Reviewing and Updating Calculated Retroactive Benefits and Deductions

This section discusses how to review calculation details and override deduction totals.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RETRODED_DEDS |

Review individual line items for each pay end date and override deduction amounts. |

|

|

Retro Benefit/Ded Calc Summary (retroactive benefit/deduction calculation summary) |

RETRODED_SUMMARY |

View summaries of calculation totals. |

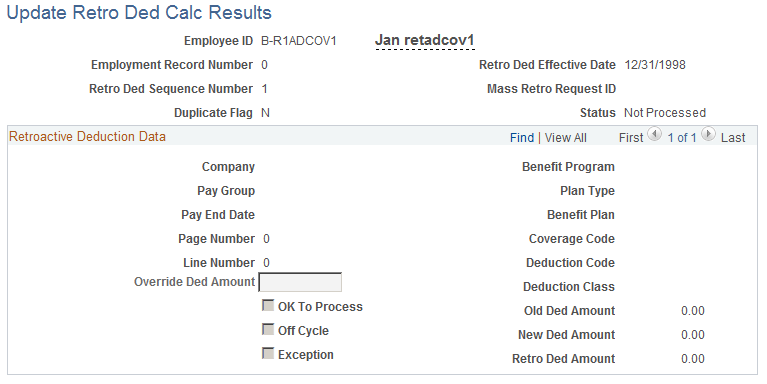

Use the Update Retro Ded Calc Results (update retroactive deduction calculation results) page (RETRODED_DEDS) to review individual line items for each pay end date and override deduction amounts.

Navigation

Image: Update Retro Ded Calc Results page

This example illustrates the fields and controls on the Update Retro Ded Calc Results page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Retroactive Deduction Data |

Results are broken up by pay end date and then further by deduction code and deduction classification. Use the scroll arrow to see calculations for each available combination. |

| Pay End Date |

Derived from the employee's actual pay history, unless none exists. This can happen if the employee is a retroactive hire, for example. In these cases, the pay end date from the appropriate pay calendar is used. |

| Company, Pay Group, Benefit Program, Plan Type, Benefit Plan, Coverage Code, Deduction Code, Page Number (page number), Line Number (line number), and Off Cycle |

Populated with values from the employee's actual pay history. If the employee has no pay history, the data is obtained from the job row that are effective for the selected record's pay end date. The page number and line number are set to zero, and the Off Cycle box is deselected. |

| Old Ded Amount (old deduction amount) |

Shows the actual amount that was calculated in the displayed pay period for the displayed deduction code and deduction class. |

| New Ded Amount (new deduction amount) |

Shows the amount that should have been deducted, according to the current data. |

| Override Ded Amount (override deduction amount) |

Enter a new amount to override the value in the New Ded Amount field. Note: For you to enter a new amount, the request must have reached Calculation status, but cannot have reached Loaded status. |

| Retro Ded Amount (retroactive deduction amount) |

Displays the difference between the new and old deductions. |

| Exception |

Selected for duplicate requests. |

| OK To Process |

Selected for all requests that aren't duplicates. |

Note: Use the scroll arrow to see calculation amounts for each deduction code/deduction classification combination.