Calculating 403(b) and 457 Extensions

This section provides an overview of 403(b) and 457 extensions and discusses how to run the 403(b) and 457 extensions process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_SV403B |

Calculate the company's or an individual employee's balances for service years, eligible earnings, and projected limits for the current or next year. Employees don't need to be enrolled in the 403(b) Savings Plan to run the Balance process. This process updates the Savings Management page. |

|

|

Review 403(b) Process Messages |

SV403_MESSAGES |

Review any error message that was issued during the savings management process. |

The Savings Management Balances process updates year-to-date and life-to-date balances for 403(b) and 457 plans and records them on the Savings Management Balances page. The process uses the balances on the savings management record for the prior year and current year payroll YTD deduction balances to update the current year's record each time the process is run. It also uses the prior year's record to update the service year's LTD field. (The first run of each year is slightly different because it deselects some fields and carries over others.)

The Savings Management process does not update current year deduction balances on the Savings Management record until PeopleSoft Payroll for North America is confirmed and the process is run.

The Savings Management Balances process creates 403(b) limit extension records for all employees in the specified company in PeopleSoft Payroll for North America. The records produced are identified as Limit Type 402, Limit Extension Type A. If an employee has 15 or more years in a 403(b) plan, the limit extension amount (EXT_AMOUNT) is populated by the 402(g) Annual Cap Expansion amount on the 403(b) Limit Table. If the employee has fewer than 15 years of service, the EXT_AMOUNT is zero.

The Savings Management Balances process creates 457 limit extension records only if the employee had 457 balances in the previous year or, if this is the first year of enrollment in a 457 plan, after the first payroll is confirmed and the process is run. The records produced are identified as Limit Type 457, Limit Extension Type A. The EXT_AMOUNT is used in the calculation of the three-year catch-up. It is empty until the employee is eligible for the catch-up. You must manually enter the EXT_AMOUNT. The amount entered is the employee's underutilized amount that is applicable.

Note: PeopleSoft software requires you to maintain your own records for underutilization. When an employee is enrolled in more than one 457 plan, you must determine which plan's underutilized amount is used.

To monitor 403(b) and 457 plan balances:

Run the Calculate 403(b) Extensions process on the Savings Management Balances page (RUNCTL_SV403B) to create the initial 403(b) row. The process creates the initial row on the Savings Management page and is identified with a limit type of 402(g). The Exception Reason A — Catch Up Extend Limit is reflected.

The SavingsManagement row for 457 plans is identified with a limit type of 457. The Exception Reason A — Catch Up Extend Limit is reflected.

Make any adjustments that should be considered during the 403(b) calculation process using the 403(b) Adjustments page.

After each confirmed payroll period, run the Calculate 403(b) Extensions process on the Savings Management Balances page (RUNCTL_SV403B) to update balances for both the 403(b) and 457 plans.

Review employee contributions and deferrals on the 403(b) Adjustements page for 402(g) Catch-up Limit Extension Type.

Review 403(b) error messages.

This process creates a single 403(b) record for employees in PeopleSoft Payroll for North America. If an employee has fewer than 15 years of service, the extension amount is 0. If an employee has 15 years or more of service, the extension amount is equal to the 402(g) Annual Cap Expansion amount on the 403(b) Limit Table.

The process deselects the Ext Election (extend election) check box. If the election extension check box is selected at year-end, the process deselects it when run in the subsequent year.

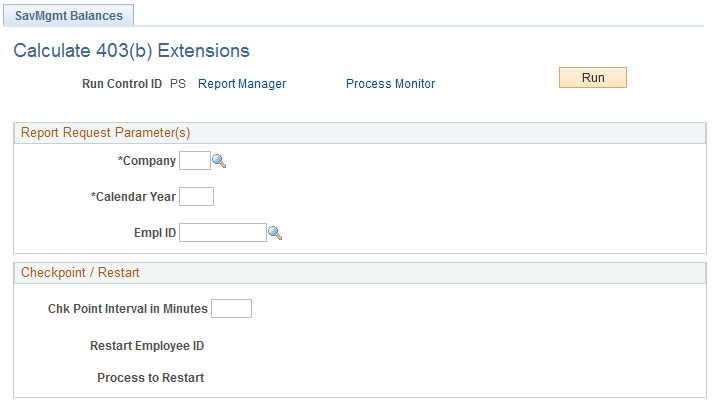

Use the Calculate 403(b) Extensions page (RUNCTL_SV403B) to calculate the company's or an individual employee's balances for service years, eligible earnings, and projected limits for the current or next year.

Employees don't need to be enrolled in the 403(b) Savings Plan to run the Balance process. This process updates the Savings Management page.

Navigation

Image: Calculate 403(b) Extensions page

This example illustrates the fields and controls on the Calculate 403(b) Extensions page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Chk Point Interval in Minutes (check point interval in minutes) |

Because this is a long process, you can indicate how often the system should save or update information to the database during the process. In case of unexpected system failure, this could limit the amount of reprocessing that the system would have to repeat. |

| Restart Employee ID and Process to Restart |

The system enters the last successful employee ID processed if the process did not successfully finish. |

The Calculate 403(b) Extensions process deselects the Ext Election (extension election) field on the Limit Exceptions grid. You can manually reset this value.

The 402(g) catch-up record is generated for all employees in PeopleSoft Payroll for North America. If the employee has 15 or more years of service, the extension amount is supplied with the 402(g) cap expansion from the 403(b) Limit Table. If the employee has fewer than 15 years of service, the extension amount is zero.

The 457 catch-up record is produced only for employees in PeopleSoft Payroll for North America with a 457 record in the prior year or 457 deductions in the current year.