Setting Up Disability Plans

To set up disability plans, use the Disability Plan Table (DISABILITY_PLN_TBL) component.

This section lists prerequisites and discusses how to enter disability plans details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DISABILITY_PLN_TBL |

Define details for disability benefit plans. |

Insurance companies typically quote disability benefits in monthly terms (as opposed to life insurance benefits, which are quoted in annual terms). Define the amount of covered salary that forms the basis for a disability plan on the Coverage Formula Table page.

See Coverage Formula Table page

Use the Disability Plan Table page (DISABILITY_PLN_TBL) to define details for disability benefit plans.

Navigation

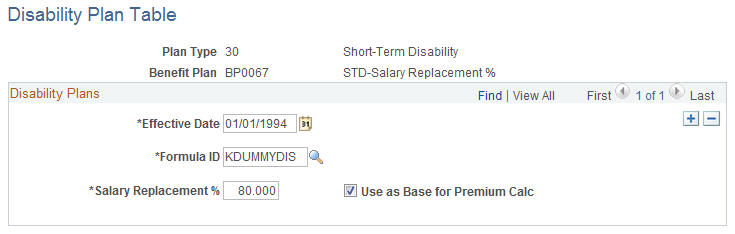

Image: Disability Plan Table page

This example illustrates the fields and controls on the Disability Plan Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Salary Replacement % (salary replacement percentage) |

Enter the percent of employee salary that this plan will replace, limited to the maximum monthly benefit. |

| Use as Base for Premium Calc (use as base for premium calculation) |

Select for the system to use the employee covered salaries to calculate disability plan premiums. When this option is selected, disability plan premium calculations are based on the salary replacement percentage of the employee's disability benefit rather than the employee's covered salary. This amount is still limited to the specified maximum monthly benefit. |

Calculation of Disability Plan Coverage

Similar to life insurance, disability plans use a coverage formula to determine the covered salary against which the premium rate is applied. Whereas life insurance plans typically calculate coverage in annual terms, disability plans typically calculate salary replacement coverage in monthly terms. You typically create a very simple formula for disability plans:

Base/12

You may want to round the base salary or final result. You could use the maximum benefit base to cap the employee's covered annual salary before the calculation, or you could use the coverage maximums to cap the resulting covered monthly salary.

The final monthly salary could be subject to either a percent-of-base type rate or a rate-per-unit type rate. Unless Use Salary Replacement as Base is selected, the rate takes into account the salary replacement percentage. This means that you would have a different rate for 50% replacement than you do for 66% replacement because the base represents only the covered salary and not the actual replace salary. However, if Use Salary Replacement as Base is selected, then the coverage base already accounts for the replacement percentage and a single set of rate would probably be used. The treatment and presentation of this plan is determined by your own business practice.