Understanding Tax Processing

This topic discusses:

Delivered tax elements.

Tax calculation.

Global Payroll for China delivers five tax deductions:

NORM TAX

DONATION

ANN BON TAX

SEVERANCE TX

REM TAX

These deductions along with the key supporting elements associated with them are discussed in Understanding Deductions and Delivered Elements for China.

This topic discusses:

Overall tax calculation process.

Normal tax calculation.

Annual bonus tax calculation.

Severance tax calculation.

Remunerated (REM) employee tax

Overall Tax Calculation Process

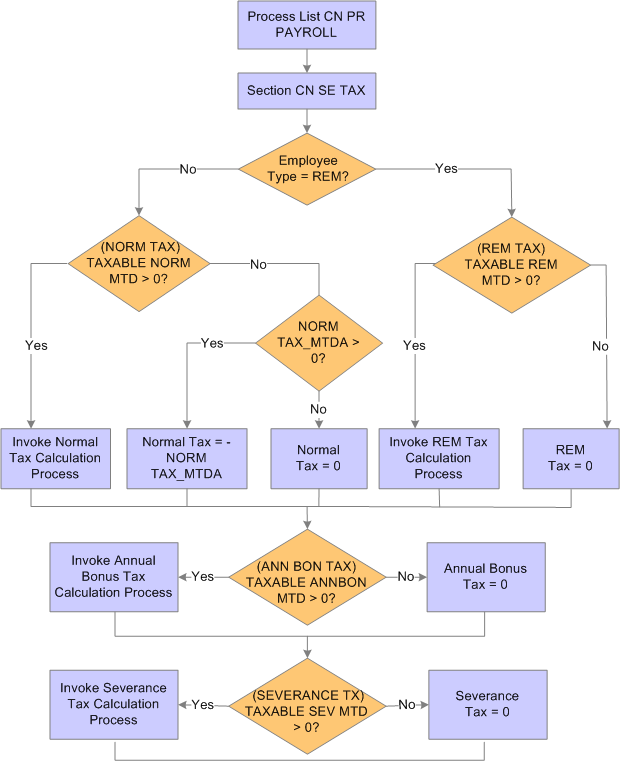

This diagram illustrates the flow of the overall tax calculation process:

Image: Overall tax calculation process

This diagram illustrates the flow of the overall tax calculation process.

The tax section CN SE TAX calls each tax deduction sequentially to perform tax calculation: NORM TAX, ANN BON TAX, SEVERANCE TX, and REM TAX. It then calls a formula to insert tax values into the tax writable array CN WA TAX REPORT after each calculation.

Normal Tax Calculation

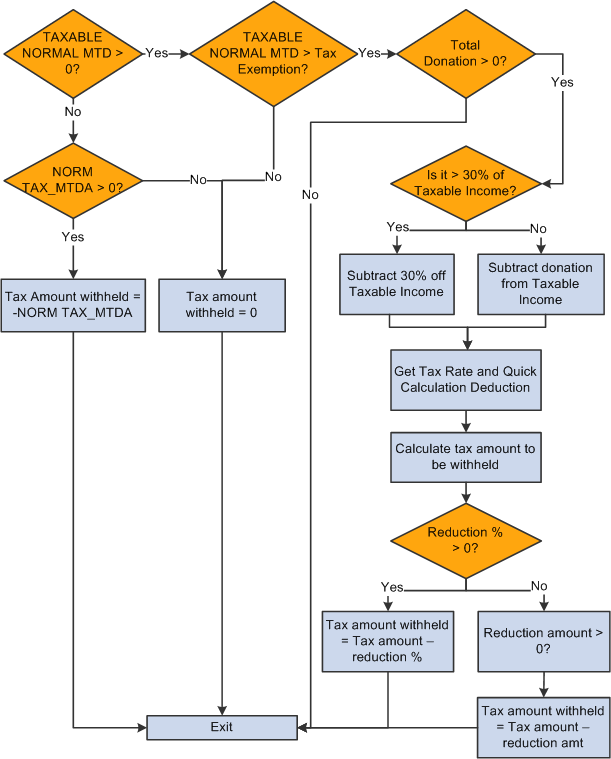

This diagram illustrates the flow of normal tax calculation:

Image: Normal tax calculation

This diagram illustrates the flow of normal tax calculation.

