- Global Limit Package Maintenance: Using this feature the bank user can maintain global limit packages (default touch point group with all internal and external touch points) and can map it to a user, user segment or a party. Also, a facility has been provided to search, view, edit and delete the limit packages maintained at a global level.

- User Limits: Using this feature, the bank user can view the current available and utilized limits of a specific retail user and can modify (increase or decrease) these limits as required.

- Sub Limit Maintenance: A bank user can now set up separate limits for payments initiated as ad-hoc payments and payments initiated towards registered payees. This feature has been enabled for the following transactions.

- – Internal Fund Transfer

- – Domestic Fund Transfer

- – International Fund Transfer

Business User specific Enhancements

- View Limits: The existing screen on which business users can view transaction limits has been enhanced to display global limits assigned to the user.

- View Derived Limits: An option has been provided to the retail user to view the available limits for a transaction, his cumulative limit, applicable cooling period and set payee limits, if any, while initiating a transaction.

8.4 Claim Money Enhancements:

The OBDX feature enabling recipients of peer to peer transfers to claim money has been enhanced in this release. Recipients can now claim funds via dynamic URLs, the links which are sent to the users as part of the payment alert. Each link is unique and tightly coupled with the payment initiated. If incorrect security code is entered more than the allowed number of times, the hold on the transfer amount is released and the transfer is cancelled.

The static claim money page has also been enhanced through the addition of the Payment ID field. The recipient is now required to enter the payment ID that is sent as part of the payment alert, on the claim money page. This way, the system is able to identify whether the security code being entered is for the specific payment or not and if incorrect security code is entered more than the permitted number of times, the transfer is cancelled.

8.5 Domestic Transfer – Network Suggestion:

Network suggestion has been introduced as part of India region specific domestic transfers.

While initiating domestic transfers towards existing payees (including multiple transfers and repeat transfers initiation) or through the ad-hoc transfer screen, the system can now suggest a network out of NEFT, IMPS and RTGS based on factors including the payee’s bank, network limits and working window maintenance. The system first disables those networks that are not supported based on these factors and suggests a network out of the enabled networks based on the network preference definition identified by the bank user.

The bank user has got the option to enable/disable the domestic transfer suggestion flag in system configuration.

8.6 Payee Account Type:

The India region domestic transfers screens (retail and corporate) have been enhanced to capture the payee account type. The account type values provided are – Savings, Current, Overdraft, Cash Credit, Loan Account and NRE. This value is sent to the host system as part of the domestic transfer details.

This value will be captured as part of domestic transfer payee creation and will be displayed on the payee transfer initiation screens along with other payee details. In case of ad-hoc domestic transfers, the payee account type will be captured at the time of transfer initiation.

8.7 Demand Draft Enhancements:

The demand draft feature (domestic as well as international draft initiation) has been enhanced through the addition of the delivery option ‘Other Address’. By selecting this option, the user can opt to have the draft delivered to an address, one that is other than the initiator’s address or a branch of the bank. If this option is selected, the user is required to enter the address at which the draft is to be delivered.

Users will also have the option to initiate ad-hoc demand drafts (domestic and international drafts), i.e. users can now request for demand drafts to be payable towards recipients that are not registered as payees with the bank.

8.8 Payee Photograph:

In order to enable users to easily identify and select their payee of choice, the system has been enhanced so as to enable business users to add payee photographs. Payee photographs can be added against both, account as well as draft payees. Retail users can add photos against payee groups as well as individual payees within payee groups. These payee photos are also displayed on the payee maintenance screens from where the user can edit as well as delete these photos.

The photo of a payee is also displayed against other payee details on payment inquiry screens such as View Repeat Transfers, Viewing Upcoming Payments, Funds Transfer History, etc. Additionally, payee photos are also displayed to corporate authorizers while authorizing initiated transfers.

