Defining MANAD Report Parameters

To set up parameters for MANAD reporting, use the MANAD Parameters BRA (GPBR_MANAD_PARMS) component.

This topic discusses how to define MANAD report parameters.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPBR_MANAD_PARMS |

Map Global Payroll data to information to be displayed on the MANAD report. |

|

|

GPBR_MANAD_RESP |

Enter responsible data for the MANAD report. |

|

|

GPBR_MANAD_ACCT |

Enter accountant data for the MANAD report. |

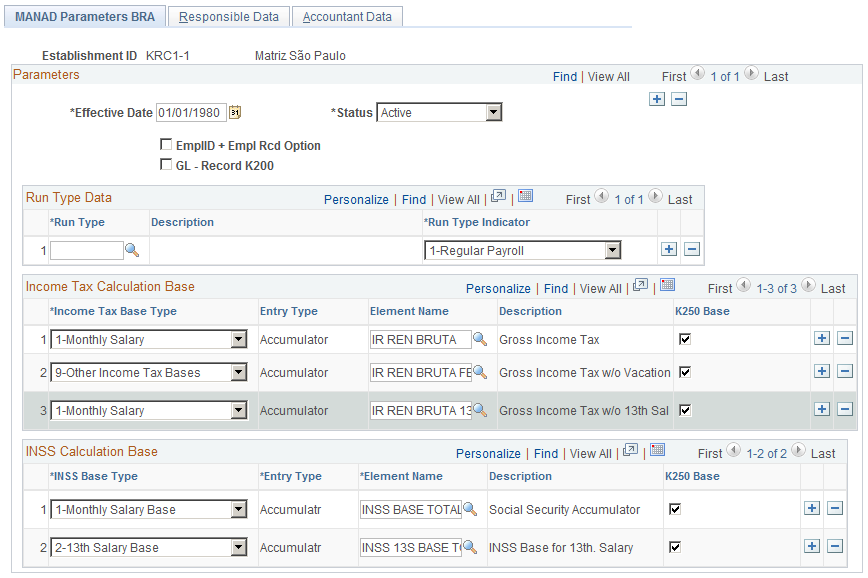

Use the MANAD Parameters BRA page (GPBR_MANAD_PARMS) to map Global Payroll data to information to be displayed on the MANAD report.

Navigation

Image: MANAD Parameters BRA page

This example illustrates the fields and controls on the MANAD Parameters BRA page.

Note: The system uses the MANAD parameters defined for the headquarter establishment (where the Headquarters Unit option is selected on the Establishment Address page) of a company as the default values for other establishments of that company.

|

Field or Control |

Definition |

|---|---|

| EmplID + Empl Rcd Option (employee ID + employee record option) |

Select to display the employee’s ID and employee record in the MANAD report. |

Run Type Data

Use this section to map payroll run types in the Global Payroll system to run types for use in the MANAD report.

For example, in a payroll run for December, there can be vacation earnings, 13th salary earnings, terminations earnings as well as deductions in addition to the regular payroll amount. When all these amounts are paid through their specific run types, the amounts need to be recorded in the MANAD report under the mapped run types that are predefined for MANAD reporting.

Income Tax Calculation Base

Use this section to map the income tax base types (predefined for MANAD reporting) to accumulator elements in the Global Payroll system. This information is used to classify each accumulator in Record K300 according to their participation in income tax calculation bases.

Suppose that both SALARIO and PREMIO are members of the IR REN BRUTA accumulator and this accumulator is mapped to the 1 - Monthly Salary income tax base type in this section. In the MANAD report, the Record K300 of SALARIO and PREMIO earnings for all employees will appear with type 1 in the Income Tax Classification field.

INSS Calculation Base

Use this section to map social welfare classifications (predefined for MANAD reporting) to elements in the Global Payroll system. This information is used to classify each accumulator, earnings and deductions element in Record K300 according to their participation in social security calculations.

|

Field or Control |

Definition |

|---|---|

| INSS Base Type |

Select an INSS base type to map to a Global Payroll element. If you select 1-Monthly Salary Base or 2-13th Salary Base, the system limits the entry type to Accumulator only. The rest of the base types can be mapped to accumulator, deduction, and earnings elements. |

| K250 Base |

Select for the corresponding entry to be included

in Record K250 for MANAD.

|

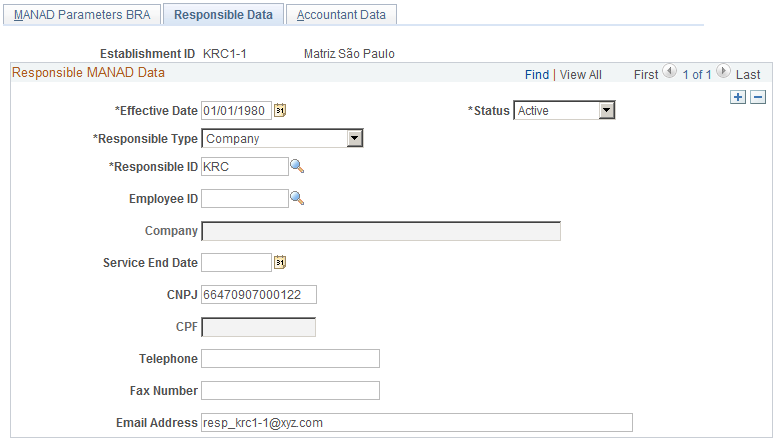

Use the Responsible Data page (GPBR_MANAD_RESP) to enter responsible data for the MANAD report.

Navigation

Image: Responsible Data page

This example illustrates the fields and controls on the Responsible Data page.

Use this page to enter data for use in Record 0100 in the MANAD report.

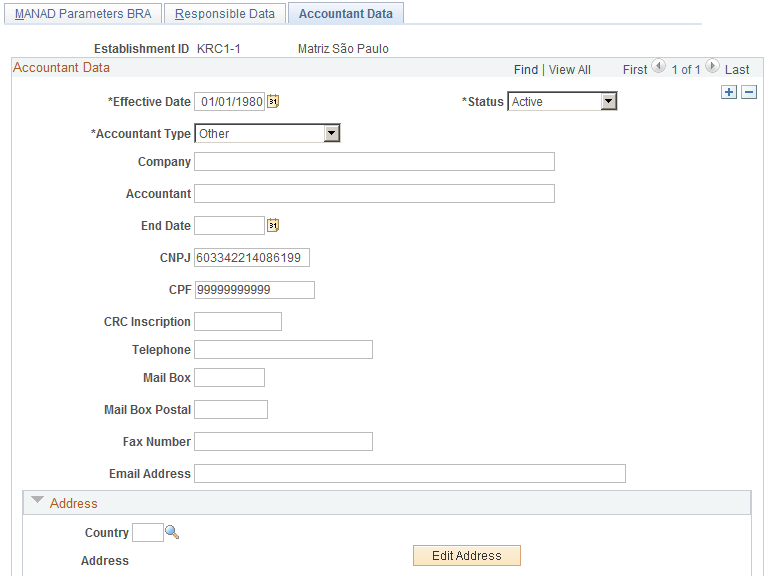

Use the Accountant Data page (GPBR_MANAD_ACCT) to enter accountant data for the MANAD report

Navigation

Image: Accountant Data page

This example illustrates the fields and controls on the Accountant Data page.

Information entered on this page is used to create Record 0050 for all existing accounting responsible entities for the required period specified for issuing the exportation file.

If the end date of the accounting service is not specified on this page, the system derives the end date by subtracting one day from the begin date of the next responsible entity.