Year End Accessibility for Self Service Users

This topic provides an overview of the accessibility feature enabled for year end tax forms (USA).

Note: Currently this feature is enabled for Forms W-2, W-2c, W-2AS, W-2GU, W-2VI, W-2cAS, W-2cGU and W-2cVI.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAXFORM_ACC_SETUP |

In the Self Service accessibility page for Year End Forms (USA), the following configurations are delivered by Payroll for North America:

|

In accessibility mode, the system displays the selected tax forms on a PeopleSoft page. This feature is available only if the corresponding year end accessibility set up is defined for the selected year using the Year End Accessibility Setup page.

You can also view and print the year-end forms in PDF format in addition to the online page. For example, to view the W-2 or W-2c forms in pdf format use the Printable W-2 or Printable W-2c button.

Note: Accessibility set up is available from the year 2012 onwards.

In the Self Service accessibility page for Year End Forms (USA), the following configurations are delivered by Payroll for North America:

Map the valid boxes and codes with the corresponding XML tag from the corresponding Taxform Definition

Define the display/processing logic

Define override description

Note: Oracle recommends that you modify only the override description and form instructions.

Navigation

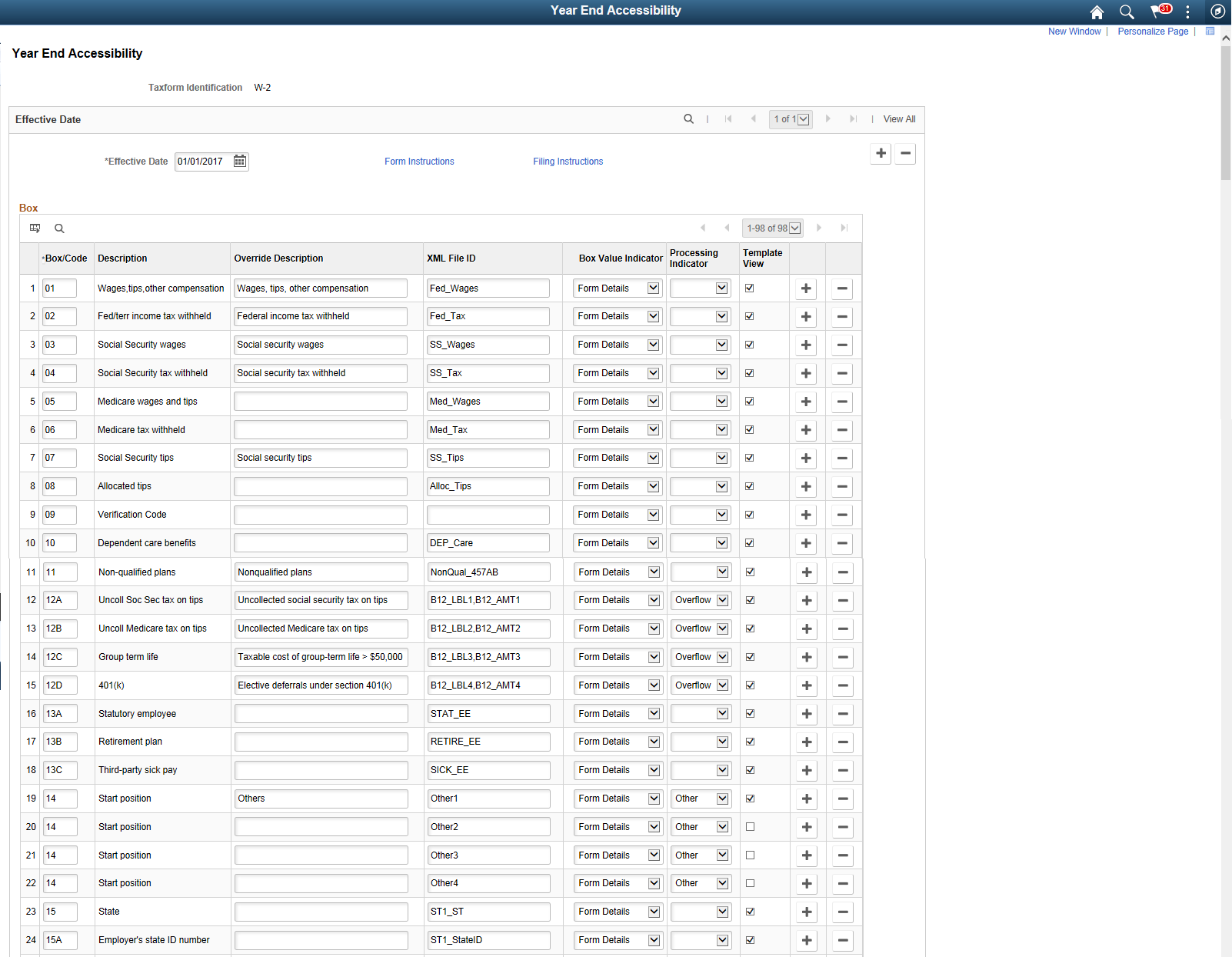

Image: Year End Accessibility Setup Page

This example illustrates the fields and controls on the Year End Accessibility Setup Page for W-2. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Taxform Identification |

Displays the selected tax form. Here, for example we have selected W-2. |

| Box/Code |

Based on the selected tax form and year, system populates the corresponding Box/Codes from the Tax Form Definitions Page along with the description. |

| Description |