9. Qualifications

| Sr No | Oracle Banking Digital Experience Modules | Host Integration* | Version |

| 1 | Oracle Banking Digital Experience Originations | Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 and 14.1.0.0.0 |

| 2 | Oracle Banking Digital Experience Retail Servicing | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 and 14.1.0.0.0 | ||

| Oracle Banking Payments | 14.0.0.0.0 and 14.1.0.0.0 | ||

| 3 | Oracle Banking Digital Experience Corporate Servicing | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 and 14.1.0.0.0 | ||

| Oracle Banking Payments | 14.0.0.0.0 and 14.1.0.0.0 | ||

| Oracle Banking Virtual Account Management | 14.1.0.0.0 | ||

| Oracle Banking Liquidity Management | 14.1.0.0.0 | ||

| 4 | Oracle Banking Digital Experience Retail Peer to Peer Payment | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 and 14.1.0.0.0 | ||

| 5 | Oracle Banking Digital Experience Merchant Payments | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 and 14.1.0.0.0 | ||

| 6 | Oracle Banking Digital Experience Customer Financial Insights | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 and 14.1.0.0.0 | ||

| 7 | Oracle Banking Digital Experience Corporate Trade Finance | Oracle FLEXCUBE Universal Banking | 14.0.0.0.0 |

| 8 | Oracle Banking Digital Experience Wallets | Independent of Core Banking solution | NA |

* Refer 'Transaction Host Integration Matrix' section available in module specific user manuals to know transaction level integration details.

10. Browser Support

This chapter lists the qualification of Oracle Banking Digital Experience 18.3.0.0.0 release with various browsers:

| Chrome |

Firefox |

Microsoft Browser | Safari | |

|---|---|---|---|---|

| Android | Supported * | Not Supported | N/A | N/A |

| iOS | Not Supported | Not Supported | N/A | Supported |

| Mac OS X | Supported | Supported | N/A | Supported |

| Windows | Supported | Supported | Supported | Not Supported |

* Support on the Android operating system is limited to Chrome for Android

For complete Browser support policy, please refer : http://www.oracle.com/technetwork/indexes/products/browser-policy-2859268.html

11. Known Issues and Limitations

This chapter covers the known anomalies and limitations in of Oracle Banking Digital Experience Release 18.3.0.0.

11.1 Oracle Banking Digital Experience Known Issues

NA

11.2 Oracle Banking Digital Experience Limitations

- Liquidity Management solution offered by OBDX mandatorily needs Oracle Liquidity Management Solution in the backend for integration.

- Virtual Account Management solution offered by OBDX mandatorily needs Oracle Virtual Account Management Solution in the backend for integration.

12. OBDX 18.3.0.1.0 Release (March 2019)

12.1 Highlights

This section describes the enhancements made in OBDX as a part of 18.3.0.1.0 release.

OBDX has enriched the corporate banking module in this release to cater to corporate requirements through the introduction of Credit Facility Management and Corporate Lending Management features.

12.1.1 Credit Facility Management

Credit facility is an umbrella of financial assistance offered by Banks or Financial institutions to Corporates to meet their financial needs.

OBDX has introduced Credit Facility Management module with the ability to the existing corporates to originate new Credit Facility request along with the management of their existing Facilities and Collaterals.

This module has been divided under two main functions, which is Credit Facility Origination and Credit Facility Servicing.

Credit Facility Origination

Credit Facility origination module of OBDX is integrated with Oracle Banking Credit Facility Process Management System (OBCFPM) for initiation of new facility origination/amendment application and for tracking the application status.

- New Credit Facility Application and Existing Facility Amendment Application

Corporate Facility Origination solution enables the existing corporate to initiate an application for new credit facility or a sub facility under an existing credit facility by entering their funding requirements, Collateral details and by uploading the required documents. Using the ‘Facility Amendment Application’ feature, the request can also be initiated for change in facility amount/tenure and for addition of new collateral.

