Viewing and Updating Data for Illness and Maternity Certificates

This section provides an overview of illness and maternity certificates.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPFR_ILLNESS_1 |

View or update the basic administrative information that will appear on certificates for illness, maternity, and paternity. |

|

|

GPFR_ILLNESS_2 |

View or update information about the absences due to maternity or illness. This page does not apply to long-term illness. |

|

|

GPFR_ILLNESS_3 |

View or update the reference salaries. The page displays the employee's gross pay for the last three months before the leave date. This page does not apply to long-term illness. |

|

|

GPFR_ILLNESS_4 |

Enter the information that the social security agency needs to pay the social security allowance to your organization, rather than directly to the payee. |

|

|

GPFR_ILLNESS_5 |

Enter the total insurance contributions and number of worked hours for a payee with a long-term illness. Use this page for long-term illnesses only. |

The Certificate of Wages, registered under the number 11135-02, provides proof that a payee is entitled to receive social security payments for sick leave or maternity leave. Payees are entitled to these benefits if they worked the statutory minimum period during the reference period preceding the absence or if they paid the sickness contribution on the minimum number of SMIC hours.

Payees selected for this certificate are those whose absence begin date is in the specified period, and where absence begin date = original absence begin date (to avoid including relapses).

The Update Ill/Mat Certifs FRA component consists of five pages that display the data that the system retrieved when you launched the Certificates Data Retrieval process. This is the same data that is printed on the certificates. Add or update information on these pages, as needed.

The information that you enter is reflected on the certificates but does not update the Global Payroll or HR database.

The Long-Term Illness Certificate must be prepared for employees on a continuous leave of absence lasting up to 6 months. This certificate is used by the social security agency to calculate the rate for the daily allowances.

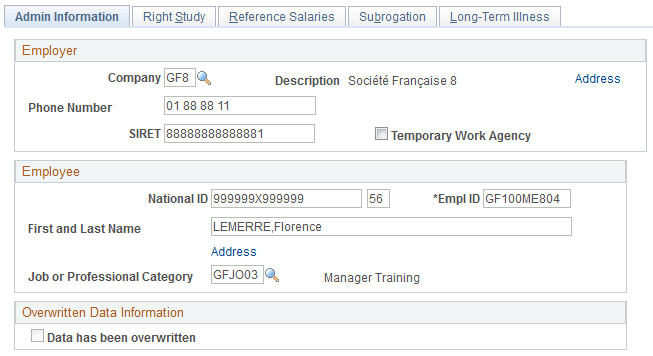

Use the Admin Information page (GPFR_ILLNESS_1) to view or update the basic administrative information that will appear on certificates for illness, maternity, and paternity.

Navigation

Image: Update Ill/Mat Certifs FRA - Admin Information page

This example illustrates the fields and controls on the Update Ill/Mat Certifs FRA - Admin Information page. You can find definitions for the fields and controls later on this page.

Note: You must run the Illness/Maternity Certificate Application Engine process (GPFR_ILL_AE ) using the Extract Certificates Data FRA component before accessing the pages in the Update Ill/Mat Certifs FRA component.

Employer

|

Field or Control |

Definition |

|---|---|

| Company |

Select the company with which the employee was associated on the original date of the absence. |

| Phone Number |

Displays the phone number for the company. |

| SIRET |

Displays the SIRET identification number for the company. |

| Temporary Work Agency |

Select if the employer is a temporary work agency. |

| Address |

Click this link to access the Company Address page, which displays the address of the company that you selected. |

Employee

|

Field or Control |

Definition |

|---|---|

| National ID and EmplID |

Displays the payee's national ID followed by the EmplID (employee ID). |

| First and Last Name |

Displays the employee's first and last name. |

| Address |

Click this link to access the Employee Address page, which displays the payee's address. |

| Job or Professional Category |

Displays the employee's job or professional category. |

Overwritten Data Information

|

Field or Control |

Definition |

|---|---|

| Data has been overwritten |

Select if you want to enter any information about the employer that differs from the information already stored in the HR (HR) database. The information only prints on the current certificate; the HR database is not updated. |

