Setting Up Savings Plans

This section discusses how to set up savings plans using the Savings Plan Table (SAVINGS_PLAN_TBL) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

SAVINGS_PLAN_TBL1 |

Define employee investment limits. |

|

|

SAVINGS_PLAN_TBL2 |

Define employer contributions. |

|

|

SAVINGS_PLAN_TBL5 |

Set up employee rollover options. |

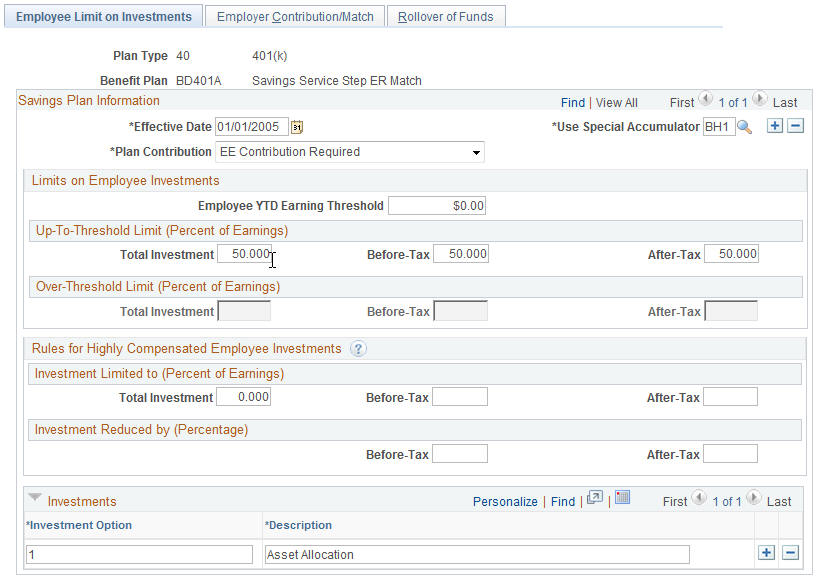

Use the Employee Limit on Investments page (SAVINGS_PLAN_TBL1) to define employee investment limits.

Navigation

Image: Employee Limit on Investments page

This example illustrates the fields and controls on the Employee Limit on Investments page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Use Special Accumulator |

Enter a special accumulator to identify eligible earnings for calculating employee deductions. Special accumulators are set up using the Special Accumulator Table. |

| Plan Contribution |

Select who will be a contributor to this savings plan: EE Contribution Optional (employee contribution optional): You might use this for plans that feature an employer nonmatching contribution, with voluntary additional employee contributions. You might also use it for a zero-contribution enrollment plan allowing for rollover funds. EE Contribution Required (employee contribution required): This option enables employer matching. Employer Only (No EE) (employer only [no employee]): You could use this to establish an employer-funded savings benefit. |

Limits on Employee Investments

|

Field or Control |

Definition |

|---|---|

| Employee YTD Earning Threshold (employee year-to-date earning threshold) |

This amount is used to determine when the over-threshold limit applies. If this amount is left at zero, the up-to-threshold limits apply to all levels of earnings. |

|

Field or Control |

Definition |

|---|---|

| Up-To-Threshold Limit (Percent of Earnings) |

Enter the before-tax, after-tax, and total percentage of earnings that an employee can invest, as long as the employee year-to-date (YTD) earnings threshold has not been met. |

| Over-Threshold Limit (Percent of Earnings) |

Enter the before-tax, after-tax, and total percentage amounts that an employee can invest after the YTD earnings threshold has been met. |

Rules for Highly Compensated Employee Investments

In response to marginal or failed 401(k) and 401(m) nondiscrimination testing, you may need to reduce investments by highly compensated employees (HCEs) to comply with regulations. Enter the before-tax, after-tax, and total investment amounts that an employee can invest.

For example, you could set a lower 8% before-tax contribution cap on HCEs or set up a 2% reduction on elected contribution of each HCE to bring deferrals into compliance. Depending on the results of the nondiscrimination testing, you can adjust the limits throughout the year.

Investments

Enter a numerical identifier for each investment option and a description.

Note: U.S. federal government users enter an alphabetical identifier.