On submission of the applications from OBDX, the requests gets assigned to the bank (OBCFPM Bank User) for further processing. -

- Application Tracker

Application tracker allows the corporate user to view the current status of submitted applications for new facility and amendment of existing facilities and also to resume applications that have been saved as draft. Corporate can also view the details of the submitted application and can download the documents provided at the time of application submission..

Credit Facility Servicing

Credit Facility Servicing module of OBDX is integrated with Oracle FLEXCUBE Enterprise Limits and Collateral![]() Collateral refers to the security or collateral provided by the applicants as a guarantee to enable their applications to be approved. Management (ELCM). Credit Facility servicing module of OBDX enables the corporate user to inquire existing Credit Facilities and Collaterals.

Collateral refers to the security or collateral provided by the applicants as a guarantee to enable their applications to be approved. Management (ELCM). Credit Facility servicing module of OBDX enables the corporate user to inquire existing Credit Facilities and Collaterals.

- Facilities and Collateral Management Overview

Facility and Collateral Overview feature provides synopsis of available and utilized amount of Credit Facilities and collaterals for a corporate in a graphical manner to facilitate quick decisioning.

- Facility and Collateral Summary and Details

Module also provides function that lists down all the facilities available for corporate with an option to check the detailed view of a facility along with the information of collaterals and covenants linked to the facility.

Collateral summary enables the corporate to view all the collateral groups along with the collaterals linked to each group along with an option to view the details of a collateral along with the covenants linked.