The description defined for the corresponding Box/Code in the Tax Form Definitions Page is automatically populated here. Note: In accessibility mode it is important to give a proper description to the Box/Code for the screen reader to interpret. If you need to override the delivered description, use the Override Description field to enter an alternate or new description. |

| Override Description |

Enter the description to be displayed in the View Year End Form page (accessibility mode). If this field is left blank, the default description will be displayed. |

| XML File ID |

XML File ID is the mapping between the Box/Code and the XML tag in the XMLP template for the corresponding Taxform Definition. |

| Box Value Indicator |

This field indicates the mapping of the Box/Code to the corresponding section in View Year End Form page (accessibility mode). The options listed below are applicable to W-2, W-2AS, W-2GU and W-2VI forms.

The options listed below are applicable to W-2c, W-2cAS, W-2cGU and W-2cVI forms.

In the View Year End Form page (accessibility mode), the Box/Code details will be displayed in each section based on this mapping. |

| Processing Indicator |

This field indicates the processing type for each Box/Code. Available options are:

Note: By default, normal processing is followed if this field is left blank. |

| Template View |

In the View Year End Form page (accessibility mode), only the Box/Code with form values will be displayed by default. If Template View is selected for a Box/Code, on selecting ‘View All Boxes’ option in the View Form Page, Box/Code details will be populated even if form value is not present. |

Form Instructions

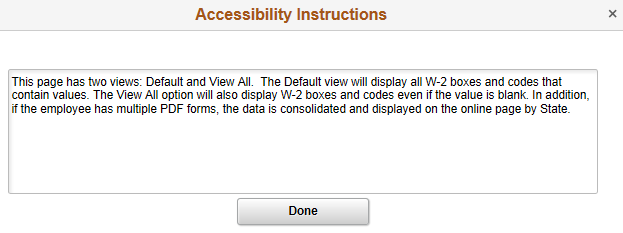

Form Instructions defined in Year End Accessibility Setup Page is displayed as accessibility instructions in the View Form page (accessibility mode). This is the standard accessibility instructions PeopleSoft delivers. If required, the user can modify the instructions.

Click the Form Instructions link in the Year End Accessibility page to view or update the accessibility instructions.

Image: Accessibility Instructions Page

This example illustrates the Accessibility Instructions.

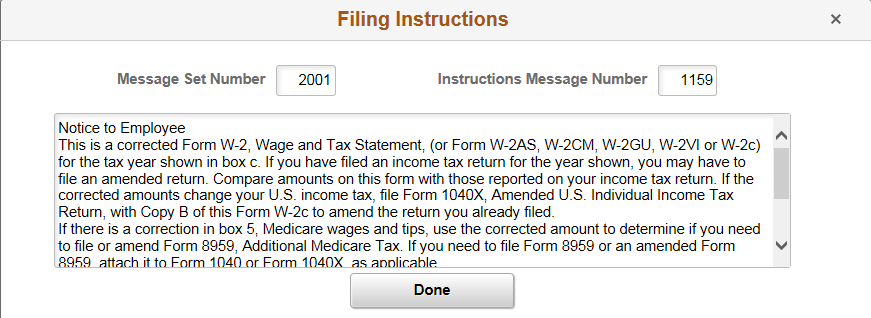

Filing Instructions

Filing instructions are managed through message catalogs. Click the Filing Instructions link in the Year End Accessibility page to view the filing instructions.

Image: Filing Instructions

This example illustrates the Filing Instructions.

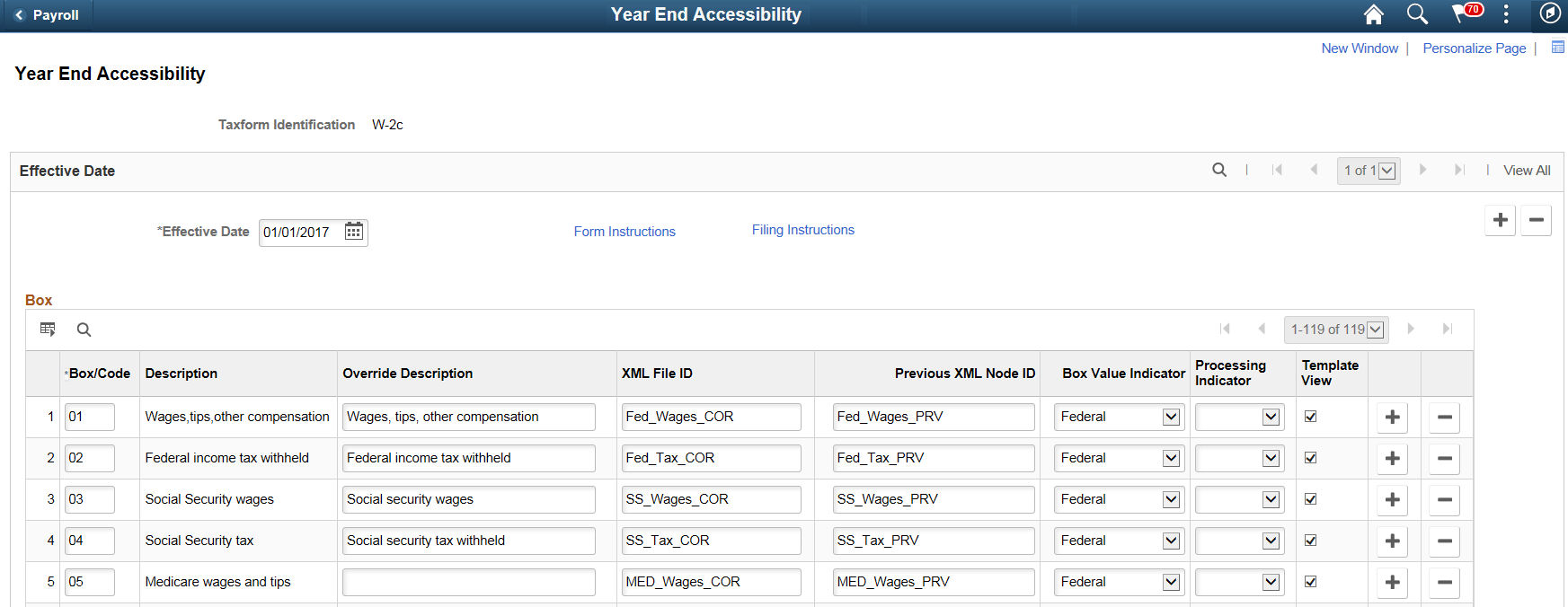

Year End Accessibility Setup Page for W-2c

Select W-2c in the Tax Form Identification field to setup Self-Service accessibility mapping for corrected W-2 Forms. This setup of W-2c also handles accessibility mapping for W-2c territories like W-2AS, W-2GU and W-2VI.

