Managing Professionals

This topic discusses the professionals management business process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPES_PERCEP_KEY |

Maintain perception (income) key and subkey data for tax models. A subkey, together with a key, identifies the kind of job that a professional or other type of employee provides to a company. |

|

|

PERSONAL_DATA4 |

Select an organizational relationship and checklist to create for this person. |

|

|

GPES_TAX2_RSLT |

Enter and maintain the earning income and tax results adjustments for professionals (or other types of employees) for whom you did not calculate payroll. |

Professionals are persons who provide a company a service without a labor contract. Professionals are contingent workers, not employees. PeopleSoft Global Payroll for Spain assumes that you do not process their payments through payroll. Instead, the professional provides the company with a bill. The company must pay the professional's bill and withhold a percentage of IRPF tax from the amount paid to the professional. The withholding percentage for IRPF taxes depends on the perception key and subkey that defines the services offered by the professional. The company does not have to contribute to social security for the professional.

Through the IRPF Tax Review ESP component you can enter the amount paid to the professional and the withholding amount applied. You can also specify the perception key and subkey to identify the work that the professional provides. The report generation processes consider the values that you enter on this page when you generate the Model 110 report, the Model 111 report, the Model 190 report, the individual professional's Tax Deduction report, and the Tax Deduction report.

To manage data for professionals:

Maintain perception key and subkey values through the Perception Keys ESP component.

Add the professional into the system through the Add a Person component, identifying the person's organizational relationship as a professional by selecting the Contingent Worker check box on the Organizational Relationships page.

A professional is a contingent worker or a person who provides services to the organization and who does not have a legal employee relationship with the organization.

Enter the perception key, subkey, amount paid, and withholding amounts for the professional for a specific fiscal territory and month on the IRPF Tax Review page.

Generate the affected reports monthly, quarterly, or yearly as required.

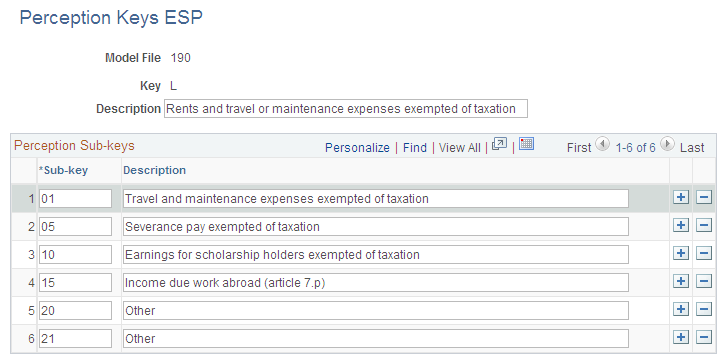

Use the Perception Keys ESP page (GPES_PERCEP_KEY) to maintain perception (income) key and subkey data for tax models.

A subkey, together with a key, identifies the kind of job that a professional or other type of employee provides to a company.

Navigation

Image: Perception Keys ESP page

This example illustrates the fields and controls on the Perception Keys ESP page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Model File and Key |

The system displays the selected model file and perception key combination. |

| Description |

Enter or maintain the description of the perception key for the specified model file. |

| Subkey and Description |

Enter or maintain the perception subkey value and its related description. |

Delivered Perception Keys

Oracle delivers as system data the following perception key and subkey data for the 190, 296, and 345 tax models:

|

Model File |

Key |

Description |

Subkey |

Description |

|---|---|---|---|---|

|

190 |

A |

Employees under labor contract. |

Not applicable |

Not applicable |

|

190 |

F |

Earnings from courses, conferences, colloquia, or seminars or from literary, scientific, or artistic productions for which the payee cedes rights. |