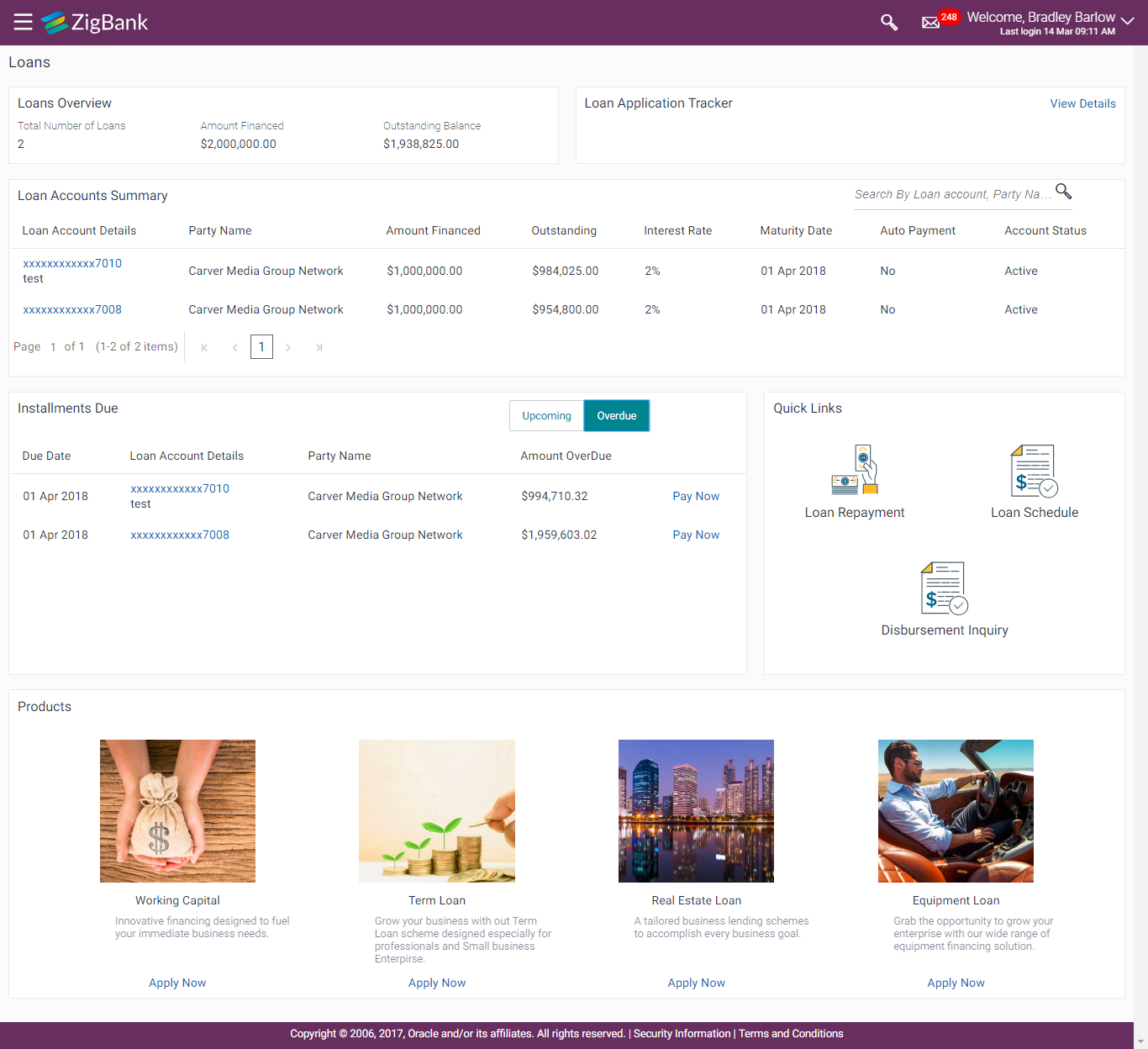

12.1.2 Corporate Lending Management

Corporates often needs to borrow money to meet their funding requirements typically to invest in infrastructure, expand business operations, upgrade to the latest plant and machinery etc. OBDX has enriched the corporate banking module by introducing Corporate Lending Features with Loan Origination capability and Loan Accounts Management.

Corporate Loan Origination

Most of the corporates consider borrowing a business loan from the financial institutions is a convenient option because of its flexibility and affordability. Corporate Loan Origination solution provides with an ability to the existing corporate customers to initiate the request for new Business Loan and track the application status using the Digital Banking Platform.

Corporate Loan Origination module offered by OBDX is integrated with Oracle Banking Corporate Lending Process Management (OBCLPM) for initiation of new loan request and for tracking the application status and Oracle FLEXCUBE Enterprise Limits and Collateral Management (ELCM) for fetching and utilizing the existing facilities.

- New Loan Application

Loan Origination solution, introduced in this release, facilitates existing corporate to initiate a new business loan for by providing details like Loan Requirements, Real Estate and plant and machinery information based on the product selection.

Module supports Loan Origination for following Corporate Lending Products: - Term Loan

- Working Capital

- Real Estate Loan

- Equipment Loan

On submission of the application from OBDX, the requests gets assigned to the bank (OBCLPM Bank User) for further processing

- Application Tracker

Application Tracker enables the corporate user to view the progress of submitted loan applications and also to retrieve and to resume applications that have been saved as draft. Corporate can also view the details of the submitted application and can download the documents provided at the time of application submission.

Corporate Loan Servicing

Product![]() A product is created based on the bank's business requirements and has certain typical parameters that describe its attributes or characteristics. Every product is defined under Product Class and Product Group.

For example, a product 'Fixed rate home loan' is defined under product group 'Home Loan' and product class 'Loans'. provides a platform by which banks can offer their corporate customers an enriching Digital Banking Experience in servicing the corporate loans accounts. Corporate Loan Servicing module of OBDX is integrated with Oracle Banking Corporate Lending (OBCL).

A product is created based on the bank's business requirements and has certain typical parameters that describe its attributes or characteristics. Every product is defined under Product Class and Product Group.

For example, a product 'Fixed rate home loan' is defined under product group 'Home Loan' and product class 'Loans'. provides a platform by which banks can offer their corporate customers an enriching Digital Banking Experience in servicing the corporate loans accounts. Corporate Loan Servicing module of OBDX is integrated with Oracle Banking Corporate Lending (OBCL).

