Setting Up Benefit Rates

To set up benefit rates, use the Benefit Rate Types (BN_RATE_TYPE) and Benefit Rates (BN_RATE_TABLE) components.

This section provides overviews of benefit rates and percent of gross limits.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BN_RATE_TYPE |

Define benefit rate types. |

|

|

BN_RATE_TABLE |

Enter benefit rate information. |

|

|

BN_RATE_LMT_SEC |

Define the percent-of-gross limits. |

Benefit rates are used by plan types AX (Simple Benefits), 1X (Health Benefits), 2X (Life and Accidental Death), and 3X (Disability). The Benefit Rate table defines rates in terms of flat amounts, percentages of compensation base, or rates per-unit-of-coverage. It also defines the criteria to use to select an individual rate from the table, such as age, gender, coverage code, benefit plan, or compensation range. The structure of a set of benefit rates (the rate terms and the selection criteria) is defined in the Benefit Rate Types page, while the rate data is entered in the Benefit Rates page. Benefit rate types enable you to mix and match criteria and rate terms to create benefit rates that best fit your business needs.

Some states set a limit on the amount an employee pays for certain benefits, especially health insurance. This limit is based on a percentage of the employee's gross pay, and the percentage is defined on the Calculation Rules Table. However, this limit applies only to the portion of a benefit cost that represents coverage for the employee—the cost to cover a spouse or other family members is not subject to the limit. In general, the benefits rates do not break out costs per person. Therefore, the Benefit Rate table has a special entry area for defining what portion of the overall employee rate is subject to this optional limit.

If the percent-of-gross limit is, in fact, defined, then the system applies this limit by calculating benefit costs like this:

Lesser of [(EE Premium Amount Subject to Limit) or (Gross Pay × Limit %)] plus (Total EE Premium Amount − EE Premium Amount Subject to Limit)

Suppose that a monthly-paid employee is enrolled in family medical coverage, which has a flat rate of 300 USD per month. The amount of the employee's portion is 125 USD. The following example shows how to apply a 1.0% of gross pay limit to the employee-only coverage:

Total EE Premium Amount = 300 USD

EE Premium Amount Subject to Limit = 125 USD

Limit = 1.0% of Gross Pay

Gross Pay = 10,000 USD

The deduction is calculated as:

[Lesser of (125 or (10,000 × .01))] + (300 − 125)

= [Lesser of (125 or 100)] + (175)

= (100) + (175)

= 275 USD

The amount of the employee premium in excess of the limited deduction is 25 USD (300 − 275). This excess amount is added to the employer-paid premium.

Here's another example. Instead of the employee's single-coverage portion of the premium being a flat amount of 125 USD, assume that this is 30% of the premium amount:

Total EE Premium Amount = 300 USD

EE Premium Amount Subject to Limit = 30%

Limit = 1.0% of Gross Pay

Gross Pay = 10,000 USD

The deduction is calculated as:

[Lesser of (300 × 30%) or (10,000 × .01))] + (300 − 125)

= [Lesser of (90 or 100)] + (175)

= (90) + (175)

= 265 USD

In this case, 35 USD (300 - 265) is added to the employer-paid premium.

You can define limits on the employee's portion of a benefit premium by specifying a percent of gross limit on the Calculation Rules Table.

For example, current legislation in Hawaii requires that employers charge no more than 1.5% of an employee's gross wages for medical coverage. Only the employee's personal coverage is subject to this limit.

If the rate table indicates that the employer pays part of the premium, then any premium in excess of this final employee deduction amount (in this case, 1.5% of gross wages) is redirected (added) to the employer-paid portion of the premium. If the employer does not pay part of the premium, then no redirection occurs.

Use the Benefit Rate Types page (BN_RATE_TYPE) to define benefit rate types.

