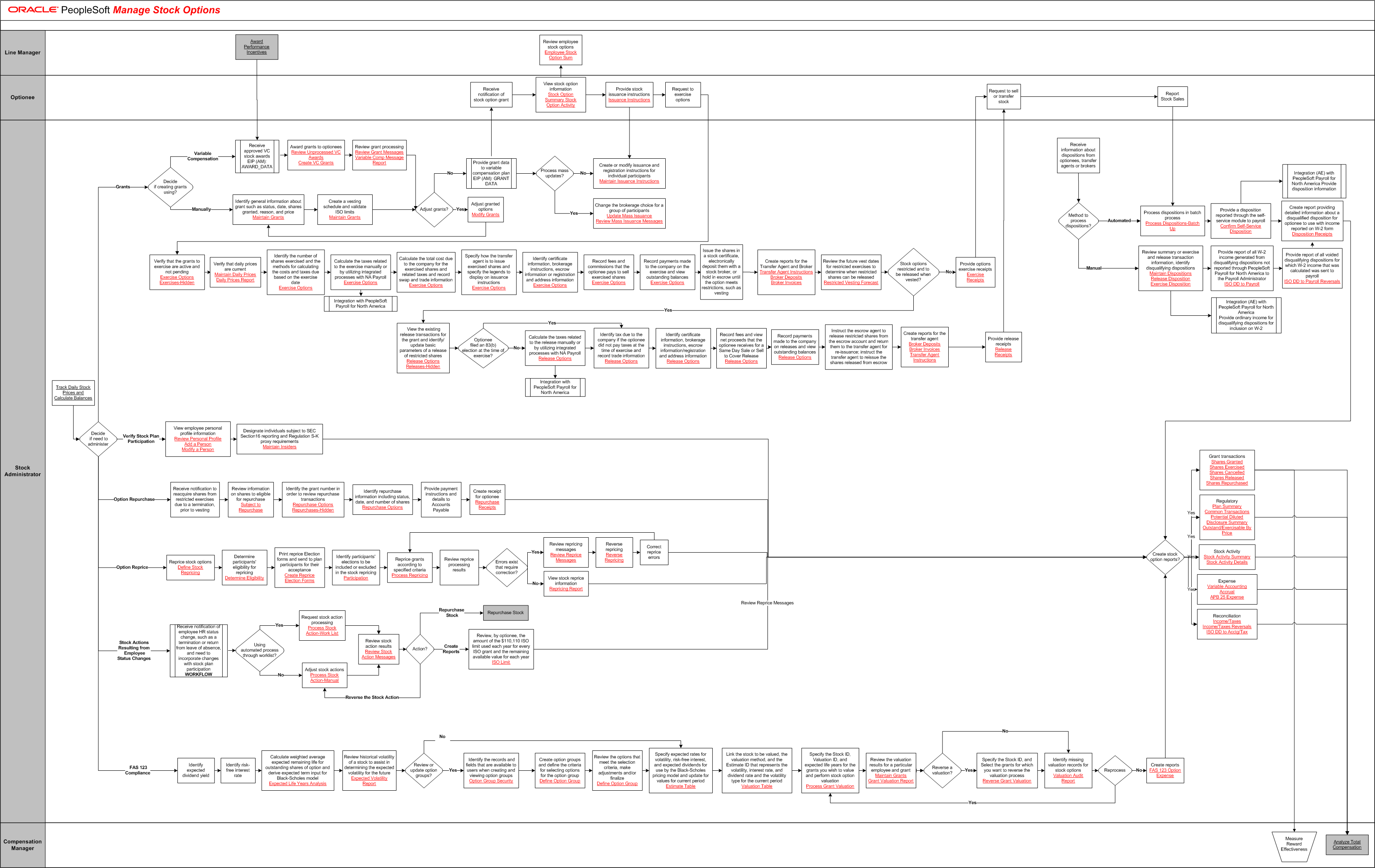

Manage Stock Options

The tables on this page list the tasks for this business process, grouped by role. Some roles may be listed more than once if their tasks are performed at different points in the process. Follow the task numbers in order, unless the Task Description column provides instructions to go to a different task number. Click links in the Task Description column to view detailed diagrams for those tasks or to go to the online help for those pages.