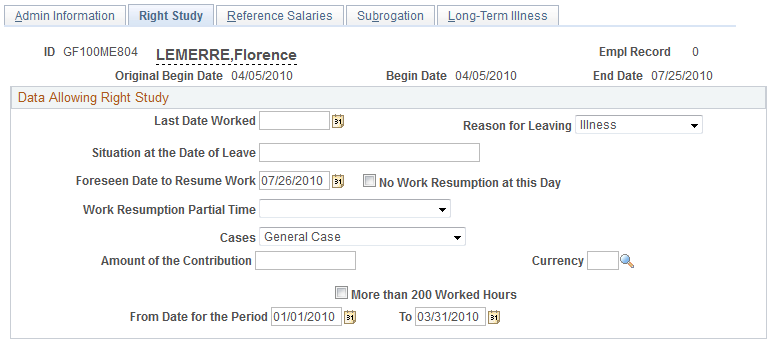

Use the Right Study page (GPFR_ILLNESS_2) to view or update information about the absences due to maternity or illness.

This page does not apply to long-term illness.

Navigation

Image: Update Ill/Mat Certifs FRA - Right Study page

This example illustrates the fields and controls on the Update Ill/Mat Certifs FRA - Right Study page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Last Date Worked |

Enter the date of the last paid day on which the employee worked. Please note that you must enter the date yourself, it does not display by default. |

| Reason for Leaving |

Displays the reason for the employee's absence as entered on the Absence Event Entry page: Illness or Maternity. |

| Situation at the Date of Leave |

Enter the reason for the absence if the employee was unemployed, on vacation, in military service, or absent for some reason other than illness or maternity on the last date worked preceding the leave. Enter up to 30 characters. |

| Foreseen Date to Resume Work (resume work date) |

Enter the date that the employee will return to work. |

| No Work Resumption at this Day |

If the payee is has not yet returned from the absence, select this check box. |

| Work Resumption Partial Time |

If the employee will resume work on a part-time basis, enter the reason for working part time: Medical Reason or Personal Reason. |

| Cases |

Select a value to indicate what the contribution amount and hours are based on. General appears by default. Select Particular for seasonal workers, employees who work at home, and so on. Then enter the contribution amount and hours. |

| Amount of the Contribution |

If General appears in the Case field, the amount of the contribution represents total contributions for sickness insurance, maternity insurance, disability insurance, and death insurance based on the wages earned during the six calendar months preceding the leave date. If you select Particular in the Case field, enter the same information for the wages earned during the 12 preceding calendar months. |

| More Than 200 Worked Hours |

This field appears if the Case field is set to General. If the payee worked at least 200 hours during the last 3 calendar months or the last 90 consecutive days, the system automatically selects this check box and deselects the Amount of the Contribution field. |

| More Than 800 Worked Hours |

This check box appears if you select Particular in the Case field. Select this check box if the payee worked more than 800 hours within the 12 calendar months or 365 consecutive days preceding the leave date. |

| From Date for the Period |

Displays the begin date of the period of validity for the previous four fields. Typically, the period is 3, 6, or 12 months. |

| To |

Displays the end date of the period of validity. Typically the period is 3, 6, or 12 months. |

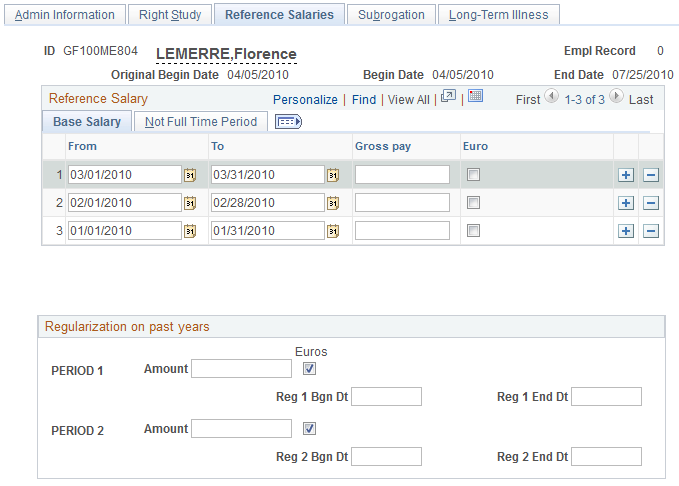

Use the Reference Salaries page (GPFR_ILLNESS_3) to view or update the reference salaries.