The NORM TAX deduction invokes the formula CN FM CALC NORM TX, which derives normal tax from calculated normal salary. The formula references bracket CN BR TX EXEMPTION to load tax exemption according to the employee type CN VR EE TYPE. It calls formula CN FM DONATION to deduct the tax-exempt portion of donations from the taxable income if any donations exist. CN FM CALC NORM TX then calls formula CN FM CALC TAX to calculate tax.

The formula CN FM CALC NORM TX:

Deducts tax exemption CN BR TX EXEMPTION from taxable normal salary TAXABLE NORMAL MTD to get taxable income.

Calls CN FM DONATION to subtract the tax-exempt portion of donation from step 1 if any donations exist.

If the total donation is greater than 30% of the taxable income from step 1, the 30% of taxable income becomes the tax-exemption portion and the system deducts it from the amount derived in step 1 to obtain the final taxable income, CN VR TAX INCOME.

If the total donation is less than 30% of the taxable income from step 1, the entire donation is tax exempted and the system deducts it from the amount derived in step 1 to get the final taxable income, CN VR TAX INCOME.

Calls formula CN FM CALC TAX.

References the tax table CN BR TAX RATE to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's normal salary for one pay period in the current financial year.

Subtracts the reduction from the tax amount if the payee is eligible for disability reduction. If a payee override exists, the assumption is that it overrides an amount; otherwise, the formula uses the percent value retrieved from the CN BR TX EXEMPTION bracket.

Therefore, if an override exists, the tax withheld equals the tax amount from step 3a minus the override amount. If the tax withheld is less than zero, the formula sets the tax to zero. If no override exists, the formula subtracts the reduction percent from the tax withheld from step 3a.

Deducts any normal tax already paid.

If TAXABLE NORMAL MTD is less than tax exemption and normal tax exists from earlier segments in the period, makes NORM TAX_MTDA negative to reverse calculated amount. Otherwise, sets NORM TAX_MTDA to 0.

Annual Bonus Tax Calculation

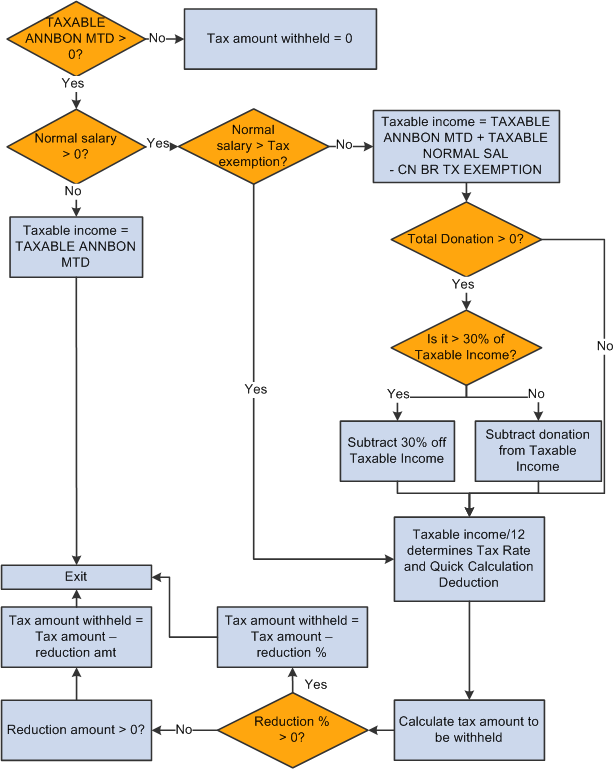

This diagram illustrates the flow of annual bonus tax calculation:

Image: Annual bonus tax calculation

This diagram illustrates the flow of annual bonus tax calculation.