Navigation

Image: Benefit Rate Types page

This example illustrates the fields and controls on the Benefit Rate Types page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Rate or Percent |

Select Rate if you are specifying either flat amounts or rates per-unit-of-coverage, or Percent if the rate is calculated as a percentage of compensation. |

| Uses Compensation |

This field is automatically selected if either the rate type is Percent or any of the key fields that are used will use the employee's compensation data to determine the rate. |

| Uses Demographics |

This field is automatically selected if any of the key fields that are used will use demographic data to determine the rate. |

Rate Keys

|

Field or Control |

Definition |

|---|---|

| Key Nbr (key number) |

The key number controls the order in which the keys appear when you create a rate table. |

| Field Name |

The application field to use as a key in the Benefit Rate table. This list of available fields is fixed and limited to: Note: The source of any biographical information is determined by the Source of Demographics field on the Calculation Rules Table page.

|

| Matching Operator |

Specify the type of comparison operation the system uses when attempting to match a value with the keys of a benefits rate table. Use this field to resolve each key ("=" for discrete keys such as codes, and ">," ">=," "<," and "<=" for numeric brackets.) Note: You can define only one numeric bracket, and it must be the last key. |

Delivered Benefit Rate Types

Benefit rate types delivered with your system are:

Age–Graded. (By Gender, Smoker): Defines rates, flat amounts, or per unit of coverage for the insured based on gender and smoker status within specific age brackets.

Flat Rate: Defines rates that are based on a specific monetary amount.

Percent of Base: Defines rates as simple fixed percentages of an employee's compensation base.

Length of Service (Months): Defines rates (flat amounts or per unit of coverage) based on length-of-service brackets.

Compensation Bands: Defines rates (flat amounts or per unit of coverage) based on compensation brackets.

Covered Person Type: Defines rates (flat amounts or per unit of coverage) individually for each covered person type. This rate type is applicable only to Health plans because they are the only plan type that supports coverage codes.

This rate type allows qualified and nonqualified persons to be assigned to different rates and results in a rate being calculated per covered person on the enrollment.

Benefit Plan and Coverage Code: Defines rates, flat amounts, or per unit of coverage based on the benefit plan and coverage code enrollment. This rate type is useful for consolidating all rates for a given health provider into a single table.

Use the Benefit Rates page (BN_RATE_TABLE) to enter benefit rate information.

Navigation

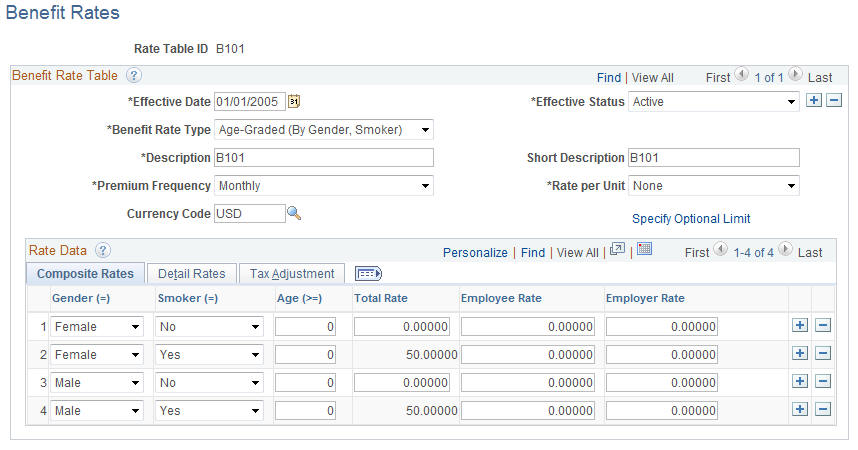

Image: Benefit Rates page

This example illustrates the fields and controls on the Benefit Rates page. You can find definitions for the fields and controls later on this page.

Warning! PeopleSoft Base Benefits delivers a set of rates with an ID of IRS. PeopleSoft Payroll for North America uses these IRS rates to calculate imputed income. The IRS table ID set should not be changed.

