Managing Employee Termination Information

This topic provides an overview of the Manage Terminations ESP component and discusses how to enter employee termination data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_TERM_MNG |

Provide the necessary data to handle conditions for employees who are terminated. To manage severance pay, you need to enter data in this page. In case you have to calculate the statutory severance pay, you must also enter the termination reason in this page. |

Use the Manage Terminations ESP component to manage the additional termination data that affects payroll calculation. This component works in conjunction with the termination processing functionality of the Job Data component. After you perform a termination action on an employee through the Job Data component, you can then use the Manage Terminations ESP component to provide additional termination data, if necessary, for that terminated employee.

Use the Manage Terminations ESP page (GPES_TERM_MNG) to provide the necessary data to handle conditions for employees who are terminated.

To manage severance pay, you need to enter data in this page. In case you have to calculate the statutory severance pay, you must also enter the termination reason in this page.

Navigation

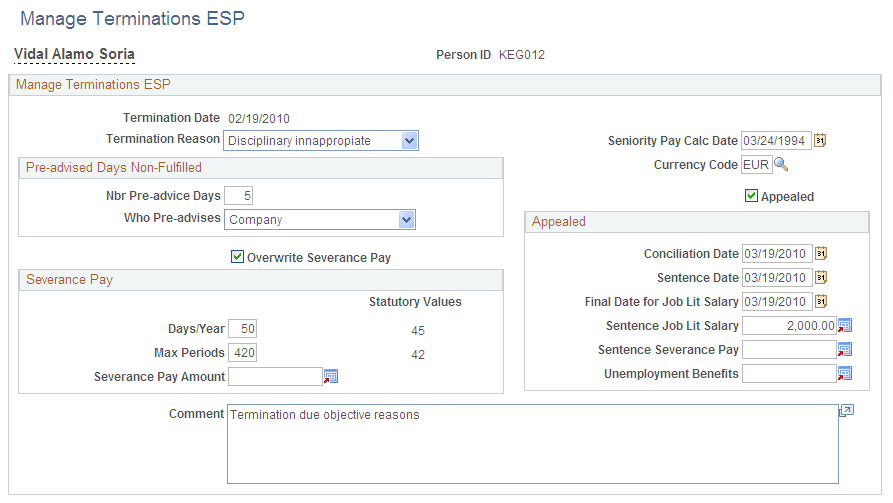

Image: Manage Terminations ESP page

This example illustrates the fields and controls on the Manage Terminations ESP page. You can find definitions for the fields and controls later on this page.

Manage Terminations ESP

|

Field or Control |

Definition |

|---|---|

| Termination Date |

Displays the last date that the employee is active in the company. The system obtains this value from the employee's job data record. |

| Termination Reason |

Select the reason why the employee was terminated. The number of statutory days that the system uses when it calculates severance pay depends on the termination reason that you select. T.G.S.S. defines and supplies companies with the valid termination reasons and statutory values. Based on your selection, the system displays the appropriate statutory values as defined by law in the Statutory Values column of the Severance Pay group box. You must maintain the statutory values for each termination reason on the Severance Days page. The system also uses your selection when calculating indemnification days to pay the employee. |

| Seniority Pay Calc Date (seniority pay calculation date) |

Displays the initial date that the system considers when calculating the employee's severance pay, indemnification days, and job litigation salary. The system obtains this value from the hire date of the employee's job data record. |

| Currency Code |

Select the currency code for the termination pay. |

| Comment |

Enter any additional comments about the processing of the employee's termination. This field is for information purposes only. |

Pre-advised Days Non-Fulfilled

Use this group box when the employee or employer has failed to notify the other within the minimum number of preadvice days.

|

Field or Control |

Definition |

|---|---|

| Nbr Pre-advice Days (number preadvice days) |

Enter the number of days by which the employee or employer has failed to meet the legal number of preadvice days that are required at the end of a labor agreement. These nonfulfilled preadvice days increase or reduce the employee's last payment depending on whether the employee or the employer committed the violation, as specified in the Who Pre-advises field. You must enter a positive value. |

| Who Pre-advises |

Select who has to fulfill the preadvice days that you have specified in the Nbr Pre-advice Days field. Values are:

|

Severance Pay

To overwrite the severance pay, select the Overwrite Severance Pay check box. Then use the Severance Pay group box to modify the days of indemnification by year of service or the total amount to pay as indemnification. The values that you enter in these fields overwrite the days or amount that the payroll process determines. Values for days of salary by worked year and maximum number of periods vary depending on the contract type and termination reason.

