Identifying Age-50 Extensions

This section provides an overview of the Age-50 extension and describes how to run the Age-50 process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BN_AGE50_RUNCTL |

You run the process separately for each limit type. For each limit type, a single Age-50 extension record is produced for each year for each eligible employee in PeopleSoft Payroll for North America. The process changes the election to ON by default. |

The Age-50 process produces two types of age 50 limit extension types. The process assumes that an eligible employee has elected the age-50 extension. The election can be manually deselected on the Savings Management page.

Select the 402(g) option for 401(k) plans, 403(b) plans, or both. One record with Limit Type 402, Limit Extension Type B is produced for any employee in PeopleSoft Payroll for North America who is age 50 or more by the date specified on the run control.

Select the 457 option for 457 plans. One record with Limit Type 457, Type B is produced for any employee in PeopleSoft Payroll for North America who is age 50 or more by the date specified on the run control.

The Identify Age-50 Extensions process:

Identifies the employees in PeopleSoft Payroll for North America who are age 50 or more.

Creates Age-50 limit extension records that increase the 402(g) Savings Plan limits, the 457 Savings Plan limits, or both for elective deferrals as authorized by IRS regulations. The limit extension records are displayed on the Limit Exceptions grid.

Always selects the Ext Election (extend election) field on the Limit Exceptions grid. This value can be reset manually.

Age-50 records can be added manually. For employees who are not eligible for either a catch-up or Age-50 extension, the added record can be used to enter either of the following override amounts:

402(g) limit amount override amount on the Age-50 402(g) row.

457 limit amount override amount on the Age-50 457 row.

To set up the Age 50 catch-up for an employee through the Savings Management table, enter the employee ID and add the extension limit (for example, $5500). Alternatively, run the Identify Age 50 Extensions process for the appropriate annual cap expansion amount.

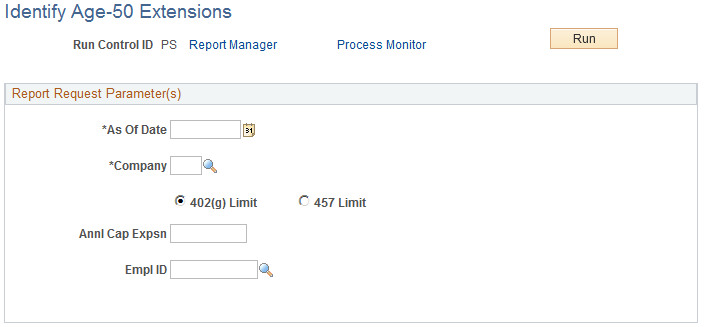

Use the Identify Age-50 Extensions page (BN_AGE50_RUNCTL) to you run the process separately for each limit type.

For each limit type, a single Age-50 extension record is produced for each year for each eligible employee in PeopleSoft Payroll for North America. The process changes the election to ON by default.

Navigation

Image: Identify Age-50 Extensions page

This example illustrates the fields and controls on the Identify Age-50 Extensions page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| As Of Date |

Enter the last day of the calendar year for which the Age-50 extension applies. |

| 402(g) Limit and 457 Limit |

Select the limit extension that you want to run. Two separate runs are required to produce each type of the Age-50 limit extension. |

| Annl Cap Expsn (annual cap expansion) |

Enter the amount specified by the IRS. |