The page displays the employee's gross pay for the last three months before the leave date. This page does not apply to long-term illness.

Navigation

Image: Update Ill/Mat Certifs FRA - Reference Salaries page: Base Salary tab

This example illustrates the fields and controls on the Update Ill/Mat Certifs FRA - Reference Salaries page: Base Salary tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Gross Pay |

Displays the gross amount of the employee's earnings on which contributions to sickness, maternity, disability, and death insurance were based. CSG and other mandatory contributions are also deducted for maternity leave. |

| Euro |

This check box is selected automatically if the salary is paid in euros. |

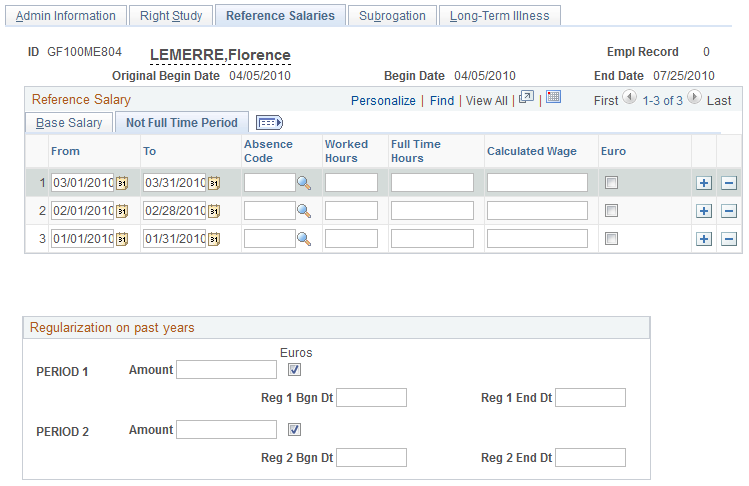

Reference Salaries: Not Full Time Period Tab

Access the Not Full Time Period tab.

Image: Update Ill/Mat Certifs FRA - Reference Salaries page: Not Full Time Period tab

This example illustrates the fields and controls on the Update Ill/Mat Certifs FRA - Reference Salaries page: Not Full Time Period tab. You can find definitions for the fields and controls later on this page.

The Not Full Time Period tab appears data only if the payee worked part time during the reference period.

|

Field or Control |

Definition |

|---|---|

| Absence Code |

Displays the absence code associated with the absence. |

| Worked Hours |

Displays the actual number of hours worked. |

| Full Time Hours |

Displays the number of hours that the payee would have worked if able to work all of the full-time schedule. |

| Calculated Wage |

Displays the full-time equivalent wage. |

| Euro |

This check box is selected automatically if the salary is paid in euros. |

Regularization on Past Years

|

Field or Control |

Definition |

|---|---|

| Period 1 Amount |

Enter an amount if you made retroactive adjustments outside of Global Payroll for France to a payee's contributions during the calendar year that precedes the reference period indicated in the Bgn Dt and End Dt fields. The system does not populate this field. Do not enter the amount of retroactive adjustments that were made by Global Payroll for France. When Global Payroll for France calculates contribution amounts each month, it automatically adds or subtracts any retroactive adjustments, as applicable. Thus, the current period contributions already reflect any retro adjustments that may have been made. |

| Period 2 Amount |

Enter the retroactive amount applicable to period 2, which is the calendar year that began two years before the reference period indicated in the Bgn Dt and End Dt fields. The system does not populate this field. |

Use the Subrogation page (GPFR_ILLNESS_4) to enter the information that the social security agency needs to pay the social security allowance to your organization, rather than directly to the payee.