Line Manager

Task Number | Task Description |

|---|---|

1 |

Go to task number 9. |

Stock Administrator

Task Number | Task Description |

|---|---|

2 | Receive information about dispositions from optionees, transfer agents or brokers. If Method to process dispositions is Automated, Go to task number 45. If Method to process dispositions is Manual, Go to task number 3. |

3 | Review summary or exercise and release transaction information, identify disqualifying dispositions. In parallel: Go to task number 4, Go to task number 6. |

4 | Provide report of all W-2 income generated from disqualifying dispositions not reported through PeopleSoft Payroll for North America to the Payroll Administrator. |

5 | Provide report of all voided disqualifying dispositions for which W-2 income that was calculated was sent to payroll. Go to task number 48. |

6 | Integration (AE) with PeopleSoft Payroll for North America Provide ordinary income for disqualifying dispositions for inclusion on W-2. End of activity. |

7 | Track Daily Stock Prices and Calculate Balances. If Decide if need to administer is Grants, Go to task number 8. If Decide if need to administer is Verify Stock Plan Participation, Go to task number 55. If Decide if need to administer is Option Repurchase, Go to task number 57. If Decide if need to administer is Option Reprice, Go to task number 63. If Decide if need to administer is Stock Actions Resulting from Employee Status Changes, Go to task number 73. If Decide if need to administer is FAS 123 Compliance, Go to task number 79. |

8 | Determine if Decide if creating grants using. If Decide if creating grants using is Variable Compensation, Go to task number 9. If Decide if creating grants using is Manually, Go to task number 12. |

9 | Receive approved VC stock awards EIP (AM): AWARD_DATA. |

10 | Award grants to optionees. |

11 | Review grant processing. Go to task number 14. |

12 | Identify general information about grant such as status, date, shares granted, reason, and price. |

13 | Create a vesting schedule and validate ISO limits. |

14 | Determine if Adjust grants. If Adjust grants is No, Go to task number 15. If Adjust grants is Yes, Go to task number 54. |

15 | Provide grant data to variable compensation plan EIP (AM): GRANT DATA. In parallel: Go to task number 16, Go to task number 51. |

Optionee

Task Number | Task Description |

|---|---|

16 | Receive notification of stock option grant. |

17 | View stock option information. In parallel: Go to task number 18, Go to task number 19. |

Line Manager

Task Number | Task Description |

|---|---|

18 | Review employee stock options. End of activity. |

Optionee

Task Number | Task Description |

|---|---|

19 | Provide stock issuance instructions. In parallel: Go to task number 20, Go to task number 52. |

20 | Request to exercise options. |

Stock Administrator

Task Number | Task Description |

|---|---|

21 | Verify that the grants to exercise are active and not pending. |

22 | Verify that daily prices are current. |

23 | Identify the number of shares exercised and the methods for calculating the costs and taxes due based on the exercise date. |

24 | Calculate the taxes related to the exercise manually or by utilizing integrated processes with NA Payroll. In parallel: Go to task number 25, Go to task number 50. |

25 | Calculate the total cost due to the company for the exercised shares and related taxes and record swap and trade information. |

26 | Specify how the transfer agent is to issue exercised shares and specify the legends to display on issuance instructions. |

27 | Identify certificate information, brokerage instructions, escrow information or registration and address information. |

28 | Record fees and commissions that the optionee pays to sell exercised shares. |

29 | Record payments made to the company on the exercise and view outstanding balances. |

30 | Issue the shares in a stock certificate, electronically deposit them with a stock broker, or hold in escrow until the option meets restrictions, such as vesting. |

31 | Create reports for the Transfer Agent and Broker. |

32 | Review the future vest dates for restricted exercises to determine when restricted shares can be released. If Stock options restricted and to be released when vested is No, Go to task number 33. If Stock options restricted and to be released when vested is Yes, Go to task number 34. |

33 | Provide options exercise receipts. Go to task number 43. |

34 | View the existing release transactions for the grant and identify/update basic parameters of a release of restricted shares. If Optionee filed an 83(b) election at the time of exercise is Yes, Go to task number 36. If No, Go to task number 35. |

35 | Calculate the taxes related to the release manually or by utilizing integrated processes with NA Payroll. In parallel: Go to task number 36, Go to task number 49. |

36 | Identify tax due to the company if the optionee did not pay taxes at the time of exercise and record trade information. |

37 | Identify certificate information, brokerage instructions, escrow information/registration and address information. |

38 | Record fees and view net proceeds that the optionee receives for a Same Day Sale or Sell to Cover Release. |

39 | Record payments made to the company on releases and view outstanding balances. |

40 | Instruct the escrow agent to release restricted shares from the escrow account and return them to the transfer agent for re-issuance; instruct the transfer agent to reissue the shares released from escrow. |

41 | Create reports for the transfer agent. |

42 | Provide release receipts. |

Optionee

Task Number | Task Description |

|---|---|

43 | Request to sell or transfer stock. |

44 | Report Stock Sales. |

Stock Administrator

Task Number | Task Description |

|---|---|

45 | Process dispositions in batch process. |

46 | Provide a disposition reported through the self-service module to payroll. Confirm Self-Service Disposition In parallel: Go to task number 47, Go to task number 48. |

47 | Integration (AE) with PeopleSoft Payroll for North America Provide disposition information. End of activity. |