The ANN BONUS TAX deduction invokes the formula CN FM CALC SP TAX, which derives the annual bonus tax based on calculated annual bonus. If any unused tax exempted amount exists when the normal salary is lower than the tax exemption, the system subtracts it from taxable income. It calls formula CN FM DONATION to deduct the tax-exempt portion of donations from the taxable income if normal tax was not calculated because normal salary is lower than the tax-exempt amount. CN FM CALC SP TAX then calls formula CN FM CALC TAX to calculate tax.

The formula CN FM CALC SP TAX:

Calculates the taxable income by subtracting the unused portion of tax exemption if normal salary exists and no normal tax was calculated. In this case, taxable income = TAXABLE ANNBON MTD + TAXABLE NORMAL SAL – CN BR TX EXEMPTION. This taxable income is divided by 12 to find the tax rate and quick calculation deduction.

If normal salary is greater than the tax exemption, then taxable income equals the annual bonus amount. In this case, taxable income = TAXABLE ANNBON MTD. This taxable income is divided by 12 to find the tax rate and quick calculation deduction.

Calls formula CN FM CALC TAX.

References the tax table CN BR TAX RATE to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's normal salary for one pay period in the current financial year.

Subtracts the reduction from the tax amount if the payee is eligible for disability reduction. If a payee override exists, the assumption is that it overrides an amount; otherwise, the formula uses the percent value retrieved from the CN BR TX EXEMPTION bracket.

Therefore, if an override exists, the tax withheld equals the tax amount from Step 3a minus the override amount. If the tax withheld is less than zero, the formula sets the tax to zero. If no override exists, the formula subtracts the reduction percent from the tax withheld from step 3a.

Subtracts any annual bonus tax already calculated in the month.

Severance Tax Calculation

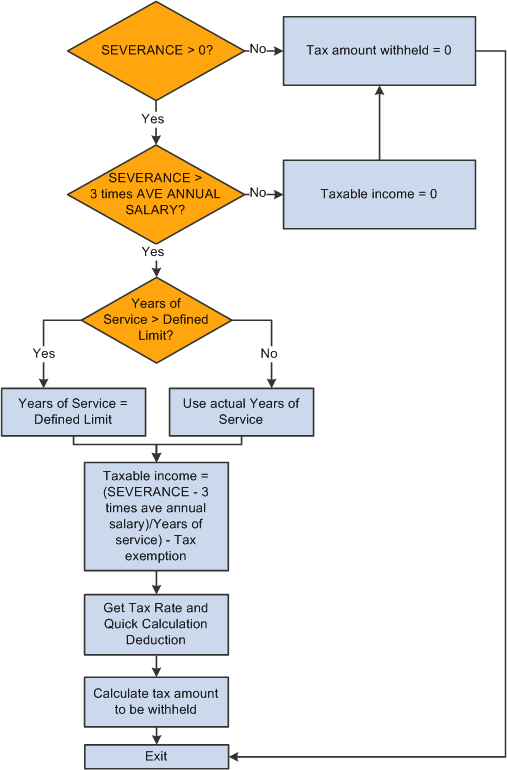

This diagram illustrates the flow of severance tax calculation:

Image: Severance tax calculation

This diagram illustrates the flow of severance tax calculation.

The SEVERANCE TX deduction invokes the formula CN FM CALC SEV TAX, which derives severance tax from the calculated severance payment. CN FM CALC SEV TAX then calls formula CN FM CALC TAX to calculate tax.

The formula CN FM CALC SEV TAX:

Calculates taxable income.

If severance pay is below 3 times the city average annual salary, the system exempts it from tax. In this case, taxable income = 0.

If severance pay is 3 times higher than last year's city average annual salary, the system calculates tax based on the amount above 3 times the city average annual salary of last year by allocating the amount into the number of months equivalent to total years of service for the current employer. If years of service is more than the defined limit, the formula caps the value at that limit. In this case, taxable income = severance pay – 3 times city average annual salary ÷ years of service.