Benefit Rate Table

Use the Benefit Rate Table group box to define the structure of the rate table.

|

Field or Control |

Definition |

|---|---|

| Benefit Rate Type |

Select from one of the system-delivered or custom rate types. This controls the overall structure of this rate table, especially the keys in the Rate Data section |

| Premium Frequency |

Define how you quote the cost of benefit rates. If the employee's pay frequency differs from the premium frequency, the system annualizes the coverage rates and divides by employee pay frequency to determine the pay period rate. |

| Rate per Unit |

|

| Currency Code |

(Optional) Select a currency code to indicate the currency in which the rate data is specified. This is for informational purposes only—the system does not perform any currency conversion during deduction or cost calculations. However, the system does use this information when you are in the Benefit Program Table pages to match available benefit rates against the currency code associated with the benefit program. |

| Specify Optional Limit |

Click to access the Amount Subject to Limit page. |

Rate Data

Use this group box to enter composite rates, detail rates, or tax adjustments. Composite rates are based on a specific dollar amount. Composite rates define rates as either Employee or Employer without defining a tax class. The actual tax class used is determined dynamically during processing based on the tax classes defined within the applicable deduction code. Tax classes A and B (after-tax and before-tax) are employee classes, and classes T and N (taxable and nontaxable) are employer classes. The deduction code cannot define more than one employee tax class or employer tax class unless a GTL (group term life) or DPL (dependent life) effect is involved, in which case both N and T are allowed because the T class will be managed by the imputed income processing.

You can enter rates using either the Composite method or theDetail method, but not both.

Composite Rates

Enter the rates that are based on a specific dollar amount. The appearance of the grid is based on the benefit rate type.

|

Field or Control |

Definition |

|---|---|

| Age (>) |

You can enter the keys based on your criteria from the benefit rate type. |

| Total Rate |

Enter the total cost of the coverage. Include any administrative fee that you may charge. |

| Employee Rate |

Enter the rate charged to the employee and deducted through the paycheck. This is either after-tax or before-tax, depending on the deduction code definition. |

| Employer Rate |

Enter the rate the employer pays to subsidize the cost of a benefit. This is either taxable or nontaxable, depending on the deduction code definition. |

| Employee Percent |

Enter the employee's portion of contribution. If you've specified a percent, this represents the percentage of base that the employee pays for the benefit. |

| Employer Percent |

Enter the percentage of base that the employer contributes towards the benefits. |

Note: The fields that appear in the Rate Data group box depend upon the rate type that you select.

Detail Rates

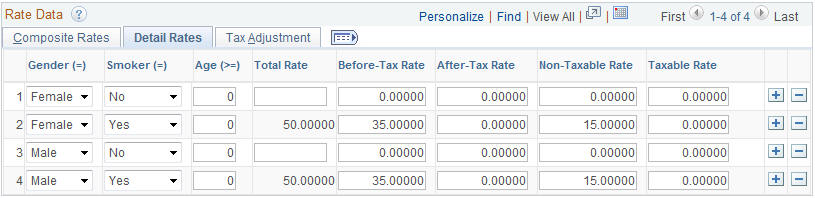

Access the Detail Rates tab on the Benefit Rates page.

Image: Benefit Rates page: Detail Rates tab

This example illustrates the fields and controls on the Benefit Rates page: Detail Rates tab. You can find definitions for the fields and controls later on this page.

Use the Detail Rates grid to split employee premiums across Before and After Tax, or to split employer premiums across taxable and nontaxable.

An example is premiums for domestic partner health coverage in the US, where the cost for qualified individuals can be Before Tax, but non-qualified individuals are After Tax.

|

Field or Control |

Definition |

|---|---|

| Before-Tax Rates, After-Tax Rate, Non-Taxable Rate, and Taxable Rate |

Allocate the total rate across the tax classes as desired. The classes here have the same meaning and impact as those specified in the deduction code. Any given tax class rate will be taken only if the deduction code being processed also has that tax class defined. You should not specify a taxable rate component for use in plans that are subject to imputed income. The system expects to generate the taxable cost for these plans. |

| Before-Tax Percent, After-Tax Percent, Non-Taxable Percent, and Taxable Percent |

Allocate the percentages across the tax classes as desired. |

Warning! Oracle's PeopleSoft Base Benefits delivers a set of rates with an ID of IRS. PeopleSoft Payroll for North America uses these IRS rates to calculate imputed income. The IRS table ID set should not be changed.

