Base Salary

This topic discusses:

Base salary in Spain.

Adjustments to salary.

Complemento Absorbible.

Seniority.

Typically in Spain, an employee's base salary is defined by the labor agreement. However, with HR and PeopleSoft Global Payroll for Spain you can set up employee compensation in different ways to suit your company needs.

The base salary is a basic earning. It is typically calculated as Unit * Rate, where the rate code is established by the labor agreement or in other ways, depending on the setup of your company's compensation. The unit is calculated with the formula GEN FM UNIDADES. The calculated value depends on the type of employee (daily or monthly).

Note: PeopleSoft Global Payroll for Spain uses the GEN RC SAL BASE rate code to specify the base salary. This rate code is linked to the SALBSE rate code defined in HR.

To calculate an employee's total salary, you may have to consider some adjustments to the basic compensation that are specified in the labor agreement, or that result from an employee's personal agreement.

If the salary in the employee's personal agreement is the same as the amount reflected in the labor agreement, no adjustment is necessary. This salary includes both base salary and complements.

Adjustments may include:

Gross to net: Make this adjustment if the employee's gross salary defined by the labor agreement for his professional category is different from the gross salary in his personal agreement.

Net to gross: Make this adjustment if you need to calculate an employee's annual gross salary from an agreed net amount.

The difference between the real gross defined in employees' personal agreements and the total earnings that they should receive in their professional category must be reflected in an earning element called complemento absorbible. In the case of net guarantee, the complemento absorbible is the difference between the calculated gross (calculated from the net) and the total earnings based on the professional category of the employee.

The calculation rule for complemento absorbible is defined as Unit * Rate, where Unit is the number of days worked in a month and Rate is the rate code GEN RC COM ABS EST. The earning is identified in the Customer Fields area with a value equal to 9-COMPABS.

To calculate the complemento absorbible, you must override the variable GEN VR TIPO AJ SAL for that employee using the value BRUTO for gross to net adjustment or the value NETO for net to gross adjustment. Use the Supporting Elements Overrides page to enter this override.

Companies often calculate seniority by subtracting the seniority date from the payroll period end date. This is the PeopleSoft-delivered calculation method, but you can change it to fit your company's needs. If you want to change the calculation method, specify a custom duration or formula to calculate seniority years for a labor agreement on the Labor Agreement - Seniority page or modify the code of formula CLI FM ANTIG DESDE.

Note: Absences can decrease seniority years based on the number of months absent.

You can measure seniority pay in different ways. Typically, you measure seniority in multiples of three years (trienniums) or four years (cuatrenniums). You can also measure seniority as a mixture of years.

PeopleSoft Global Payroll for Spain delivers trienniums and cuatrenniums, but you can create a different seniority measurement by adding a new earning using one of the existing earnings as a template. If you define a new seniority measurement, add it on the Seniority Earnings page and identify those new seniority earnings with value 5–ANTIGDAD in the Custom Field5.

The most common way to determine seniority is to associate an amount with a triennium or cuatrennium. For example, an employee could get 18 EUR per month for the first triennium and 21 EUR per month for the second triennium. So if an employee has six years of seniority, he would get 39 EUR per month in seniority earnings.

Another typical seniority calculation method is a percentage over the base salary or base salary plus a complement.

Here's an example:

Assume that you have a programmer who is at Salary Level 4, earning 700 EUR per month. The labor agreement defines seniority as a cuatrennium that is 4 percent of the base salary. The programmer has eight years of seniority, which is equal to two cuatrenniums. His seniority earnings per month is calculated as:

Number of cuatrenniums x (Percentage x Base) = Seniority earnings.

2 (cuatrenniums) x (0.04 x 700 EUR) = 56 EUR per month.

Consolidated Seniority (Antigüedad consolidada)

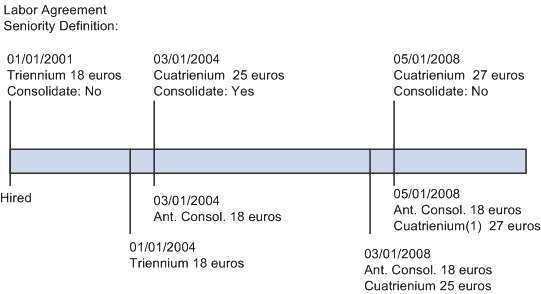

Sometimes, the labor agreement establishes a change in the measurement of seniority, for example, from trienniums to cuatrenniums. When this happens, part of the seniority amount can appear as another earnings element called consolidated seniority (antigüedad consolidada). The consolidated seniority element must reflect the total amount that the employee was receiving until the date of the change. This occurs if you select the Consolidation check box when adding a new effective-dated row on the Labor Agreement - Seniority page. If you don't select this check box, the seniority calculation considers only the new values or percentages when calculating the total amount to be paid for seniority.

Example

Image: Labor agreement seniority example

This example shows how consolidated seniority can affect an employee's seniority earnings: