Setting Up Pension Plans

To set up pension plans, use the Pension Plan Table (PENS_PLAN_TABLE_US) component.

This section discusses how to enter US and Canadian pension plan details.

Note: Pension plans are also managed by PeopleSoft Pension Administration. However, the pension plan must be set up in the Manage Base Benefits business process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PENS_PLAN_TABLE_US |

Enter details for U.S.-defined pension plans. |

|

|

PENSION_PLAN_TABLE |

Enter details for Canadian-defined pension plans. |

Use the Pension Plan Table page (PENS_PLAN_TABLE_US) to enter details for U.S.-defined pension plans.

Navigation

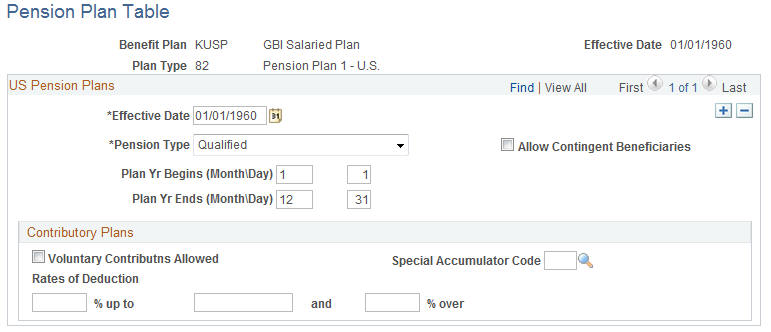

Image: Pension Plan Table page

This example illustrates the fields and controls on the Pension Plan Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Pension Type |

Select the type of pension plan. Valid values for U.S. pension plans are Qualified and Non Qualified. Do not select Defined Benefit or Money Purchase, as these are valid only for Canadian pension plans. |

| Allow Contingent Beneficiaries |

Select if the plan allows nonspouse beneficiaries. (If selected, the MDIB group box appears.) |

| Plan Yr Begins (Month/Day) (plan year begins [month/day]) and Plan Yr Ends (Month/Day) (plan year ends [month/day]) |

Specify the month and day when your plan year begins. A plan year normally ends the day before the next one begins. However, if you change your plan year, the row for the resulting short plan year will have nonconsecutive begin and end dates. Be sure to include a row for a short plan year. Failure to do this can cause calculation errors. A short plan refers to the period of transition when a change occurs in the plan year. For example, assume a plan has a fiscal year starting from July 1 to June 31. Due to a business decision, the plan year changes to January 1 to December 31, beginning on January 1, 2004. The short plan year would be from July 1, 2003 to December 31, 2004. |

| MDIB Rule Should Apply (minimum distribution incidental benefit rule should apply) |

Select if the MDIB rule applies. |

| MDIB Age Difference (minimum distribution incidental benefit age difference) |

Enter an age difference. |

| Contributory Plans |

You can incorporate U.S. pension plans (plan types 82 to 87) into a manual or automated benefit program only if the plan is defined as a contributory plan in which the employee contributes some portion of earnings to the plan. Note: The system does not determine whether the rules that you set up meet Internal Revenue Code qualification standards. Such compliance is your responsibility. |

| Voluntary Contributions Allowed |

No parameters exist for defining voluntary contribution rates; these are established on an employee-by-employee basis when you enroll employees in the plan. |

| Special Accumulator Code |

Enter the code that tracks pensionable earnings. |

| Rates of Deduction |

Enter contribution rates. You can have different rates above and below a threshold. For example, employees can contribute 2% of earnings up to 50,000 USD and 3% of earnings above that. Enter the rate up to the threshold in the first Rates of Deduction field, the threshold in the next field, and the rate beyond the threshold in the final field. If the threshold changes—for example, if you use the Taxable Wage Base (TWB) as the threshold—insert additional effective-dated rows to record the changes. |

Use the Pension Plan Table CAN page (PENSION_PLAN_TABLE) to enter details for Canadian-defined pension plans.