Note: PeopleSoft Global Payroll for China delivers a years-of-service limit of 12. When determining years of service for a payee, the system rounds up to the nearest integer.

Calls formula CN FM CALC TAX.

References the tax table CN BR TAX RATE to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's normal salary for one pay period in the current financial year.

Subtracts the reduction from the tax amount if the payee is eligible for disability reduction. If a payee override exists, the assumption is that it overrides an amount; otherwise, the formula uses the percent value retrieved from the CN BR TX EXEMPTION bracket.

Therefore, if an override exists, the tax withheld equals the tax amount from step 2a minus the override amount. If the tax withheld is less than zero, the formula sets the tax to zero. If no override exists, the formula subtracts the reduction percent from the tax withheld from step 2a.

Multiplies calculated tax by the years of service to calculate the final amount of tax withheld.

Subtracts any severance tax already calculated in the month.

Remunerated (REM) EmployeeTax

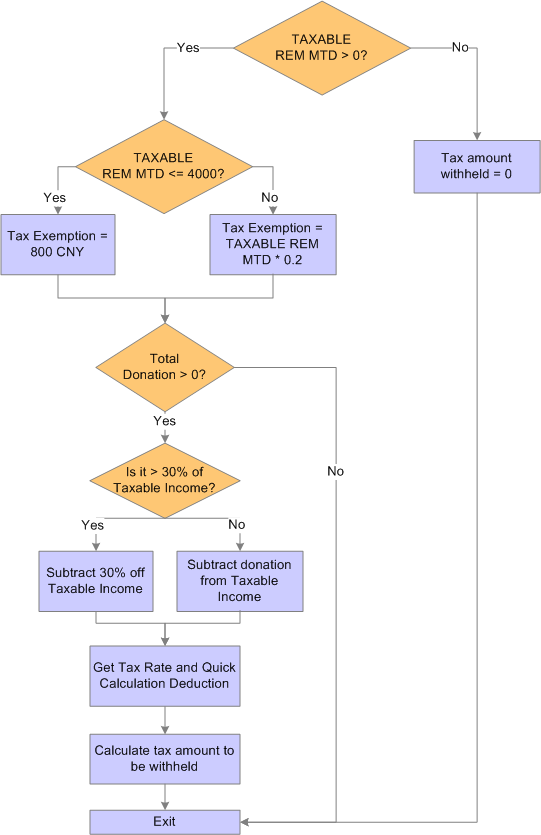

This diagram illustrates the flow of remunerated (REM) tax calculation (for interns, consultants, instructors, contractors, and other employees who are paid for services rendered):

Image: REM tax calculation

This diagram illustrates the flow of REM tax calculation.

The REM TAX deduction invokes formula CN FM CALC REM TX, which calculates normal salary to derive REM tax. It then calls CN FM REM TAX, which inserts the REM tax calculation values into the CN WA TAX REPORT writable array for tax reporting purposes.

The formula CN FM CALC REM TX:

Calculates taxable income (CN VR TAX INCOME).

If TAXABLE REM MTD is less than or equal to 4,000 CNY, then CN VR TAX INCOME = TAXABLE NORMAL MTD – CN VR EXMPT AMT.

If TAXABLE REM MTD is greater than 4,000 CNY, then CN VR TAX INCOME = TAXABLE NORMAL MTD – (TAXABLE NORMAL MTD * CN VR EXMPT PCT).

Calls CN FM DONATION to subtract the tax-exempt portion of donation from step 1 if any donations exist.

If the total donation is greater than 30% of the taxable income from step 1, the 30% of taxable income becomes the tax-exemption portion and the system deducts it from the amount derived in step 1 to obtain the final taxable income, CN VR TAX INCOME.

If the total donation is less than 30% of the taxable income from step 1, the entire donation is tax exempted and the system deducts it from the amount derived in step 1 to get the final taxable income, CN VR TAX INCOME.

References the tax table CN BR TAX RT REM to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's remunerated salary for one pay period in the current financial year.

Calls the formula CN FM TX REDUCTION if the employee is disabled.

Deducts any REM tax already paid.