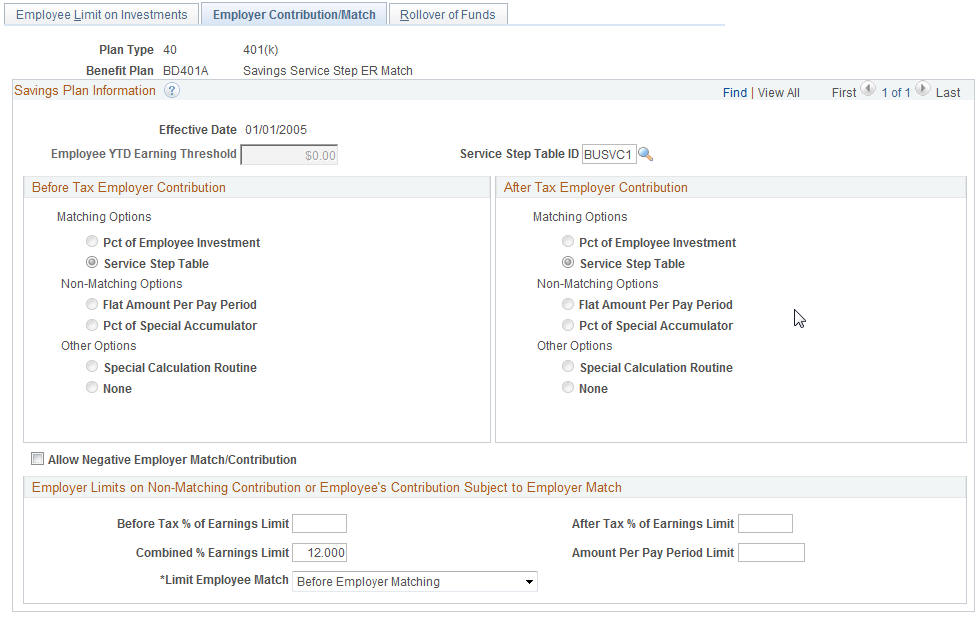

Use the Employer Contribution/Match page (SAVINGS_PLAN_TBL2) to define employer contributions.

Navigation

Image: Employer Contribution/Match page

This example illustrates the fields and controls on the Employer Contribution/Match page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Employee YTD Earning Threshold (employee year-to-date earning threshold) |

Displays the value enter on the Employee Limit on Investments page for this field. |

| Service Step Table ID |

Use to link the rate of employer matching contributions to an employee's length of service. If you enter a service step table ID, the system automatically selects Service Step Table option in the Before Tax Employer Contribution and After Tax Employer Contribution group boxes. |

Before and After Tax Employer Contribution

Employer contribution refers to amount employer contributes towards employee's savings plan, either on a matching or nonmatching basis.

In a matching contribution, the employer's contribution is dependent or limited by employee's contribution in the savings plan.

|

Field or Control |

Definition |

|---|---|

| Pct of Employee Investment (percent of employee investment) |

Select to enter the percentage the organization will match of an employee contribution in the Percent Match field. For example, if an organization matches 25% of an employee's contribution, the system will generate an employer match of 25 U.S. dollars (USD) for an employee with a 401k contribution of 100 USD. |

| Service Step Table |

Select to use a service step table that defines different levels of percent match of employee's earnings per length of service and deduction class. For example, the service step table specified After 24 Months of Service, the employer will matches 40% of up to 3% of Employee's Earnings and 60% of up to 8% of Earnings for Before Tax. Hence if employee had 36 months of service and had Before Tax contribution 10% of his Before Tax Earnings of $1,000, then his first 3% of contribution is at 40% giving $12 while the next 5% (8% less 3% already matched) is at 60% giving $30. Hence, Employer Match Total is $42. |

In a nonmatching contribution, the employer's contribution is independent of employee's contribution and sets the contribution using the following options:

|

Field or Control |

Definition |

|---|---|

| Flat Amount Per Pay Period |

Select and enter the dollar amount that the employer will contribute per pay period regardless of the amount an employee contributes in the Flat Amount field. |

| Pct of Special Accumulator (percent of special accumulator) |

Select and enter a percentage of an employer contribution in the Under Threshold field. A special accumulator is predefined total of certain earnings, a percentage of which is what employer will contribute. |

You can also identify other options or enter additional information, such as contribution percentages and amounts, for employer matching and contribution.

|

Field or Control |

Definition |

|---|---|

| Special Calculation Routine |

Select to have the system use a custom routine that is not supported by the standard PeopleSoft system. You must modify your COBOL programs. |

| Percent Matching |

Enter the percentage the organization will match of an employee contribution. This field appears when the Pct of Employee Investment option is selected. |

| Flat Amount |

Enter the dollar amount that the employer will contribute per pay period regardless of the amount an employee contributes. This field appears when the Flat Amount Per Pay Period option is selected. |

| Under Threshold |

Enter a percentage of an employer contribution. This field appears when the Pct of Special Accumulator option is selected. |

| Allow Negative Employer Match/Contribution |

Select to enable negative earnings to result in an employer match when the employee's contribution is negative. The system will not make a positive contribution when there are negative earnings present, this includes rollovers, flat dollar contribution amounts, and excess credits. The earnings are used in the calculation, but only to generate running employer totals—the earnings do not interfere with the match-tier processing. The negative employer match/contribution resets to zero if not allowed. |

