Entering Information for Reporting Tax

To set up tax reporting, use the Pay Entities AUS (GPAU_PYENT_DTL) and Supplier Information AUS (GPAU_SUPPLIER) components.

Tax reporting varies depending on the information that the system stores about the organization.

This topic lists the pages used to enter information for reporting tax.

Note: You use the pages discussed in this section to create the following files, which you submit to the ATO: the Group Tax file, the Payment Summaries file, and the TFN declaration.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Pay Entities AUS Page |

GPAU_PYENT_EXT |

Enter pay entity information that the ATO requires in various reports or electronic files. |

|

GPAU_SPPLR_DATA1 |

Enter information about the organization submitting the fortnightly TFN declaration. The information entered on this page is included in the electronic file that is generated. |

|

|

Supplier Address Page |

GPAU_SPPLR_DATA2 |

Enter supplier address information. |

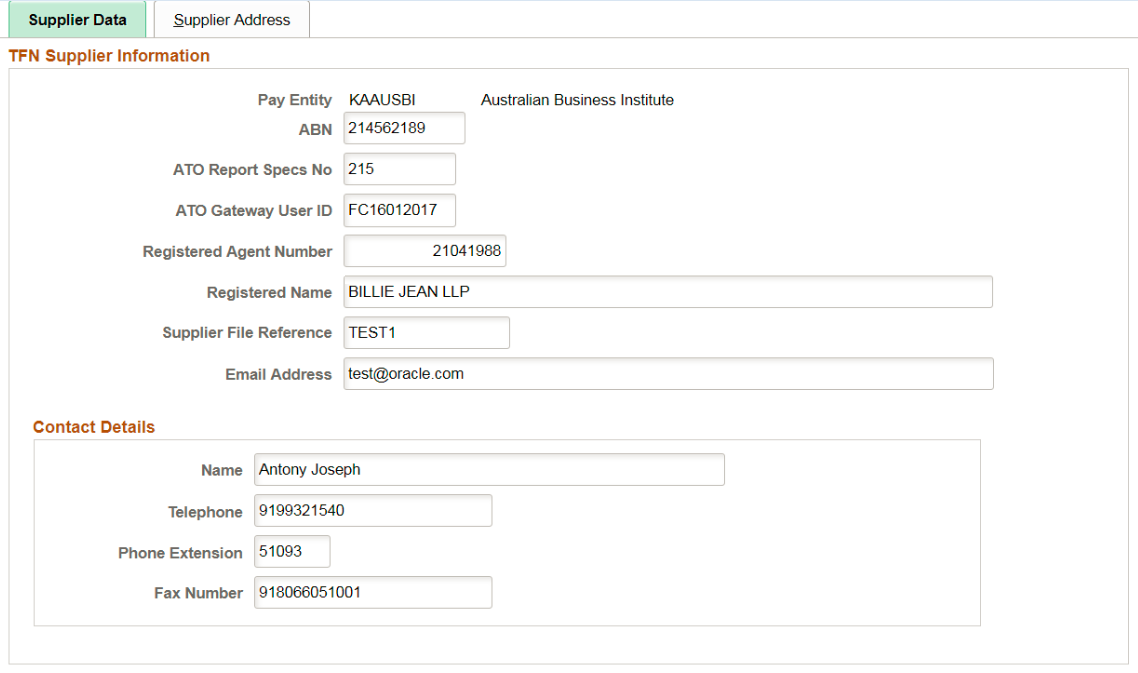

Use the Supplier Data Page page (GPAU_SPPLR_DATA1) to enter information about the organization submitting the fortnightly TFN declaration. The information entered on this page is included in the electronic file that is generated.

Navigation

Image: Supplier Data Page

This example illustrates the Supplier Data page.