Setting Up ACA Eligibility Tables

This section provides an overview of multiple companies and ACA Eligibility tables and describes how to set up ACA Eligibility tables for HR Manage Base Benefits.

Note: ACA employer shared responsibility takes into account only the work performed in the United States. Employees working abroad, whether or not U.S. citizens, will not be taken into account for determining whether the employer owes an Employer Shared Responsibility payment. Therefore, include only U.S. companies in this table.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ACA_TBL |

Define ACA Common IDs to group together companies under the same ownership. |

|

|

ACA_CMPY_TBL |

Assign a company to an ACA Common ID. |

Based on IRS rules, companies that have a common owner or that are otherwise generally related are combined and treated as a single employer for determining whether or not they collectively employ a minimum of 50 full-time employees (or full-time equivalents). If the combined employee total meets the minimum requirement, each separate company is subject to the Employer Shared Responsibility provisions, including those companies that individually do not employ enough employees to meet the minimum requirement.

Note: The rules for combining related employers do not apply for purposes of determining whether a particular company owes an Employer Shared Responsibility payment. This will be determined separately for each related company.

For example, if three companies have common ownership and each of the three companies has only 40 employees, since the combined employee count of the three companies is greater than 49, each of the three individual companies is subject to the Employer Shared Responsibility provisions and requirements. Each company is then evaluated individually to determine whether or not that company complies with the Employer Shared Responsibility provisions and requirements. If two of the companies are found to be in compliance (i.e., all eligible employees are offered health coverage) and one company is found not to be in compliance (i.e., at least one of its employees purchased insurance on one of the state exchanges), only the non-compliant company will be subject to any applicable penalties.

To account for this scenario, group companies under the same ownership using ACA Common ID table and ACA Company table.

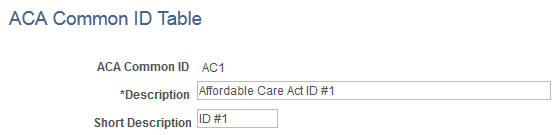

Use the ACA Common ID Table page (ACA_TBL) to define ACA Common IDs to group companies under the same ownership.

Navigation

Image: ACA Common ID Table page

This example illustrates the fields and controls on the ACA Common ID Table page.

Use the ACA Company Table page (ACA_CMPY_TBL) to associate a company to an ACA Common ID. This is effective dated; i.e., a company can be associated to different ACA Common IDs at different points in time.

Navigation

Set Up HCM > Common Definitions > Affordable Care Act > ACA Company Table

Image: ACA Company Table

This example illustrates the fields and controls on the ACA Company Table page.