Employer Limits on Non-Matching Contribution or Employee's Contribution Subject to Employer Match

|

Field or Control |

Definition |

|---|---|

| Before Tax % of Earnings Limit, After Tax % of Earnings Limit, and Combined % of Earnings Limit |

Enter a percentage of before, after, or combined earnings that will be matched by the employer contribution. For example, if the Before Tax % of Earnings Limit field had 6%, then the employer would match contributions up to 6% of the employee's rate of contribution. If the employee only contributed 5%, only 5% would be matched. |

| Amount Per Pay Period Limit |

Select a dollar amount upon which to apply the employer contribution. |

| Limit Employee Match |

Select a method for calculating an employer's savings plan match. This can be done in two different ways: one limits the employee's contributions subject to matching after the employer match calculation and the other limits the employee contributions prior to calculating the employer match. Options are After Employer Match and Before Employer Match. |

You can define the maximum amount that the employer contributes to a savings plan, on either a matching or nonmatching basis.

When you are defining a nonmatching contribution plan, this data defines the actual amount an employer contributes.

For example, your organization might fund savings plans with after-tax dollars at 3% of the employee's earnings, up to 500 USD per pay period. You would enter 3% in the After-Tax % of Earnings Limit field and 500 in the Amount Per Pay Period Limit field.

When you are defining a plan that has an employer match, this data defines the maximum amount of employee funds eligible for matching, rather than defining the amount of the employer match.

For example, your organization might match 50% of an employee's contributions, but only on a before-tax basis, up to 6% of earnings or 1,000 USD per pay period, whichever is less. In this example, you would enter 6% in the Before-Tax % of Earnings Limit field and 1000 in the Amount per Pay Period Limit field.

Use the Combined % of Earnings Limit field to combine the limits for both before-tax and after-tax employer match.

Use the Limit Employee Match field to specify whether the limit or reduction is applied before or after the employer match is calculated as described in the examples below.

This feature applies only for employer match calculations that use the Service Step Table.

Example: Limiting Employee Match Before or After Employer Match When Using the Service Step Table

This example uses the following data:

Savings plan limit for employer contribution: 4.5%

Service Step table:

Up to 3% of employee earnings: 100% match.

Up to 6% of employee earnings: 50% match.

Employee enrollment:

Before-tax: 1%

After-tax: 6%

Earnings: $5225

Before-tax deduction: 52.25

After-tax deduction: $315.50

After Employer Matching

The reduction (limit) of the employee contributions that are subject to matching after the match calculation is calculated like this:

Before-tax employer match: $52.25

(1% earnings x 100% match)

Non-taxable Employer match: $182.88

[( 3% x 100% match = $156.75) + (3% x 50% match = $78.38)] = (4.5% x $5225) = $235.13 match

$235.13 – $52.25 = $182.88

Before Employer Matching

The reduction (limit) of the employee contributions subject to matching before the match calculation is calculated like this:

Before-tax employer match: $52.25

(1% earnings x 100% match)

Non-taxable Employer match: $169.82

[(4.5% limit – 1% earnings used for before-tax = 3.5%) (3% x 100% match = $156.75) + (.5% x 50% =13.06) = $169.82

This section contains information about employer match per employee contribution before-tax and after-tax calculation for Thrift Savings Plans including Roth 401(k).

Note: Use this TSP employer match calculation logic only if the deduction is for TSP EE Contrib-Agency Match, i.e., Reporting Code = ‘TSP EE Contrib – Agency Match’.

To calculate the employer match using the Agency Matching Contribution formula, use the total of TSP and Roth 401(k) employee contribution amounts to determine the percentage of pay contributed. To calculate the employer match, the following rules apply:

The first 3% of contribution is 100% Employer Match.

The remaining contribution is 50% Employer Match.

Total contribution for matching cannot exceed 5%.

Set up the service step table to define before-tax and after-tax values. For more information, see Setting Up Service Step Table.

Thrift Savings Plan (TSP) Employer Match Calculation Example

In this example, the employee earnings is $4000.

