Identifying Company Tax Details

To set up identification of company tax details, use the Tax Number Table MYS (GPMY_TAX_TBL) and Statutory Region Table MYS (GPMY_STAT_REG) components.

This section discusses how to identify company tax details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

COMPANY_TABLE2 |

Set up default company information; for example, the Malaysian reference and registration numbers that are used by various statutory reports. |

|

|

GPMY_STAT_REG |

Maintain statutory regional information for EPF, SOCSO, and taxation reporting. |

|

|

GPMY_TAX_TBL |

Maintain employer contact information for tax reporting. |

|

|

GPMY_TAX_ORG_NBR |

Associate a tax reference number with an organizational unit, such as a company, pay group, location, establishment, or department. |

|

|

Tax Reference Number Details Page |

GPMY_TAX_ORG_SEC |

View employer details that are associated with the tax reference number. |

Use the Default Settings page (COMPANY_TABLE2) to set up default company information; for example, the Malaysian reference and registration numbers that are used by various statutory reports.

Navigation

|

Field or Control |

Definition |

|---|---|

| Reference Number |

Enter the company reference number, which is a number that the government of Malaysia assigns to an organization to uniquely identify it. This number is also the Company C File Number. This number is used in Annual Statement of Tax Deductions - Malaysian CP159 report (GPMYTX05). |

| Registration Number |

Enter the Company Registration Number, which is a number that the government of Malaysia assigns to an organization to uniquely identify it. The Registration Number is used in CP39 Monthly Statement of Tax Deductions - Electronic form (GPMYTX04). |

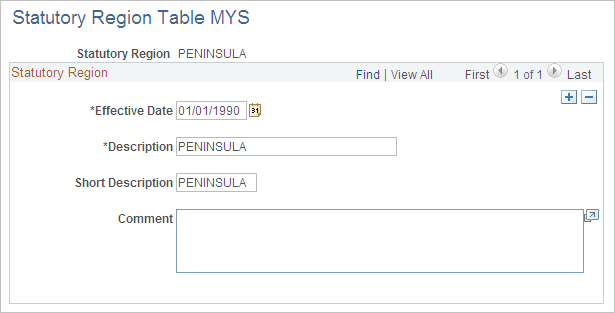

Use the Statutory Region Table MYS page (GPMY_STAT_REG) to maintain statutory regional information for EPF, SOCSO, and taxation reporting.

Navigation

Image: Statutory Region Table MYS page

This example illustrates the fields and controls on the Statutory Region Table MYS page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Statutory Region |

Enter the statutory region. This region is reported on the following forms: EPF Form 6, SOCSO Form 8A, SOCSO Form 8B, CP39 Monthly Statement of Tax Deductions - Electronic form, and Employee Tax Refund Form - Malaysian CP159A/PCB2(II). |

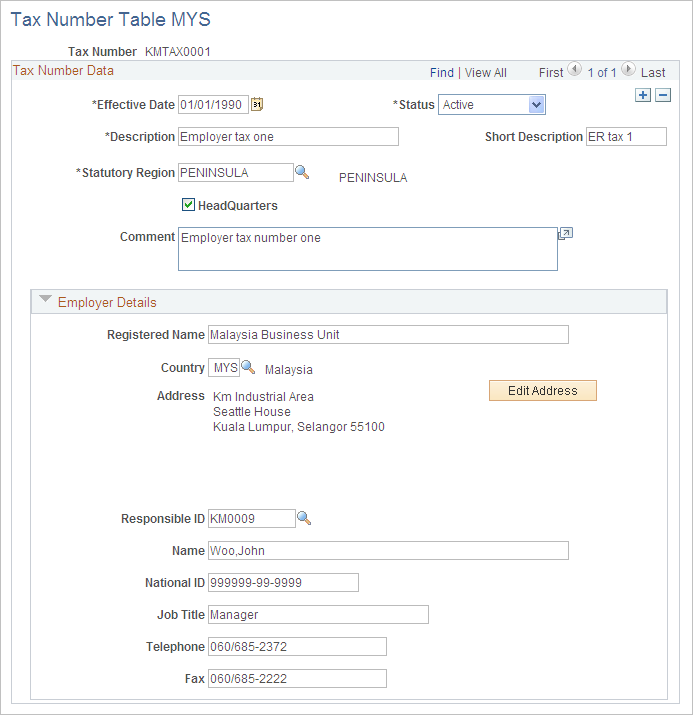

Use the Tax Number Table MYS page (GPMY_TAX_TBL) to maintain employer contact information for tax reporting.

Navigation

Image: Tax Number Table page

This example illustrates the fields and controls on the Tax Number Table page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Registered Name |

Enter the employer's official name. |

| Address |

Enter the employer's address. |

| Responsible ID |

Enter the employee ID of the organization's tax contact. |

| Name |

Enter the name of the organization's contact person for taxation inquiries. This name appears as the company contact in all reports that are submitted to the Department of Inland Revenue. |

| National ID |

Enter the contact person's national ID. |

| Job Title |

Enter the job title of the company contact for taxation inquiries. This information appears in all the reports that are submitted to the Department of Inland Revenue. |

| Telephone and Fax |

Enter the telephone and fax number of the company contact for taxation inquiries. This information appears in all reports that are submitted to the Department of Inland Revenue. |

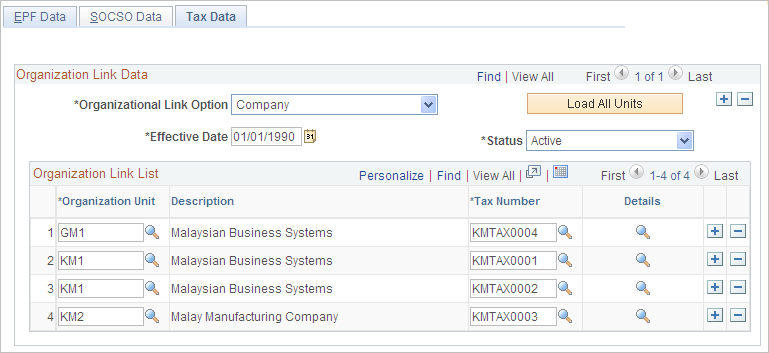

Use the Tax Data page (GPMY_TAX_ORG_NBR) to associate a tax reference number with an organizational unit, such as a company, pay group, location, establishment, or department.

Navigation

Image: Tax Data page

This example illustrates the fields and controls on the Tax Data page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Organizational Link Option |

Select an organizational link. Options are: Company, Pay Group, Location, Establishment, and Department. |

| Load All Units |

Click to insert a list of all possible organizational units into the organization link list. You can then specify the tax references number for each unit. |

| Effective Date and Status |

Enter the effective date and status of the organization link. If the organizational link option changes, all the organizational units are deleted and all existing organizational link options become inactive. |

| Details |

Click to view the Tax Reference Number Details page, which displays the employer details that are associated with the tax number. |