Image: Year End Accessibility Setup Page for W-2c

This example illustrates the fields and controls on the Year End Accessibility Setup Page for W-2c. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Taxform Identification |

Displays the selected tax form. Here, we have selected W-2c. |

| Box/Code |

Based on the selected tax form and year, system populates the corresponding Box/Codes from the Tax Form Definitions Page along with the description. |

| Description |

The description defined for the corresponding Box/Code in the Tax Form Definitions Page is automatically populated here. Note: In accessibility mode it is important to give a proper description to the Box/Code for the screen reader to interpret. If you need to override the delivered description, use the Override Description field to enter an alternate or new description. |

| Override Description |

Enter the description to be displayed in the View Year End Form page (accessibility mode). If this field is left blank, the default description will be displayed. |

| XML File ID |

XML File ID is the mapping between the Box/Code and the XML tag in the XMLP template for the corresponding Taxform Definition. |

| Previous XML Node ID |

Displays the XML File ID before correction. |

| Box Value Indicator |

This field indicates the mapping of the Box/Code to the corresponding section in View Year End Form page (accessibility mode). The options listed below are applicable to W-2c, W-2cAS, W-2cGU and W-2cVI forms.

The options listed below are applicable to W-2, W-2AS, W-2GU and W-2VI forms.

In the View Year End Form page (accessibility mode), the Box/Code details will be displayed in each section based on this mapping. |

| Processing Indicator |

This field indicates the processing type for each Box/Code. Available options are:

Note: By default, normal processing is followed if this field is left blank. |

| Template View |

In the View Year End Form page (accessibility mode), only the Box/Code with form values will be displayed by default. If Template View is selected for a Box/Code, on selecting ‘View All Boxes’ option in View Form Page, Box/Code details will be populated even if form value is not present. |

Form Instructions

Form Instructions defined in Year End Accessibility Setup Page is displayed as accessibility instructions in the View Form page (accessibility mode). This is the standard accessibility instructions PeopleSoft delivers. If required, user can modify the instructions.

Click the Form Instructions link in the Year End Accessibility page to view or update the accessibility instructions.

Filing Instructions for W-2c

Filing instructions are managed through message catalogs. Click the Filing Instructions link in the Year End Accessibility page to view the filing instructions.

Image: Filing Instructions for W-2c

This example illustrates the Filing Instructions for W-2c.