Before-tax Employee Contribution = $4000 x 2% = $80

After-tax Employee Contribution = $4000 x 4% = $160

Non-taxable Before-tax Employer Match = $4000 x 2% x 100% = $80

Non-taxable Employer Match = $4000 x 1% x 100% + $4000 x 2% x 50% = $80

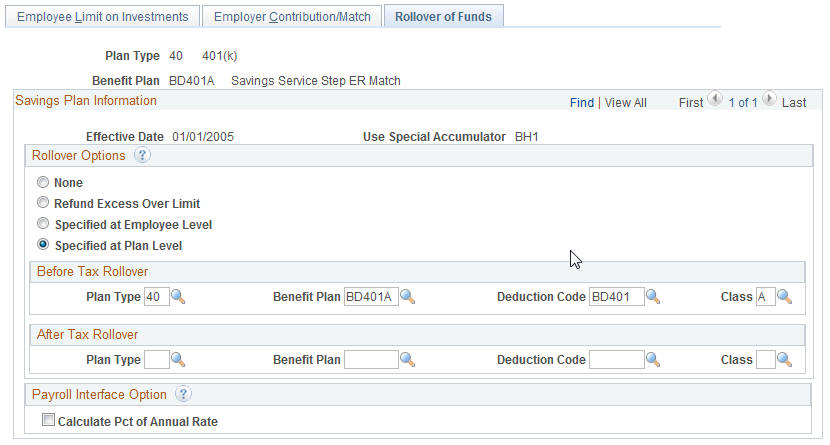

Use the Rollover of Funds page (SAVINGS_PLAN_TBL5) to set up employee rollover options.

Navigation

Image: Rollover of Funds page

This example illustrates the fields and controls on the Rollover of Funds page. You can find definitions for the fields and controls later on this page.

Note: Employer-only plans cannot receive rollovers from another plan, because rollovers are a form of employee contribution.

|

Field or Control |

Definition |

|---|---|

| Rollover Options |

Choose from the following: None: Rollovers are not allowed. Refund Excess Over Limit: Use with 403(b) plans, for which the limiting of employee contributions is more dynamic. In certain situations, an employee's contributions are not limited as quickly as they should be. On subsequent pay runs, the system may determine that the employee was allowed to contribute too much. This option enables the system to reduce prior contributions in excess of the current limit by creating a refund or negative deduction of the excess deferral amount. Specified at Employee Level: Rollover amounts are based on information entered on the employee enrollment pages. The plan type, benefit plan, deduction code, and class for before-tax, after-tax, or both are made on employee enrollment records. Specified at Plan Level: Rollover amounts are based on information entered on the benefit plan pages. Enter the plan type, benefit plan, deduction code, and class for before-tax, after-tax, or both. Note: Specified at Plan Level and Specified at Employee Level require that the employee be enrolled in the specified rollover savings plan before the actual rollover event occurs during a payroll run. If you want a savings plan to receive rollover funds without active employee contributions, set up the plan as Employee Contribution Optional on the Employee Limit on Investments page and enroll employees with a zero contribution amount. |

| Before Tax Rollover and After Tax Rollover |

Enter the plan type, benefit plan, deduction code, and class for the rollover options. |

| Calculate Pct of Annual Rate (calculate percentage of annual rate) |

Select to enable PeopleSoft Payroll Interface to calculate deductions for a savings plan. Payroll Interface estimates employee deductions using an employee's annual compensation rate. This is considered an estimate because the annual rates and actual earnings, not available to PeopleSoft Payroll Interface, are not necessarily the same. Also, no year-to-date accumulators are available to apply regulatory limits. With the exception of savings plan deductions, PeopleSoft Payroll Interface does not calculate deductions that are based on a percentage of an employee's earnings. To calculate such deductions, you need either PeopleSoft Payroll for North America or an appropriate interface with another payroll system. |

This topic contains set up specifications for Thrift Savings Plans (TSP) (Plan Type - 42) that includes the Roth 401(k) plan for federal employees.

For more information about Thrift Savings Plan (TSP) including Roth 401(k), see product documentation for PeopleSoft HCM: Payroll for North America.

Setting Up TSP Employer Match - FERS Plan

The following table contains the fields and values to set up the TSP Employer Match - FERS Plan:

|

Page Name |

Section |

Field Name |

Value |

|---|---|---|---|

|

Employee Limit on Investments |

|

After-Tax |

Enter the percentage of earnings which is the limit for contributing to Roth 401(k) plan. |

|

Employer Contribution/Match |

|

Combined % Earnings Limit |

Enter the combined percentage earnings limit. This will be the combined earnings matching for TSP and Roth. |

|

|

Service Step Table ID |

Use the service step table defined for TSP - Roth 401(k) employer match. |

Setting Up TSP No Match - CSRS Plan

The following table contains the fields and values to set up the TSP No Match - CSRS Plan:

|

Page Name |

Section |

Field Name |

Value |

|---|---|---|---|

|

Employee Limit on Investments |

|

After-Tax |

Enter the percentage of earnings. |

|

Employer Contribution/Match |

|

Combined % Earnings Limit |

Leave this field empty as there is no employer match associated with this plan. |

|

|

Service Step Table ID |

Leave this field empty as there is no employer match associated with this plan. |