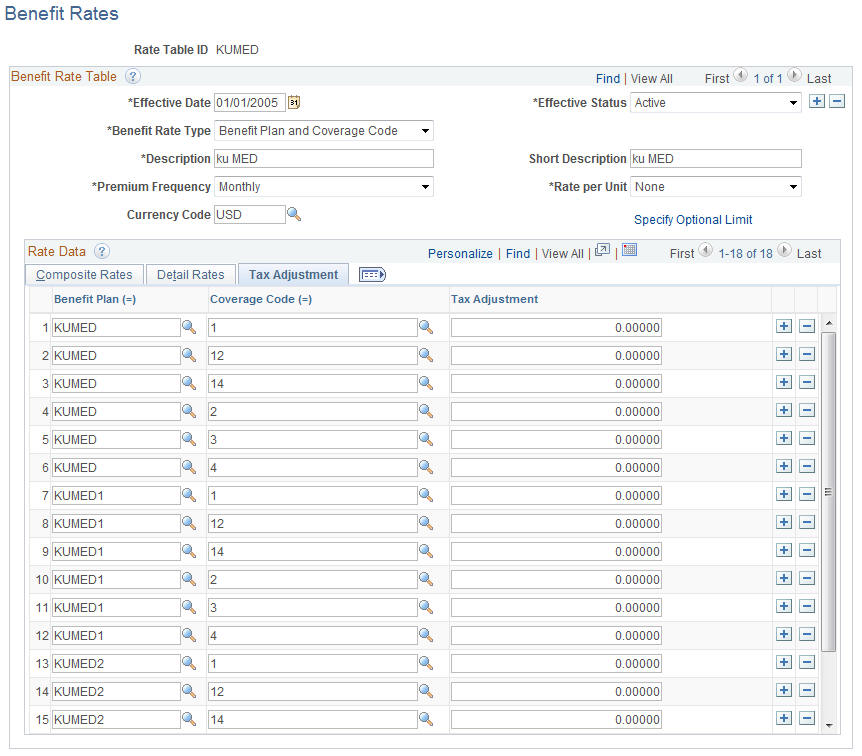

Tax Adjustment

Access the Tax Adjustment tab on the Benefit Rates page.

Image: Benefit Rates page, Tax Adjustment tab

This example illustrates the fields and controls on the Benefit Rates page, Tax Adjustment tab. You can find definitions for the fields and controls later on this page.

The tab displays a column for the Non-Taxable Before-Tax benefit deduction class (labeled Tax Adjustment). Define the rates applicable to adult children here. For the Percent of Base rate type, the column label is Adjustment Percent.

The Tax Adjustment tab has the same attributes as the rate columns on the existing tabs:

Default zero amount, numeric 5 decimals, etc., for amount rates.

Percent of Base Rate Type Adjustment Percent field attributes have the same attributes as the other percentage rate fields on the page.

The Total Rate column formulae on the two existing tabs does not include the rate on the tax adjustment tab.

The functionality is targeted at the two rate types that are most suited to health care deductions:

Benefit Plan and Coverage Code

Covered Person Type

In addition, the Percentage of Base type is included.

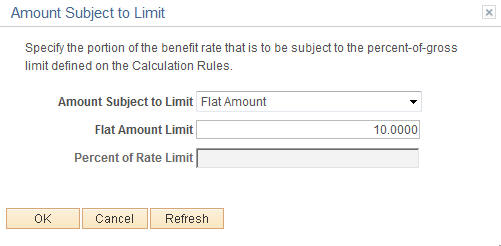

Use the Amount Subject to Limit page (BN_RATE_LMT_SEC) to define the percent-of-gross limits.

Navigation

Click the Specify Optional Limit link on the Benefit Rates page.

Image: Amount Subject to Limit page

This example illustrates the fields and controls on the Amount Subject to Limit page. You can find definitions for the fields and controls later on this page.

Specify the portion of the benefit rate to be subject to the percent-of-gross limit defined in the Calculation Rules Table page.

|

Field or Control |

Definition |

|---|---|

| Amount Subject to Limit |

Select whether the limit amounts is:

|

| Flat Amount Limit |

This field is available if you selected Entire Rate Amount in the Amount Subject to Limit field. Enter the amount that is subject to the limit. |

| Percent of Rate Limit |

This field is available if you selected Percent of Rate in the Amount Subject to Limit field. Enter the percentage amount of the employee rate that is subject to the limit. |