Navigation

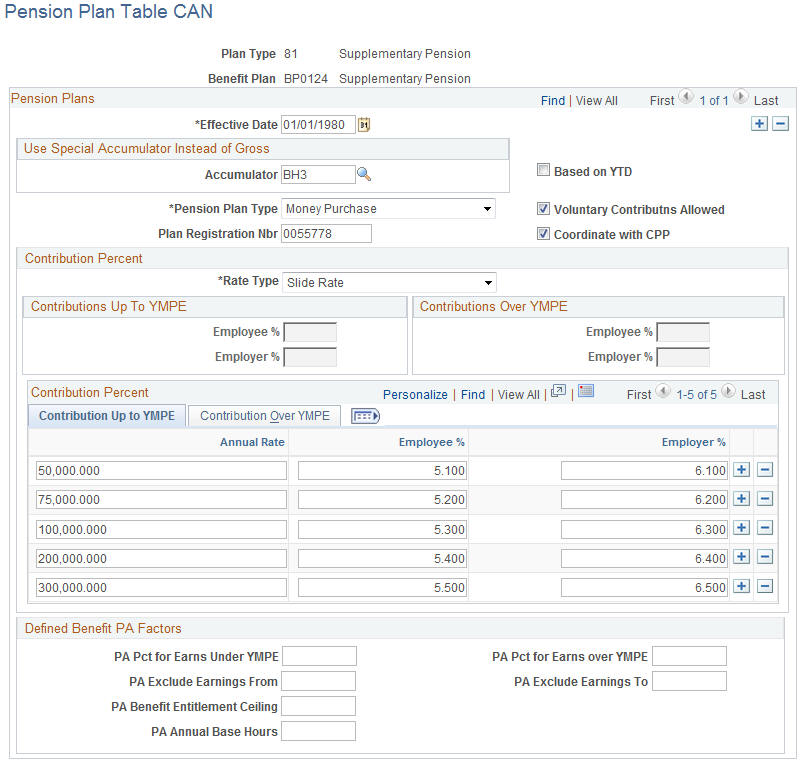

Image: Pension Plan Table CAN

This example illustrates the fields and controls on the Pension Plan Table CAN. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Use Special Accumulator Instead of Gross |

Enter the special accumulator code that you want the system to use in pension calculations. The system normally performs pension plan calculations based on employee total gross. If you use a special accumulator, work with your payroll department to define the code and details. You can define several special accumulators—as many as you need—to process savings, retirement, and pension plans. |

| Based on YTD (based on year-to-date) |

Select if you identified a special accumulator in the Use Special Accumulator Instead of Gross field. The system will add the current period special accumulator earnings to the special accumulator year-to-date balance. If you do not select the check box, the system takes the special accumulator earnings for the current pay period and annualizes them based on the number of pay periods in the year. |

| Pension Plan Type |

Select the type of pension plan. Valid values for Canadian pension plans are Defined Benefit and Money Purchase. Do not select either Qualified or Non Qualified, as these are valid only for U.S. pension plans. Defined benefit calculates the pension credit and does not maintain a pension adjustment balance for the employee. Defined benefit pension credits must be calculated based on the retirement benefits accrued by each employee, according to the provisions of the plan and the plan year. The system doesn't have the information to perform this calculation. Money purchase calculates the pension credit for the current period as the total of all employee and employer contributions to the plan. The system posts the total of all pension credits for the period (an employee can be enrolled in more than one pension plan at the same time) to the Pension Adjustment Year-To-Date balance for the employee. If your pension plan has been defined as a money-purchase type, the Pension Adjustment (PA) amount is automatically calculated and maintained by the pay confirmation process and represents a combination of the employee and employer contributions. |

| Voluntary Contributns Allowed (voluntary contributions allowed) |

Select to allow employees whom you enroll in the plan to make voluntary contributions above the amount that you define for the plan. |