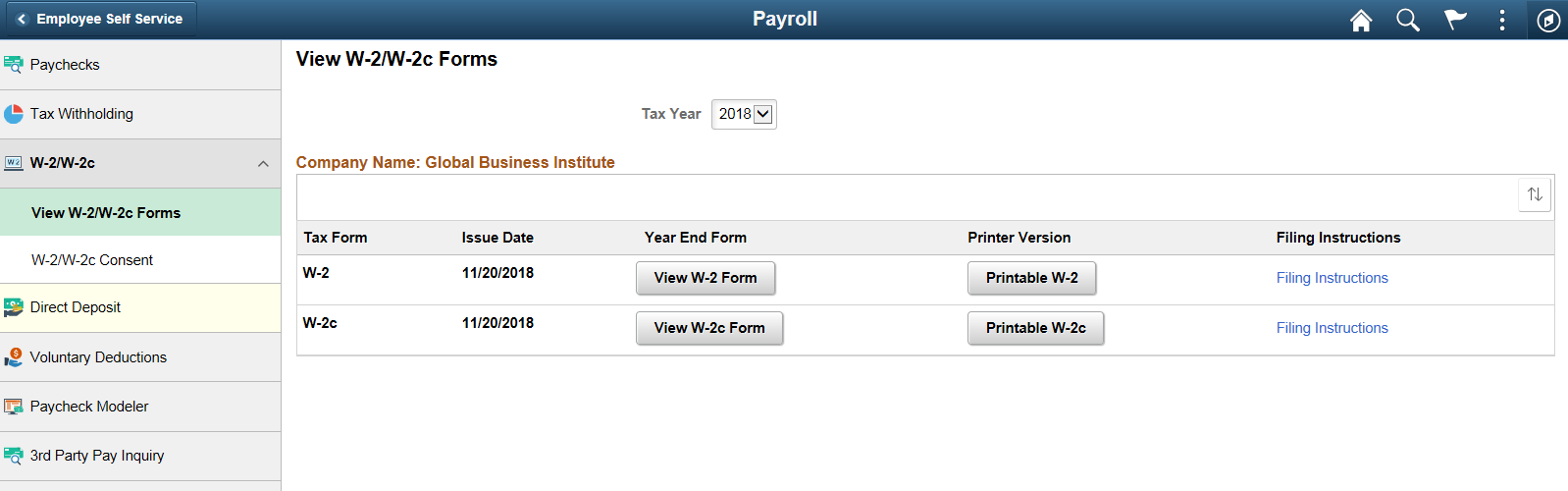

Use View W-2/W-2c Forms Page in accessibility mode to view the selected tax forms on a PeopleSoft page (and not in a PDF file).

Note: This feature is available only if the corresponding year end accessibility set up is defined for the selected year. For more information, see Year End Accessibility Setup Page

If required, you can also view the year-end form in pdf format.

Navigation

From the Employee Self-Service home page, click the Payroll tile to access the Payroll page. Then click the W-2/W-2c Forms option and select View W-2/W-2c Forms from the left navigation pane.

Image: View W-2/W-2c Forms Page in Accessibility Mode

This example illustrates the View W-2/W-2c Forms Page in Accessibility Mode.

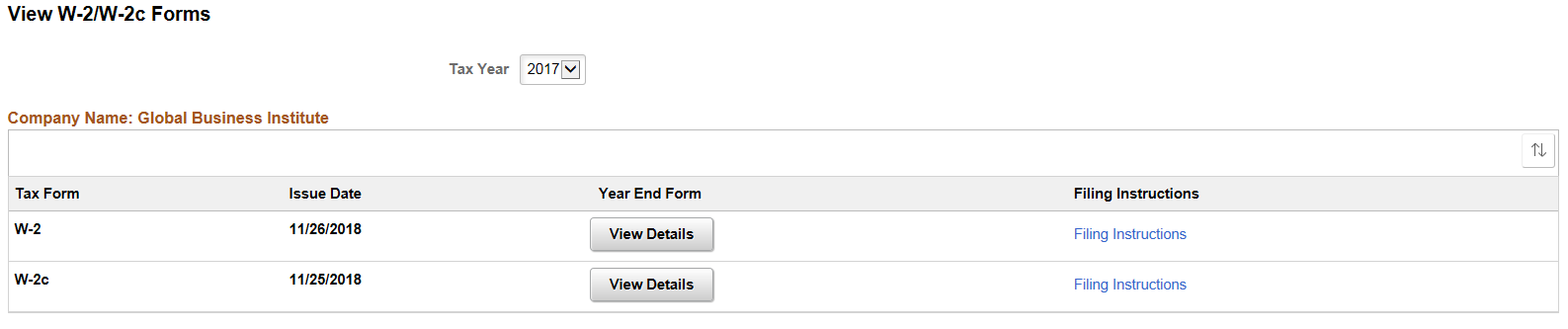

The View W-2/W-2c Forms page displays View Details button for employees with multiple forms.

