Setting Up U.S. Health FSA Carryover

This topic describes how to set up U.S. Health FSA Carryover.

US Health FSA Carryover enables you to:

Set up the FSA Benefits table to use either the grace period option, or the carryover option, or none.

Set the maximum FSA carryover limit. The maximum carryover amount should not exceed $500.

Adjust the carryover balance.

Additionally, you can:

Review and override the FSA carryover amount during benefits enrollment.

Review available claim amounts.

Review the carryover amount using the Year-to-Date Activity page.

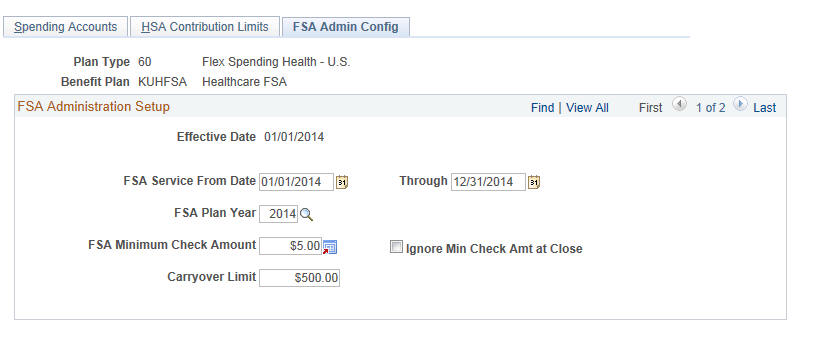

Use the FSA Benefits Table > FSA Admin Config tab to define the maximum FSA carryover limit.

Navigation

Set Up HCM > Product Related > Base Benefits > Plan Attributes > FSA Benefits Table > FSA Admin Config

Image: FSA Benefits Table page

This example illustrates the fields and controls on the FSA Benefits Table page. You can find definitions for the fields and controls later on this page.

The following table lists the carryover option used, based on the FSA Service From and Through dates:

|

Validation |

Carryover Option |

|---|---|

|

If FSA Service Through Date – FSA Service From Date is <= 12 months and Carryover Limit is blank |

No carryover option is used. |

|

If FSA Service Through Date – FSA Service From Date is > 12 months and Carryover Limit is blank |

Grace Period is allowed. |

|

If FSA Service Through Date – FSA Service From Date is <= 12 months and Carryover Limit > 0 |

Carryover Amount is used. |

|

If FSA Service Through Date – FSA Service From Date is > 12 months and Carryover Limit > 0 |

This is an invalid entry. An error message will be displayed. |

Note: As a Benefits Administrator, ensure the following when setting up the FSA Configuration for each plan year:

A $125 cafeteria plan that allows FSA carryover cannot have an additional grace period in the plan year to which unused amounts are carried over. Accordingly, if a plan permits amounts unused in a plan year to be carried over to the following plan year, the plan cannot provide for a grace period in the plan year to which the amount is carried over. For example, a calendar year plan permitting a carryover of unused 2014 health FSA amounts to 2015 cannot have a grace period in 2015, but might have had a grace period during the first 2 ½ months of 2014.

If a plan has a grace period and is amended later to add a carryover provision, the grace period provision must be eliminated by no later than the end of the plan year from which amounts may be carried over. The ability to eliminate a grace period provision previously adopted for a plan year in which the amendment is adopted may be subject to legal constraints.