Generating Tax Reports

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_CR_RPT_DTA_RC |

Generate report data for finalized payrolls. |

|

|

GPCN_TAX_DATA_RC |

Generate the Individual Income Tax Withholding and Tax Withholding Detail reports. |

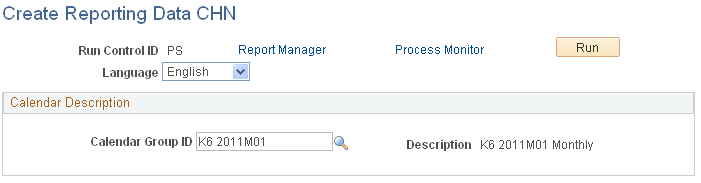

Use the Create Reporting Data CHN page (GPCN_CR_RPT_DTA_RC) to generate report data for finalized payrolls.

Navigation

Image: Create Reporting Data CHN page

This example illustrates the fields and controls on the Create Reporting Data CHN page.

|

Field or Control |

Definition |

|---|---|

| Calendar Group ID |

Select the calendar group for which you want to generate report data. You can select only finalized calendar groups. |

The Create Reporting Data CHN (GPCN_CR_DATA) Application Engine process calls the GPCN_TAX Application Engine process, which generates tax report data for the selected calendar group.

The GPCN_CR_DATA process simultaneously calls the GPCN_PHFSI Application Engine process, which generates Public Housing Fund and Social Insurance (PHF/SI) report data for the selected calendar group.

Note: Instead of manually running the GPCN_CR_DATA process from this page to generate report data, you can select the GP_PAYE Job process instead of the GPPDPRUN COBOL process when you finalize a calendar group. This is similar to the way that GPCN_CR_DATA, GP_PAYE calls both GPCN_TAX and GPCN_PHFSI.

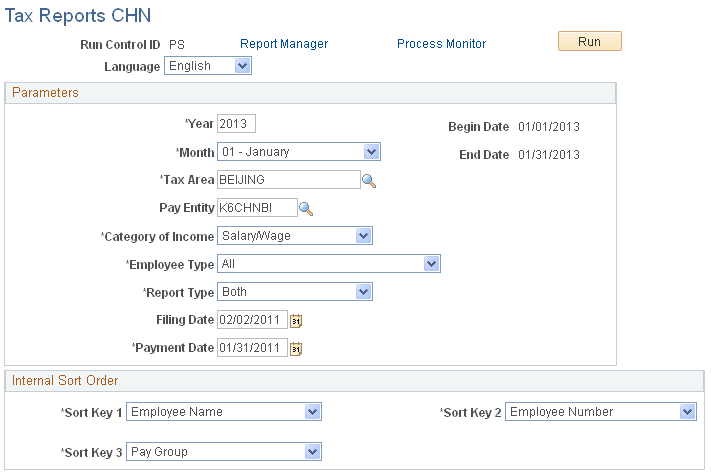

Use the Tax Reports CHN page (GPCN_TAX_DATA_RC) to generate the Individual Income Tax Withholding and Tax Withholding Detail reports.

Navigation

Image: Tax Reports CHN page

This example illustrates the fields and controls on the Tax Reports CHN page.

|

Field or Control |

Definition |

|---|---|

| Year andMonth |

Enter the year and month for which you are generating the report. |

| Tax Area |

Enter the tax area for which you are generating the report. Values are:

|

| Pay Entity |

Enter the pay entity for which you are generating the report. If you leave this field blank, the process creates a report for all pay entities in the selected tax area. |

| Category of Income |

Select the category of the income for which you are generating the report. Values are:

|

| Employee Type |

Select the type of employee for which you are generating the report. Values are:

|

| Report Type |

Select which report to generate.

|

| Filing Date |

Enter the date on which you file the report. |

| Payment Date |

Enter the date when the company submits income tax to the local taxation administration. This is a required field for the Individual Income Tax Withholding report and is available only if you select Summary or Both in theReport Type field. |

| Internal Sort Order |

Use the sort keys to sort your generated reports by Employee Name, Employee Number, and Pay Group. If you select Employee Name, the report is sorted by the payees' Han Yu Pin Yin names. |

Note: If the system calculates tax using the retro when earned override set, the taxable amount with retro does not appear on the tax reports. In this case, you must report the retro tax amount directly to the Tax Bureau.