| Coordinate with CCP (coordinate with Canadian Pension Plan) |

Select to have the system reduce the calculated contribution amount for both the employee and the employer by the amount contributed to the Canada Pension Plan (CPP) for the current pay period. Warning! When you define the pension contribution as a before-tax deduction, the system calculates the amount to deduct before it performs the normal tax calculation. When you select Coordinate with CPP, the system performs a special CPP/QPP calculation prior to calculation of the pension contribution. To ensure that CPP/QPP is correctly calculated, you or your payroll department must define the pension benefit deduction priority as lower (a higher number) than all taxable benefits. |

| Plan Registration Nbr (plan registration number) |

Enter the registration number for the pension plan. The system uses the plan registration number for reporting on the T4 tax form at the end of the year. |

| Contribution Percent |

Use this group box to define the employer and employee contribution percentages. The rate type that you select determines the information that you will need to provide. |

| Rate Type |

Select a rate type. Valid values are Fixed Rate, None, and Slide Rate. If you select Fixed Rate, the Pension Rate Table becomes available and you must enter the rates to use to process the employee and employer contributions. This is based on YTD earnings and should not be selected even if a special accumulator is used. If more than one set of rates apply, Oracle recommends that you use Slide Rate. If you choose None, use the fields to the right to define the rates. If you select Slide Rate, the Pension Rate Table becomes available and you must enter the rates to use to process the employee and employer contributions. To avoid setup problems, define your rates in both Contribution Up to YMPE and Contribution Over YMPE for each earnings limit and ensure that a ceiling earnings limit is entered that cannot be exceeded by annualizing an employee's pay. Otherwise, an error message is reported during the pay calculation run. |

| Contribution Up To YMPE (contribution and up to yearly maximum pensionable earnings), Contribution Over YMPE (contribution and over yearly maximum pensionable earnings), Employer % (employer percent), and Employee % (employee percent) |

To define rates that are not based on a table, select None in the Rate Type field and use Contribution & Up to YMPE, Employee %, and Employer %, and Contribution & Over YMPE, Employee %, and Employer %. YMPE is an amount set by the government upon which CPP/QPP contributions are made. It is a ceiling, and excess earnings on this ceiling are not subject to CPP/QPP contributions. |

| Annual Rate |

To define fixed or sliding rates, select either Fixed Rate or Sliding Rate in the Rate Type field. For example, you enter three sets of rates and you enter limits of $20,000, $60,000, and $80,000 for the rates. When the system processes an employee pension contribution for pensions defined using fixed rates, it looks for the set of rates with the lowest associated earnings limit that is greater than employee annual earnings. If employee annual earnings exceed the highest earnings limit amount, the system uses the rates associated with the highest amount. When the system processes an employee pension contribution for pensions with sliding rates, it splits the earnings between different rate levels up to employee annual earnings. Here is an example for fixed rates: An employee with annual earnings of $50,000 uses rates associated with the $20,000 earnings limit for the first $20,000, and uses rates associated with the $60,000 earnings limit for the remaining $30,000. Here is an example for sliding rates: an employee with annual earnings of $50,000 uses the rates associated with the $60,000 earnings limit. If the annual earnings for another employee are $90,000, the system uses the rates associated with the $80,000 earnings limit. |

| Defined Benefit PA Factors |

If you want to use the SQR (Structured Query Report) program TAX104CN as a template Pension Adjustment Calculation routine, complete the Defined Benefit PA Factors group box. TAX104CN calculates and loads the appropriate balance records. To complete the group box, contact your pension administrator or an appropriate governing office. The only optional field in this group box is PA Annual Base Hours. If this field is blank, the system applies the employee's standard work hours from the Job Data - Job Information page to perform the calculation. If your pension plan has been defined as a money purchase type, the pension adjustment (PA) amount is automatically calculated and maintained by the pay confirmation process and represents a combination of the employee and employer contributions. If you have pension plans set up as defined benefit plans, leave the pension adjustment amounts in the Defined Benefit PA Factors group box blank. Typically, you will generate the pension adjustment amounts using an external service provider, or perhaps an internal process, outside of the PeopleSoft application. When the information is calculated, you must import it into the PeopleSoft system. |