01 |

Literary, scientific, or artistic earnings not exempt from taxation. |

|

190 |

F |

Same as above. |

02 |

All other perceptions under key F. |

|

190 |

G |

Earnings as economic compensation for professional services. |

01 |

For perceptions for which the deduction to apply is the general rule established in Article 93.1 of IPRF Law. |

|

190 |

G |

Same as above. |

02 |

For specific percentage to apply in case of special and detailed activity in law. Representative of Tabacalera (tobacco company), insurance representative, and so on. |

|

190 |

G |

Same as above. |

03 |

For perceptions with a reduced percentage to apply according to Art. 93.1 of IRPF law. Deductions are for taxpayers who start their professional activity in the period declared and the next two periods. |

|

190 |

L |

Exempt rents and travel or maintenance expenses. |

01 |

Travel and maintenance expenses exempt from taxation, according Article 8 of Tax regulation. |

|

190 |

L |

Same as above. |

05 |

Severance pay exempt according to Article 7a of tax law and Article 1 of regulation. |

|

190 |

L |

Same as above. |

10 |

Exempt earnings for scholarship holders according to Article 7 j of tax law. |

|

190 |

L |

Same as above. |

15 |

Income due work abroad (article 7p). |

|

190 |

L |

Same as above. |

20 |

Other |

|

190 |

M |

Job Income eligible for 33rd America's Cup reduction |

Not applicable |

Not applicable |

|

296 |

T |

Job rents. |

1 |

Withholding applied to general type. |

|

296 |

T |

Same as above. |

3 |

Intern exemption. |

|

345 |

C |

Promoter contributions to pensions plan. |

1 |

In charge to employee. |

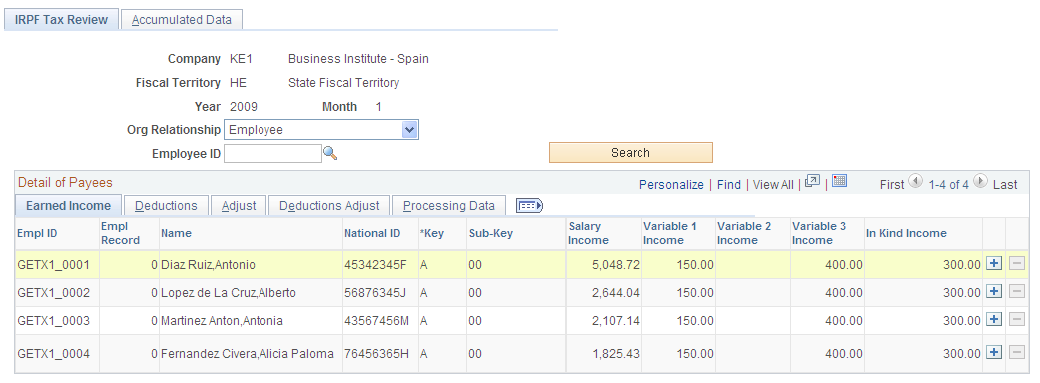

Use the IRPF Tax Review page (GPES_TAX2_RSLT) to review online the monthly tax data that the payroll process calculates for IRPF tax reporting.

You can also adjust the calculated income and withholding amounts. For contingent workers or persons of interest, you can insert new rows of data for each specific job and salary type that a person might have. You can enter IRPF tax data for any person who is not processed through payroll. The system uses this data when you generate IRPF tax reports.

You can also use the IRPF Tax Review page to enter and maintain the earning income and tax results adjustments for professionals (or other types of employees) for whom you did not calculate payroll.

Navigation

Image: IRPF Tax Review page

This example illustrates the fields and controls on the IRPF Tax Review page. You can find definitions for the fields and controls later on this page.

Search Criteria

Upon accessing the page, select the company, fiscal territory, year, and month for which you want to enter data for professionals. To search for professionals only, select the Contingent Worker value in the Org Relation (organization relationship) field. Enter the employee ID to narrow the search results. These filters facilitate budget management and tracing of professional services within a company. Click the Search button to retrieve the professionals based on the search criteria. The system displays a grid with fields that are relevant only to professionals.

Detail of Payees - Adjust

Use this tab to enter amounts for the professional for the selected fiscal period and month. This tab shows the same fields as the earned Income tab but the fields are editable. The system differentiates between the data that the payroll process generates and the data that you enter manually.