Managing the Prenotification Process

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_PRENOTE |

If a payee's bank account information changes and prenoting is required, update prenote dates and status. |

In the United States, payees who elect to receive direct deposits may be subject to prenoting. Prenoting is the process of verifying routing numbers and account number information for an electronic transfer through a zero-dollar transaction. Typically, the prenote period is 10 days. During this time, the employer pays the payee with a check instead of a deposit, and a zero-dollar deposit is sent to the payee's bank account. This way, if the payee entered an invalid transit or account number, the bank rejects the transaction, but the payee is still paid on time.

Prenotification is optional. If you decide to use prenotification, you can set it up to run when you define PeopleSoft Global Payroll for United States installation settings.

You can also set up different prenotification periods for each source bank, if needed. For one source bank, the prenote wait days can be 10 days, and for another source bank, it can be 8 days. You can define this in PeopleSoft Global Payroll for United States during source bank account setup.

To set up and update prenotification for payees:

Indicate whether prenotification is required at the payee level on the Installation Settings USA page.

This setting controls whether the default for the Prenotification Required check box is selected or deselected on the Bank Prenote Information USA page.

The Installation Settings USA page is discussed in this product documentation.

Indicate the prenote wait days for a United States source bank on the US Bank Additional Data page.

What you enter at the source bank level determines whether the prenotification process is required. If you enter 0 wait days, a prenote will not be generated at the payee level.

Note: The US Bank Additional Data page is discussed in the PeopleSoft HCM Application Fundamentals product documentation.

Set up bank account information for a payee on the Maintain Bank Accounts page.

Note: The Maintain Bank Account page is discussed in the Global Payroll core documentation.

Define prenote information for a payee on the Bank Prenote Information USA page.

Note: If USA is selected as the country code on the Maintain Bank Accounts page, the Prenote Information link appears. This is where you can manually update a payee's prenotification status.

Prenotification and Installation Considerations

If you previously installed a Global Payroll country extension other than PeopleSoft Global Payroll for United States and you have payees with United States bank accounts, and then you install PeopleSoft Global Payroll for United States, you may need to generate a prenote record for those payees with existing United States bank accounts or update prenote information online through the payee Maintain Bank Accounts (PYE_BANKACCT) component for the process to run properly.

Prenotification Processing

The prenotification process is part of the PeopleSoft Global Payroll for United States banking process.

See Processing Payments.

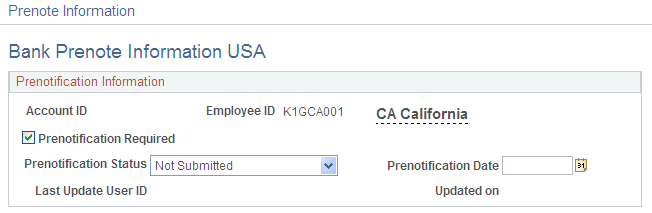

Use the Bank Prenote Information USA page (GPUS_PRENOTE) to if a payee's bank account information changes and prenoting is required, update prenote dates and status.

Navigation

Select the Prenote Information link on the Maintain Bank Accounts page. This link is available only if you select the Prenote Process Allowed check box on the Installation Settings USA page.

Image: Bank Prenote Information USA page

This example illustrates the fields and controls on the Bank Prenote Information USA page.

|

Field or Control |

Definition |

|---|---|

| Prenotification Required |

Select if the prenotification process is required for the payee's bank account. This field determines whether prenotes are generated. Note: If you selected the Prenote Process Allowed check box on the Installation Settings USA page, this field is automatically selected. However, if this field is selected but the prenote wait days is defined as 0 at the source bank level, no prenote exists. Prenote definition at the source bank level can override prenote information defined elsewhere. |

|

Field or Control |

Definition |

|---|---|

| Prenotification Status |

Indicate the status of the prenotification process for the selected bank account. Values are Completed, Not Submitted, Rejected, and Submitted. The prenote process automatically updates this field, but you can also update it manually. The Rejected field value indicates that the source bank rejected the payee bank account information. The Rejected status is not set by the prenote process; it can only be set manually. See Processing Payments. |

|

Field or Control |

Definition |

|---|---|

| Prenotification Date |

Enter the date of the prenote if you want to override the date when the prenotification was last run. Overriding the prenote date may cause prenotification to occur again unless the prenotification status is set to Complete. Prenote days are counted according to this date. Typically, prenote information is updated if the bank ID or bank account information changes for a payee. Prenote information is not updated for payee banking details, such as changes to net pay distribution. |

| Last Update User ID |

Displays the user ID of the person who last updated prenote information. |

| Updated On |

Displays the date and time that the prenote was last updated. Prenote days are counted according to this date. Typically, prenote information is updated if the bank ID or bank account number changes for a payee. |

Note: To activate the prenote fields for a bank account, you must select the Apply button at the bottom of this page.