Image: View W-2/W-2c Forms Page in Accessibility Mode for employees with multiple forms

This example illustrates the View W-2/W-2c Forms Page in Accessibility Mode for employees with multiple forms.

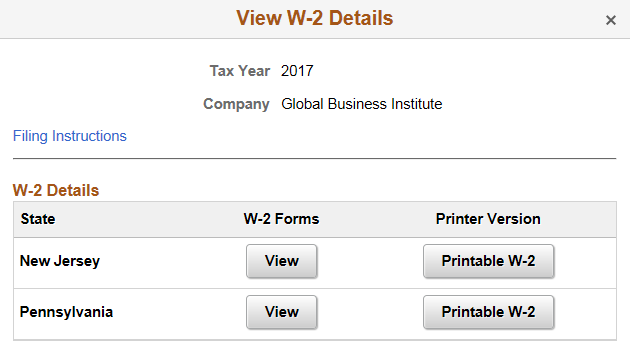

Select the View Details button corresponding to W-2 tax form to open the View W-2 Details page.

Image: View W-2 Details Page

In this example, the employee has two W-2s. One for New Jersey and one for Pennsylvania.

Click View button to open the W-2 form in accessibility mode.

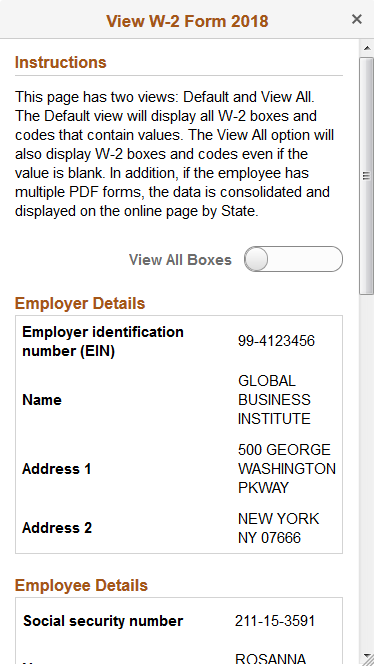

Image: (Smartphone) View W-2 Form Page in accessibility mode

This example illustrates the View W-2 Form Page in accessibility mode for the smartphone.