48 | Create report providing detailed information about a disqualified disposition for optionee to use with income reported on W-2 form. Go to task number 94. |

49 | Integration with PeopleSoft Payroll for North America. End of activity. |

50 | Integration with PeopleSoft Payroll for North America. End of activity. |

51 | Determine if Process mass updates. If Process mass updates is No, Go to task number 52. If Process mass updates is Yes, Go to task number 53. |

52 | Create or modify issuance and registration instructions for individual participants. Maintain Issuance Instructions End of activity. |

53 | Change the brokerage choice for a group of participants. End of activity. |

54 | Adjust granted options. Go to task number 12. |

55 | View employee personal profile information. |

56 | Designate individuals subject to SEC Section16 reporting and Regulation S-K proxy requirements. Go to task number 94. |

57 | Receive notification to reacquire shares from restricted exercises due to a termination, prior to vesting. |

58 | Review information on shares to eligible for repurchase. |

59 | Identify the grant number in order to review repurchase transactions. |

60 | Identify repurchase information including status, date, and number of shares. |

61 | Provide payment instructions and details to Accounts Payable. |

62 | Create receipt for optionee. Go to task number 94. |

63 | Reprice stock options. |

64 | Determine participants' eligibility for repricing. |

65 | Print reprice Election forms and send to plan participants for their acceptance. |

66 | Identify participants' elections to be included or excluded in the stock repricing. |

67 | Reprice grants according to specified criteria. |

68 | Review reprice processing results. If Errors exist that require correction is Yes, Go to task number 69. If No, Go to task number 72. |

69 | Review repricing messages. |

70 | Reverse repricing. |

71 | Correct reprice errors. In parallel: Go to task number 67, Go to task number 94. |

72 | View stock reprice information. Go to task number 94. |

73 | Receive notification of employee HR status change, such as a termination or return from leave of absence, and need to incorporate changes with stock plan participation WORKFLOW. If Using automated process through worklist is Yes, Go to task number 74. If No, Go to task number 75. |

74 | Request stock action processing. Process Stock Action-Work List Go to task number 76. |

75 | Adjust stock actions. |

76 | Review stock action results. If Action is Repurchase Stock, Go to task number 77. If Action is Create Reports, Go to task number 78. If Action is Reverse the Stock Action, Go to task number 75. |

77 | Perform external activity:. Stop and complete Repurchase Stock. End of activity. |

78 | Review, by optionee, the amount of the. $110,110 ISO limit used each year for every ISO grant and the remaining available value for each year Go to task number 94. |

79 | Identify expected dividend yield. |

80 | Identify risk-free interest rate. |

81 | Calculate weighted average expected remaining life for outstanding shares of option and derive expected term input for Black-Scholes model. |

82 | Review historical volatility of a stock to assist in determining the expected volatility for the future. If Review or update option groups is No, Go to task number 86. If Review or update option groups is Yes, Go to task number 83. |

83 | Identify the records and fields that are available to users when creating and viewing option groups. |

84 | Create option groups and define the criteria for selecting options for the option group. |

85 | Review the options that meet the selection criteria, make adjustments and/or finalize. |

86 | Specify expected rates for volatility, risk-free interest, and expected dividends for use by the Black-Scholes pricing model and update for values for current period. |

87 | Link the stock to be valued, the valuation method, and the Estimate ID that represents the volatility, interest rate, and dividend rate and the volatility type for the current period. |

88 | Specify the Stock ID, Valuation ID, and expected life years for the grants you wish to value and perform stock option valuation. |

89 | Review the valuation results for a particular employee and grant. In parallel: Go to task number 90, Go to task number 89. |

90 | Determine if Reverse a valuation. If Reverse a valuation is No, Go to task number 92. If Reverse a valuation is Yes, Go to task number 91. |

91 | Specify the Stock ID, and Select the grants for which you want to reverse the valuation process. |

92 | Identify missing valuation records for stock options. If Reprocess is No, Go to task number 93. If Reprocess is Yes, Go to task number 88. |

93 | Create reports. |

94 | Determine if Create stock option reports. If Create stock option reports is Yes, Go to task number 95. If Create stock option reports is Yes, Go to task number 96. If Create stock option reports is Yes, Go to task number 97. If Create stock option reports is Yes, Go to task number 98. If Create stock option reports is No, Go to task number 99. |

95 | Grant transactions. Go to task number 100. |

96 | Regulatory. Go to task number 100. |

97 | Stock Activity. Go to task number 100. |

98 | Expense. Go to task number 100. |

99 | Reconciliation. |

Compensation Manager

Task Number | Task Description |

|---|---|

100 |

End of activity. |

Stock Administrator

Task Number | Task Description |

|---|---|

101 | No. End of activity. |