|

Field or Control |

Definition |

|---|---|

| Overwrite Severance Pay |

Select to overwrite the severance pay values that the system calculates during the processing of the employee's payroll during the termination period. If you select this check box, the fields in the Severance Pay group box become available for edit. Use these fields to make the necessary overrides. |

| Days/Year |

Displays the number of indemnification days by year that the payroll process considers when calculating the employee's severance pay amount. The system automatically determines the indemnification days by year and displays the value in the Statutory Values column. The system determines the statutory value based on the number of indemnification days by year that is mandatory by law for the specified termination reason. You define these values by termination reason on the Severance Days page. To override the statutory value that the system determines, enter a value that is greater than the statutory value. When using this override, you must clear the Severance Pay Amount field. Note that the employee is taxed for the severance pay amount that corresponds to the number of days by year that are over the statutory value. |

| Max. Periods (maximum periods) |

Displays the maximum number of periods for indemnification that the payroll process considers when calculating the employee's severance pay amount. The system automatically determines the maximum periods and displays the value in the Statutory Values column. The system determines the statutory value based on the minimum number of periods mandatory by law for the specified termination reason. You define these values by termination reason on the Severance Days page. To override the statutory value that the system determines, enter a value that is greater than the statutory value. When using this override, you must clear the Severance Pay Amount field. |

| Severance Pay Amount |

Use this field to override the amount that the system would automatically calculate by multiplying the Days/Year value by a daily salary. Enter the amount of the employee's severance pay. When using this override, you must clear any override value from the Days/Year and Max. Periods fields. If you instead want to use the severance pay amount that the system calculates, then you must leave this field blank. Note: The employee is taxed for the severance pay amount that is over the statutory value. |

Appealed

If the employee disagrees with the employer about termination or severance pay, select the Appealed check box. Then use the Appealed group box to enter the job litigation information related to the dispute.

|

Field or Control |

Definition |

|---|---|

| Appealed |

Select this check box if the employee does not agree with the termination reason or severance pay and lodges an appeal against the termination. If you select this check box, the fields in the Appealed group box become available for edit. Enter the necessary appeals data into these fields. Deselect this check box to indicate that the end of the labor relation is effective and that no further action concerning the former employee is required. |

| Conciliation Date |

If applicable, enter the date that the employer and employee reach an agreement in mediation, arbitration, and conciliation (Servicio de Mediación Arbitraje y Conciliación [SMAC]) court. This field is for information purposes. |

| Sentence Date |

If applicable, enter the date on which the judge of the SMAC court dictates a resolution between the employee and the employer. This occurs if the two parties cannot reconcile. Thus you need enter this date only if no conciliation date exists. |

| Final Date for Job Lit. Salary (final date for job litigation salary) |

Enter the final date that the payroll process uses to calculate job litigation salary for the employee. This value can be the conciliation date, the sentence date, or another date upon which the employee and employer reach an agreement. The payroll calculation process considers this date the last date to calculate job litigation salary, using it to determine the number of days in which litigation is involved. Leaving this field blank causes the job litigation salary to be zero and the employee's final payment does not change. If the employer deposits the maximum statutory amount for severance pay, leave this field blank so that this salary will not be paid. Note: The system uses the rehire date of the payee as the first day of the litigation salary period. |

| Sentence Job Lit. Salary (sentence job litigation salary) |

Enter the amount that the judge imposes as job salary that is due to the employee during the litigation period. For example, if the termination date is January 19 and the final date for job litigation salary is January 24, then the job litigation salary is based on the 20th through the 24th, which is the litigation period. This amount overrides the amount that the payroll process calculates for job litigation salary. The payroll process distributes this amount across the months and days of the affected payroll period to properly pay for contributions and taxes. In case of litigation salaries, contributions are reported under L02 payment type in the FAN File. If you enter a value for this field, you must also enter a value for the Final Date for Job Lit. Salary field. |

| Sentence Severance Pay |

Enter the amount that the judge imposes as severance payment. This amount overwrites the severance pay amount that the payroll process calculates. The employer must pay this amount to the employee less the amount already paid upon termination. |

| Unemployment Benefits |

Enter the amount that INEM has paid to the employee during the job litigation period. You can deduce this amount based on the net amount to pay as job litigation salary for the affected period. If you enter a value for this field, you must also enter a value for the Final Date for Job Lit. Salary field. |