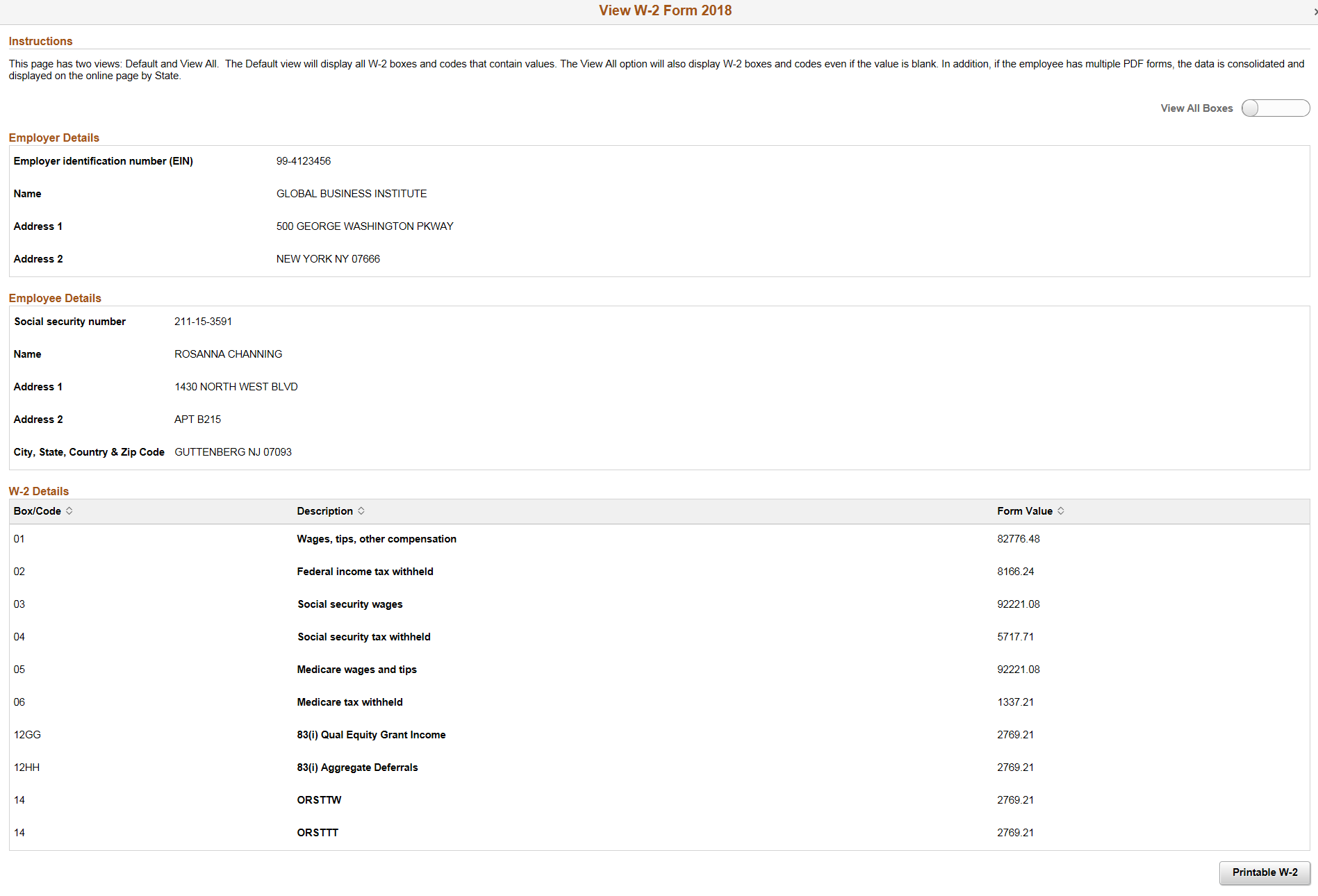

Image: (Desktop) View W-2 Form Page in accessibility mode

This example illustrates the View W-2 Form page in accessibility mode for the desktop.

In the View W-2/W-2c Forms Page, select the View Details button corresponding to W-2c tax form to open the View W-2c Details page.

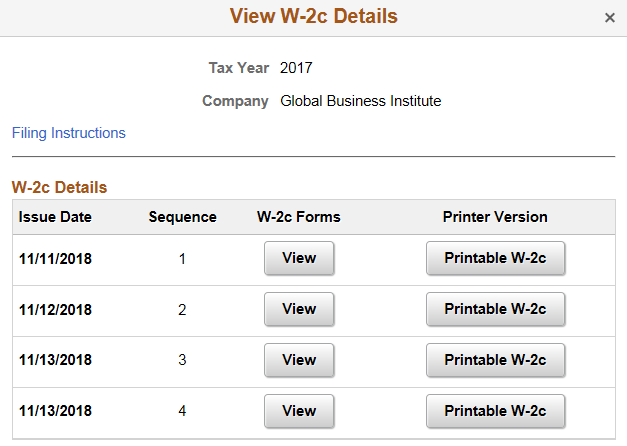

Image: View W-2c Details Page

In this example, the employee has four W-2c that were processed on various days.

Click View button to open the W-2c form in accessibility mode.

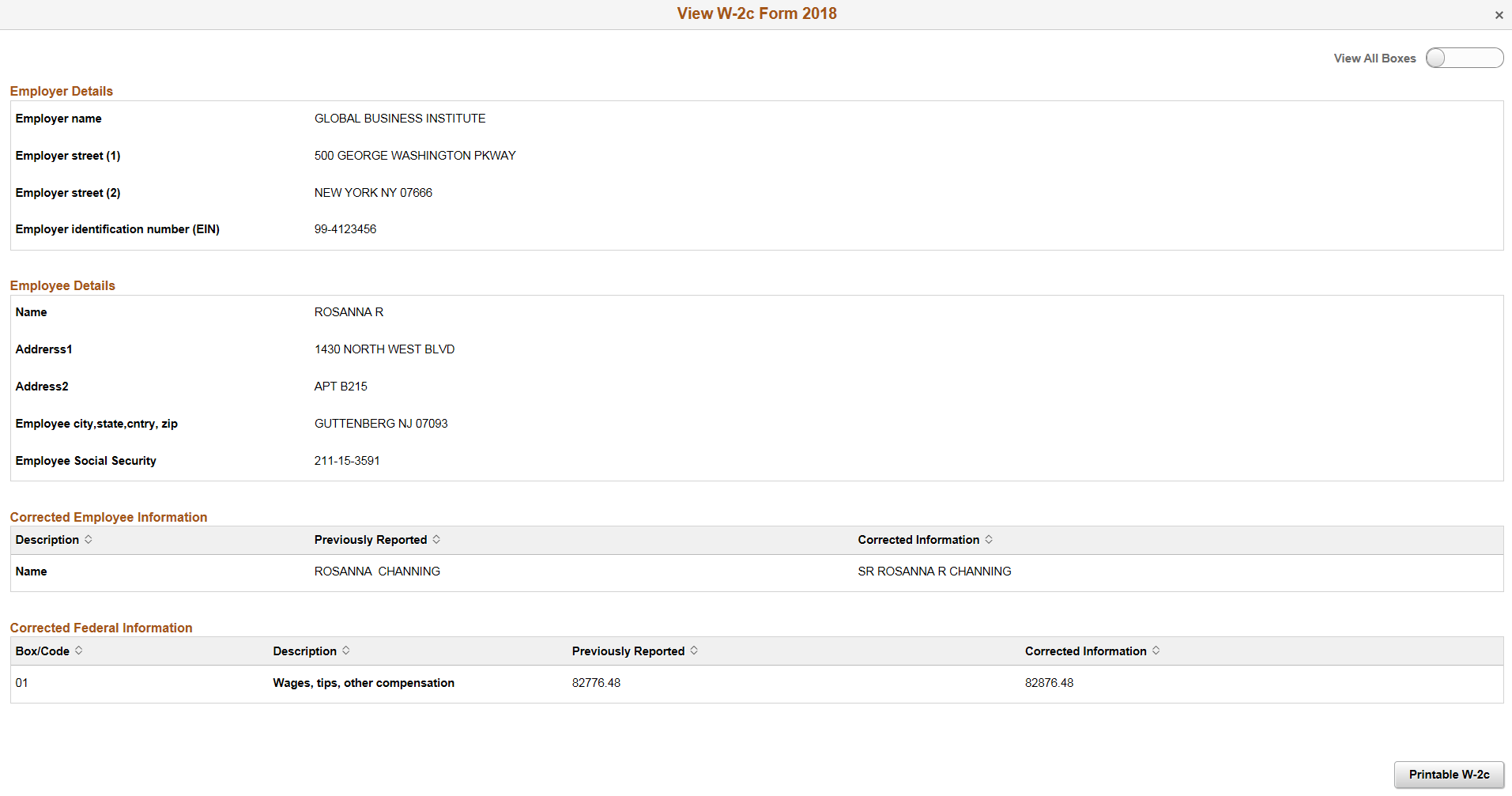

Image: View W-2c Form Page in Accessibility Mode

This example illustrates the View W-2c Form page in accessibility mode.

This page is displayed based on the configuration defined in the Year End Accessibility Setup Page

|

Field or Control |

Definition |

|---|---|

| View All Boxes |

Select this push button to show all the Box/Code which are selected as Template View in the Year End Accessibility page. Note: If this push button is not selected only the Box/Code with form values will be displayed by default. |

| Printable W-2/ Printable W-2c |

Click this button to view the PDF file. |