- Loan Overview, Details and Transactions

Loan Overview features provides with the consolidated and easy to understand view of their business loans position, with an option to check the detailed view each loan account. Corporate also can view the information of upcoming and overdue loan installments and also the detailed loan account activity.

- Disbursement Details, Repayment Schedule and Repayments

Quick & hassle-free online loan repayment option allows the corporate to initiate payment against outstanding installments or even to pay full settlement amount using Digital Banking Platform. Users can also view the loan disbursement information along with the option to view and download loan amortization schedule.

12.2 Qualifications

| Sr No | Oracle Banking Digital Experience Modules | Host Integration* | Version |

| 1 | Oracle Banking Digital Experience Originations | Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 and 14.2.0.0.0 |

| 2 | Oracle Banking Digital Experience Retail Servicing | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 and 14.2.0.0.0 | ||

| Oracle Banking Payments | 14.1.0.0.0 | ||

| 3 | Oracle Banking Digital Experience Corporate Servicing | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 and 14.2.0.0.0 | ||

| Oracle Banking Payments | 14.1.0.0.0 | ||

| Oracle Banking Credit Facility Process Management System (OBCFPM) | 14.1.0.1.0 | ||

| Oracle FLEXCUBE Enterprise Limits and Collateral Management (ELCM) | 14.2.0.0.0 | ||

| Oracle Banking Corporate Lending Process Management (OBCLPM) | 14.1.0.1.0 | ||

| Oracle Banking Corporate Lending (OBCL) | 14.2.0.0.0 | ||

| 4 | Oracle Banking Digital Experience Retail Peer to Peer Payment | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 | ||

| 5 | Oracle Banking Digital Experience Merchant Payments | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 | ||

| 6 | Oracle Banking Digital Experience Customer Financial Insights | Oracle FLEXCUBE Core Banking |

11.7.0.0.0 |

| Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 | ||

| 7 | Oracle Banking Digital Experience Corporate Trade Finance | Oracle FLEXCUBE Universal Banking | 14.1.0.0.0 |

| 8 | Oracle Banking Digital Experience Wallets | Independent of Core Banking solution | NA |

* Refer 'Transaction Host Integration Matrix' section available in module specific user manuals to know transaction level integration details.

12.3 Browser Support

This chapter lists the qualification of Oracle Banking Digital Experience 18.3.0.1.0 release with various browsers:

| Chrome |

Firefox |

Microsoft Browser | Safari | |

|---|---|---|---|---|

| Android | Supported * | Not Supported | N/A | N/A |

| iOS | Not Supported | Not Supported | N/A | Supported |

| Mac OS X | Supported | Supported | N/A | Supported |

| Windows | Supported | Supported | Supported | Not Supported |

* Support on the Android operating system is limited to Chrome for Android

For complete Browser support policy, please refer : http://www.oracle.com/technetwork/indexes/products/browser-policy-2859268.html

12.4 Known Issues and Limitations

This chapter covers the known anomalies and limitations in of Oracle Banking Digital Experience Release 18.3.0.1.0

12.4.1 Oracle Banking Digital Experience Known Issues

NA

12.4.2 Oracle Banking Digital Experience Limitations

- Credit Facility Management solution offered by OBDX mandatorily needs Oracle Banking Credit Facility Process Management System (OBCFPM) and Oracle FLEXCUBE Enterprise Limits and Collateral Management (ELCM) in the backend for integration.

- Corporate Lending Management solution offered by OBDX mandatorily needs Oracle Banking Corporate Lending Process Management (OBCLPM), Oracle Banking Corporate Lending (OBCL) and Collateral Management (ELCM) in the backend for integration.

- Credit Facility Management and Corporate Lending Management modules are currently not supported on mobile and tablet devices.