Navigation

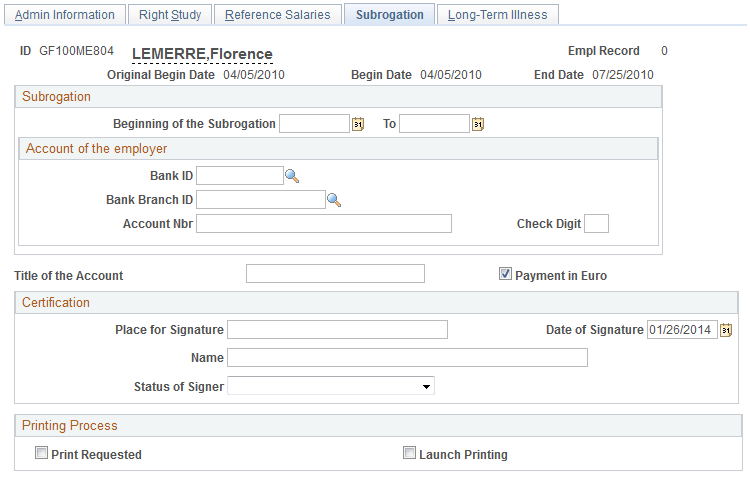

Image: Update Ill/Mat Certifs FRA - Subrogation page

This example illustrates the fields and controls on the Update Ill/Mat Certifs FRA - Subrogation page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Beginning of the Subrogation |

Enter the begin date for which you are submitting a claim for subrogation. |

| To |

Enter the end date for which you are submitting a claim for subrogation. |

Account of the employer

|

Field or Control |

Definition |

|---|---|

| Bank ID |

Enter the bank ID that the social security agency should use to deposit the funds. |

| Bank Branch ID |

Enter the bank branch ID that the social security agency should use to deposit the funds. |

| Account # |

Enter the account number that the social security agency should use to deposit the funds. |

| Check Digit |

Enter the digit of the check that the social security agency should use to deposit the funds. |

| Title of the Account |

Enter the title of the company's bank account into which the funds are to be deposited. |

| Payment in Euro |

Select if you want to receive the allowance in euros. |

Certification

The values of the fields in the Certification group box can be predefined on the Certification page, which you access by clicking the Certification by the Employer link on the Extract Certificates Data FRA page You can also enter the certification information directly on the Subrogation page.

See Certification Page.

Printing Process

|

Field or Control |

Definition |

|---|---|

| Print Requested |

Indicates whether a certificate has been printed for the absence. This check box is selected automatically if a certificate has been printed. |

| Launch Printing |

When you select this check box, the Launch button appears. Click this button to access the Certificates Report FRA page and print the certificate. |

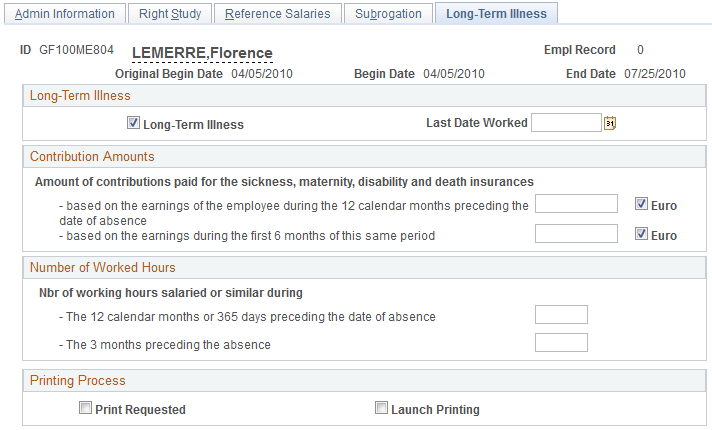

Use the Long-Term Illness page (GPFR_ILLNESS_5) to enter the total insurance contributions and number of worked hours for a payee with a long-term illness.

Use this page for long-term illnesses only.

Navigation

Image: Update Ill/Mat Certifs FRA - Long-Term Illness page

This example illustrates the fields and controls on the Update Ill/Mat Certifs FRA - Long-Term Illness page. You can find definitions for the fields and controls later on this page.

Long Term Illness

|

Field or Control |

Definition |

|---|---|

| Long Term Illness |

Select if you want to prepare a certificate for a long-term illness (absences entered with the take element MLT LG MALADIE). |

| Last Date Worked |

Enter the last day that the employee worked. Please note that you must enter the date yourself, it does not display by default. |

Contribution Amounts

In this group box, enter the amount of health insurance contributions that have been deducted from the employee's earnings in either the top or bottom field, as appropriate. If the amount that you enter is in euros, select the Euro check box.

Number of Worked Hours

In this group box, enter the total number of paid hours that the payee worked in either the top or bottom field, as appropriate.