Understanding the Organizational Structure

Image: Organizational structure of Global Payroll

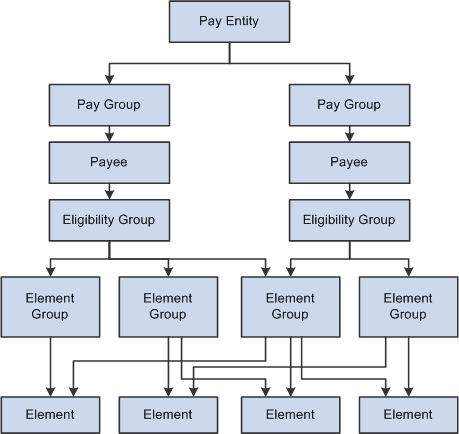

This diagram shows the components of the Global Payroll organizational structure for payroll processing.

Elements are the basic building blocks of Global Payroll. Element groups are used to communicate lists of elements to eligibility groups. Eligibility groups are associated with pay groups. Payees who share pay characteristics belong to pay groups. Multiple pay groups are linked to a single pay entity, the business organization that pays payees.

Eligibility groups and element groups are used to control which elements a payee receives. Element Groups contain individual elements such as earnings, deductions, absence entitlements, and absence takes. Eligibility Groups in turn contain Element Groups. This two-level approach allows for a more efficient setup, as illustrated by the following example.

Each payee is assigned to an eligibility group, such as an eligibility group for managers or one for staff employees. You might have some elements, such as management bonuses, for managers only; other elements, such as overtime, for staff employees only; and other elements, such as base pay and taxes, for which all payees are eligible.

Example

Suppose that you have two groups of payees—managers and staff employees—so you create two eligibility groups.

You have 50 earning elements. Of those, 10 earnings (E1-E10) are for managers only, 10 earnings (E11-E20) are for staff employees only, and 30 earnings (E21-E50) are for all payees. You have 20 tax deduction elements (D1-D20) for all payees and 10 voluntary deduction elements (D21-D30) available for managers only.

Without element groups, you'd have to add 70 elements to the management eligibility group and 70 elements to the staff eligibility group.

With the element group concept, you create five element groups:

Management Earnings (earnings that only managers receive).

Staff Earnings (earnings that only staff employees receive).

Common Earnings (earnings that are available to both groups of payees).

Taxes (the 20 deductions).

Voluntary Deductions (the 10 deductions for managers only).

This table lists the element groups that you would add to the eligibility groups:

|

Eligibility Group |

Element Group Members |

|---|---|

|

Management |

Management Earnings (E1-E10) Common Earnings (E21-E50) Taxes (D1-D20) Voluntary Deductions (D21-D30) |

|

Staff |

Staff Earnings (E11-E20) Common Earnings (E21-E50) Taxes (D1-D20) |

Another benefit of element groups becomes apparent if you add elements after initial implementation. Say that you create a new tax (D21) after implementation. Instead of having to add that new element to every eligibility group, you add it to one element group (Taxes).