Entering Retirement Allowance Data

This section discusses how to enter years of service and data from an employee's Retirement Income report.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPJP_RA_PYE_DATA |

Enter data that is used to calculate a payee's withholding tax on a retirement allowance. |

Use the Maintain Ret Allow Data JPN page (GPJP_RA_PYE_DATA) to enter data that is used to calculate a payee's withholding tax on a retirement allowance.

Navigation

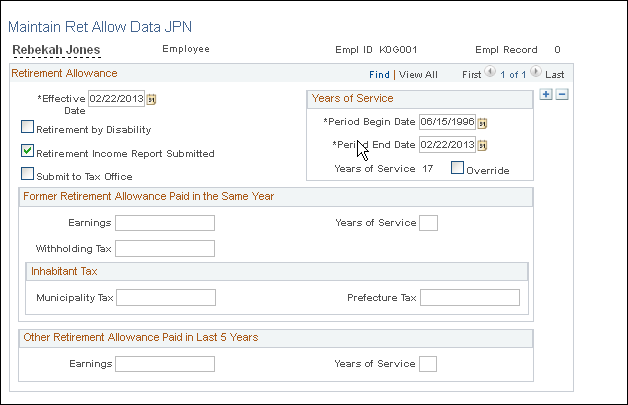

Image: Maintain Ret Allow Data JPN page

This example illustrates the fields and controls on the Maintain Ret Allow Data JPN page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Effective Date |

Enter the payee's retirement date. |

| Date of Death |

This field appears only if the payee's date of death is entered on the Biographical Details page in Administer Workforce JPN. It is used with the Period End Date field. |

| Retirement by Disability |

Select if the retirement is due to disability. |

| Retirement Income Report Submitted |

Select if the payee submitted a Retirement Income report to your organization. If this check box is deselected, the system applies an income tax rate of 20 percent to the gross amount of the retirement allowance. |

| Submit to Tax Office |

This check box is used when printing the Legal Payment Summary report. If selected, the payee's earnings and withholding tax are included in the figures that are reported as submitted to the tax office. |

Years of Service

|

Field or Control |

Definition |

|---|---|

| Period Begin Date |

The system displays the payee's hire date or rehire date by default (as defined on the Job Information page). You can enter a different date. |

| Period End Date |

The system displays the payee's termination date by default (as defined on the Job Information page). You can enter a different date. If a date of death is displayed on this page for the payee, and that date matches the period end date, the system considers the retirement allowance as paid due to the payee's death and calculates income tax and inhabitant tax as zero. It also excludes the retirement allowance from the Retirement Allowance Withholding Tax Report. |

| Years of Service |

The system calculates and displays the number of years of service based on the difference between the period begin date and period end date. You can manually enter a number in this field by using the Override check box. |

| Override |

To manually enter the years of service, select this check box to make the Years of Service field editable. |

Former Retirement Allowance Paid in Same Year

Complete the fields in this group box using the data that the employee reported on the Retirement Income report. The system references the data in these fields when it calculates taxes on the retirement allowance.

Other Retirement Allowance Paid in Last 5 Years

Complete the fields in this group box using the data that the employee reported on the Retirement Income report. The system references the data in these fields when it calculates taxes on the retirement allowance.

If an employee works in two different organizations simultaneously, retirement allowance deductions should be made for only one instance in the overlapping period.